Flight Management Systems Market Report

Published Date: 03 February 2026 | Report Code: flight-management-systems

Flight Management Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Flight Management Systems market, covering current trends, market size, growth forecasts, and regional insights for the period from 2023 to 2033.

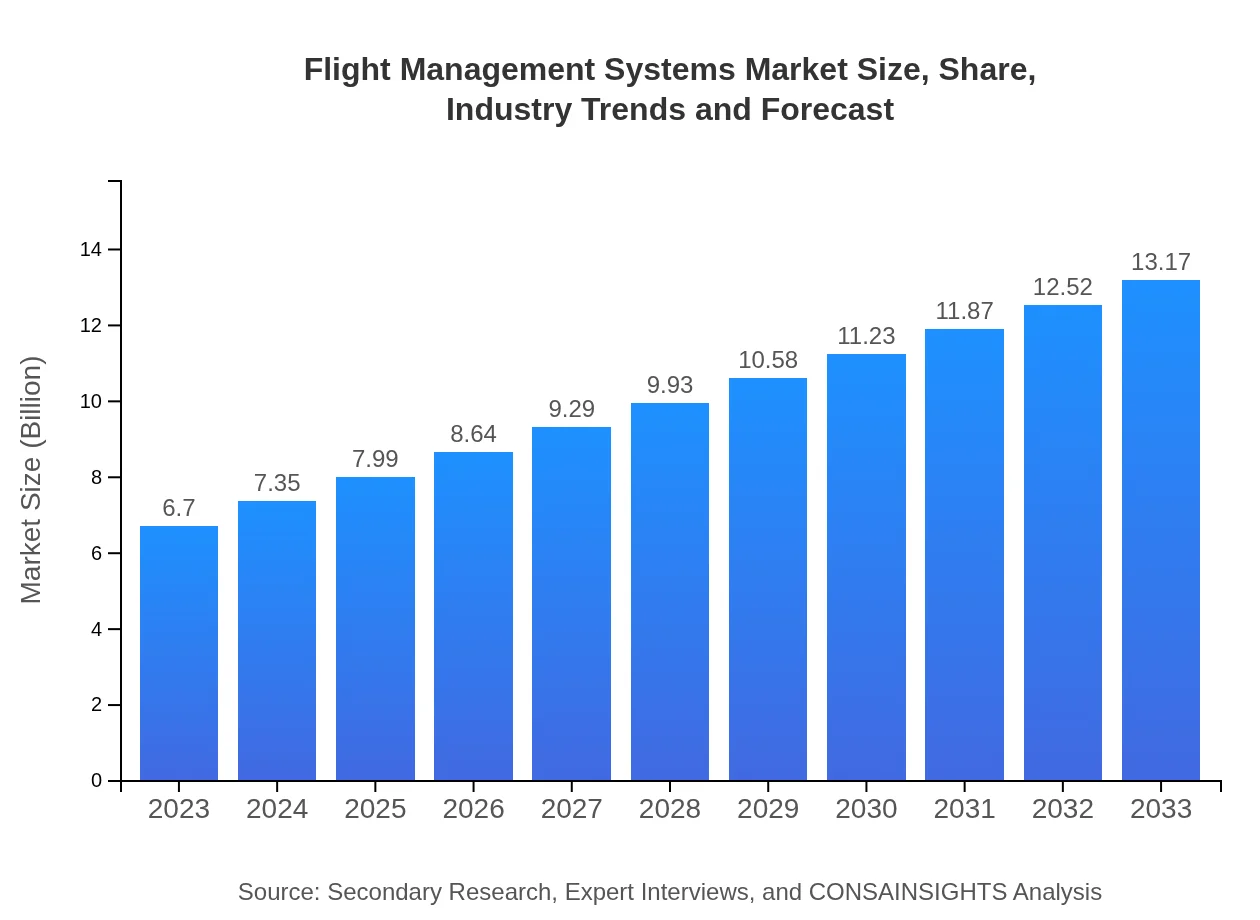

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $13.17 Billion |

| Top Companies | Honeywell International Inc., Rockwell Collins, Thales Group, Garmin Ltd. |

| Last Modified Date | 03 February 2026 |

Flight Management Systems Market Overview

Customize Flight Management Systems Market Report market research report

- ✔ Get in-depth analysis of Flight Management Systems market size, growth, and forecasts.

