Food Agriculture Technology And Products Market Report

Published Date: 31 January 2026 | Report Code: food-agriculture-technology-and-products

Food Agriculture Technology And Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Agriculture Technology and Products market, detailing insights on market growth, segmentation, and trends projected from 2023 to 2033.

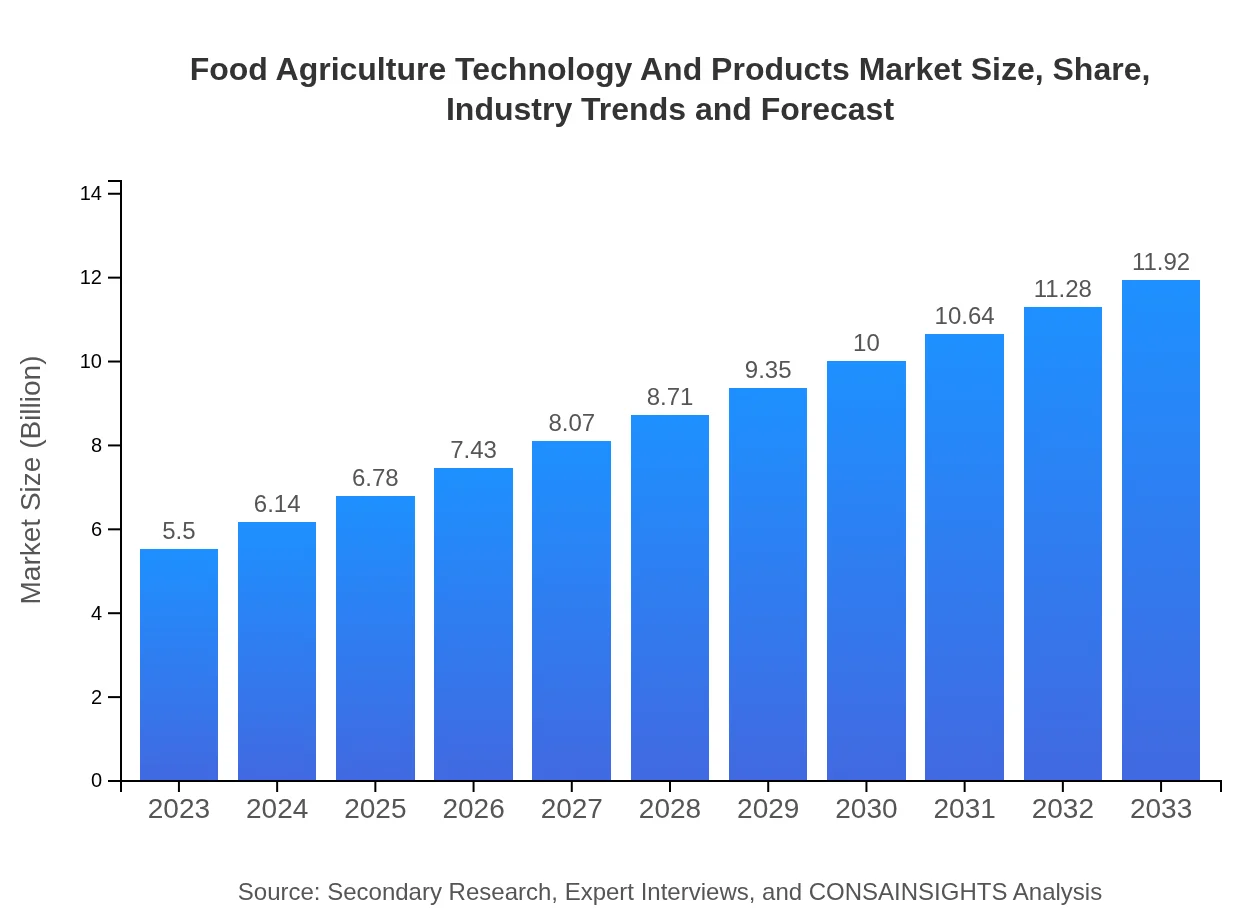

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.92 Billion |

| Top Companies | Bayer Crop Science, Corteva Agriscience, Deere & Company (John Deere), Syngenta AG, Trimble Inc. |

| Last Modified Date | 31 January 2026 |

Food Agriculture Technology And Products Market Overview

Customize Food Agriculture Technology And Products Market Report market research report

- ✔ Get in-depth analysis of Food Agriculture Technology And Products market size, growth, and forecasts.

