Foam Dressings Market Report

Published Date: 31 January 2026 | Report Code: foam-dressings

Foam Dressings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Foam Dressings market covering key insights, market size, growth forecasts from 2023 to 2033, and in-depth regional assessments. It explores trends, market segmentation, and competitive landscapes to aid stakeholders in strategic decision-making.

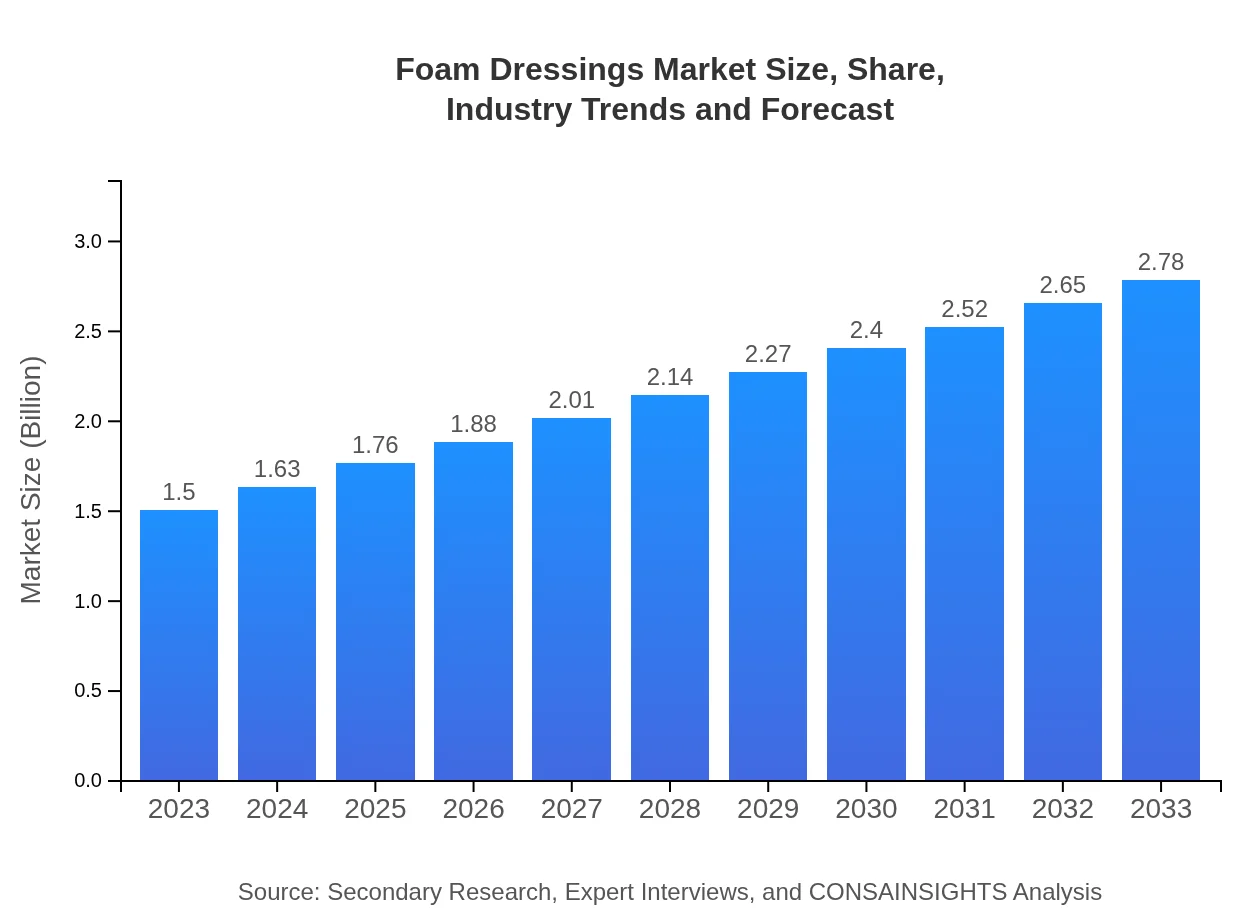

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Smith & Nephew, 3M, Mölnlycke Health Care, Hollister Incorporated |

| Last Modified Date | 31 January 2026 |

Foam Dressings Market Overview

Customize Foam Dressings Market Report market research report

- ✔ Get in-depth analysis of Foam Dressings market size, growth, and forecasts.

