Fluid Handling System Market Report

Published Date: 22 January 2026 | Report Code: fluid-handling-system

Fluid Handling System Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Fluid Handling System market, including market trends, analysis, and forecasts from 2023 to 2033. Key insights include market size, growth rates, and competitive landscape, providing a comprehensive view for stakeholders and decision-makers.

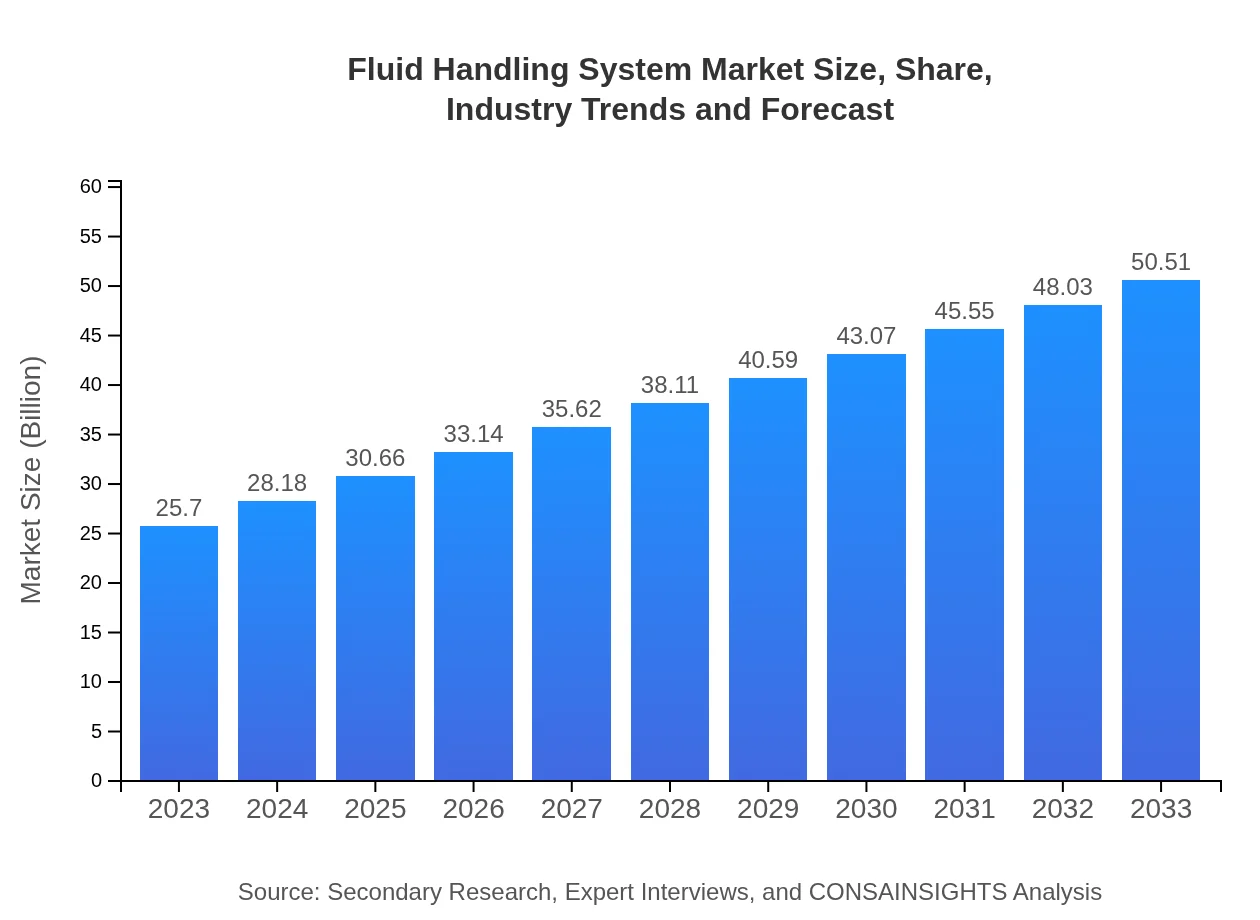

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.51 Billion |

| Top Companies | Flowserve Corporation, Pentair PLC, Emerson Electric Co., KSB SE & Co. KGaA, Schneider Electric |

| Last Modified Date | 22 January 2026 |

Fluid Handling System Market Overview

Customize Fluid Handling System Market Report market research report

- ✔ Get in-depth analysis of Fluid Handling System market size, growth, and forecasts.

