Flight Navigation System Market Report

Published Date: 03 February 2026 | Report Code: flight-navigation-system

Flight Navigation System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Flight Navigation System market, covering current trends, market size, segmentation, regional insights, and forecasts from 2023 to 2033. It offers valuable data and insights for stakeholders in the aviation industry.

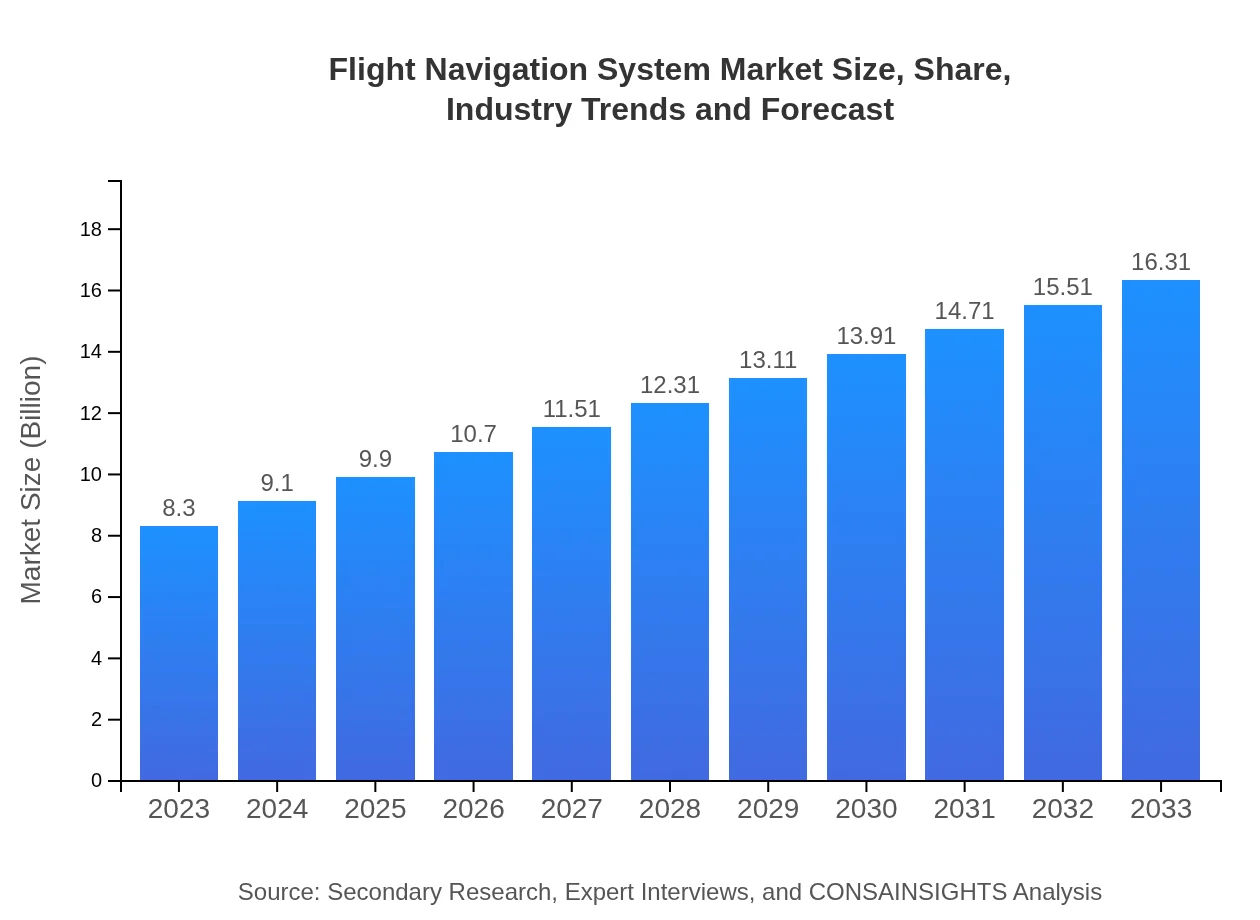

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.31 Billion |

| Top Companies | Garmin Ltd., Rockwell Collins, Honeywell International Inc., Thales Group, Boeing Company |

| Last Modified Date | 03 February 2026 |

Flight Navigation System Market Overview

Customize Flight Navigation System Market Report market research report

- ✔ Get in-depth analysis of Flight Navigation System market size, growth, and forecasts.

