Food Certification Market Report

Published Date: 31 January 2026 | Report Code: food-certification

Food Certification Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the Food Certification market, offering insights on market trends, size, segmentation, and regional analysis from 2023 to 2033. It outlines key players, industry dynamics, and future growth forecasts.

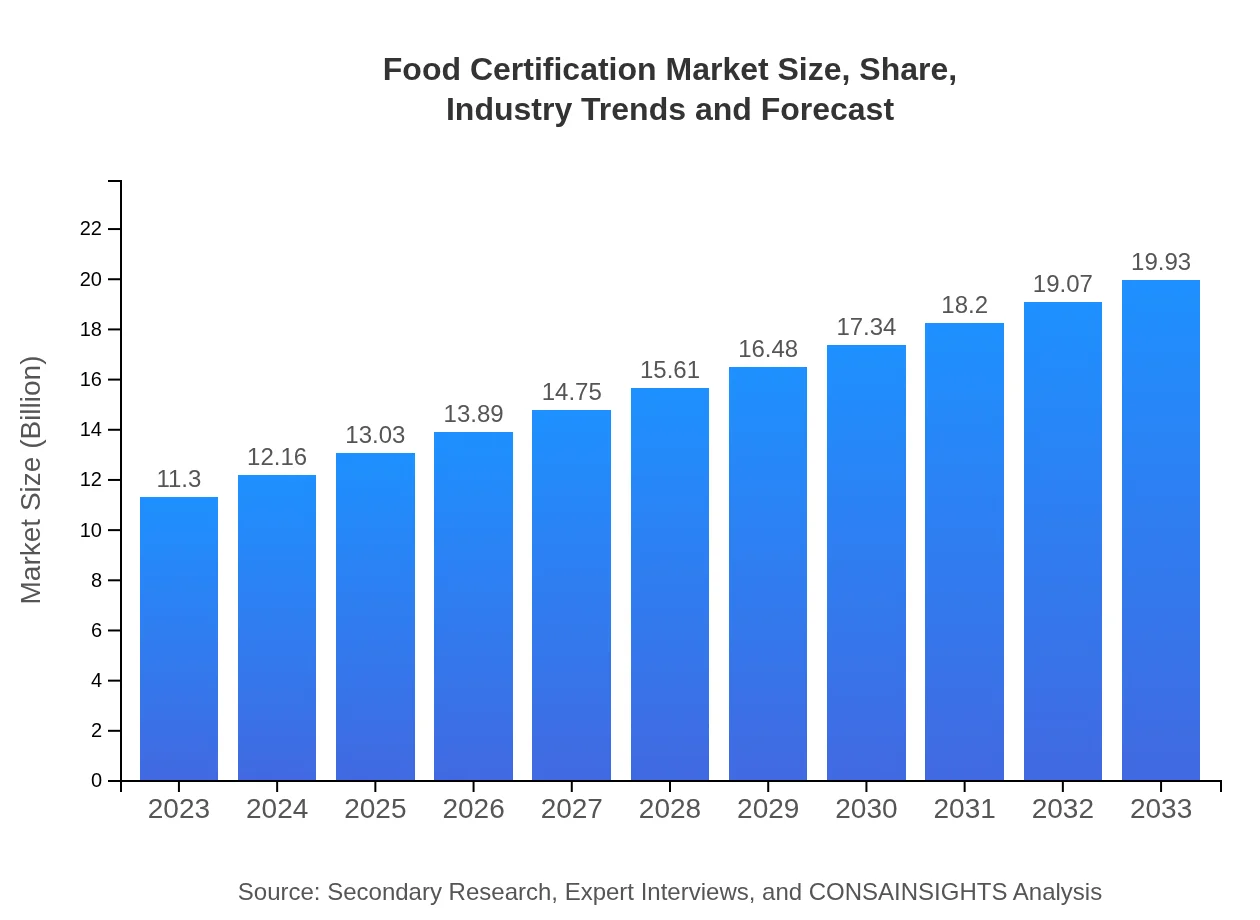

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.30 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $19.93 Billion |

| Top Companies | SGS SA, Bureau Veritas, Intertek Group, TÜV SÜD, DNV GL |

| Last Modified Date | 31 January 2026 |

Food Certification Market Overview

Customize Food Certification Market Report market research report

- ✔ Get in-depth analysis of Food Certification market size, growth, and forecasts.

- ✔ Understand Food Certification's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Certification

What is the Market Size & CAGR of Food Certification market in 2033?

