Food And Beverage Processing Equipment Market Report

Published Date: 22 January 2026 | Report Code: food-and-beverage-processing-equipment

Food And Beverage Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the food and beverage processing equipment market from 2023 to 2033, including trends, industry dynamics, regional insights, and projections based on current data and future forecasts.

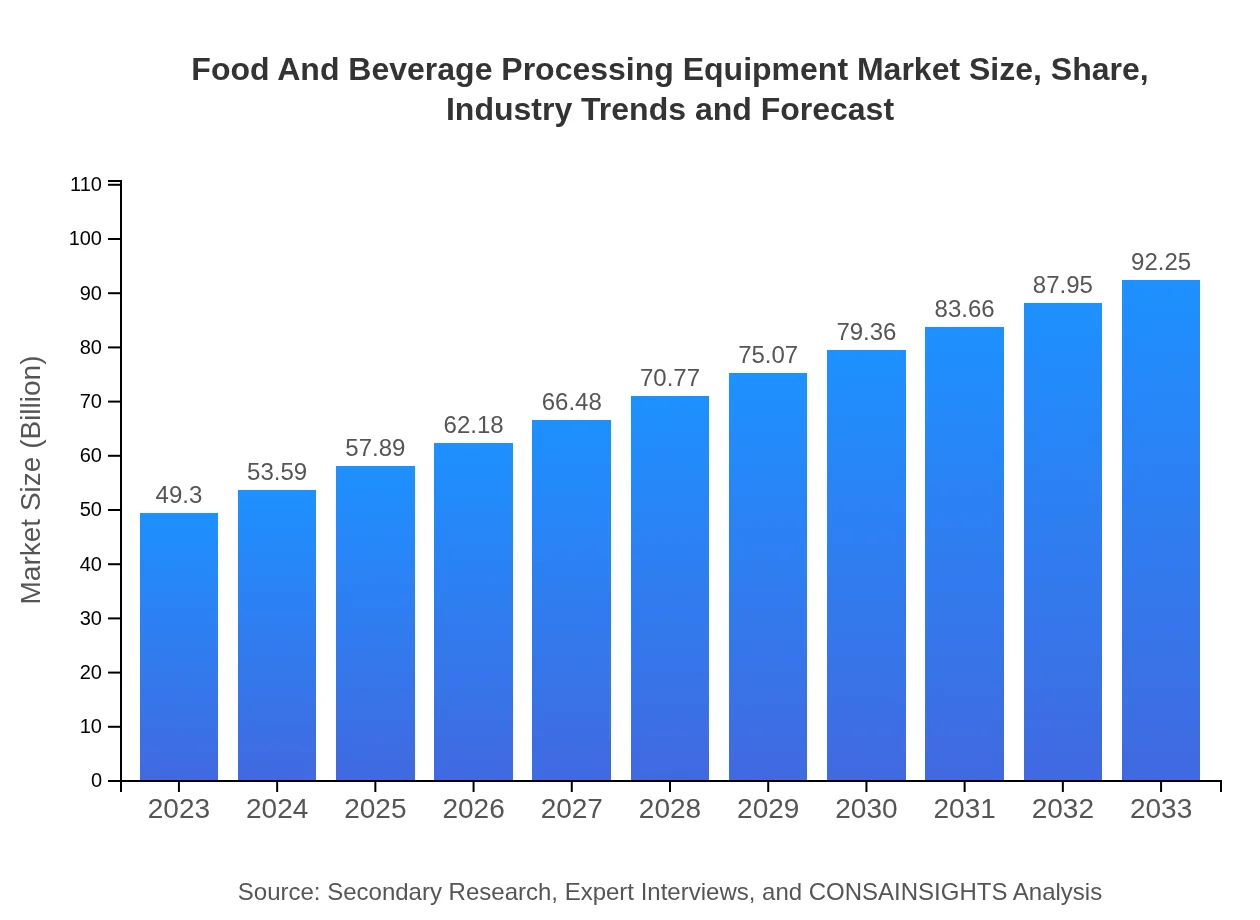

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $49.30 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $92.25 Billion |

| Top Companies | GEA Group, Tetra Pak, SPI Group |

| Last Modified Date | 22 January 2026 |

Food And Beverage Processing Equipment Market Overview

Customize Food And Beverage Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Food And Beverage Processing Equipment market size, growth, and forecasts.

