Fleet Management Solutions Market Report

Published Date: 31 January 2026 | Report Code: fleet-management-solutions

Fleet Management Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fleet Management Solutions market from 2023 to 2033, including market size, trends, and forecasts, as well as insights by region and market segment.

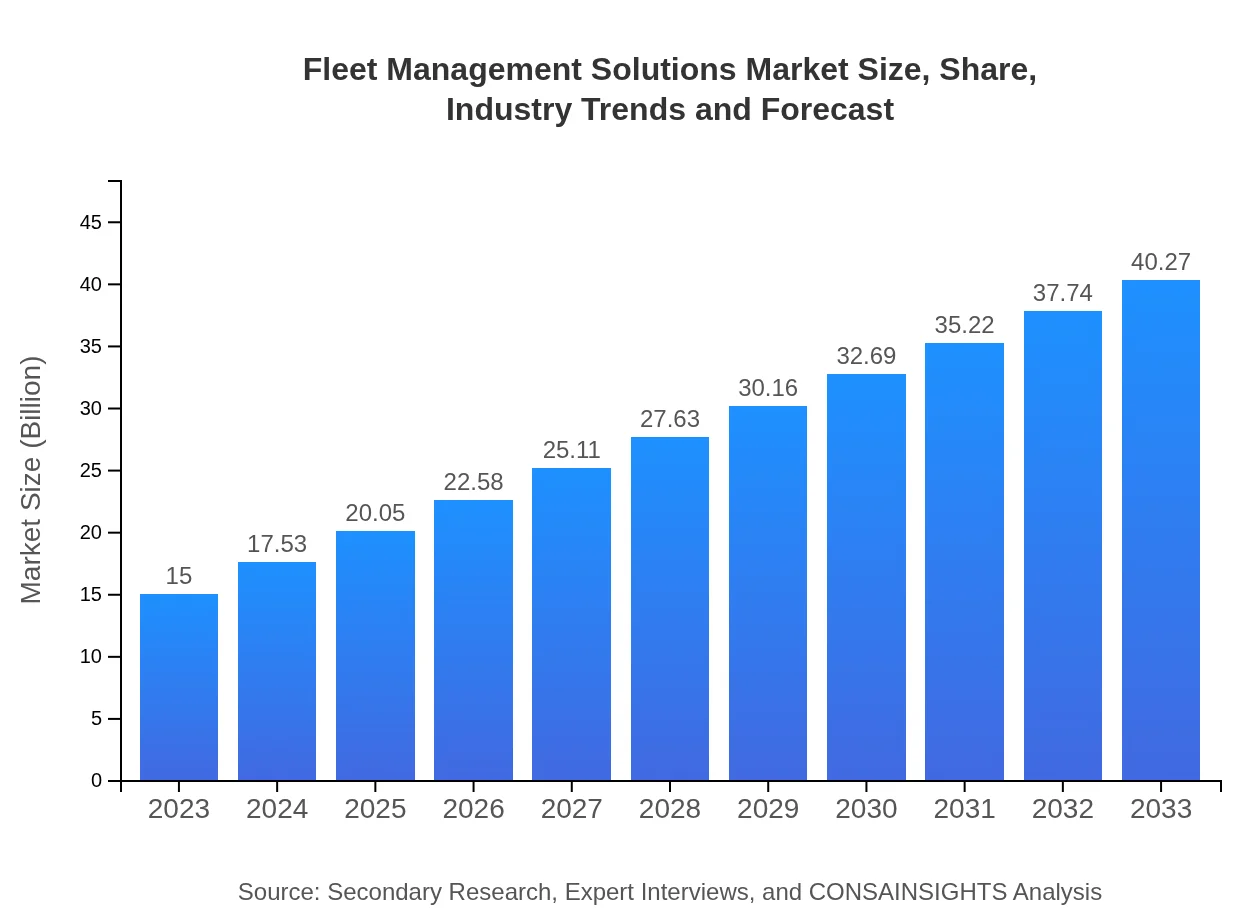

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $40.27 Billion |

| Top Companies | Teletrac Navman, Verizon Connect, Geotab, Samsara , Omnicomm |

| Last Modified Date | 31 January 2026 |

Fleet Management Solutions Market Overview

Customize Fleet Management Solutions Market Report market research report

- ✔ Get in-depth analysis of Fleet Management Solutions market size, growth, and forecasts.