- ✔ Understand Flight Navigation System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flight Navigation System

What is the Market Size & CAGR of Flight Navigation System market in 2023?

Flight Navigation System Industry Analysis

Flight Navigation System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flight Navigation System Market Analysis Report by Region

Europe Flight Navigation System Market Report:

Europe's Flight Navigation System market is expected to grow from USD 2.74 billion in 2023 to USD 5.39 billion by 2033. This growth can be attributed to stringent regulatory standards and a focus on safety enhancements within the aviation sector.Asia Pacific Flight Navigation System Market Report:

The Asia Pacific region is projected to experience substantial growth, with the market size expected to increase from USD 1.58 billion in 2023 to USD 3.10 billion by 2033. This growth is driven by rising air travel demand, increasing military aerospace expenditures, and technological advancements in navigation systems.North America Flight Navigation System Market Report:

North America boasts a significant market share, with the market size estimated to rise from USD 2.73 billion in 2023 to USD 5.37 billion by 2033. The presence of major aviation players and high adoption rates of advanced navigation systems facilitate this growth.South America Flight Navigation System Market Report:

In South America, the market is anticipated to grow from USD 0.72 billion in 2023 to USD 1.41 billion in 2033. Factors such as expanding aviation infrastructure and investment in air traffic management contribute to market advancement in this region.Middle East & Africa Flight Navigation System Market Report:

The Middle East and Africa region is projected to grow from USD 0.53 billion in 2023 to USD 1.04 billion by 2033. The increasing militarization of nations within this region and the modernization of existing aviation systems are key factors fuelling growth.Tell us your focus area and get a customized research report.

