Food Additives Market Report

Published Date: 31 January 2026 | Report Code: food-additives

Food Additives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Additives market, covering key insights and detailed data forecasts from 2023 to 2033. It includes market size estimates, growth rates, industry trends, and competitive landscape information to assist stakeholders in making informed decisions.

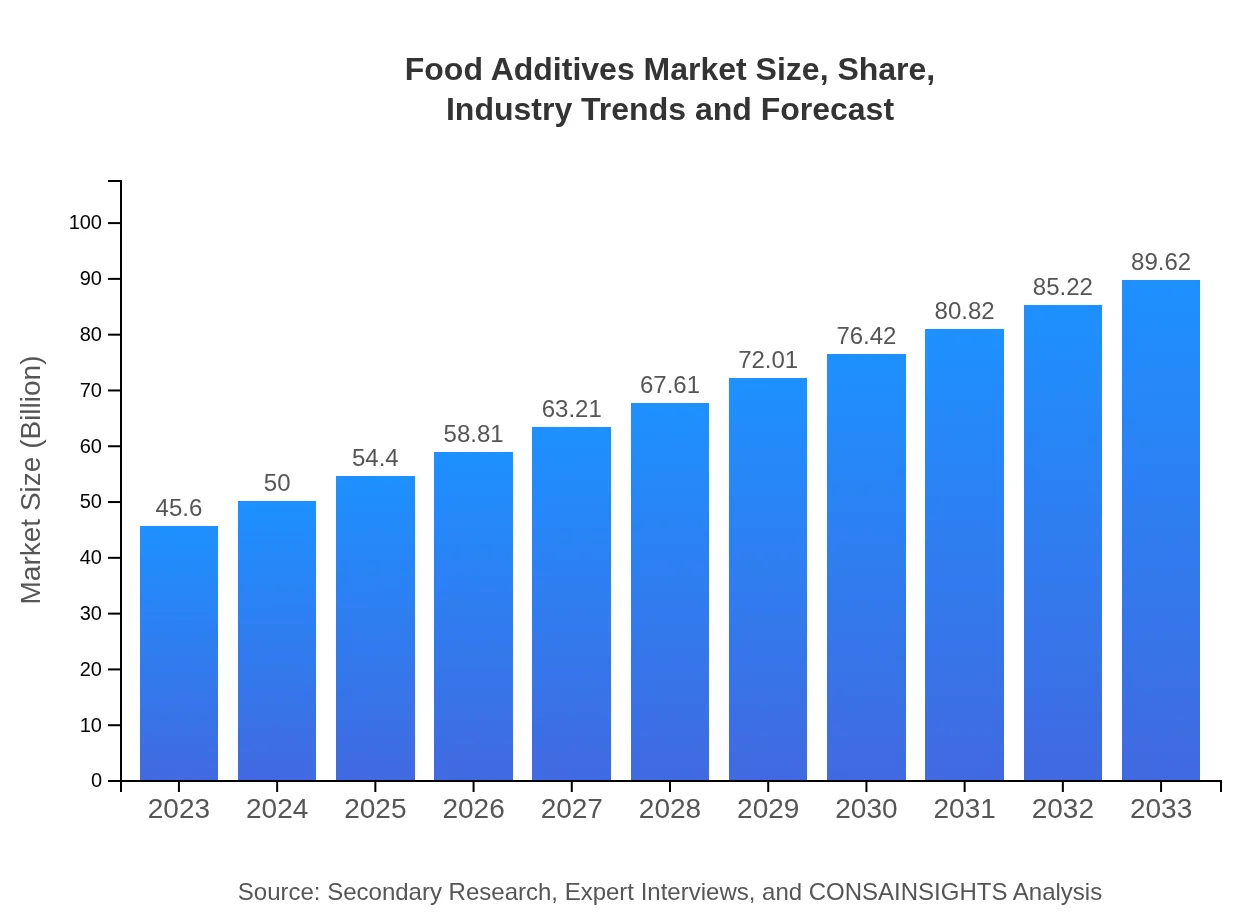

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $89.62 Billion |

| Top Companies | DuPont de Nemours, Inc., Cargill, Inc., Tate & Lyle PLC, Ajinomoto Co., Inc., BASF SE |

| Last Modified Date | 31 January 2026 |

Food Additives Market Overview

Customize Food Additives Market Report market research report

- ✔ Get in-depth analysis of Food Additives market size, growth, and forecasts.

