Flocculant And Coagulant Market Report

Published Date: 31 January 2026 | Report Code: flocculant-and-coagulant

Flocculant And Coagulant Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Flocculant And Coagulant market, offering insights into market dynamics, growth trends, and segment performances. The forecast period extends from 2023 to 2033, addressing market size, growth rates, and regional analyses.

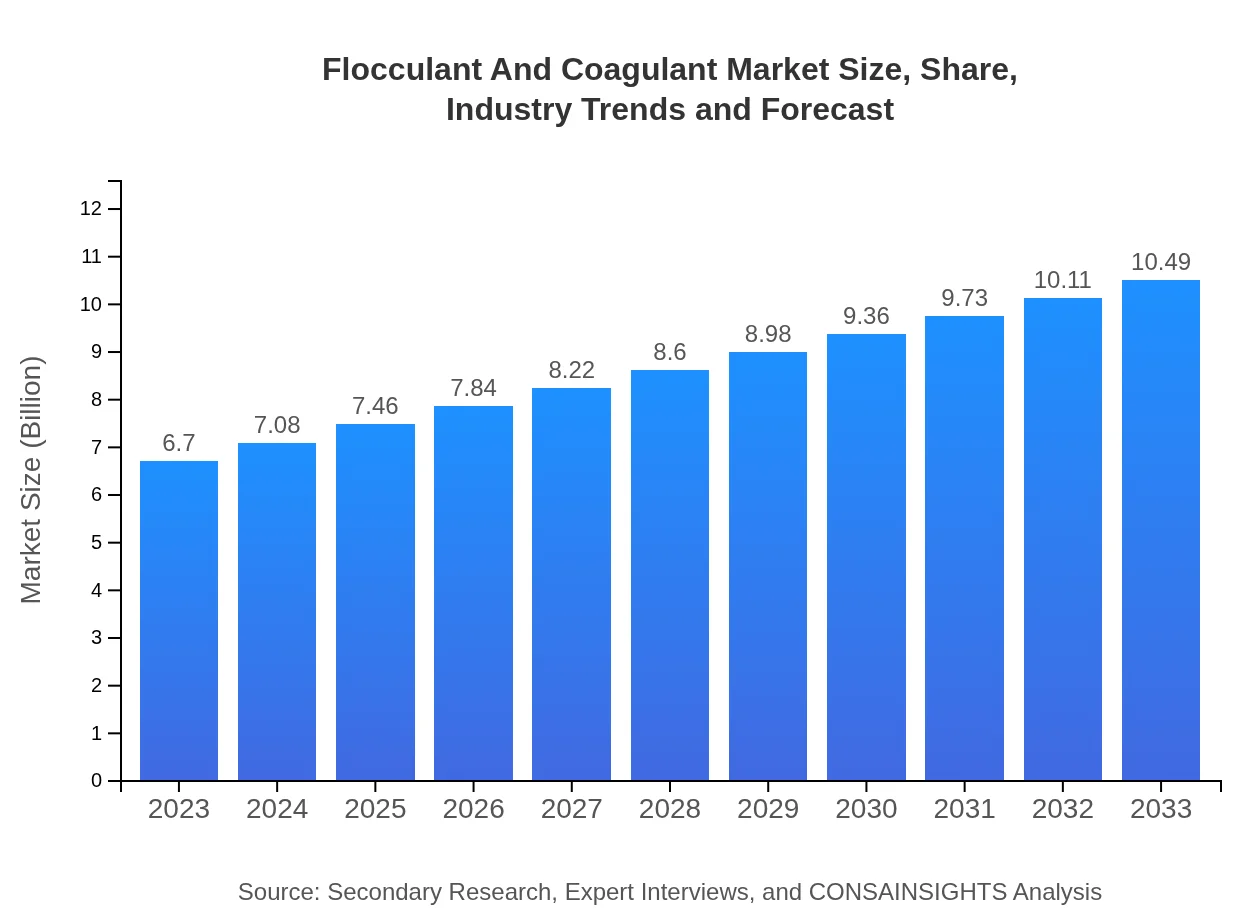

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.70 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $10.49 Billion |

| Top Companies | BASF SE, Ecolab Inc., Kemira Oyj, SNF Group, Solvay S.A. |

| Last Modified Date | 31 January 2026 |

Flocculant And Coagulant Market Overview

Customize Flocculant And Coagulant Market Report market research report

- ✔ Get in-depth analysis of Flocculant And Coagulant market size, growth, and forecasts.

