Flavoring Agents Market Report

Published Date: 31 January 2026 | Report Code: flavoring-agents

Flavoring Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Flavoring Agents market, highlighting trends, forecasts, and key insights from 2023 to 2033. The data covers market size, growth rates, segmentation, regional insights, and major players in the industry.

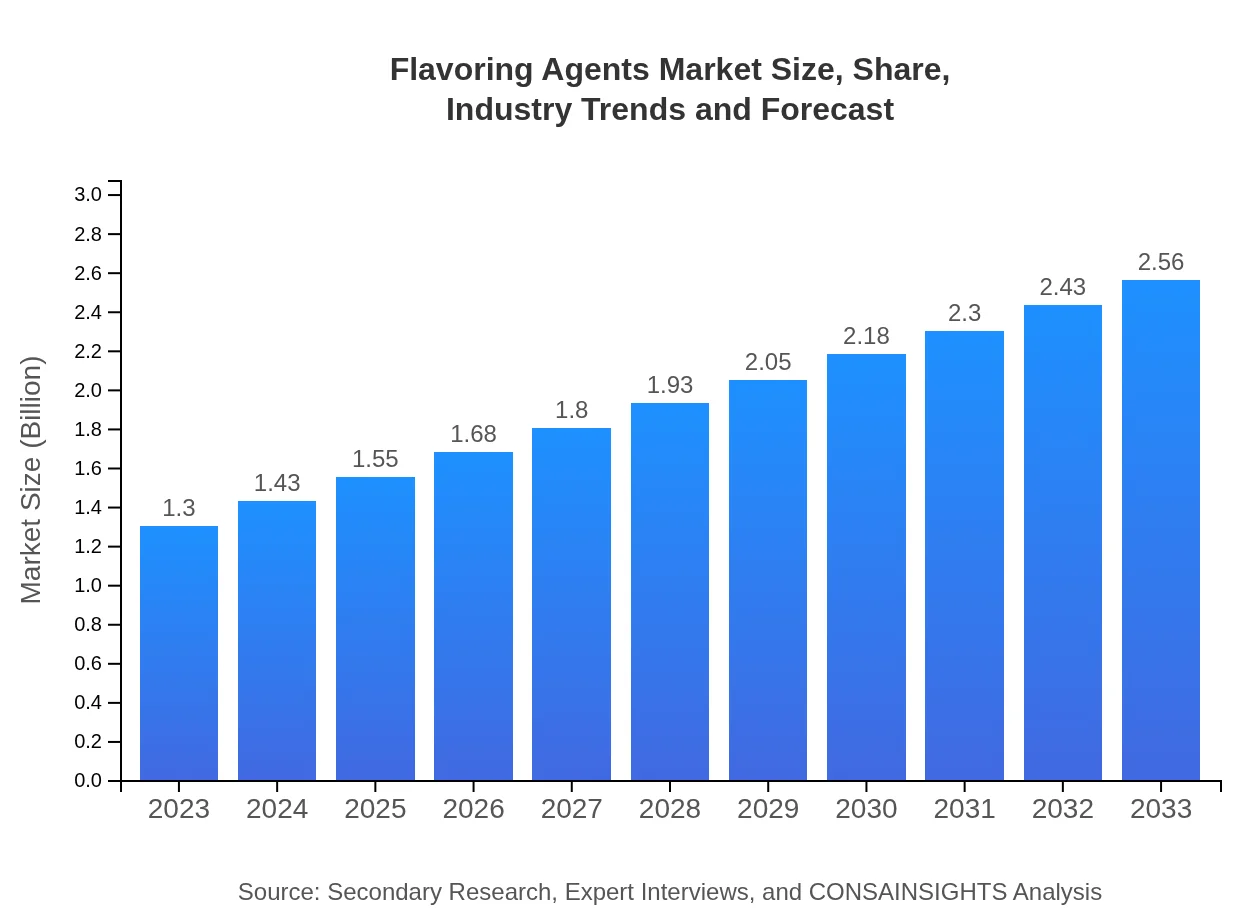

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.56 Billion |

| Top Companies | Givaudan, Firmenich, International Flavors & Fragrances (IFF), Symrise AG |

| Last Modified Date | 31 January 2026 |

Flavoring Agents Market Overview

Customize Flavoring Agents Market Report market research report

- ✔ Get in-depth analysis of Flavoring Agents market size, growth, and forecasts.