- ✔ Understand Fluid Handling System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fluid Handling System

What is the Market Size & CAGR of Fluid Handling System market in 2023?

Fluid Handling System Industry Analysis

Fluid Handling System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fluid Handling System Market Analysis Report by Region

Europe Fluid Handling System Market Report:

Europe holds a significant position in the Fluid Handling System market, with growth from $7.65 billion in 2023 to $15.04 billion by 2033. This growth is fueled by stringent environmental regulations and a shift towards sustainable practices in industrial processes.Asia Pacific Fluid Handling System Market Report:

The Fluid Handling System market in Asia Pacific is estimated to grow from $4.38 billion in 2023 to $8.61 billion in 2033, driven by rapid industrialization and infrastructure development. Countries like China and India are major contributors to this growth due to rising urbanization and energy demands.North America Fluid Handling System Market Report:

The North American market size is forecasted to increase from $9.86 billion in 2023 to $19.38 billion in 2033, supported by technological advancements in fluid management systems and increasing investments in pipeline infrastructure.South America Fluid Handling System Market Report:

In South America, the market is projected to expand from $2.17 billion in 2023 to $4.27 billion in 2033, influenced by growing agriculture and mining sectors that require effective fluid handling solutions.Middle East & Africa Fluid Handling System Market Report:

The Middle East and Africa market is expected to rise from $1.64 billion in 2023 to $3.22 billion in 2033, as investment in oil and gas exploration and production ramps up, necessitating advanced fluid handling technologies.Tell us your focus area and get a customized research report.

