Fleet Management Market Report

Published Date: 02 February 2026 | Report Code: fleet-management

Fleet Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fleet Management market, offering insights on market size, trends, and forecasts from 2023 to 2033, along with regional and segment-wise breakdowns.

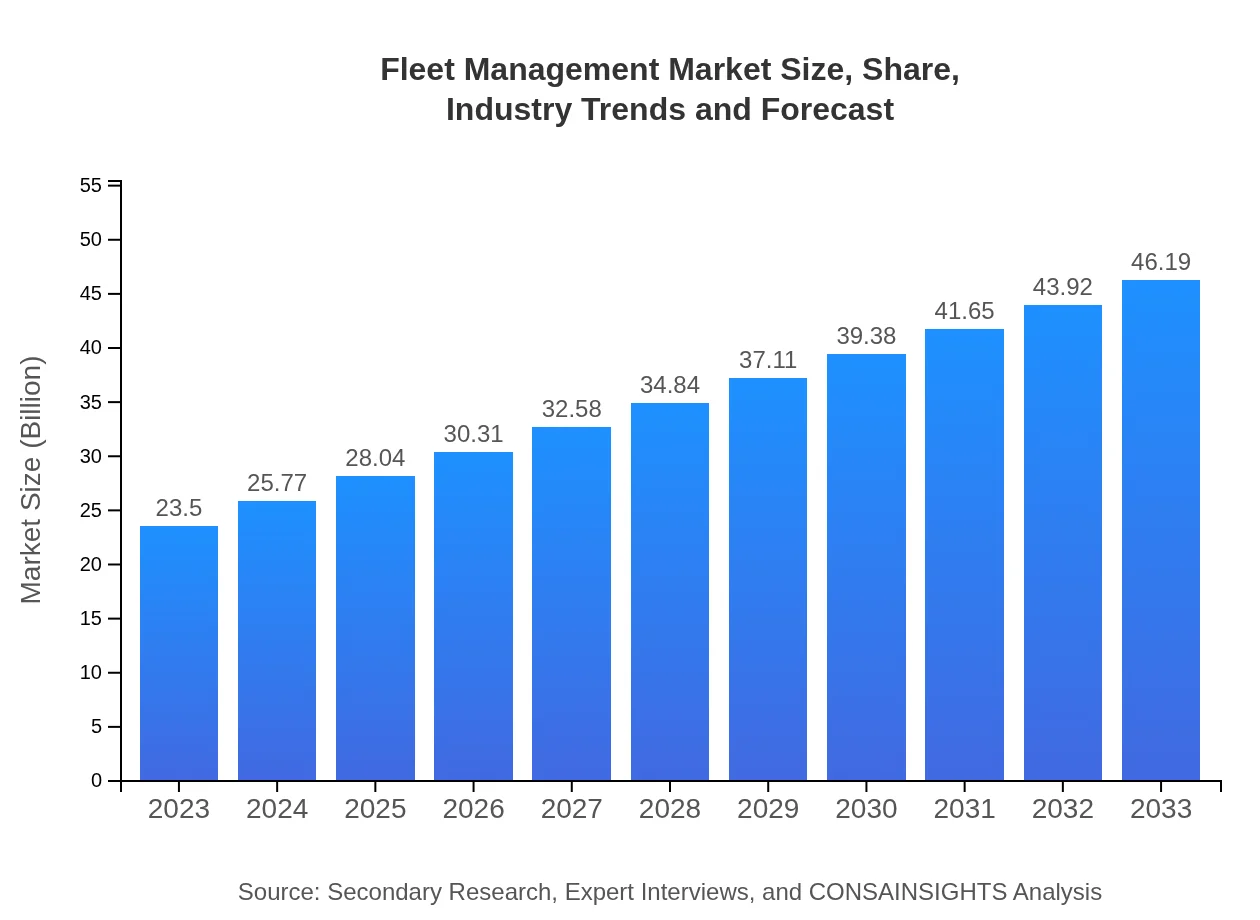

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $46.19 Billion |

| Top Companies | Verizon Connect, Teletrac Navman, Geotab, Samsara , Fleet Complete |

| Last Modified Date | 02 February 2026 |

Fleet Management Market Overview

Customize Fleet Management Market Report market research report

- ✔ Get in-depth analysis of Fleet Management market size, growth, and forecasts.

