Flavor Systems Market Report

Published Date: 31 January 2026 | Report Code: flavor-systems

Flavor Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Flavor Systems market, highlighting key insights, trends, and growth forecasts from 2023 to 2033. It explores market size, segmentation, regional dynamics, technological advancements, and the leading players in the industry.

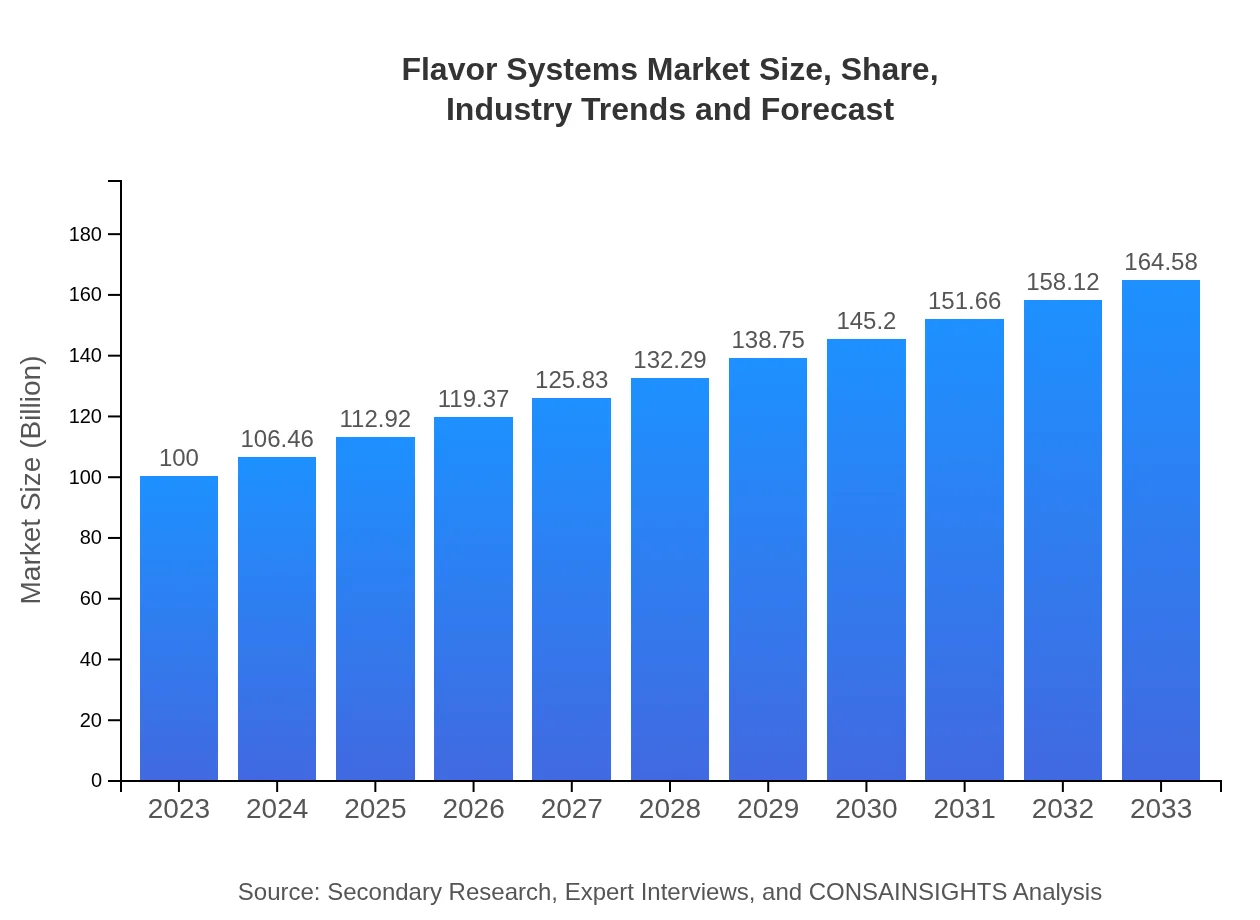

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Givaudan, IFF (International Flavors & Fragrances), Firmenich, Symrise |

| Last Modified Date | 31 January 2026 |

Flavor Systems Market Overview

Customize Flavor Systems Market Report market research report

- ✔ Get in-depth analysis of Flavor Systems market size, growth, and forecasts.