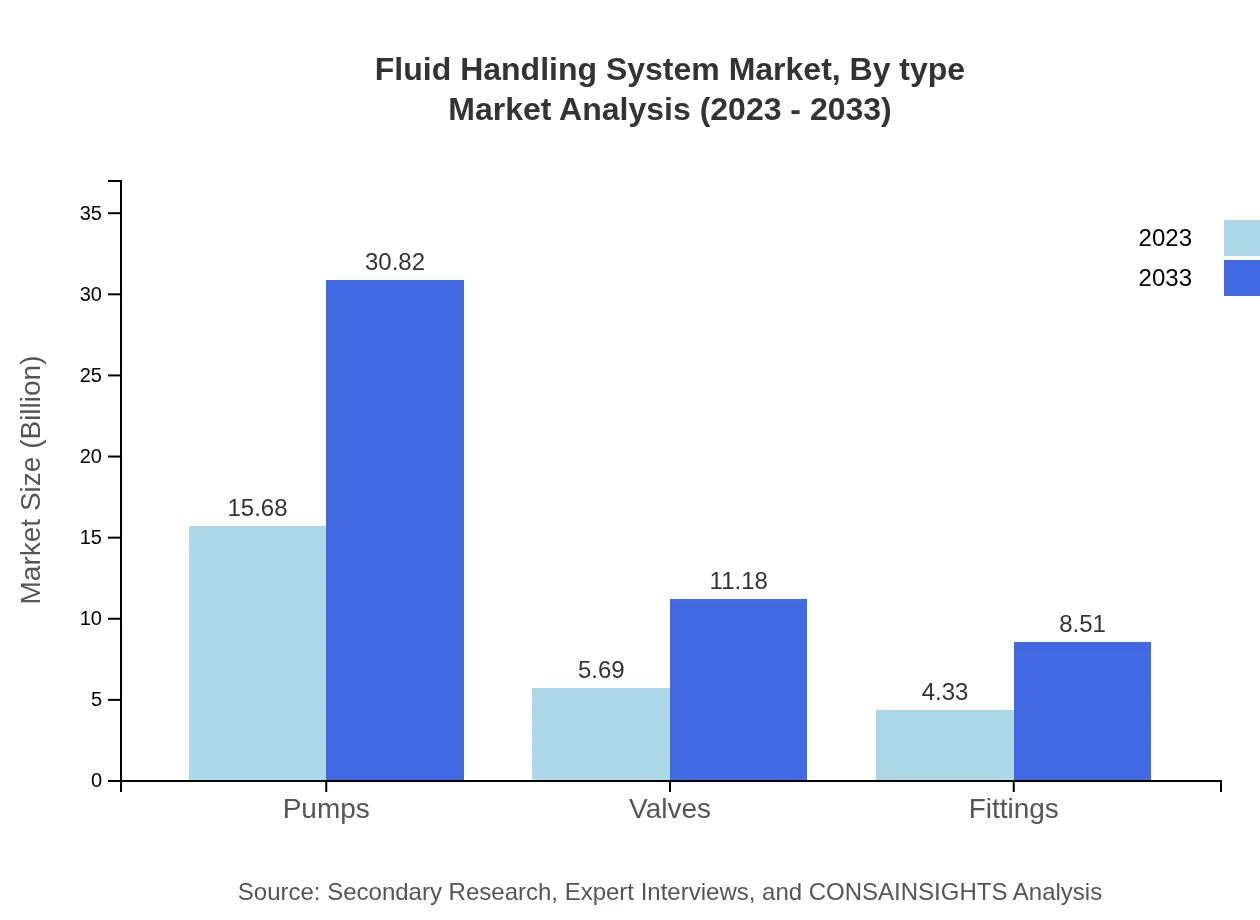

Fluid Handling System Market Analysis By Type

In 2023, the market for pumps, which is the largest segment, stands at $15.68 billion. By 2033, it is expected to reach $30.82 billion, maintaining a share of 61.01%. Valves account for a market size of $5.69 billion in 2023, and are projected to grow to $11.18 billion, holding a 22.14% share. Fittings also show significant growth, starting at $4.33 billion in 2023 and reaching $8.51 billion by 2033 with a 16.85% share.

