Fluid Power Equipment Market Report

Published Date: 22 January 2026 | Report Code: fluid-power-equipment

Fluid Power Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fluid Power Equipment market from 2023 to 2033, detailing market size, industry trends, technological advancements, regional insights, and competitive landscape analysis.

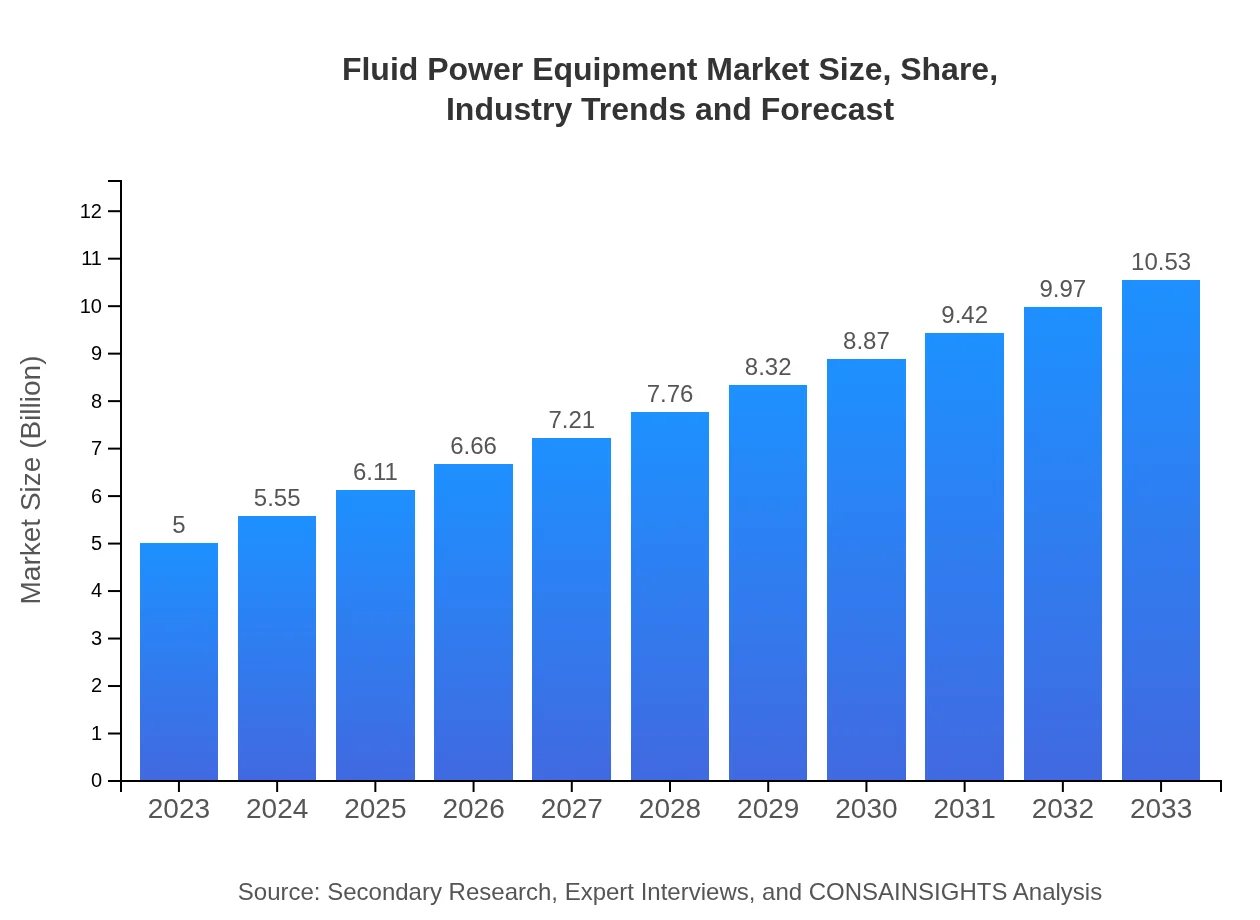

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Parker Hannifin Corporation, Bosch Rexroth AG, Eaton Corporation, Hydac International, Siemens AG |

| Last Modified Date | 22 January 2026 |

Fluid Power Equipment Market Overview

Customize Fluid Power Equipment Market Report market research report

- ✔ Get in-depth analysis of Fluid Power Equipment market size, growth, and forecasts.