- ✔ Understand Fleet Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fleet Management

What is the Market Size & CAGR of Fleet Management market in 2023?

Fleet Management Industry Analysis

Fleet Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fleet Management Market Analysis Report by Region

Europe Fleet Management Market Report:

In Europe, the market is projected to increase from $6.77 billion in 2023 to $13.31 billion by 2033. Stringent regulations related to emissions and driver safety are propelling the demand for advanced fleet management solutions.Asia Pacific Fleet Management Market Report:

The Asia Pacific region is expected to experience significant growth in the Fleet Management market, with an estimated market size of $4.66 billion in 2023, projected to reach $9.15 billion by 2033. The rapid expansion of logistics networks and the increasing adoption of technology in transportation are key drivers of this growth.North America Fleet Management Market Report:

North America, with a market size of $8.18 billion in 2023, is expected to grow to $16.08 billion by 2033. This growth is fueled by high technological adoption rates and a significant push towards sustainable transport solutions.South America Fleet Management Market Report:

South America's market size in 2023 was $1.34 billion, and it's anticipated to grow to $2.63 billion by 2033, driven by rising investments in infrastructure and increasing demand for efficient transportation solutions.Middle East & Africa Fleet Management Market Report:

The Middle East and Africa market was valued at $2.55 billion in 2023 and is expected to double to $5.02 billion by 2033. Growth is driven by increasing urbanization, oil price fluctuations, and demand for smart solutions in fleet monitoring.Tell us your focus area and get a customized research report.

