Flow Computer Oil Gas Market Report

Published Date: 31 January 2026 | Report Code: flow-computer-oil-gas

Flow Computer Oil Gas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Flow Computer Oil Gas market from 2023 to 2033, showcasing market size, growth forecasts, and key trends affecting the industry. It also highlights regional insights, technological advancements, and competitive landscapes in this evolving sector.

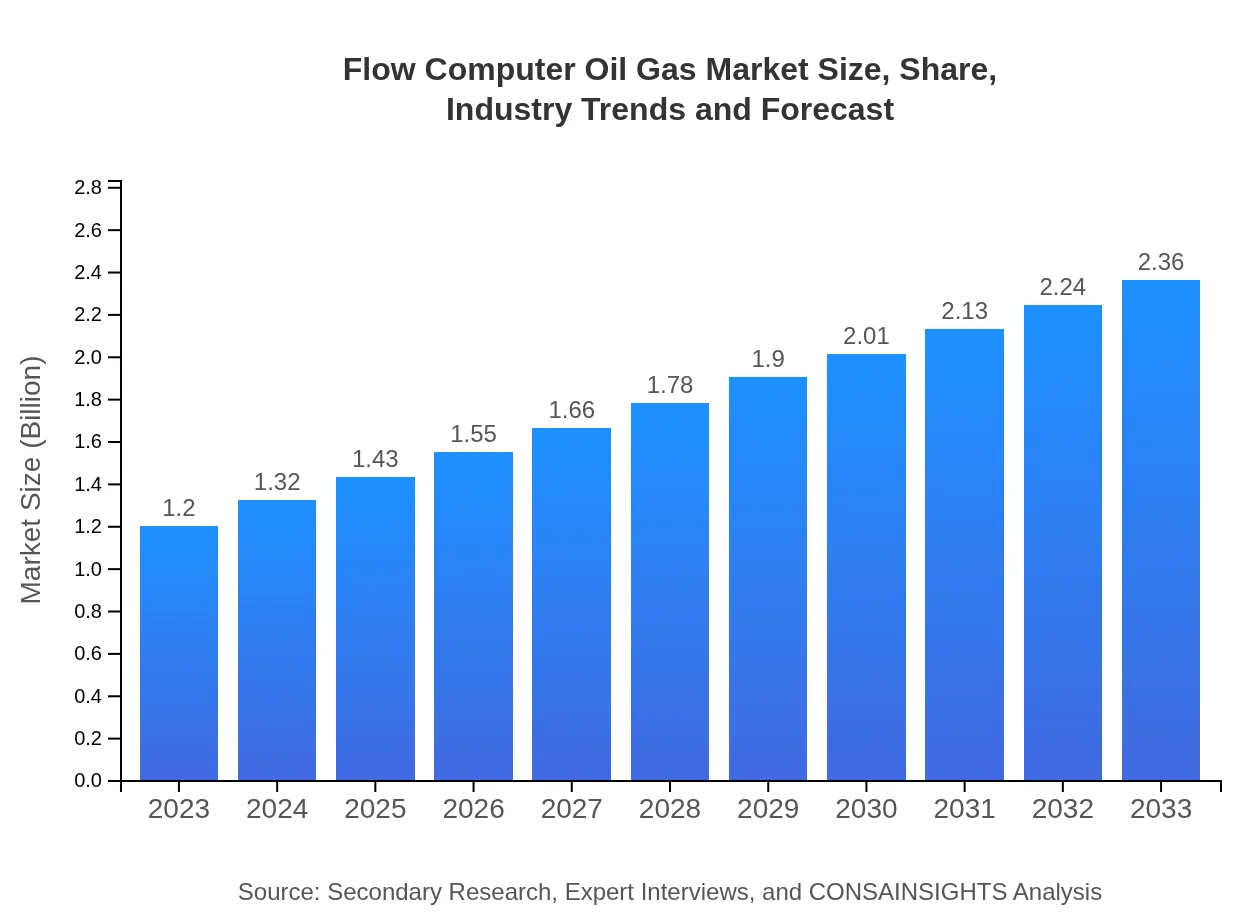

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.36 Billion |

| Top Companies | Emerson Electric Co., Honeywell International Inc., Siemens AG, KROHNE Group, Schneider Electric |

| Last Modified Date | 31 January 2026 |

Flow Computer Oil Gas Market Overview

Customize Flow Computer Oil Gas Market Report market research report

- ✔ Get in-depth analysis of Flow Computer Oil Gas market size, growth, and forecasts.

