Flywheel Energy Storage Market Report

Published Date: 31 January 2026 | Report Code: flywheel-energy-storage

Flywheel Energy Storage Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Flywheel Energy Storage market, highlighting key trends, market size, and forecasts up to 2033. It offers insights into segmentation, technological advancements, and regional performances to help stakeholders make informed decisions.

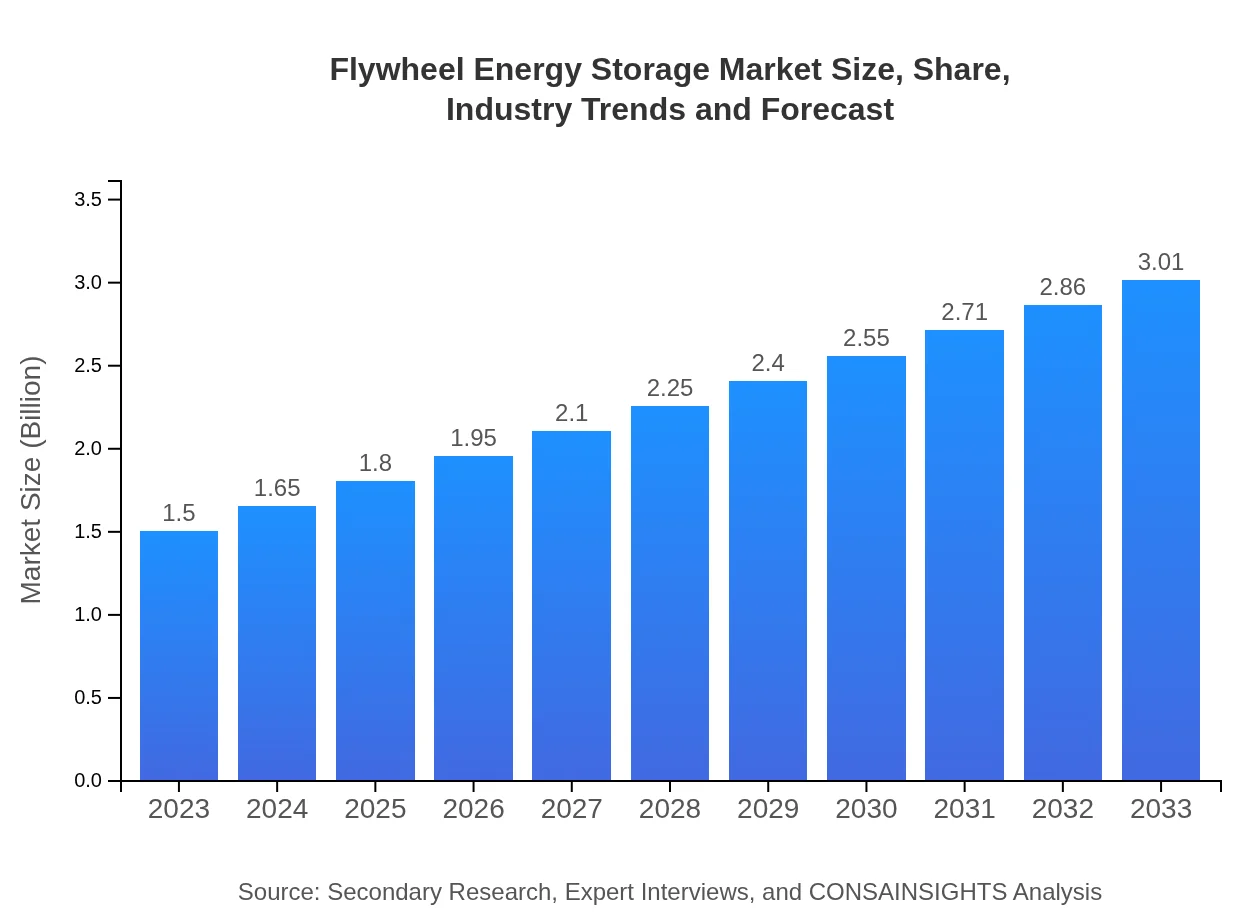

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.0% |

| 2033 Market Size | $3.01 Billion |

| Top Companies | Beacon Power, Ambri, VYCON, Active Power |

| Last Modified Date | 31 January 2026 |

Flywheel Energy Storage Market Overview

Customize Flywheel Energy Storage Market Report market research report

- ✔ Get in-depth analysis of Flywheel Energy Storage market size, growth, and forecasts.