- ✔ Understand Food Agriculture Technology And Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Agriculture Technology And Products

What is the Market Size & CAGR of Food Agriculture Technology And Products market in 2023?

Food Agriculture Technology And Products Industry Analysis

Food Agriculture Technology And Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Agriculture Technology And Products Market Analysis Report by Region

Europe Food Agriculture Technology And Products Market Report:

Europe's Food Agriculture Technology And Products market is anticipated to rise from 1.86 billion USD in 2023 to 4.04 billion USD by 2033, driven by stringent regulations promoting sustainable practices, along with substantial investments in R&D in agricultural sciences.Asia Pacific Food Agriculture Technology And Products Market Report:

The Asia Pacific region is projected to witness significant growth, with the market expected to grow from 1.00 billion USD in 2023 to 2.17 billion USD by 2033. The region's agriculture is rapidly modernizing with increased adoption of smart farming technologies, driven by the need to enhance crop yields and quality.North America Food Agriculture Technology And Products Market Report:

North America will see its market grow from 1.83 billion USD in 2023 to 3.97 billion USD by 2033, supported by strong investments in agri-tech innovations, food safety enhancements, and sustainability initiatives across diverse agricultural sectors.South America Food Agriculture Technology And Products Market Report:

In South America, the market is poised to increase from 0.47 billion USD in 2023 to 1.03 billion USD by 2033, fueled by substantial agricultural exports and the implementation of advanced farming techniques designed to boost production efficiency and sustainability.Middle East & Africa Food Agriculture Technology And Products Market Report:

The Middle East and Africa region's market is projected to grow from 0.33 billion USD in 2023 to 0.71 billion USD by 2033, with a growing emphasis on food security and efficient water management practices, enhancing agricultural productivity in the face of climate challenges.Tell us your focus area and get a customized research report.