- ✔ Understand Flocculant And Coagulant's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flocculant And Coagulant

What is the Market Size & CAGR of Flocculant And Coagulant market in 2023?

Flocculant And Coagulant Industry Analysis

Flocculant And Coagulant Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flocculant And Coagulant Market Analysis Report by Region

Europe Flocculant And Coagulant Market Report:

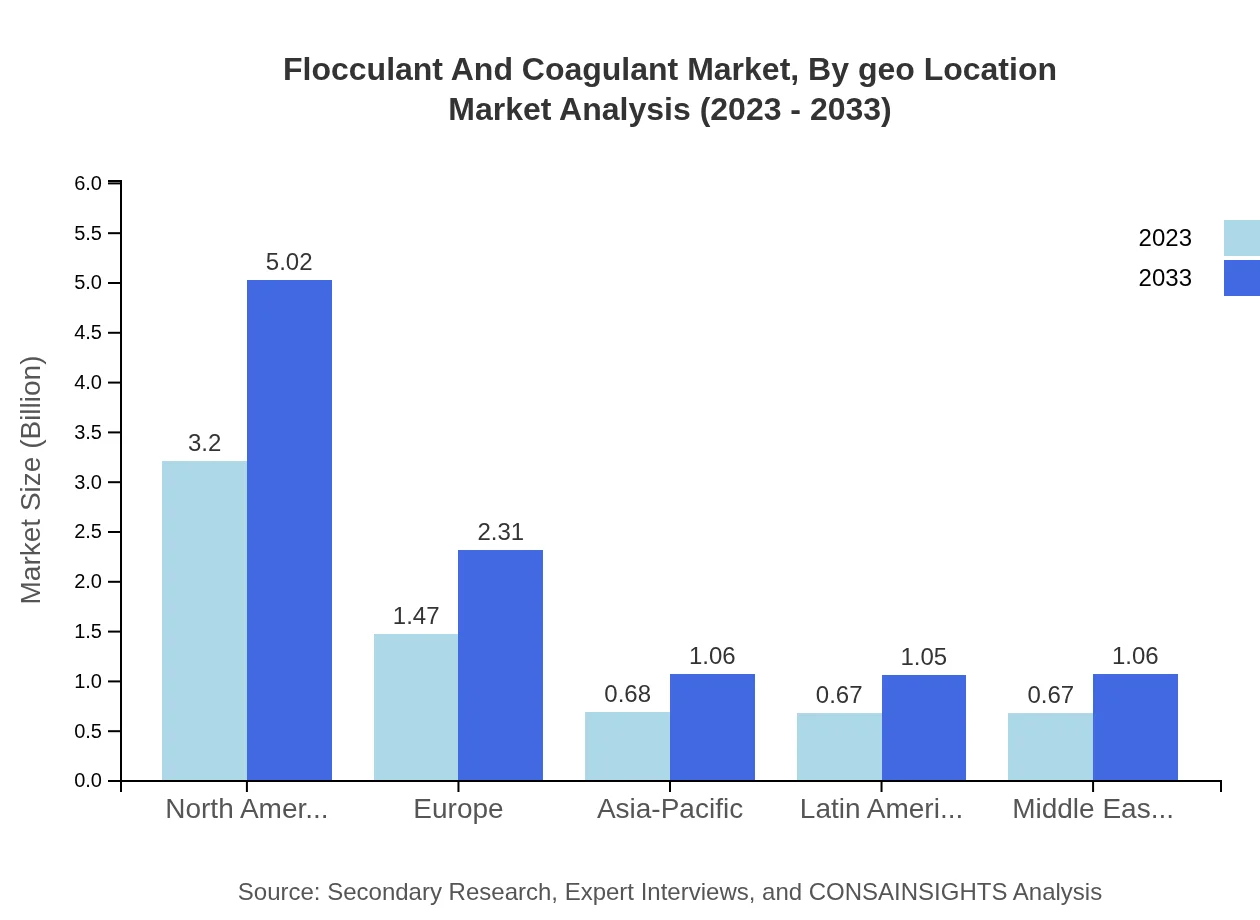

Europe is projected to grow from $2.23 billion in 2023 to $3.49 billion in 2033, driven by advanced regulatory frameworks around waste treatment and growing investments in eco-sustainable technologies in the water treatment sector.Asia Pacific Flocculant And Coagulant Market Report:

The Asia Pacific region is anticipated to experience significant growth, with a market size projected to grow from $1.19 billion in 2023 to $1.86 billion by 2033. This expansion is fueled by rapid industrialization, urbanization, and increasing investments in infrastructure development, particularly in water supply and wastewater management initiatives.North America Flocculant And Coagulant Market Report:

North America leads the market, with a valuation of $2.43 billion in 2023 forecasted to reach $3.80 billion by 2033. The region's emphasis on eco-friendly water treatment practices and stringent regulations contributes to its robust market position.South America Flocculant And Coagulant Market Report:

South America is expected to see moderate growth, with market values rising from $0.28 billion in 2023 to $0.44 billion in 2033. Driven by emerging economies and urban development, the South American market is increasingly adopting advanced water treatment solutions.Middle East & Africa Flocculant And Coagulant Market Report:

The Middle East and Africa are set for steady growth, with market sizes anticipated to rise from $0.58 billion in 2023 to $0.90 billion by 2033, reflecting growing industrial activities and increasing investments aimed at improving water sanitation and management.Tell us your focus area and get a customized research report.

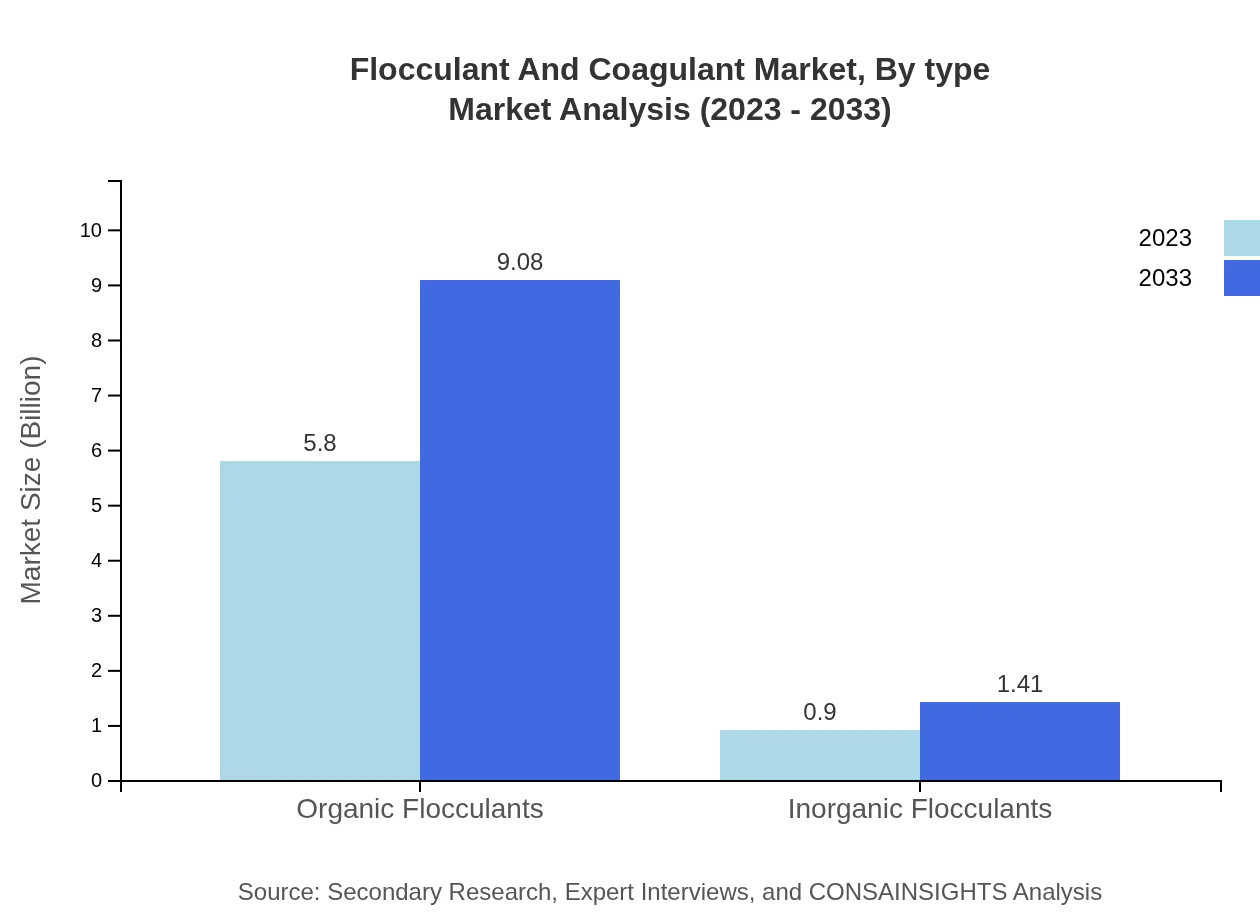

Flocculant And Coagulant Market Analysis By Type

The market consists of organic and inorganic flocculants, where organic flocculants dominate due to their efficiency and less environmental impact. In 2023, organic flocculants are valued at $5.80 billion, projected to grow to $9.08 billion by 2033, capturing 86.53% of the market share.