- ✔ Understand Flywheel Energy Storage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flywheel Energy Storage

What is the Market Size & CAGR of Flywheel Energy Storage Market in 2023?

Flywheel Energy Storage Industry Analysis

Flywheel Energy Storage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flywheel Energy Storage Market Analysis Report by Region

Europe Flywheel Energy Storage Market Report:

Europe's market is set to grow from $0.47 billion in 2023 to $0.94 billion in 2033, propelled by stringent regulations on carbon emissions and a strong push towards renewable energy sources emphasizing the need for effective energy storage solutions.Asia Pacific Flywheel Energy Storage Market Report:

The Asia Pacific region is expected to grow from $0.28 billion in 2023 to $0.56 billion in 2033, led by increasing investments in renewable energy and the growing demand for grid stabilization. Countries like China and India are focusing on enhancing grid infrastructure, thereby boosting the Flywheel Energy Storage market.North America Flywheel Energy Storage Market Report:

The North American market is anticipated to rise from $0.57 billion in 2023 to $1.13 billion in 2033, supported by technological advancements and regulatory frameworks encouraging the use of energy storage systems in grid management and utility sectors.South America Flywheel Energy Storage Market Report:

In South America, the market is projected to increase from $0.11 billion in 2023 to $0.21 billion by 2033. The push for renewables in nations such as Brazil and Chile provides opportunities for Flywheel solutions to support energy reliability and efficiency.Middle East & Africa Flywheel Energy Storage Market Report:

The Middle East and Africa market is expected to experience growth from $0.08 billion in 2023 to $0.16 billion in 2033, driven by the rising demand for energy security in developing regions and investments in clean energy technologies.Tell us your focus area and get a customized research report.

