Foam Glass Market Report

Published Date: 02 February 2026 | Report Code: foam-glass

Foam Glass Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Foam Glass market, covering essential insights, trends, and data from 2023 to 2033. It includes market size projections, regional insights, segment analysis, and forecasts to guide industry stakeholders in making informed decisions.

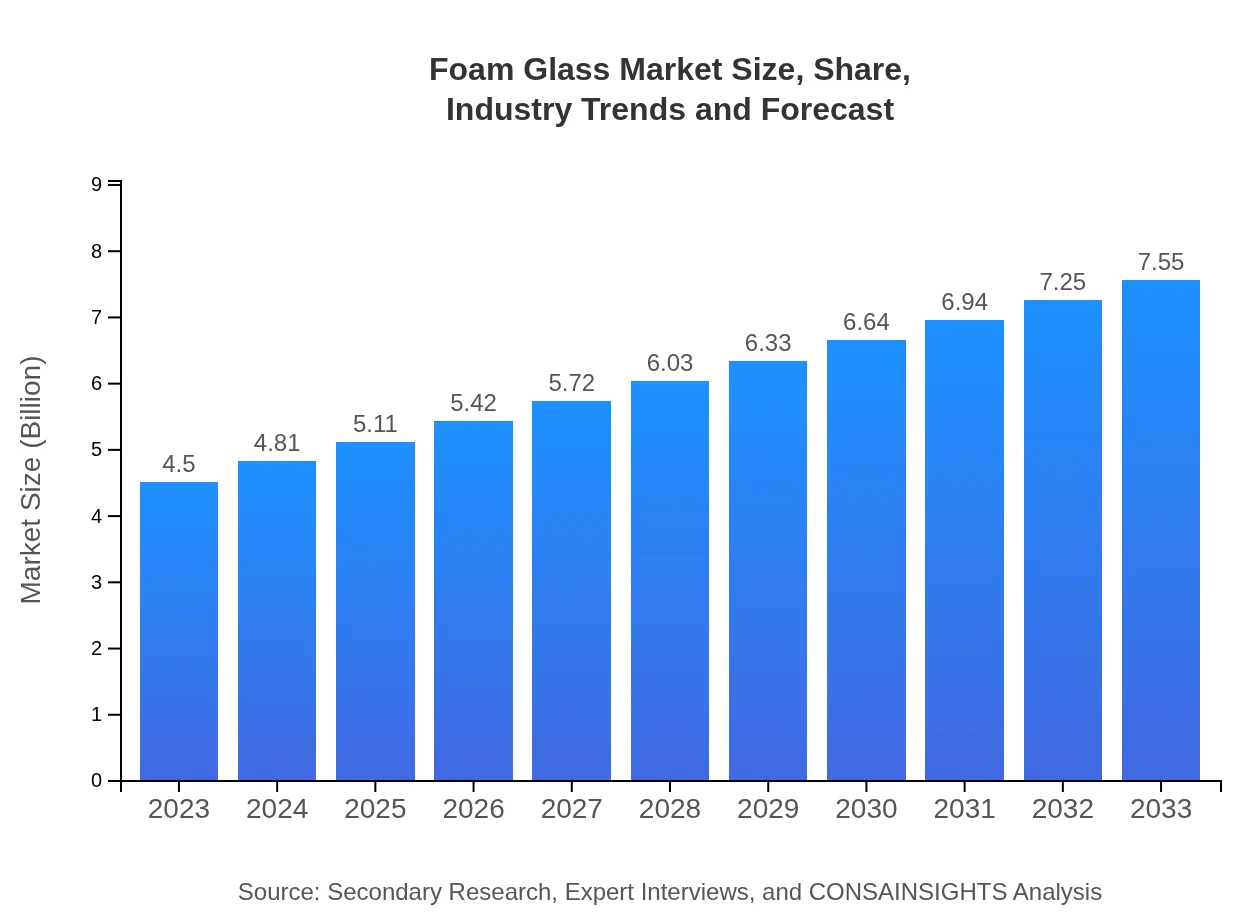

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $7.55 Billion |

| Top Companies | Owens Corning, BASF SE, Pittsburgh Corning Corporation, Saint-Gobain |

| Last Modified Date | 02 February 2026 |

Foam Glass Market Overview

Customize Foam Glass Market Report market research report

- ✔ Get in-depth analysis of Foam Glass market size, growth, and forecasts.