- ✔ Understand Flavoring Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flavoring Agents

What is the Market Size & CAGR of Flavoring Agents market in 2023?

Flavoring Agents Industry Analysis

Flavoring Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flavoring Agents Market Analysis Report by Region

Europe Flavoring Agents Market Report:

Europe's Flavoring Agents market is anticipated to grow from USD 0.32 billion in 2023 to USD 0.62 billion in 2033, bolstered by the trend toward organic and clean-label flavors. The focus on natural ingredients is influencing product formulation across the region.Asia Pacific Flavoring Agents Market Report:

The Asia Pacific region is predicted to witness substantial growth, driven by a surge in food and beverage production. The market size is expected to increase from USD 0.27 billion in 2023 to USD 0.52 billion in 2033. Rising populations and urbanization trends heavily contribute to this growth, alongside changing consumer preferences for novel flavors.North America Flavoring Agents Market Report:

North America remains a leading market for flavoring agents, estimated to grow from USD 0.48 billion in 2023 to USD 0.94 billion in 2033. This growth is largely attributed to high demand from the food industry, alongside significant investments in flavor R&D.South America Flavoring Agents Market Report:

South America presents a smaller but growing market for flavoring agents, with the size projected to rise from USD 0.10 billion in 2023 to USD 0.19 billion in 2033. The key drivers include a growing middle class and increasing demand for processed food.Middle East & Africa Flavoring Agents Market Report:

The Middle East and Africa region is expected to see a market size increase from USD 0.14 billion in 2023 to USD 0.28 billion in 2033. Factors such as enhanced social media influence on food trends and tourism are likely contributing to flavor diversity and excitement in the market.Tell us your focus area and get a customized research report.

