Food And Beverage Foaming Agent Market Report

Published Date: 31 January 2026 | Report Code: food-and-beverage-foaming-agent

Food And Beverage Foaming Agent Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food And Beverage Foaming Agent market from 2023 to 2033. It includes insights on market size, trends, regional analysis, segment performance, and forecasts to guide stakeholders in their strategic planning.

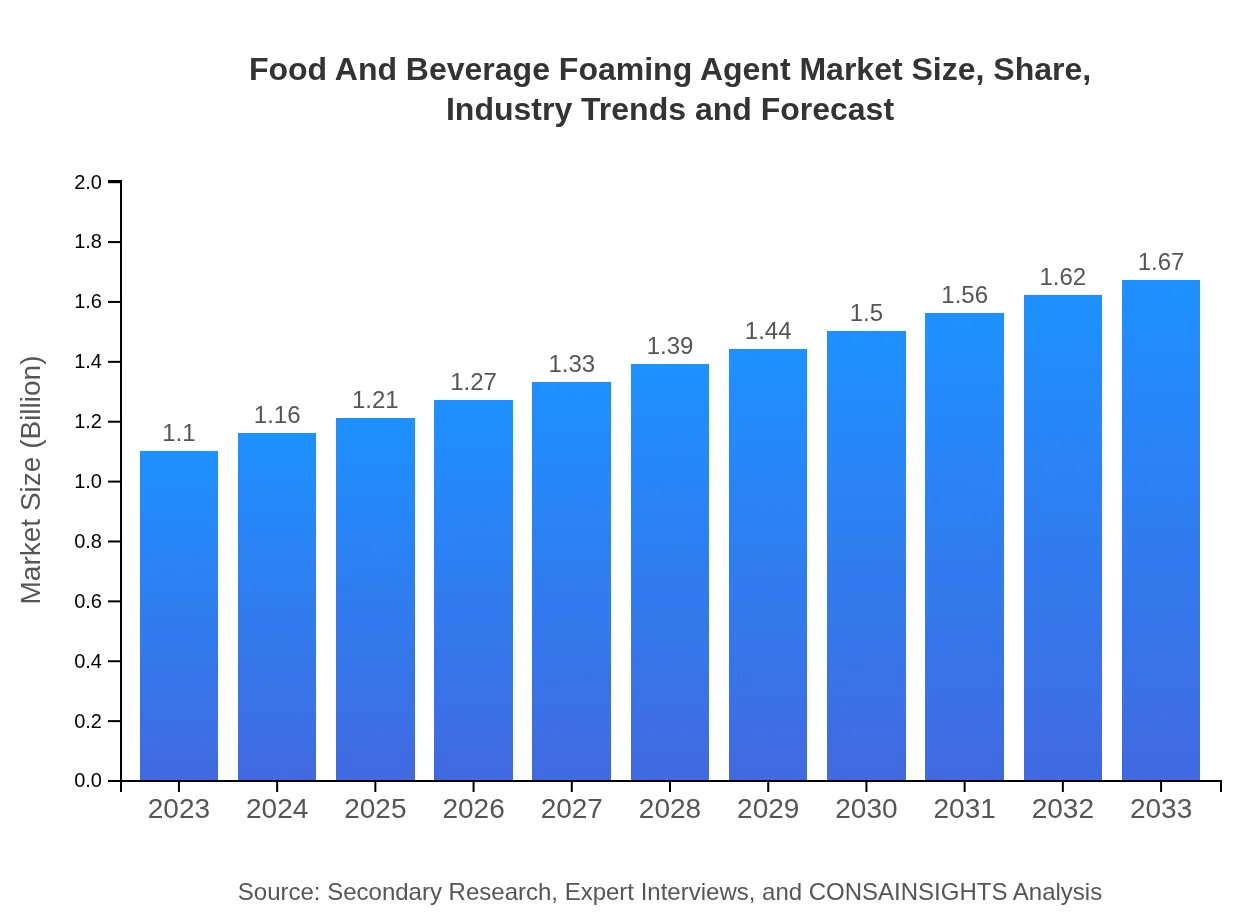

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.10 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $1.67 Billion |

| Top Companies | Dupont, Kerry Group, BASF, Sigma Aldrich |

| Last Modified Date | 31 January 2026 |

Food And Beverage Foaming Agent Market Overview

Customize Food And Beverage Foaming Agent Market Report market research report

- ✔ Get in-depth analysis of Food And Beverage Foaming Agent market size, growth, and forecasts.

