Flexographic Printing Machine Market Report

Published Date: 01 February 2026 | Report Code: flexographic-printing-machine

Flexographic Printing Machine Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Flexographic Printing Machine market, detailing its size, growth projections, segmentation, and key trends from 2023 to 2033. Insights into regional performance and major industry players are also examined.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

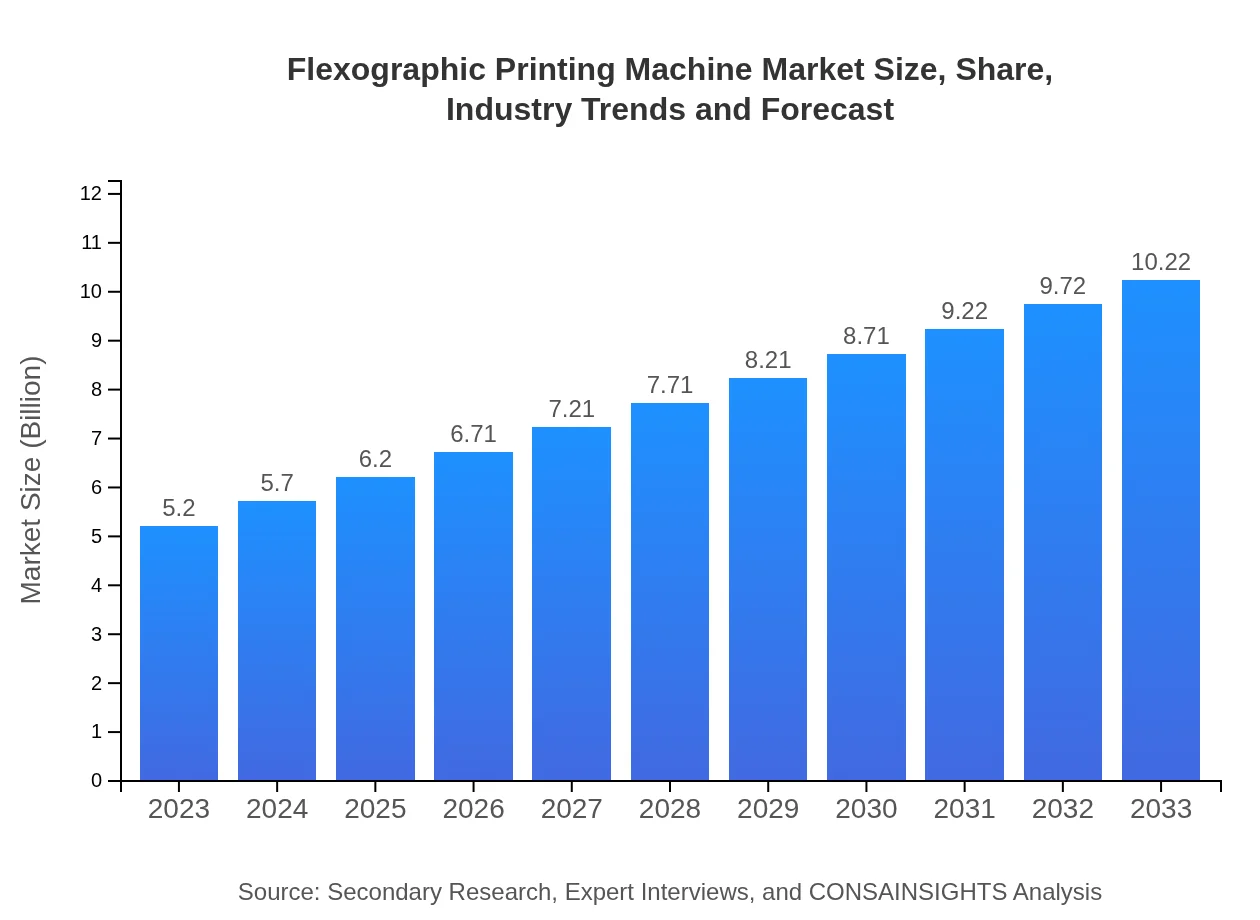

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Bobst Group SA, Heidelberger Druckmaschinen AG, Mark Andy Inc., Gallus Ferd. Rüesch AG, Epson ColorWorks |

| Last Modified Date | 01 February 2026 |

Flexographic Printing Machine Market Overview

Customize Flexographic Printing Machine Market Report market research report

- ✔ Get in-depth analysis of Flexographic Printing Machine market size, growth, and forecasts.