- ✔ Understand Flow Computer Oil Gas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flow Computer Oil Gas

What is the Market Size & CAGR of Flow Computer Oil Gas market in {Year}?

Flow Computer Oil Gas Industry Analysis

Flow Computer Oil Gas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flow Computer Oil Gas Market Analysis Report by Region

Europe Flow Computer Oil Gas Market Report:

The European market for Flow Computer Oil Gas is projected to increase from $0.38 billion in 2023 to $0.75 billion by 2033. The region is focusing on transitioning towards sustainable energy practices, manifesting in the increased integration of flow computer technologies that meet environmental standards. Countries like the UK, Germany, and Norway are leading in adopting innovative measurement solutions.Asia Pacific Flow Computer Oil Gas Market Report:

The Asia Pacific region is experiencing rapid growth in the Flow Computer Oil Gas market, with a market size of $0.24 billion in 2023 projected to reach $0.46 billion by 2033. Factors contributing to this include rising energy demands, increased oil and gas exploration activities, and investments in energy infrastructure across countries like China and India. Additionally, the focus on digitization within the energy sector enhances the appeal of flow computer technologies.North America Flow Computer Oil Gas Market Report:

North America remains a dominant player in the Flow Computer Oil Gas market, currently valued at $0.38 billion and expected to grow to $0.76 billion by 2033. The region benefits from advanced technological integration and stringent regulatory frameworks, which prioritize efficiency and safety. The U.S. and Canada are the key markets, with a strong focus on shale gas extraction driving demand for sophisticated flow measurement systems.South America Flow Computer Oil Gas Market Report:

In South America, the market is currently valued at $0.10 billion in 2023, with projections to rise to $0.20 billion by 2033. The growth is primarily driven by ongoing oil extraction projects and the increasing need for efficient management of resources. Countries such as Brazil and Argentina are notable players, undertaking significant infrastructural upgrades to support their oil and gas industries.Middle East & Africa Flow Computer Oil Gas Market Report:

The Middle East and Africa market is currently valued at $0.09 billion, with expectations of rising to $0.18 billion by 2033. This growth is primarily attributed to the ongoing expansion of oil and gas facilities and the need for technologies that enhance recovery rates. The UAE and Saudi Arabia lead investments in flow management systems as part of their broader vision for energy security.Tell us your focus area and get a customized research report.