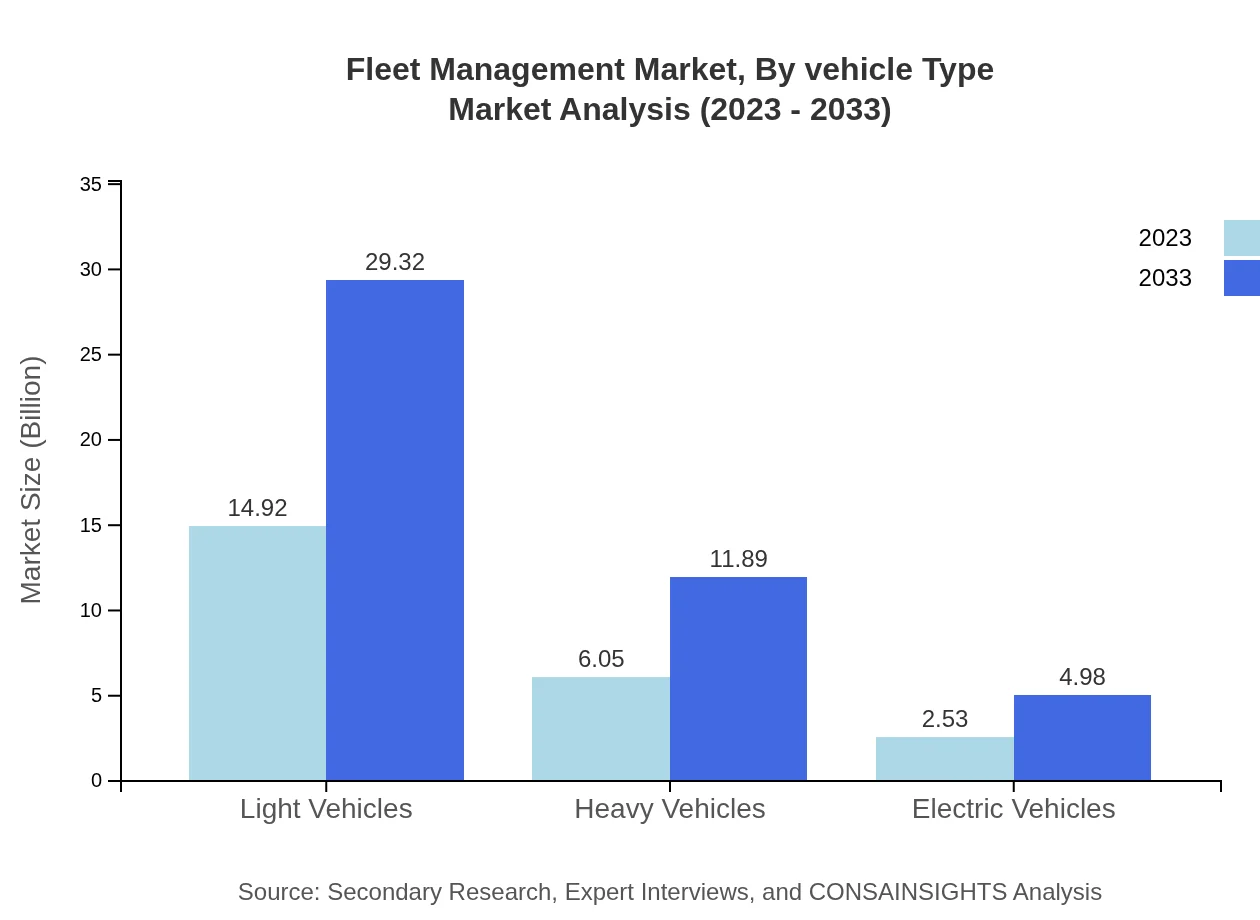

Fleet Management Market Analysis By Vehicle Type

The Fleet Management market's performance by vehicle type includes light vehicles and heavy vehicles. Light vehicles account for significant market share, with a size of $14.92 billion in 2023 and projected to grow to $29.32 billion by 2033. Heavy vehicles follow with a size of $6.05 billion, expected to reach $11.89 billion in the same period.