- ✔ Understand Fleet Management Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fleet Management Solutions

What is the Market Size & CAGR of Fleet Management Solutions market in 2023?

Fleet Management Solutions Industry Analysis

Fleet Management Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fleet Management Solutions Market Analysis Report by Region

Europe Fleet Management Solutions Market Report:

The European market for Fleet Management Solutions is set to grow significantly, from $4.42 billion in 2023 to $11.86 billion by 2033. The focus on reducing emissions and enhancing fleet efficiency has catalyzed widespread adoption in this market.Asia Pacific Fleet Management Solutions Market Report:

The Asia Pacific region is witnessing a burgeoning demand for Fleet Management Solutions, projected to grow from $2.72 billion in 2023 to $7.29 billion by 2033. Rapid industrialization, increasing vehicle sales, and rising logistics activities are key drivers of this growth.North America Fleet Management Solutions Market Report:

In North America, the market size is anticipated to rise from $5.74 billion in 2023 to $15.41 billion by 2033. The region is a leader in fleet management technology adoption, driven by high operational costs and regulatory requirements.South America Fleet Management Solutions Market Report:

South America’s market for Fleet Management Solutions is expected to grow from $0.77 billion in 2023 to $2.06 billion by 2033. The region is gradually adopting technological advancements, although growth is tempered by economic fluctuations.Middle East & Africa Fleet Management Solutions Market Report:

In the Middle East and Africa, the market is projected to grow from $1.36 billion in 2023 to $3.65 billion by 2033. The growth is propelled by infrastructure developments and increasing regulatory measures aimed at improving fleet safety and compliance.Tell us your focus area and get a customized research report.

