Food Betaine Market Report

Published Date: 31 January 2026 | Report Code: food-betaine

Food Betaine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Betaine market, exploring current trends, market size, segmentation, and future forecasts from 2023 to 2033. Insights cover regional performance, technological advancements, and key market players, offering valuable data for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

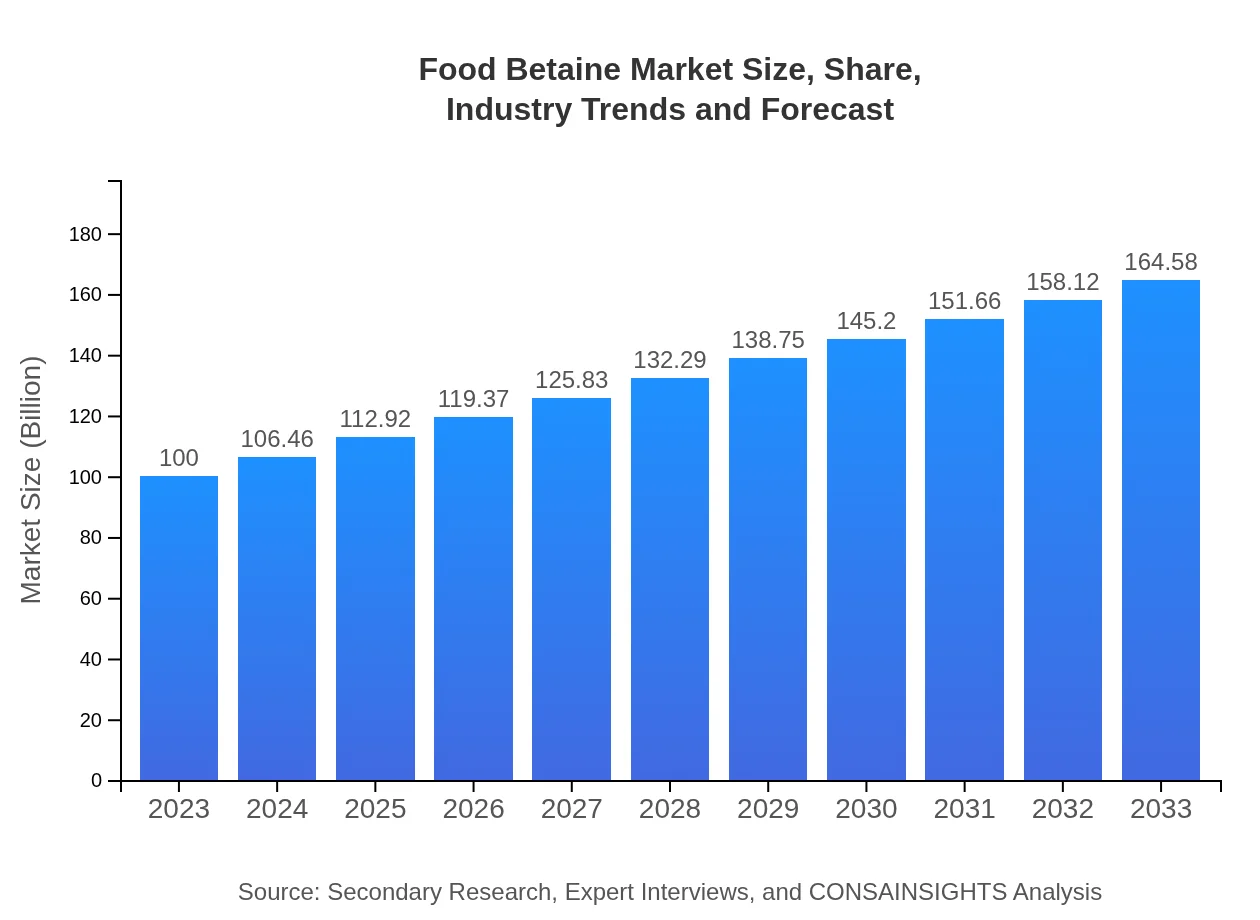

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Ginkgo BioWorks, Swiss Nutrition AG, Associated British Foods plc |

| Last Modified Date | 31 January 2026 |

Food Betaine Market Overview

Customize Food Betaine Market Report market research report

- ✔ Get in-depth analysis of Food Betaine market size, growth, and forecasts.