- ✔ Understand Foam Glass's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Foam Glass

What is the Market Size & CAGR of Foam Glass market in 2023?

Foam Glass Industry Analysis

Foam Glass Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Foam Glass Market Analysis Report by Region

Europe Foam Glass Market Report:

Europe holds a significant share of the Foam Glass market, projected to grow from 1.31 billion USD in 2023 to 2.19 billion USD by 2033. Strict regulations regarding environmental impact and a strong push for sustainable construction materials are driving market advancements. The market is characterized by various players focusing on R&D to produce eco-friendly, high-performance materials.Asia Pacific Foam Glass Market Report:

The Asia Pacific Foam Glass market is projected to grow from 0.83 billion USD in 2023 to 1.40 billion USD by 2033. Key factors include rapid urbanization, infrastructural developments, and rising demand for energy-efficient materials in countries like China and India. The region presents vast opportunities for market players to tap into burgeoning construction and industrial sectors.North America Foam Glass Market Report:

North America's Foam Glass market is set to expand from 1.72 billion USD in 2023 to 2.89 billion USD by 2033. The region's focus on sustainable building practices, along with supportive government policies for green construction, is propelling the demand for Foam Glass. Major construction firms are also investing in innovative insulation solutions.South America Foam Glass Market Report:

In South America, the market is expected to grow modestly from 0.19 billion USD in 2023 to 0.32 billion USD by 2033. The growth is primarily driven by increased construction activity and infrastructural projects, particularly in Brazil and Argentina. However, the region faces challenges related to economic stability, which can impact market performance.Middle East & Africa Foam Glass Market Report:

The Foam Glass market in the Middle East and Africa is forecasted to increase from 0.45 billion USD in 2023 to 0.76 billion USD by 2033, thanks to growing infrastructure projects and expanding real estate developments, particularly in UAE and South Africa. The region's diverse climate conditions also create a need for effective insulation materials.Tell us your focus area and get a customized research report.