- ✔ Understand Flexographic Printing Machine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flexographic Printing Machine

What is the Market Size & CAGR of Flexographic Printing Machine market in 2023?

Flexographic Printing Machine Industry Analysis

Flexographic Printing Machine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flexographic Printing Machine Market Analysis Report by Region

Europe Flexographic Printing Machine Market Report:

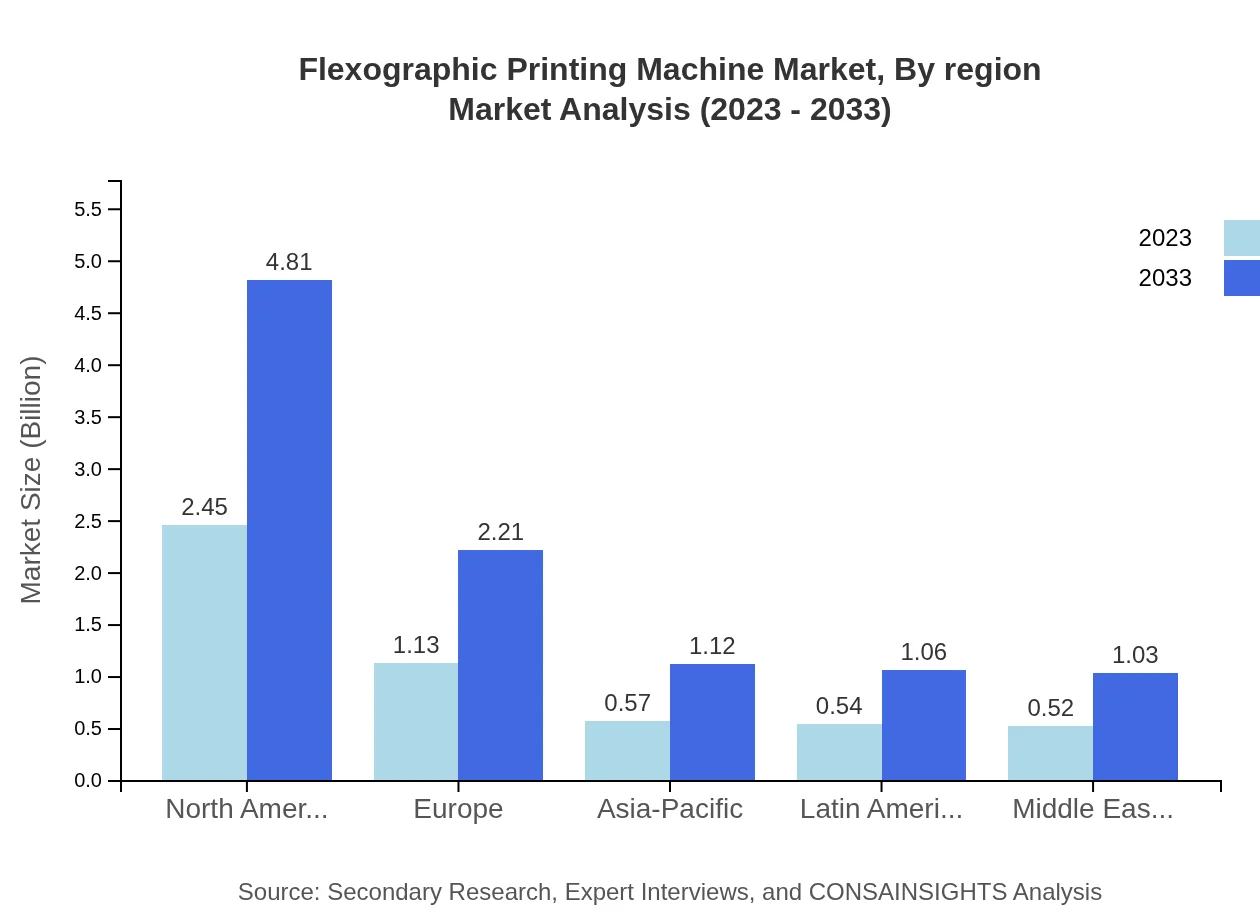

The European market is poised to grow from $1.60 billion in 2023 to $3.14 billion by 2033. The increasing focus on sustainable printing practices and regulatory measures boosting eco-friendly materials will further enhance market growth in this region.Asia Pacific Flexographic Printing Machine Market Report:

In the Asia Pacific region, the Flexographic Printing Machine market is expected to grow from $0.89 billion in 2023 to $1.75 billion by 2033, driven by rising disposable incomes and increasing consumption in emerging markets like India and China. The demand for adaptable packaging solutions is also boosting the flexographic printing sector.North America Flexographic Printing Machine Market Report:

In North America, the market size is estimated to grow from $1.94 billion in 2023 to $3.82 billion by 2033. This growth is driven by the presence of established FMCG markets and a surge in e-commerce packaging requirements, fostering demand for advanced flexographic printing technologies.South America Flexographic Printing Machine Market Report:

The South America market is projected to expand from $0.33 billion in 2023 to $0.66 billion in 2033. Growth is supported by increasing investments in the food and beverage sector and rising demand for sustainable packaging solutions throughout the region.Middle East & Africa Flexographic Printing Machine Market Report:

The Middle East and Africa segment is expected to grow from $0.44 billion in 2023 to $0.86 billion by 2033. The rise in packaging demand, particularly in the food and beverage sectors, is a major driving force in this region.Tell us your focus area and get a customized research report.