- ✔ Understand Flight Management Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flight Management Systems

What is the Market Size & CAGR of Flight Management Systems market in 2023?

Flight Management Systems Industry Analysis

Flight Management Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flight Management Systems Market Analysis Report by Region

Europe Flight Management Systems Market Report:

The European market is valued at 1.62 billion USD in 2023, anticipating growth to approximately 3.19 billion USD by 2033. Factors including stringent safety regulations, a focus on reducing operational costs, and rising demand for efficient flight operations propel this growth. Collaborative projects among European countries further enhance technology integration in flight management.Asia Pacific Flight Management Systems Market Report:

The Asia Pacific region in 2023 is valued at approximately 1.30 billion USD, with forecasts suggesting it will grow to around 2.55 billion USD by 2033. The growth is attributed to rapid urbanization, increased air travel, and significant investments in aviation infrastructure. Market players are also exploring partnerships with local airlines to enhance their market penetration.North America Flight Management Systems Market Report:

North America dominates the Flight Management Systems market with a size of 2.35 billion USD in 2023, expected to reach 4.62 billion USD by 2033. The region is renowned for its advanced aerospace sector, with high investment in R&D and innovation driving market growth. The presence of leading market players accelerates the adoption of cutting-edge systems.South America Flight Management Systems Market Report:

In South America, the market size is estimated at 0.63 billion USD in 2023, projected to reach 1.24 billion USD by 2033. The region is gradually witnessing an increase in air traffic demands and government initiatives to boost aviation safety and efficiency, contributing to market expansion.Middle East & Africa Flight Management Systems Market Report:

The Middle East and Africa market is estimated at 0.79 billion USD in 2023, projected to grow to 1.56 billion USD by 2033. The increasing number of passengers, coupled with substantial investment in airline expansions and modernizations, supports market growth in this region.Tell us your focus area and get a customized research report.