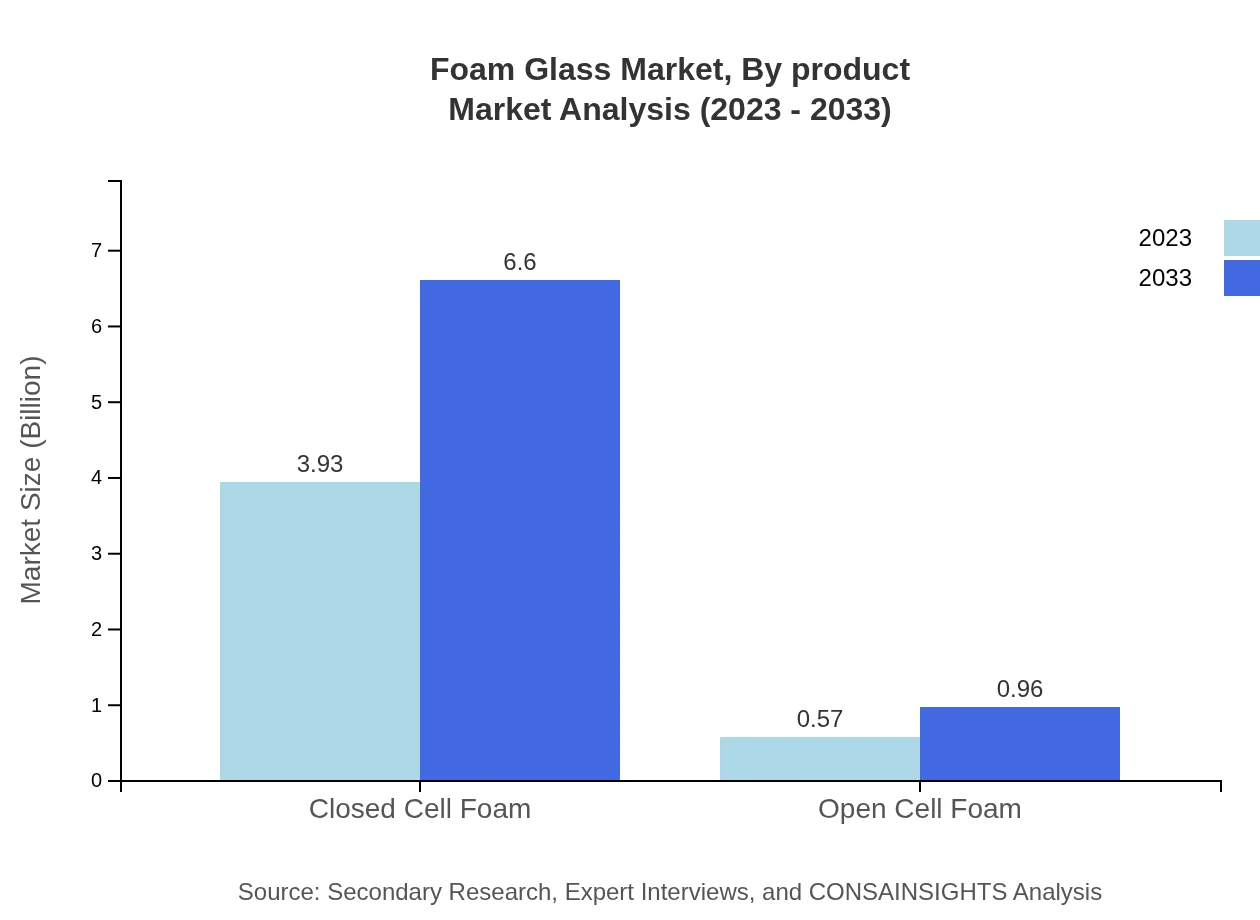

Foam Glass Market Analysis By Product

The Foam Glass market primarily consists of two product types: closed-cell Foam Glass and open-cell Foam Glass. Closed-cell Foam Glass dominated the market in 2023 with a value of 3.93 billion USD, maintaining a share of 87.32%. It is favored for its excellent insulating properties and is widely used in construction. Open-cell Foam Glass, while smaller in size with a market valuation of 0.57 billion USD (12.68% share), is gaining traction for applications that require more flexibility.