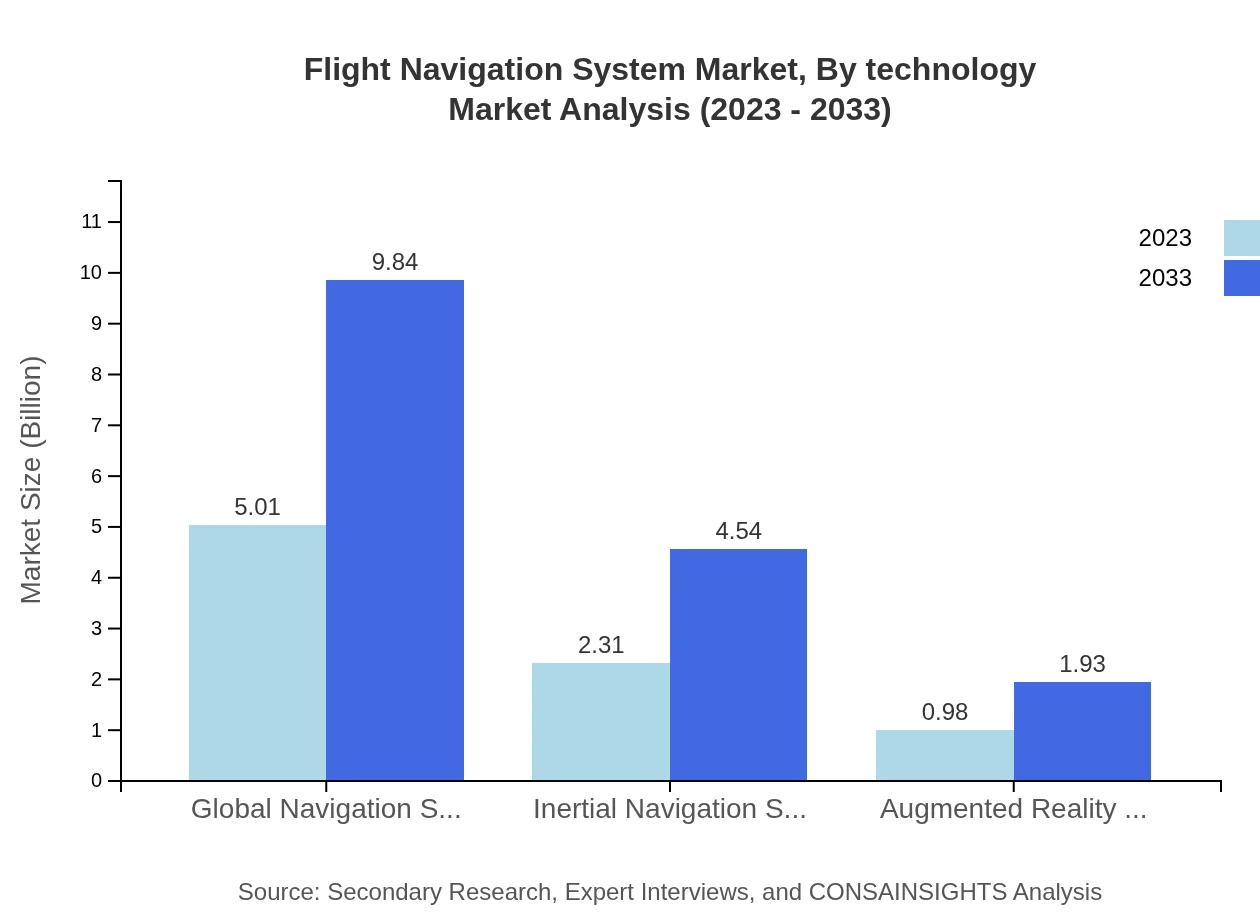

Flight Navigation System Market Analysis By Technology

The Flight Navigation System market by technology includes segments such as Global Navigation Satellite Systems (GNSS), Inertial Navigation Systems (INS), and Augmented Reality Navigation Systems. IN 2023, the GNSS segment accounted for approximately 60.32% of the market, leading the technological innovation in navigation systems. The INS segment followed, commanding 27.83% market share with increasing demand for precision in navigation. Augmented Reality Navigation Systems, although a smaller segment, are gaining traction due to their application in modern cockpit designs.

