Flour Market Report

Published Date: 31 January 2026 | Report Code: flour

Flour Market Size, Share, Industry Trends and Forecast to 2033

This detailed report covers the Flour market, providing insights into market trends, segmentation, and forecasts from 2023 to 2033. It analyzes various factors affecting the market, including size, growth potential, and regional developments.

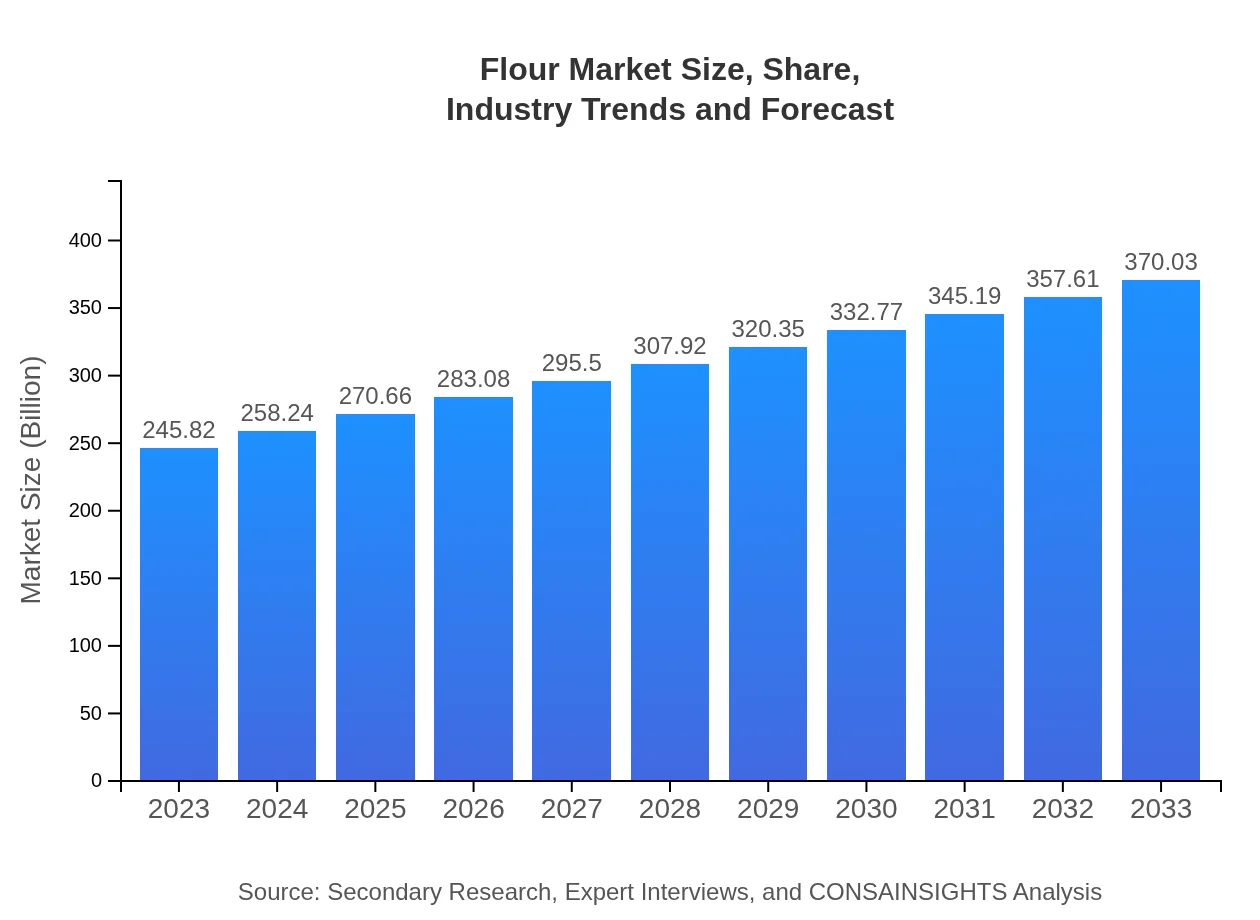

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $245.82 Billion |

| CAGR (2023-2033) | 4.1% |

| 2033 Market Size | $370.03 Billion |

| Top Companies | General Mills, Archer Daniels Midland Company (ADM), Conagra Brands, King Arthur Baking Company |

| Last Modified Date | 31 January 2026 |

Flour Market Overview

Customize Flour Market Report market research report

- ✔ Get in-depth analysis of Flour market size, growth, and forecasts.

