Flavour Carriers Market Report

Published Date: 31 January 2026 | Report Code: flavour-carriers

Flavour Carriers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an insightful analysis of the Flavour Carriers market, covering trends, forecasts up to 2033, market size, and CAGR, along with a detailed regional breakdown and company profiles.

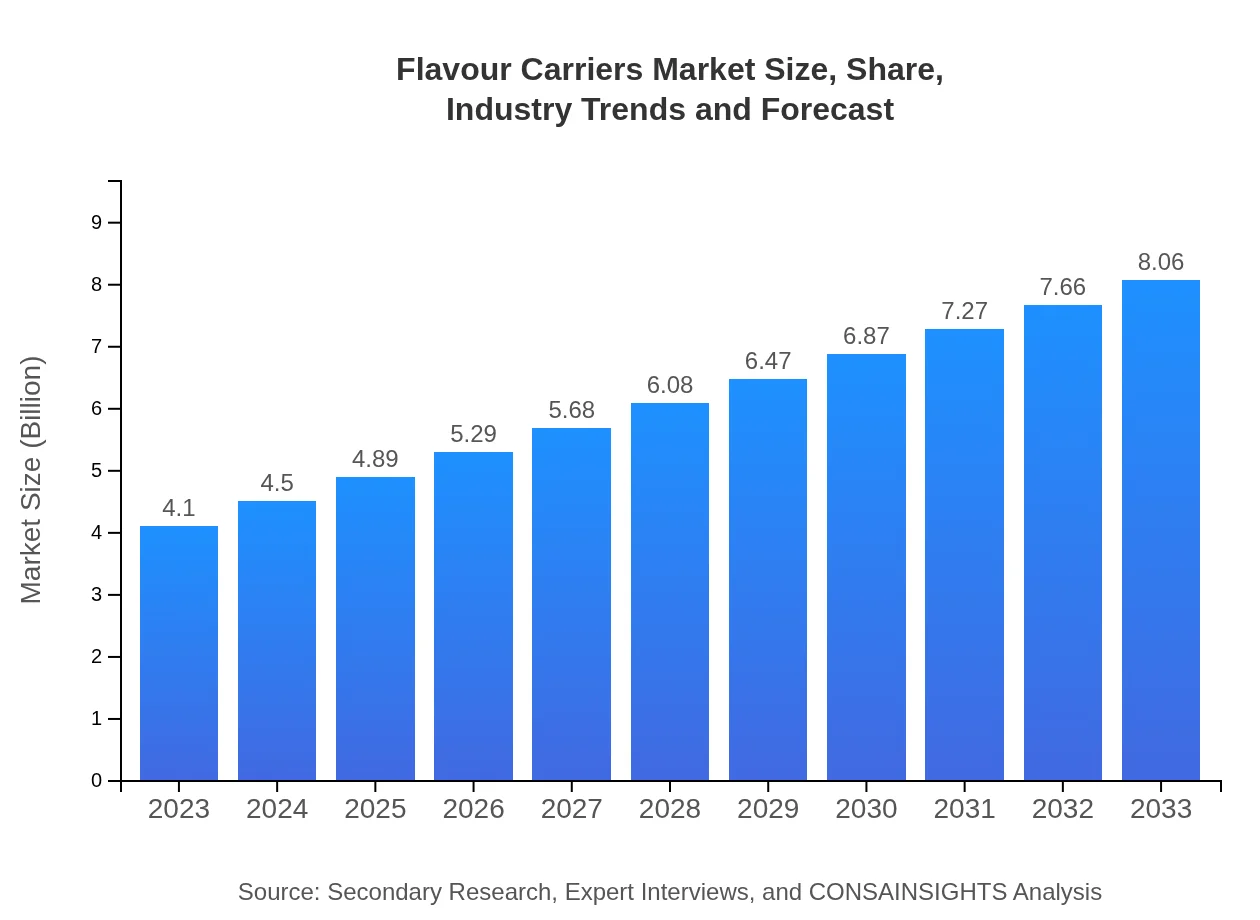

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.10 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.06 Billion |

| Top Companies | Givaudan SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Firmenich SA, T.Hasegawa Co. Ltd. |

| Last Modified Date | 31 January 2026 |

Flavour Carriers Market Overview

Customize Flavour Carriers Market Report market research report

- ✔ Get in-depth analysis of Flavour Carriers market size, growth, and forecasts.