- ✔ Understand Foam Dressings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Foam Dressings

What is the Market Size & CAGR of Foam Dressings market in 2023?

Foam Dressings Industry Analysis

Foam Dressings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Foam Dressings Market Analysis Report by Region

Europe Foam Dressings Market Report:

Europe's market will see growth from 0.40 billion USD in 2023 to 0.74 billion USD by 2033. The expansion of facilities offering advanced wound care products and an increasing geriatric population are crucial factors for this growth.Asia Pacific Foam Dressings Market Report:

The Asia Pacific Foam Dressings market is poised for significant growth, with a projected increase from 0.33 billion USD in 2023 to 0.61 billion USD by 2033. Rising healthcare spending, growing awareness about advanced wound care, and increasing incidences of surgical procedures are the primary drivers in this region.North America Foam Dressings Market Report:

North America holds a substantial share of the global Foam Dressings market, projected to increase from 0.52 billion USD in 2023 to 0.97 billion USD by 2033. The region's growth is underscored by a high prevalence of chronic wounds, increasing surgical procedures, and the presence of established healthcare systems.South America Foam Dressings Market Report:

In South America, the market is expected to grow from 0.06 billion USD in 2023 to 0.11 billion USD by 2033. The increasing investment in healthcare infrastructure and awareness of contemporary wound care solutions are anticipated to stimulate growth in this region.Middle East & Africa Foam Dressings Market Report:

The Middle East and Africa market is expected to grow from 0.19 billion USD in 2023 to 0.36 billion USD by 2033. Increasing healthcare expenditure and a growing emphasis on patient-centric healthcare are influencing the adoption of foam dressings in this region.Tell us your focus area and get a customized research report.