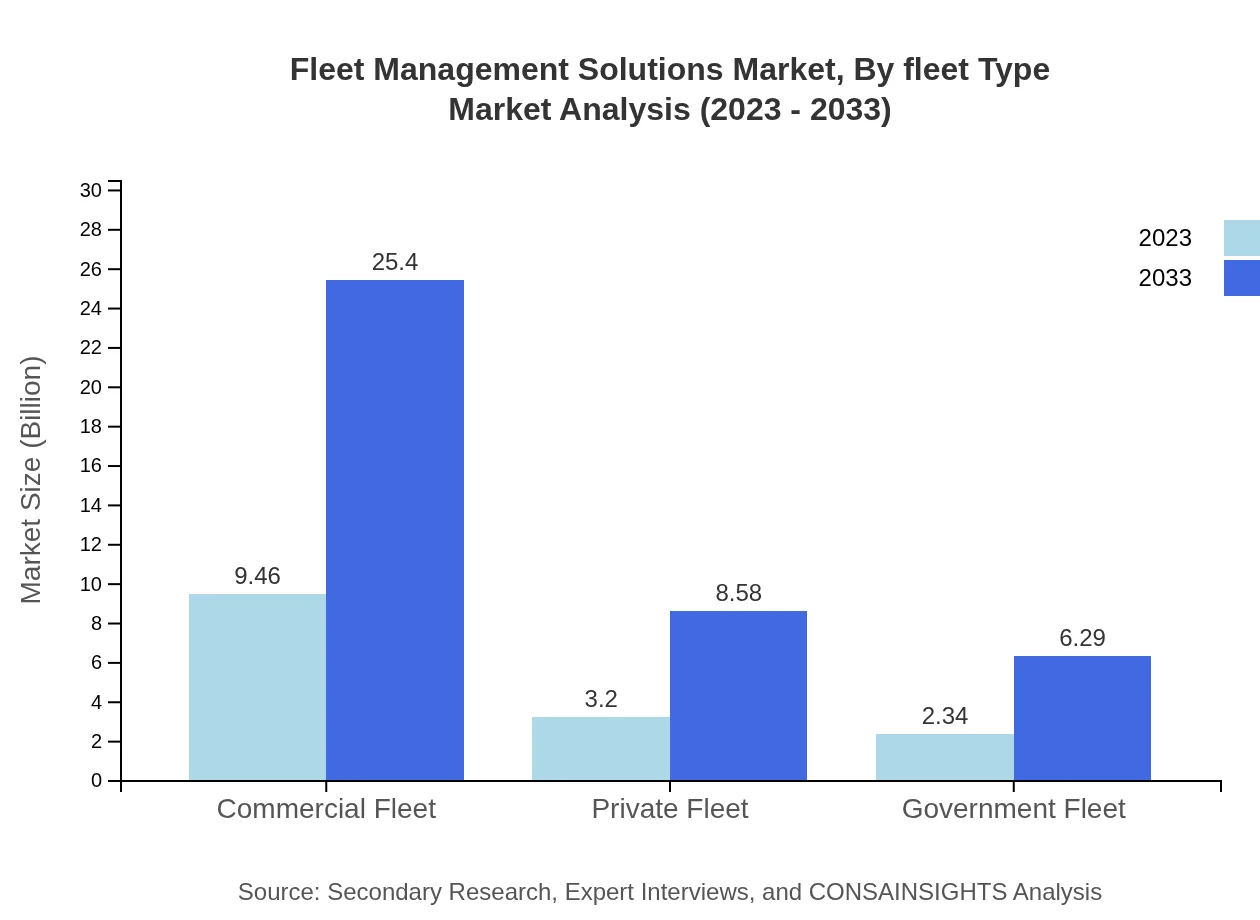

Fleet Management Solutions Market Analysis By Fleet Type

The Fleet Management Solutions market by fleet type showcases significant variance. The Commercial Fleet segment dominates the market, valued at $9.46 billion in 2023 and predicted to grow to $25.40 billion by 2033. This segment's share remains consistent, emphasizing its critical role in logistics and transport. In contrast, the Private Fleet segment demonstrates notable growth, increasing from $3.20 billion to $8.58 billion in the same timeframe.