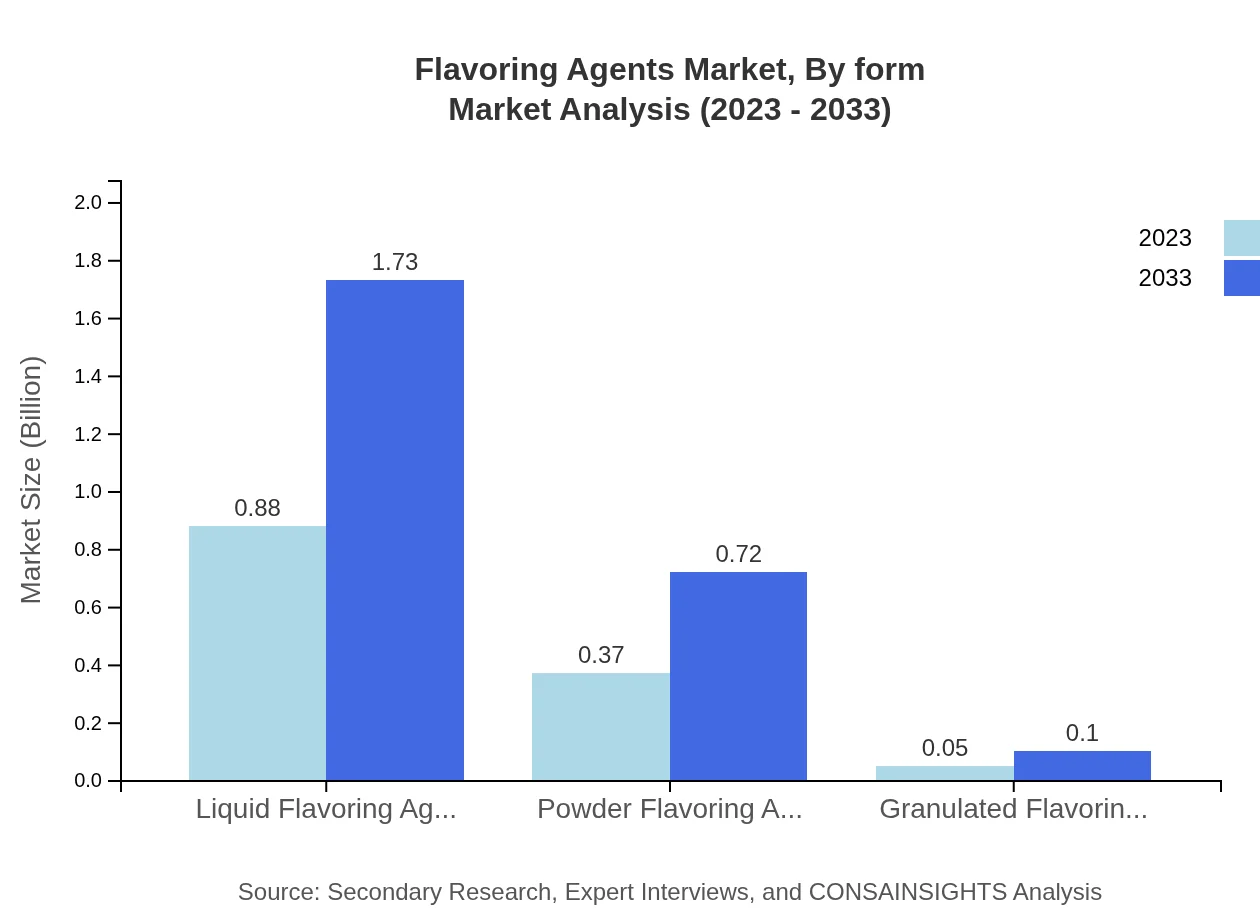

Flavoring Agents Market Analysis By Type

The flavoring agents market is extensively classified by type, including liquid, powder, and granulated variants. Liquid flavoring agents dominate with a market size projected to grow from USD 0.88 billion in 2023 to USD 1.73 billion in 2033, representing 67.6% market share. Powder flavoring agents, while smaller, are also essential, expected to rise from USD 0.37 billion to USD 0.72 billion, commanding 28.32% of the market share.