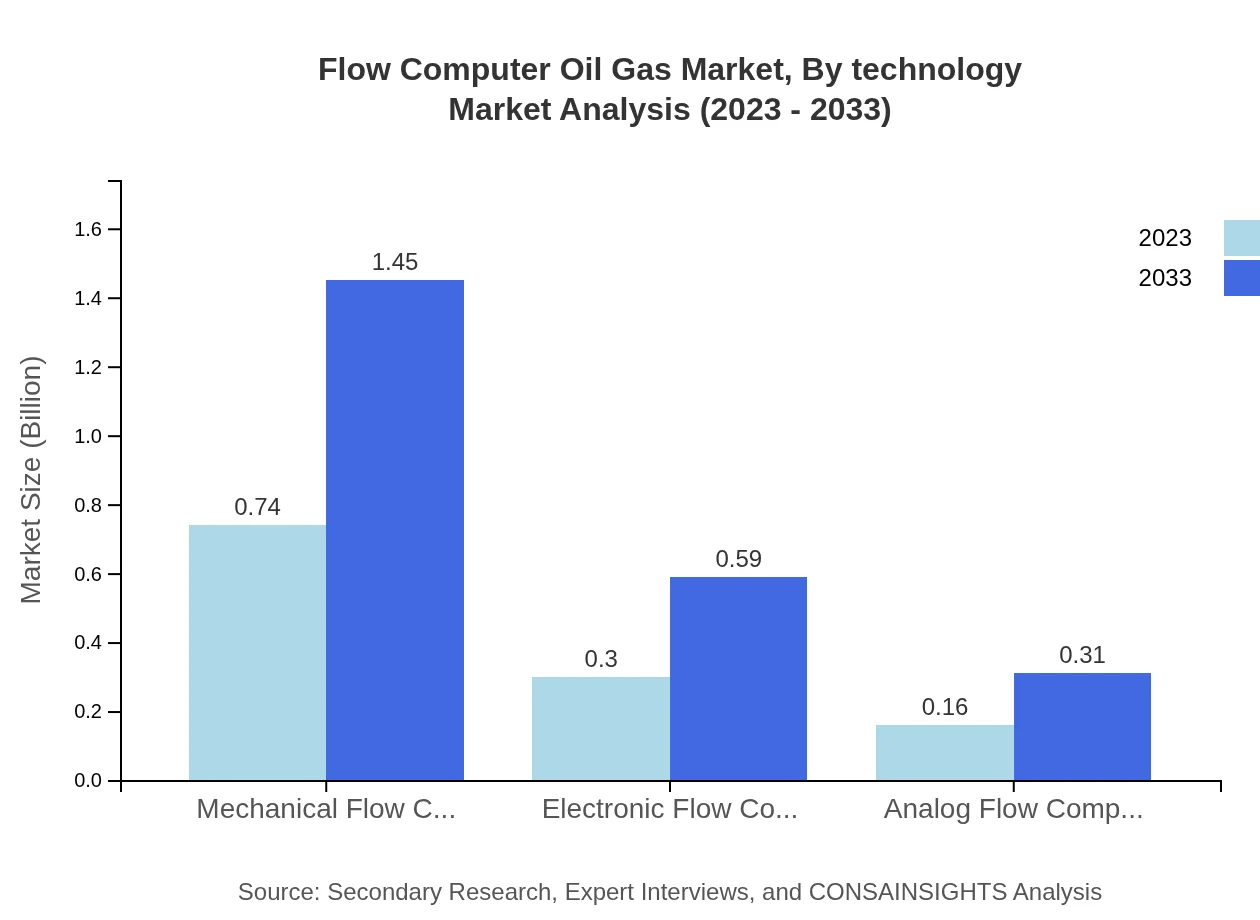

Flow Computer Oil Gas Market Analysis By Technology

The Flow Computer Oil Gas market is segmented into mechanical, electronic, and analog flow computers. Mechanical flow computers occupy the largest market share at 61.69% in 2023, driven by their reliability in harsh environments. Electronic flow computers, holding 25.11% of the market, are gaining traction due to their advanced data-processing capabilities. Analog flow computers account for 13.2%, appealing to niche applications where simplicity is prioritized.