- ✔ Understand Flavour Carriers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flavour Carriers

What is the Market Size & CAGR of Flavour Carriers market in 2023?

Flavour Carriers Industry Analysis

Flavour Carriers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flavour Carriers Market Analysis Report by Region

Europe Flavour Carriers Market Report:

Europe’s flavour carrier market is expected to grow from USD 1.41 billion in 2023 to USD 2.78 billion by 2033. Stringent regulations surrounding food safety and a high demand for organic products are propelling manufacturers to focus on developing innovative flavour delivery systems that align with consumer preferences.Asia Pacific Flavour Carriers Market Report:

In the Asia Pacific region, the market is projected to expand from USD 0.74 billion in 2023 to USD 1.46 billion by 2033. This growth is fueled by the increasing demand for flavour carriers in the food and beverage industry, particularly in countries like China and India, where a growing middle-class population and rising disposable incomes are elevating consumer preferences for quality products.North America Flavour Carriers Market Report:

North America holds a significant portion of the global market and is projected to increase from USD 1.40 billion in 2023 to USD 2.74 billion by 2033. The trend towards natural ingredients and clean labels is particularly strong in the United States, where consumer awareness about health and sustainability continues to drive the demand for natural flavour carriers.South America Flavour Carriers Market Report:

The South American market for flavour carriers is expected to grow from USD 0.12 billion in 2023 to USD 0.23 billion by 2033. The region's growth is driven by a burgeoning food and beverage sector, alongside increasing health and wellness trends that favor the use of natural flavours over synthetic options.Middle East & Africa Flavour Carriers Market Report:

The Middle East and Africa market can expect an increase from USD 0.43 billion in 2023 to USD 0.84 billion by 2033. This growth is attributable to the rising urbanization and changes in dietary habits that favor convenience foods, thereby increasing the consumption of processed food products requiring flavour carriers.Tell us your focus area and get a customized research report.