- ✔ Understand Fluid Power Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fluid Power Equipment

What is the Market Size & CAGR of Fluid Power Equipment market in 2023?

Fluid Power Equipment Industry Analysis

Fluid Power Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fluid Power Equipment Market Analysis Report by Region

Europe Fluid Power Equipment Market Report:

Europe's Fluid Power Equipment market is projected to increase from $1.49 billion in 2023 to $3.15 billion by 2033. The region's focus on sustainability and energy efficiency is expected to drive innovations and demand for hydraulic and pneumatic systems.Asia Pacific Fluid Power Equipment Market Report:

The Asia Pacific region is projected to grow significantly, with a market value of approximately $1.99 billion by 2033, up from $0.94 billion in 2023. Key growth drivers include rapid industrialization, increased manufacturing output, and investments in automation technologies.North America Fluid Power Equipment Market Report:

North America remains a leading market for Fluid Power Equipment, expected to escalate from $1.86 billion in 2023 to $3.91 billion by 2033. The U.S. is a crucial growth center due to its emphasis on automation and high-tech manufacturing processes.South America Fluid Power Equipment Market Report:

In South America, the market is expected to witness growth from $0.35 billion in 2023 to $0.73 billion by 2033, driven by government initiatives aimed at enhancing infrastructure and manufacturing capabilities.Middle East & Africa Fluid Power Equipment Market Report:

The Middle East and Africa market is forecasted to grow from $0.36 billion in 2023 to $0.75 billion in 2033. Emerging construction projects and oil & gas industries are significant contributors to this region's growth.Tell us your focus area and get a customized research report.