- ✔ Understand Food Betaine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Betaine

What is the Market Size & CAGR of Food Betaine market in 2023?

Food Betaine Industry Analysis

Food Betaine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Betaine Market Analysis Report by Region

Europe Food Betaine Market Report:

In Europe, the market is forecasted to expand from $28.30 million in 2023 to $46.58 million by 2033, driven by stringent regulations favoring clean label products and the increasing trend of personalized nutrition among consumers.Asia Pacific Food Betaine Market Report:

In Asia Pacific, the Food Betaine market is estimated to reach $33.33 million by 2033, growing from $20.25 million in 2023. The increase is driven by expanding health awareness and the growing food and beverage sector in countries such as China and India. Market players are focusing on developing region-specific products to leverage the diverse consumer base.North America Food Betaine Market Report:

North America leads the market with expected growth from $36.43 million in 2023 to $59.96 million by 2033. The robust demand for sports nutrition products and functional foods significantly contributes to this growth. Companies are increasingly focusing on marketing health benefits to promote the use of betaine in food products.South America Food Betaine Market Report:

The South American market, with an estimated growth from $1.34 million in 2023 to $2.21 million in 2033, is gradually embracing functional foods. The rising middle-class population is expected to drive demand for healthier food options, thus promoting the adoption of food betaine.Middle East & Africa Food Betaine Market Report:

The Middle East and Africa anticipate growth from $13.68 million in 2023 to $22.51 million by 2033. Market expansion is supported by a growing awareness of health and wellness, complemented by an increase in disposable income and consumer spending on health-related food products.Tell us your focus area and get a customized research report.