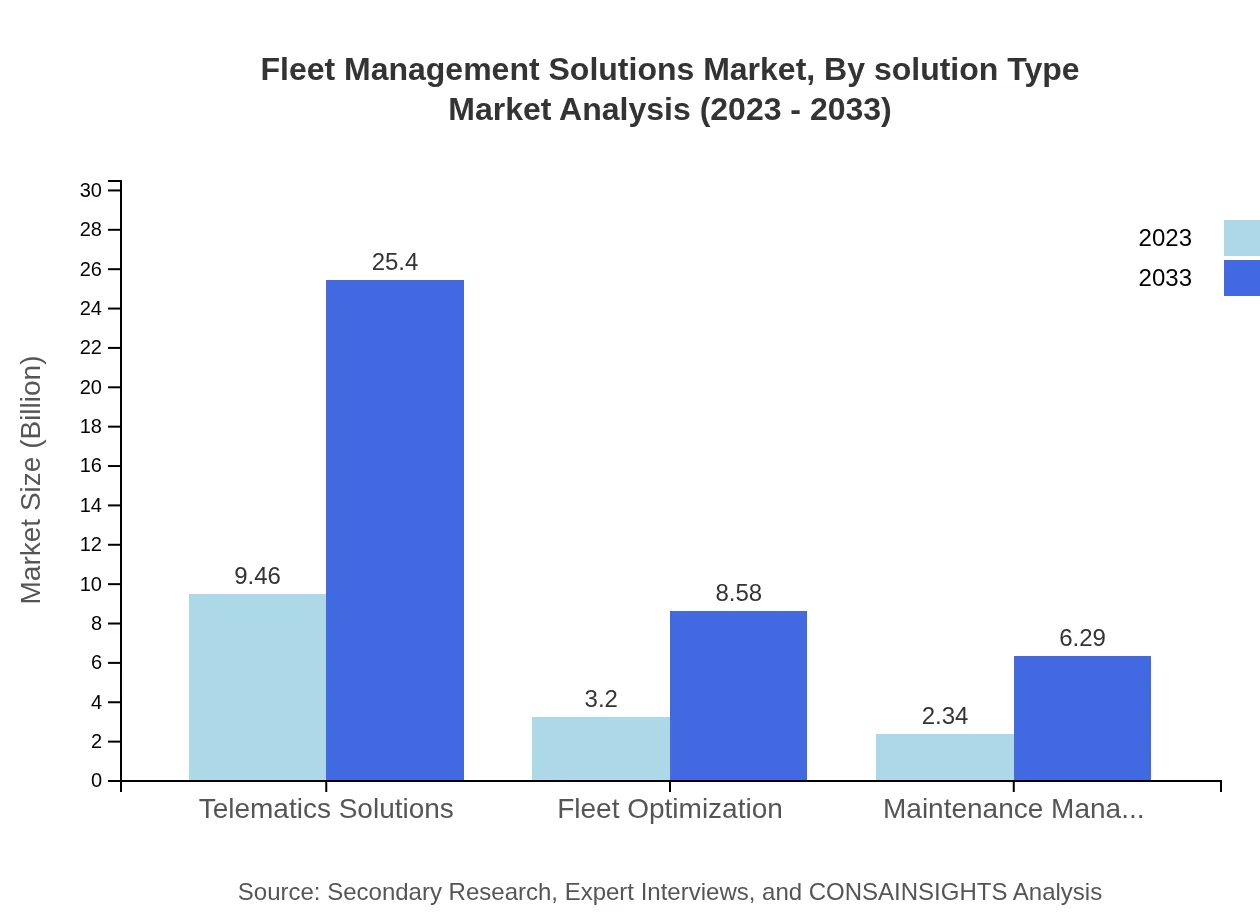

Fleet Management Solutions Market Analysis By Solution Type

Analysis of the Fleet Management Solutions market by solution type reveals that Telematics Solutions significantly constitute the market, with a valuation of $9.46 billion in 2023 and expected to reach $25.40 billion by 2033. Fleet Optimization and Maintenance Management solutions are also critical, growing from $3.20 billion to $8.58 billion and $2.34 billion to $6.29 billion, respectively.