- ✔ Understand Flour's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flour

What is the Market Size & CAGR of Flour market in 2023?

Flour Industry Analysis

Flour Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flour Market Analysis Report by Region

Europe Flour Market Report:

Europe is expected to see substantial growth, with the Flour market rising from $79.40 billion in 2023 to $119.52 billion by 2033. The demand for high-quality flour products and the popularity of artisanal baking in countries like France and Italy are significant contributing factors. There is a rising inclination towards organic and sustainable products among consumers.Asia Pacific Flour Market Report:

The Asia Pacific region is anticipated to experience considerable growth in the Flour market, valued at $46.88 billion in 2023, projected to reach $70.56 billion by 2033. The increasing population, rising disposable incomes, and growing urbanization are key drivers of this growth. There is notable demand for traditional flour-based products like noodles, with countries such as China and India leading consumption.North America Flour Market Report:

North America, with a market size of $79.89 billion in 2023, is projected to grow to $120.26 billion by 2033. The U.S. is a dominant player, supported by the strong presence of major flour producers and the increasing trend of home baking. Consumer preferences for gluten-free and alternative flour options are also reshaping the market landscape.South America Flour Market Report:

In South America, the Flour market is expected to grow from $11.60 billion in 2023 to $17.47 billion by 2033. Brazil and Argentina are the largest consumers, driven by their robust agricultural sectors and rising demand for baked goods and processed foods. The trend towards healthy eating and organic products is also influencing market dynamics in this region.Middle East & Africa Flour Market Report:

The Middle East and Africa flour market is projected to expand from $28.05 billion in 2023 to $42.22 billion by 2033, driven by increasing urbanization and population growth. The region has a rich culinary heritage that relies heavily on flour-based products, particularly in countries like Egypt and South Africa.Tell us your focus area and get a customized research report.

