Fluoroscopy Market Report

Published Date: 31 January 2026 | Report Code: fluoroscopy

Fluoroscopy Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fluoroscopy market, encompassing insights from 2023 to 2033, including market size, growth trends, segmentation, regional analysis, and key industry players.

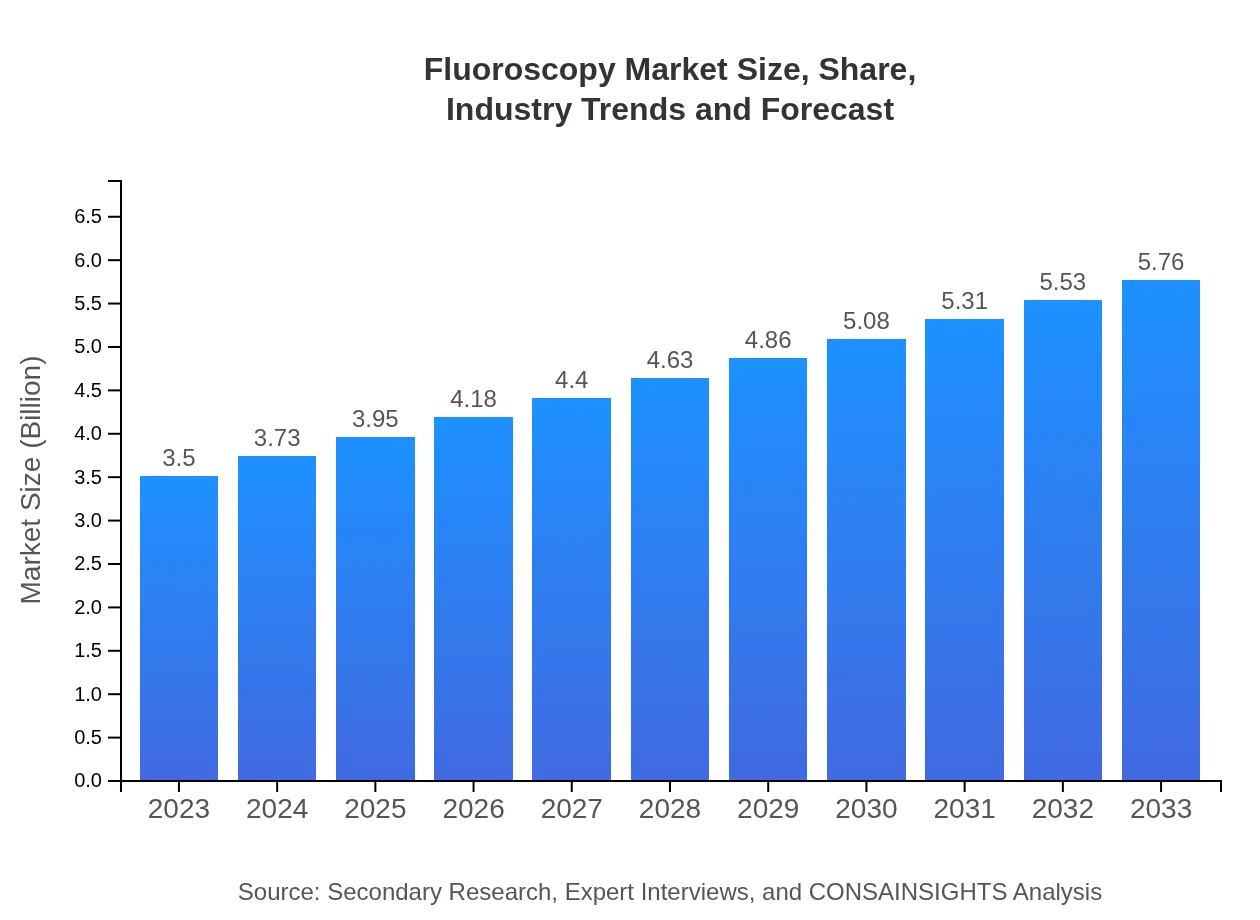

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $5.76 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Philips Healthcare, Hitachi Medical Systems, Canon Medical Systems |

| Last Modified Date | 31 January 2026 |

Fluoroscopy Market Overview

Customize Fluoroscopy Market Report market research report

- ✔ Get in-depth analysis of Fluoroscopy market size, growth, and forecasts.