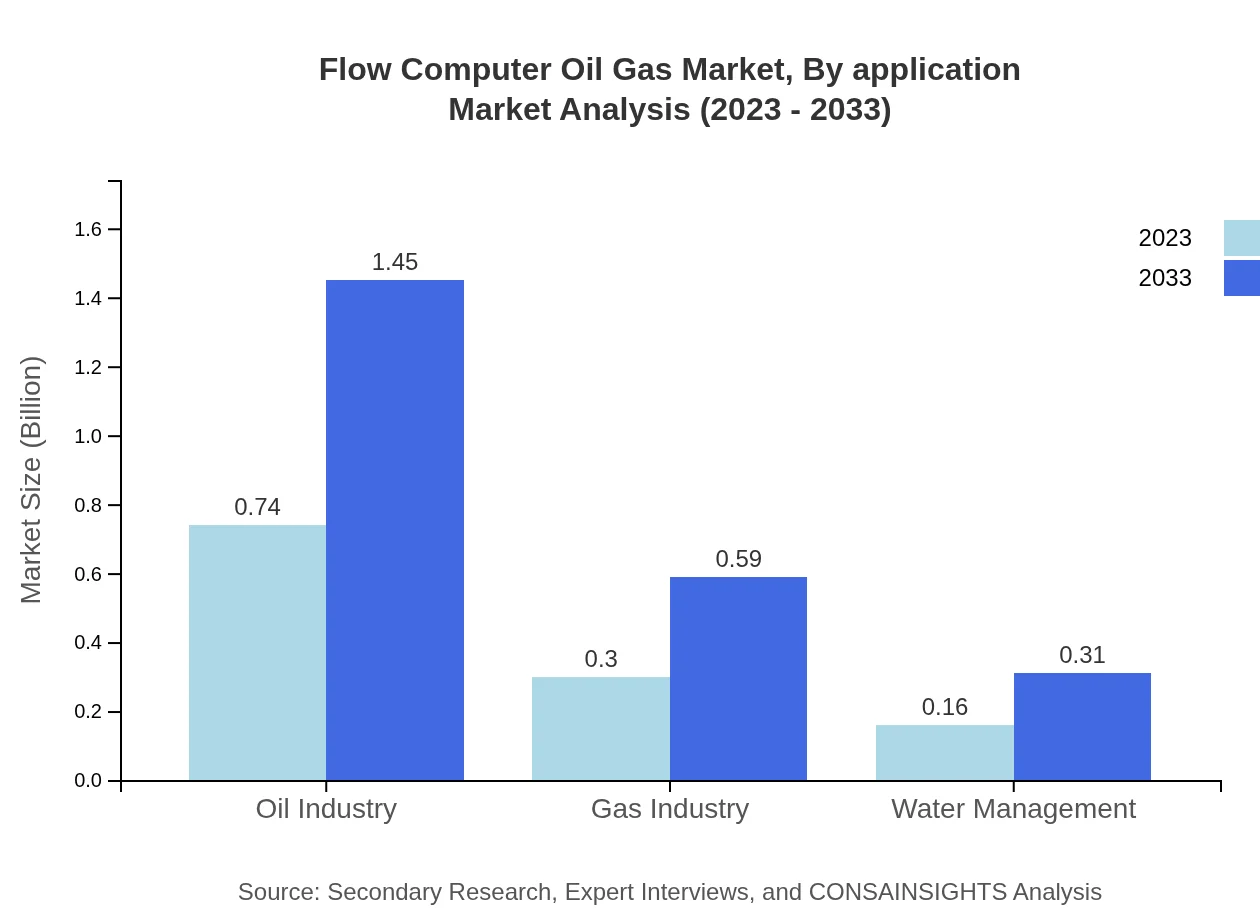

Flow Computer Oil Gas Market Analysis By Application

Market segmentation by application spans upstream, midstream, and downstream operations. The upstream sector dominates with a 61.69% share in 2023, reflecting extensive extraction activities. The downstream sector follows with 25.11%, where flow computers optimize refining processes. Midstream applications account for 13.2%, focusing on the transportation and storage of oil and gas products.