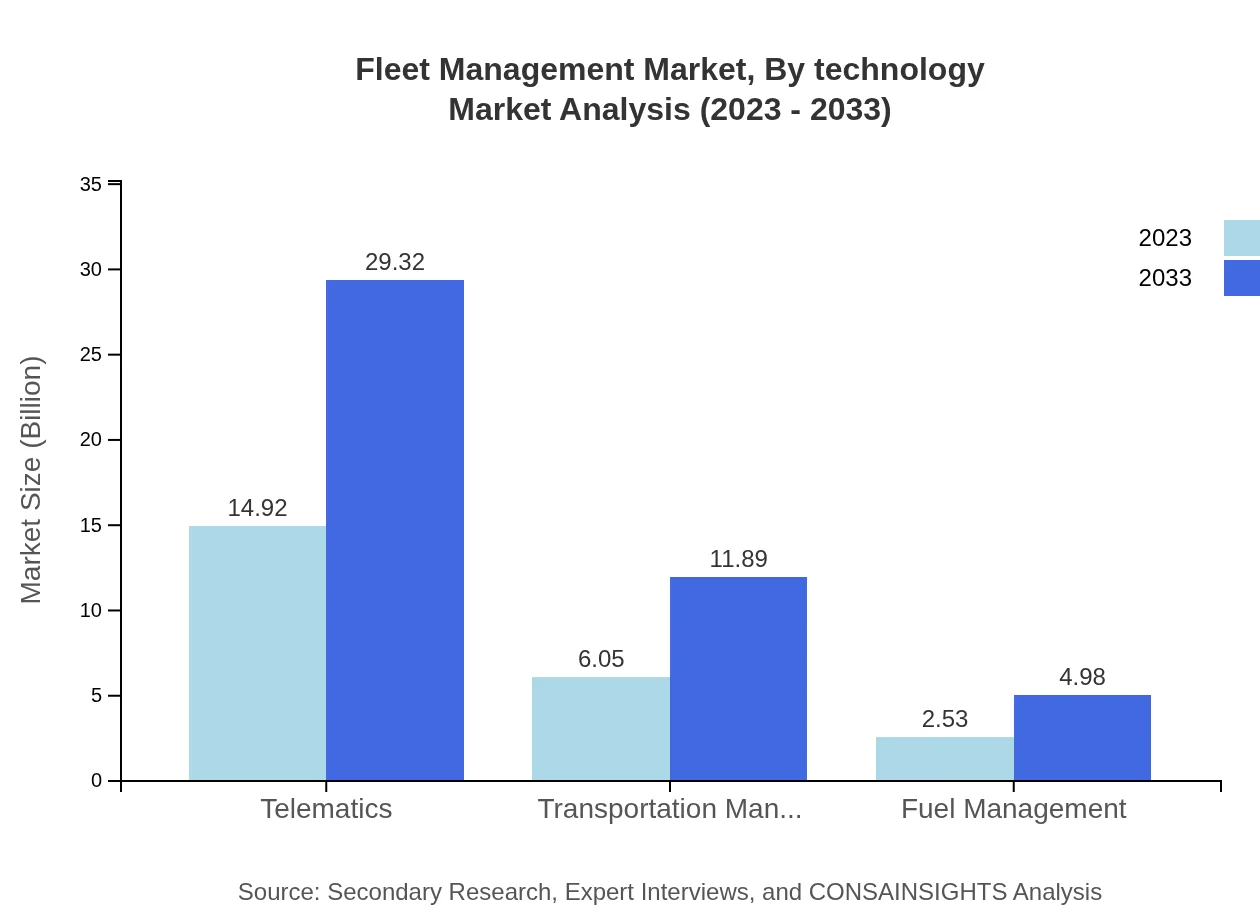

Fleet Management Market Analysis By Technology

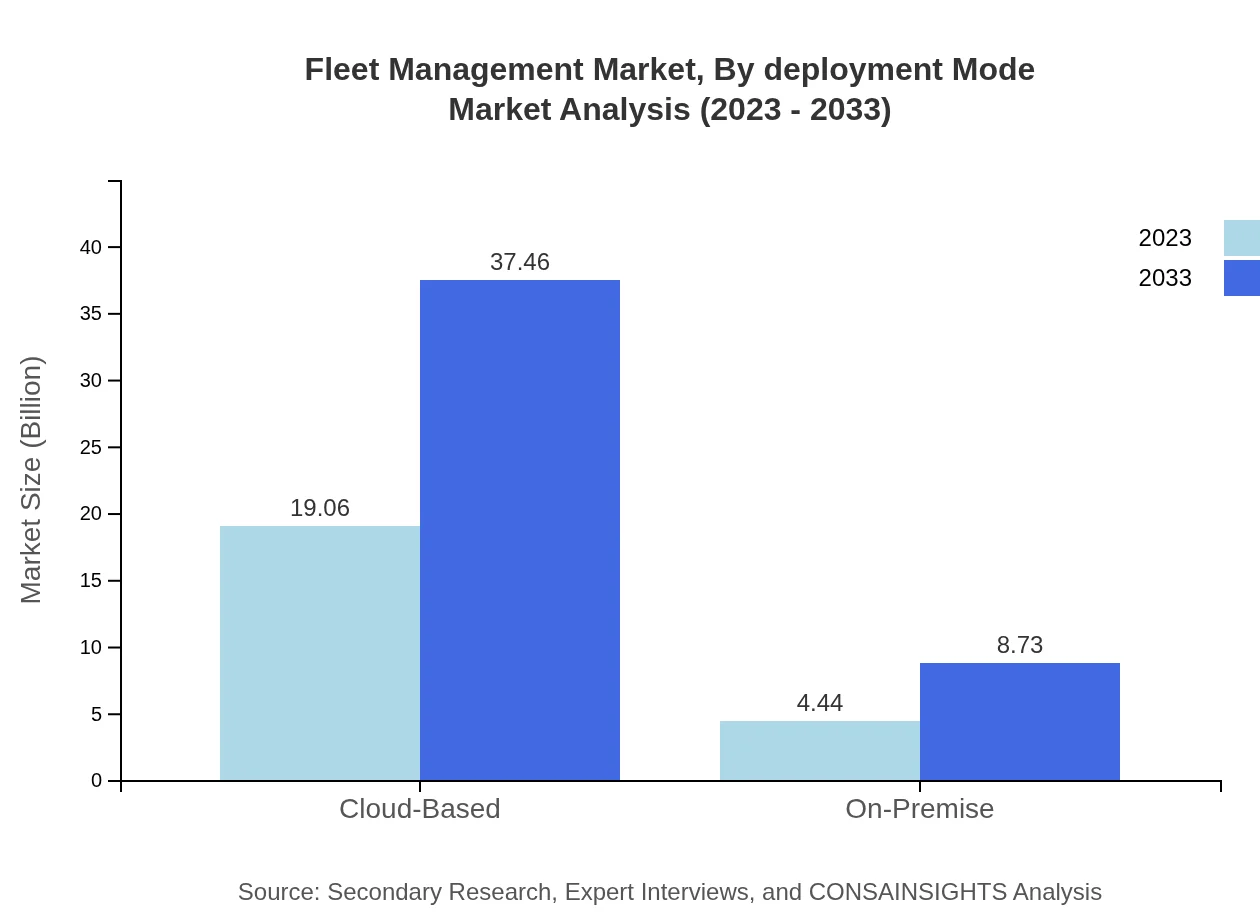

In terms of technology, the Fleet Management market is greatly influenced by telematics, which dominated with a market size of $14.92 billion in 2023. Cloud-based solutions also play a crucial role, growing from $19.06 billion in 2023 to $37.46 billion by 2033, reflecting a clear shift towards digitalization.