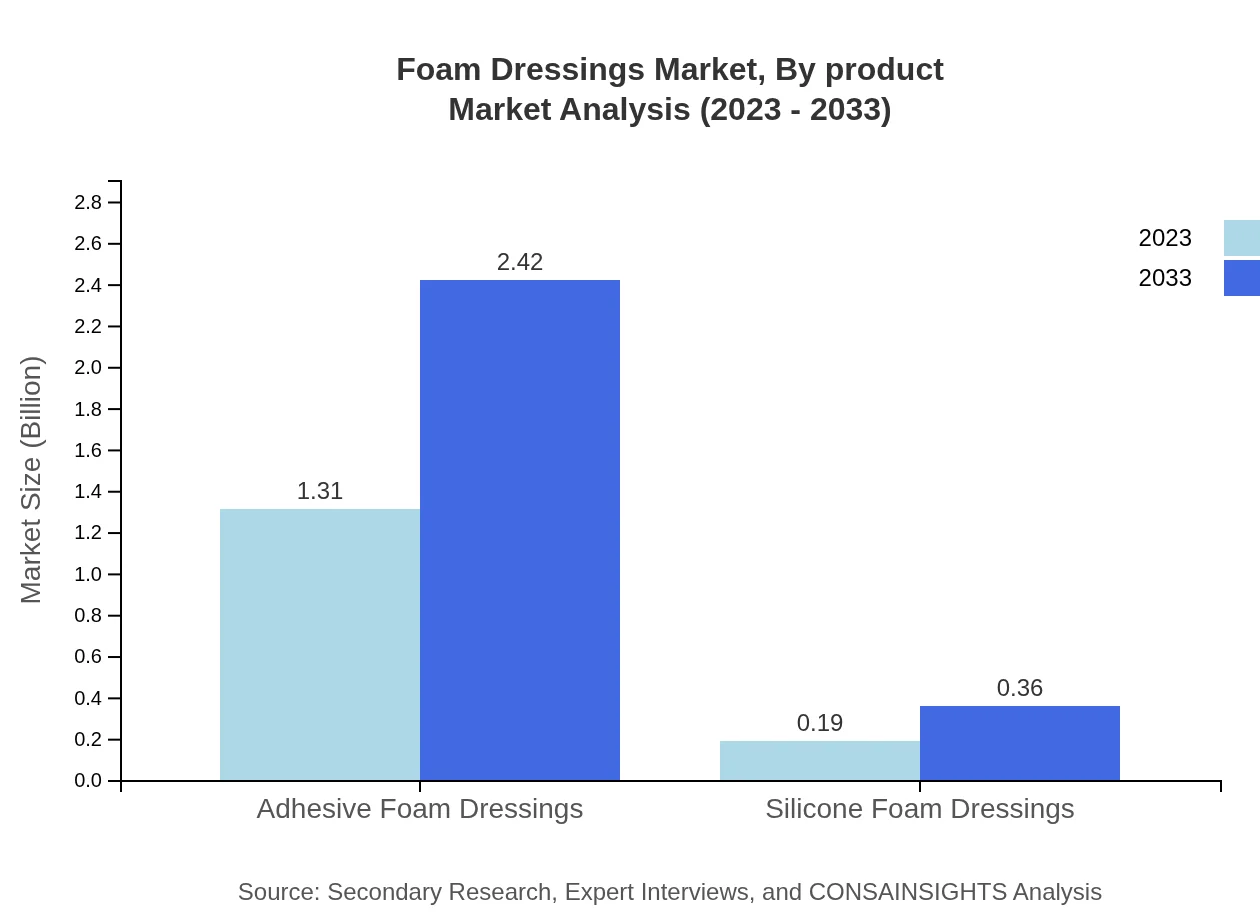

Foam Dressings Market Analysis By Product

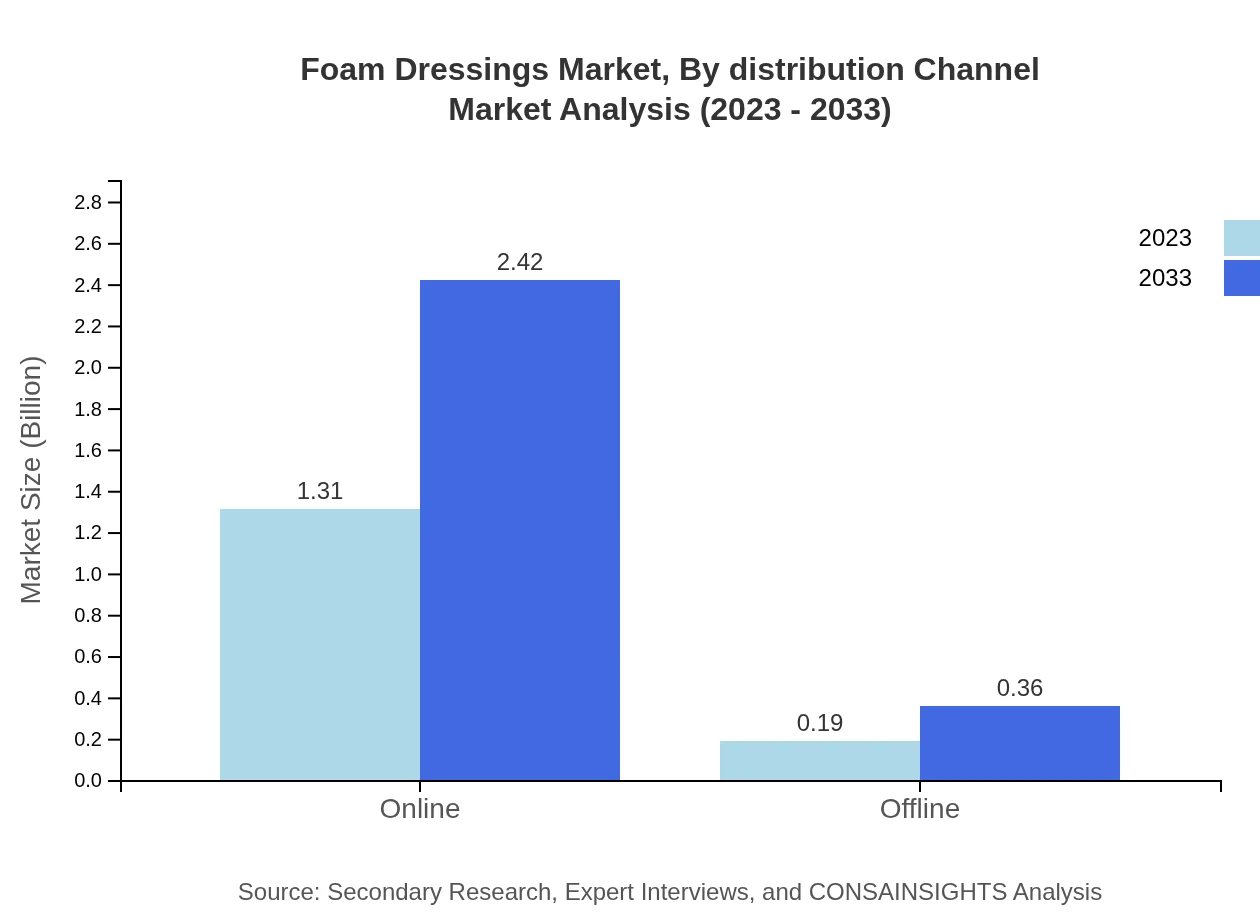

The product analysis highlights the significant market share of adhesive foam dressings estimated at 1.31 billion USD in 2023, anticipated to rise to 2.42 billion USD by 2033. Silicone foam dressings, though smaller in market size, are projected to grow from 0.19 billion USD in 2023 to 0.36 billion USD by 2033, reflecting technological advancements and specialty products emerging in the market.