- ✔ Understand Flavor Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flavor Systems

What is the Market Size & CAGR of Flavor Systems market in 2023?

Flavor Systems Industry Analysis

Flavor Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flavor Systems Market Analysis Report by Region

Europe Flavor Systems Market Report:

In Europe, the Flavor Systems market is witnessing growth from $29.70 billion in 2023 to $48.88 billion by 2033. Regulatory frameworks supporting food safety and quality are influencing market developments. The region's focus on sustainability and health trends, including the rise in plant-based diets, is propelling the demand for natural flavors.Asia Pacific Flavor Systems Market Report:

In the Asia Pacific region, the Flavor Systems market is projected to grow from $19.07 billion in 2023 to $31.38 billion by 2033. The region's expanding population and rising disposable incomes are contributing to increased consumption of processed foods, driving demand for innovative flavors. Additionally, traditional cuisine flavors are being integrated into modern food products, further boosting the market.North America Flavor Systems Market Report:

North America represents a substantial portion of the global Flavor Systems market, with estimates from $35.25 billion in 2023 to $58.01 billion by 2033. A robust consumer inclination towards natural and organic products is shaping market trends. The prevalence of established food manufacturing companies fosters innovation and competition.South America Flavor Systems Market Report:

The Latin American Flavor Systems market is expected to grow from $6.26 billion in 2023 to $10.30 billion by 2033. The growing food and beverage sector, coupled with changing dietary preferences and increased tourism, creates a demand for unique and diverse flavors. Regulatory support for food safety also aids market growth.Middle East & Africa Flavor Systems Market Report:

The Middle East and Africa Flavor Systems market is anticipated to move from $9.72 billion in 2023 to $16.00 billion by 2033. The expanding food sector, along with increasing urbanization and changing lifestyles, drive the demand for flavored products. The region's diverse culinary heritage also presents vast opportunities for flavor innovation.Tell us your focus area and get a customized research report.