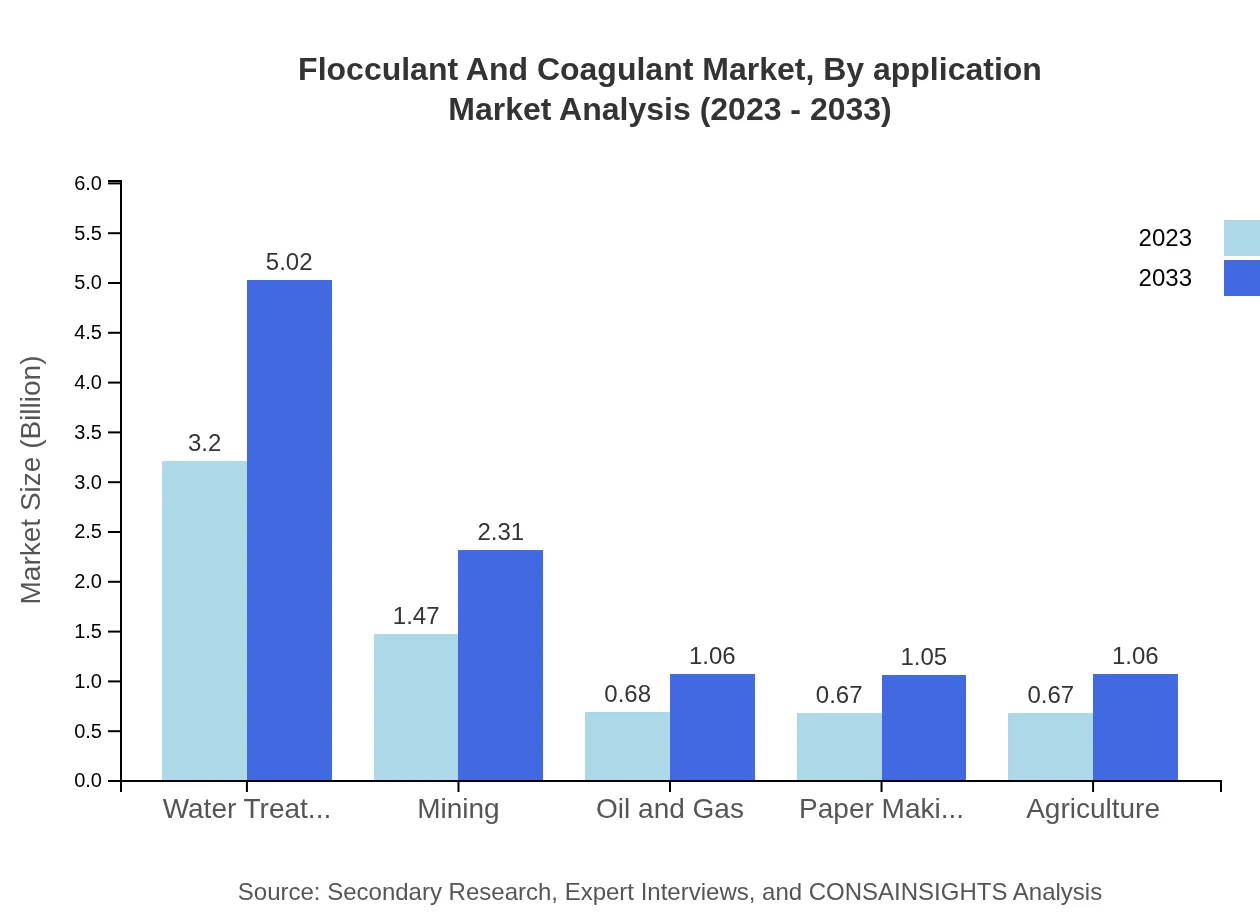

Flocculant And Coagulant Market Analysis By Application

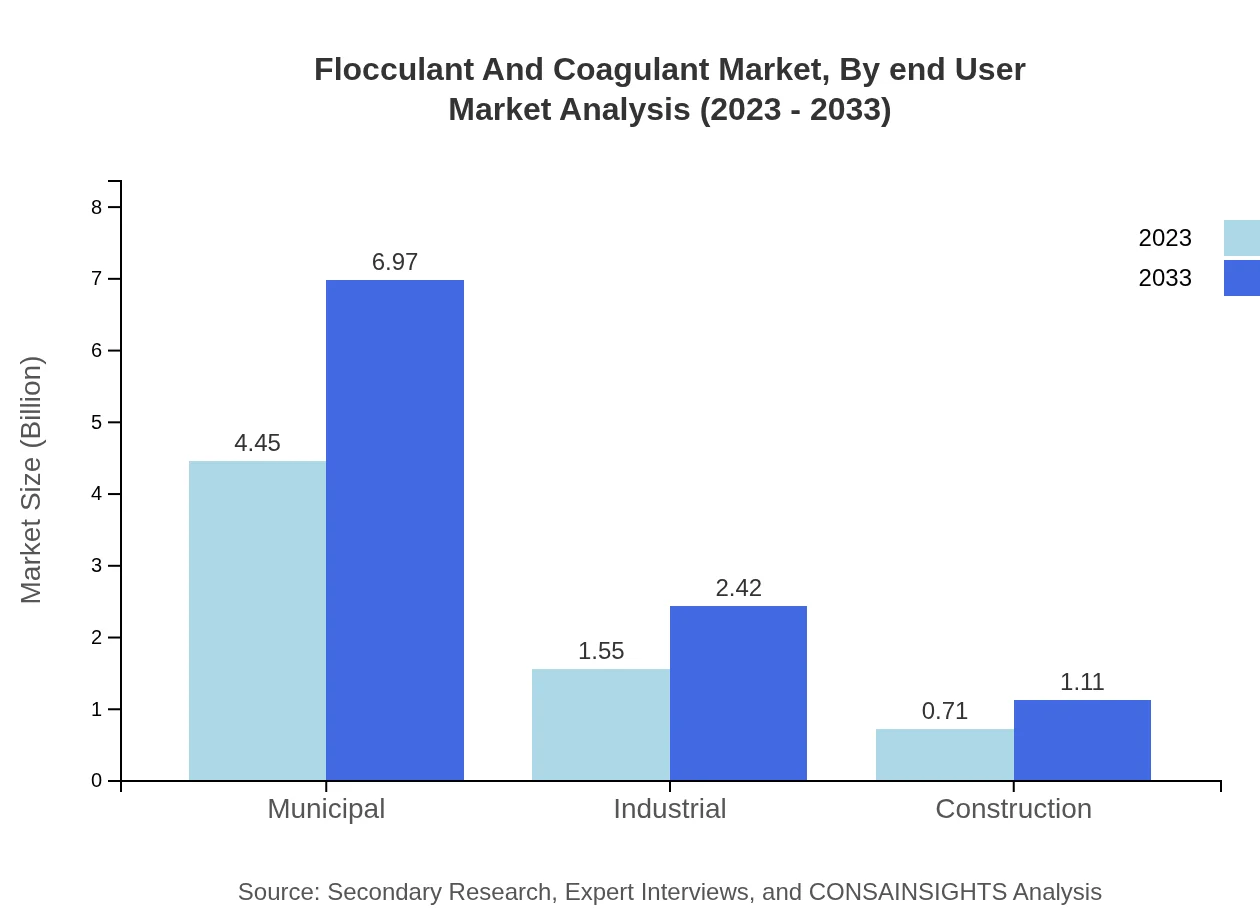

The applications of flocculants and coagulants vary across sectors such as municipal water treatment, industrial applications, and agriculture. Municipal applications currently dominate with a market size of $4.45 billion in 2023, increasing to $6.97 billion by 2033, enjoying a stable share of approximately 66.4%.