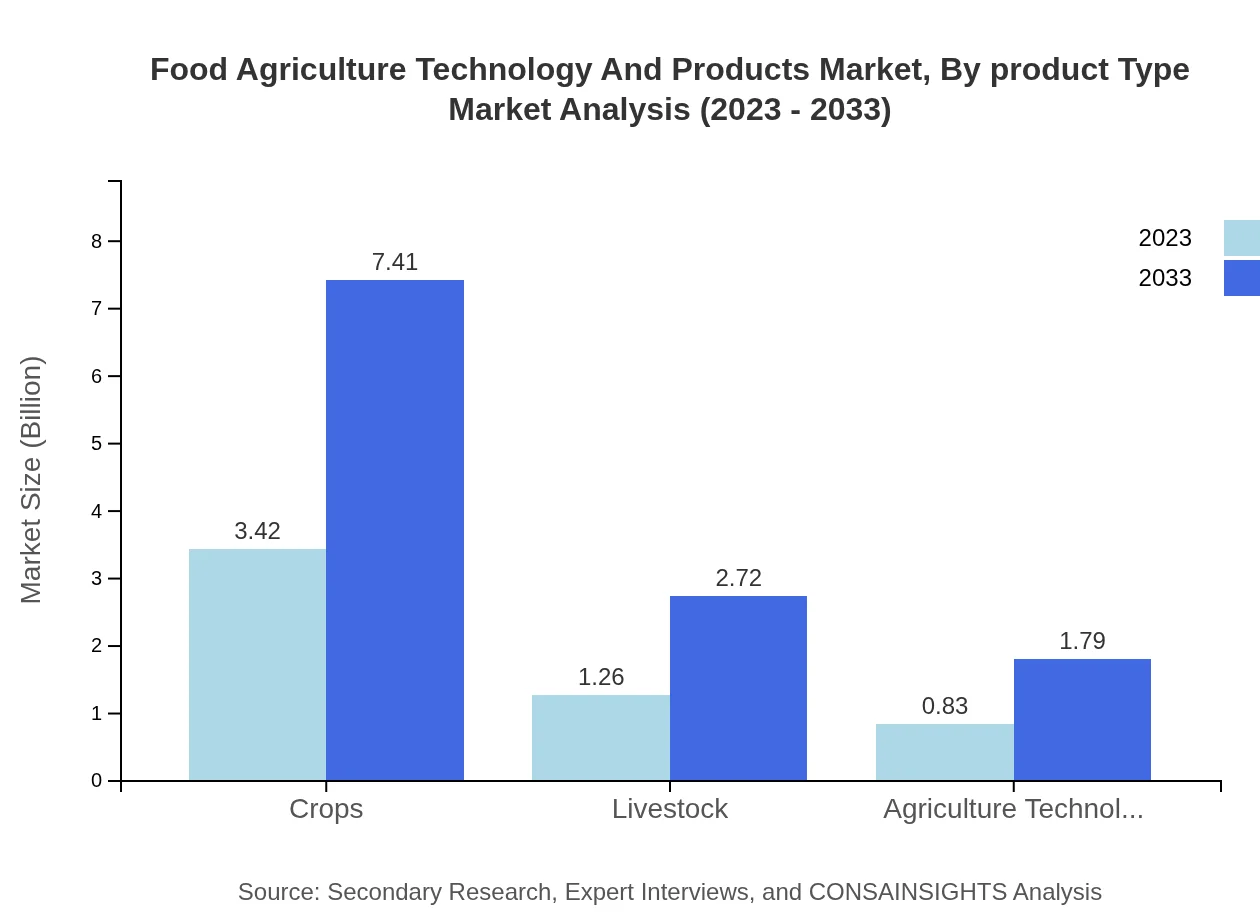

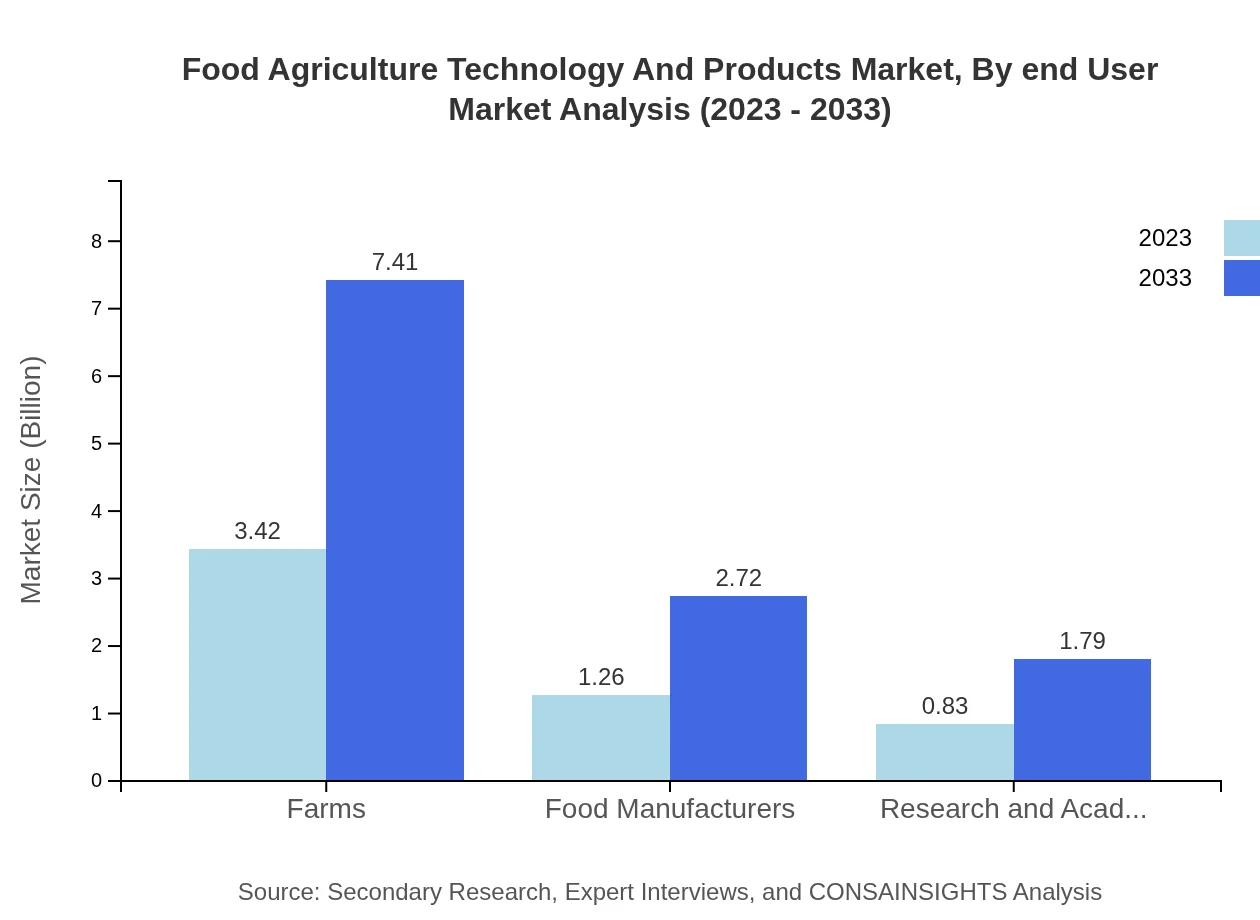

Food Agriculture Technology And Products Market Analysis By Product Type

The analysis of the Food Agriculture Technology and Products market by product type shows a robust performance across several categories. Farms dominate the segment with a market size of 3.42 billion USD in 2023, projected to reach 7.41 billion USD by 2033, with a share of 62.13%. Food manufacturers contribute significantly with 1.26 billion USD in 2023, growing to 2.72 billion USD in 2033. Other important segments include biotechnology, smart agriculture, and food processing, highlighting the diverse applications of technology in enhancing agricultural efficiency.