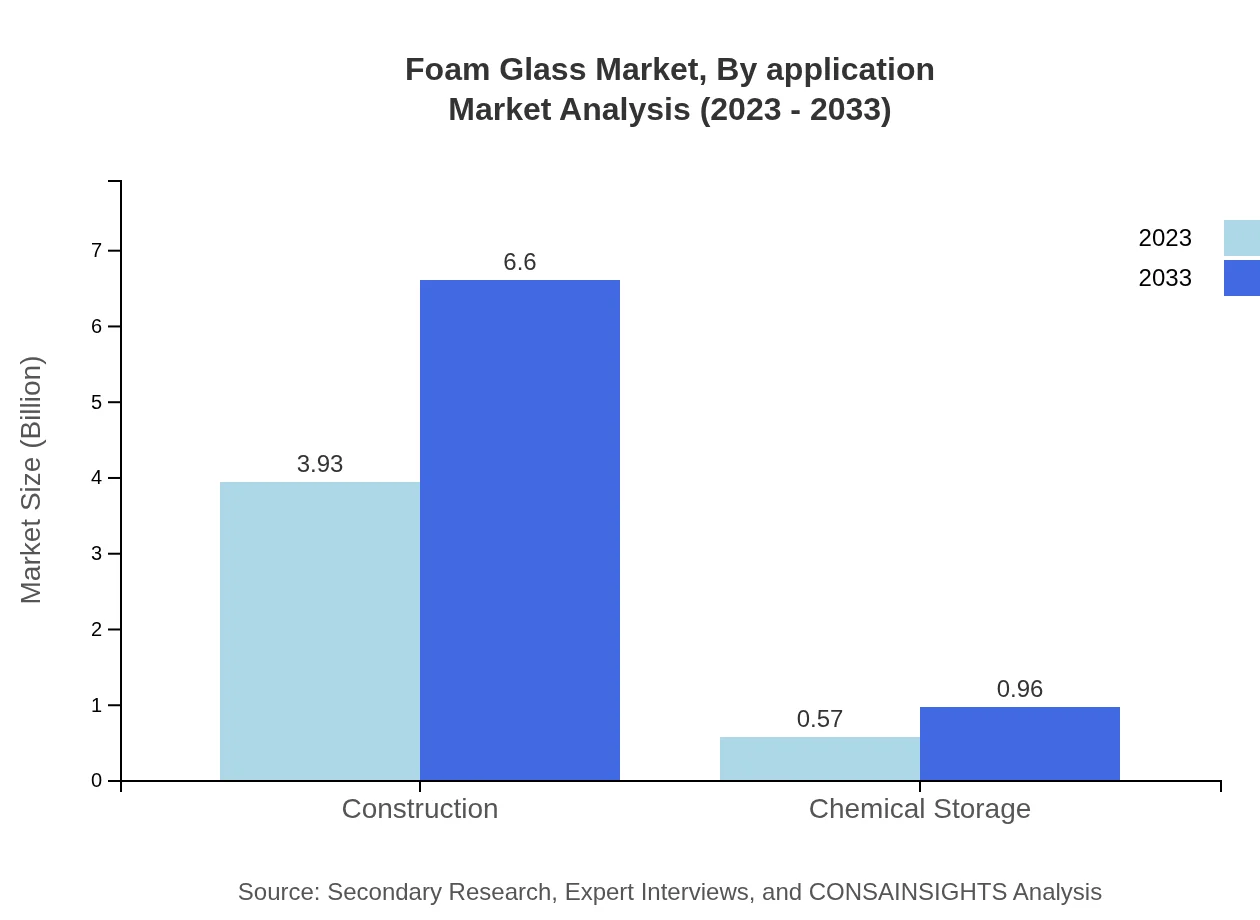

Foam Glass Market Analysis By Application

The primary applications of Foam Glass include the construction industry, chemical storage, and food preservation. The construction segment accounted for 2.83 billion USD in 2023, representing 62.98% of the market due to the increasing emphasis on sustainable building materials. The chemical storage application also reported significant growth, expected to reach 0.57 billion USD by 2033.