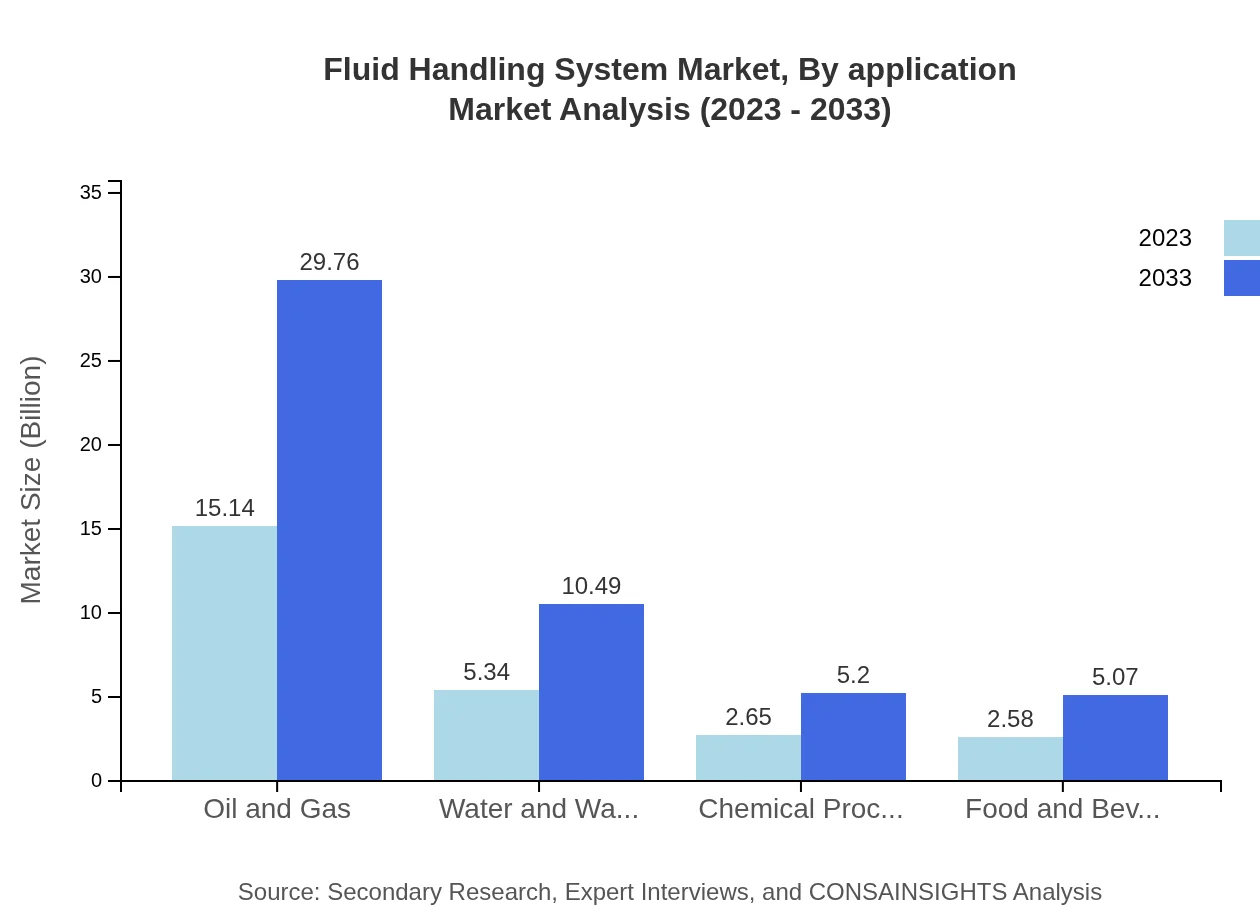

Fluid Handling System Market Analysis By Application

The major applications include oil and gas with a market of $15.14 billion in 2023, which could reach $29.76 billion by 2033, reflecting a 58.91% market share. Water and wastewater management holds a market of $5.34 billion, anticipated to double to $10.49 billion. Other notable segments include chemical processing and food and beverage production, with increasing importance as industries prioritize fluid safety and compliance.