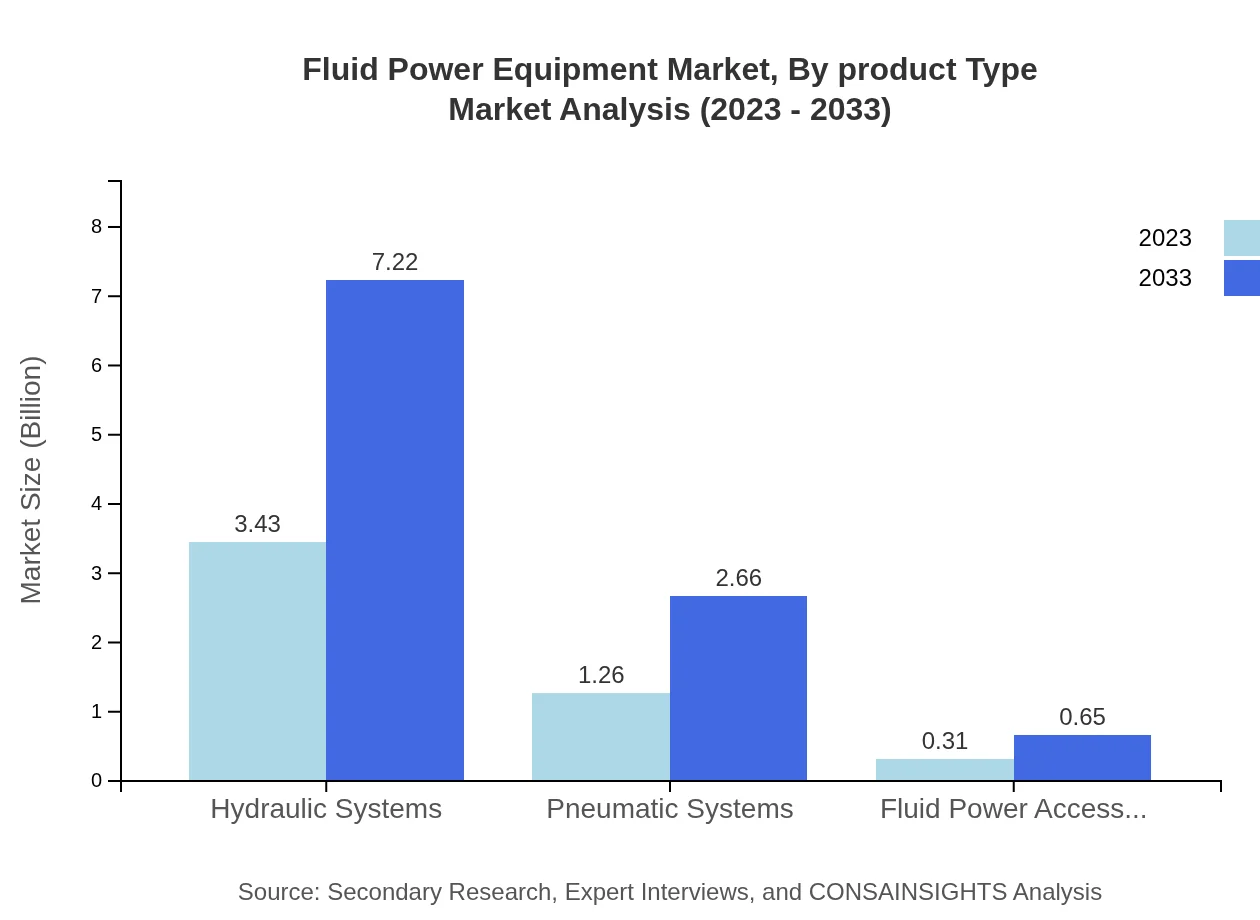

Fluid Power Equipment Market Analysis By Product Type

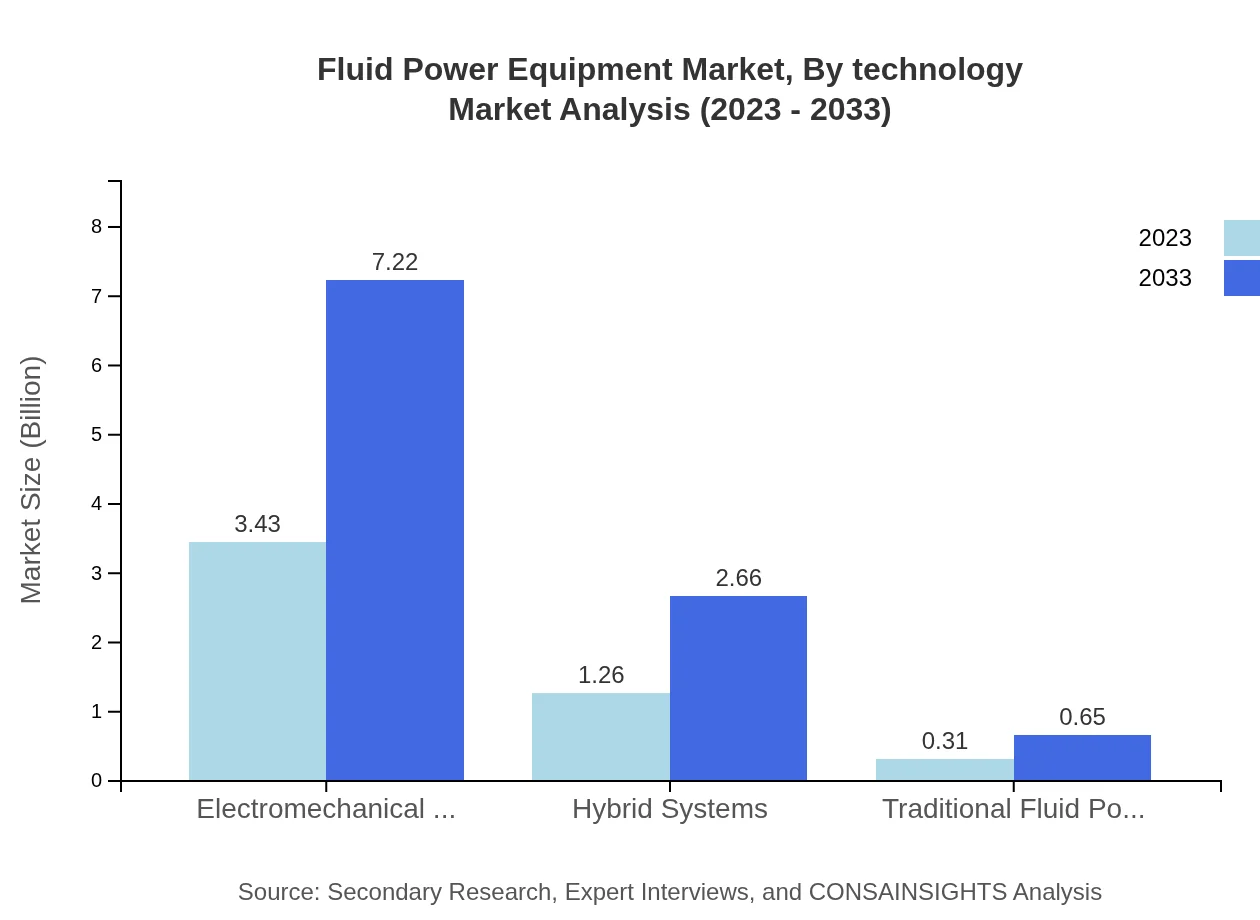

The Fluid Power Equipment market's leading segment is Electromechanical Systems, projected to grow from $3.43 billion in 2023 to $7.22 billion by 2033. Hydraulic Systems also hold a substantial market share of approximately 68.59%, reflecting their predominant use in various applications. Pneumatic and Hybrid Systems follow, indicating an expanding preference for versatile solutions in automation.