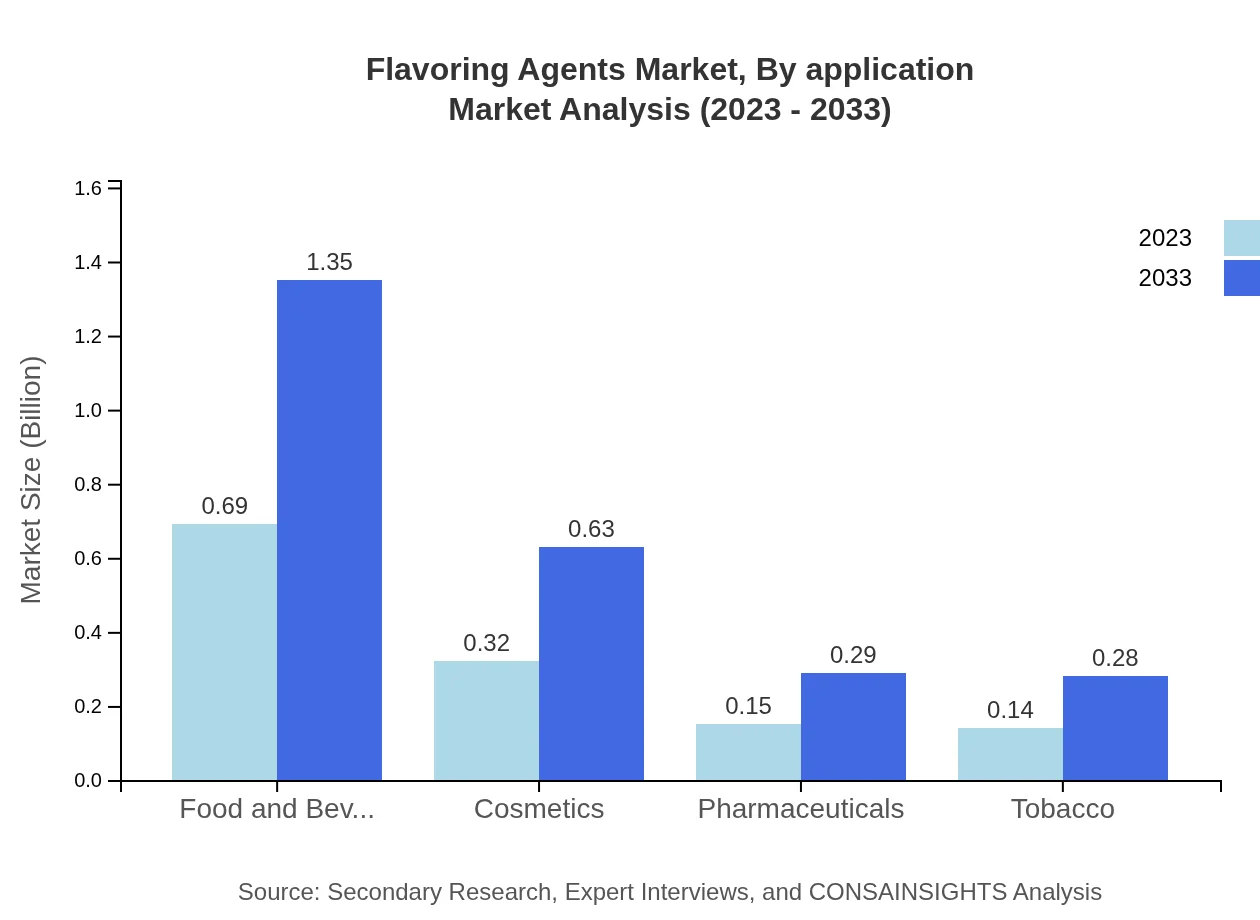

Flavoring Agents Market Analysis By Application

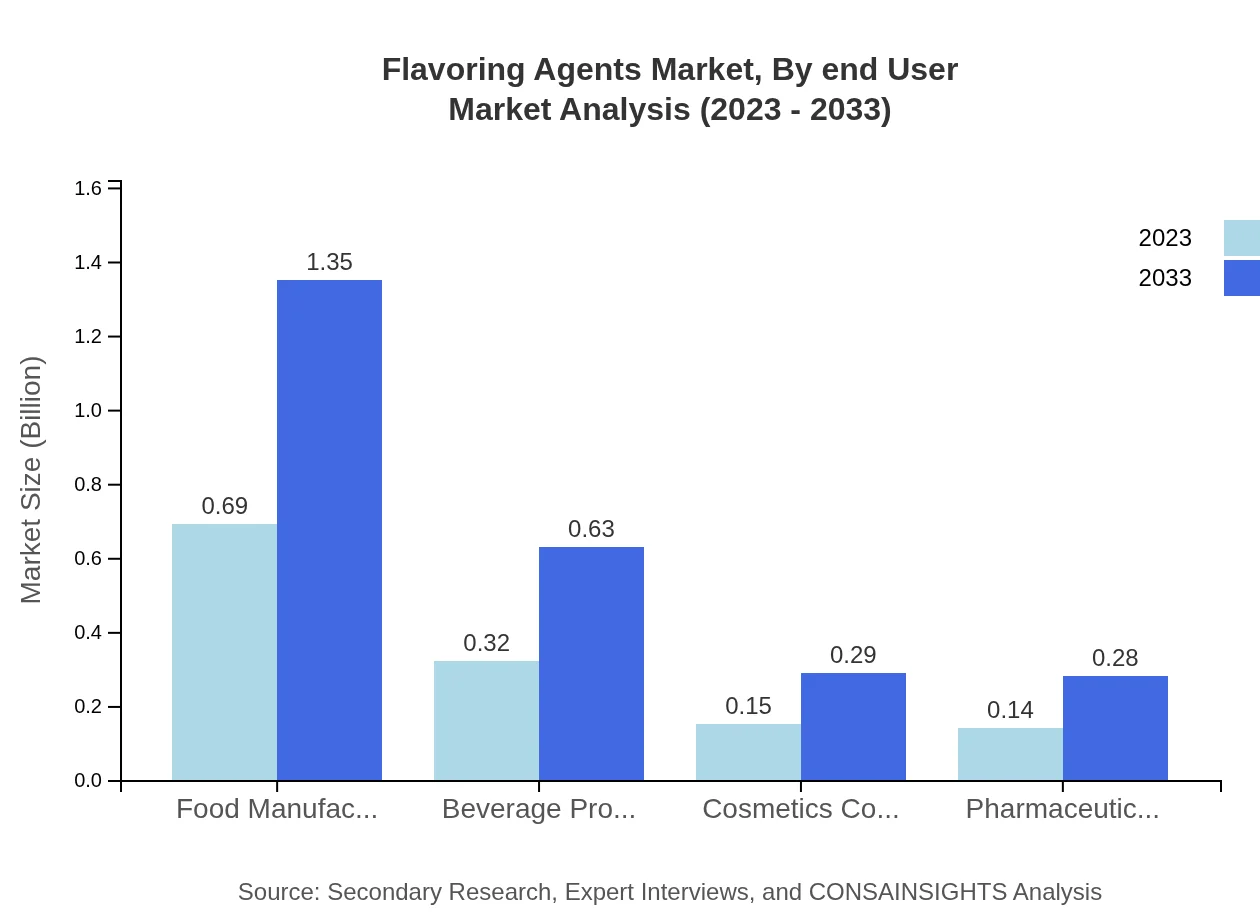

The applications of flavoring agents span multiple industries, with the food and beverage sector accounting for approximately 52.97% of the market in 2023. It is projected to reach USD 1.35 billion by 2033. Other significant applications include beverages, cosmetics, and pharmaceuticals, each reflecting trends of utilizing flavor to enhance product appeal and consumer satisfaction.

Flavoring Agents Market Analysis By Form

Flavoring agents are segmented by form into liquid, powder, and granulated offerings. The preference for liquid flavoring agents is evident in various applications, but the powder form is steadily gaining traction due to its convenience in various recipes and snack products.