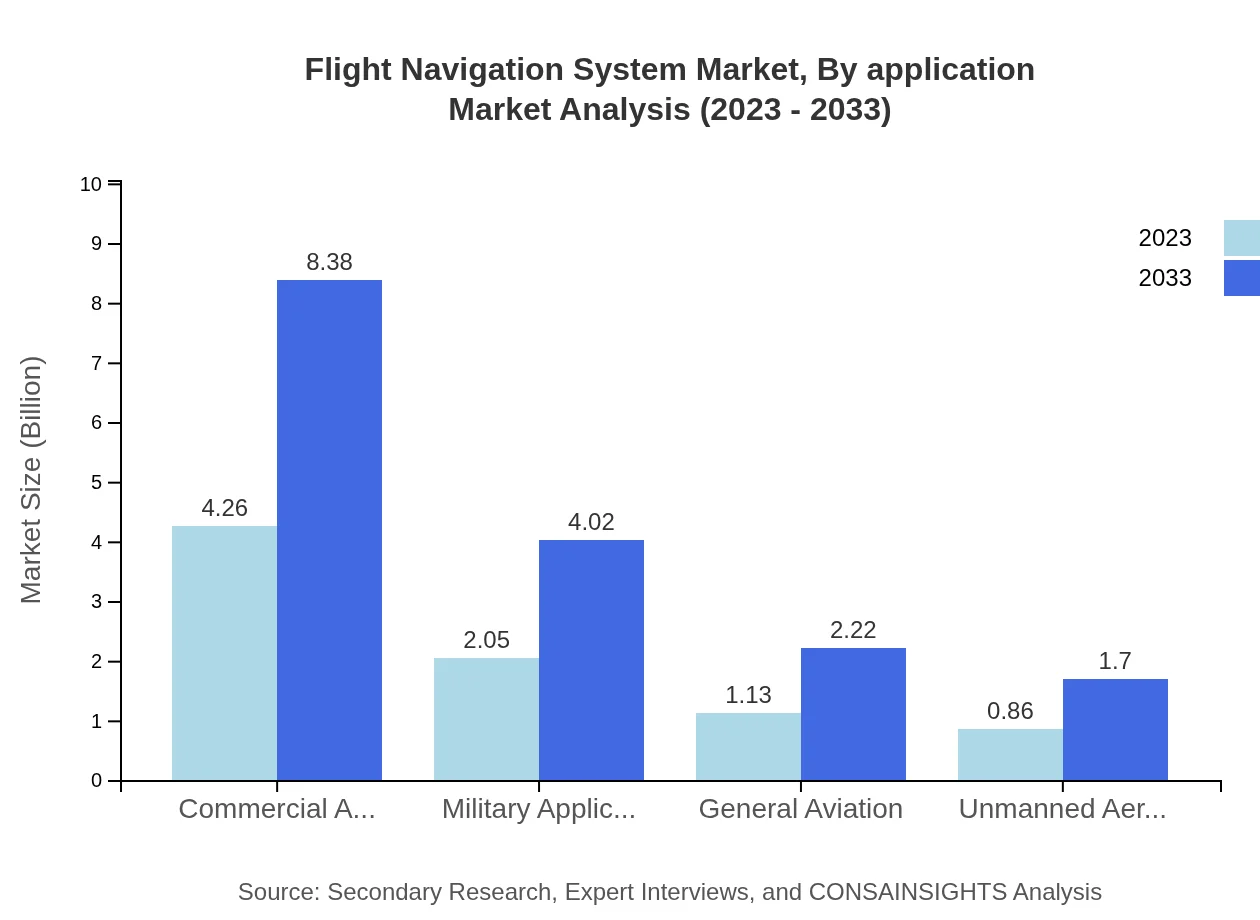

Flight Navigation System Market Analysis By Application

This market segment includes various applications such as Commercial Aviation, Military Applications, General Aviation, and UAV operations. The Commercial Aviation application leads the market with a 51.36% share, emphasizing the significance of efficient flight operations in commercial airlines. Military Applications hold a share of 24.66%, reflecting the need for advanced navigation systems in defense and tactical areas.