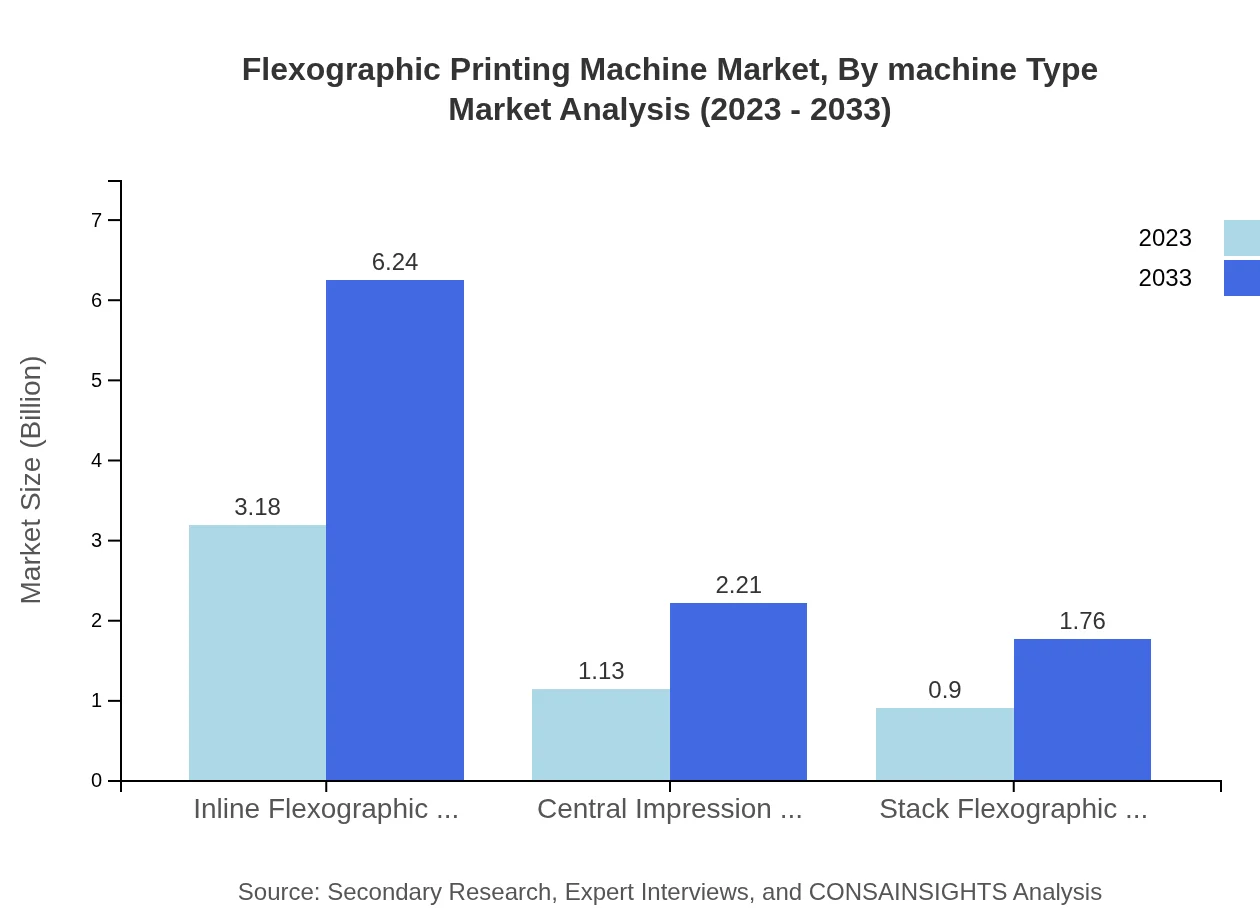

Flexographic Printing Machine Market Analysis By Machine Type

In recent years, the market dynamics have shown a significant shift towards inline flexographic printing machines, which accounted for $3.18 billion in 2023, expected to reach $6.24 billion by 2033. In contrast, central impression machines, showing steady performance, are projected to rise from $1.13 billion to $2.21 billion in the same period. Stack machines, while smaller in market size, also present growth opportunities, moving from $0.90 billion to $1.76 billion.