- ✔ Understand Fluoroscopy's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fluoroscopy

What is the Market Size & CAGR of Fluoroscopy market in 2023?

Fluoroscopy Industry Analysis

Fluoroscopy Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fluoroscopy Market Analysis Report by Region

Europe Fluoroscopy Market Report:

Europe's Fluoroscopy market is projected to expand from $1.13 billion in 2023 to $1.86 billion by 2033. The market is influenced by a strong emphasis on healthcare innovations, with countries like Germany and the United Kingdom investing significantly in healthcare technologies. Regulatory initiatives aimed at improving safety standards further support the market's growth.Asia Pacific Fluoroscopy Market Report:

The Asia-Pacific Fluoroscopy market is anticipated to witness robust growth, starting at $0.68 billion in 2023 and projected to reach $1.11 billion by 2033. Factors contributing to this growth include an increase in healthcare expenditure, rising awareness of advanced diagnostic techniques, and a growing elderly population requiring medical imaging. Countries like Japan and China are at the forefront, leveraging technological advancements in fluoroscopy.North America Fluoroscopy Market Report:

North America, with a starting market size of $1.13 billion in 2023, is predicted to grow to $1.86 billion by 2033. The United States remains a leader in the introduction of advanced fluoroscopy technologies, bolstered by increasing procedural volumes and the presence of major market players. The integration of digital health solutions and an aging population are also pivotal factors driving growth in this region.South America Fluoroscopy Market Report:

In South America, the Fluoroscopy market is expected to grow from $0.23 billion in 2023 to $0.37 billion by 2033. The growth is stimulated by increasing healthcare budgets, improving medical facilities, and a rising prevalence of chronic diseases. The focus on improving healthcare infrastructure in countries like Brazil and Argentina will further enhance market conditions.Middle East & Africa Fluoroscopy Market Report:

The Middle East and Africa region exhibits a growth potential, increasing from $0.34 billion in 2023 to $0.56 billion by 2033. Healthcare reforms and infrastructural investments in countries like UAE and Saudi Arabia are central to market growth. Rising health awareness and the need for advanced diagnostic solutions are also critical drivers in this region.Tell us your focus area and get a customized research report.