- ✔ Understand Food And Beverage Foaming Agent's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food And Beverage Foaming Agent

What is the Market Size & CAGR of Food And Beverage Foaming Agent market in 2023-2033?

Food And Beverage Foaming Agent Industry Analysis

Food And Beverage Foaming Agent Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food And Beverage Foaming Agent Market Analysis Report by Region

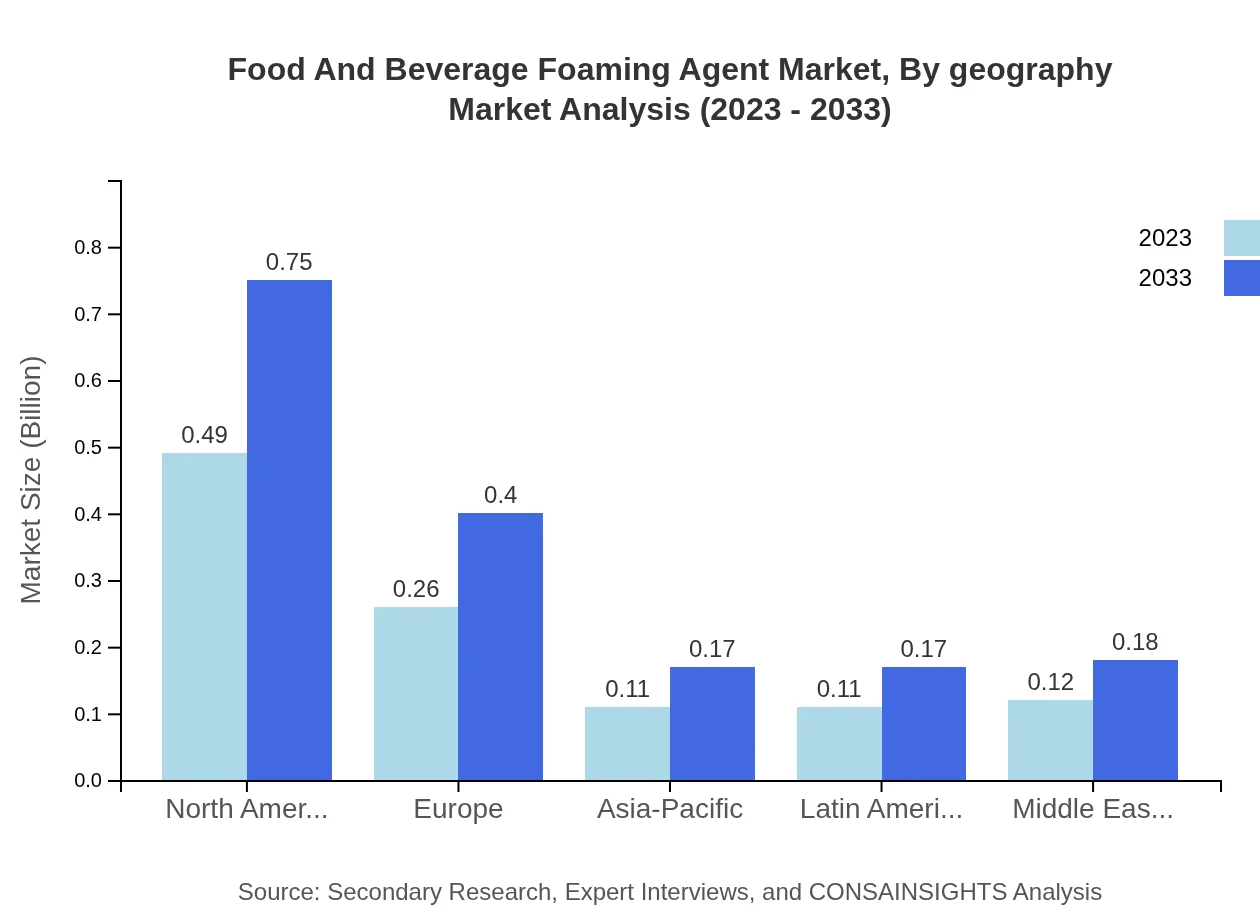

Europe Food And Beverage Foaming Agent Market Report:

In Europe, the market size is estimated at 0.33 billion USD in 2023, anticipated to expand to 0.50 billion USD by 2033. The region promotes stringent food safety regulations, leading to increased demand for quality foaming agents.Asia Pacific Food And Beverage Foaming Agent Market Report:

In the Asia Pacific region, the market size is approximately 0.18 billion USD in 2023, expected to grow to 0.27 billion USD by 2033. Increasing disposable income and urbanization are leading to higher consumption of processed food and beverages, fueling market growth.North America Food And Beverage Foaming Agent Market Report:

The North American region holds a significant market share, estimated at 0.43 billion USD in 2023 and projected to reach 0.65 billion USD by 2033. Health trends towards low-fat and clean-label products are encouraging innovation in foaming agents.South America Food And Beverage Foaming Agent Market Report:

South America is projected to witness modest growth with a current market size of 0.06 billion USD in 2023, growing to 0.09 billion USD by 2033. Changing dietary patterns and an increase in local food manufacturing are key factors driving demand.Middle East & Africa Food And Beverage Foaming Agent Market Report:

The Middle East and Africa market is on a growth trajectory with the market size at 0.10 billion USD in 2023 projected to increase to 0.15 billion USD by 2033. Growing food and beverage industries in countries such as UAE and South Africa are driving market advances.Tell us your focus area and get a customized research report.