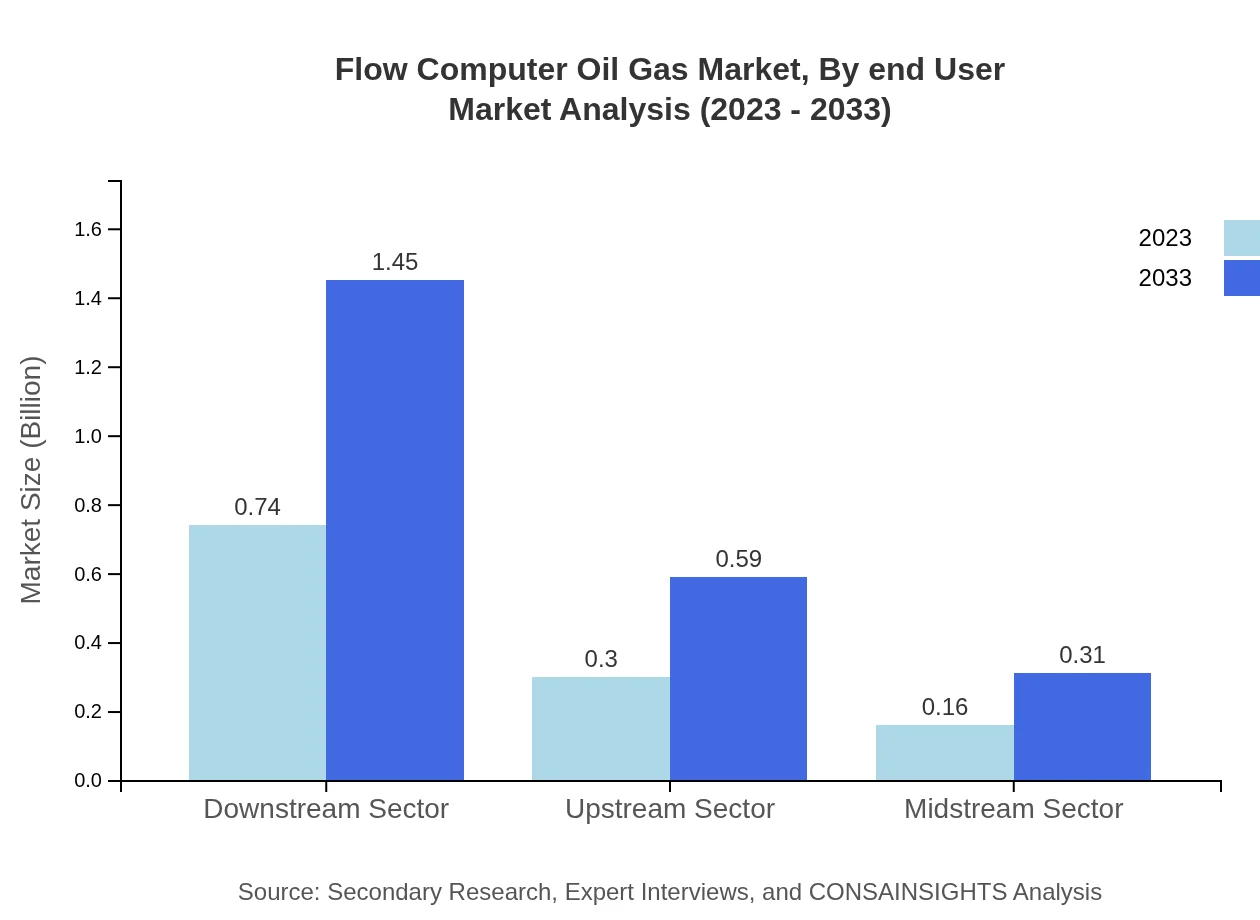

Flow Computer Oil Gas Market Analysis By End User

The end-user segmentation includes oil and gas companies, water management services, and other industrial applications. The oil industry commands a significant 61.69% share in 2023, indicating the primary market for flow computers. Gas companies account for 25.11%, while the water management sector holds 13.2%, expanding its use of flow measurement technologies.

