Flea And Tick Product Market Report

Published Date: 31 January 2026 | Report Code: flea-and-tick-product

Flea And Tick Product Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the flea and tick product market, focusing on market trends, size, industry dynamics, and forecasts from 2023 to 2033. Insights on regional performance, product segmentation, and competitive landscape are provided to aid stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

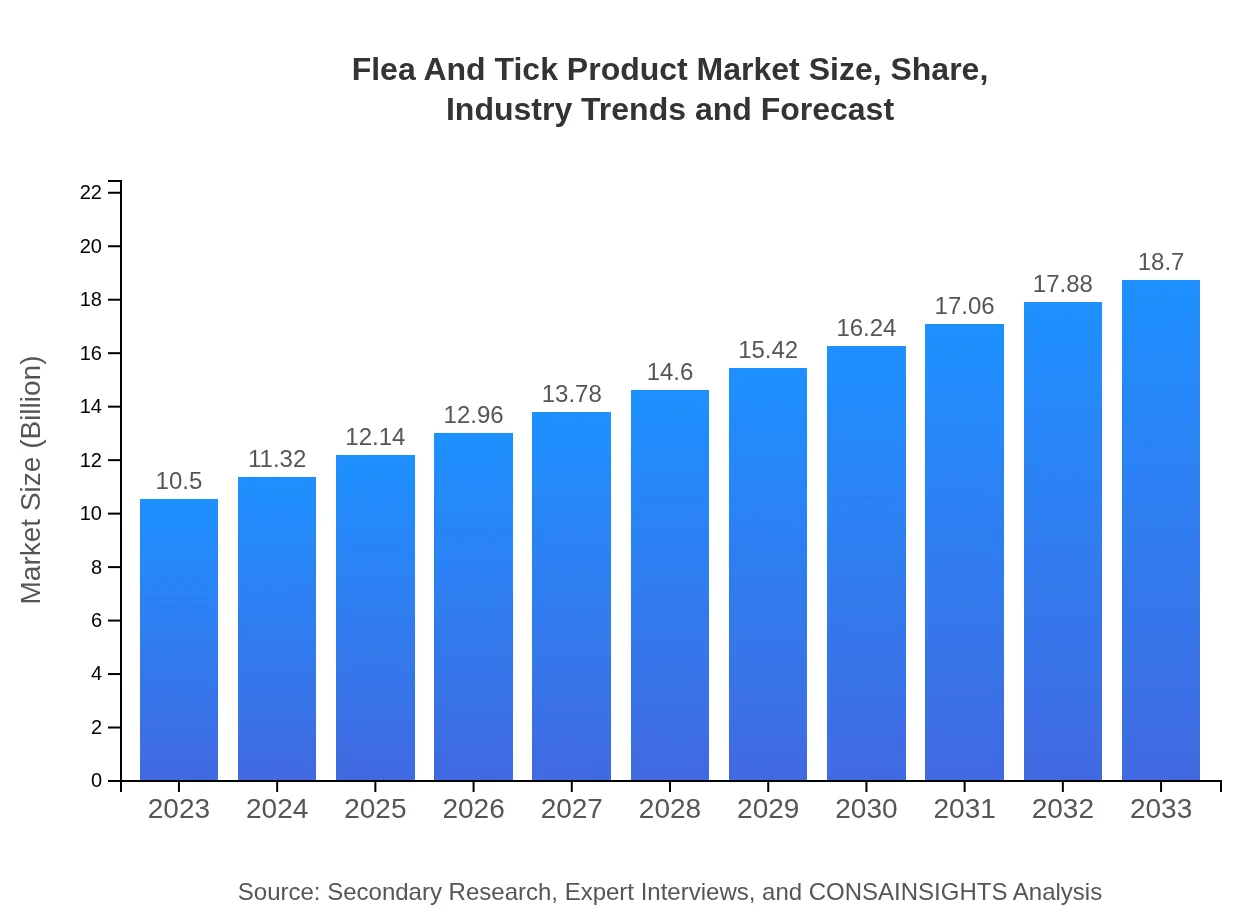

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Boehringer Ingelheim, Merck Animal Health, Zoetis, PetIQ, Eli Lilly and Company |

| Last Modified Date | 31 January 2026 |

Flea And Tick Product Market Overview

Customize Flea And Tick Product Market Report market research report

- ✔ Get in-depth analysis of Flea And Tick Product market size, growth, and forecasts.