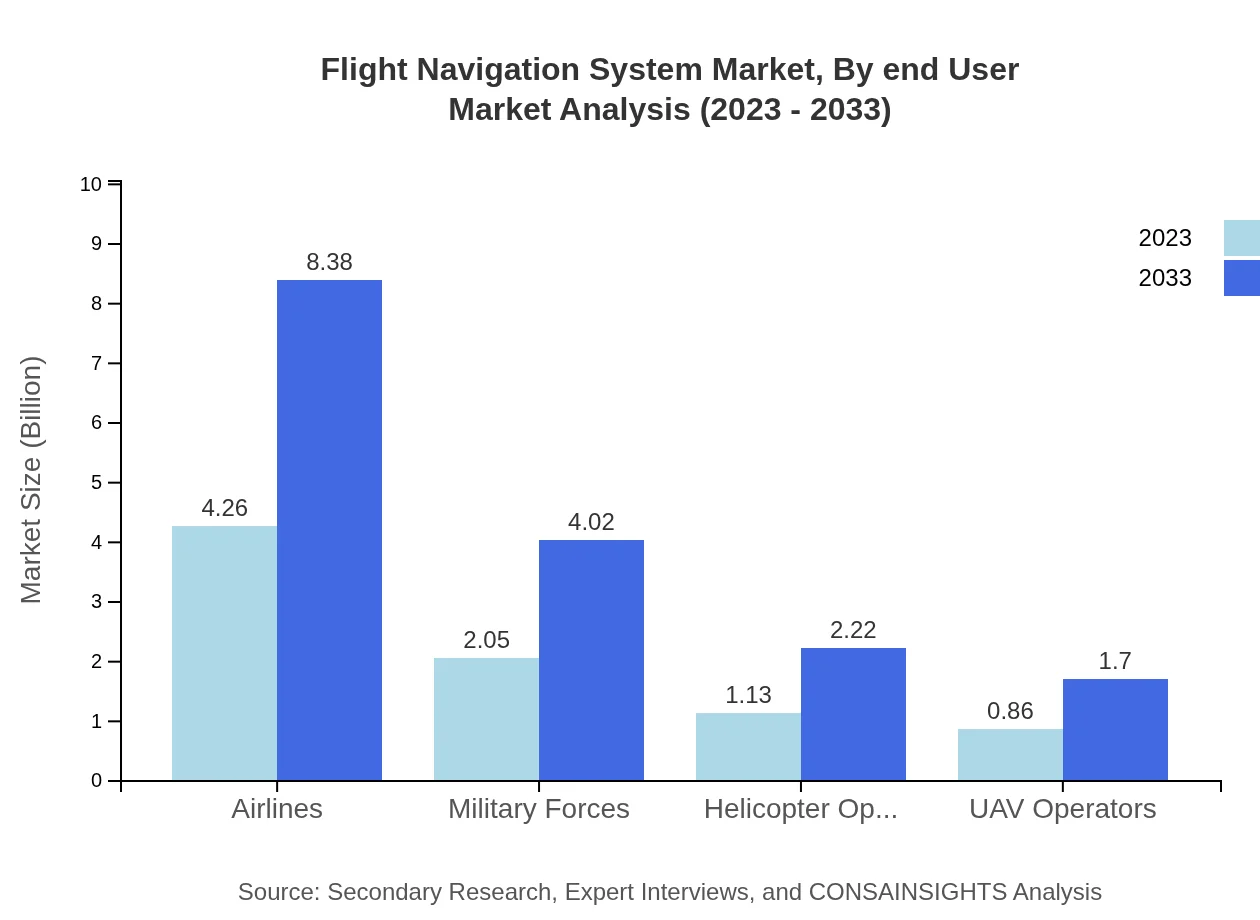

Flight Navigation System Market Analysis By End User

The end-user segmentation includes Airlines, Military Forces, Helicopter Operators, and UAV Operators. Airlines dominate the market due to the growing passenger demand and necessity for efficient navigation systems, while Military Forces are also significant players, requiring high-accuracy systems for operations.