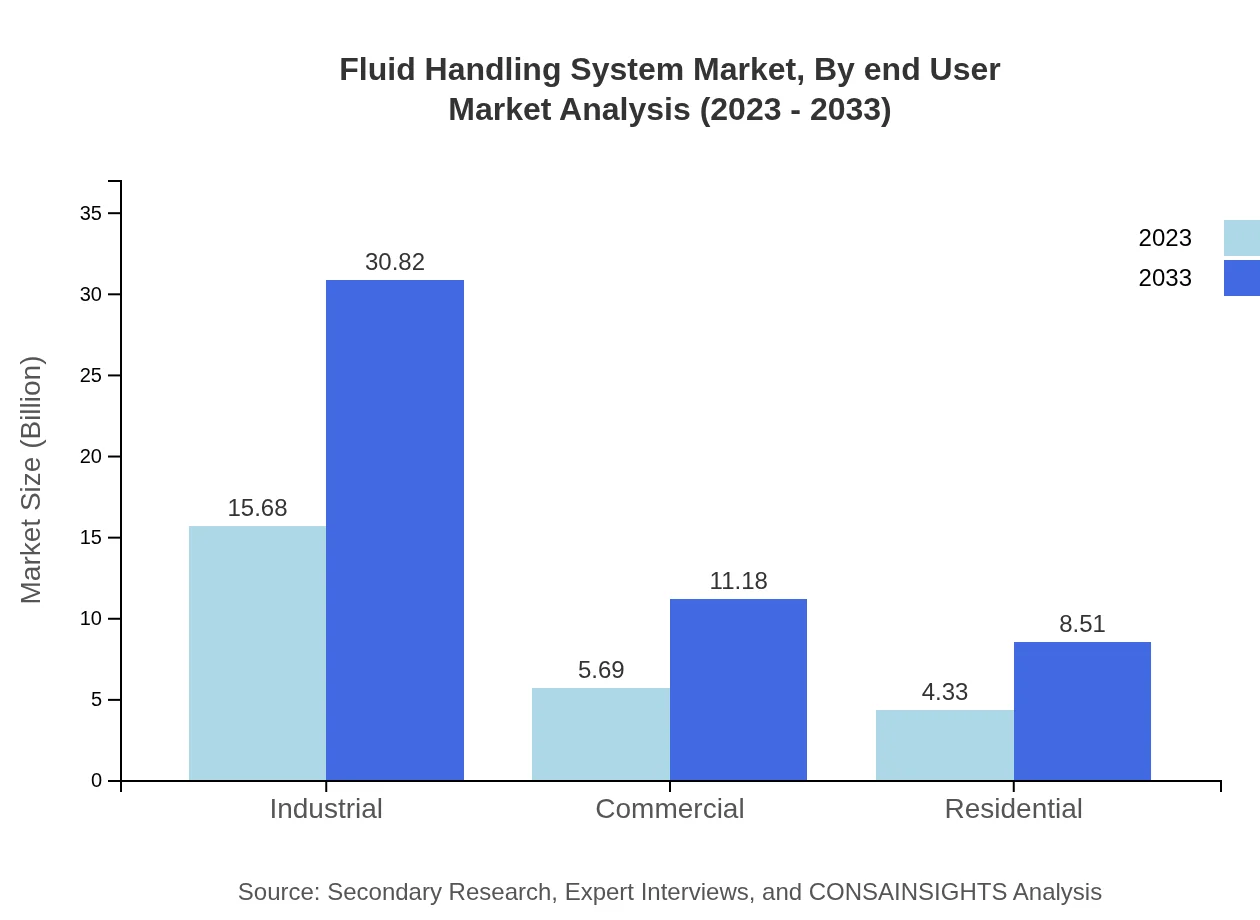

Fluid Handling System Market Analysis By End User

Industrial end-users lead the segment with a size of $15.68 billion in 2023 and are expected to grow to $30.82 billion by 2033, capturing 61.01% market share. Commercial applications follow with $5.69 billion, growing to $11.18 billion, while residential applications will see substantial growth from $4.33 billion to $8.51 billion.