- ✔ Understand Food Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Additives

What is the Market Size & CAGR of Food Additives market in 2023?

Food Additives Industry Analysis

Food Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Additives Market Analysis Report by Region

Europe Food Additives Market Report:

The European market is set to grow from 13.84 billion USD in 2023 to 27.20 billion USD by 2033. Increasing awareness regarding food quality and health concerns pushes demand for innovative food additives. Regulatory bodies in the region also impose stringent standards that encourage the growth of safe and effective food additives.Asia Pacific Food Additives Market Report:

In the Asia Pacific region, the Food Additives market is projected to grow from 8.50 billion USD in 2023 to 16.71 billion USD by 2033, reflecting an increasing demand for food safety and quality. The growing fast-food chains, coupled with rising disposable incomes, are significant drivers. Additionally, changing dietary patterns are encouraging the adoption of preservatives and flavor enhancers.North America Food Additives Market Report:

In North America, the market size is anticipated to increase from 16.58 billion USD in 2023 to 32.59 billion USD by 2033. The growing trend of clean-label products and consumer preference for organic additives are influencing the market positively. Innovations in food technology and a strong regulatory framework support market growth.South America Food Additives Market Report:

The South American Food Additives market is expected to expand from 2.70 billion USD in 2023 to 5.31 billion USD by 2033. In this region, the shift towards processed foods and a rising awareness of food safety will drive growth. Regional regulations supporting the use of certain additives will also contribute positively.Middle East & Africa Food Additives Market Report:

The Middle East and Africa market will see growth from 3.98 billion USD in 2023 to 7.82 billion USD by 2033. Urbanization and changing lifestyles contribute to the rising consumption of processed foods. Additionally, the expansion of international food chains is increasing the demand for various food additives.Tell us your focus area and get a customized research report.