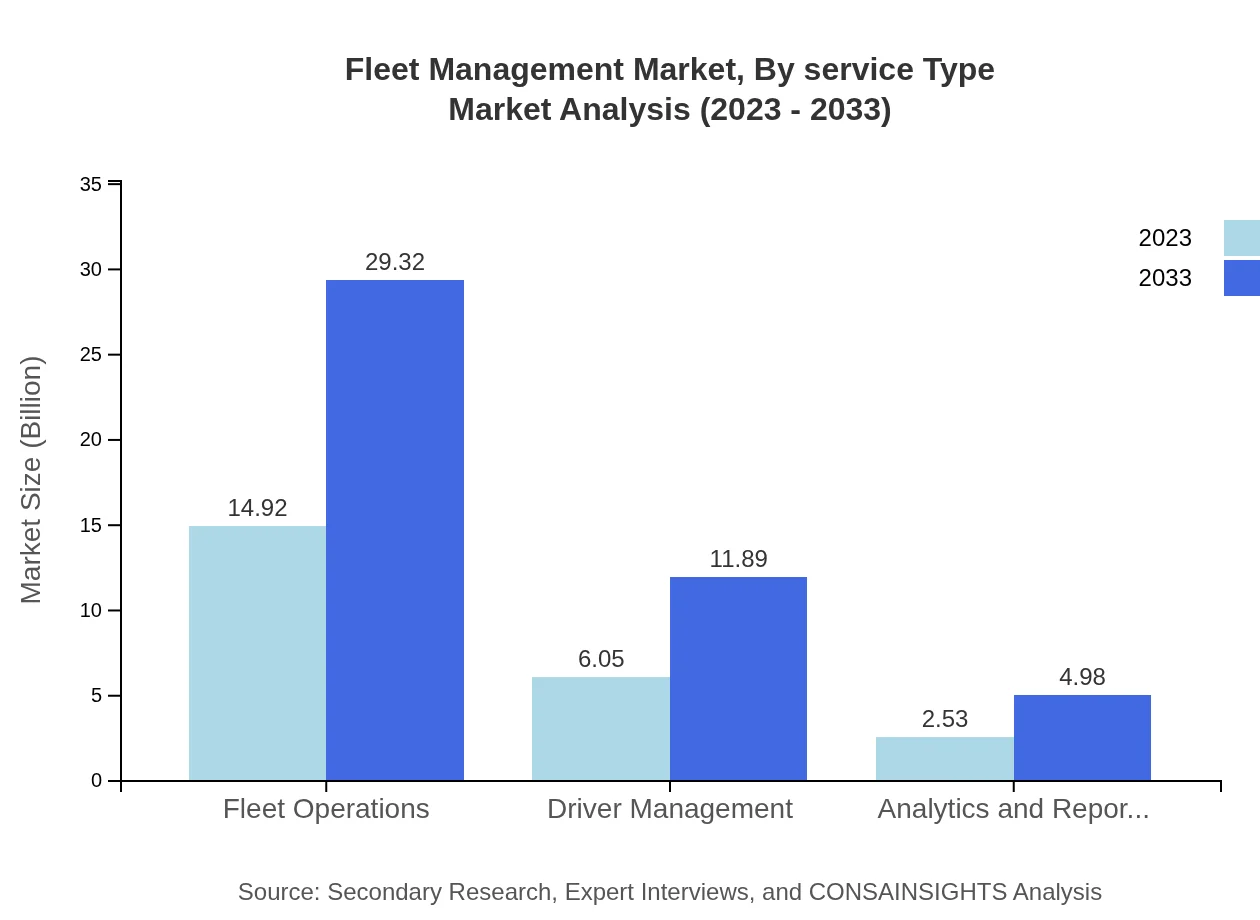

Fleet Management Market Analysis By Service Type

The service type segment of the Fleet Management market includes transportation management systems and fuel management, among others. The transportation management system market is projected to grow from $6.05 billion in 2023 to $11.89 billion by 2033, highlighting its importance in the overall market.