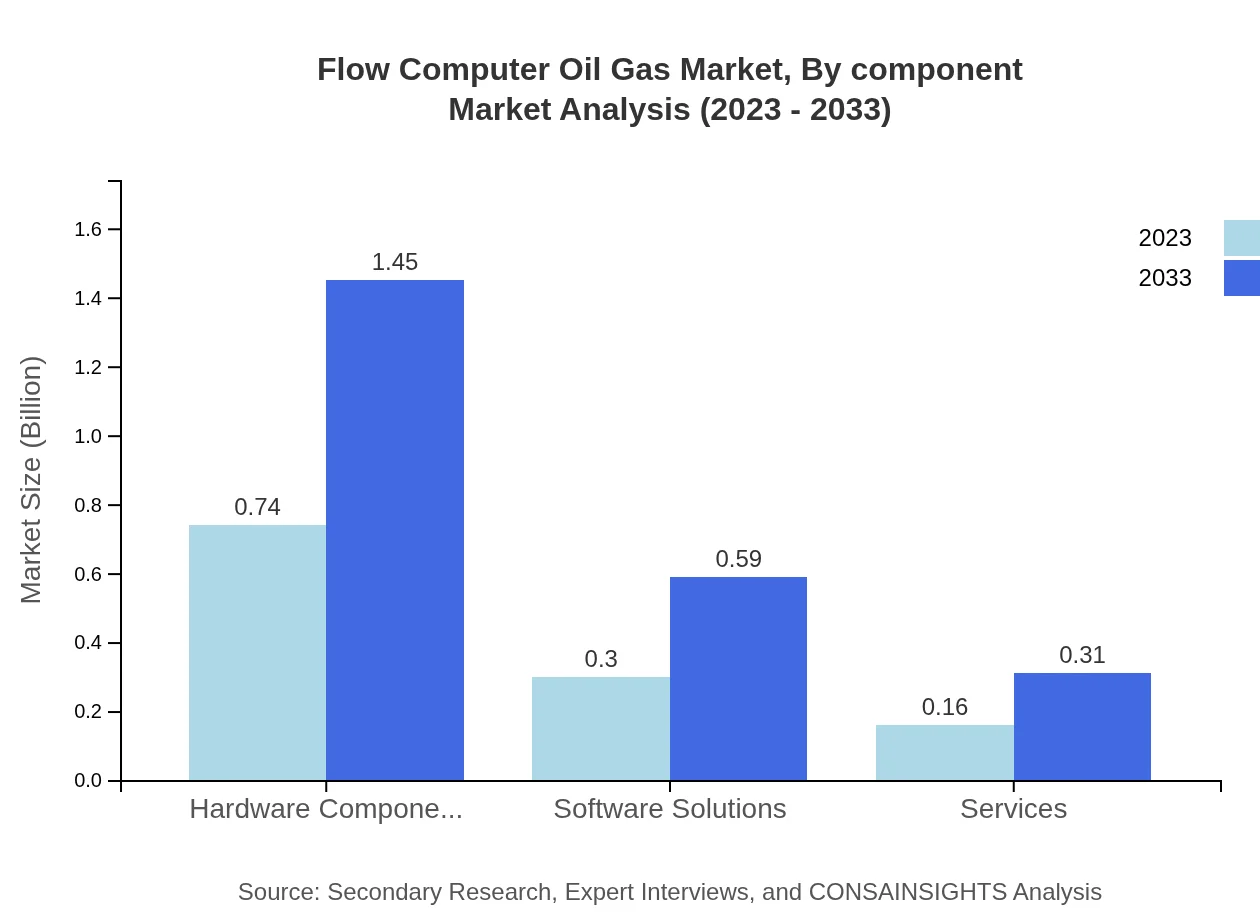

Flow Computer Oil Gas Market Analysis By Component

The component segmentation covers hardware components, software solutions, and services. Hardware components dominate with a 61.69% market share, reflecting the foundational role of physical flow measurement devices. Software solutions occupy 25.11%, where real-time data analytics are critical, while services constitute 13.2%, emphasizing installation and maintenance offerings.