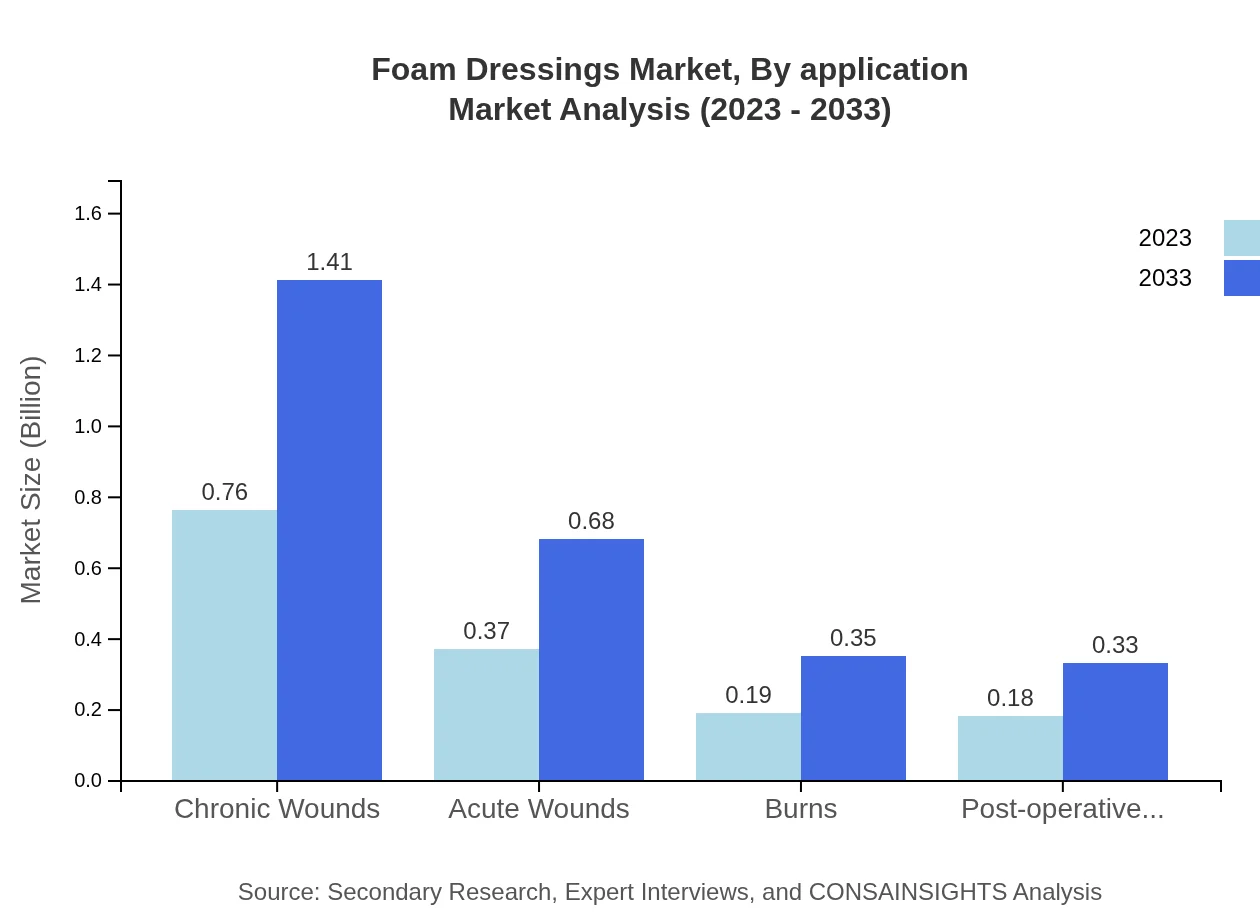

Foam Dressings Market Analysis By Application

In terms of application, chronic wound management is the frontrunner, accounting for significant market share. The size for chronic wounds stands at approximately 0.76 billion USD in 2023, with projections to grow to 1.41 billion USD by 2033. Other applications, including acute wounds, burns, and post-operative care, are also witnessing favorable trends, with notable market sizes projected for growth.