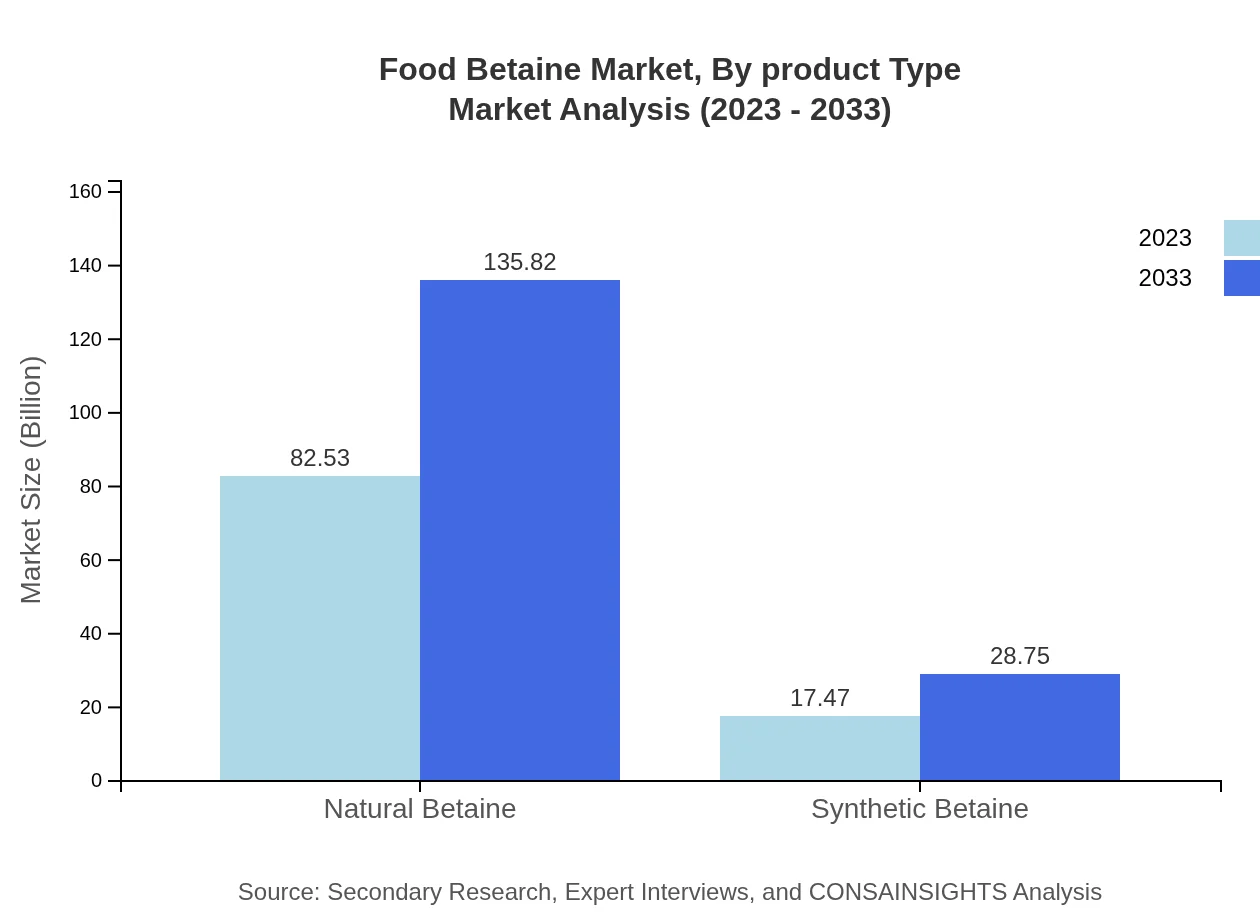

Food Betaine Market Analysis By Product Type

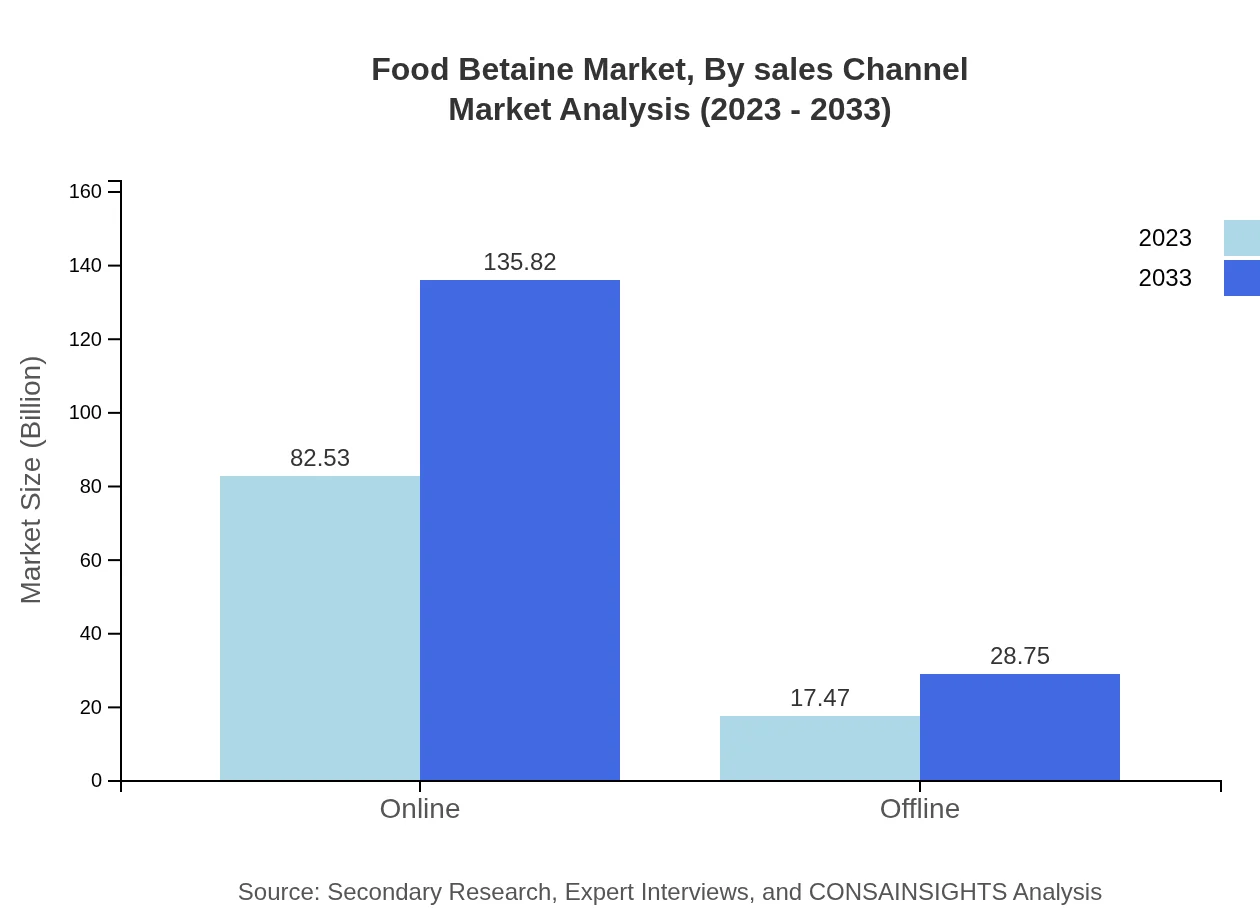

In the Food Betaine market, Natural Betaine dominates with a market share of 82.53% in 2023, reaching $82.53 million, and is projected to grow to $135.82 million by 2033. Synthetic Betaine, while smaller, is growing steadily, expected to rise from $17.47 million in 2023 to $28.75 million in 2033.