- ✔ Understand Flea And Tick Product's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flea And Tick Product

What is the Market Size & CAGR of Flea And Tick Product market in 2023?

Flea And Tick Product Industry Analysis

Flea And Tick Product Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flea And Tick Product Market Analysis Report by Region

Europe Flea And Tick Product Market Report:

Europe’s flea and tick product market is poised to expand from $3.49 billion in 2023 to $6.22 billion by 2033. Consumer trends toward chemical-free solutions and the adoption of preventive care drive this growth.Asia Pacific Flea And Tick Product Market Report:

In 2023, the Asia Pacific flea and tick product market is valued at $1.94 billion, projected to grow to $3.45 billion by 2033. Factors influencing growth in this region include increasing pet ownership and evolving lifestyles that prioritize pet health, alongside rising disposable incomes.North America Flea And Tick Product Market Report:

North America, being a significant market, has an estimated value of $3.51 billion in 2023, growing to $6.26 billion by 2033. The region benefits from a high rate of pet ownership and substantial expenditure on premium pet health products.South America Flea And Tick Product Market Report:

The South American market is expected to increase from $1.02 billion in 2023 to $1.81 billion in 2033. Growth drivers include a growing awareness of pet healthcare and the rising prevalence of flea and tick infestations as urban pet ownership rises.Middle East & Africa Flea And Tick Product Market Report:

The Middle East and Africa region holds a market value of $0.54 billion in 2023, with growth projected to reach $0.96 billion by 2033. Although smaller in size, the market is expanding due to the increasing recognition of pest control’s importance in overall pet health.Tell us your focus area and get a customized research report.