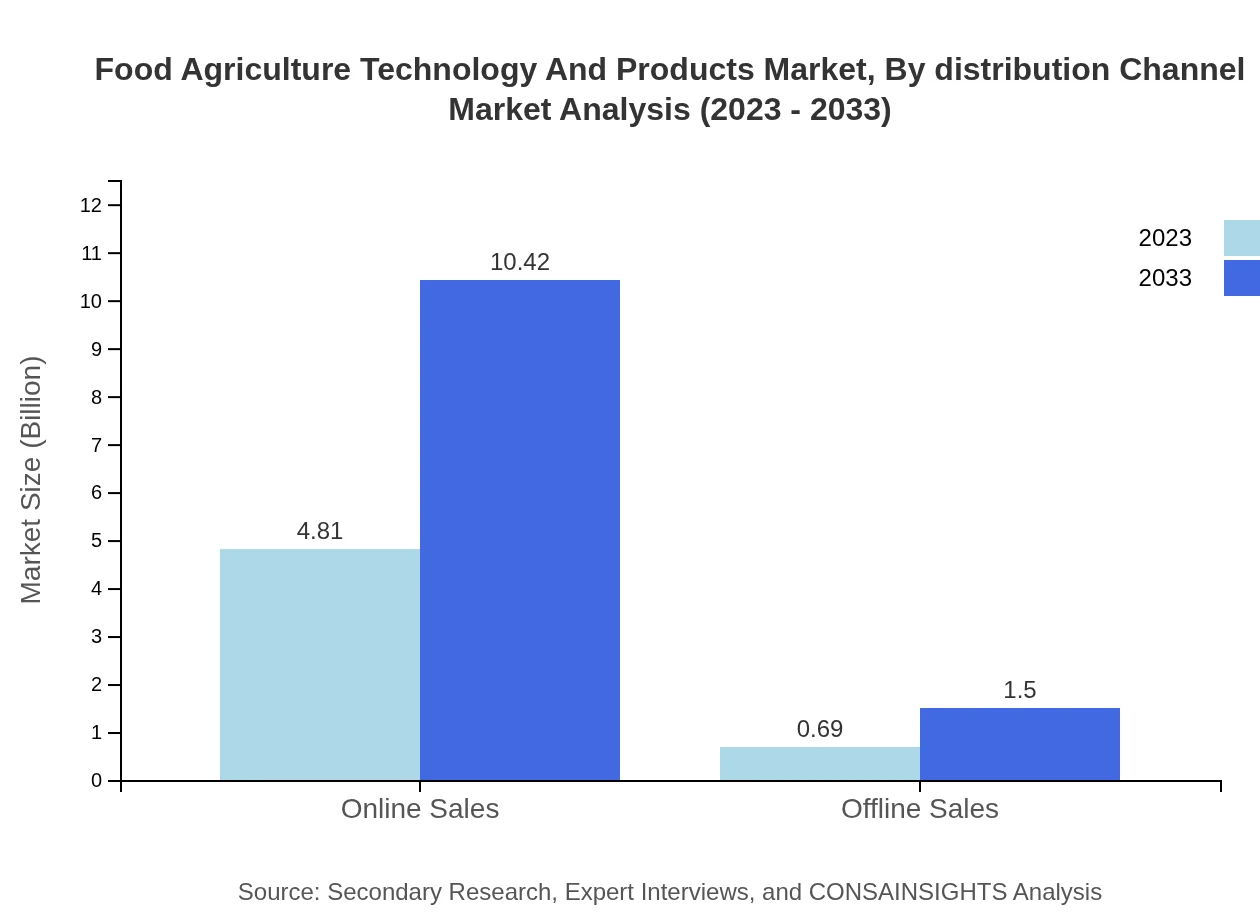

Food Agriculture Technology And Products Market Analysis By Distribution Channel

The distribution channels in the Food Agriculture Technology and Products market exhibit distinct characteristics. Online sales, holding an impressive share of 87.43% in 2023 valued at 4.81 billion USD, are growing rapidly due to increased digital transformation in the industry. Offline sales, while smaller at 0.69 billion USD in 2023, with a 12.57% market share, are still critical for reaching diverse customer segments, including smallholder farmers.