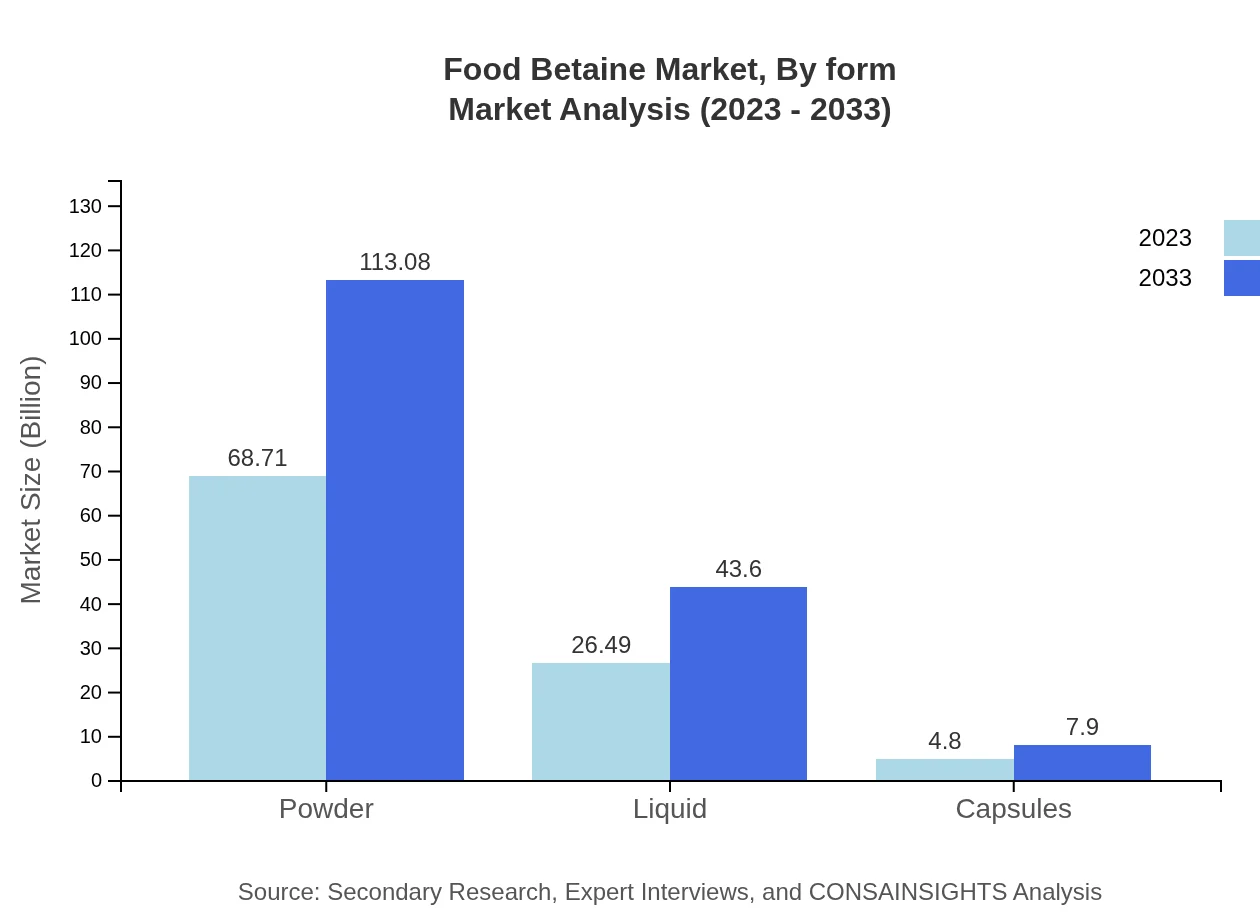

Food Betaine Market Analysis By Form

Powdered betaine holds the largest market share, contributing $68.71 million in 2023 and is predicted to grow to $113.08 million by 2033. Liquid forms follow at $26.49 million in 2023, anticipated to reach $43.60 million by 2033, while capsules remain a niche segment, growing from $4.80 million to $7.90 million over the same period.