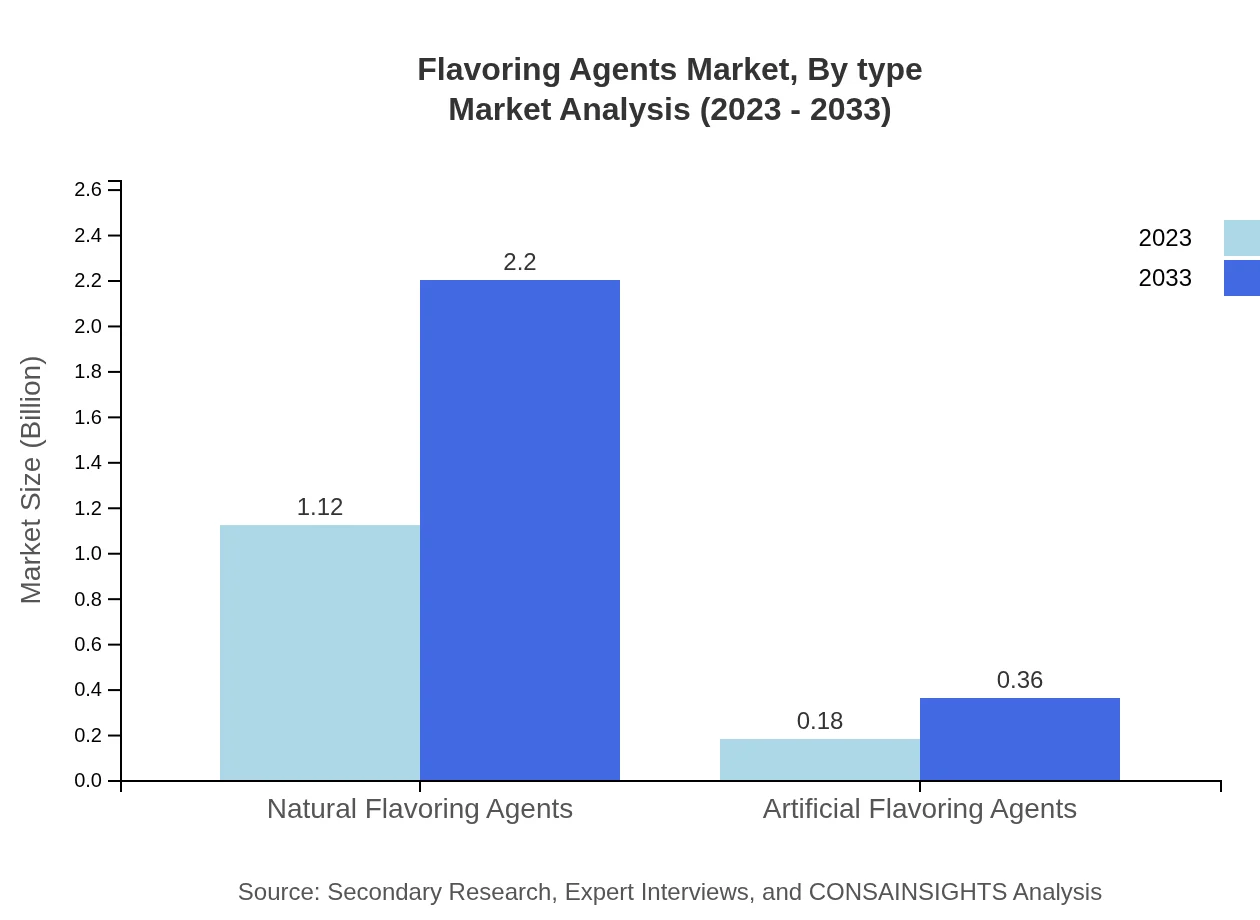

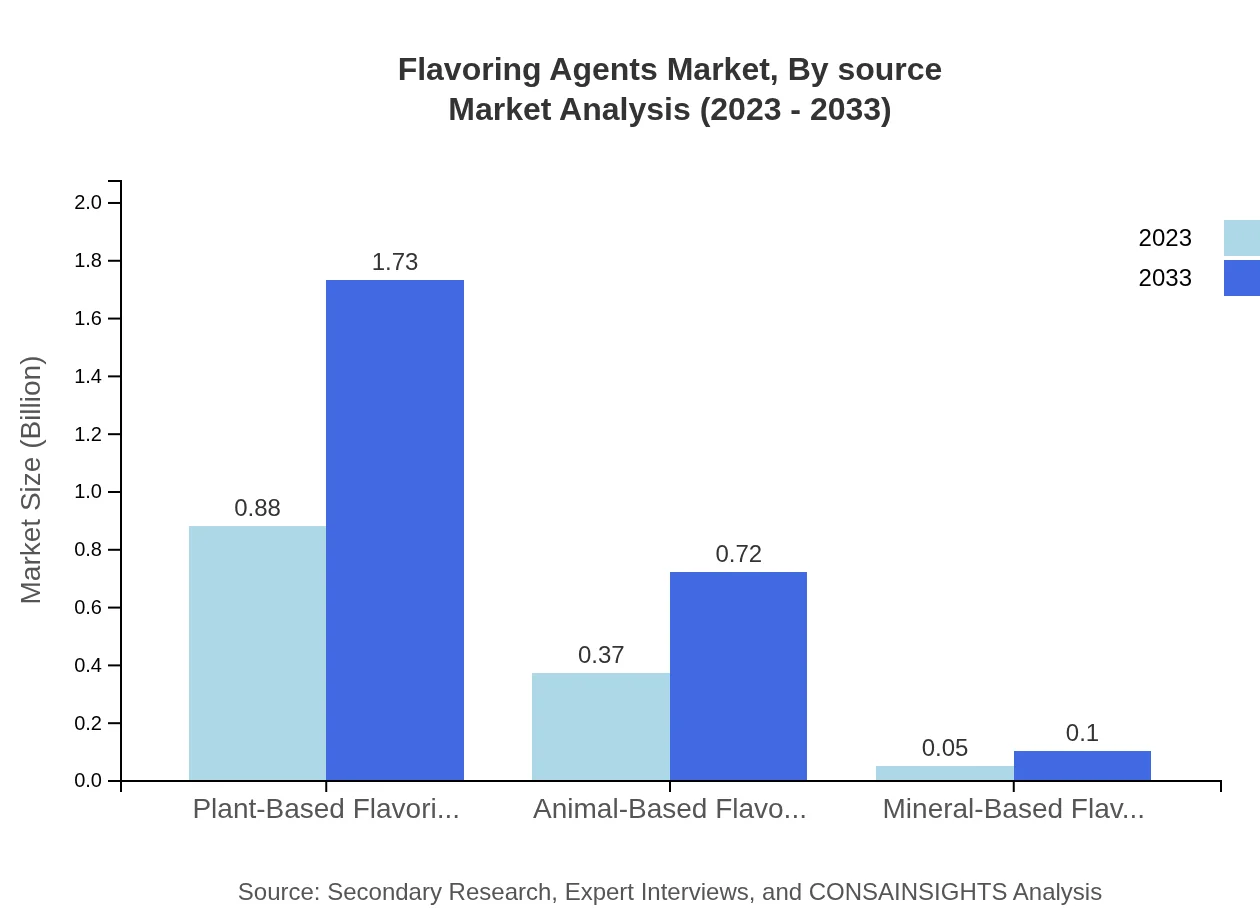

Flavoring Agents Market Analysis By Source

Natural and artificial flavoring agents form the backbone of the market, with natural flavors projected to exceed artificial counterparts due to the rising clean-label trend. Natural flavoring agents, with a market size of USD 1.12 billion in 2023, are expected to grow to USD 2.20 billion by 2033, retaining an 85.96% market share.

Flavoring Agents Market Analysis By End User

The Flavoring Agents market is significantly driven by food manufacturers and beverage producers, collectively comprising a major portion of the market. The food manufacturing sector leads with a size anticipated to grow from USD 0.69 billion in 2023 to USD 1.35 billion by 2033, representing the essentials of flavoring products.

Flavoring Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flavoring Agents Industry

Givaudan:

A leader in the flavoring agents sector, Givaudan specializes in developing flavors for the food and beverage industry, known for its extensive portfolio of natural flavorings.Firmenich:

Notable for its commitment to sustainability, Firmenich develops innovative flavoring ingredients for the food, beverage, and fragrance industries, focusing on natural and organic sources.International Flavors & Fragrances (IFF):

IFF excels in creating flavors and fragrances, known for leveraging cutting-edge technology in flavor development and sustained growth in international markets.Symrise AG:

Symrise takes a holistic approach to flavoring agents, integrating sustainability and innovation to thrive in the global market, particularly in liquid flavors.We're grateful to work with incredible clients.

FAQs

What is the market size of flavoring Agents?

The global flavoring agents market is valued at approximately $1.3 billion in 2023 and is expected to grow at a CAGR of 6.8%, projected to reach higher valuations by 2033.