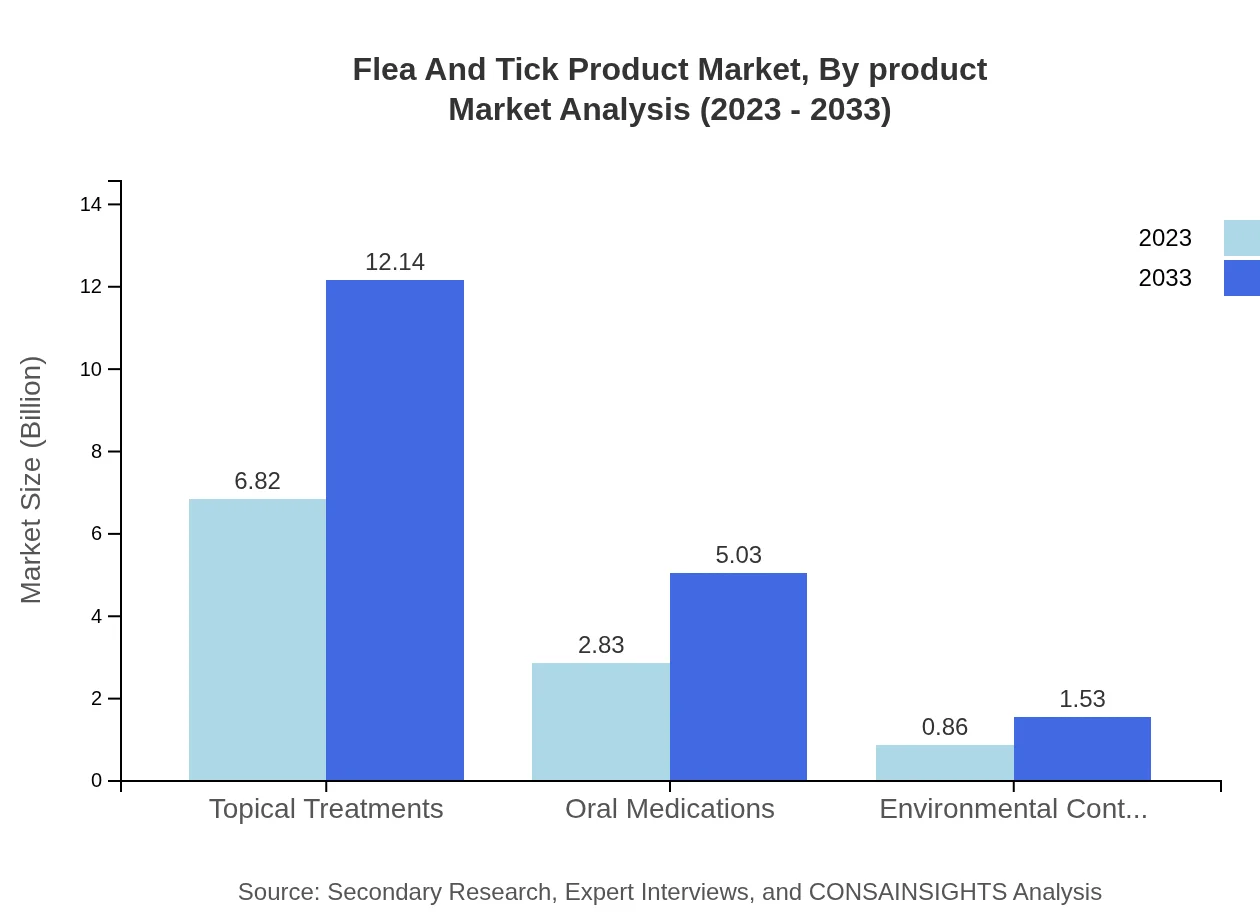

Flea And Tick Product Market Analysis By Product

The product segment of the flea and tick market consists primarily of topical treatments (worth $6.82 billion in 2023, expected to reach $12.14 billion by 2033), followed by oral medications and environmental control products. Topical treatments dominate due to their effectiveness and ease of use in a home setting.