Food Certification Industry Analysis

Food Certification Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Certification Market Analysis Report by Region

Europe Food Certification Market Report:

Europe leads the Food Certification market, with projections rising from $3.65 billion in 2023 to $6.44 billion by 2033. Strong governmental regulations on food safety, along with cultural preferences for certified organic and ethical food products, drive this growth. The European Union's regulatory frameworks maintain high certification standards, further reinforcing consumer trust.Asia Pacific Food Certification Market Report:

The Asia Pacific region is anticipated to witness significant growth in the Food Certification market, projected to rise from $2.03 billion in 2023 to $3.57 billion by 2033. This growth is fueled by increasing consumer awareness, government support for food safety regulations, and growing imports and exports. Countries like India and China are seeing rising demand for certified food products as health consciousness increases.North America Food Certification Market Report:

North America is a significant player in the Food Certification market, projected to increase from $4.17 billion in 2023 to $7.36 billion by 2033. The region benefits from stringent regulations and a high consumer demand for organic and healthy food products. The presence of multiple certification bodies further facilitates efficient market operation, while recent technology adoption enhances traceability and compliance.South America Food Certification Market Report:

In South America, the Food Certification market is expected to expand from $0.21 billion in 2023 to $0.37 billion by 2033. Challenges such as fragmented food safety regulations and varying enforcement levels across countries impact growth. However, there is a notable push for organic certifications, particularly in Brazil and Argentina, which fosters market opportunities.Middle East & Africa Food Certification Market Report:

The Middle East and Africa region is also seeing growth, with the market expected to grow from $1.24 billion in 2023 to $2.19 billion by 2033. Expanding urbanization, increased health awareness, and rising imports of food products are key factors propelling market growth, although challenges include logistics and varying certifications across countries.Tell us your focus area and get a customized research report.