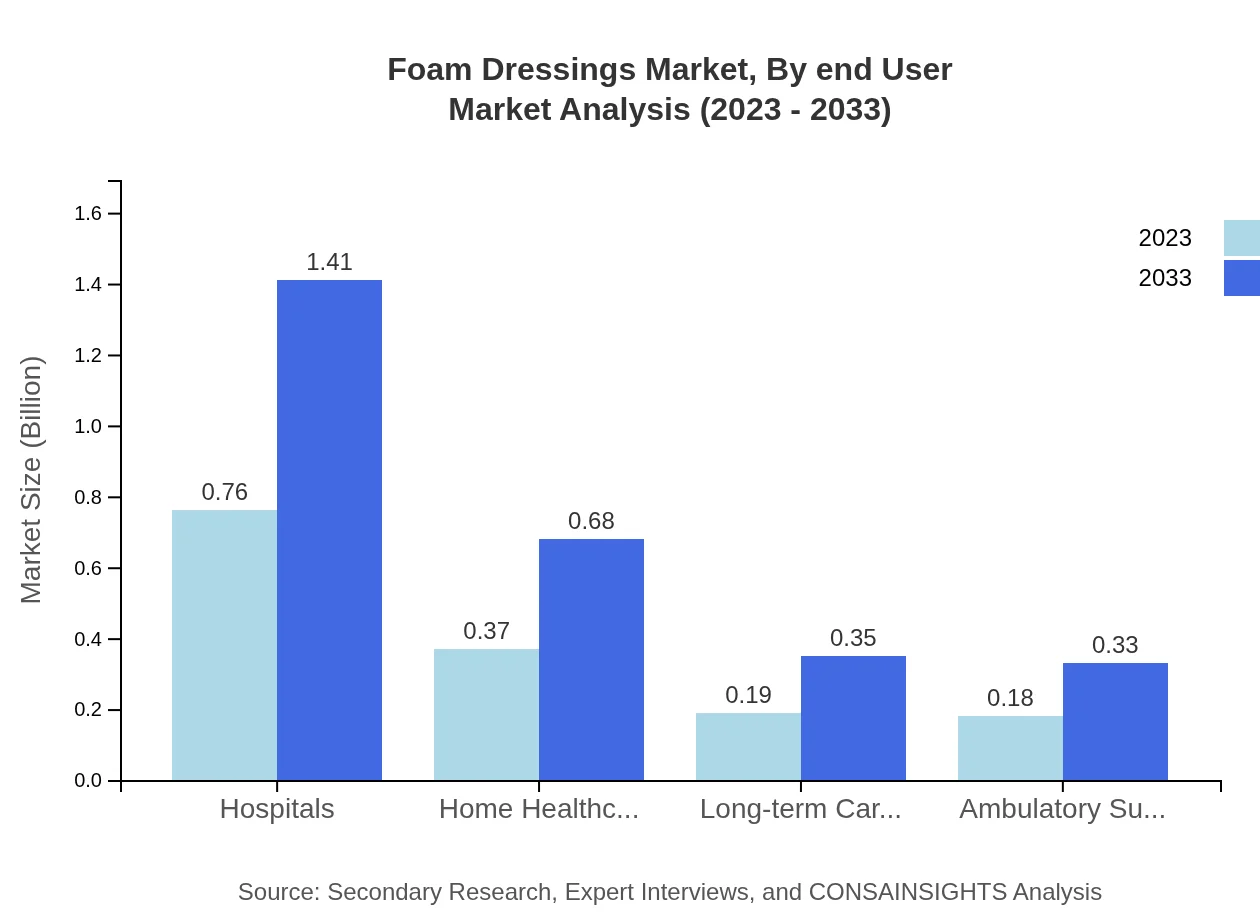

Foam Dressings Market Analysis By End User

Hospitals hold the largest share of the market value, with an estimated 0.76 billion USD in 2023, growing to 1.41 billion USD by 2033. Other significant end-users include home healthcare facilities and ambulatory surgery centers. The growth in these segments will be driven by expanding healthcare access and the need for reliable wound care management.

Foam Dressings Market Analysis By Distribution Channel

Online distribution channels dominate the market, projected to grow from 1.31 billion USD in 2023 to 2.42 billion USD by 2033. Increasing e-commerce penetration and the convenience of online shopping are the primary drivers. Offline channels still play a vital role, particularly in regions with less access to internet services, but they see slower growth rates.

Foam Dressings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Foam Dressings Industry

Smith & Nephew:

A leading player in the wound care market, Smith & Nephew offers a range of foam dressings recognized for their effectiveness in managing wounds while promoting healing.3M:

With a robust portfolio of innovative healthcare solutions, 3M produces high-quality foam dressings known for their advanced technology and patient comfort.Mölnlycke Health Care:

Specializing in wound care products, Mölnlycke provides foam dressings that cater to diverse needs, ensuring effective management of complex wounds.Hollister Incorporated:

Hollister is known for its superior-quality wound care dressings, including foam products that offer excellent moisture management and comfort.We're grateful to work with incredible clients.

FAQs

What is the market size of foam Dressings?

The foam dressings market is currently valued at approximately $1.5 billion with a projected CAGR of 6.2%. By 2033, the market is expected to experience significant growth, indicating a strong demand for advanced wound care products.

What are the key market players or companies in this foam Dressings industry?

Key players in the foam dressings industry include companies such as 3M, Smith & Nephew, ConvaTec, and Medtronic. These organizations lead through innovation and robust distribution channels, contributing to the overall market growth.

What are the primary factors driving the growth in the foam dressings industry?

Factors driving growth in the foam dressings market include the rising incidence of chronic wounds, an increasing elderly population, advancements in wound care technology, and growing healthcare expenditure, which collectively enhance demand for effective wound management solutions.

Which region is the fastest Growing in the foam dressings?

North America is currently the fastest-growing region in the foam dressings market, projected to increase from $0.52 billion in 2023 to $0.97 billion by 2033. Asia Pacific also demonstrates significant growth potential, advancing from $0.33 to $0.61 billion.

Does ConsaInsights provide customized market report data for the foam dressings industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of stakeholders in the foam dressings industry, ensuring that the insights align with the individual requirements and strategic objectives of businesses.

What deliverables can I expect from this foam dressings market research project?

Deliverables from the foam dressings market research project typically include comprehensive market analysis reports, growth forecasts, competitive landscape assessments, and detailed insights into consumer trends and preferences, aiding informed decision-making.

What are the market trends of foam dressings?

Current trends in the foam dressings market include a shift towards advanced materials such as silicone, increased adoption of digital health technologies for wound management, and growing consumer preference for home healthcare solutions.