- ✔ Understand Food And Beverage Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food And Beverage Processing Equipment

What is the Market Size & CAGR of Food And Beverage Processing Equipment market in 2023?

Food And Beverage Processing Equipment Industry Analysis

Food And Beverage Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food And Beverage Processing Equipment Market Analysis Report by Region

Europe Food And Beverage Processing Equipment Market Report:

Europe's market size will grow from USD 17.63 billion in 2023 to USD 32.99 billion by 2033. The region is witnessing a shift towards more eco-friendly processing technologies, with stringent regulations and high consumer awareness prevailing in the food sector.Asia Pacific Food And Beverage Processing Equipment Market Report:

The Asia-Pacific region is projected to see substantial growth, with the market size increasing from USD 8.26 billion in 2023 to USD 15.46 billion by 2033. This growth is driven by rising population densities, urbanization, and a burgeoning middle-class demographic that demands a variety of processed food options.North America Food And Beverage Processing Equipment Market Report:

North America is expected to rise from USD 16.84 billion in 2023 to USD 31.51 billion by 2033, bolstered by significant technological investments and enhanced production facilities focusing on quality and sustainability in food processing.South America Food And Beverage Processing Equipment Market Report:

In South America, the market is anticipated to grow from USD 4.24 billion in 2023 to USD 7.94 billion by 2033. The growth is attributed to increasing investments in the food processing sector and a rising trend towards automation and modernization in food production.Middle East & Africa Food And Beverage Processing Equipment Market Report:

The Middle East and Africa are expected to grow from USD 2.32 billion in 2023 to USD 4.34 billion by 2033, owing to an increase in food safety awareness and growing investments in food infrastructure development.Tell us your focus area and get a customized research report.