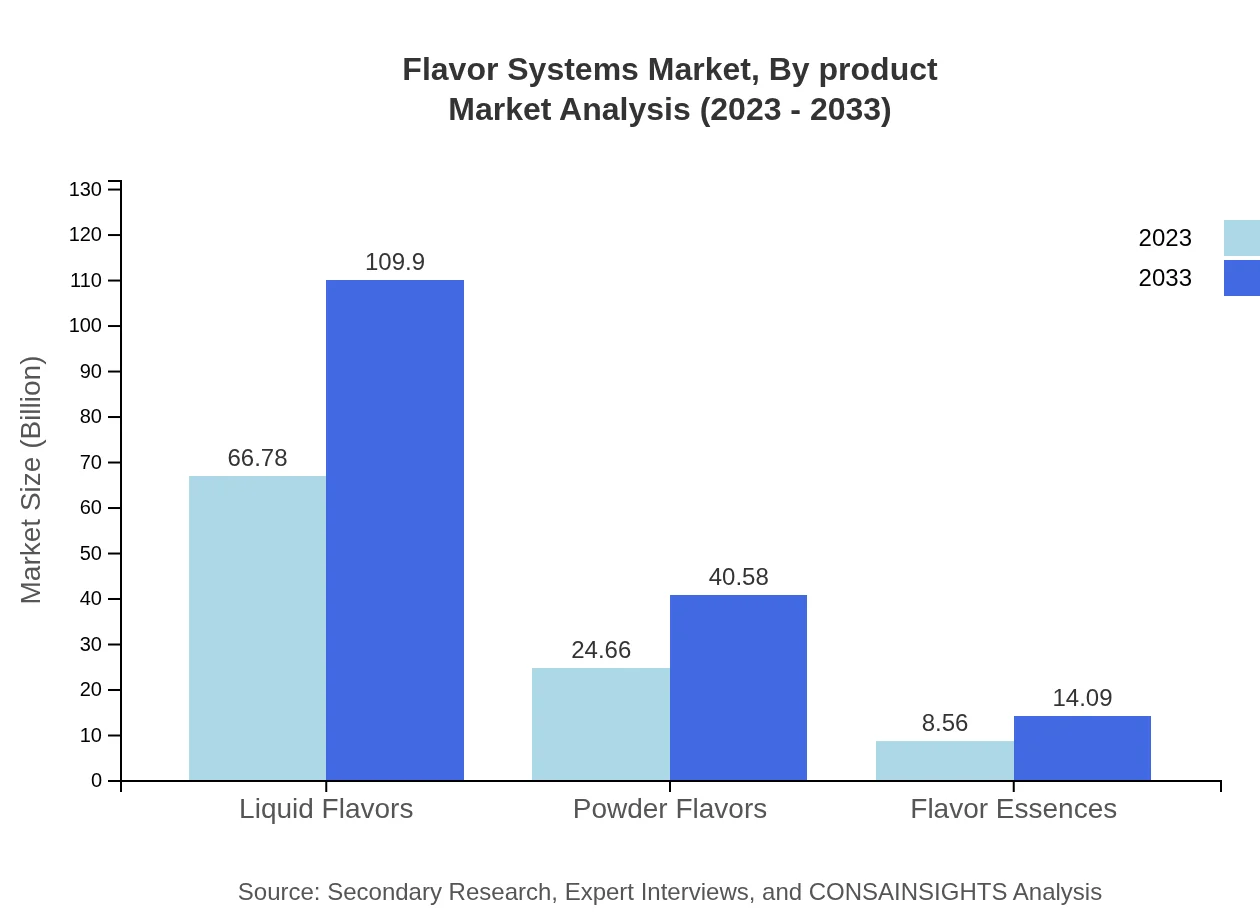

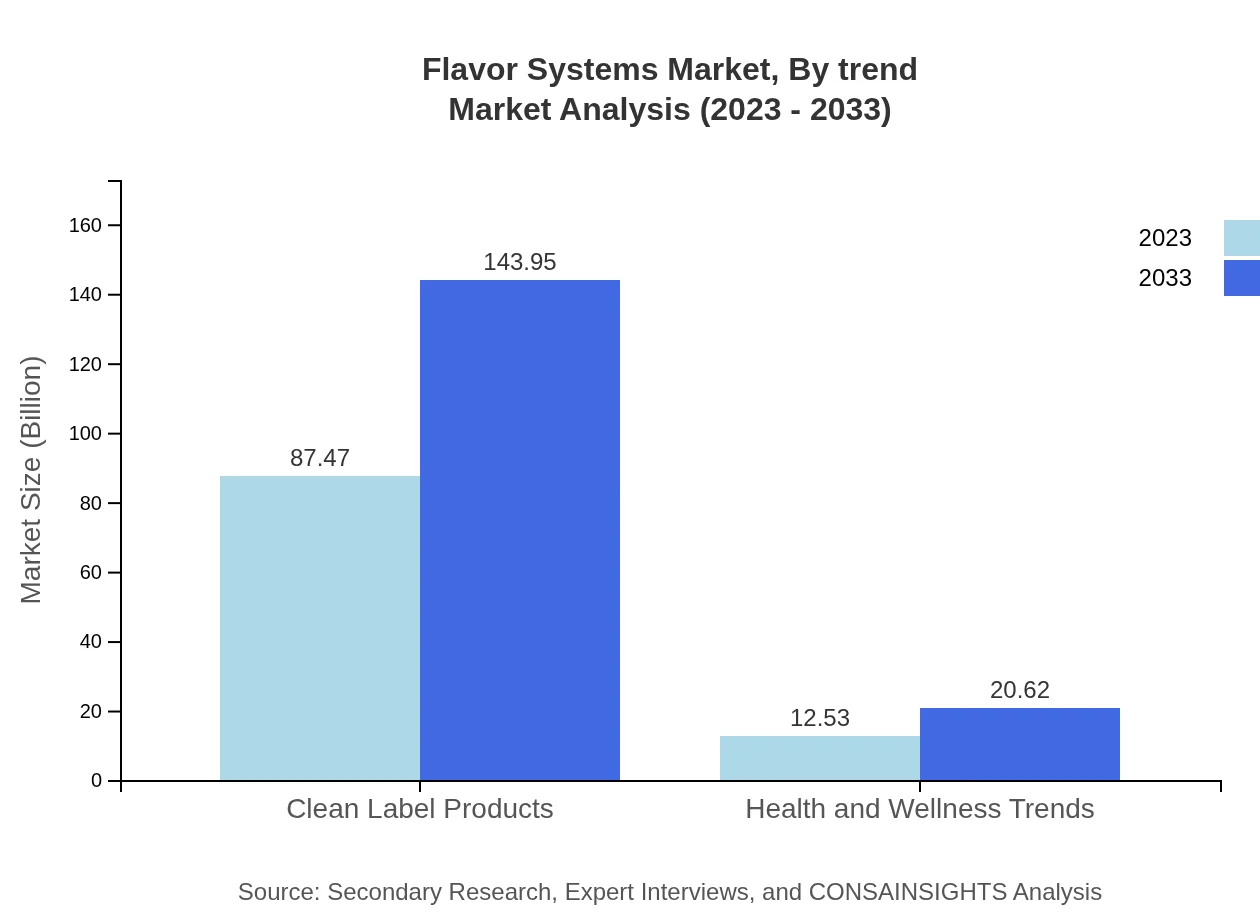

Flavor Systems Market Analysis By Product

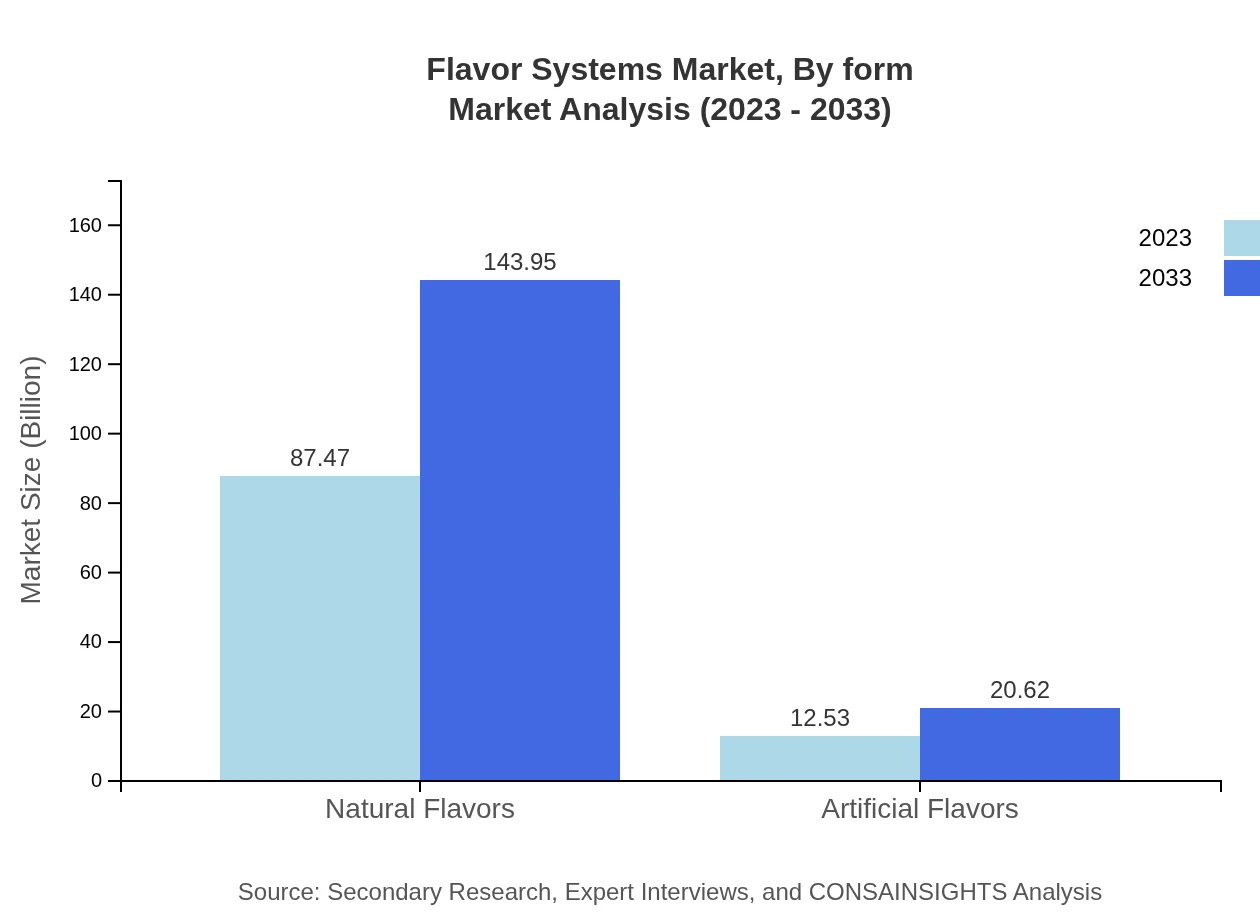

Natural Flavors continue to dominate the Flavor Systems market, expected to grow from $87.47 billion in 2023 to $143.95 billion by 2033. In contrast, Artificial Flavors are projected to increase from $12.53 billion to $20.62 billion, reflecting steady demand across various applications. The rise of Clean Label Products aligns with consumer preferences for transparency in ingredient sourcing, growing significantly in the next decade.