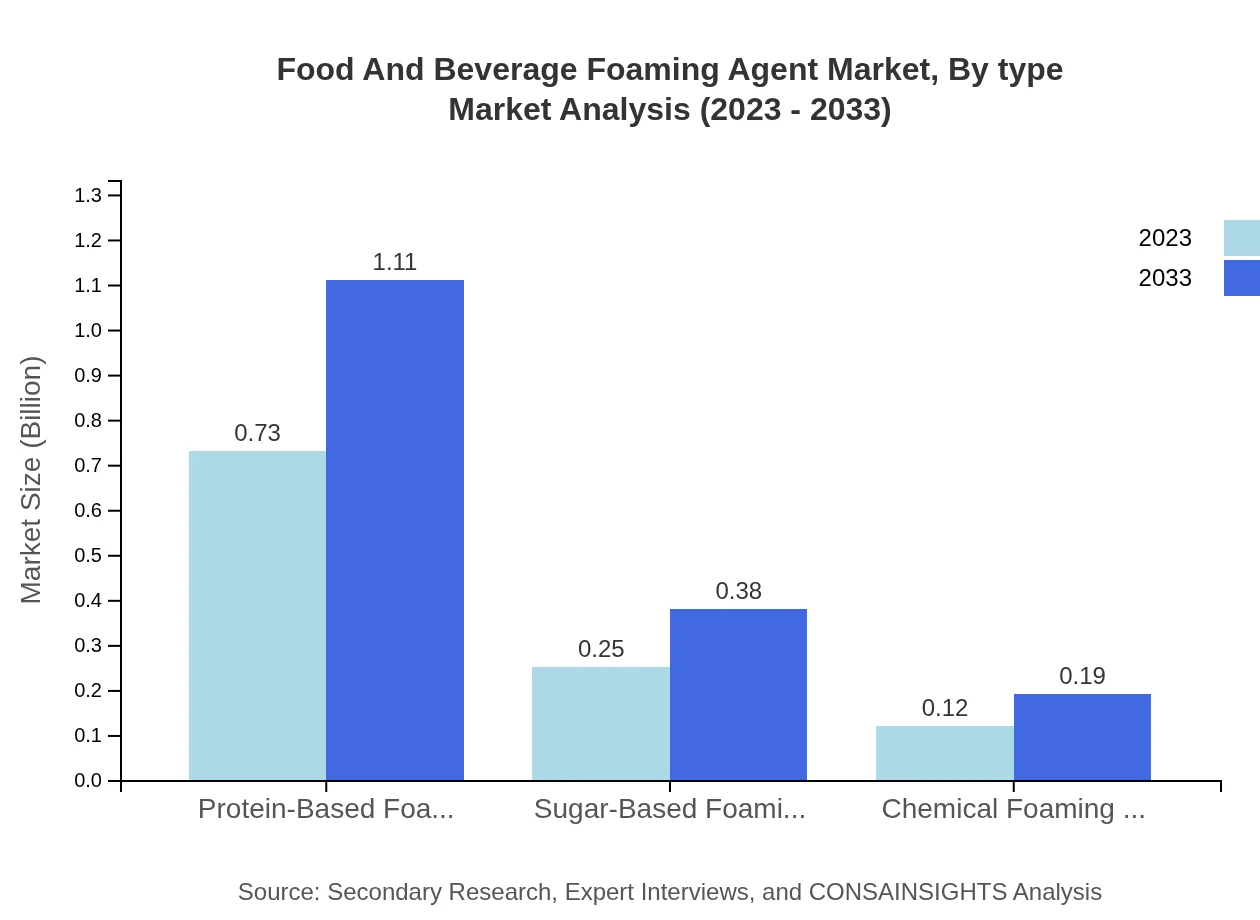

Food And Beverage Foaming Agent Market Analysis By Type

The protein-based foaming agents currently dominate the market with a size of 0.73 billion USD in 2023, expected to reach 1.11 billion USD by 2033, accounting for 66.15% market share. Sugar-based foaming agents hold a significant share with a market size of 0.25 billion USD set to grow to 0.38 billion USD. Chemical foaming agents are smaller but growing, moving from 0.12 billion USD to 0.19 billion USD.