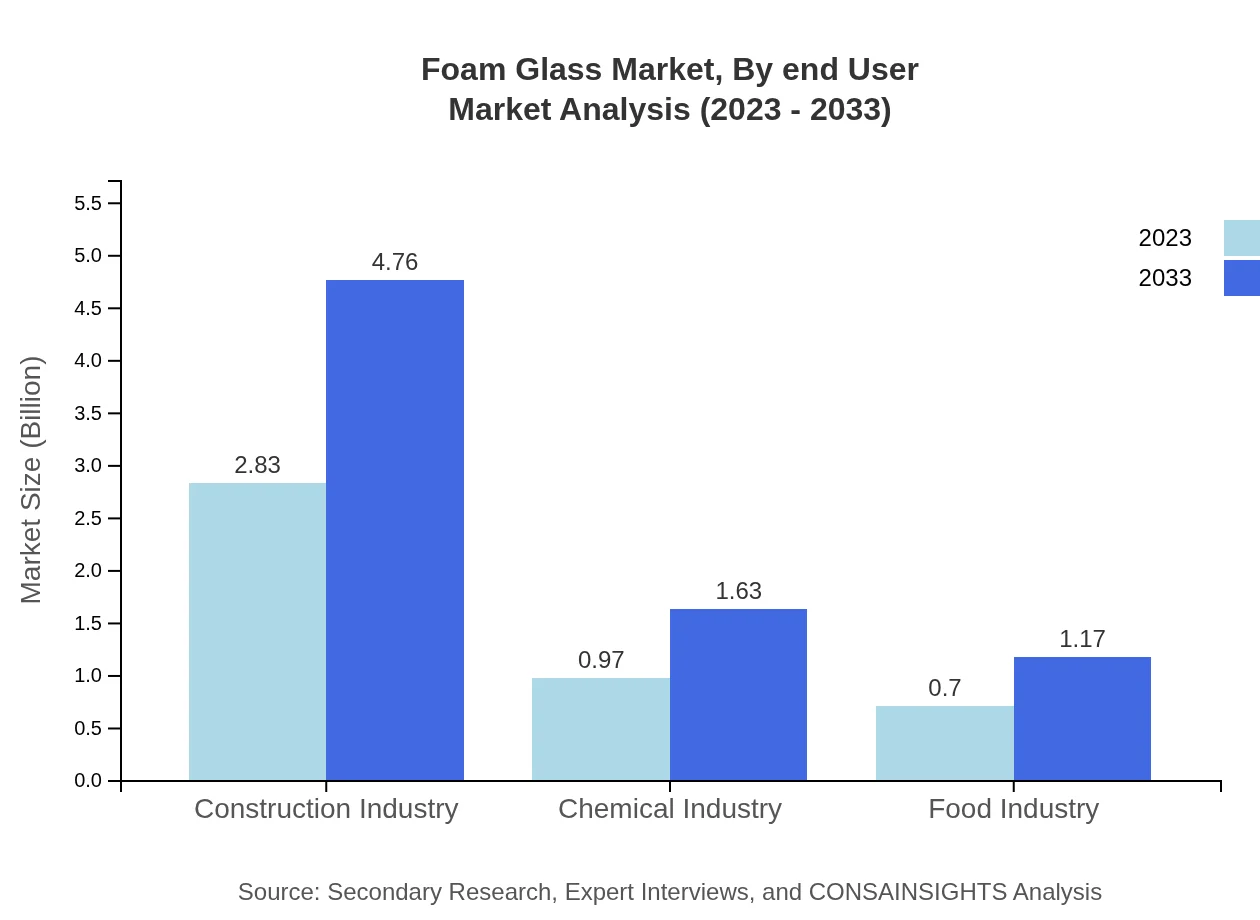

Foam Glass Market Analysis By End User

The Foam Glass market serves various end-user industries, prominently construction, chemicals, and food industries. The construction sector is the largest consumer, valued at 3.93 billion USD in 2023, driven by robust building activity and regulations favoring energy-efficient insulation materials. In contrast, the food industry, though smaller, is anticipated to grow significantly, reaching 1.17 billion USD by 2033.