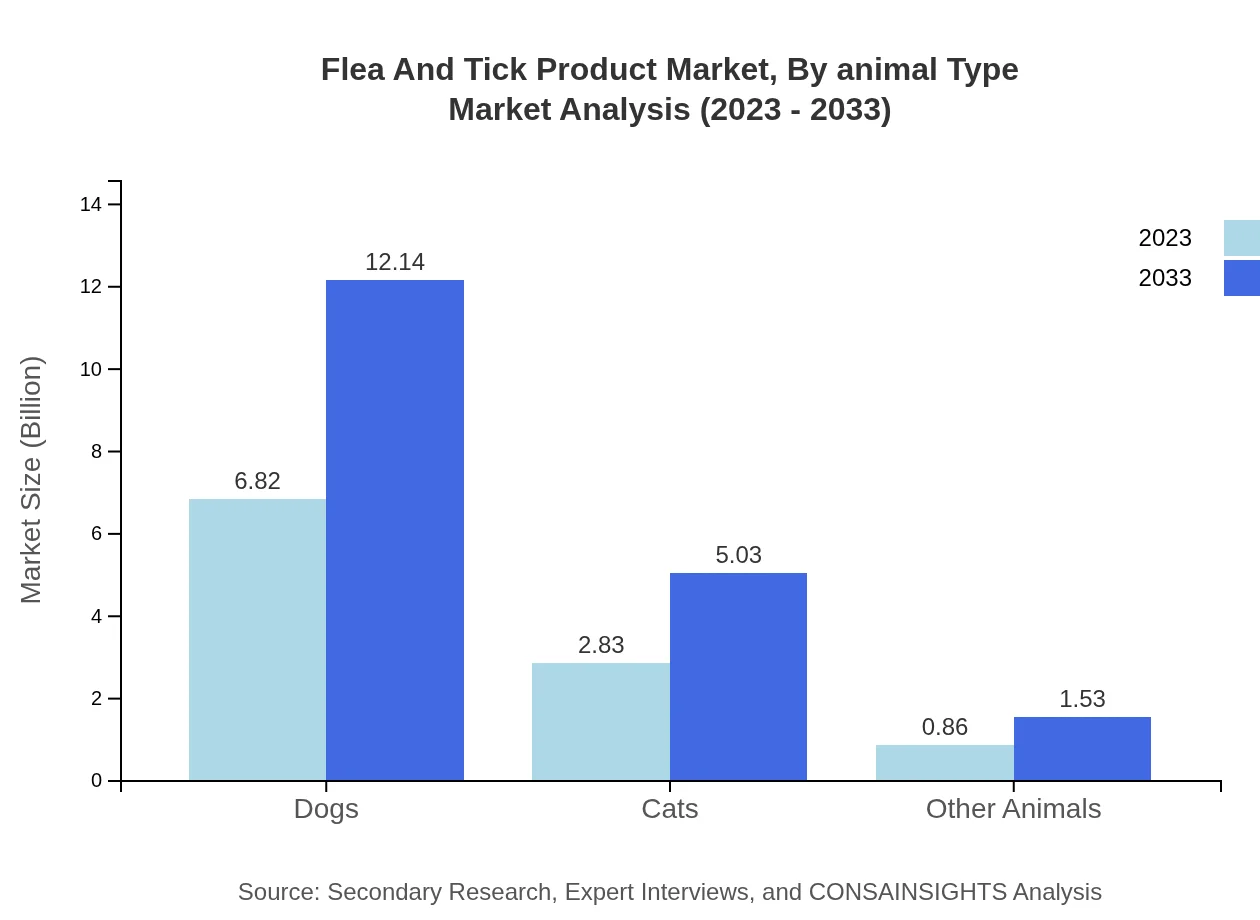

Flea And Tick Product Market Analysis By Animal Type

When segmented by animal type, the market reveals that products for dogs constitute the majority share, valued at $6.82 billion in 2023 compared to $2.83 billion for cats and $0.86 billion for other animals. This trend is anticipated to continue as dog ownership remains prevalent in many markets.