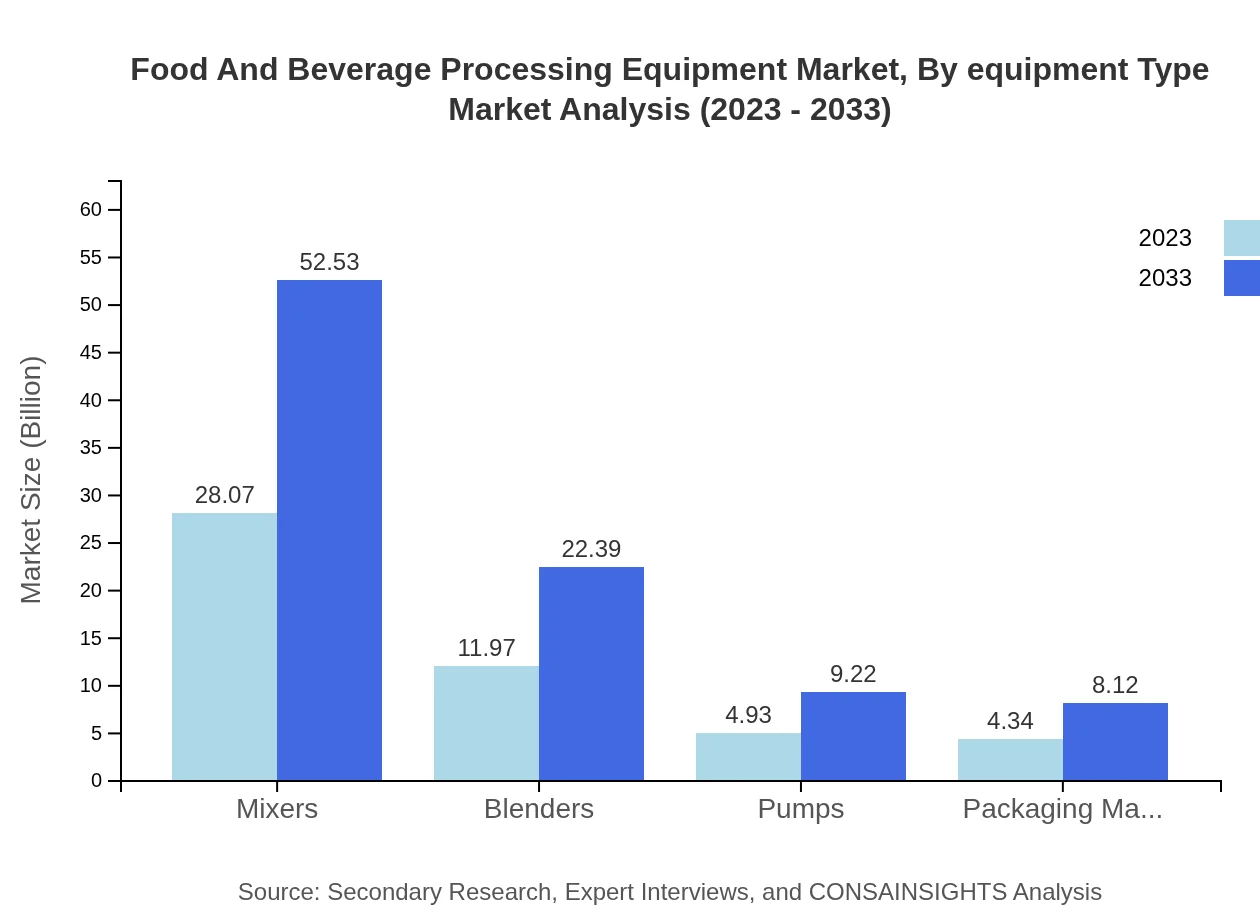

Food And Beverage Processing Equipment Market Analysis By Equipment Type

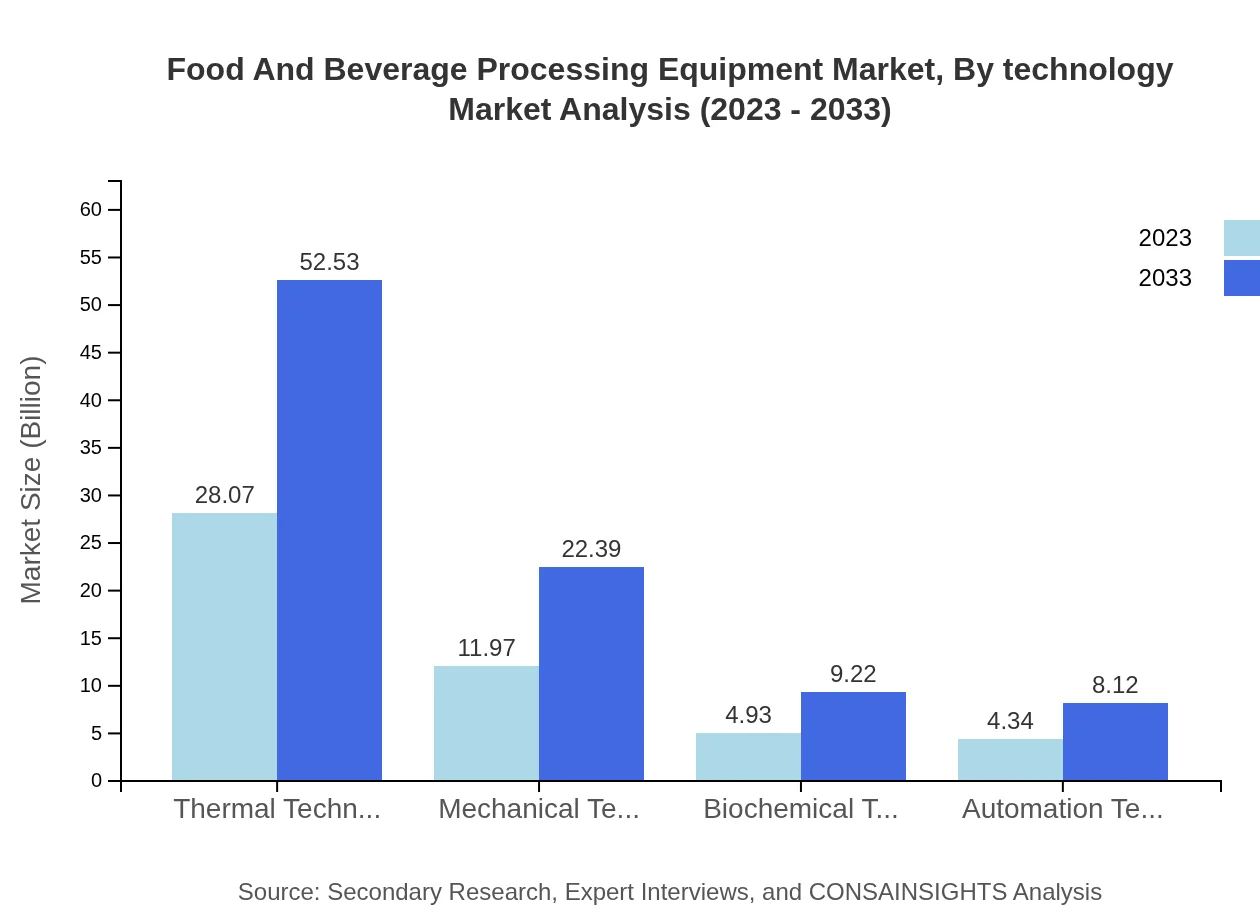

In 2023, thermal technology leads the market with revenue of USD 28.07 billion, projected to increase to USD 52.53 billion by 2033. Following this, mechanical technology holds a significant share, expected to grow from USD 11.97 billion in 2023 to USD 22.39 billion by 2033. Other segments, including biochemical, automation, and packaging technologies, also show robust growth, catering to diverse industry requirements.