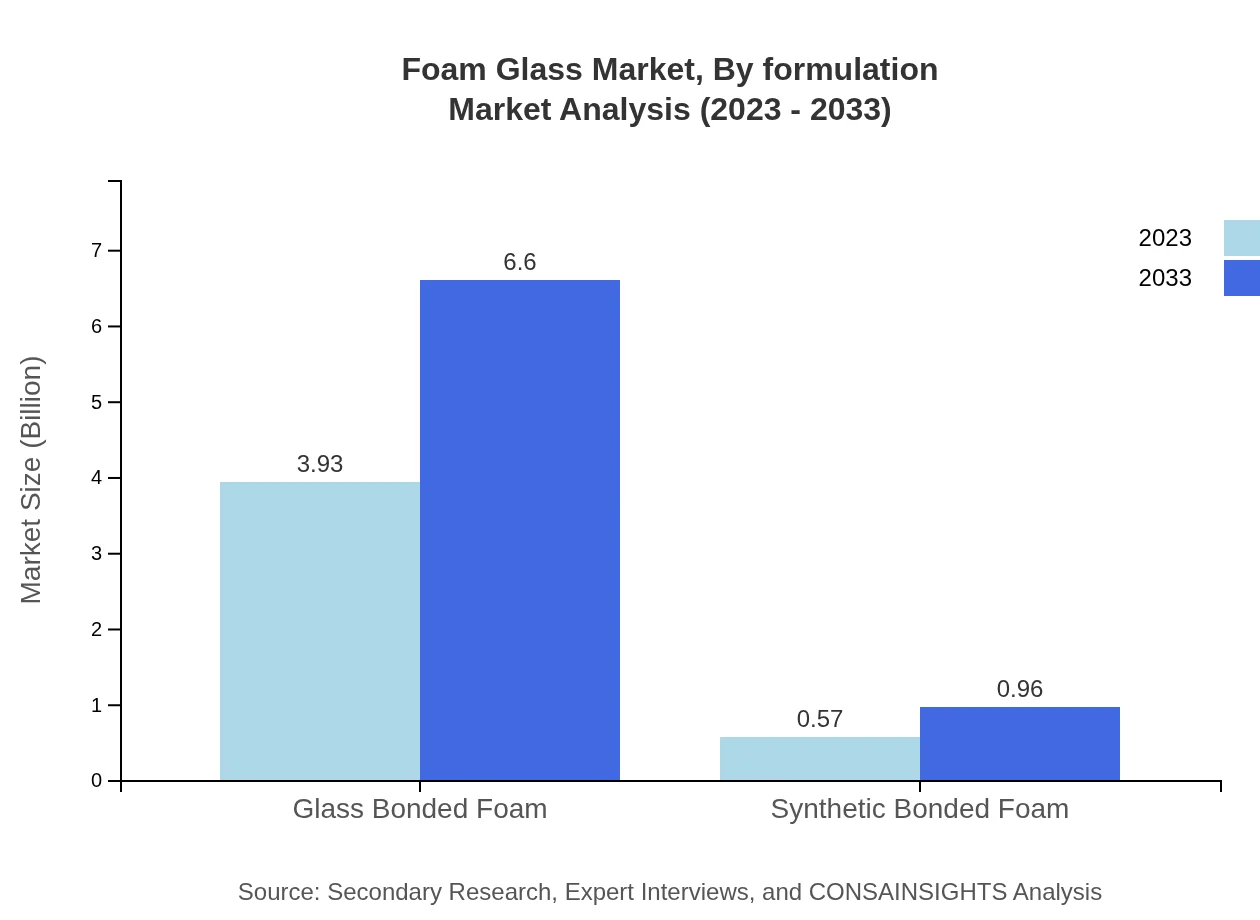

Foam Glass Market Analysis By Formulation

Foam Glass products are categorized into glass bonded and synthetic bonded formulations. Glass bonded Foam Glass, with a market size of 3.93 billion USD representing 87.32% market share in 2023, is preferred for its durability and insulation performance. Synthetic bonded variants, though lower at 0.57 billion USD, are being explored for new applications due to cost-effectiveness.