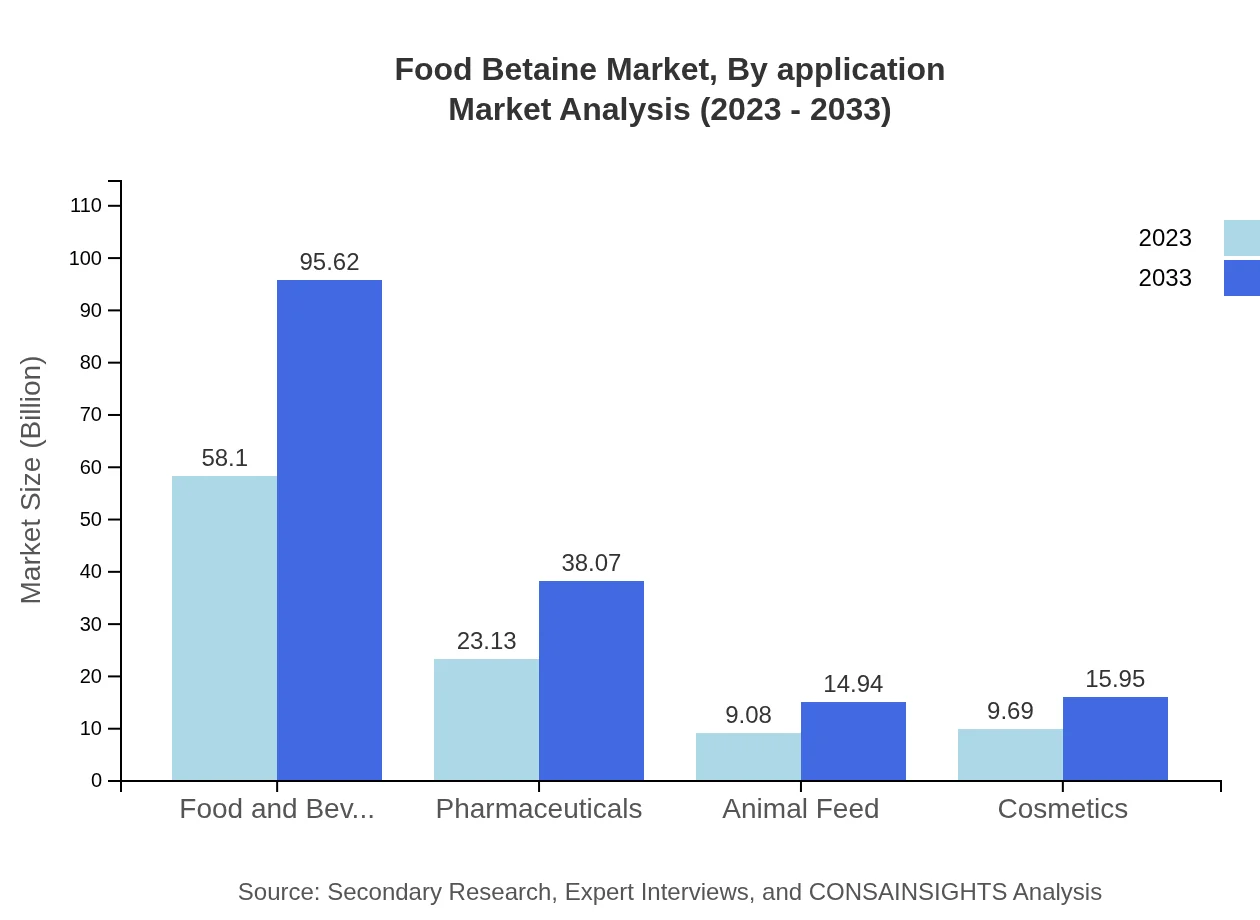

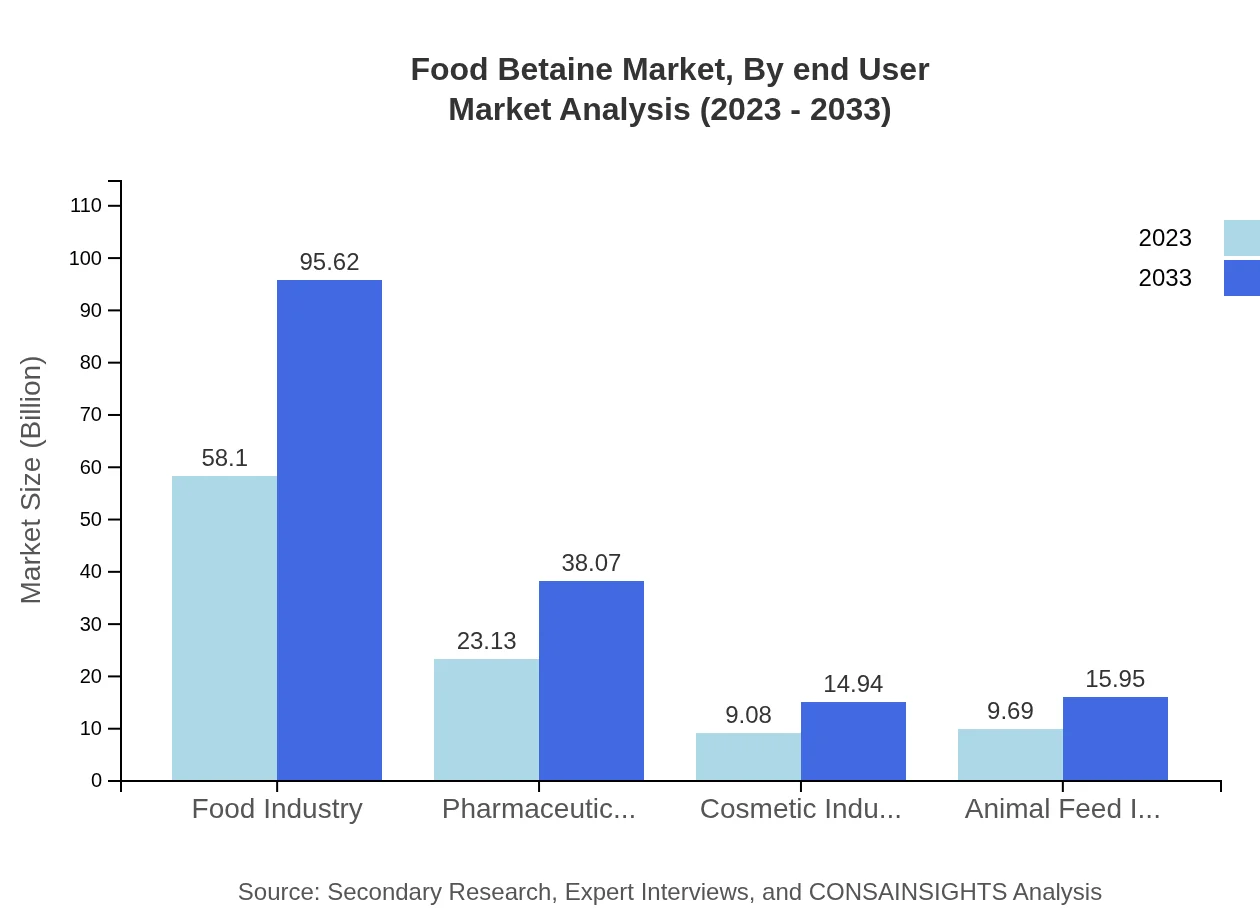

Food Betaine Market Analysis By Application

The Food and Beverages applications remain the most significant segment, with a substantial market share of $58.10 million in 2023, projected to grow to $95.62 million by 2033. Pharmaceuticals and Cosmetics also play important roles, contributing $23.13 million and $9.08 million, respectively, in 2023.

Food Betaine Market Analysis By Sales Channel

The online sales channel is gaining traction, expected to grow from $82.53 million in 2023 to $135.82 million by 2033, highlighting the shift towards e-commerce. Offline sales, while still relevant, are projected to rise from $17.47 million to $28.75 million over the same period.

Food Betaine Market Analysis By End User

Key end users include food manufacturers and individual consumers. In 2023, food manufacturers accounted for a considerable portion of market consumption, valued at $58.10 million, projected to rise to $95.62 million by 2033, while individual consumers are expected to grow from $4.80 million to $7.90 million.

Food Betaine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Betaine Industry

Ginkgo BioWorks:

A leading biotechnology company utilizing synthetic biology to produce highly efficient natural ingredients including betaine, focusing heavily on biomanufacturing technologies.Swiss Nutrition AG:

Involved in the production of various dietary supplements and functional food ingredients, including betaine, emphasizes high-quality raw materials and sustainable production methods.Associated British Foods plc:

A diversified international food, ingredients and retail group that produces a wide range of products ensuring stringent quality control and reliability in nutrition supply.We're grateful to work with incredible clients.

FAQs

What is the market size of Food Betaine?

The Food Betaine market is valued at approximately $100 million in 2023, with a projected CAGR of 5%. By 2033, the market is expected to reach significant expansion, indicating strong growth in demand for food-grade betaine products.