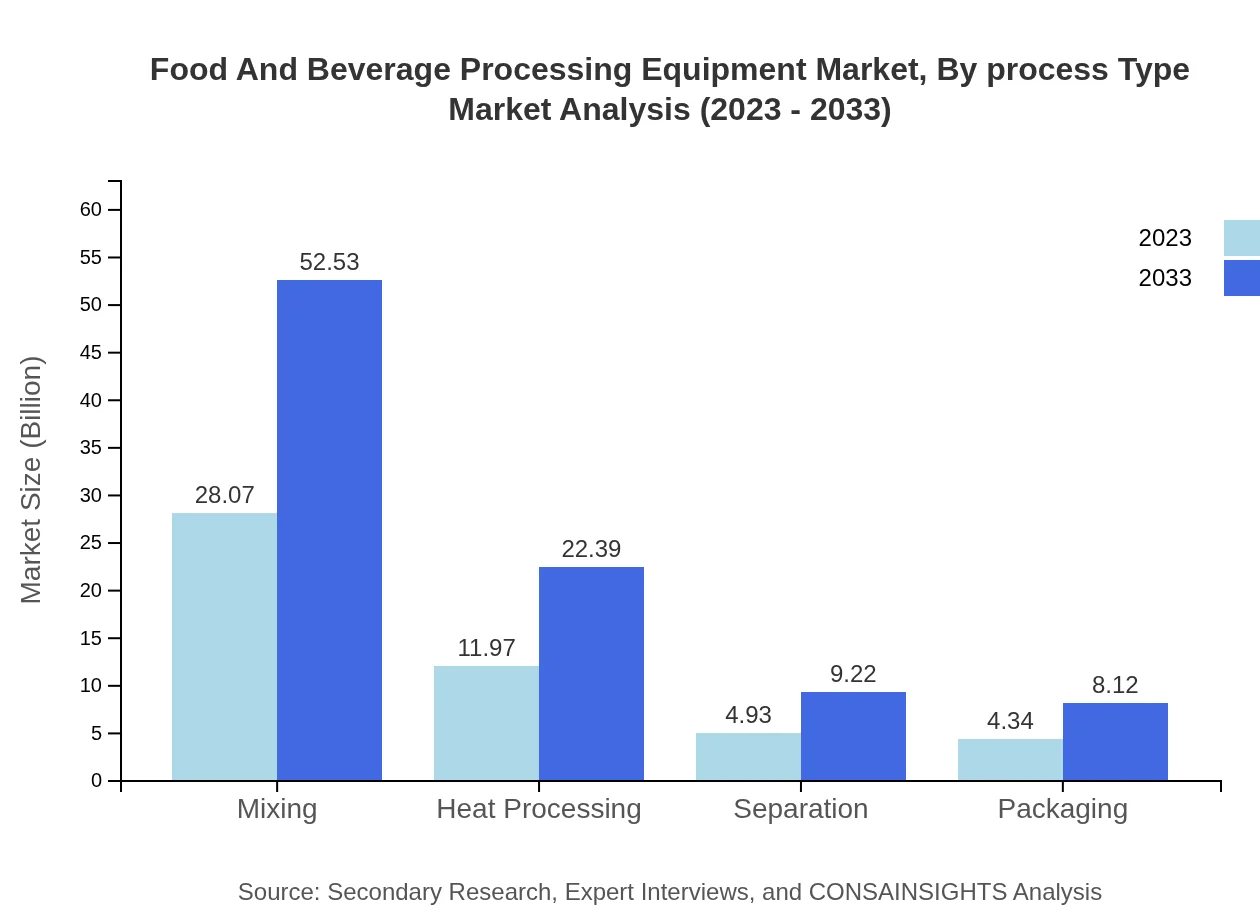

Food And Beverage Processing Equipment Market Analysis By Process Type

The market shows a clear preference towards mixing processes, which lead with a market size of USD 28.07 billion in 2023, with a reach of USD 52.53 billion by 2033. Heat processing and separation technologies account for USD 11.97 billion and USD 4.93 billion respectively in 2023, both set for substantial growth in the coming years as demand for diverse products increases.