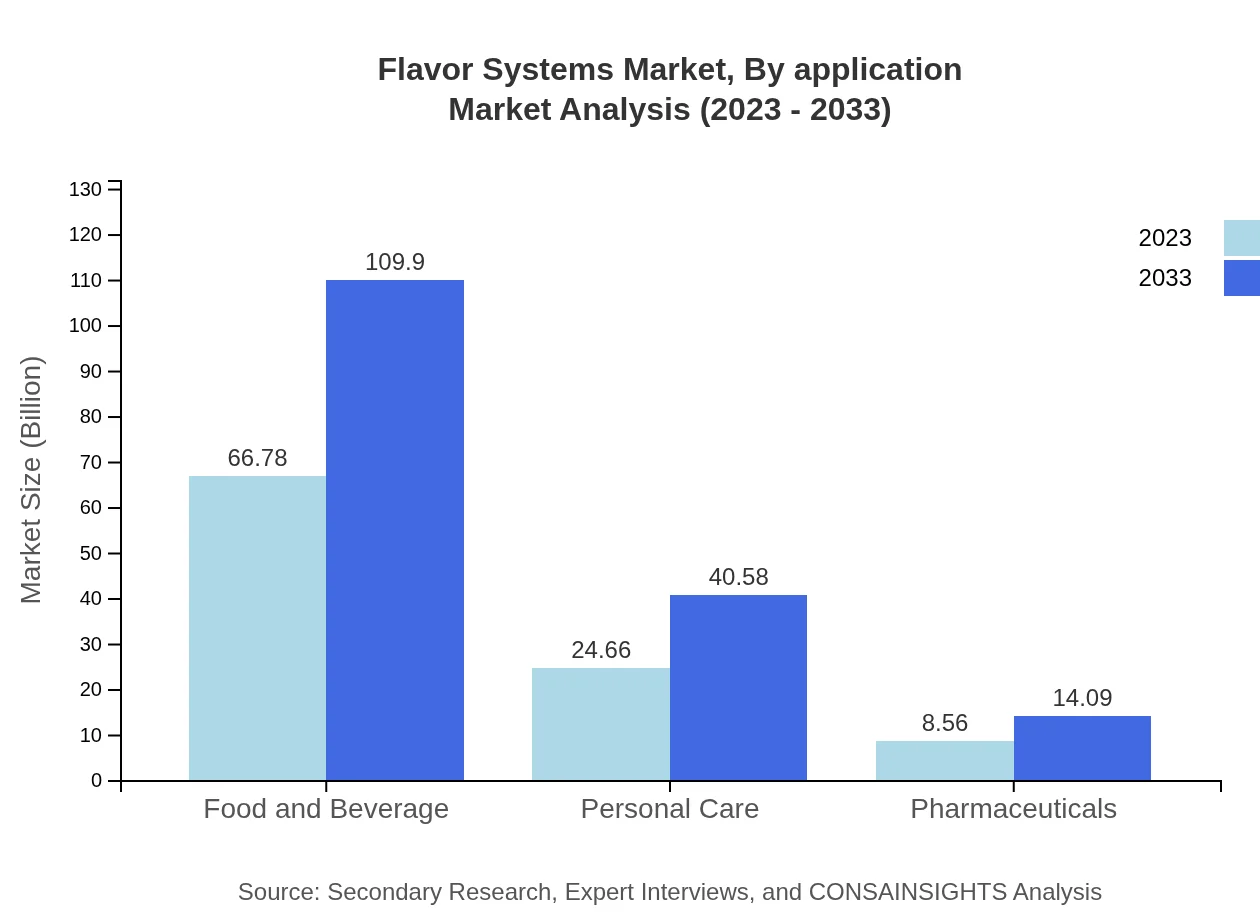

Flavor Systems Market Analysis By Application

The Food and Beverage sector holds a significant share of the market, with revenues projected to rise from $66.78 billion in 2023 to $109.90 billion by 2033. This segment is seeing a shift towards organic and health-focused flavor products. Other applications, such as personal care and pharmaceuticals, are also expanding, leveraging flavors to enhance product appeal.

Flavor Systems Market Analysis By Form

Liquid Flavors are a dominant segment due to their versatility and application in beverages, forecasted to grow from $66.78 billion to $109.90 billion from 2023 to 2033. Powder Flavors, with their ease of use in snack foods and baked goods, will also see a significant rise from $24.66 billion to $40.58 billion, reflecting changing consumer preferences.