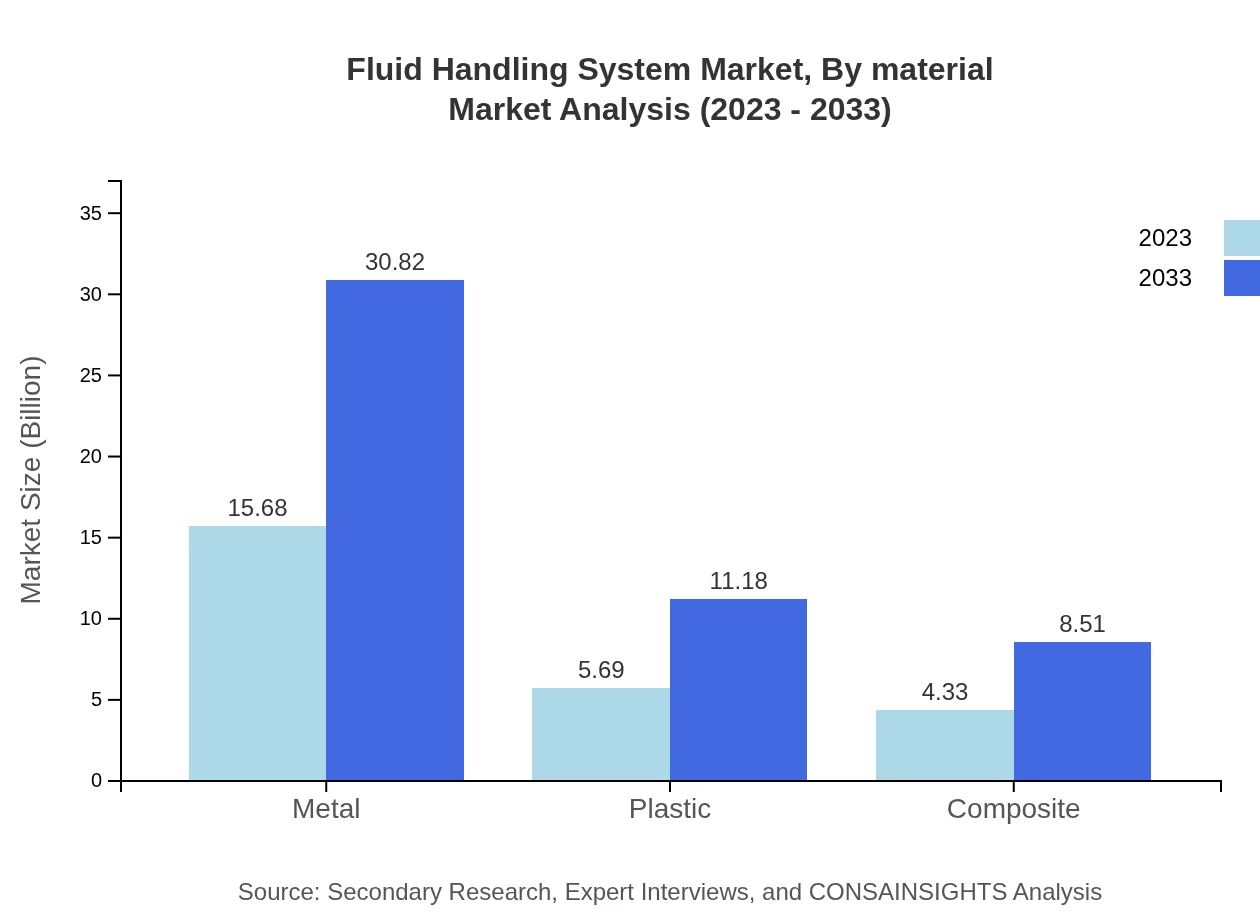

Fluid Handling System Market Analysis By Material

Metal materials dominate the Fluid Handling System segment with a market size of $15.68 billion in 2023 and expected growth to $30.82 billion by 2033. Plastics present another significant segment, starting at $5.69 billion in 2023 and scaling to $11.18 billion by 2033, while composites will also see growth from $4.33 billion to $8.51 billion.