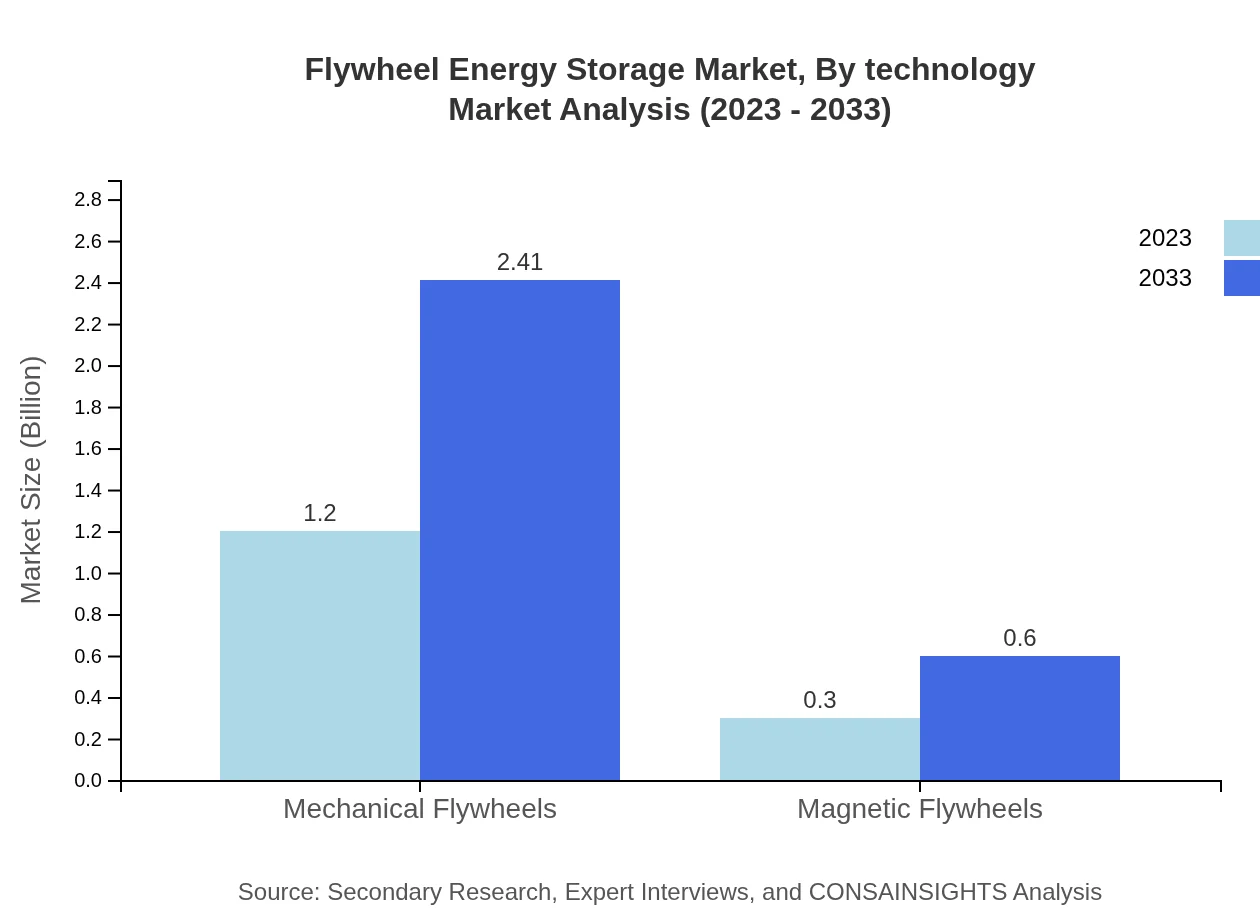

Flywheel Energy Storage Market Analysis By Technology

The Flywheel Energy Storage technology segment dominated the market in 2023, with a size of $1.20 billion expected to double to $2.41 billion by 2033. Mechanical flywheels hold the majority market share, accounting for 80.07% due to their widespread use in grid stabilization and renewable energy integration.