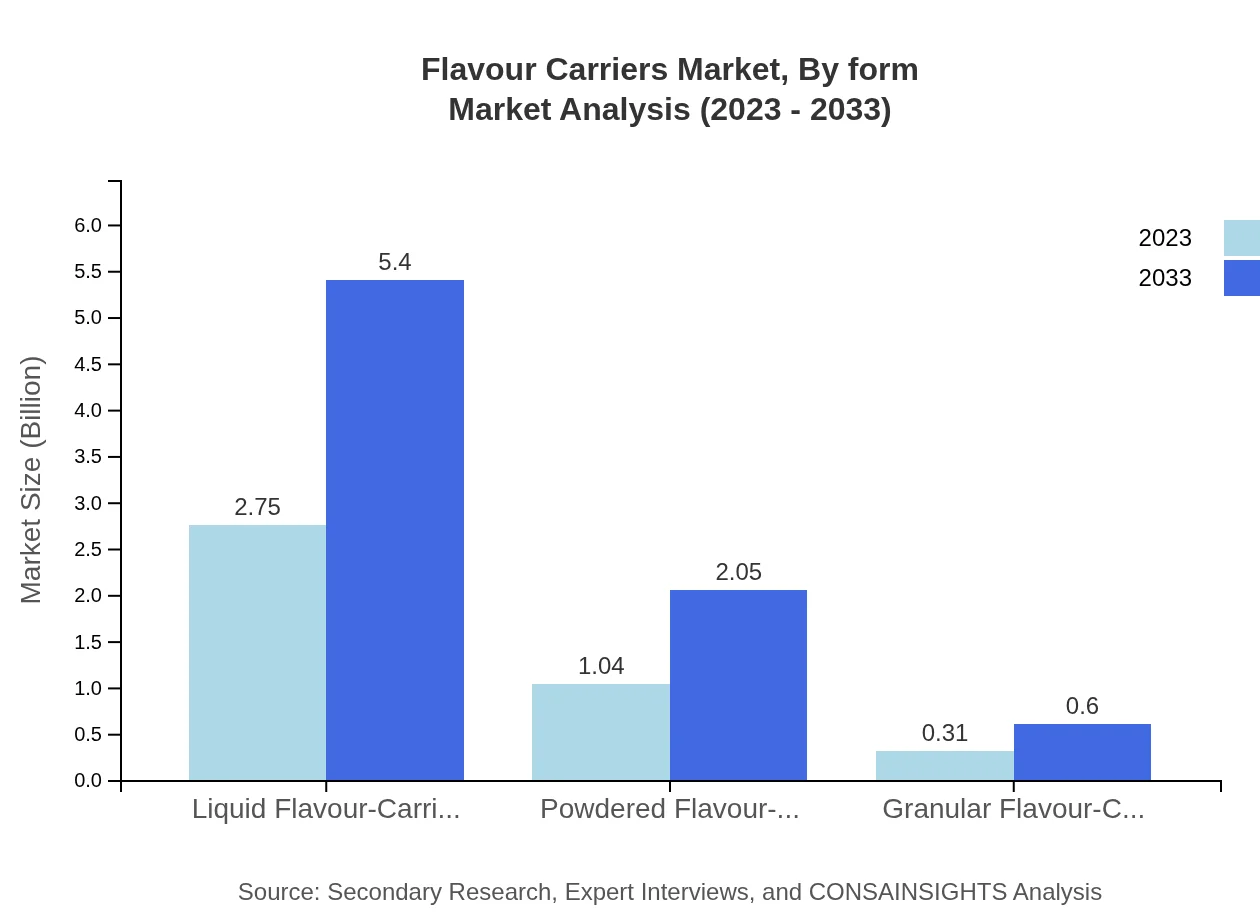

Flavour Carriers Market Analysis By Type

The market showcases a diverse range of flavour carriers including Liquid, Powdered, and Granular forms. Liquid Flavour-Carriers are projected to hold a dominant market share of 67.02% in 2023, with a size of USD 2.75 billion, growing to USD 5.40 billion by 2033. Powdered flavour carriers will also see growth, increasing from USD 1.04 billion in 2023 to USD 2.05 billion by 2033, while Granular flavor carriers present a smaller but significant segment.