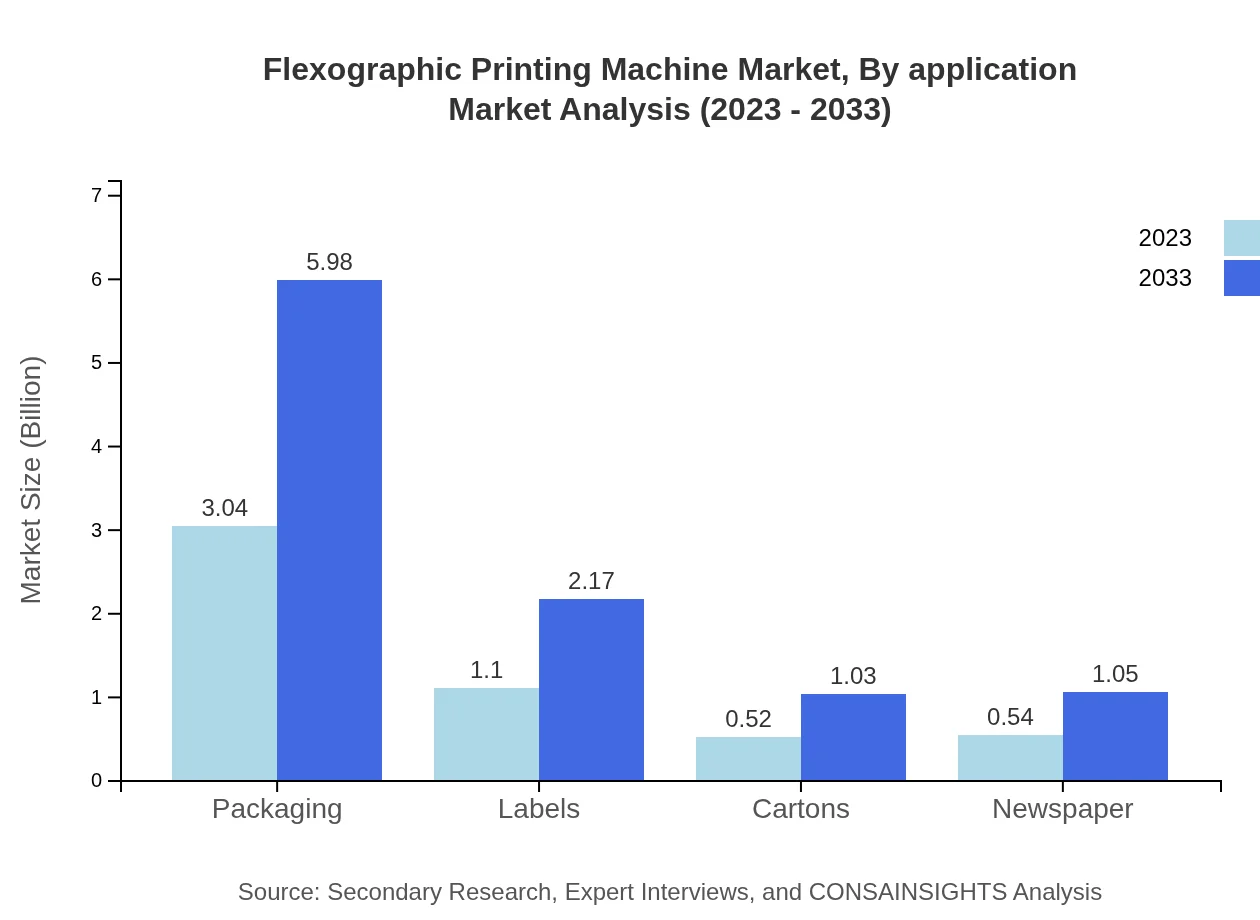

Flexographic Printing Machine Market Analysis By Application

The application segment is dominated by packaging, which holds a share of 58.47% in 2023, poised to reach $5.98 billion by 2033. Labels constitute another significant area, starting at $1.10 billion and expected to grow to $2.17 billion. The pharmaceutical sector also represents a notable share with growth projections highlighting the need for high-quality print finishes in packaging.