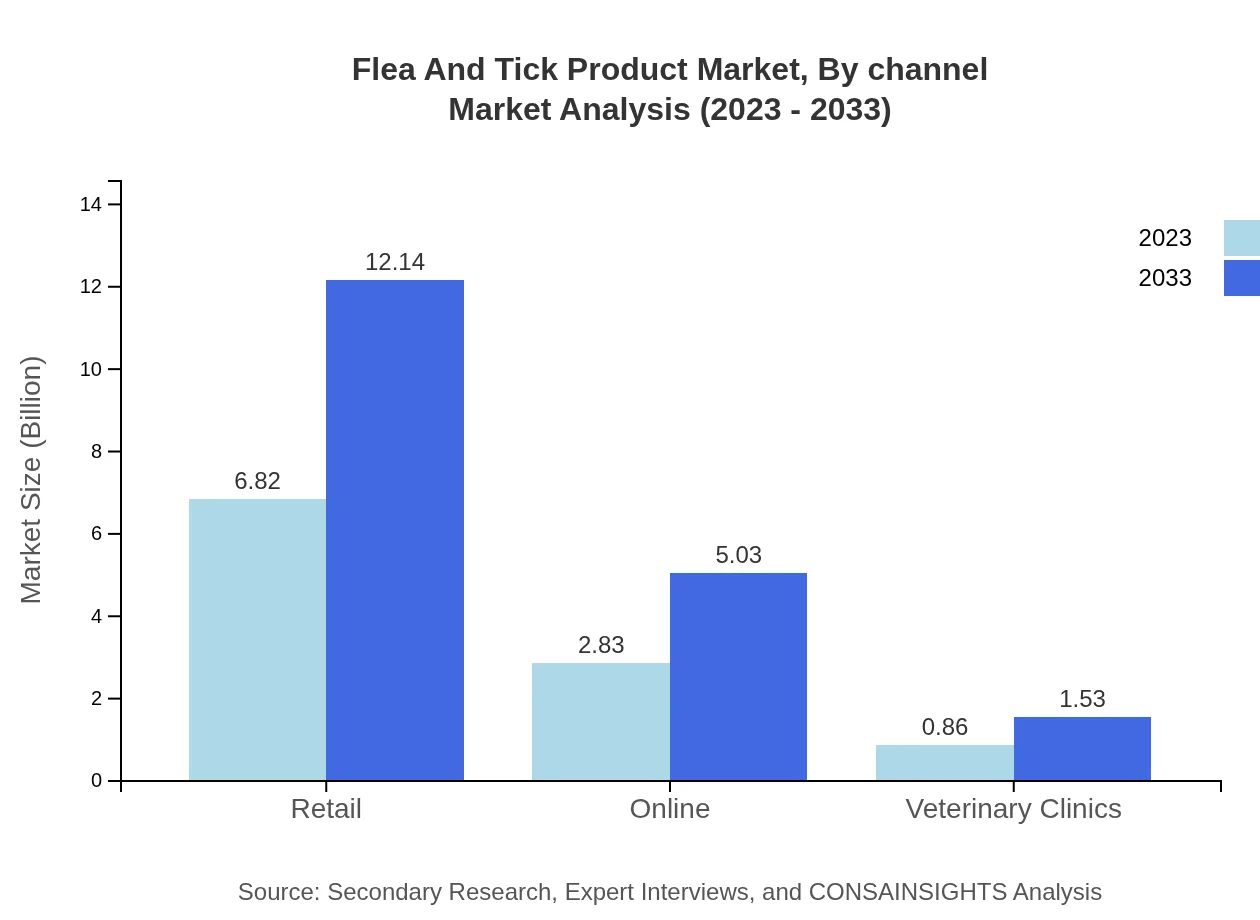

Flea And Tick Product Market Analysis By Channel

Retail remains the dominant channel for flea and tick products, accounting for $6.82 billion in 2023, while online sales are also growing rapidly, valued at $2.83 billion. The ease of online shopping and home delivery services is encouraging consumers to opt for these channels.