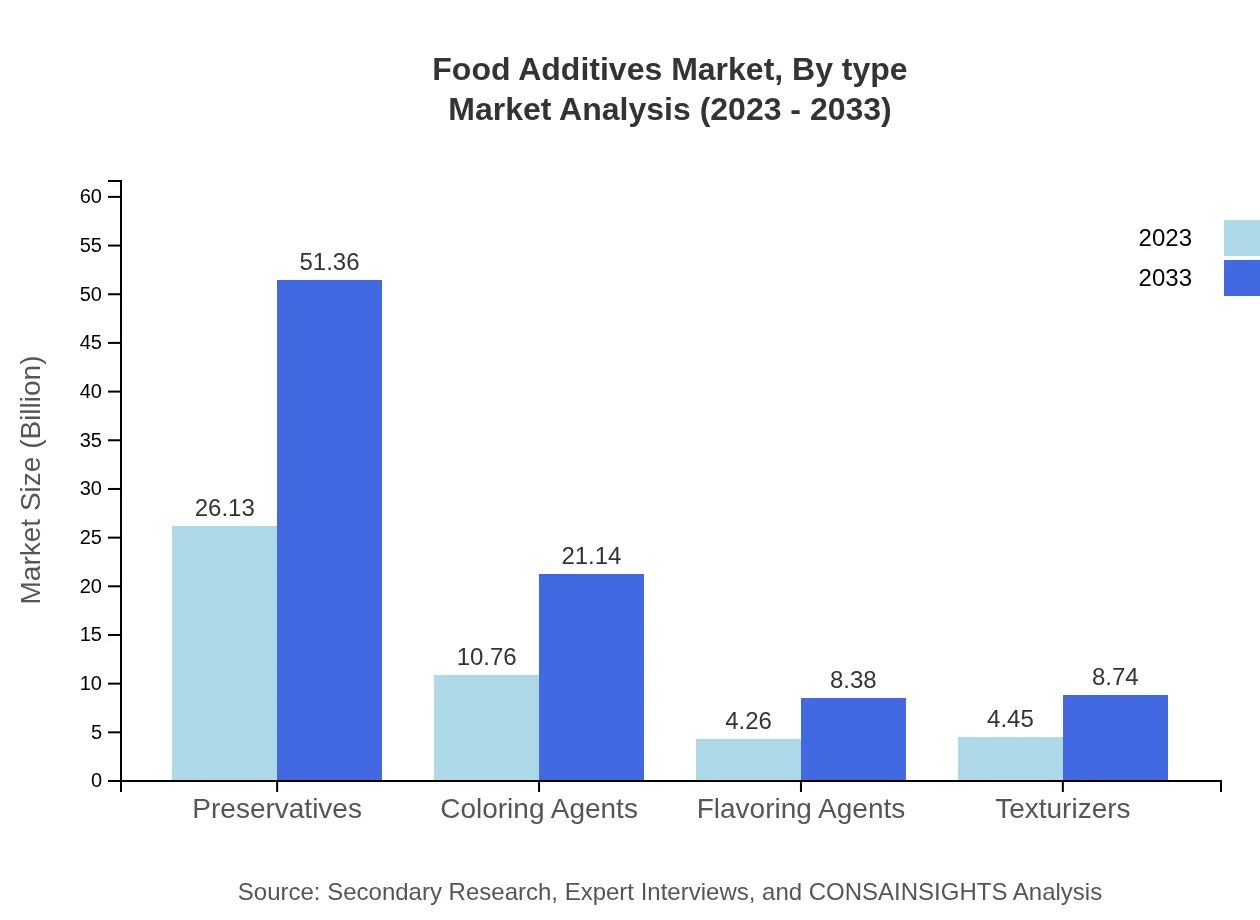

Food Additives Market Analysis By Type

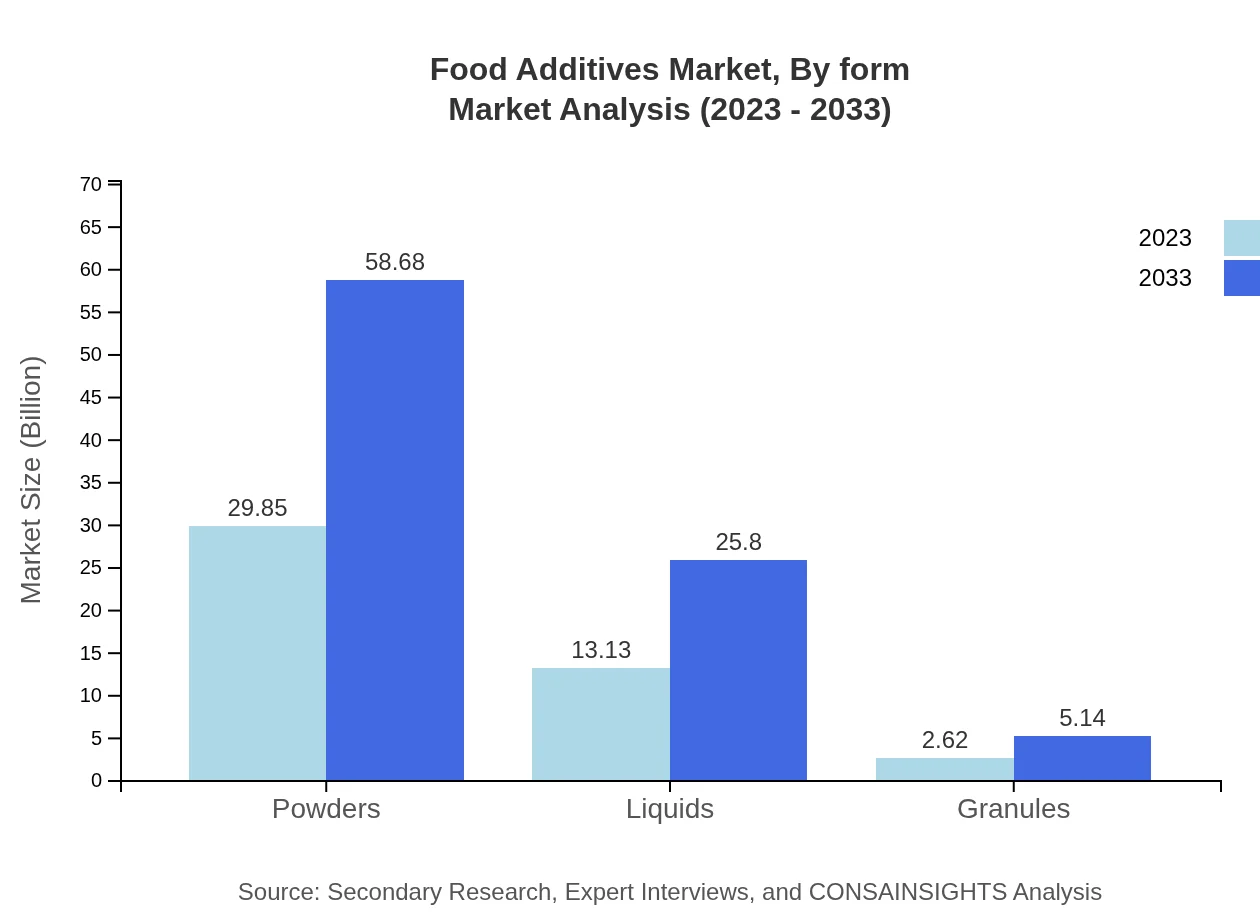

By Type segmentation explores the performance of various food additive types: - Powders: Size from 29.85 billion USD in 2023 to 58.68 billion USD in 2033. - Liquids: Size set to grow from 13.13 billion USD to 25.80 billion USD. - Granules: Expected growth from 2.62 billion USD to 5.14 billion USD. - Preservatives: Increased from 26.13 billion USD to 51.36 billion USD, indicating their critical role in extending shelf life. - Coloring Agents: Anticipated growth from 10.76 billion USD to 21.14 billion USD, reflecting ongoing interests in food aesthetics. - Flavoring Agents: Expected market increase from 4.26 billion USD to 8.38 billion USD. - Texturizers: From 4.45 billion USD to 8.74 billion USD, highlighting ongoing developments in texture enhancement.