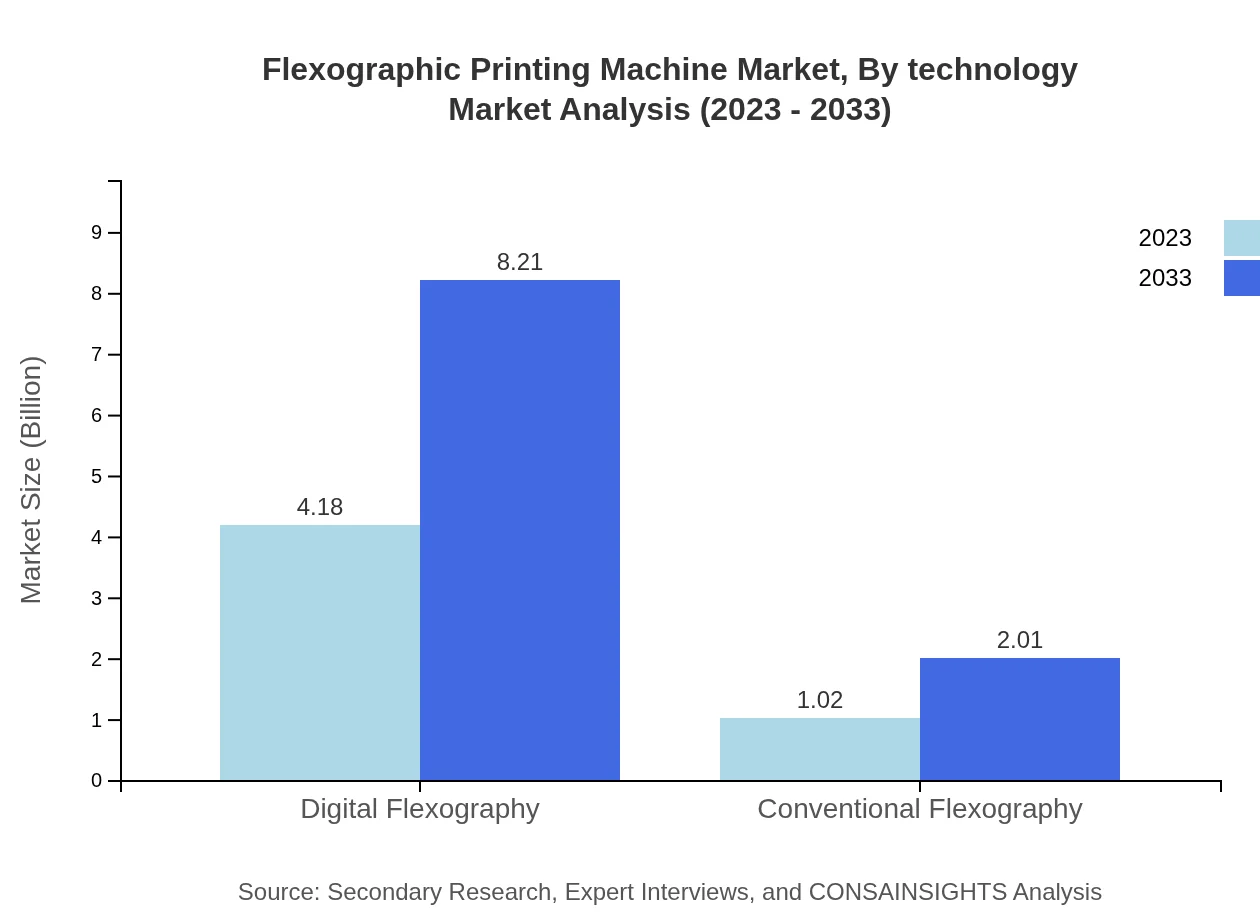

Flexographic Printing Machine Market Analysis By Technology

The technology segment is witnessing a transition with digital flexography leading the charge, accounting for a staggering 80.31% market share in 2023 and expected to maintain its dominance with $8.21 billion by 2033. Conversely, traditional conventional flexography needs to adapt to remain relevant, projected to grow moderately from $1.02 billion to $2.01 billion.