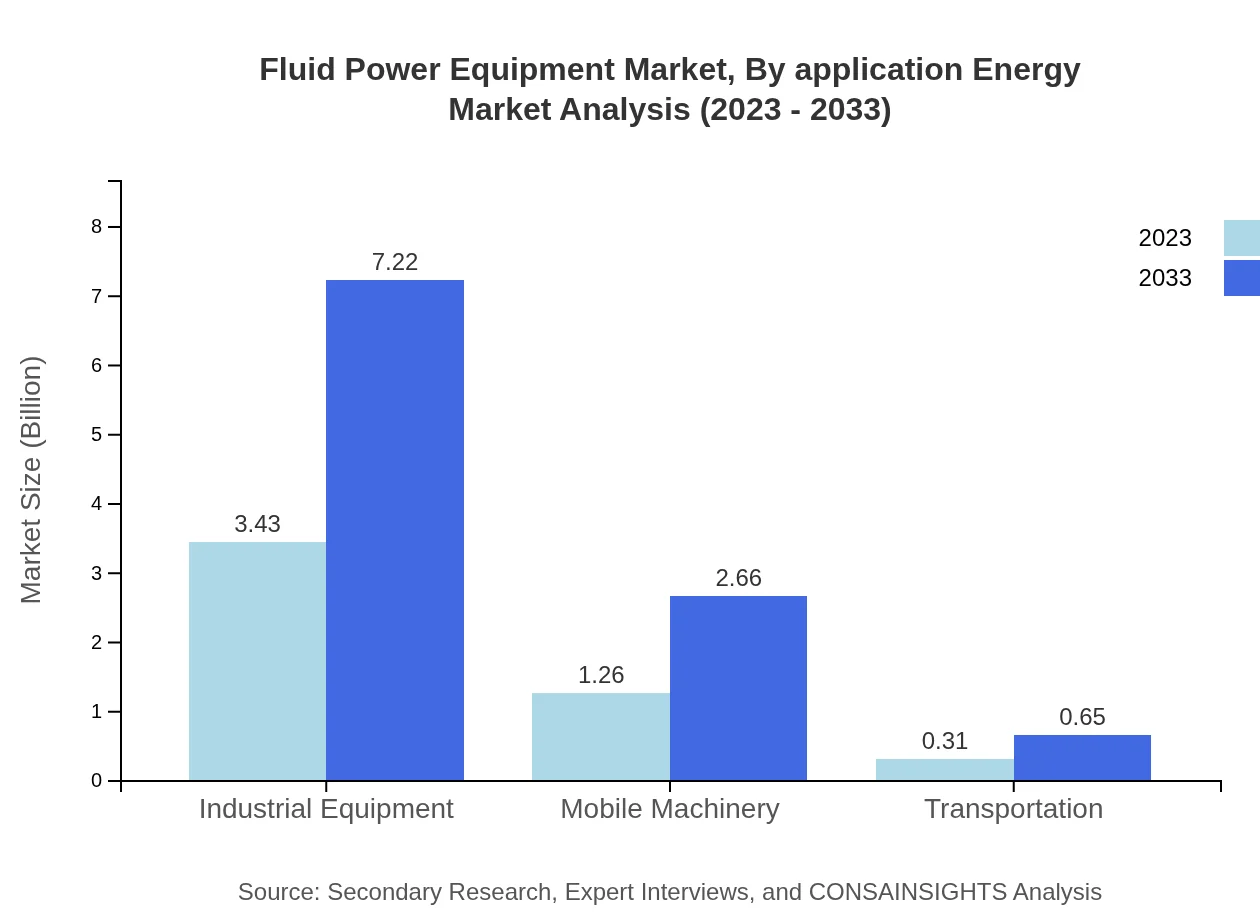

Fluid Power Equipment Market Analysis By Application Energy

The automotive industry leads in terms of application, constituting about 68.59% of the market in 2023. This is projected to stay consistent through 2033, supported by technological advancements in vehicle automation. Other significant applications include manufacturing and aerospace, which are poised for growth as companies aim for increased operational efficiency.