What are the key market players or companies in the Food Betaine industry?

Key players in the Food Betaine industry include major companies focused on production and distribution. These often include both established food ingredient companies and emerging suppliers specializing in betaine-derived products, contributing to varied market segments.

What are the primary factors driving the growth in the Food Betaine industry?

Growth in the Food Betaine industry is primarily driven by increasing consumer awareness of health benefits, rising demand in food and beverages, and expanding applications in pharmaceuticals and cosmetics. Additionally, trends toward natural ingredients fuel market expansion.

Which region is the fastest Growing in the Food Betaine market?

The fastest-growing region for the Food Betaine market is North America, projected to grow from $36.43 million in 2023 to $59.96 million by 2033. Europe and Asia Pacific also show robust growth, reflecting increasing consumer trends.

Does ConsaInsights provide customized market report data for the Food Betaine industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Food Betaine industry. Clients can request detailed insights and analytics that target their unique market requirements and strategic objectives.

What deliverables can I expect from this Food Betaine market research project?

Clients can expect comprehensive market research deliverables, including detailed reports on market size, growth forecasts, competitive analysis, regional insights, and segment-specific data that empower informed business decisions.

What are the market trends of Food Betaine?

Market trends for Food Betaine highlight a shift towards natural sources, with natural betaine projected to dominate. Innovation in betaine applications across industries like food, cosmetics, and animal feed also marks significant trends impacting future growth.