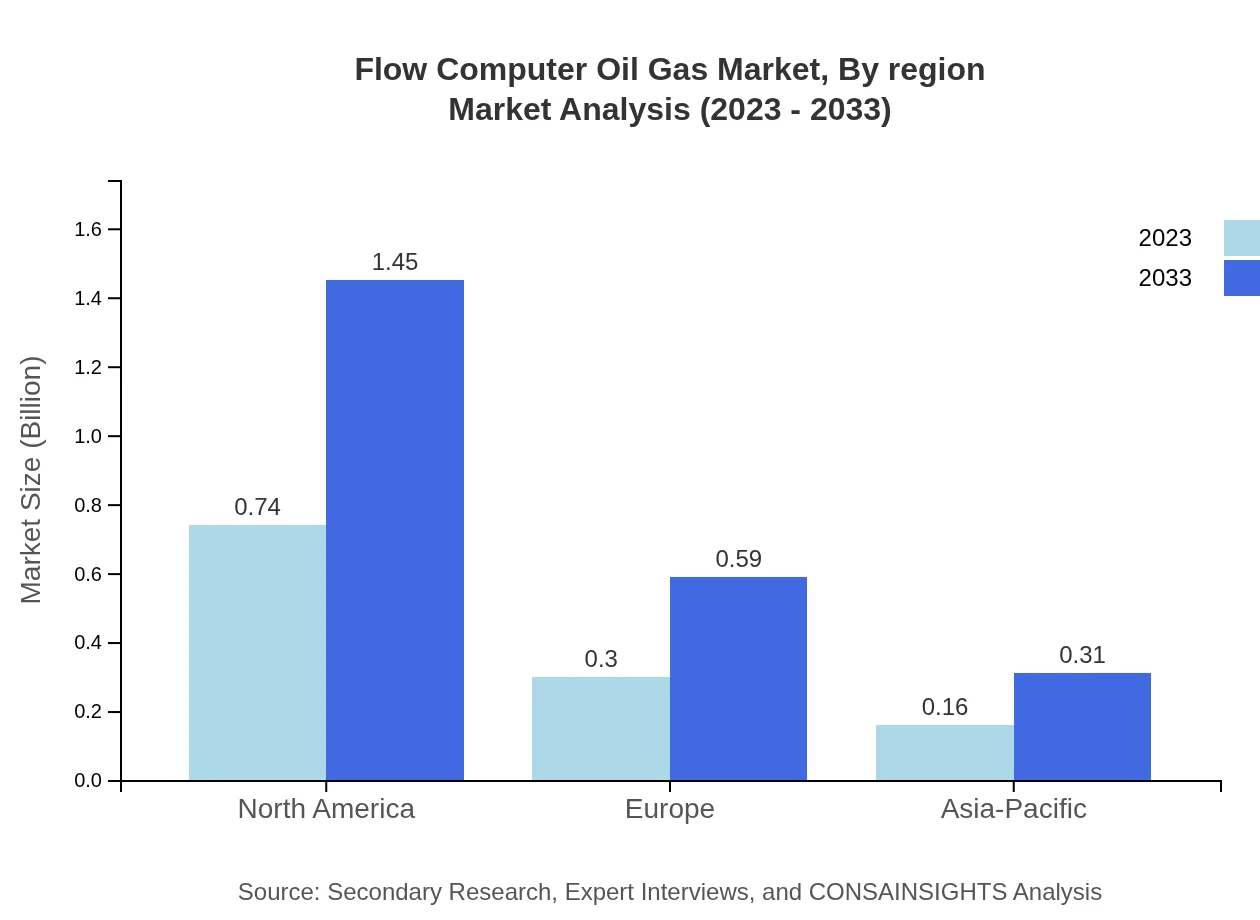

Flow Computer Oil Gas Market Analysis By Region

By region, North America holds the highest share at 61.69% in 2023, driven by sophisticated technological implementations. Europe follows at 25.11%, primarily led by regulatory necessities. The Asia Pacific region constitutes 13.2%, with increasing investments in oil and gas infrastructure boosting demand.

Flow Computer Oil Gas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flow Computer Oil Gas Industry

Emerson Electric Co.:

Emerson is a leading provider of automation solutions, delivering flow computer technologies and comprehensive industry insights that enhance operational efficiency across various sectors, including oil and gas.Honeywell International Inc.:

Honeywell focuses on digital transformation solutions, offering advanced flow measurement devices and software that optimize performance and enhance decision-making in critical operations.Siemens AG:

Siemens is known for its innovations in flow measurement technologies, leveraging its expertise in industrial automation to deliver solutions that integrate seamlessly into oil and gas operations.KROHNE Group:

KROHNE specializes in flow measurement and control solutions, providing tailored systems that maximize efficiency and ensure compliance with regulatory standards.Schneider Electric:

Schneider Electric offers integrated software solutions alongside hardware, driving energy efficiency and sustainability throughout the oil and gas supply chain.We're grateful to work with incredible clients.

FAQs

What is the market size of flow Computer Oil Gas?

The flow computer oil and gas market is currently valued at approximately $1.2 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8%, indicating significant expansion by 2033.

What are the key market players or companies in this flow Computer Oil Gas industry?

Key players in the flow computer oil and gas industry include prominent companies specializing in measurement technology, automation, and monitoring solutions. These companies significantly influence market innovation and competitive dynamics.

What are the primary factors driving the growth in the flow Computer Oil Gas industry?

Growth in the flow computer oil and gas sector is driven by advancements in technology, increased oil and gas production, regulatory requirements for accurate measurement, and the need for enhanced efficiency and cost reduction.

Which region is the fastest Growing in the flow Computer Oil Gas?

The fastest-growing region in the flow computer oil and gas market is projected to be North America, with the market size expected to grow from $0.38 billion in 2023 to $0.76 billion in 2033.

Does ConsaInsights provide customized market report data for the flow Computer Oil Gas industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements in the flow computer oil and gas industry, ensuring comprehensive insights that align with client needs.

What deliverables can I expect from this flow Computer Oil Gas market research project?

Expect detailed reports that include market size, growth projections, competitive analysis, regional dynamics, and segment-wise insights, ensuring a comprehensive understanding of the flow computer oil and gas market.

What are the market trends of flow Computer Oil Gas?

Current trends in the flow computer oil and gas market include the integration of IoT technology, increased automation, enhanced data analytics capabilities, and a growing focus on sustainability and energy efficiency.