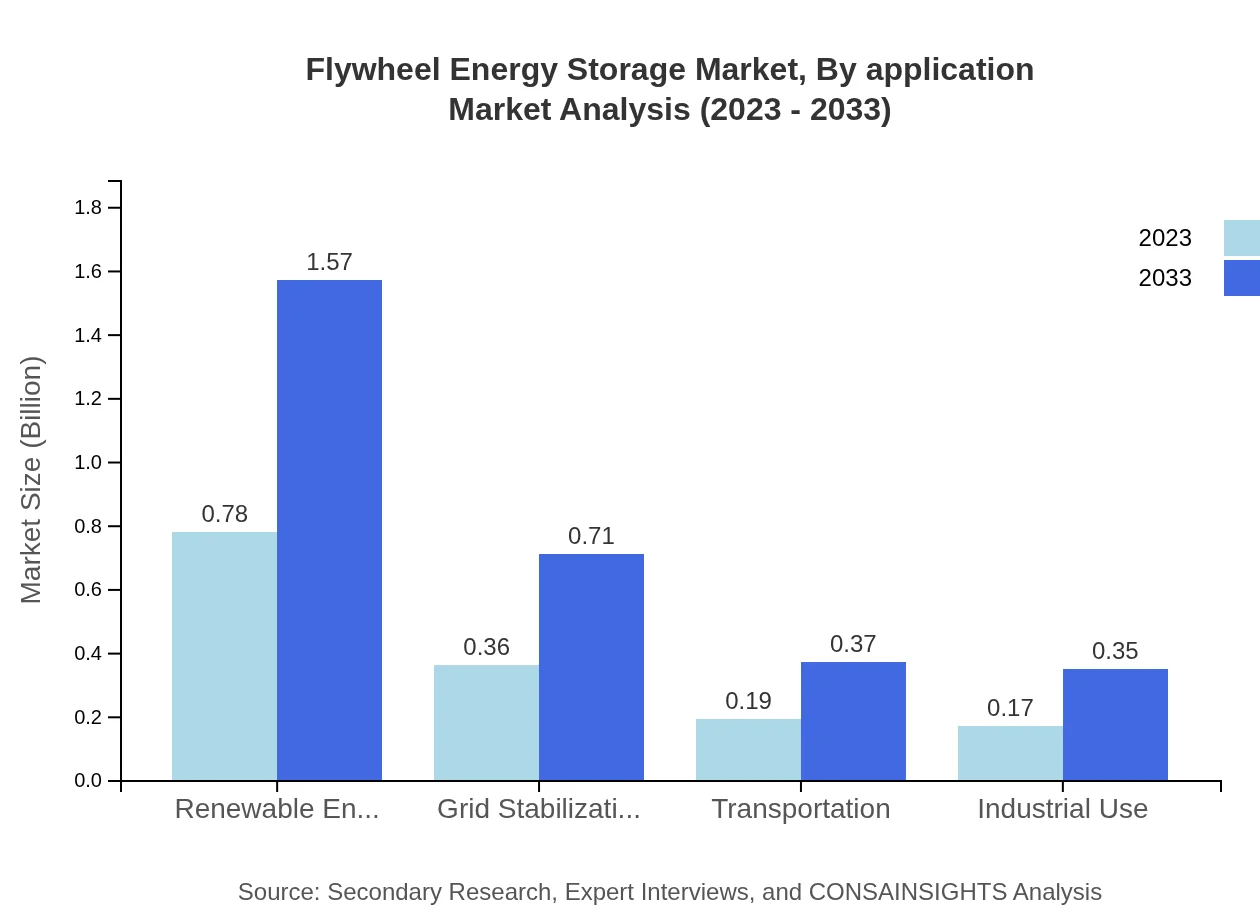

Flywheel Energy Storage Market Analysis By Application

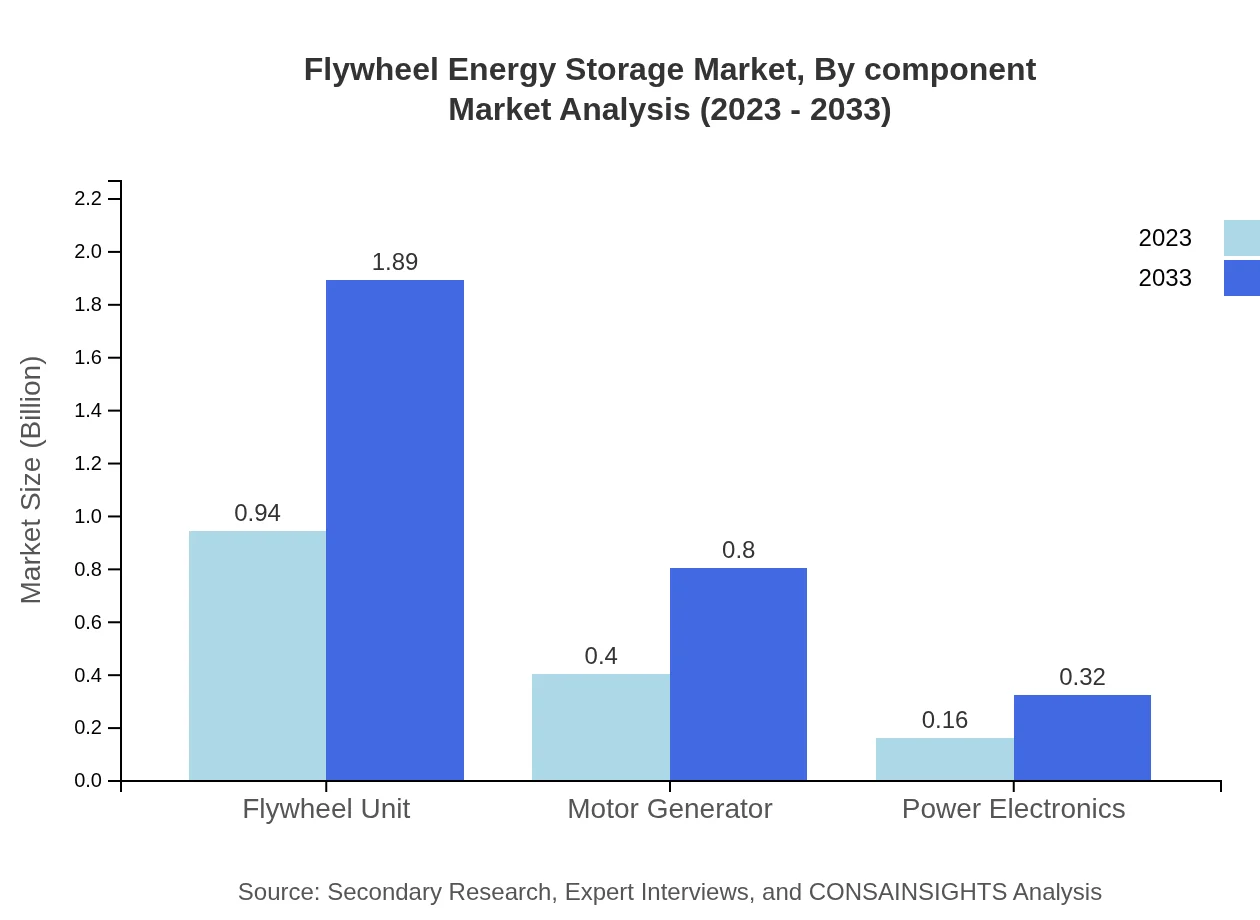

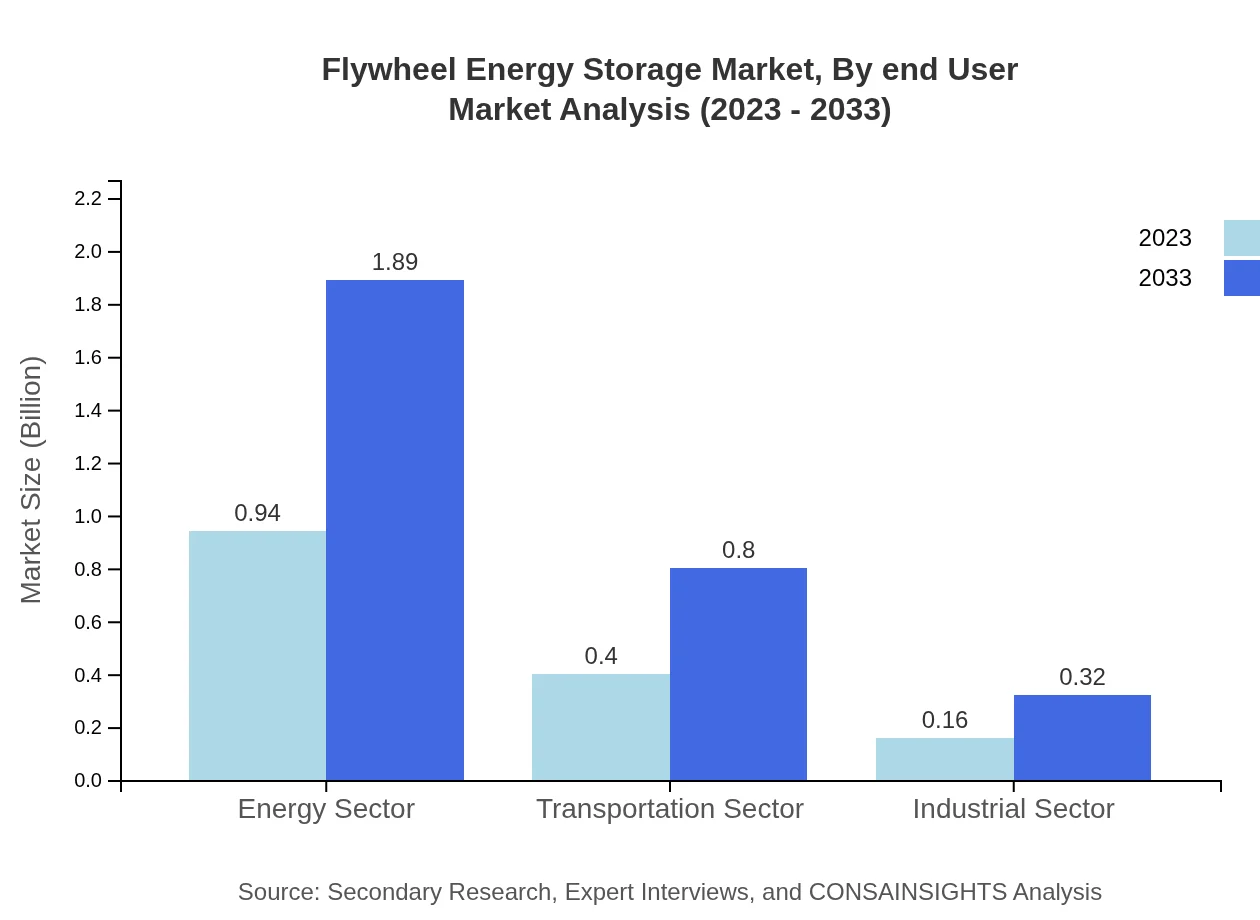

The energy sector represents the largest application segment, reaching $0.94 billion in 2023 and projected to expand to $1.89 billion by 2033. Transportation is also notable, growing from $0.40 billion to $0.80 billion, underscoring the increasing role of Flywheel systems in electric vehicles and public transport solutions.

Flywheel Energy Storage Market Analysis By Component

The Flywheel Unit segment is significant, valued at $0.94 billion in 2023, with expectations to reach $1.89 billion by 2033. Additionally, the motor generator and power electronics components are essential to system efficiency and performance, contributing to a well-rounded market landscape.

Flywheel Energy Storage Market Analysis By End User

The industrial sector is a leading end-user, with a market size of $0.16 billion in 2023, anticipated to double to $0.32 billion by 2033. As industries increasingly integrate energy storage solutions, Flywheel technologies find applications in manufacturing processes and industrial automation.