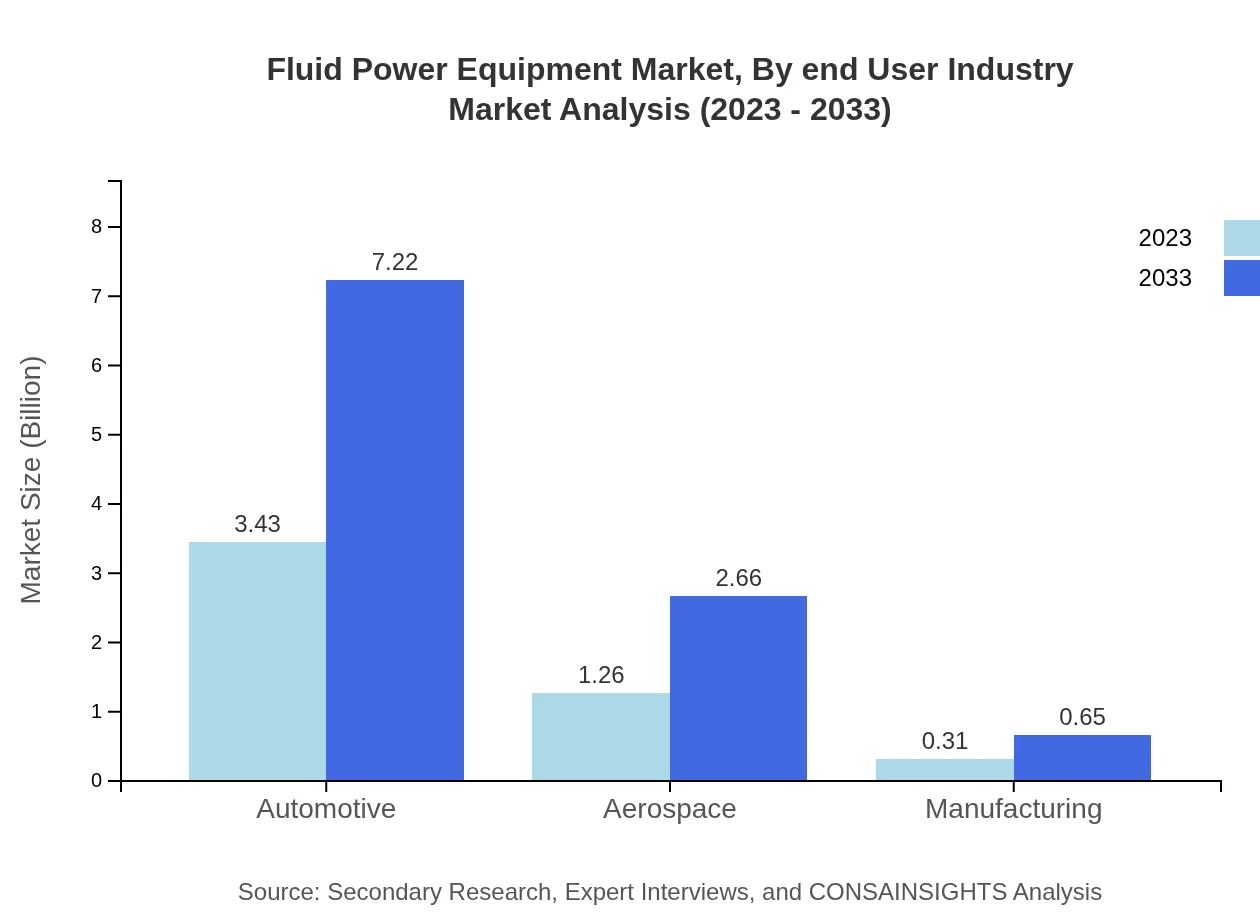

Fluid Power Equipment Market Analysis By End User Industry

Major end-user industries for Fluid Power Equipment include automotive, aerospace, industrial equipment, and mobile machinery. As of 2023, automotive drives 68.59% of the demand, with forecasts indicating sustained interest due to automotive automation. Industrial applications (6.17%) and mobile machinery (25.24%) are also crucial as industries embrace fluid technology for enhanced performance.

Fluid Power Equipment Market Analysis By Technology

Technological innovations play a significant role in shaping the Fluid Power Equipment market. Current trends include integration of IoT for predictive maintenance, advanced control technologies for improved precision, and energy-saving designs that align with global sustainability goals. The focus on smart technologies is expected to expand significantly through 2033.