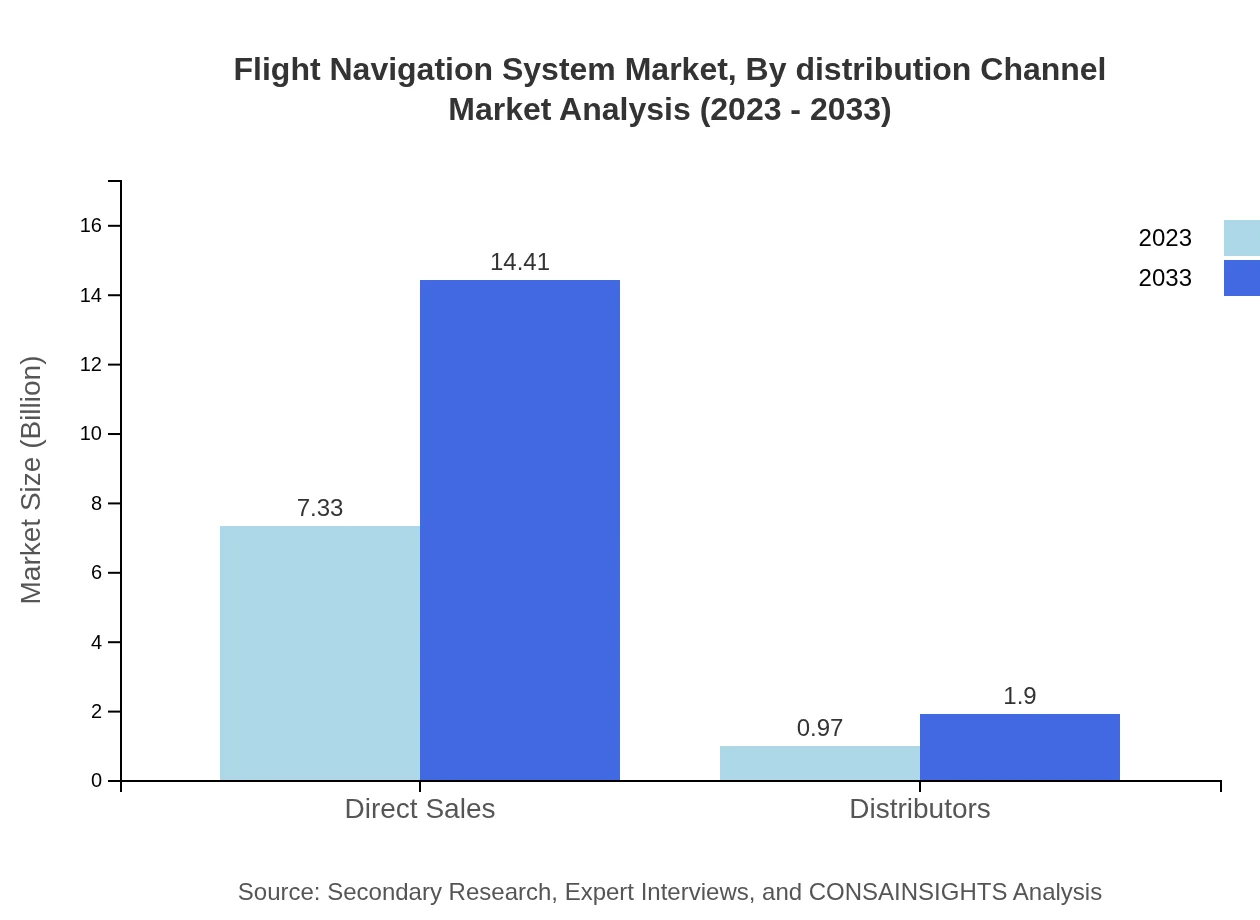

Flight Navigation System Market Analysis By Distribution Channel

The distribution channels for Flight Navigation Systems can be broken down into Direct Sales and Distribution through third-party vendors. Direct Sales represents the majority of the market, allowing companies to establish closer relationships with customers. However, channel distributions via distributors are also critical in reaching wider markets.