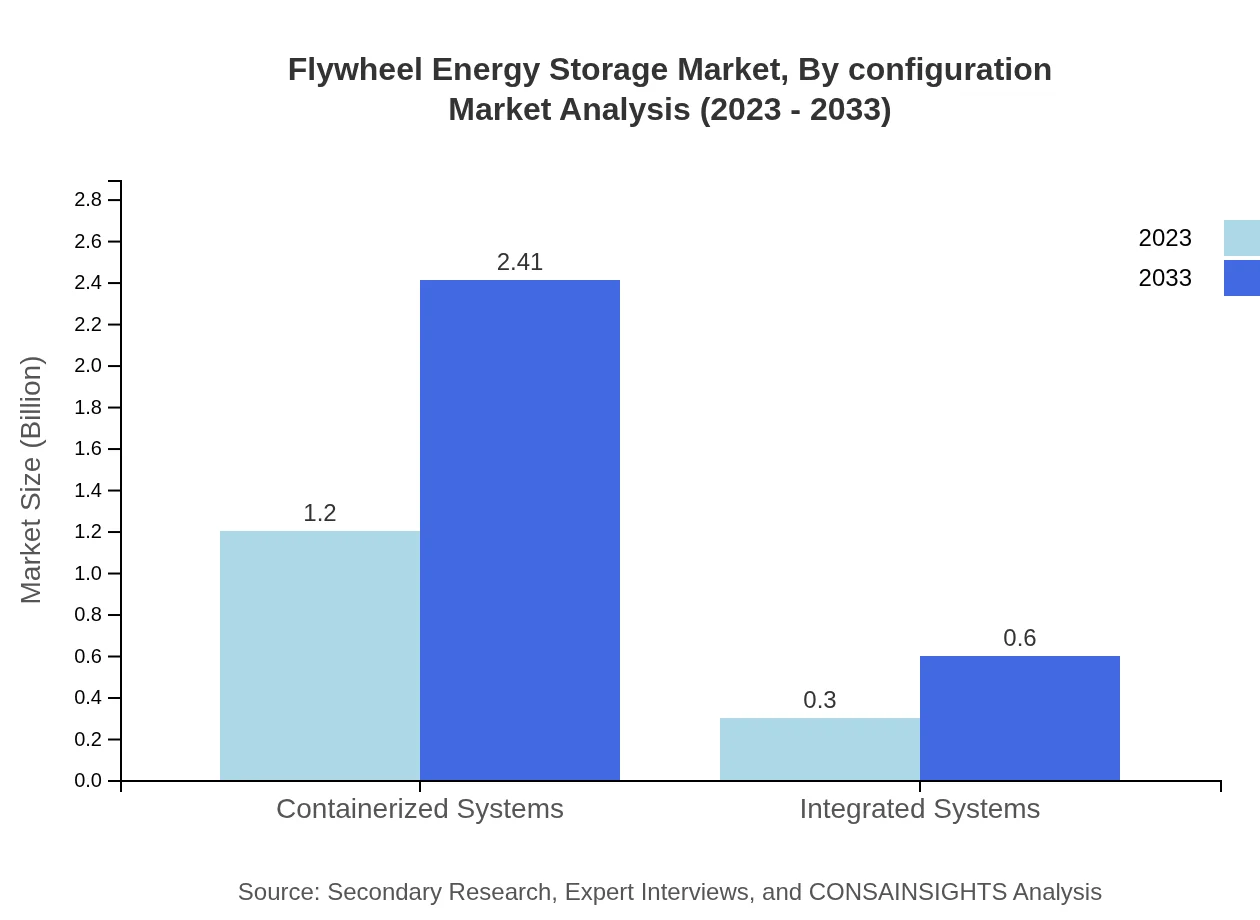

Flywheel Energy Storage Market Analysis By Configuration

Containerized Systems lead the configuration segment, valued at $1.20 billion in 2023 and forecasted to grow to $2.41 billion by 2033. These systems offer easy deployment and scalability, making them preferable for various applications, especially in remote and decentralized energy setups.

Flywheel Energy Storage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flywheel Energy Storage Industry

Beacon Power:

A pioneering company in the Flywheel Energy Storage sector, Beacon Power focuses on frequency regulation services, utilizing its advanced flywheel technology to stabilize the grid. Their solutions are integral to the smart grid evolution.Ambri:

Ambri specializes in innovative energy storage systems, utilizing liquid metal batteries alongside flywheel technology to provide reliable, long-duration energy storage for industrial applications and grid systems.VYCON:

VYCON manufactures high-speed flywheel energy storage systems known for their exceptional efficiency and rapid response times, catering primarily to data centers and electric grid applications.Active Power:

A leader in power and energy storage solutions, Active Power specializes in flywheel technology that delivers uninterruptible power and energy storage for mission-critical applications, ensuring reliability and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of flywheel Energy Storage?

The Flywheel Energy Storage market is currently valued at approximately $1.5 billion and is projected to grow at a CAGR of 7.0% from 2023 to 2033, indicating strong future potential.

What are the key market players or companies in the flywheel Energy Storage industry?

Key players in the flywheel energy storage market include companies specializing in renewable energy integration, grid stabilization technology, and advanced energy solutions, focusing on innovations in mechanical and magnetic flywheels.

What are the primary factors driving the growth in the flywheel Energy Storage industry?

Factors driving growth include rising demand for renewable energy solutions, the need for grid stabilization, increasing adoption of hybrid energy systems, and advancements in flywheel technology enhancing energy efficiency.

Which region is the fastest Growing in the flywheel Energy Storage?

The North American region is the fastest-growing market for flywheel energy storage, expected to rise from $0.57 billion in 2023 to $1.13 billion by 2033, driven by increased investment in energy storage technologies.

Does ConsaInsights provide customized market report data for the flywheel Energy Storage industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the flywheel energy storage industry, ensuring relevant insights and analysis for informed decision-making.

What deliverables can I expect from this flywheel Energy Storage market research project?

Expect detailed market analysis, segmentation data, regional insights, trend evaluations, competitive landscapes, and forecasts tailored to the flywheel energy storage sector, comprehensive enough for strategic planning.

What are the market trends of flywheel Energy Storage?

Current market trends include increased efficiency in mechanical flywheels, a surge in renewable energy projects, advanced grid stabilization technologies, and a growing preference for containerized and integrated energy systems.