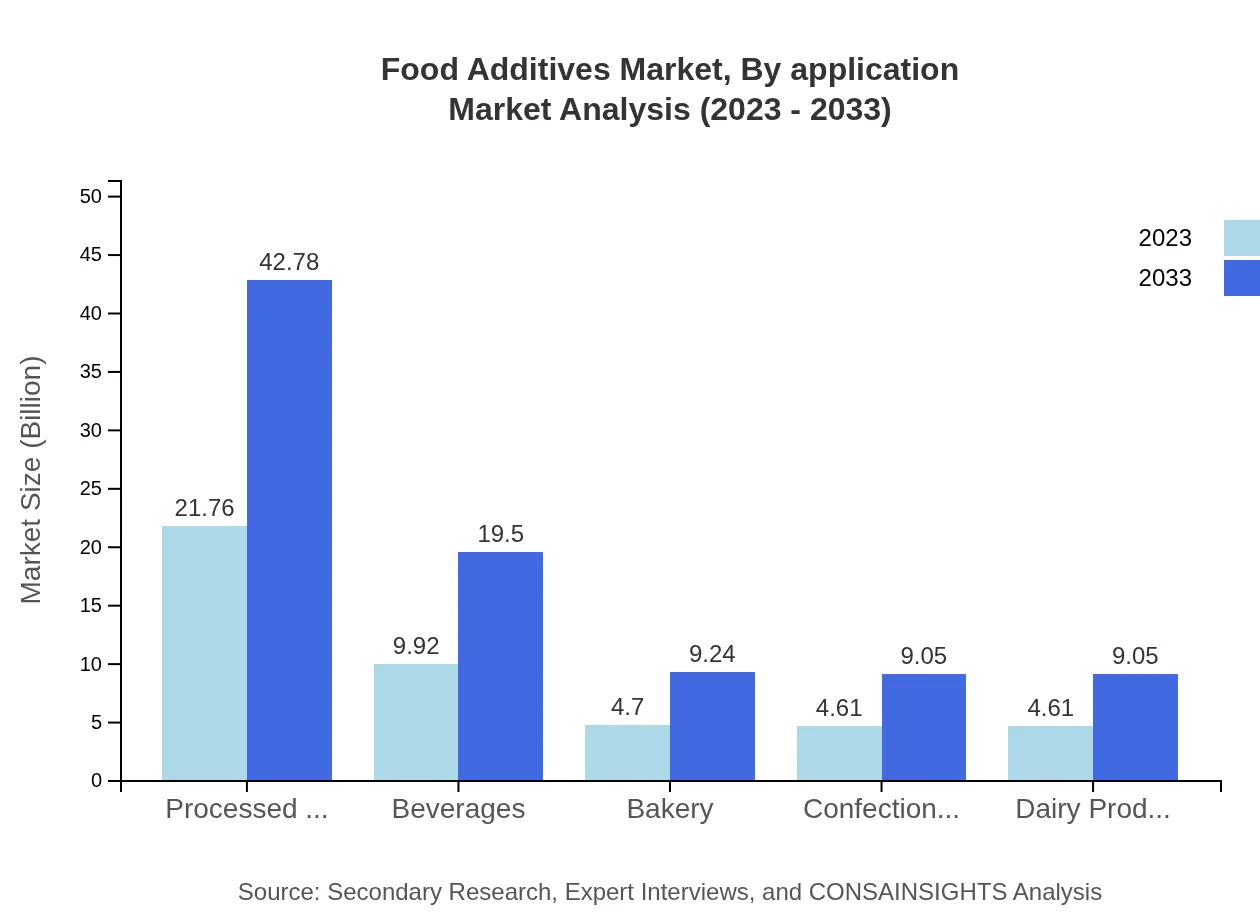

Food Additives Market Analysis By Application

Applications of food additives are diversely categorized, with significant performance insights: - Processed Foods: Size from 21.76 billion USD in 2023 to 42.78 billion USD in 2033. - Beverages: Projected to grow from 9.92 billion USD to 19.50 billion USD. - Bakery: Maintaining a steady increase from 4.70 billion USD to 9.24 billion USD. - Confectionery and Dairy Products: Both markets expected to double from 4.61 billion USD to 9.05 billion USD.