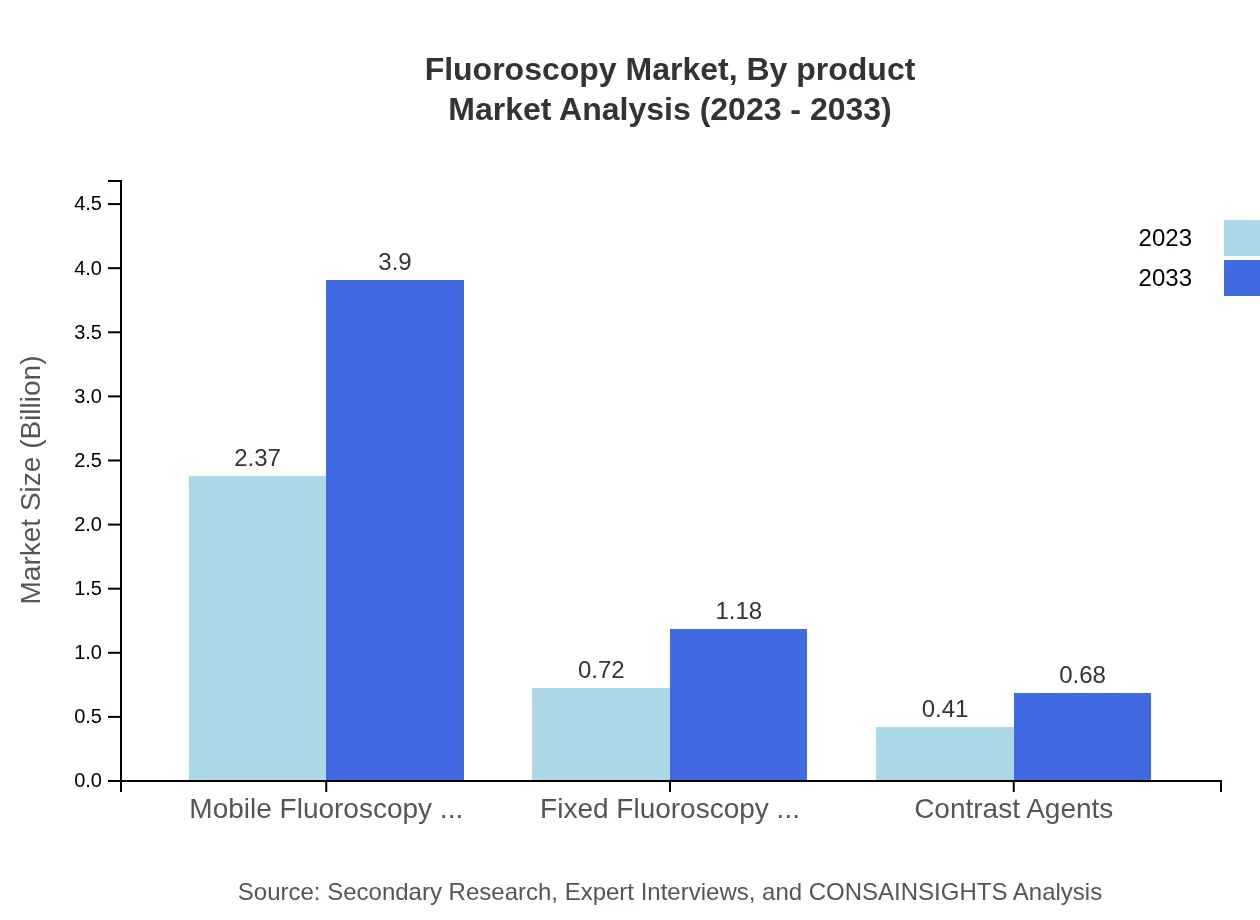

Fluoroscopy Market Analysis By Product

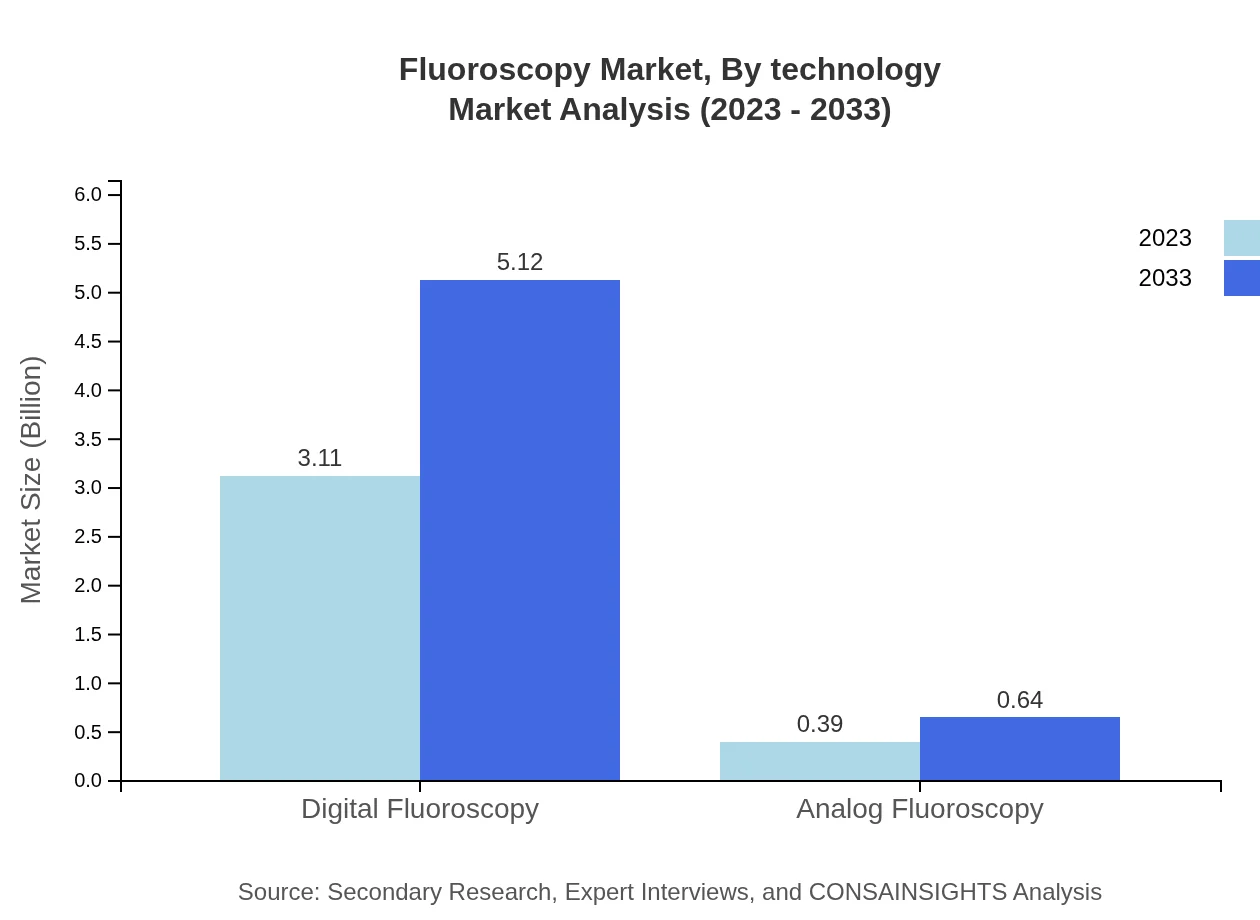

The Fluoroscopy market segment by product showcases diverse categories such as digital and analog fluoroscopy systems. Digital fluoroscopy systems currently dominate the market with a share of 88.83%, valued at $3.11 billion in 2023, and forecasted to reach $5.12 billion by 2033. Analog systems, while less prominent, still play a notable role, particularly in regions where cost constraints are significant. Overall, the demand for mobile fluoroscopy systems is witnessing heightened interest due to their convenience and efficiency.