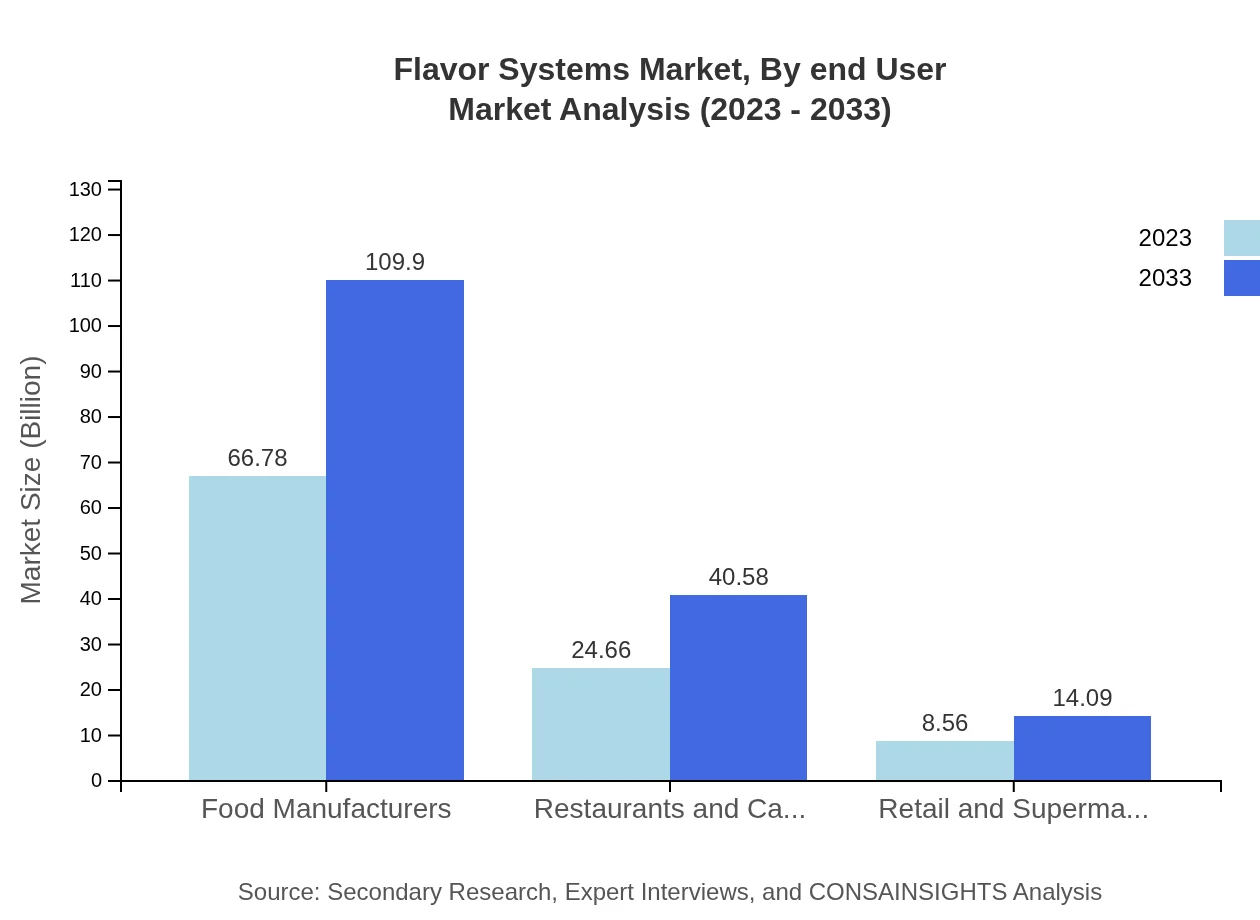

Flavor Systems Market Analysis By End User

Food Manufacturers and Restaurants/Cafés are the primary end-users of flavor systems, with revenues for Food Manufacturers projected to grow from $66.78 billion to $109.90 billion and for Restaurants and Cafés from $24.66 billion to $40.58 billion during the forecast period. This growth is driven by increasing consumer demand for flavored dishes in various dining establishments.

Flavor Systems Market Analysis By Trend

Health and Wellness trends are prominently influencing flavor systems, with an expected growth from $12.53 billion to $20.62 billion by 2033. Additionally, there is a marked increase in the demand for sustainable flavor sources, which aligns with global trends towards environmentally responsible consumption.

Flavor Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flavor Systems Industry

Givaudan:

Givaudan is a global leader in flavor and fragrance creation, known for its innovative flavor solutions in food and beverages. The company invests heavily in R&D to develop new flavors that resonate with changing consumer tastes.IFF (International Flavors & Fragrances):

IFF specializes in flavor innovations that cater to diverse markets. With a strong commitment to sustainability, IFF focuses on creating natural and clean-label flavor products that meet health-conscious consumer demands.Firmenich:

Firmenich is a family-owned company renowned for its quality flavors and fragrances. With a focus on natural solutions, Firmenich actively collaborates with clients to deliver custom flavor profiles tailored to the market.Symrise:

Symrise is a global supplier of fragrances and flavors, dedicated to enhancing food products. The company's emphasis on innovation and sustainability positions it favorably in the competitive landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of Flavor Systems?

The Flavor Systems market is estimated at $100 million in 2023, with a projected CAGR of 5% from 2023 to 2033, indicating robust growth in demand and application across various industries.

What are the key market players or companies in the Flavor Systems industry?

Key players in the Flavor Systems industry include major multinational corporations specializing in flavors and fragrances, such as Firmenich, Givaudan, and International Flavors & Fragrances (IFF), contributing to innovation and market expansion.

What are the primary factors driving the growth in the Flavor Systems industry?

Growth in the Flavor Systems industry is driven by increasing consumer demand for natural ingredients, innovations in food and beverage products, and rising health consciousness among consumers, leading to a shift towards clean label products.

Which region is the fastest Growing in the Flavor Systems market?

Asia Pacific emerges as the fastest-growing region in the Flavor Systems market, expanding from $19.07 million in 2023 to $31.38 million by 2033, fueled by growing urbanization and changing dietary preferences.

Does ConsaInsights provide customized market report data for the Flavor Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the Flavor Systems industry, providing insights that meet the unique needs of various stakeholders.

What deliverables can I expect from this Flavor Systems market research project?

Expect comprehensive deliverables including detailed market analysis, forecasts, competitive landscapes, segmented data insights, and tailored recommendations to support strategic decision-making in the Flavor Systems market.

What are the market trends of Flavor Systems?

Current trends in the Flavor Systems market include a rising preference for natural flavors, a focus on health-oriented products, and innovation in flavor technologies aimed at enhancing consumer experiences.