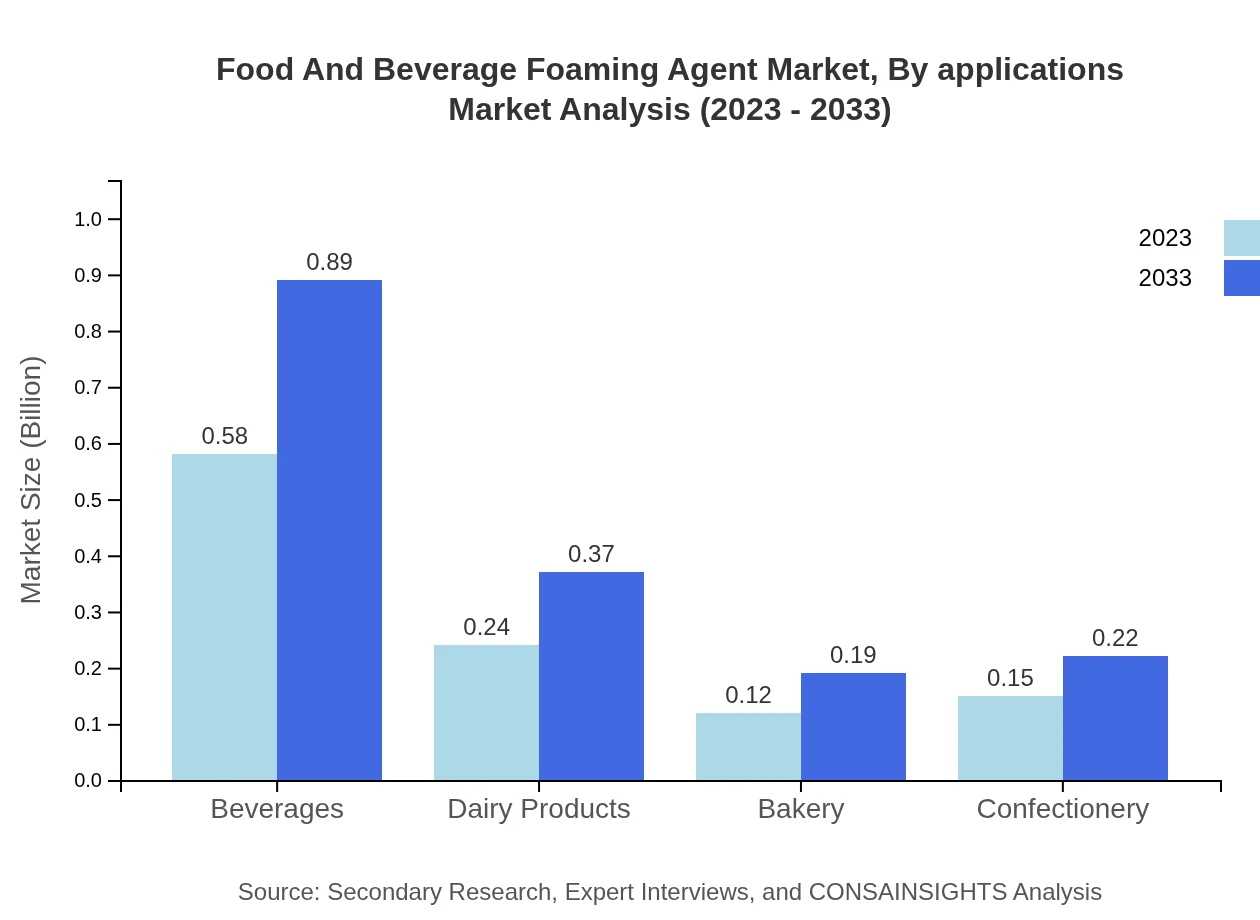

Food And Beverage Foaming Agent Market Analysis By Applications

By applications, beverages are the largest consumers of foaming agents, with a market size of 0.58 billion USD in 2023, expected to see considerable growth to 0.89 billion USD by 2033. Bakery, dairy products and confectionery also play crucial roles, showcasing demand for quality enhancements in final products.