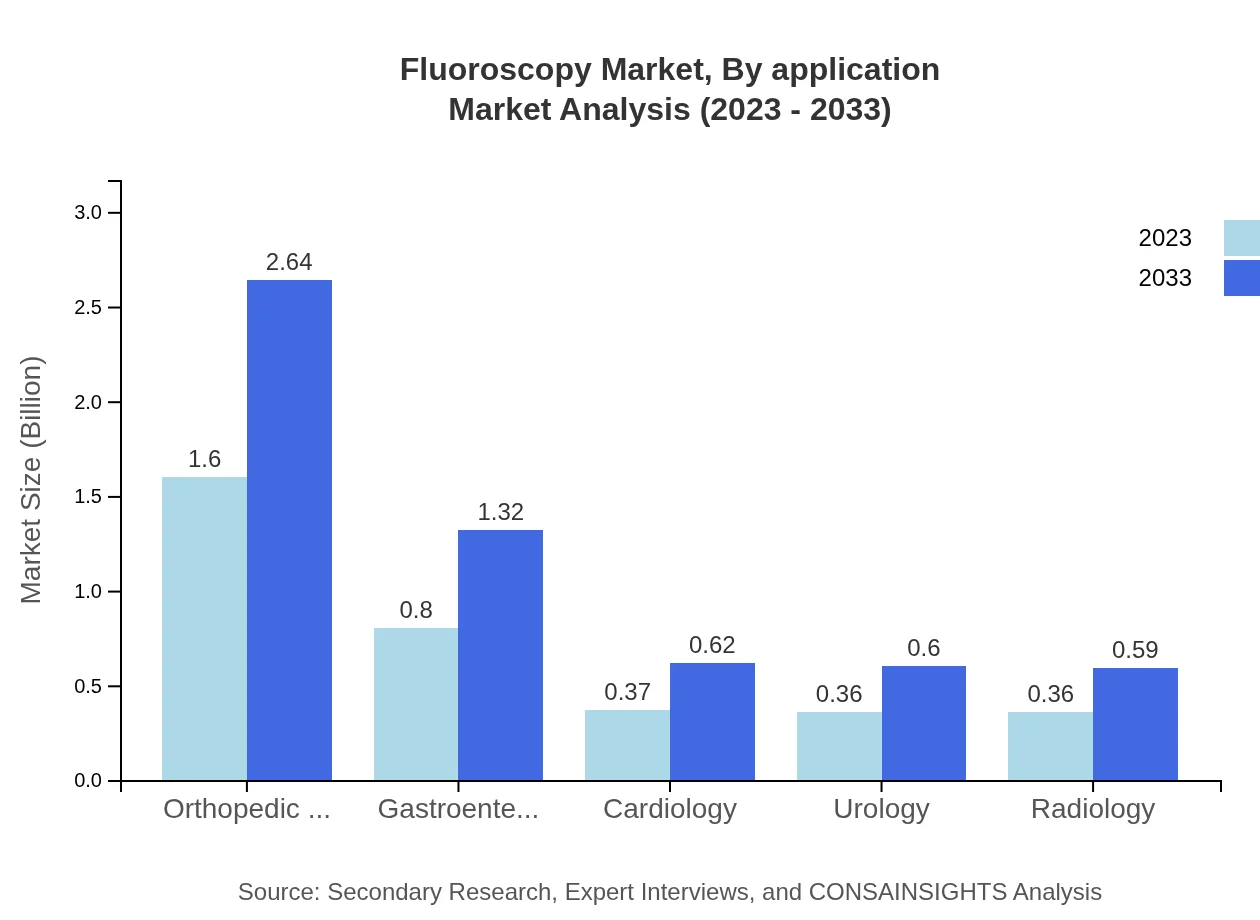

Fluoroscopy Market Analysis By Application

Applications of Fluoroscopy cover a wide range—orthopedic surgery remains the leading sector, accounting for 45.83% market share, valued at $1.60 billion in 2023, expected to grow to $2.64 billion by 2033. Gastroenterology and cardiology also contribute notable segments, with shares of approximately 22.97% and 10.68%, respectively. The versatility of fluoroscopy in various procedural applications exemplifies its vital role in modern medical diagnostics.