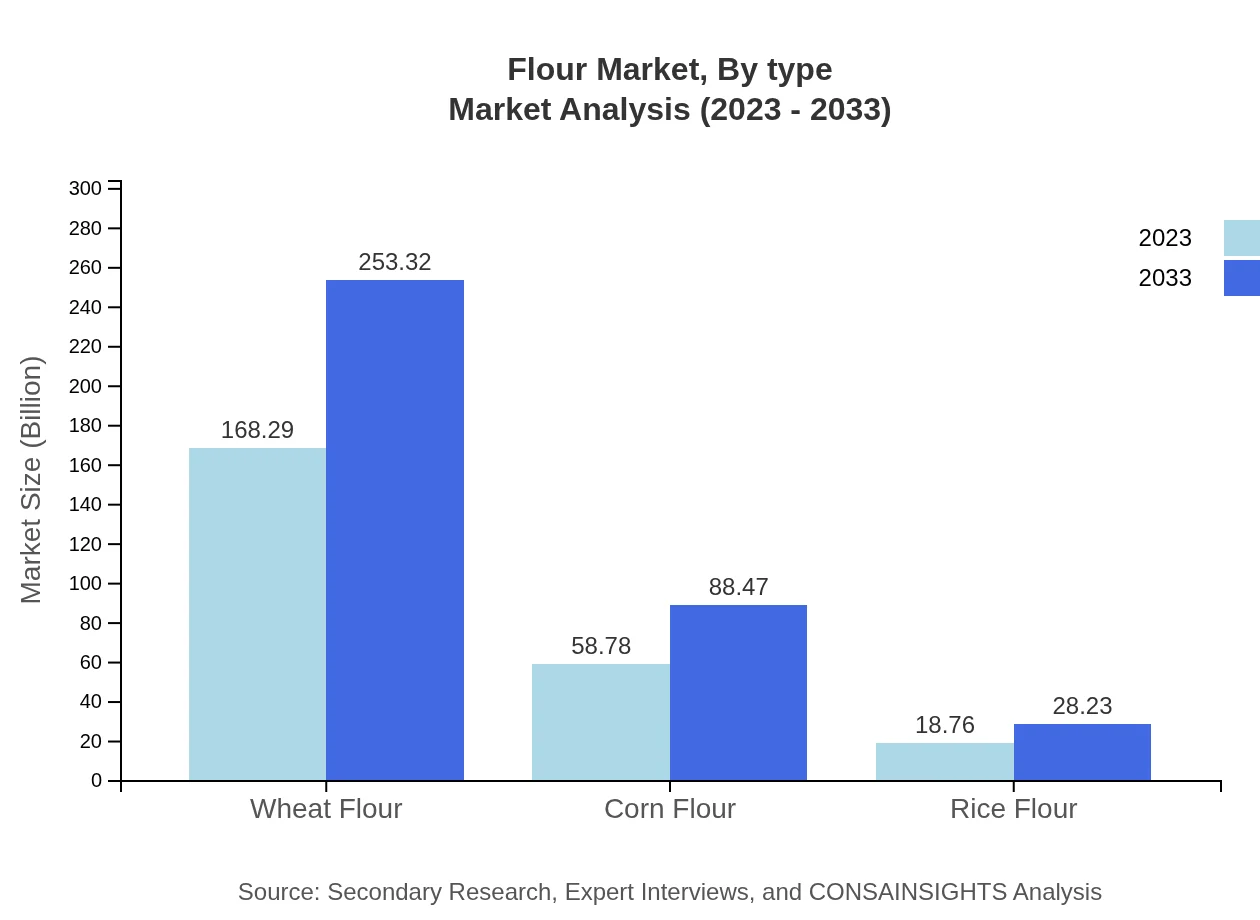

Flour Market Analysis By Type

In 2023, the Wheat Flour segment dominates the market with a size of $168.29 billion, expected to grow to $253.32 billion by 2033. Corn Flour follows with a size of $58.78 billion projected to reach $88.47 billion. Rice Flour, while smaller, shows potential growth from $18.76 billion to $28.23 billion. Wheat continues to hold the largest market share due to its versatility and widespread use in baking and cooking.