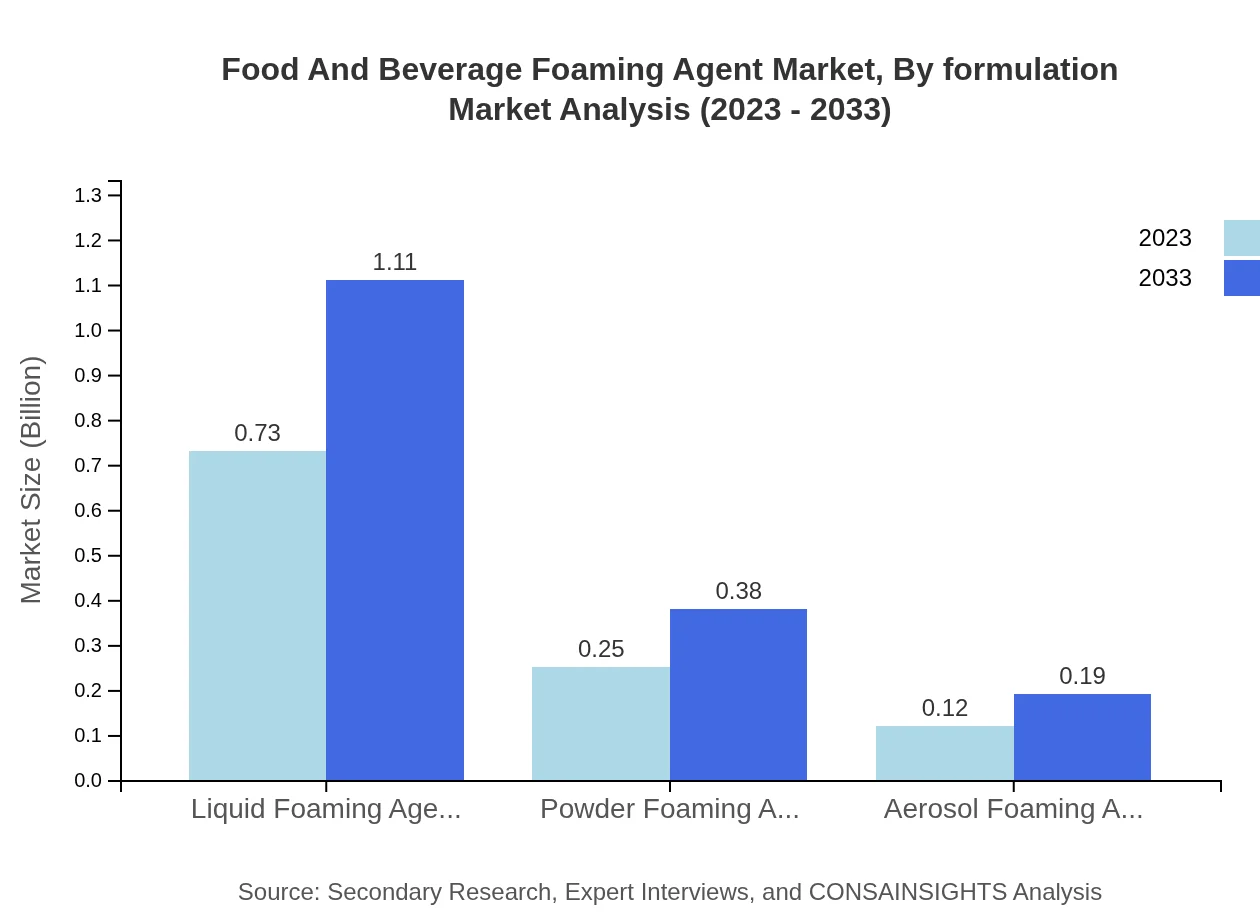

Food And Beverage Foaming Agent Market Analysis By Formulation

Liquid foaming agents account for the majority of the market, valued at 0.73 billion USD with growth forecasted to 1.11 billion USD by 2033. Powder foaming agents hold a notable market size of 0.25 billion USD, projected to grow steadily as industries seek versatility in formulations.