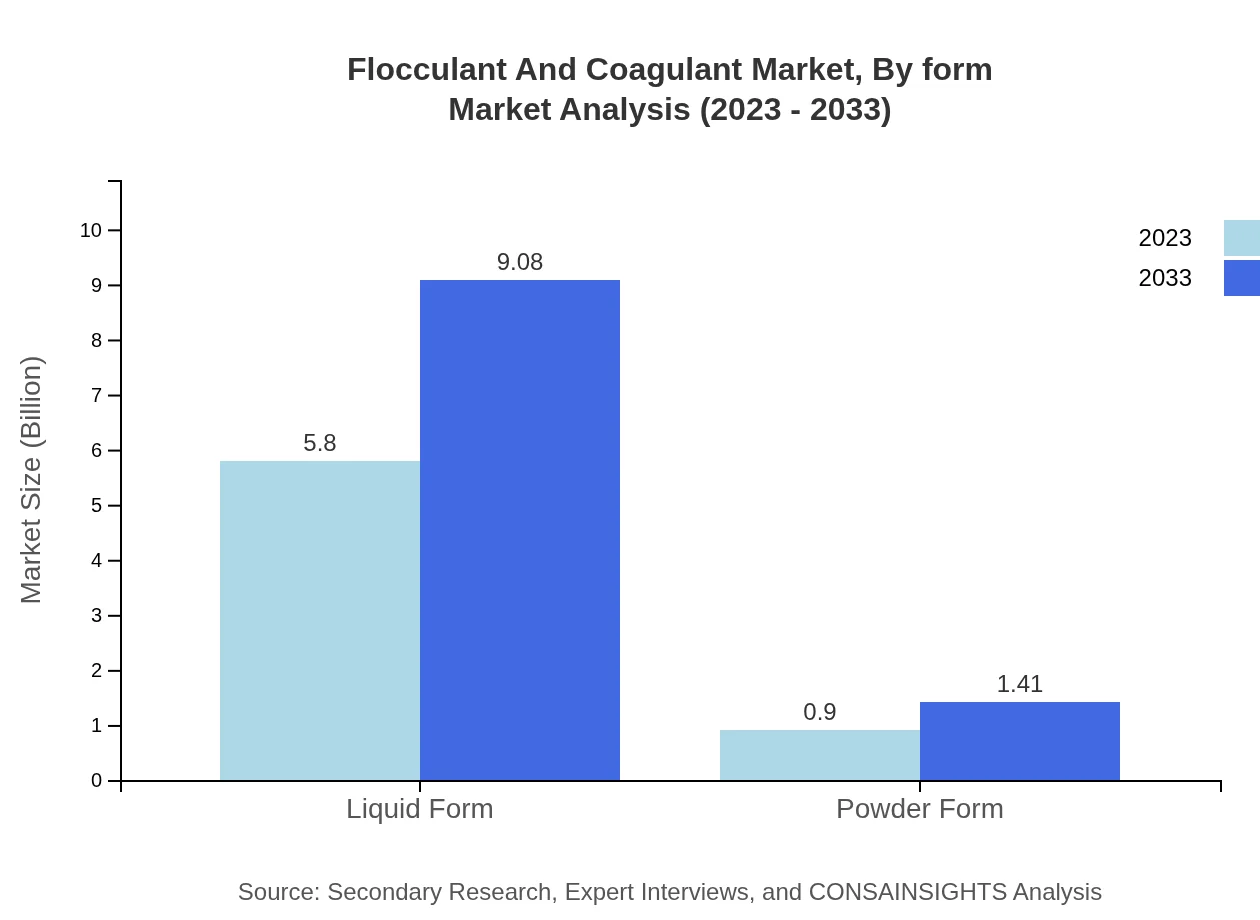

Flocculant And Coagulant Market Analysis By Form

Globally, the liquid form of flocculants is favored, projecting market sizes of $5.80 billion in 2023 to $9.08 billion in 2033 with a steady share of 86.53%. Powder forms, while less prevalent, are anticipated to grow from $0.90 billion to $1.41 billion in the same period.

Flocculant And Coagulant Market Analysis By End User

End-users include municipal, industrial, construction, and mining applications. The municipal sector emerges as the primary consumer, projected to increase its share extensively in coming years, emphasizing the need for effective wastewater management solutions.

Flocculant And Coagulant Market Analysis By Geo Location

The geographical distribution of the market reflects varied demand, with North America and Europe leading due to advanced regulatory standards and elevated industrial requirements, while Asia-Pacific exhibits the fastest growth due to burgeoning industrial sectors.

Flocculant And Coagulant Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flocculant And Coagulant Industry

BASF SE:

BASF SE is a global leader in chemicals and materials, known for its extensive range of organic and inorganic flocculants, emphasizing sustainability and performance.Ecolab Inc.:

Ecolab Inc. specializes in water purification and management solutions and is recognized for innovative water treatment products that cater to diverse industrial applications.Kemira Oyj:

Kemira Oyj is committed to developing sustainable chemical solutions for water treatment, focusing on improved operational efficiency in various industries.SNF Group:

The SNF Group provides a wide range of polymers for water treatment applications, known for their commitment to research and environmental stewardship.Solvay S.A.:

Solvay S.A. leads in the manufacture of high-performance flocculants with a focus on water treatment applications across different industrial sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Flocculant and Coagulant?