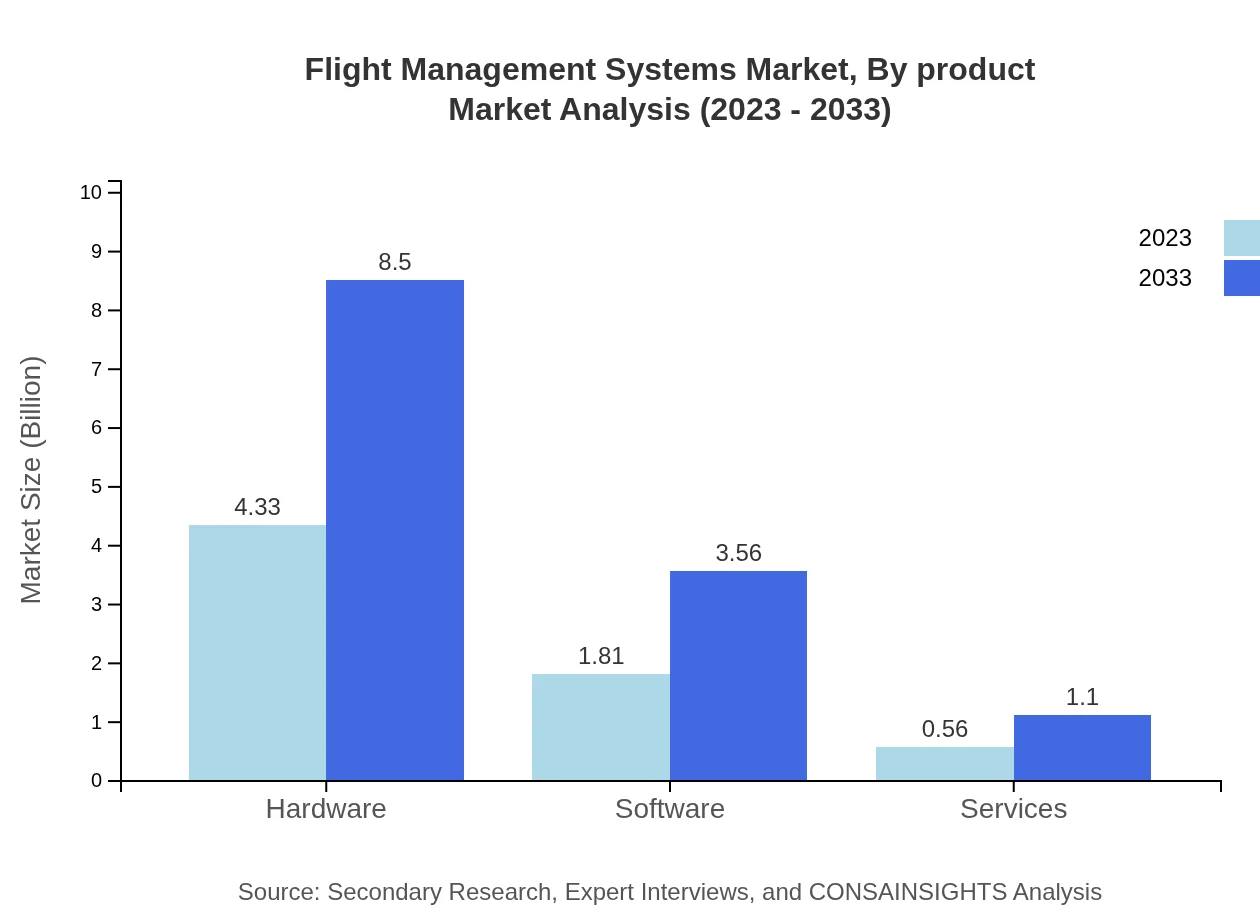

Flight Management Systems Market Analysis By Product

The Flight Management Systems market by product type consists of Hardware, Software, and Services. In 2023, the Hardware segment leads the market with a valuation of 4.33 billion USD, expected to double to 8.50 billion USD by 2033. The Software segment is projected to evolve significantly from 1.81 billion USD in 2023 to 3.56 billion USD by 2033. The Services segment, though smaller, shows growth from 0.56 billion USD to 1.10 billion USD over the same period.