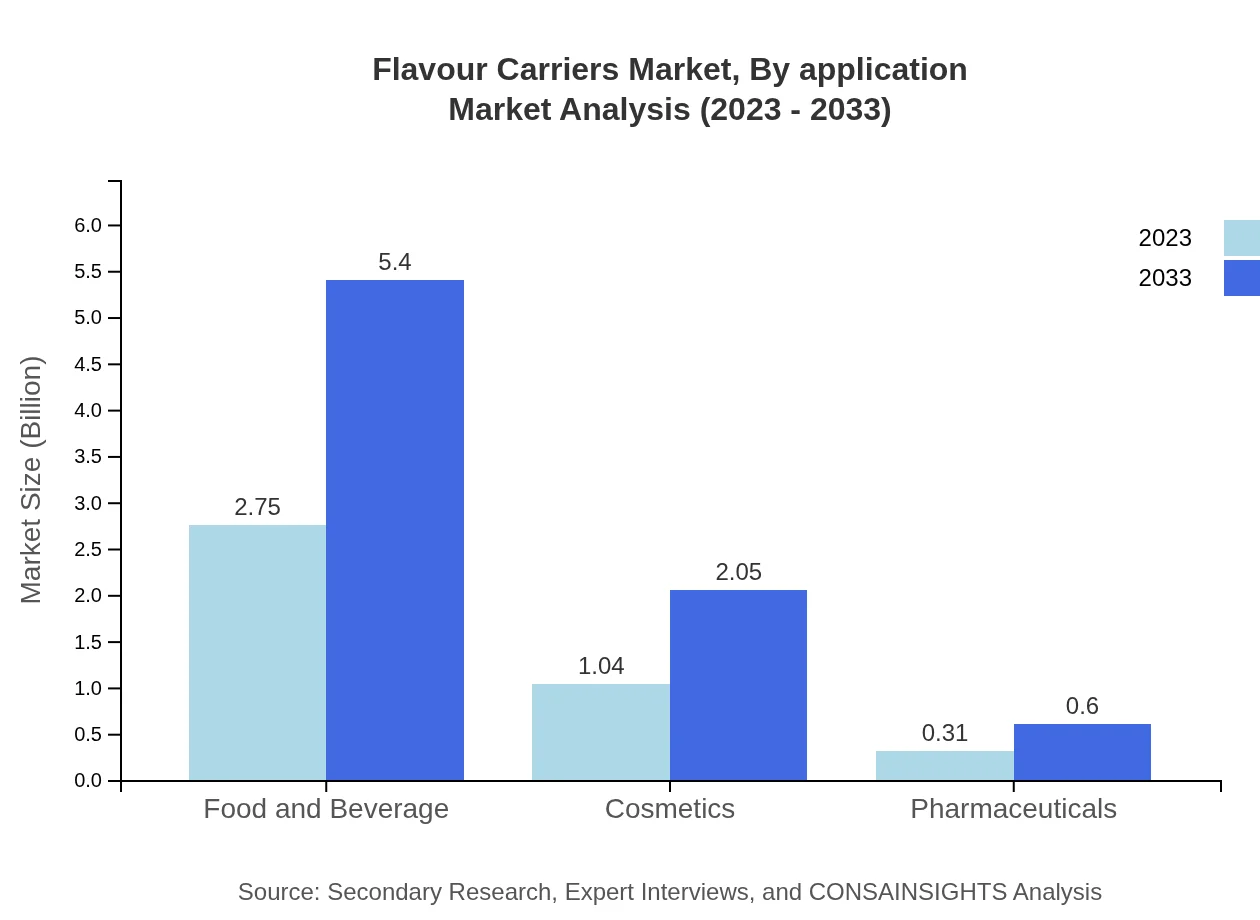

Flavour Carriers Market Analysis By Application

The Food and Beverage sector remains the largest segment, accounting for 67.02% market share in 2023, driven by the high demand for innovative and flavorful products. Cosmetics and personal care are also growing segments, with a share of 25.48% in the same year, benefiting from natural flavour trends in personal care formulations.