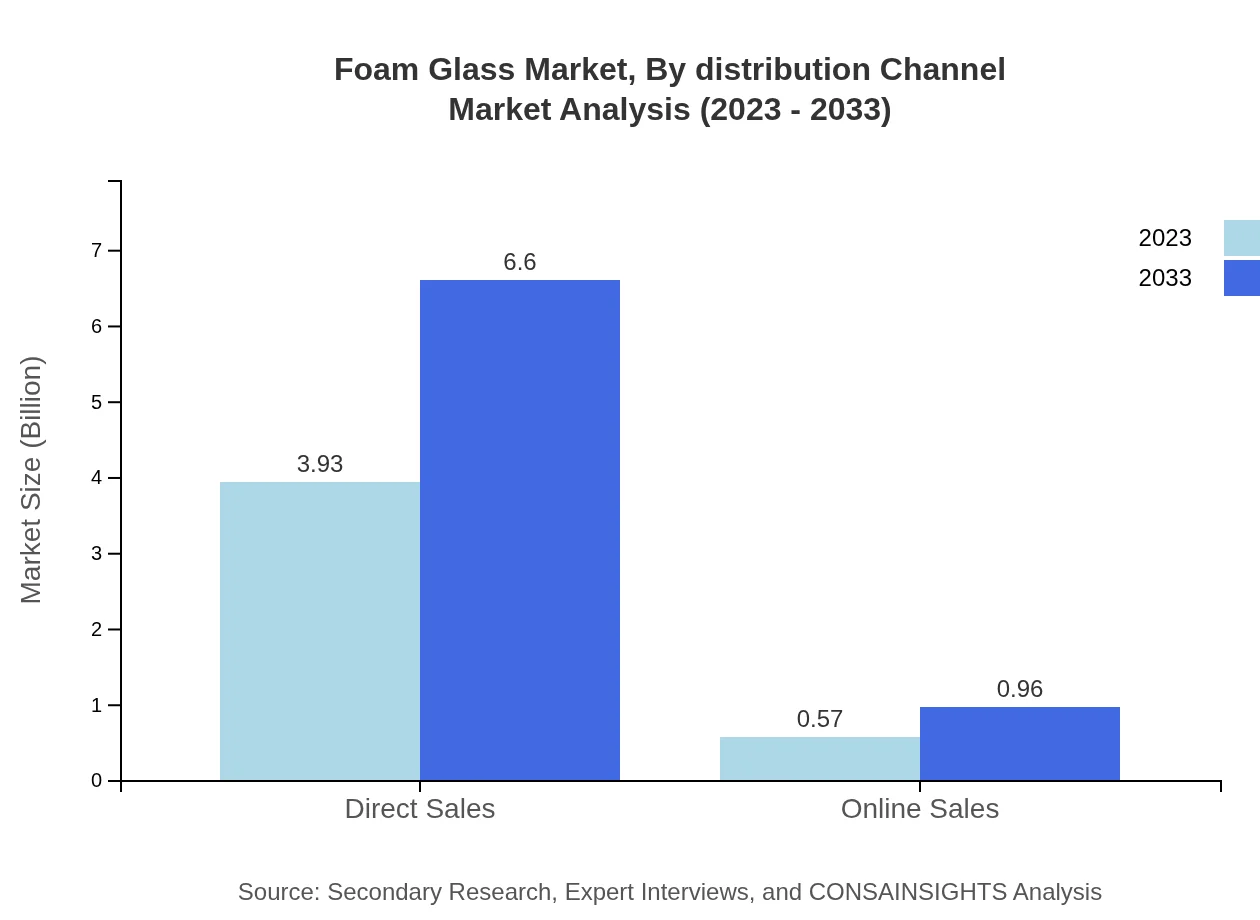

Foam Glass Market Analysis By Distribution Channel

The distribution channels for Foam Glass include direct sales and online sales. Direct sales lead the market with a size of 3.93 billion USD in 2023, attributed to established relationships between manufacturers and construction firms. Nonetheless, online sales are increasingly gaining ground, estimated at 0.57 billion USD, as e-commerce trends drive market accessibility.

Foam Glass Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Foam Glass Industry

Owens Corning:

A leading manufacturer in the insulation segment, Owens Corning is recognized for its innovative Foam Glass products, contributing significantly to sustainable building practices.BASF SE:

BASF is a global chemical company known for its extensive range of Foam Glass solutions, focusing on performance and sustainability in various applications.Pittsburgh Corning Corporation:

A pioneer in the Foam Glass market, Pittsburgh Corning is renowned for its high-quality products and commitment to innovation, helping shape industry standards.Saint-Gobain:

Saint-Gobain manufactures a diverse range of effective insulating materials, including Foam Glass, promoting energy efficiency in buildings across multiple regions.We're grateful to work with incredible clients.

FAQs

What is the market size of foam Glass?

The foam-glass market is valued at approximately $4.5 billion in 2023, with a projected CAGR of 5.2% from 2023 to 2033. By 2033, the market is expected to show significant growth and expanded opportunities.

What are the key market players or companies in this foam Glass industry?

Key players in the foam-glass industry include established companies that offer innovative insulation solutions. Market participants focus on sustainable products and competitive pricing, essential for driving growth in this expanding sector.

What are the primary factors driving the growth in the foam Glass industry?

Growth in the foam-glass industry is driven by increasing demand for lightweight insulation materials, sustainability trends, and regulatory support for energy-efficient building materials across industries including construction and manufacturing.

Which region is the fastest Growing in the foam Glass market?

In the foam-glass market, North America is emerging as the fastest-growing region, projected to increase from $1.72 billion in 2023 to $2.89 billion by 2033. Europe also shows strong growth potential in this sector.

Does ConsaInsights provide customized market report data for the foam Glass industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the foam-glass industry. Clients can access insights aligning with specific business objectives and market dynamics.

What deliverables can I expect from this foam Glass market research project?

Clients can expect comprehensive reports including market size analysis, forecasts, regional insights, and competitive landscapes. Detailed segment data and market trends will also be provided for strategic decision-making.

What are the market trends of foam Glass?

Key trends in the foam-glass market include the rising popularity of closed cell products, innovation in manufacturing processes, and increased adoption in eco-friendly construction practices, enhancing product relevance.