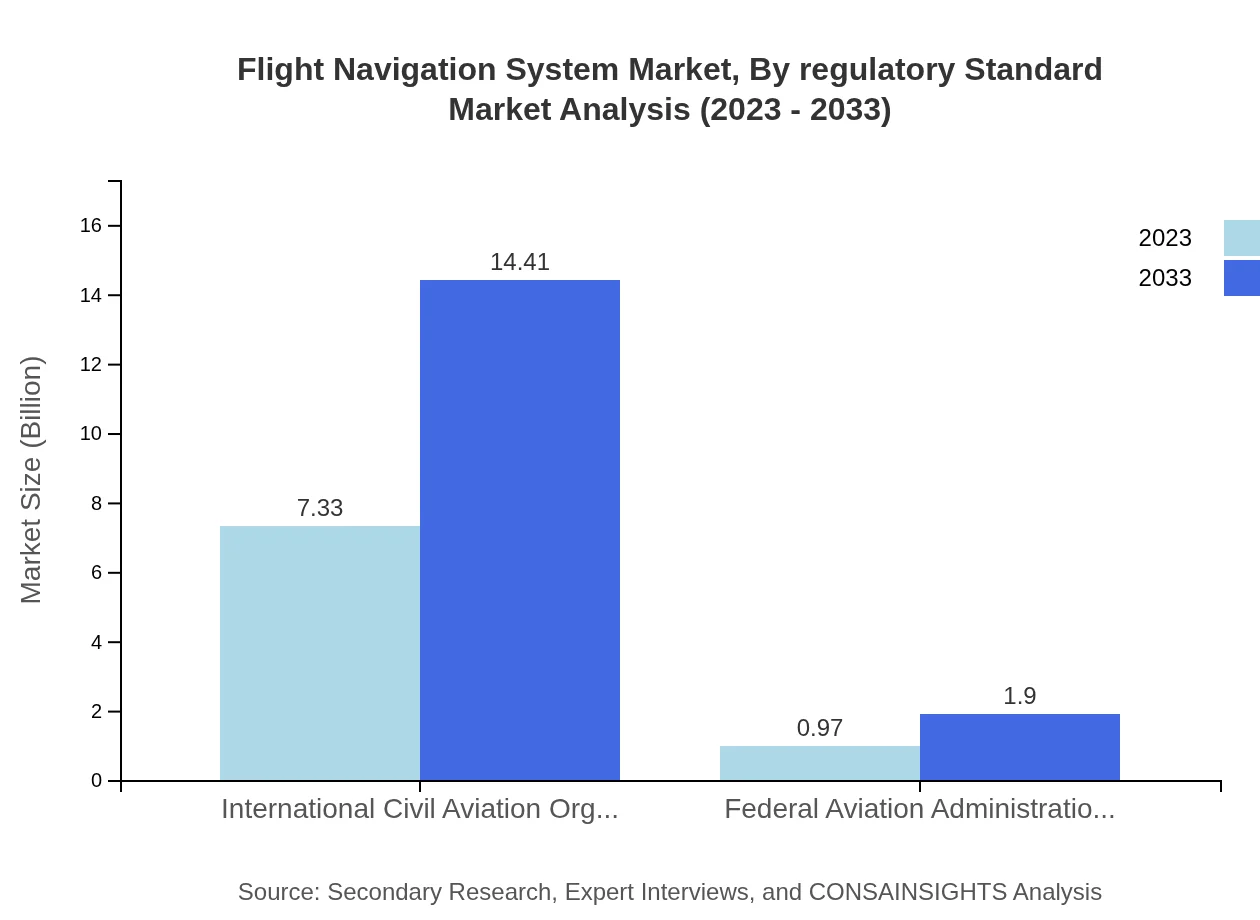

Flight Navigation System Market Analysis By Regulatory Standard

Regulatory standards play a pivotal role in shaping the Flight Navigation System market. Organizations such as the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA) set stringent regulations and quality standards essential for product validation, impacting development and market entry strategies of firms.

Flight Navigation System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flight Navigation System Industry

Garmin Ltd.:

A leader in navigation technology, Garmin offers a range of solutions for aviation, including GPS and flight management systems.Rockwell Collins:

Specializing in advanced avionics systems, Rockwell Collins provides innovative navigation and communication solutions for aircraft.Honeywell International Inc.:

Honeywell develops and manufactures aerospace products and services, including cutting-edge navigation technology that enhances flight safety.Thales Group:

Thales Group provides various integrated aerospace solutions, focusing on advanced navigation and surveillance systems.Boeing Company:

Boeing's innovations in flight navigation technologies support safe and efficient air travel globally.We're grateful to work with incredible clients.

FAQs

What is the market size of flight Navigation System?

The global Flight Navigation System market is valued at approximately $8.3 billion, with a projected CAGR of 6.8%, indicating significant growth potential through 2033.

What are the key market players or companies in this flight Navigation System industry?

Prominent companies in the flight navigation system industry include Garmin, Honeywell, Northrop Grumman, Rockwell Collins, and Thales Group. These companies lead through technological innovation and a diverse product range.

What are the primary factors driving the growth in the flight Navigation System industry?

Key drivers of growth in the flight navigation system industry include increasing air travel demand, advancements in technology like GNSS and INS, and rising military applications for precision navigation.

Which region is the fastest Growing in the flight Navigation System?

The fastest-growing region for flight navigation systems is Europe, expected to grow from $2.74 billion in 2023 to $5.39 billion by 2033, demonstrating strong market dynamics.

Does ConsaInsights provide customized market report data for the flight Navigation System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the flight navigation system industry, providing insights according to client requirements.

What deliverables can I expect from this flight Navigation System market research project?

Deliverables from the flight navigation system market research project include comprehensive reports, market forecasts, competitive analysis, and insights into consumer trends and technological advancements.

What are the market trends of flight Navigation System?

Current market trends include increased adoption of satellite-based technologies, integration of AI in navigation, and a rise in demand from both commercial and military sectors for advanced navigation systems.