What are the key market players or companies in the flavoring Agents industry?

Key players in the flavoring agents market include leading companies and manufacturers who specialize in food-grade flavorings, such as food manufacturers, beverage producers, and cosmetics companies, contributing significantly to the overall market.

What are the primary factors driving the growth in the flavoring Agents industry?

The growth of the flavoring agents market is primarily driven by rising demand from food and beverages, evolving consumer preferences for enhanced flavors, and the growing popularity of natural flavoring agents over artificial ones.

Which region is the fastest Growing in the flavoring Agents market?

In the flavoring agents market, Asia-Pacific is emerging as the fastest-growing region, expected to increase from $0.27 billion in 2023 to $0.52 billion by 2033, driven by rapid industrialization and increasing food consumption.

Does ConsaInsights provide customized market report data for the flavoring Agents industry?

Yes, ConsaInsights offers customized market report data tailored to specific client requirements in the flavoring agents industry, ensuring comprehensive insights and actionable data for strategic decision-making.

What deliverables can I expect from this flavoring Agents market research project?

Expect detailed market analysis reports, competitive landscape assessments, regional growth forecasts, segmentation studies, and customized insights that inform strategic planning in the flavoring agents sector.

What are the market trends of flavoring Agents?

Current market trends include a shift towards natural flavoring agents, increased focus on plant-based and clean label products, and innovations in flavor technology, reflecting changing consumer preferences.