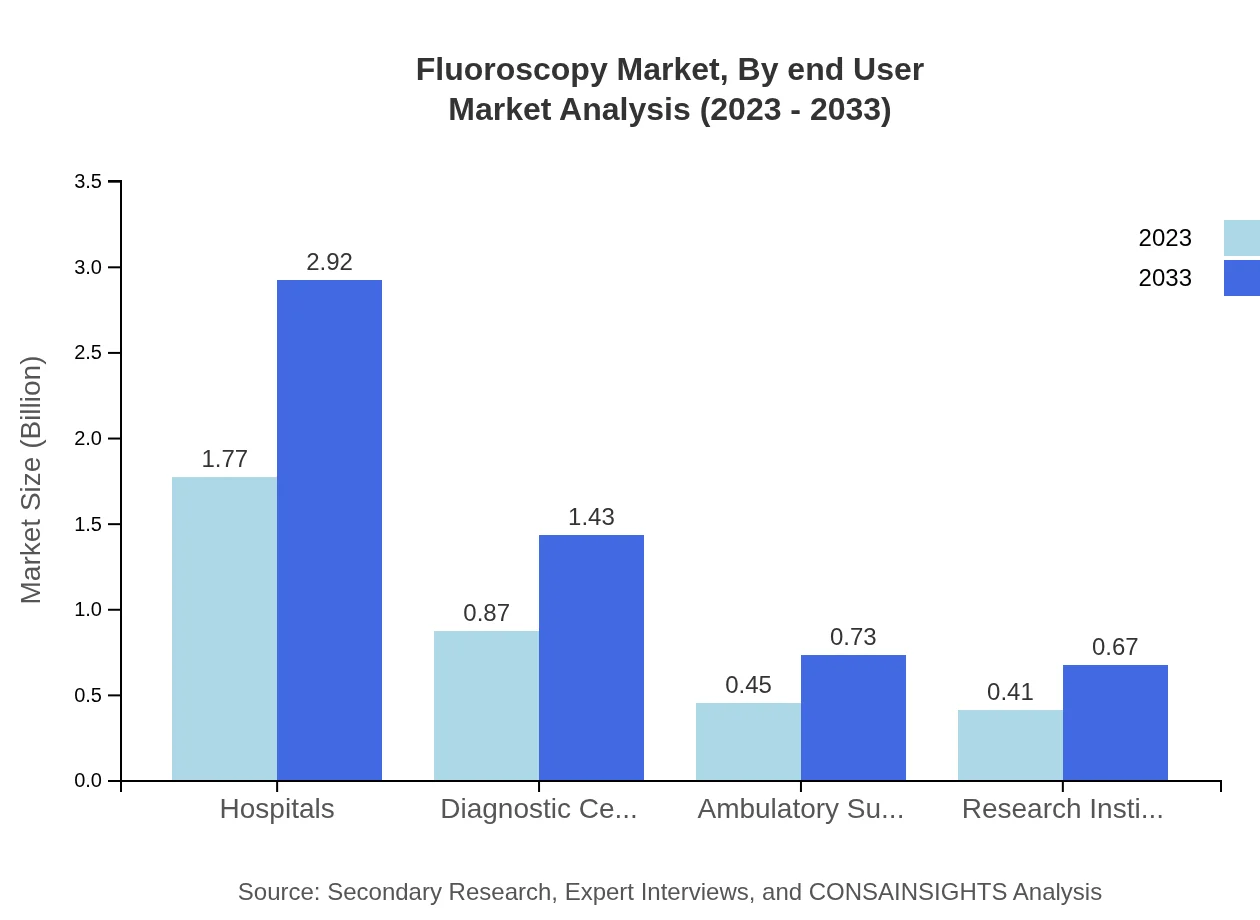

Fluoroscopy Market Analysis By End User

The end-user segment of the Fluoroscopy market is characterized by hospitals, diagnostic centers, ambulatory surgery centers, research institutes, and others. Hospitals are the largest segment, holding approximately 50.71% of the market at $1.77 billion in 2023, and projected to grow to $2.92 billion by 2033. Diagnostic centers follow with significant contributions, indicating an increasing reliance on specialized facilities for imaging solutions.

Fluoroscopy Market Analysis By Technology

Technology in the Fluoroscopy market is rapidly evolving, particularly with advancements in digital fluoroscopy that enhance image quality while reducing radiation exposure. Innovations such as AI integration for real-time analysis and enhanced system designs for better maneuverability are setting new standards. The demand for advanced technological solutions continues to influence market dynamics significantly.