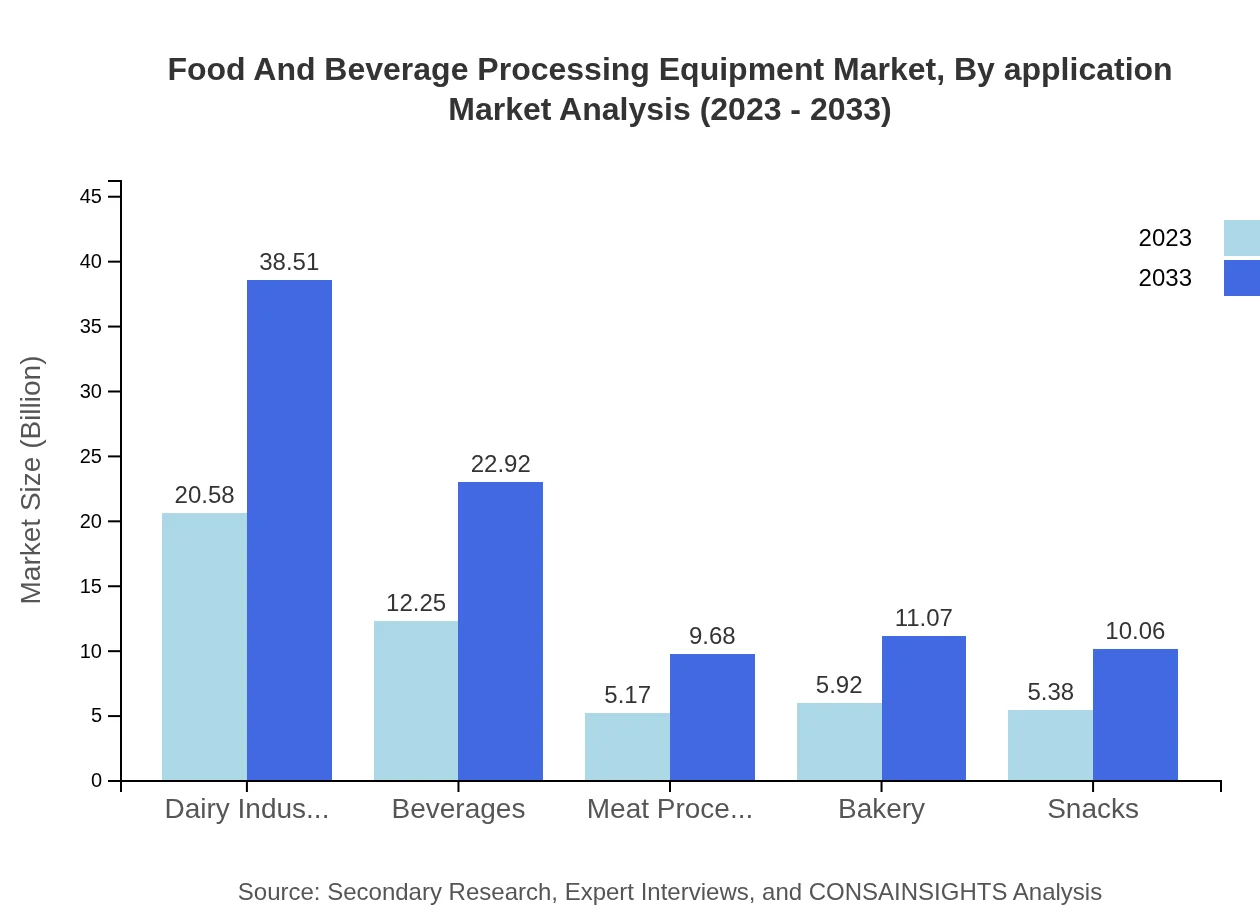

Food And Beverage Processing Equipment Market Analysis By Application

The dairy industry holds a dominant market size of USD 20.58 billion in 2023, projected to rise to USD 38.51 billion by 2033. Other applications like beverages, meat processing, and bakery showcase their growing significance, projected to see revenues of USD 12.25 billion, USD 5.17 billion, and USD 5.92 billion respectively by 2023, indicating health-conscious consumer behavior influencing product development.

Food And Beverage Processing Equipment Market Analysis By Technology

The leading technology segment, thermal technology, accounts for a significant share (56.94%) in 2023, maintaining its position through 2033. Mechanical and biochemical technologies are also crucial, with market shares of 24.27% and 9.99% respectively, indicating the diverse technological landscape that supports food processing equipment.

Food And Beverage Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food And Beverage Processing Equipment Industry

GEA Group:

GEA Group is a leading global supplier of food processing technology, offering sustainable and innovative solutions across various food sectors, focusing on dairy, beverages, and meat processing.Tetra Pak:

Tetra Pak is renowned for its advanced technology and packaging solutions for food and beverage processing, promoting sustainability and efficiency in the production process.SPI Group:

SPI Group specializes in manufacturing components and equipment for food processing, focusing on innovative designs that enhance processing capabilities and reduce waste.We're grateful to work with incredible clients.

FAQs

What is the market size of food And Beverage Processing Equipment?

The global market size for food and beverage processing equipment is projected at $49.3 billion in 2023. With a CAGR of 6.3%, it is expected to see substantial growth over the next decade, reaching new heights by 2033.

What are the key market players or companies in this food And Beverage Processing Equipment industry?

Key players in the food and beverage processing equipment industry include prominent companies such as Bühler AG, Tetra Pak, and JBT Corporation. These companies lead the market through innovation and expanding product portfolios to meet evolving consumer demands.

What are the primary factors driving the growth in the food And Beverage Processing Equipment industry?

Growth in the food and beverage processing equipment industry is driven by increasing consumer demand for processed foods, innovation in technology, and a rising focus on improving food safety. Additionally, the need for efficient production methods further accelerates market expansion.

Which region is the fastest Growing in the food And Beverage Processing Equipment?

Asia Pacific is the fastest-growing region in the food and beverage processing equipment market. Market size is expected to double from $8.26 billion in 2023 to $15.46 billion by 2033, propelled by rapid urbanization and rising disposable incomes.

Does ConsaInsights provide customized market report data for the food And Beverage Processing Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the food and beverage processing equipment industry, ensuring stakeholders receive insights relevant to their particular market interests and requirements.

What deliverables can I expect from this food And Beverage Processing Equipment market research project?

In this market research project for food and beverage processing equipment, clients can expect detailed insights including market size, growth forecasts, competitor analysis, technological trends, and regional insights, all tailored to facilitate informed decision-making.

What are the market trends of food And Beverage Processing Equipment?

Significant trends in the food and beverage processing equipment market include a shift towards automation, increasing adoption of sustainable practices, and innovations in processing technologies. These trends cater to evolving consumer preferences and regulatory requirements.