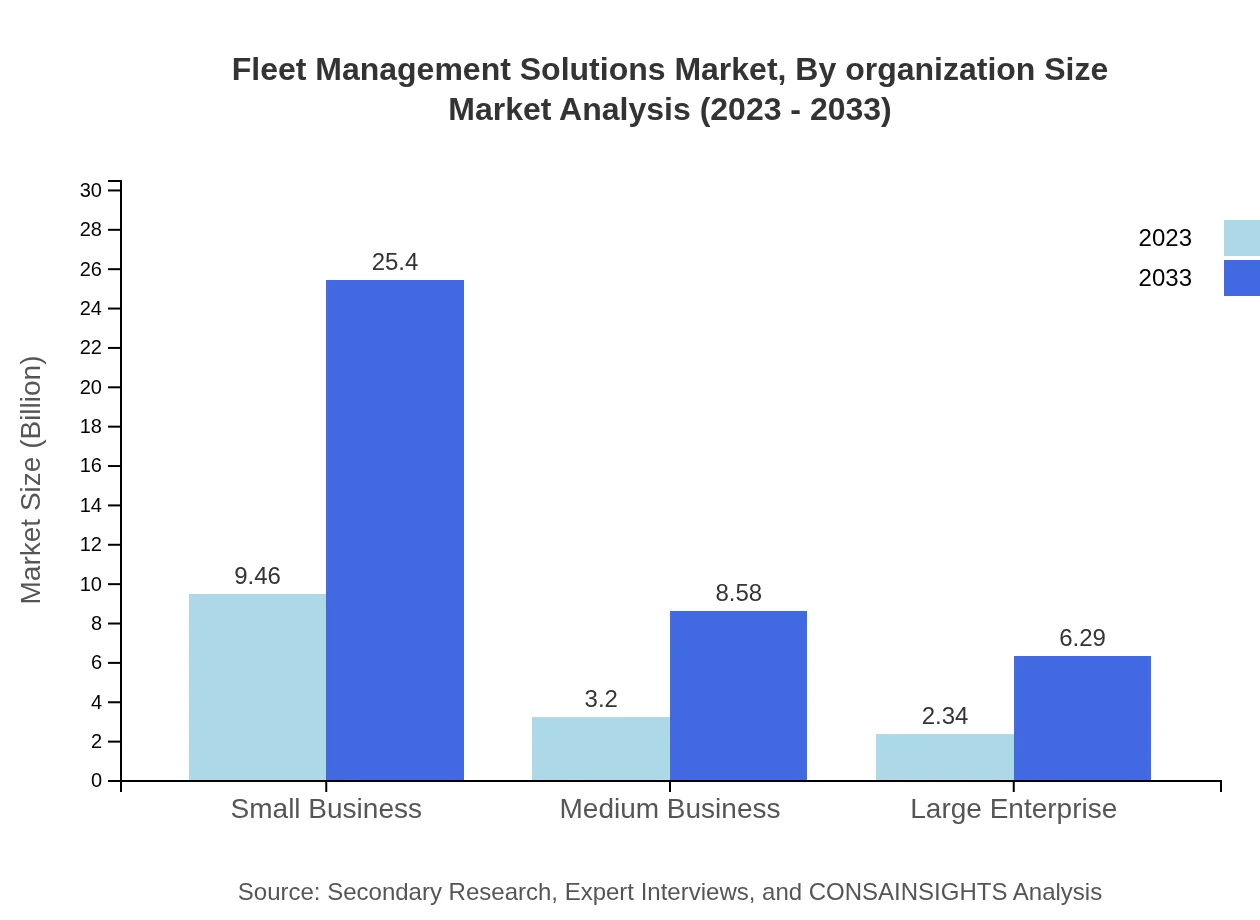

Fleet Management Solutions Market Analysis By Organization Size

In terms of organization size, the Small Business segment leads with a market size of $9.46 billion in 2023, growing to $25.40 billion by 2033. Medium and Large Enterprise segments account for $3.20 billion and $2.34 billion in 2023, respectively, reflecting a similar growth trajectory of achieving $8.58 billion and $6.29 billion by 2033.