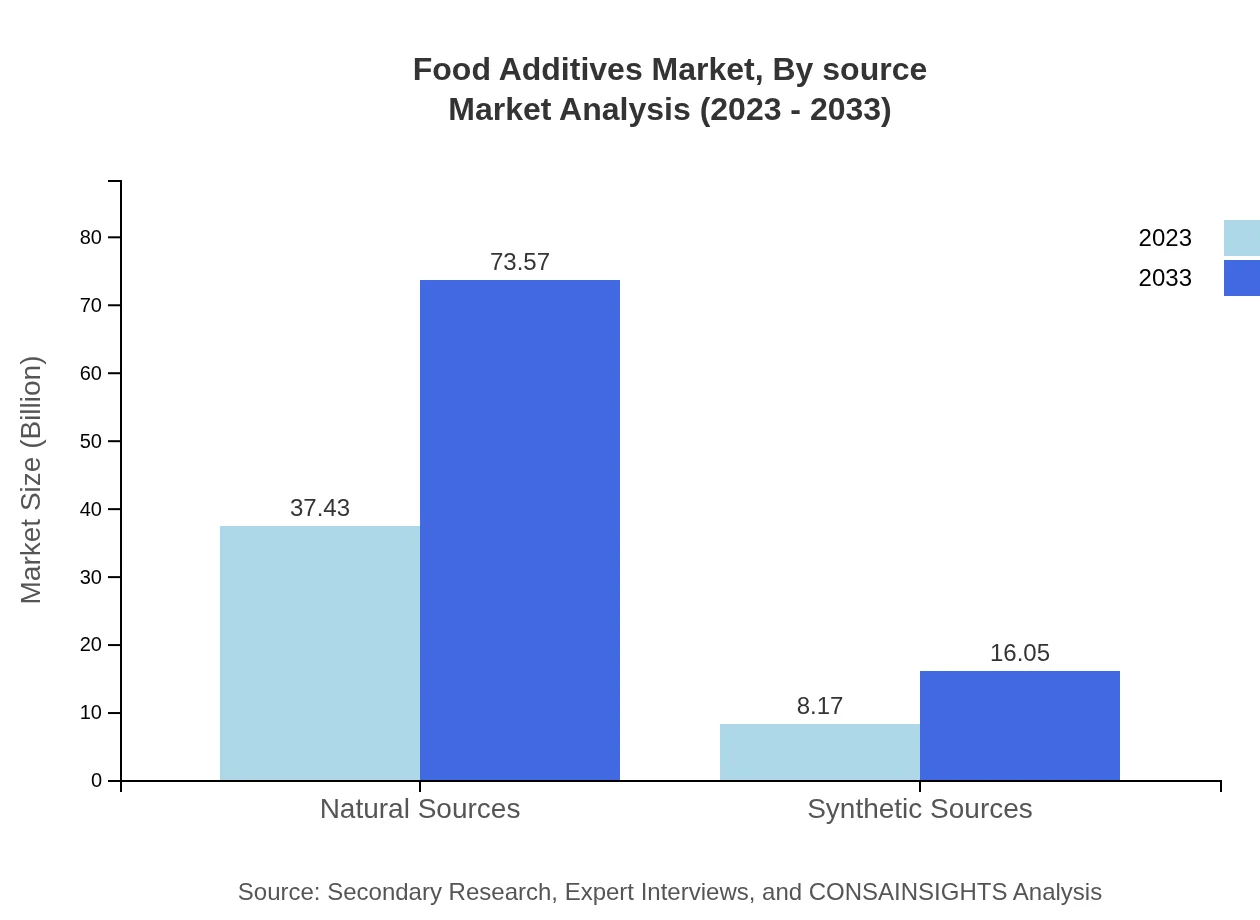

Food Additives Market Analysis By Source

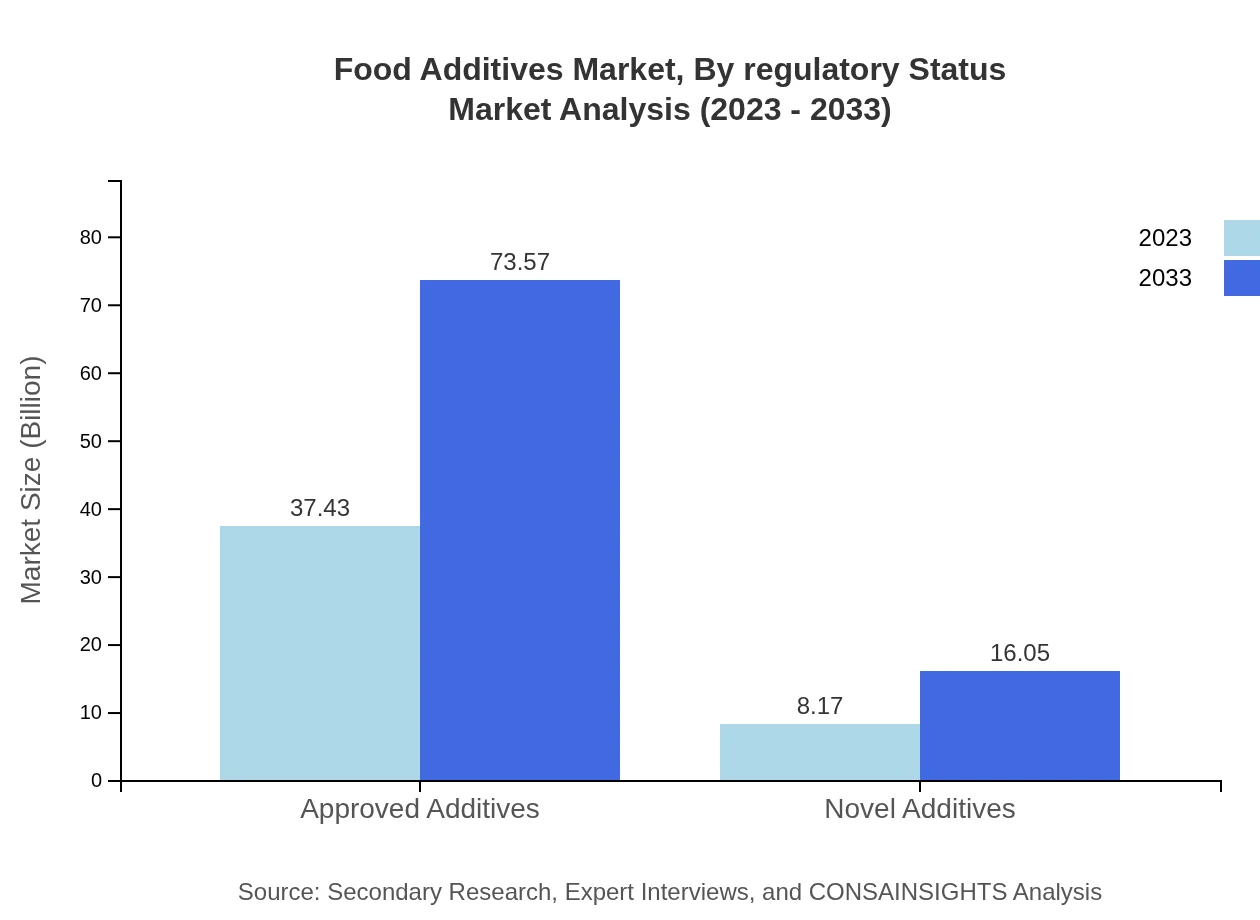

Source segmentation contours the shifts towards various additive sources: - Natural Sources: Expected to increase significantly from 37.43 billion USD to 73.57 billion USD. - Synthetic Sources: Expected growth from 8.17 billion USD to 16.05 billion USD, showing a slight increase but a solid reliance on natural additives.

Food Additives Market Analysis By Form

The form of food additives critically determines consumer preferences: - Solid forms (powders and granules) are preferred for ease of measurement and consumption, while liquid forms are gaining traction due to convenience.

Food Additives Market Analysis By Regulatory Status

In regulatory status: - Approved Additives: A substantial market share of 37.43 billion USD, growing to 73.57 billion USD, reflects consumer assurance in safety. - Novel Additives, expected to increase from 8.17 billion USD to 16.05 billion USD, showcases an emerging trend in innovative additives gaining market ground.

Food Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Additives Industry

DuPont de Nemours, Inc.:

A global science and technology company known for its innovation in food ingredients, including food additives for flavor and preservation.Cargill, Inc.:

Cargill is a major provider of food ingredients, specializing in food safety and quality enhancement additives.Tate & Lyle PLC:

A leading global provider of food ingredients, specializing in sweeteners and texturizers that enhance food texture and flavor.Ajinomoto Co., Inc.:

Japanese multinational corporation known for its amino acids and food seasoning products, contributing significantly to flavoring agents.BASF SE:

A chemistry company also producing a variety of food additives aimed at improving food quality and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of food additives?

The global food additives market is expected to reach approximately $45.6 billion by 2033, growing at a CAGR of 6.8%. The growing demand for processed food and beverages drives continuous market expansion.

What are the key market players or companies in this food additives industry?

Key players in the food additives industry include major companies such as ADM, BASF, and DuPont. These companies are pivotal in influencing market trends, product development, and regional growth.

What are the primary factors driving the growth in the food additives industry?

The primary factors driving growth in the food additives market include increasing consumer demand for processed foods, rising health consciousness, and regulatory approvals for innovative food additive solutions.

Which region is the fastest Growing in the food additives?

North America is anticipated to be the fastest-growing region, projected to grow from $16.58 billion in 2023 to $32.59 billion by 2033. Factors include evolving dietary trends and demand for natural additives.

Does ConsaInsights provide customized market report data for the food additives industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the food additives industry, ensuring relevant insights based on unique market demands and preferences.

What deliverables can I expect from this food additives market research project?

Deliverables typically include a comprehensive market analysis report, industry forecasts, competitive landscape assessments, and access to exclusive data insights relevant to the food additives sector.

What are the market trends of food additives?

Current trends in the food additives market include a shift towards natural and organic additives, increased customer demand for clean-label products, and innovation in food preservation technologies.