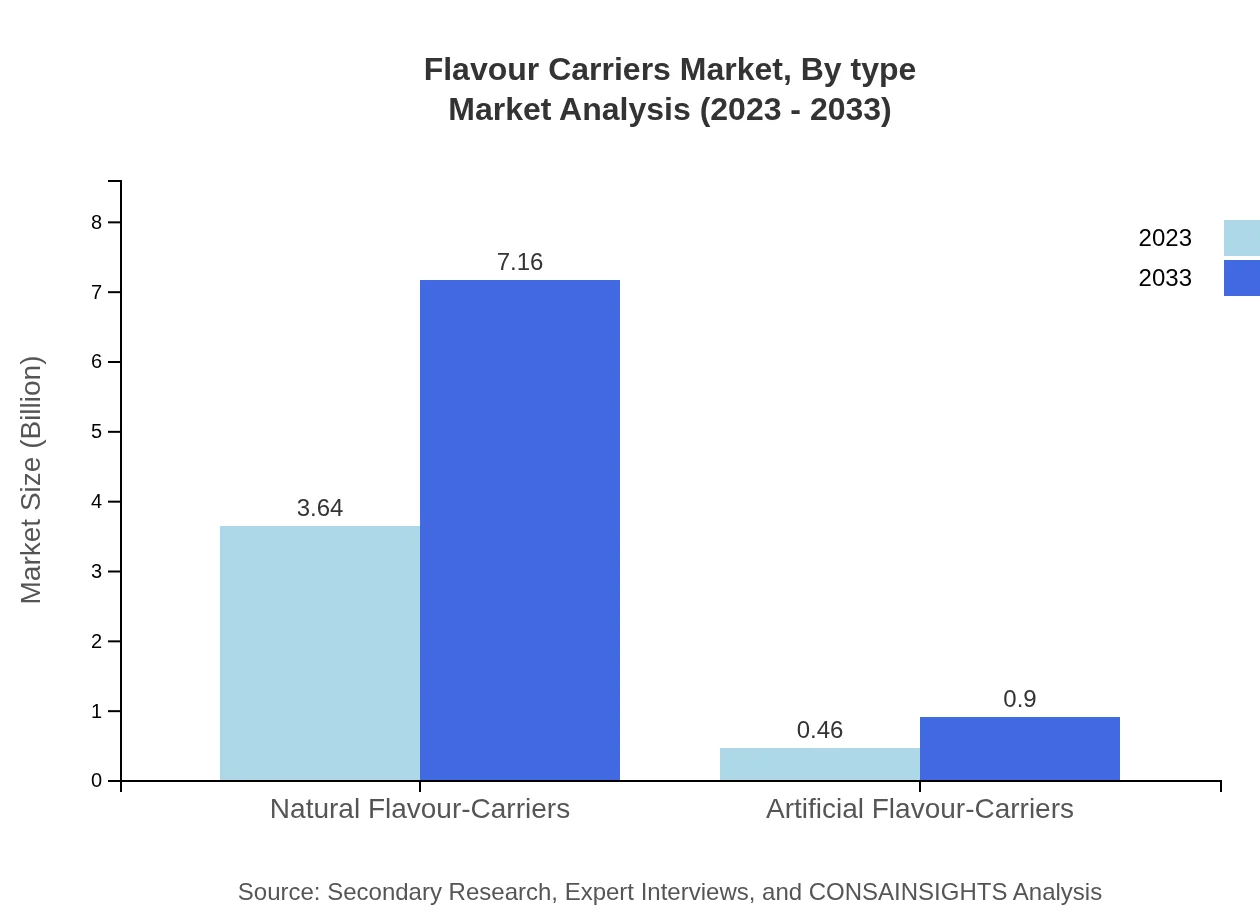

Flavour Carriers Market Analysis By Form

Natural flavour carriers are predominant, expected to maintain an 88.88% market share throughout the forecast period, reflecting the consumer shift towards clean labels. In contrast, artificial flavour carriers, despite their lower market share at 11.12%, are still relevant in applications where cost-effective solutions are paramount.