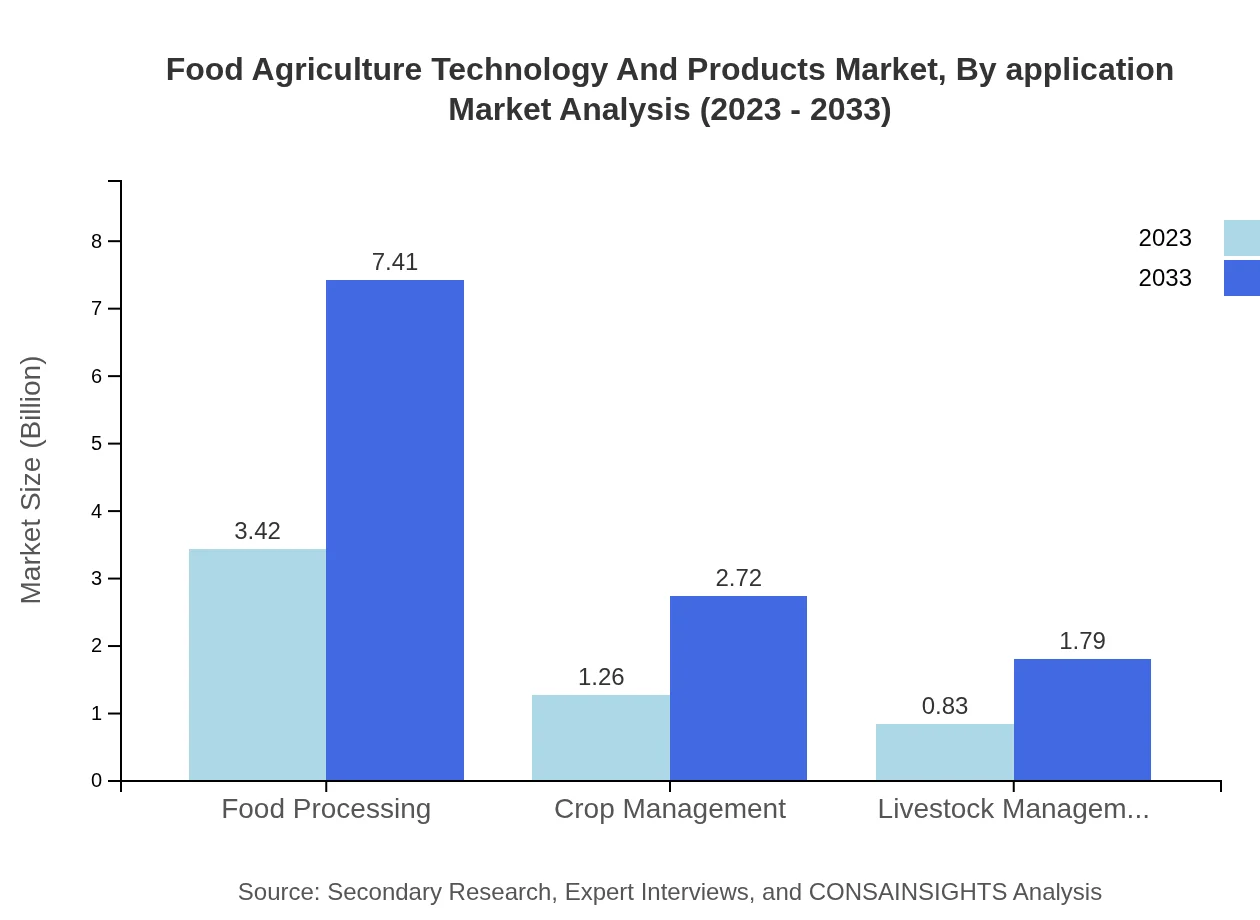

Food Agriculture Technology And Products Market Analysis By Application

In terms of application, various methods such as crop management, livestock management, and sustainable practices are important. Crop management alone will see growth from a market size of 1.26 billion USD in 2023 to 2.72 billion USD by 2033, highlighting the significance of this segment in improving overall food production.

Food Agriculture Technology And Products Market Analysis By End User

End users of food agriculture technology span across a wide spectrum, including large agricultural corporations, smallholder farms, food processing companies, and research institutions. The collective focus on increasing yield and sustainability is driving demand across all user segments.