The global flocculant and coagulant market is valued at approximately $6.7 billion in 2023, with a projected CAGR of 4.5% leading to growth by 2033. This growth is crucial for various applications including water treatment and industrial processes.

What are the key market players or companies in the Flocculant and Coagulant industry?

Key players in the flocculant and coagulant market include companies such as BASF, Kemira, SNF Floerger, and AkzoNobel. These companies have a significant influence on market dynamics and innovation, contributing to overall industry growth.

What are the primary factors driving the growth in the Flocculant and Coagulant industry?

Growth in the flocculant and coagulant industry is primarily driven by increasing demand for water treatment processes, rising industrial activities, and regulatory pressures for environmental compliance. Sustainable practices are also becoming more prominent.

Which region is the fastest Growing in the Flocculant and Coagulant?

The Asia-Pacific region is the fastest-growing area in the flocculant and coagulant market. By 2033, it is expected to increase from $1.19 billion in 2023 to approximately $1.86 billion, highlighting robust industrial growth.

Does Consainsights provide customized market report data for the Flocculant and Coagulant industry?

Yes, Consainsights provides tailored market report data for the flocculant and coagulant industry, catering to specific client needs and ensuring comprehensive insights that align with individual business strategies.

What deliverables can I expect from this Flocculant and Coagulant market research project?

Deliverables from the flocculant and coagulant market research project include comprehensive market analysis reports, segmentation data, regional insights, and future market forecasts to guide strategic planning and decision-making.

What are the market trends of Flocculant and Coagulant?

Key trends in the flocculant and coagulant market include the increasing use of organic flocculants, advancements in product formulations, and a growing emphasis on environmentally friendly solutions to enhance performance and compliance.