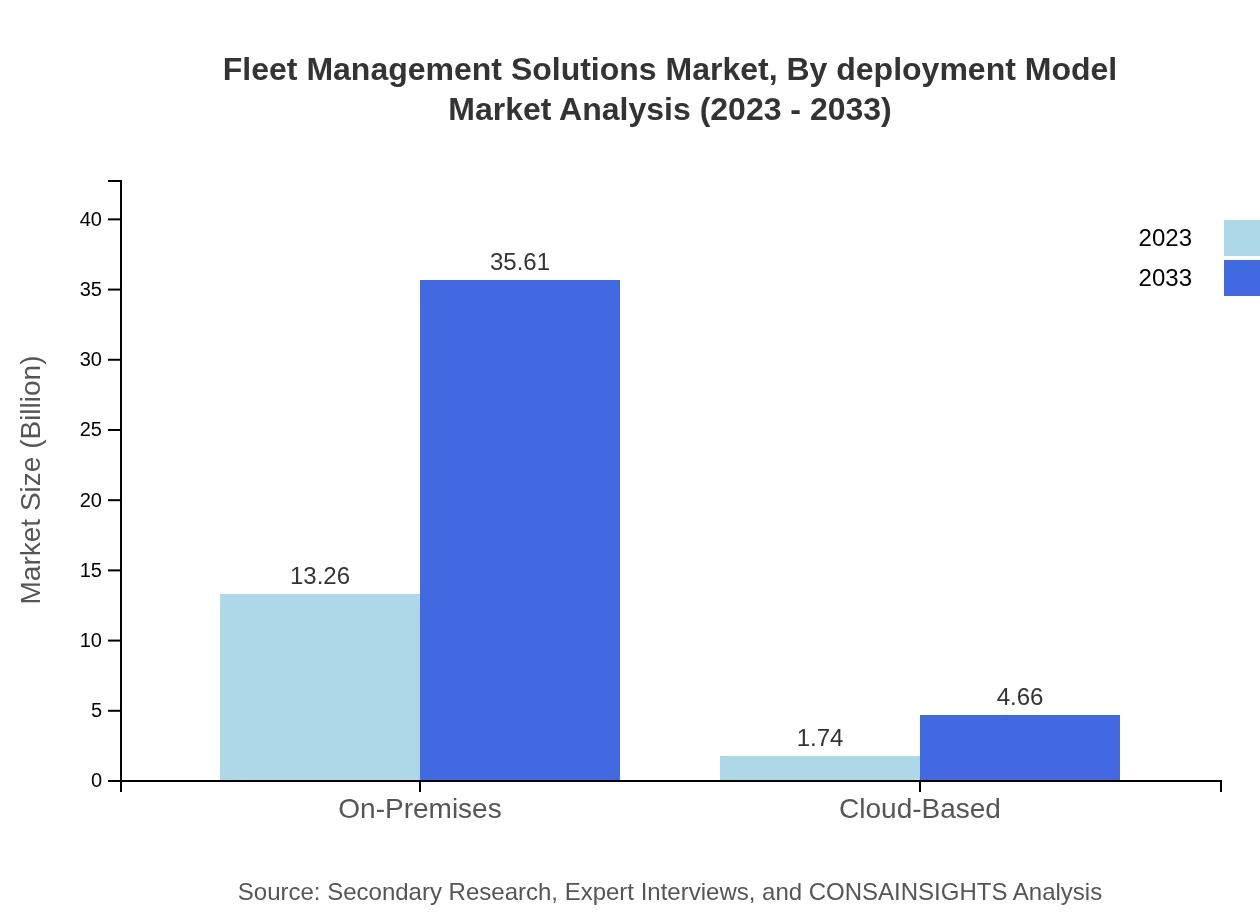

Fleet Management Solutions Market Analysis By Deployment Model

The market for Fleet Management Solutions by deployment model indicates a strong preference for On-Premises solutions with an initial size of $13.26 billion in 2023, projected to rise to $35.61 billion in the coming decade, while Cloud-Based solutions grow from $1.74 billion to $4.66 billion, indicating a growing trend towards cloud technology.