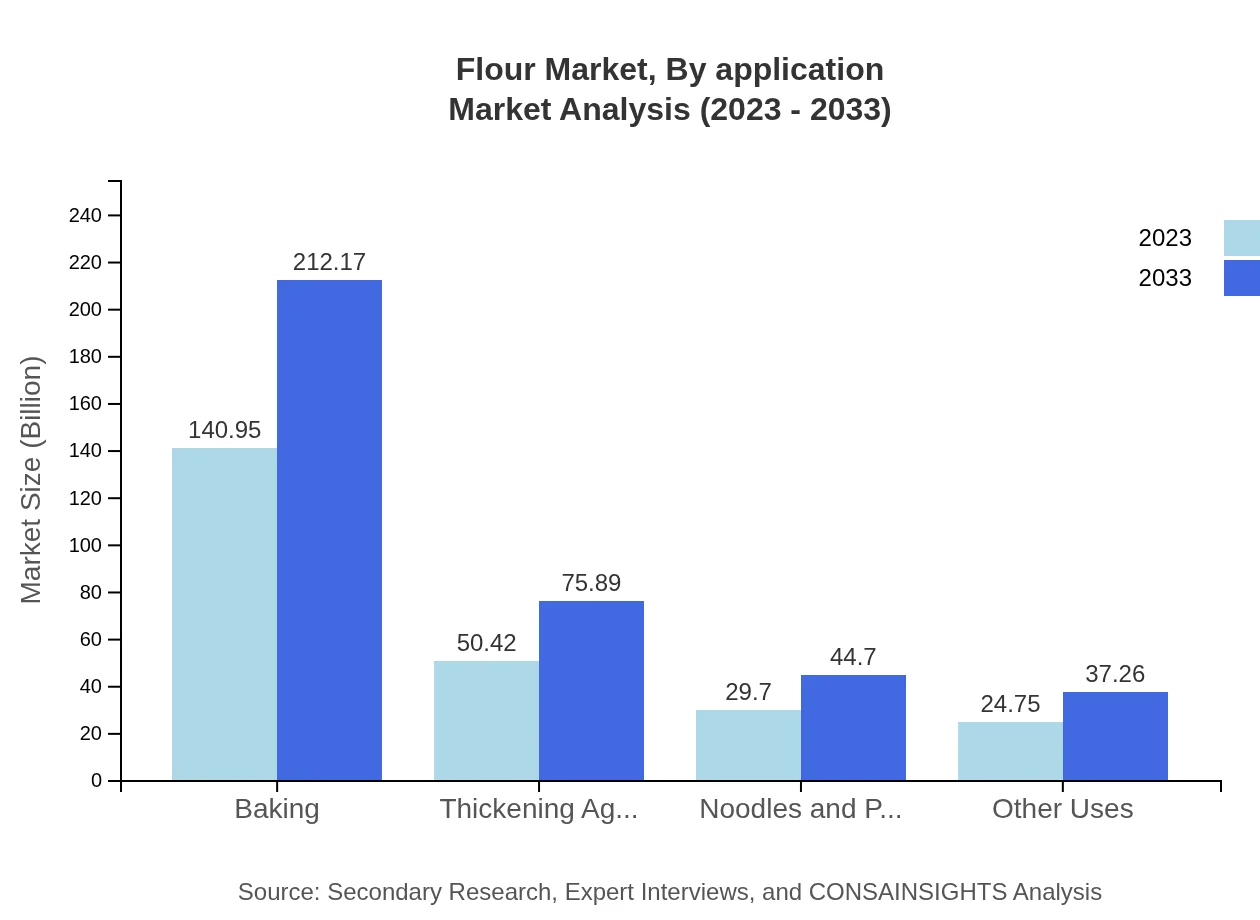

Flour Market Analysis By Application

In application segments, baking leads the market, valued at $140.95 billion in 2023 and expected to increase to $212.17 billion in 2033. Other significant applications include using flour as a thickening agent ($50.42 billion to $75.89 billion) and for noodles and pasta ($29.70 billion to $44.70 billion). These applications are vital in both home and commercial settings, reinforcing flour's importance in daily diets globally.