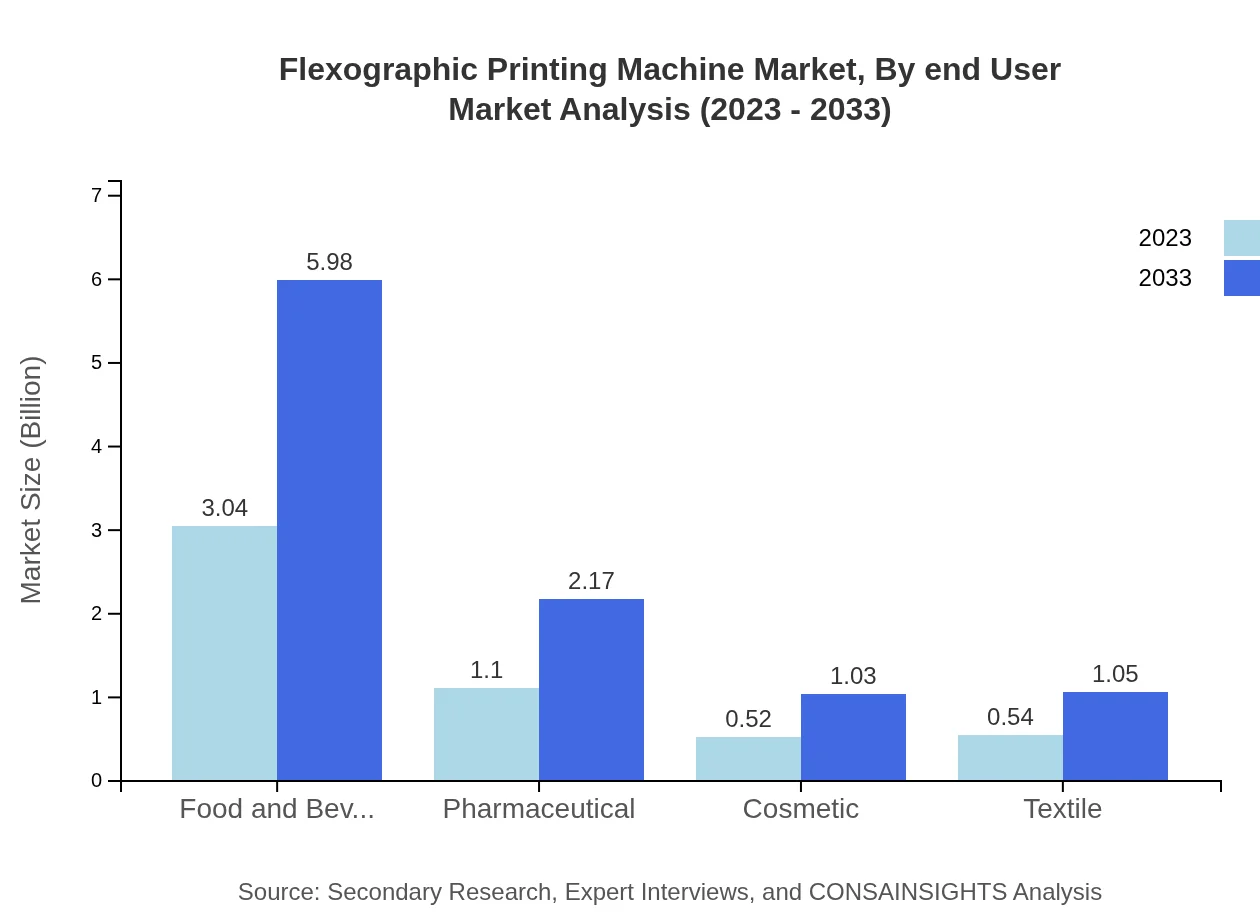

Flexographic Printing Machine Market Analysis By End User

Key end-user industries driving flexographic printing include food and beverage, contributing over 58% to the market in 2023, alongside significant inputs from pharmaceutical and cosmetic sectors. This diversification illustrates the widespread adoption of flexographic printing technology across various industries.

Flexographic Printing Machine Market Analysis By Region

Regional market analysis differentiates performance across continents with Americas leading in market size, followed closely by Europe and robust growth in Asia Pacific. Each region presents unique challenges and opportunities influenced by economic conditions and technological advancements.

Flexographic Printing Machine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flexographic Printing Machine Industry

Bobst Group SA:

A leader in the printing and packaging sectors, offering top-notch flexographic printing solutions.Heidelberger Druckmaschinen AG:

Provides innovative printing presses and a wide array of products for sustainable packaging and printing.Mark Andy Inc.:

Known for high-quality flexographic printing technology, serving various applications from labels to industrial printing.Gallus Ferd. Rüesch AG:

Specializes in label printing solutions and advanced flexographic technology for diverse industries.Epson ColorWorks:

Leads in digital inkjet printing technology, making strides in flexographic applications especially for short runs.We're grateful to work with incredible clients.

FAQs

What is the market size of flexographic printing machine?

The global flexographic printing machine market is valued at $5.2 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating robust growth potential in this industry.

What are the key market players or companies in the flexographic printing machine industry?

Key players in the flexographic printing machine market include major manufacturers like Bobst, Mark Andy, and Nilpeter, which significantly influence product innovation and market trends.

What are the primary factors driving the growth in the flexographic printing machine industry?

The growth in the flexographic printing machine market is driven by increasing demand for sustainable packaging, technological advancements, and the rise in e-commerce, which promotes label printing and packaging solutions.

Which region is the fastest Growing in the flexographic printing machine market?

North America is currently the fastest-growing region, with the market expected to grow from $1.94 billion in 2023 to $3.82 billion in 2033, emphasizing a strong demand for innovative printing technologies.

Does ConsaInsights provide customized market report data for the flexographic printing machine industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the flexographic printing machine industry, ensuring comprehensive insights that match client requirements.

What deliverables can I expect from this flexographic printing machine market research project?

Expect detailed market analysis reports, segmented data, regional insights, and strategic recommendations to enhance your business planning in the flexographic printing machine sector.

What are the market trends of flexographic printing machine?

Current trends include a shift towards digital flexography, increased automation, and a focus on sustainable materials, reflecting the industry's adaptation to environmental concerns and market demands.