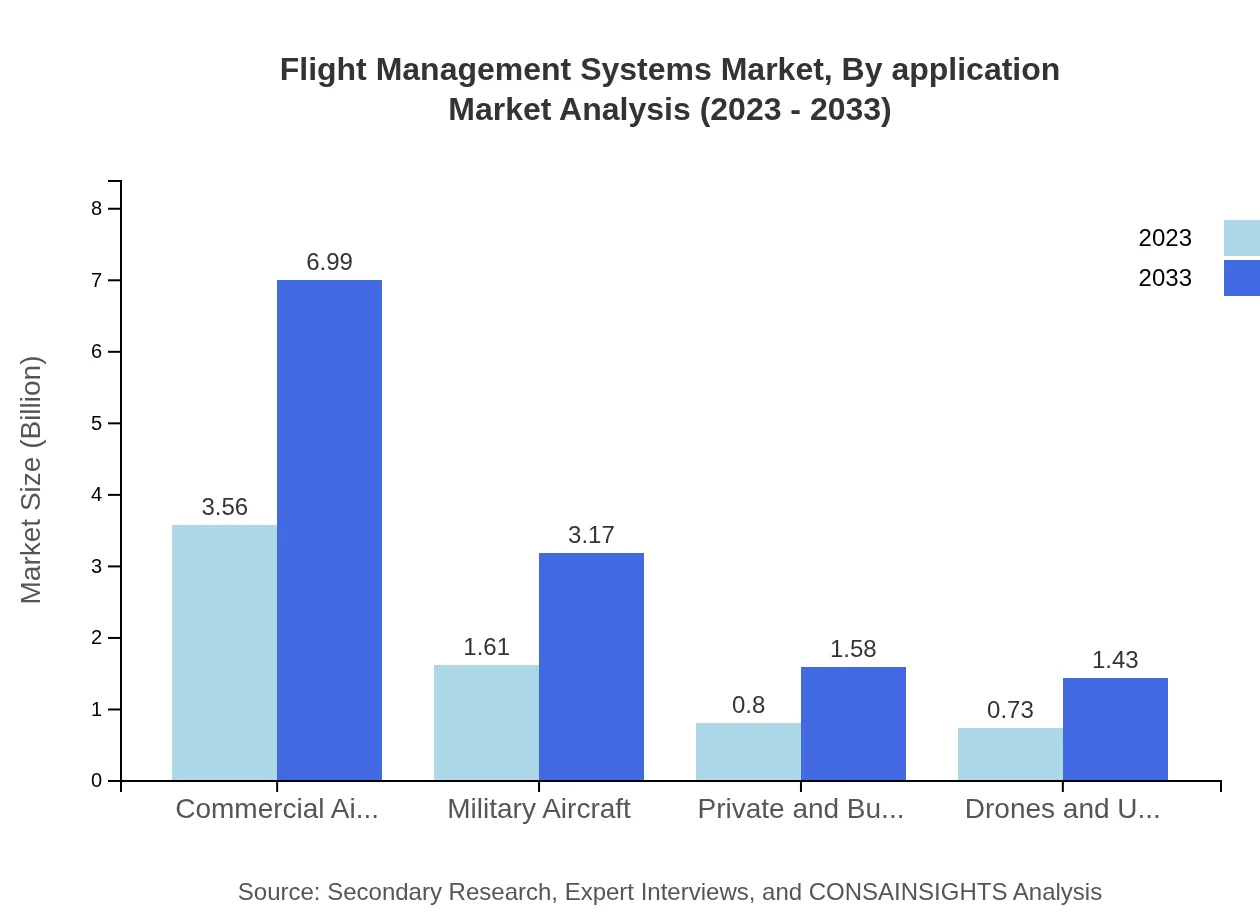

Flight Management Systems Market Analysis By Application

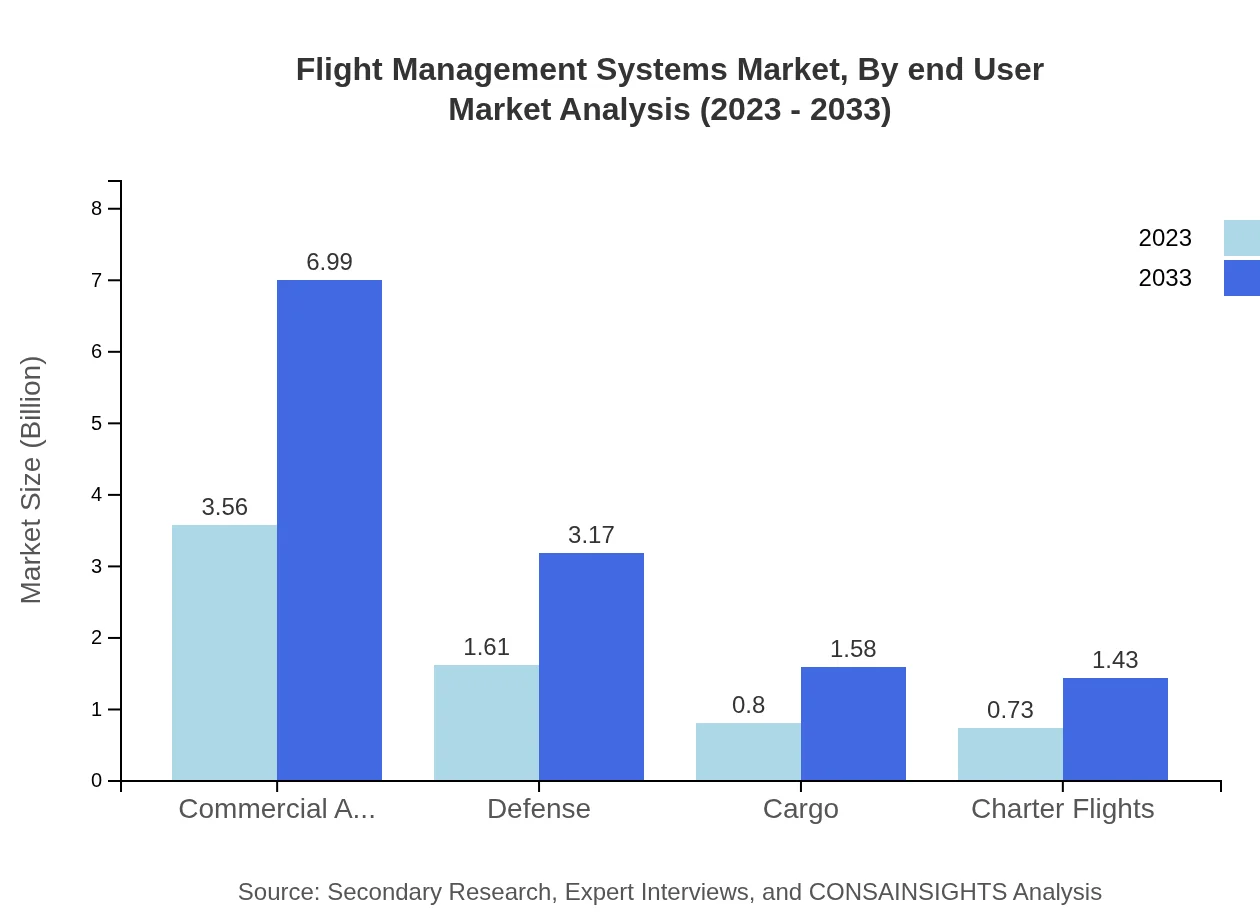

In terms of applications, the Commercial Aviation sector dominates the market, valued at 3.56 billion USD in 2023, expanding to 6.99 billion USD by 2033. The Defense segment is marked at 1.61 billion USD in 2023, expected to rise to 3.17 billion USD, focusing on advancements in military operations. Cargo and Charter Flights segments also exhibit growth, from 0.80 billion to 1.58 billion and 0.73 billion to 1.43 billion dollars, respectively, reflecting increased freight and charter operations.