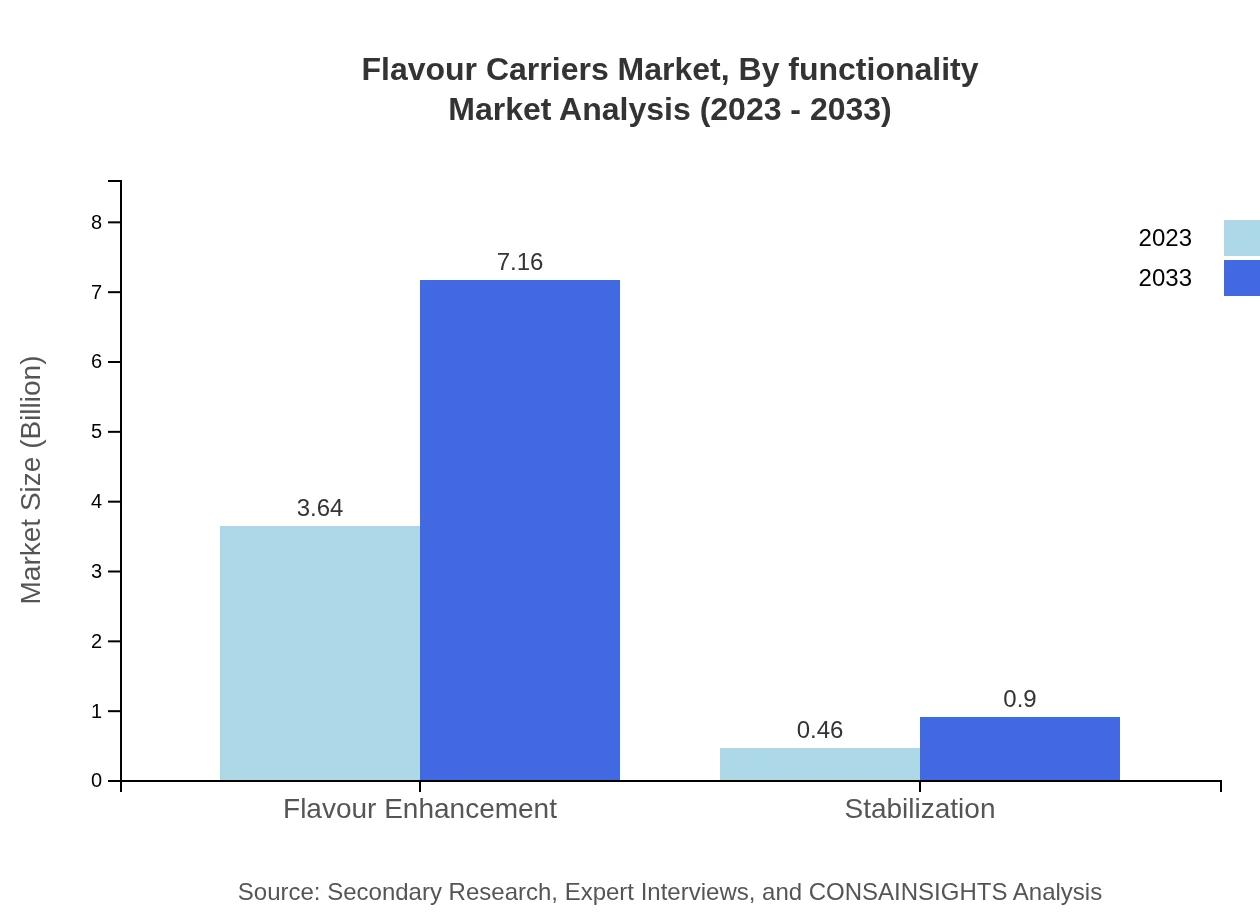

Flavour Carriers Market Analysis By Functionality

Flavour enhancement functionalities account for the majority share as consumers increasingly demand products that improve taste profiles. The flavour enhancement segment holds a remarkable 88.88% market share in 2023 while stabilization functionalities cater to a growing need for prolonged product life, comprising a noteworthy 11.12% share.

Flavour Carriers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flavour Carriers Industry

Givaudan SA:

A leader in flavors and fragrances, Givaudan specializes in developing innovative flavour systems that cater to evolving consumer tastes and preferences.International Flavors & Fragrances Inc. (IFF):

IFF provides a full range of flavour solutions across multiple segments, focusing on sustainable practices and clean label products.Symrise AG:

Symrise combines innovative technologies with sensory expertise to deliver high-quality flavour carriers used in various industries.Firmenich SA:

Firmenich emphasizes natural and sustainable ingredients, creating distinctive flavour solutions for the food and beverage industry.T.Hasegawa Co. Ltd.:

Specializing in a wide range of flavor products, T.Hasegawa contributes to the global flavour carriers market with a focus on innovation in natural flavors.We're grateful to work with incredible clients.

FAQs

What is the market size of flavour Carriers?

The flavour-carriers market is currently valued at $4.1 billion and is projected to grow at a CAGR of 6.8% over the next decade, indicating strong demand and expansion in consumer preferences.

What are the key market players or companies in the flavour Carriers industry?

Key players in the flavour-carriers industry include major companies like Firmenich, Givaudan, and International Flavors & Fragrances (IFF), which dominate market share through innovation and extensive distribution networks.

What are the primary factors driving the growth in the flavour Carriers industry?

Growth in the flavour-carriers industry is driven by rising consumer demand for natural ingredients, increased application in food and beverages, and innovation in food preservation technologies enhancing product shelf life.

Which region is the fastest Growing in the flavour Carriers?

The Asia-Pacific region is the fastest-growing market for flavour-carriers, with a projected increase from $0.74 billion in 2023 to $1.46 billion by 2033, driven by expanding food and beverage sectors.

Does ConsaInsights provide customized market report data for the flavour Carriers industry?

Yes, ConsaInsights offers customized market report data for the flavour-carriers industry, tailoring insights to specific business needs and addressing unique market opportunities for clients.

What deliverables can I expect from this flavour Carriers market research project?

Clients can expect comprehensive reports including market size forecasts, competitive analysis, regional insights, and detailed segmentation data, equipping businesses for strategic decision-making.

What are the market trends of flavour Carriers?

Trends in the flavour-carriers market include a shift towards natural flavouring agents, increasing use in health-focused products, and growing demand for clean-label products, reflecting consumer awareness and preferences.