Fluoroscopy Market Analysis By Distribution Channel

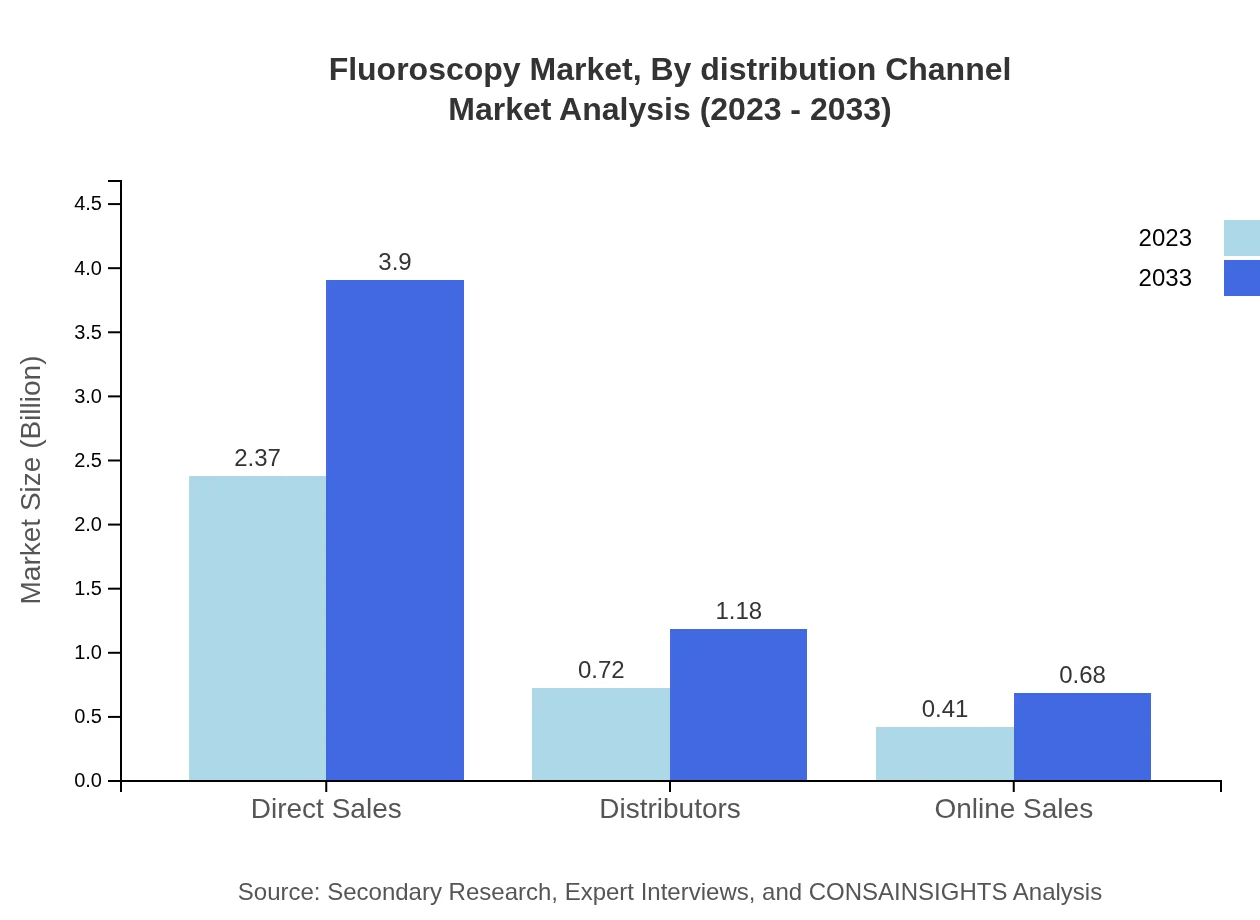

The Fluoroscopy market distribution channels exhibit a variety of methods, including direct sales, distributors, and online sales. Direct sales dominate, accounting for about 67.74% of the market with $2.37 billion in 2023 expected to reach $3.90 billion by 2033. As online sales platforms gain traction, they offer more accessible options for purchasing fluoroscopy systems, appealing to smaller practices aiming to enhance their diagnostic capabilities.

Fluoroscopy Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fluoroscopy Industry

Siemens Healthineers:

Siemens Healthineers is a renowned global leader in medical technology, providing innovative fluoroscopy solutions designed for optimized imaging and patient safety.GE Healthcare:

GE Healthcare offers a wide range of advanced fluoroscopy systems, known for their quality and efficiency in providing real-time imaging solutions for various medical applications.Philips Healthcare:

Philips Healthcare focuses on delivering breakthrough innovations in medical imaging, including state-of-the-art fluoroscopy systems that enhance the efficacy of clinical procedures.Hitachi Medical Systems:

Hitachi specializes in advanced imaging technologies, including fluoroscopy, focusing on providing healthcare professionals with precise imaging necessary for accurate diagnoses.Canon Medical Systems:

Canon is known for its advanced imaging solutions and continues to innovate in the fluoroscopy space, contributing significantly to market growth through high-quality products.We're grateful to work with incredible clients.

FAQs

What is the market size of fluoroscopy?

The fluoroscopy market is projected to reach $3.5 billion by 2033, growing at a CAGR of 5%. In 2023, the market size is estimated at approximately $2.88 billion, reflecting rising demand across various medical applications.

What are the key market players or companies in the fluoroscopy industry?

Key players in the fluoroscopy market include GE Healthcare, Siemens Healthineers, Philips Healthcare, Hitachi Medical Systems, and Canon Medical Systems, among others. These companies are at the forefront of technological advancements and market innovations.

What are the primary factors driving the growth in the fluoroscopy industry?

Growth drivers for the fluoroscopy industry include increasing incidences of chronic diseases, rising demand for minimally invasive surgeries, technological advancements in imaging techniques, and growing geriatric populations requiring diagnostic services.

Which region is the fastest Growing in the fluoroscopy?

The Asia Pacific region is the fastest-growing market in fluoroscopy, expected to grow from $0.68 billion in 2023 to $1.11 billion by 2033. This growth is fueled by improving healthcare infrastructure and increasing investments in medical technology.

Does ConsaInsights provide customized market report data for the fluoroscopy industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the fluoroscopy industry. Clients can request detailed insights and analytics based on their unique market research requirements.

What deliverables can I expect from this fluoroscopy market research project?

Deliverables from the fluoroscopy market research project typically include comprehensive reports, data analysis, market forecasts, segment insights, competitive landscape evaluations, and industry trends tailored to client specifications.

What are the market trends of fluoroscopy?

Trends in the fluoroscopy market include the shift towards digital fluoroscopy, increasing adoption of mobile fluoroscopy systems, rising integration of imaging technologies in surgical procedures, and enhanced focus on patient safety and reduced radiation exposure.