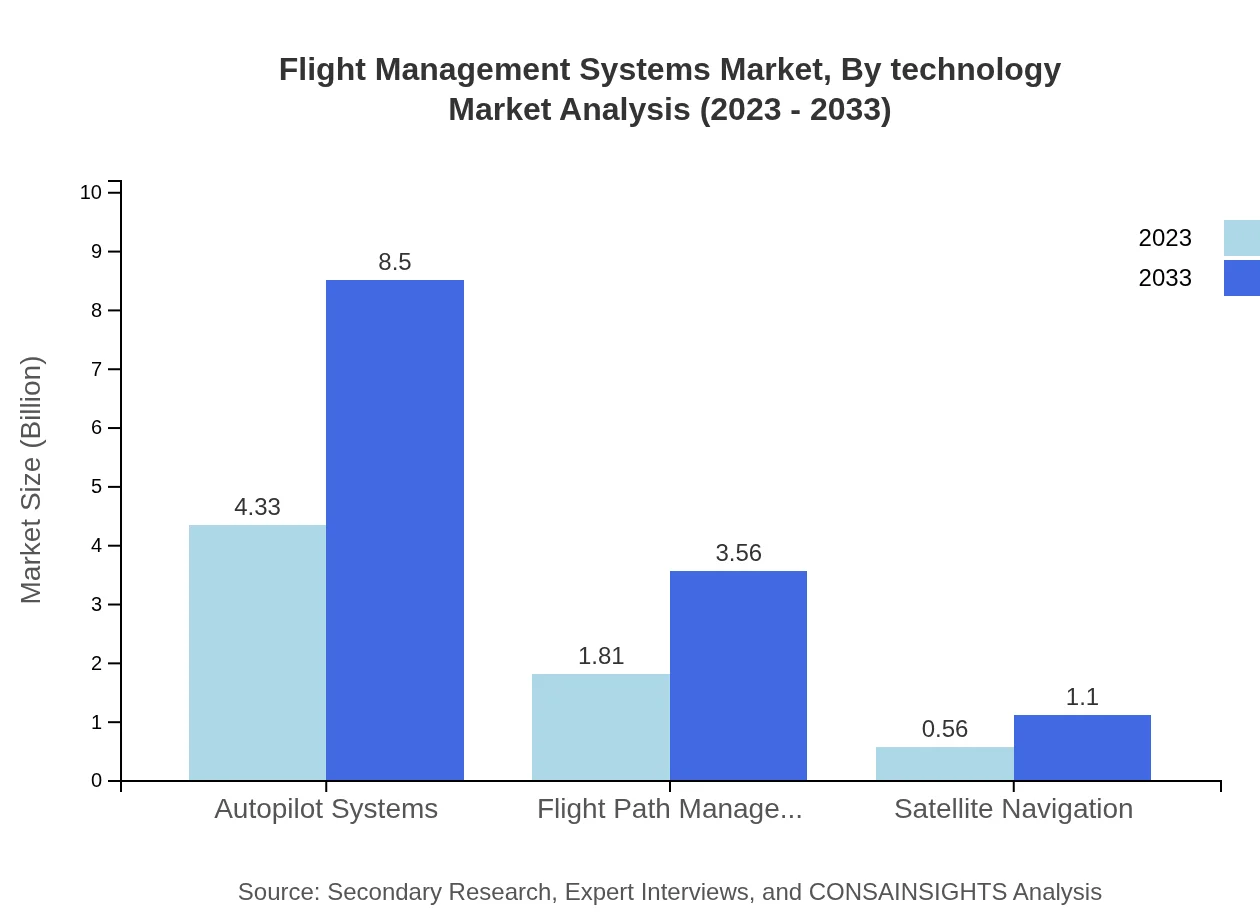

Flight Management Systems Market Analysis By Technology

The technology segment covers Autopilot Systems, Flight Path Management, and Satellite Navigation. The Autopilot Systems market is set at 4.33 billion USD in 2023, doubling by 2033, while Flight Path Management, valued at 1.81 billion USD, is expected to grow to 3.56 billion USD. Satellite Navigation will evolve from 0.56 billion to 1.10 billion dollars, showcasing the advancements in navigation technology.

Flight Management Systems Market Analysis By End User

The end-user market encapsulates Commercial Aircraft, Military Aircraft, Private and Business Jets, and UAS/Drones. Commercial Aircraft represents a significant share at 3.56 billion USD, anticipated to reach 6.99 billion USD by 2033. Military Aircraft is projected to expand from 1.61 billion to 3.17 billion dollars. The private jets market grows at a steady pace, while UAS/Drones also sees expanded demand as commercial applications increase.