Fleet Management Solutions Market Analysis By End User

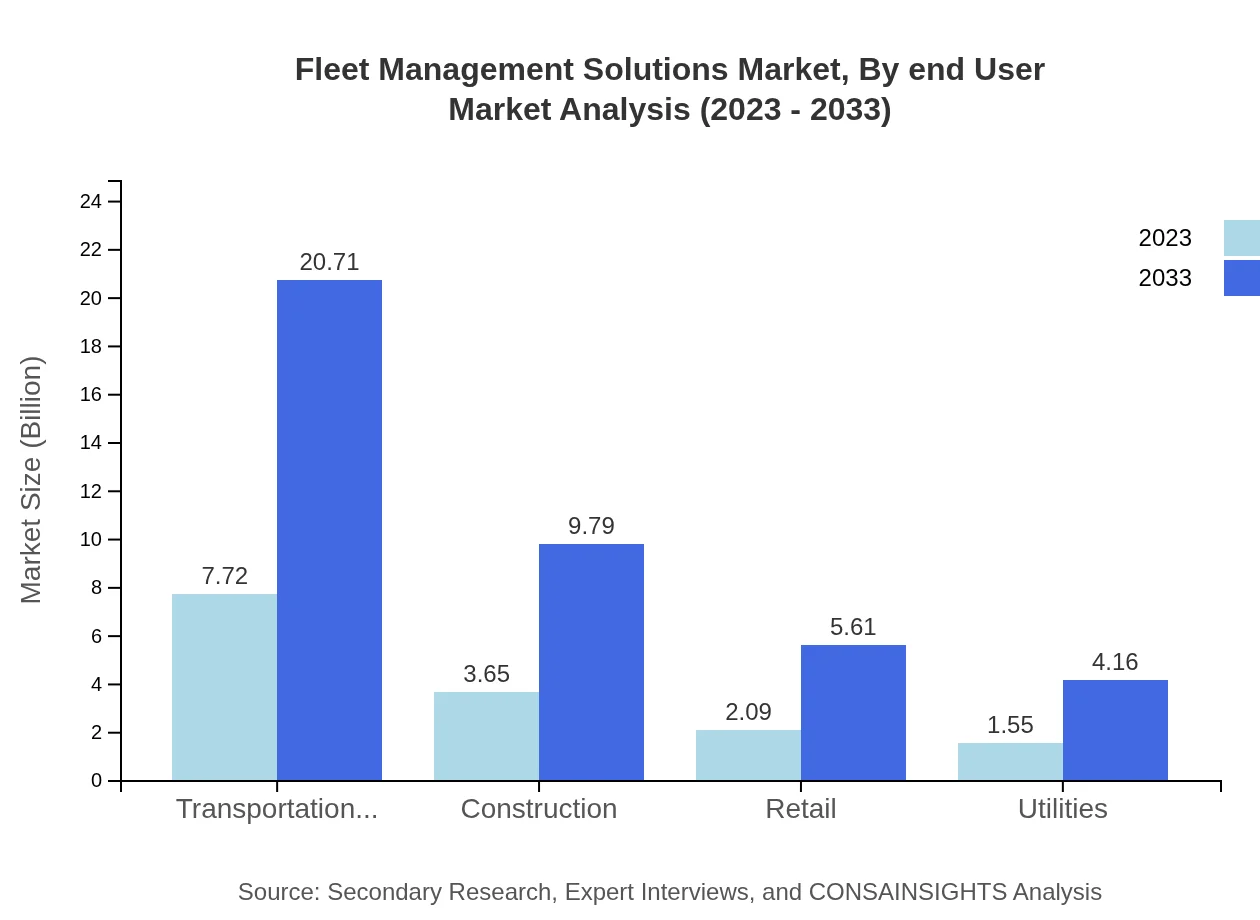

End-user analysis shows that sectors like Transportation and Logistics dominate the Fleet Management Solutions market, growing from $7.72 billion in 2023 to $20.71 billion by 2033. Construction and Retail sectors are also notable, with significant growth trajectories highlighting the versatility of fleet management applications across industries.

Fleet Management Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fleet Management Solutions Industry

Teletrac Navman:

A leader in fleet management technology, providing GPS tracking and telematics solutions that enhance efficiency and compliance.Verizon Connect:

Innovative solutions provider focused on fleet tracking and management, delivering insights that help reduce costs and improve safety.Geotab:

A prominent player in telematics and fleet management, offering comprehensive analytics to optimize vehicle performance and safety.Samsara :

Known for its IoT solutions and fleet management capabilities, Samsara provides tools to streamline operations and improve fleet efficiency.Omnicomm:

Offers advanced fleet management solutions focusing on fuel management, offering considerable insights into transportation and logistics.We're grateful to work with incredible clients.

FAQs

What is the market size of fleet Management Solutions?

The fleet management solutions market is valued at approximately $15 billion in 2023, with a CAGR of 10% projected through 2033, indicating robust growth as the demand for efficient fleet operations increases.

What are the key market players or companies in this fleet Management Solutions industry?

Key players in the fleet management solutions market include big names such as Verizon Connect, Geotab, and Omnicomm. These companies lead through innovative technology and comprehensive service offerings, contributing significantly to market evolution.

What are the primary factors driving the growth in the fleet management solutions industry?

Growth in the fleet management solutions market is primarily driven by advancements in telematics, increasing regulatory compliance, rising fuel prices, and the need for improved fleet performance and operational efficiency, pushing companies to adopt such technologies.

Which region is the fastest Growing in the fleet management solutions?

The fastest-growing region in the fleet management solutions market is North America, expected to grow from $5.74 billion in 2023 to $15.41 billion in 2033, largely due to technological advancements and increasing adoption among businesses.

Does ConsaInsights provide customized market report data for the fleet management solutions industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs, ensuring insights are directly relevant to particular segments or regional interests within the fleet management solutions industry.

What deliverables can I expect from this fleet Management Solutions market research project?

Deliverables from the fleet management solutions market research project typically include a comprehensive report with market size, growth forecasts, competitive analysis, and insights into key trends, segmented data, and regional breakdowns.

What are the market trends of fleet Management Solutions?

Current trends in the fleet management solutions market include the adoption of IoT technology, increased focus on sustainability and cost reduction, as well as the expansion of cloud-based solutions, reflecting the industry's shift towards digital transformation.