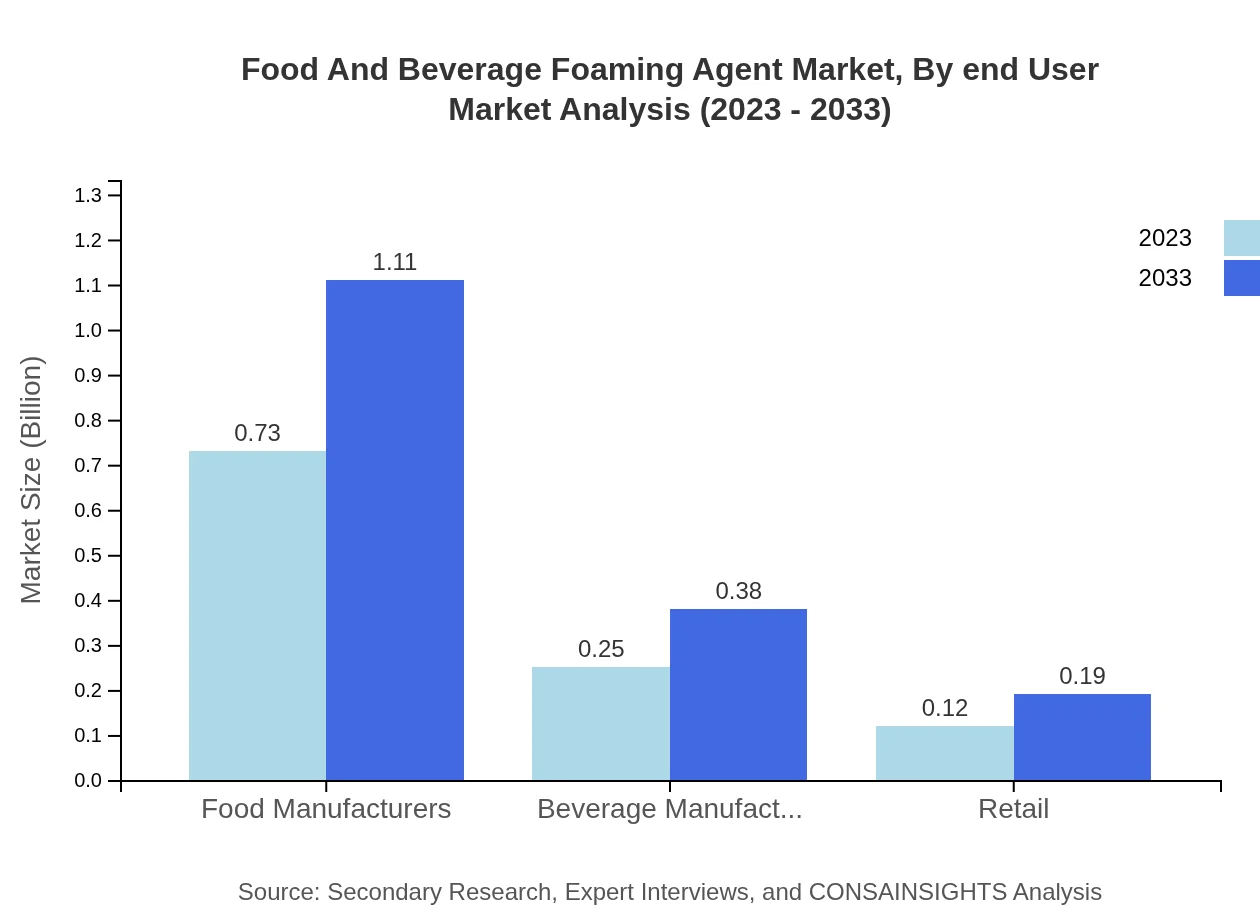

Food And Beverage Foaming Agent Market Analysis By End User

Food manufacturers dominate the market with a size of 0.73 billion USD in 2023, expected to reach 1.11 billion USD. Beverage manufacturers follow closely at 0.25 billion USD, with growth driven by trends in health and product quality.

Food And Beverage Foaming Agent Market Analysis By Geography

North America secures the largest share at 44.85%, followed by Europe at 24.08%, while Asia-Pacific captures around 10.01%. Shifting consumer preferences towards healthier options and sustainable practices influence regional performance.

Food And Beverage Foaming Agent Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food And Beverage Foaming Agent Industry

Dupont:

Dupont is a key player in the food industry, known for its innovative solutions in food additives, including foaming agents that enhance product quality.Kerry Group:

Kerry Group provides diverse food solutions, specializing in foaming agents that cater to health-conscious markets with natural ingredients.BASF:

BASF is a leader in chemical solutions, offering a range of high-quality foaming agents designed for various food and beverage applications.Sigma Aldrich:

Sigma Aldrich supplies a comprehensive range of food foaming agents that ensure product stability and quality across multiple applications.We're grateful to work with incredible clients.

FAQs

What is the market size of food And Beverage Foaming Agent?

The food and beverage foaming agent market is valued at $1.1 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.2% from 2023 to 2033. This indicates a steady growth trend in demand for these essential ingredients.

What are the key market players or companies in this food And Beverage Foaming Agent industry?

The key players in the food and beverage foaming agent market include established companies in food manufacturing and ingredient suppliers. Their competitive strategies focus on product innovation, strategic partnerships, and expanding their distribution networks to meet growing market demands.

What are the primary factors driving the growth in the food and beverage foaming agent industry?

Growth in the food and beverage foaming agent industry is driven by rising consumer demand for innovative food products, increased popularity of plant-based diets, and an expansion in the bakery and confectionery sectors, where foaming agents enhance product quality and texture.

Which region is the fastest Growing in the food and beverage foaming agent?

North America is the fastest-growing region in the food and beverage foaming agent market, with expected growth from $0.43 billion in 2023 to $0.65 billion by 2033. Other regions, such as Europe and Asia Pacific, also show significant growth potential.

Does ConsaInsights provide customized market report data for the food and beverage foaming agent industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the food and beverage foaming agent industry. This includes detailed insights that cater to niche markets or particular companies, ensuring relevance and applicability.

What deliverables can I expect from this food And Beverage Foaming Agent market research project?

Deliverables for the market research project on food and beverage foaming agents can include comprehensive reports, market size assessments, competitive landscape analysis, and trend forecasting, along with actionable insights to inform strategic decisions.

What are the market trends of food And Beverage Foaming Agent?

Key market trends include a shift towards plant-based and organic foaming agents, growth in innovative food applications, and increasing demand for cleaner labels. The industry is also witnessing advancements in technology that improve product performance.