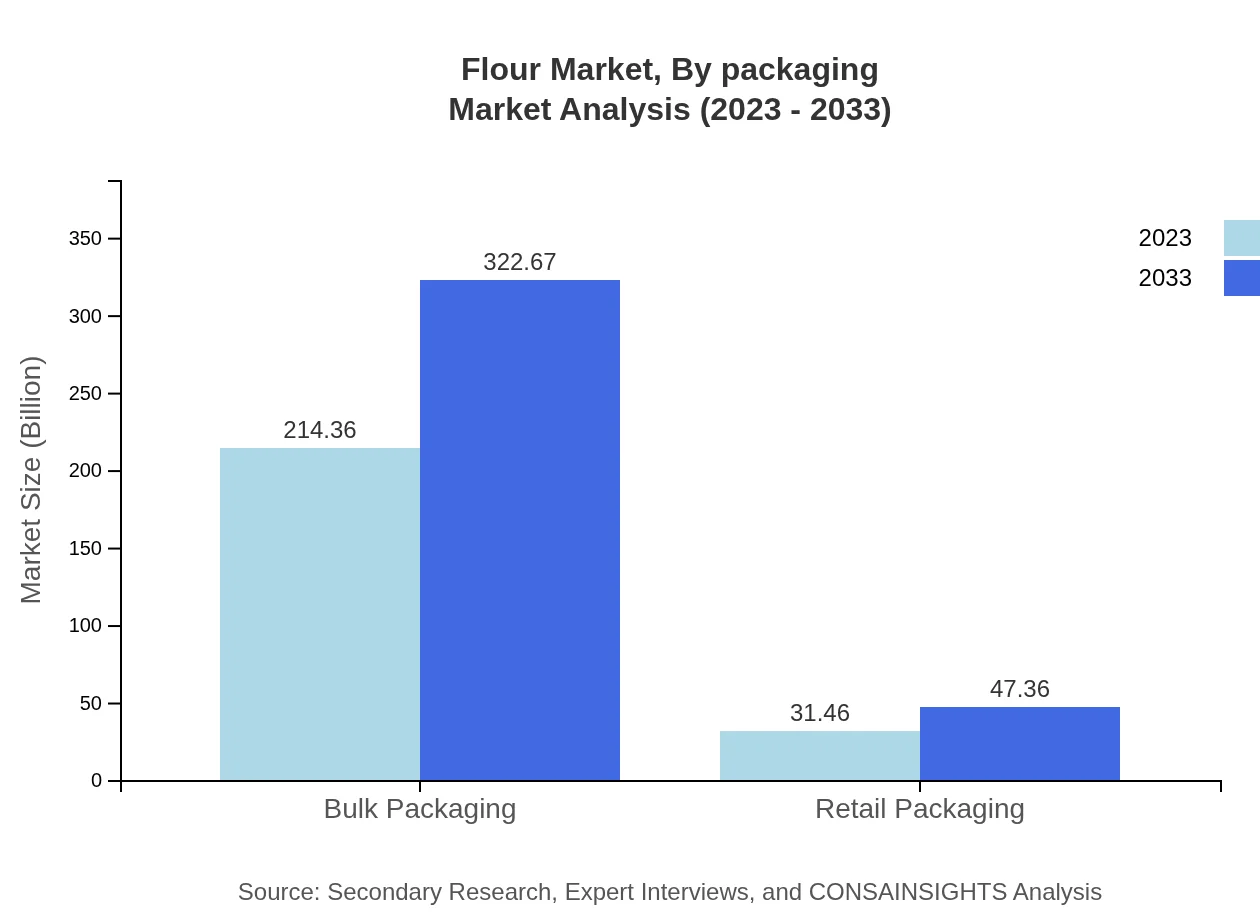

Flour Market Analysis By Packaging

The flour market can also be segmented by packaging, with bulk packaging holding a substantial share valued at $214.36 billion in 2023, expected to grow to $322.67 billion by 2033. Retail packaging, while smaller in size ($31.46 billion to $47.36 billion), is increasingly popular due to the rising trend of home baking and convenience shopping.