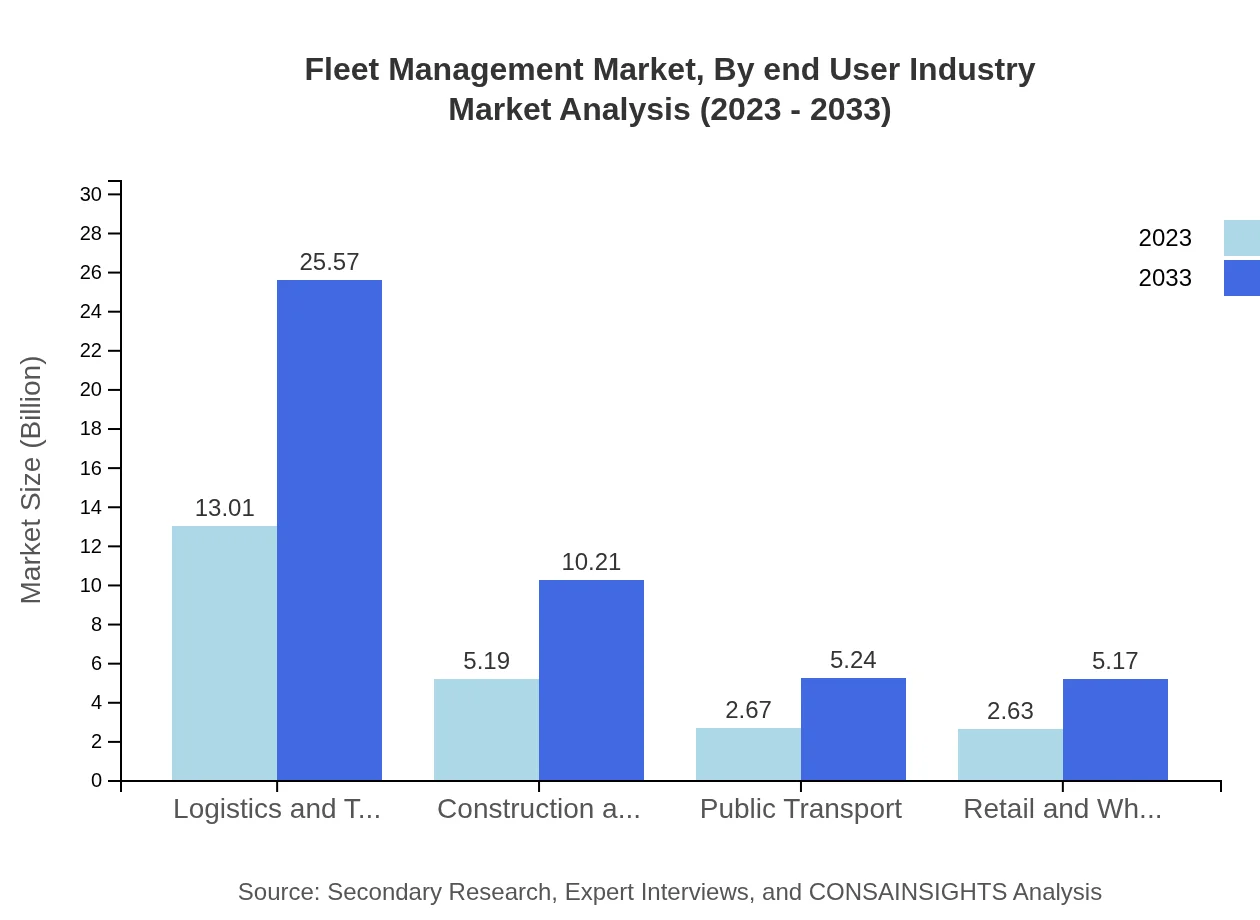

Fleet Management Market Analysis By End User Industry

This segment encompasses industries such as logistics and transportation, public transport, and retail and wholesale. The logistics and transportation sector alone is projected to grow significantly, indicating a robust demand for fleet management solutions across various end-user industries.

Fleet Management Market Analysis By Deployment Mode

The market can also be segmented by deployment mode into cloud-based and on-premise solutions. Cloud-based solutions are expected to dominate, growing from $19.06 billion in 2023 to $37.46 billion by 2033, reflecting the industry's shift towards flexible and scalable systems.

Fleet Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fleet Management Industry

Verizon Connect:

Offers comprehensive fleet management solutions, focusing on telematics and real-time data analytics to enhance fleet efficiency.Teletrac Navman:

Provides innovative tracking solutions with advanced fleet management tools designed to improve safety and operational efficiencies.Geotab:

Known for its telematics solutions, Geotab assists businesses in improving productivity through data-driven insights.Samsara :

Offers an integrated fleet management platform that combines vehicle tracking, driver safety, and equipment monitoring into a single interface.Fleet Complete:

Provides comprehensive fleet management solutions that help businesses monitor asset conditions, location, and performance metrics.We're grateful to work with incredible clients.

FAQs

What is the market size of fleet management?

The fleet management market is valued at approximately $23.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, indicating significant growth potential by 2033.

What are the key market players or companies in the fleet management industry?

Key players in the fleet management industry include established companies like telematics service providers, transportation management software developers, and fuel management solution providers, each playing a crucial role in enhancing operational efficiency.

What are the primary factors driving the growth in the fleet management industry?

Growth in the fleet management industry is driven by technological advancements in telematics, the increasing need for cost efficiency, regulatory compliance, and rising demand for real-time fleet monitoring capabilities across various sectors.

Which region is the fastest Growing in the fleet management market?

The North American region is the fastest-growing market, with an anticipated increase in market size from $8.18 billion in 2023 to $16.08 billion by 2033, fueled by advancements in technology and increased adoption of fleet management solutions.

Does ConsaInsights provide customized market report data for the fleet management industry?

Yes, ConsaInsights offers customized market report data, catering to specific requirements of businesses in the fleet management industry, ensuring tailored insights that align with strategic goals.

What deliverables can I expect from this fleet management market research project?

From the fleet management market research project, expect comprehensive reports, detailed market analysis, segmentation insights, competitive landscape evaluations, and actionable recommendations tailored to enhance decision-making processes.

What are the market trends of fleet management?

Current trends in the fleet management market include the rise of cloud-based solutions, enhanced focus on sustainability through the use of electric vehicles, and increasing implementations of advanced analytics to optimize fleet operations.