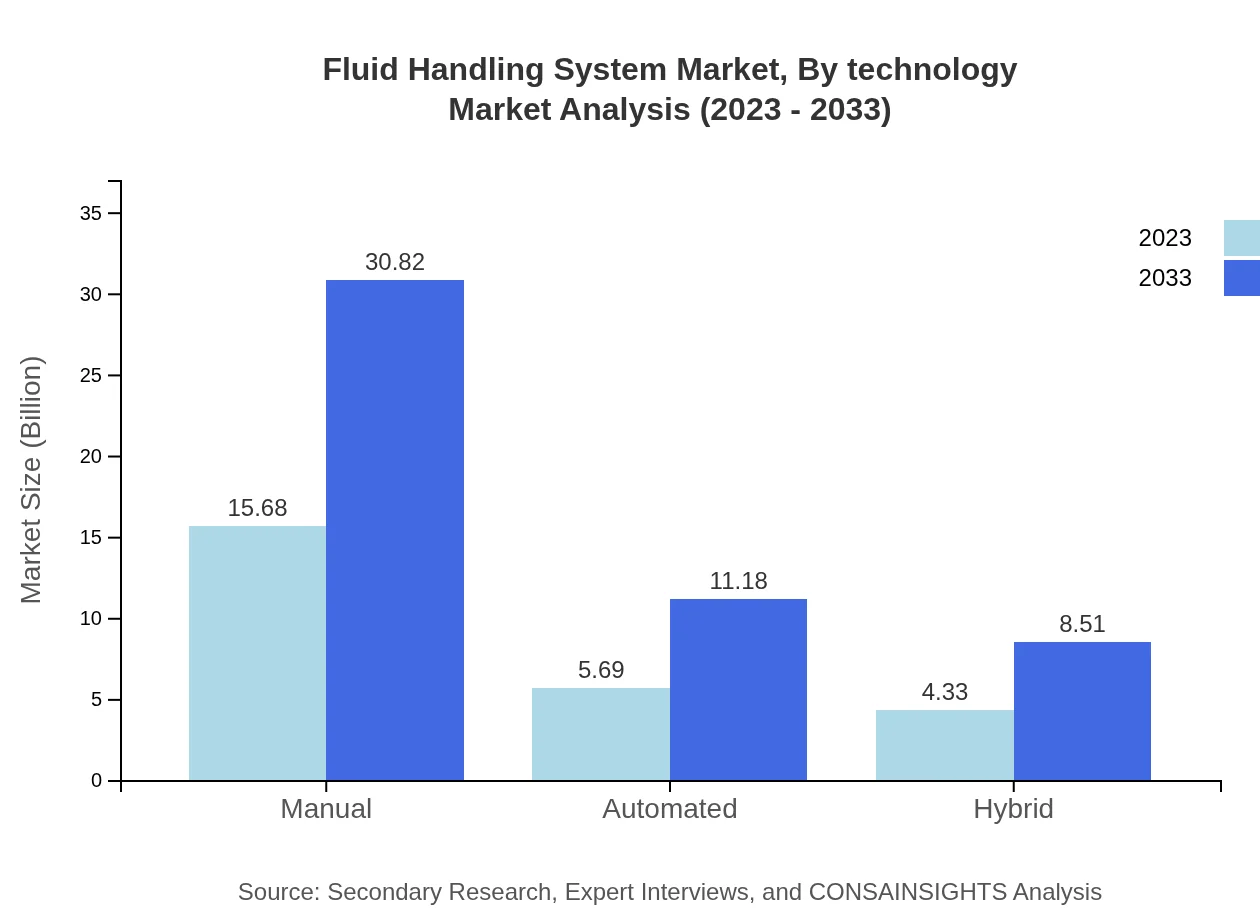

Fluid Handling System Market Analysis By Technology

Manual systems lead the market segment with a size of $15.68 billion in 2023 and growth expected to double by 2033. Automated systems, while smaller currently at $5.69 billion, are poised for rapid growth to $11.18 billion, reflecting the industry's transition towards efficiency and data integration.

Fluid Handling System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fluid Handling System Industry

Flowserve Corporation:

Flowserve is a leading provider of fluid motion control products and services. They specialize in pumps, valves, seals, and automation solutions, serving a variety of industries worldwide.Pentair PLC:

Pentair specializes in water treatment and fluid management solutions. Their innovations focus on creating sustainable solutions that enhance efficiency across application segments like residential, commercial, and industrial.Emerson Electric Co.:

Emerson provides a wide range of automation products, including valves and pumps. Their technology-driven solutions are designed to improve safety and efficiency in fluid handling applications.KSB SE & Co. KGaA:

KSB specializes in pumps and valves, particularly for the water and energy sectors. Their focus is on combining engineering excellence with sustainable practices.Schneider Electric:

Schneider Electric offers advanced fluid handling solutions integrated with IoT capabilities, aiming to optimize performance and sustainability in fluid management.We're grateful to work with incredible clients.

FAQs

What is the market size of fluid Handling System?

The global fluid handling system market is projected to reach $25.7 billion by 2033, up from $15.42 billion in 2023, with a CAGR of 6.8% during this forecast period.

What are the key market players or companies in this fluid Handling System industry?

Key players in the fluid handling system market include major corporations such as Flowserve Corporation, ITT Inc., Sulzer Ltd, and Alfa Laval, which dominate the industry with innovative technologies and a broad product range.

What are the primary factors driving the growth in the fluid Handling System industry?

The growth of the fluid handling system market is driven by increasing demand from the oil and gas sector, advancements in industrial automation, and the rising need for effective water management solutions.

Which region is the fastest Growing in the fluid Handling System?

North America is the fastest-growing region in the fluid handling system market, projected to reach $19.38 billion by 2033, followed closely by Europe, expected to grow to $15.04 billion.

Does ConsaInsights provide customized market report data for the fluid Handling System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the fluid handling system industry, providing detailed insights and projections.

What deliverables can I expect from this fluid Handling System market research project?

Deliverables from the fluid handling system market research project include comprehensive market analysis reports, segmented data insights, competitive landscape evaluations, and trend forecasts.

What are the market trends of fluid Handling System?

Current trends in the fluid handling system market include increased adoption of automation, a shift towards sustainability, and advancements in material technologies improving efficiency.