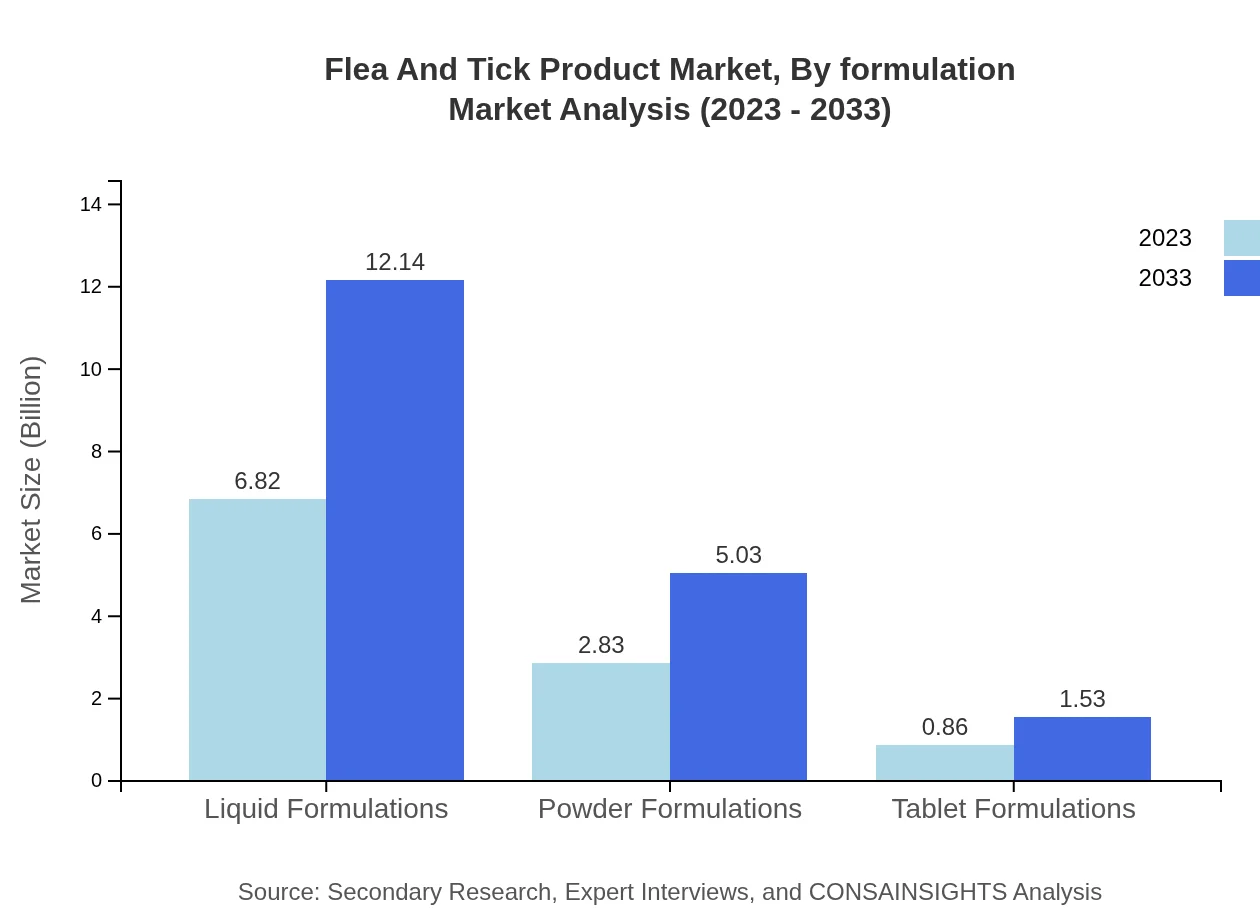

Flea And Tick Product Market Analysis By Formulation

Formulation-wise, liquid formulations lead the market representing $6.82 billion in 2023, while powder and tablet formulations are valued at $2.83 billion and $0.86 billion, respectively. Innovations in formulation technologies are expected to enhance product appeal and functionality.

Flea And Tick Product Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flea And Tick Product Industry

Boehringer Ingelheim:

A leading global player in the veterinary medicine sector, known for its innovative flea and tick preventive treatments and commitment to pet health.Merck Animal Health:

Part of Merck & Co., this company offers a range of products addressing flea and tick prevention, backed by extensive research and veterinary collaboration.Zoetis:

Specializes in animal health, providing effective treatments and preventive care solutions for flea and tick control in pets.PetIQ:

Focuses on affordable pet preventive care solutions, including flea and tick products distributed through retail and online channels.Eli Lilly and Company:

Offers a variety of veterinary products, emphasizing safety and effectiveness in flea and tick control.We're grateful to work with incredible clients.

FAQs

What is the market size of flea And Tick Product?

The global flea and tick product market is projected to reach approximately $10.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.8% from 2023.

What are the key market players or companies in this flea And Tick Product industry?

Key market players in the flea and tick product industry include well-established companies such as Bayer AG, Zoetis, Elanco Animal Health, Merck Animal Health, and PetIQ, which consistently innovate and expand their product offerings.

What are the primary factors driving the growth in the flea And Tick Product industry?

Primary factors driving growth include increasing pet ownership, rising awareness of pet health, technological advancements in product formulations, and a growing demand for natural and organic pest control solutions, which cater to health-conscious consumers.

Which region is the fastest Growing in the flea And Tick Product?

The fastest-growing region in the flea and tick product market is Europe, expected to grow from $3.49 billion in 2023 to $6.22 billion by 2033, driven by high pet ownership rates and growing disposable incomes.

Does ConsaInsights provide customized market report data for the flea And Tick Product industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the flea and tick product industry, ensuring comprehensive insights catered to individual business needs.

What deliverables can I expect from this flea And Tick Product market research project?

Deliverables from this market research project include detailed market analysis reports, segment data analysis, growth forecasts, competitive landscape insights, and consumer trend assessments specific to flea and tick products.

What are the market trends of flea And Tick Product?

Current market trends include a shift towards online purchasing platforms, increased demand for topical treatments, and a rise in eco-friendly products, reflecting pet owners' growing concerns for health and environmental impact.