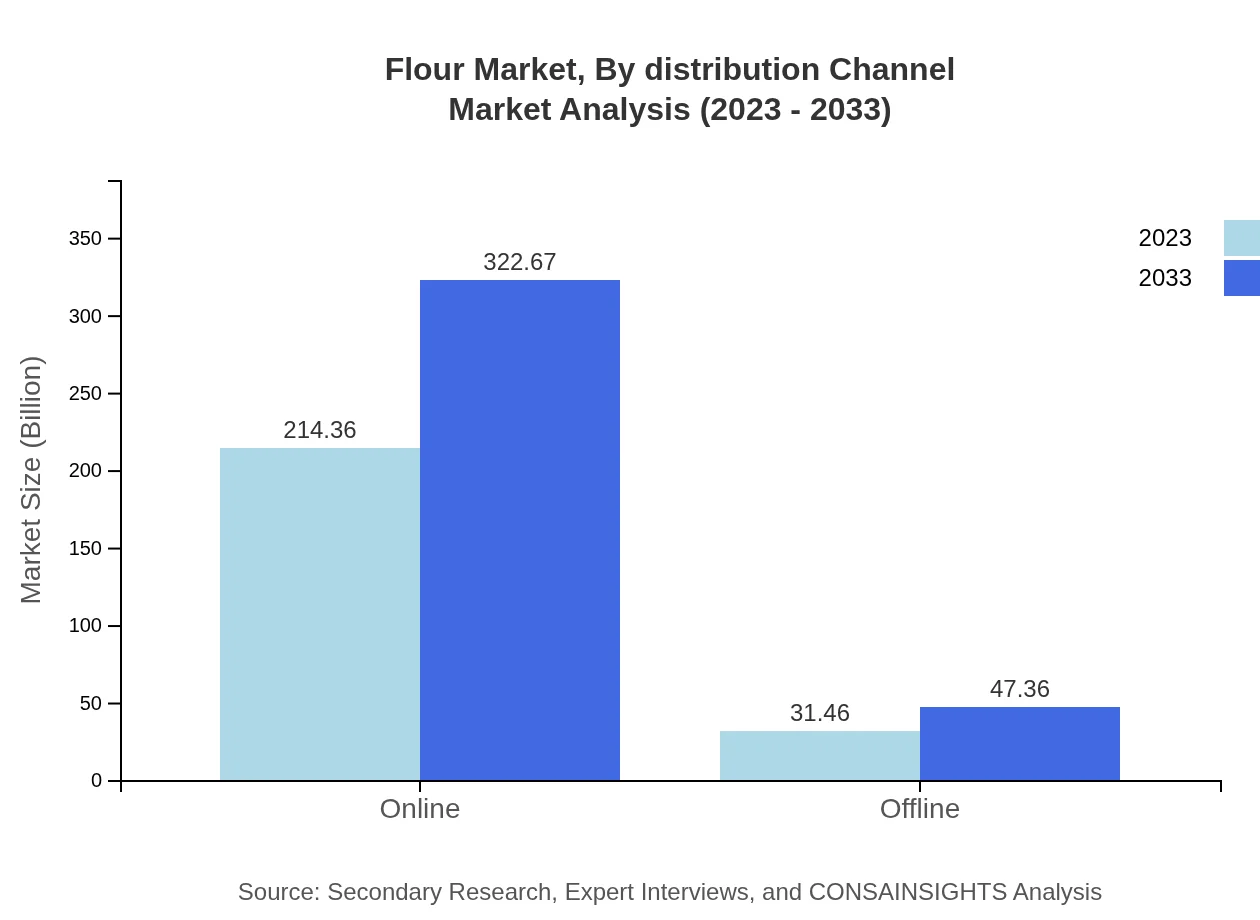

Flour Market Analysis By Distribution Channel

In terms of distribution channels, the online segment is projected to grow from $214.36 billion in 2023 to $322.67 billion by 2033, reflecting the increasing consumer preference for online shopping. In contrast, the offline segment, valued at $31.46 billion in 2023, is expected to rise to $47.36 billion, highlighting the ongoing relevance of traditional retail in the flour market.

Flour Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flour Industry

General Mills:

A leading player in the flour market, General Mills is renowned for its quality products, including Gold Medal Flour, and offers a wide range of organic and gluten-free options.Archer Daniels Midland Company (ADM):

ADM is a major grain processor and one of the largest flour millers globally, providing high-quality flour and ingredients to food manufacturers and retailers.Conagra Brands:

Known for its diverse portfolio of consumer food brands, Conagra is a significant player in the flour market, offering various flour products tailored to both consumers and the food service industry.King Arthur Baking Company:

A well-respected brand in the flour industry, King Arthur Baking Company specializes in high-quality, unbleached flour suitable for baking enthusiasts and professionals alike.We're grateful to work with incredible clients.

FAQs

What is the market size of flour?

The global flour market is valued at approximately $245.82 billion in 2023 and is projected to grow at a CAGR of 4.1%, reaching significant market sizes across various regions by 2033.

What are the key market players or companies in the flour industry?

The flour industry features key players like Archer Daniels Midland Company, General Mills, and Cargill. These companies dominate by providing diverse flour products and exploring innovative solutions to enhance production efficiency and meet consumer demand.

What are the primary factors driving the growth in the flour industry?

Key growth drivers include increasing awareness of healthy eating, the rise in bakery consumption, and the expanding food processing sector. Additionally, innovations in flour production technology and packaging are bolstering market expansion.

Which region is the fastest Growing in the flour market?

Asia-Pacific is the fastest-growing region in the flour market, anticipated to grow from $46.88 billion in 2023 to $70.56 billion by 2033, reflecting strong demand for flour in culinary and food processing applications.

Does ConsInsights provide customized market report data for the flour industry?

Yes, ConsInsights offers customized market report data tailored to specific segments and regions within the flour industry, ensuring clients receive precise insights that meet their unique business needs.

What deliverables can I expect from this flour market research project?

Deliverables include comprehensive market size assessments, segment analyses, competitive landscapes, growth forecasts, and trend identification, all tailored to equip stakeholders with actionable insights for strategic decision-making.

What are the market trends of flour?

Notable trends in the flour market include the rise of gluten-free flour alternatives, increased focus on sustainable sourcing, and growing consumer interest in organic products, which are reshaping market dynamics.