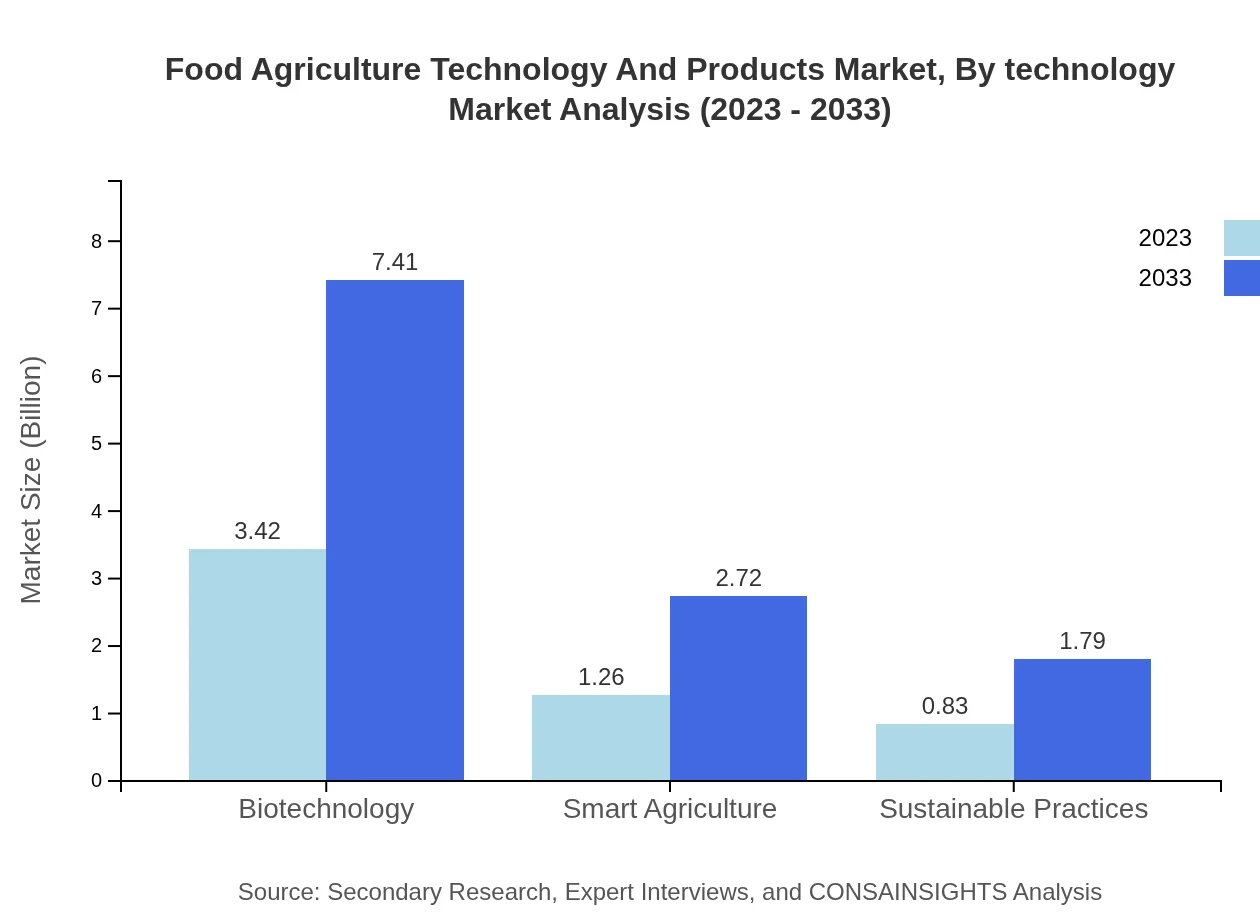

Food Agriculture Technology And Products Market Analysis By Technology

The technology segment reveals a shift towards adopting advanced technologies such as AI, IoT, and biotechnology for better efficiency in agriculture practices. Innovations like precision farming technologies are becoming crucial in adapting to climate change and improving yield.

Food Agriculture Technology And Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Agriculture Technology And Products Industry

Bayer Crop Science:

Bayer is a global leader in agriculture and crop science, committed to sustainability and innovation in crop protection, seeds, and biotechnology.Corteva Agriscience:

Corteva is dedicated to advancing agriculture through proprietary innovations in seed technology and crop protection products.Deere & Company (John Deere):

John Deere specializes in agricultural machinery and technology, integrating smart solutions to enhance farm operations and productivity.Syngenta AG:

Syngenta focuses on sustainability and innovation in the agricultural sector, particularly in crop protection and seed production.Trimble Inc.:

Trimble provides agronomic and technological solutions to enhance farm management and productivity across various agricultural sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Food Agriculture Technology and Products?

The global Food Agriculture Technology and Products market is expected to grow from $5.5 billion in 2023 to significant values by 2033, with a CAGR of 7.8%. This demonstrates a robust growth forecast that highlights increasing demand in the sector.

What are the key market players or companies in this Food Agriculture Technology and Products industry?

Key players in the Food Agriculture Technology and Products industry include major organizations involved in smart agriculture, biotechnology, and sustainable practices, contributing significantly to the growth of this dynamic market.

What are the primary factors driving the growth in the Food Agriculture Technology and Products industry?

Key growth drivers include technological advancements, increased demand for sustainable food production, and the need for precision agriculture solutions, contributing to the market's evolution and expansion.

Which region is the fastest Growing in the Food Agriculture Technology and Products?

Europe and Asia Pacific emerge as the fastest-growing regions, with market values expected to rise from $1.86 billion to $4.04 billion and $1.00 billion to $2.17 billion respectively by 2033.

Does ConsaInsights provide customized market report data for the Food Agriculture Technology and Products industry?

Yes, ConsaInsights offers customized market report data that can be tailored to specific requirements within the Food Agriculture Technology and Products industry to suit diverse client needs.

What deliverables can I expect from this Food Agriculture Technology and Products market research project?

Deliverables typically include comprehensive market analysis, segment-wise insights, competitive landscape assessments, and growth forecasts customized to the Food Agriculture Technology and Products sector.

What are the market trends of Food Agriculture Technology and Products?

Current trends indicate a strong focus on smart agriculture, sustainable practices, and biotechnology, contributing to the overall growth and evolutionary path of the Food Agriculture Technology and Products market.