Flight Management Systems Market Analysis By Architecture

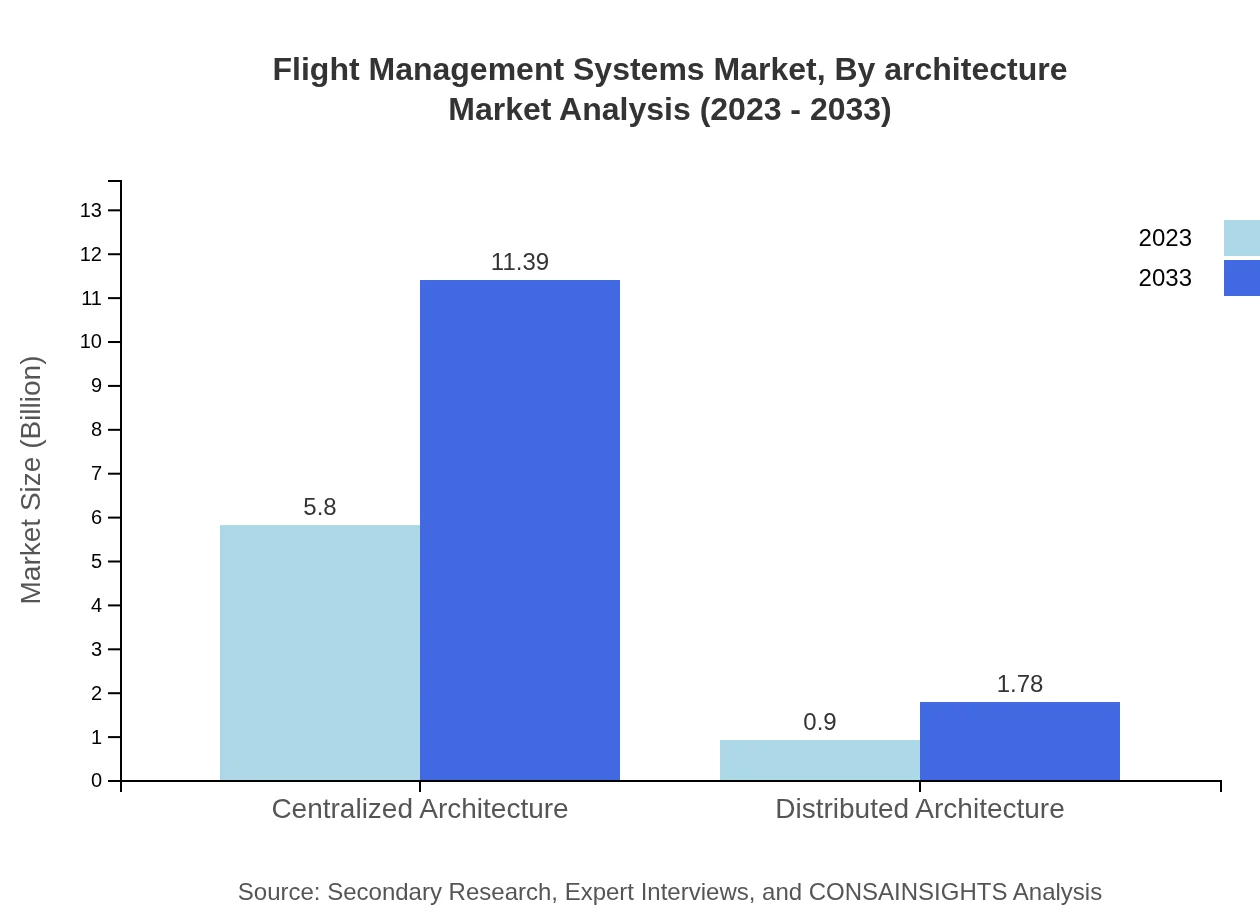

The architecture segment includes Centralized and Distributed architectures. Centralized architecture dominates the market with a valuation of 5.80 billion USD in 2023, projected to reach 11.39 billion USD by 2033. Distributed architecture, while smaller at 0.90 billion USD, showcases growth potential reaching 1.78 billion USD by 2033 as the demand for flexible and scalable systems rises.

Flight Management Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flight Management Systems Industry

Honeywell International Inc.:

Honeywell is a leading provider of integrated avionics systems, offering advanced hardware and software solutions for Flight Management Systems, with a focus on improving aircraft safety, efficiency, and operational capabilities.Rockwell Collins:

Rockwell Collins specializes in providing innovative communications and electronic solutions, including state-of-the-art Flight Management Systems pivotal to modern aviation operations and military applications.Thales Group:

Thales Group is known for its high-performance systems and services in defense and aerospace sectors, focusing on advanced flight technology integration within Flight Management Systems.Garmin Ltd.:

Garmin provides a wide range of aviation solutions, particularly its cutting-edge Flight Management Systems designed for private jets, general aviation, and commercial use.We're grateful to work with incredible clients.

FAQs

What is the market size of flight management systems?

The global flight management systems market is projected to grow from approximately $6.7 billion in 2023, with a compound annual growth rate (CAGR) of 6.8%, indicating significant growth potential leading into 2033.

What are the key market players or companies in this flight management systems industry?

Key players in the flight management systems industry include notable companies such as Collins Aerospace, Honeywell International Inc., and Thales Group, which dominate both hardware and software markets, contributing significantly to sector advancements.

What are the primary factors driving the growth in the flight management systems industry?

Driving factors include increasing air traffic, advancements in avionics technology, regulatory requirements for safety, and a growing demand for automation in navigation systems, making flight management systems essential in modern aviation.

Which region is the fastest Growing in the flight management systems?

The fastest-growing region for flight management systems is North America, projected to expand from $2.35 billion in 2023 to approximately $4.62 billion by 2033, reflecting robust growth driven by technological advancements and aviation activities.

Does ConsaInsights provide customized market report data for the flight management systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the flight management systems industry, ensuring detailed insights and comprehensive analyses based on unique requirements.

What deliverables can I expect from this flight management systems market research project?

Deliverables include detailed market analysis reports, segmentation insights, trend forecasts, competitive assessments, and strategic recommendations tailored to enhance decision-making capabilities in the flight management systems market.

What are the market trends of flight management systems?

Market trends in flight management systems highlight a shift towards advanced autopilot systems, integration of AI, and enhancements in satellite navigation technologies, promoting efficiency and safety in aviation operations.