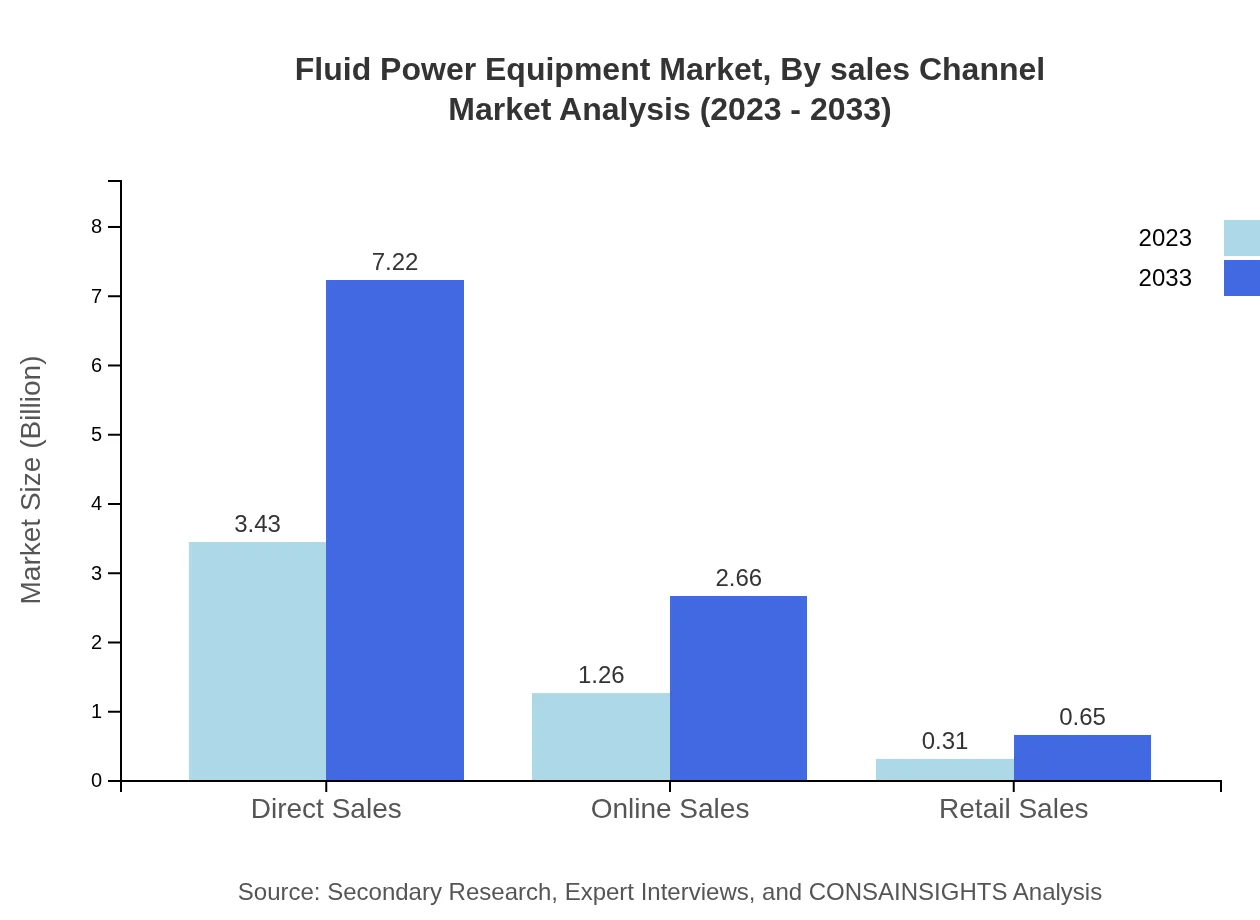

Fluid Power Equipment Market Analysis By Sales Channel

Sales channels are classified into Direct Sales, Online Sales, and Retail Sales. Direct Sales dominates the market, holding a market share of 68.59%. Online Sales (25.24%) are growing rapidly due to changing consumer preferences and increased digitalization, while Retail Sales account for 6.17%, indicating a focused shift towards online channels for product distribution.

Fluid Power Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fluid Power Equipment Industry

Parker Hannifin Corporation:

A global leader in motion and control technologies, Parker Hannifin offers an extensive range of fluid power systems and leads advancements in hydraulic and pneumatic solutions.Bosch Rexroth AG:

Bosch Rexroth is recognized for innovative hydraulic technologies and automation solutions, serving various industries including manufacturing and mobile applications.Eaton Corporation:

Eaton is known for its fluid power solutions which improve the efficiency of industrial equipment and vehicles, focusing on innovation and sustainability.Hydac International:

Hydac specializes in hydraulic systems and accessories, and has made significant contributions to fluid power technology and solutions across various sectors.Siemens AG:

Siemens integrates fluid power systems within its wide range of industrial automation solutions, making it a key player in driving technologies and edge computing in fluid power applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Fluid Power Equipment?

The global Fluid Power Equipment market size is projected to reach approximately $5 billion by 2033, with a compound annual growth rate (CAGR) of 7.5%. This strong growth reflects the increasing demand across various sectors.

What are the key market players or companies in this Fluid Power Equipment industry?

Key players in the Fluid Power Equipment industry include significant manufacturers known for innovation and market share. While specific names are not provided, they involve major companies engaged in hydraulics, pneumatics, and electromechanical systems.

What are the primary factors driving the growth in the Fluid Power Equipment industry?

Growth in the Fluid Power Equipment industry is driven by increased automation, rising demand in manufacturing, and advancements in technology. Additionally, the growing need for energy-efficient systems contributes to market expansion.

Which region is the fastest Growing in the Fluid Power Equipment?

The fastest-growing region in the Fluid Power Equipment market is projected to be North America, with market size expected to grow from $1.86 billion in 2023 to $3.91 billion by 2033, indicating robust growth opportunities.

Does ConsaInsights provide customized market report data for the Fluid Power Equipment industry?

Yes, ConsaInsights offers customized market report data for the Fluid Power Equipment industry. This service allows clients to tailor their research needs, addressing specific requirements and regional insights to enhance decision-making.

What deliverables can I expect from this Fluid Power Equipment market research project?

Deliverables from the Fluid Power Equipment market research project typically include comprehensive reports detailing market trends, forecasts, segment analysis, and regional insights, alongside visual data representations for clarity.

What are the market trends of Fluid Power Equipment?

Market trends in the Fluid Power Equipment sector include a shift towards electromechanical systems, heightened focus on sustainability, integrating IoT for efficiency, and increasing adoption across various industrial applications.