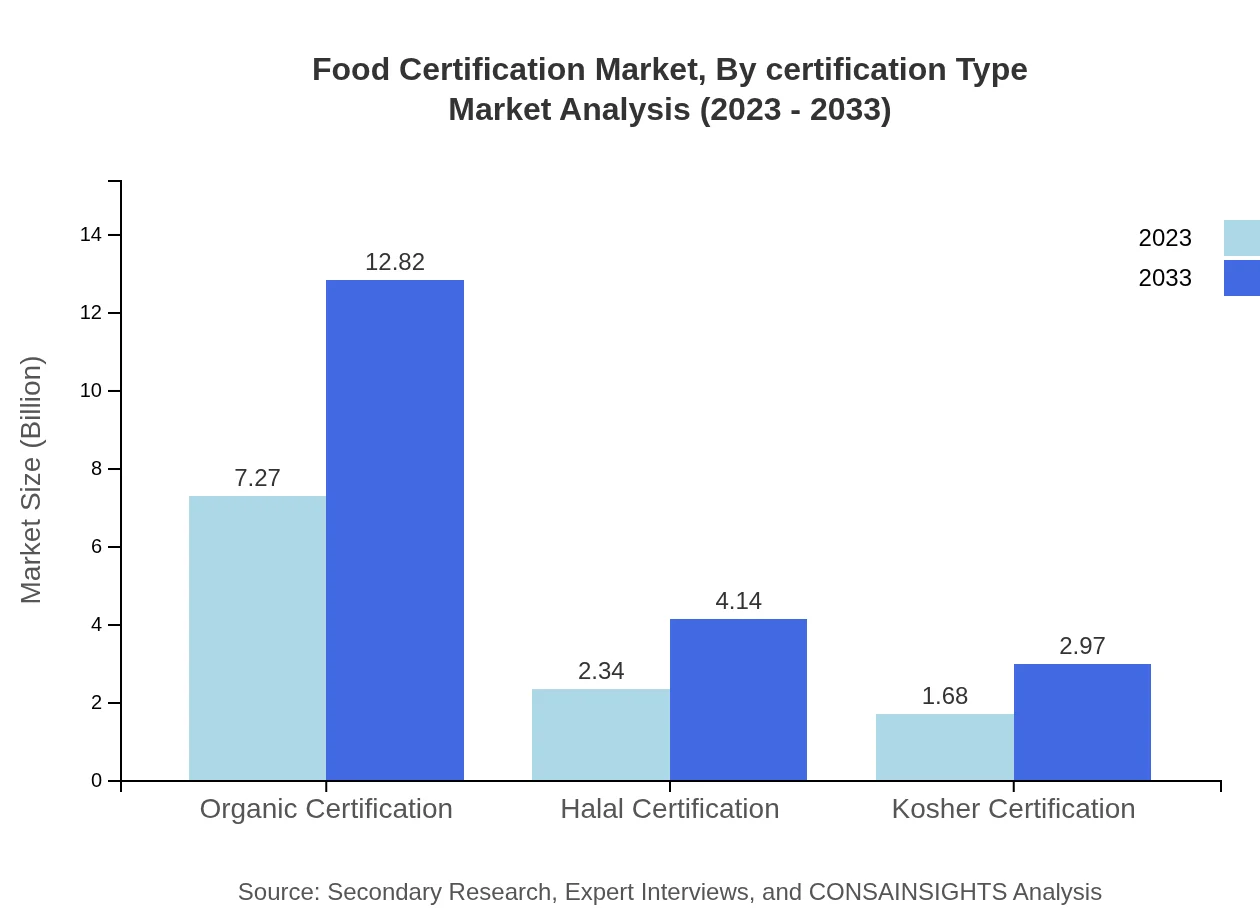

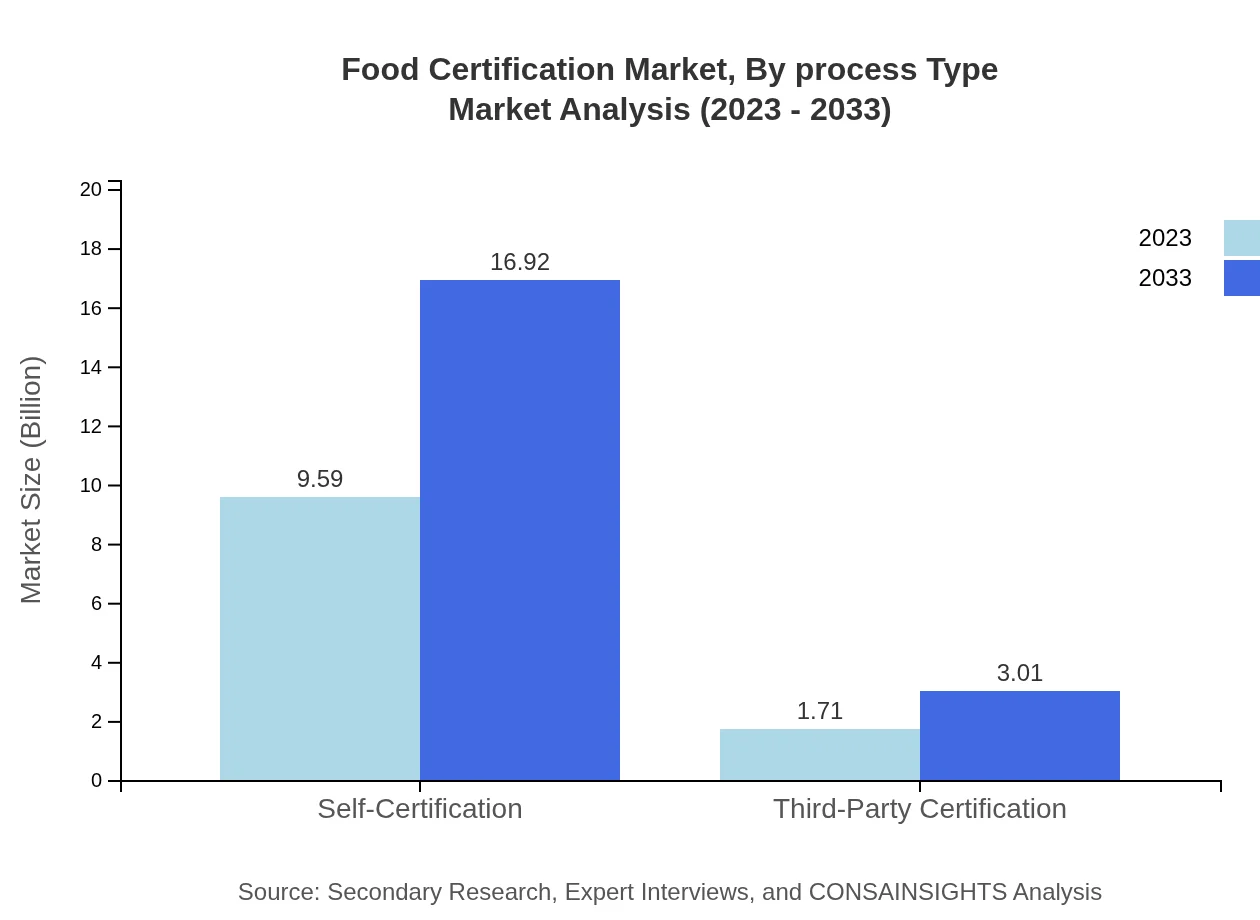

Food Certification Market Analysis By Certification Type

The Food Certification market is significantly influenced by the types of certifications prevalent in the industry. Self-Certification, projected to expand from $9.59 billion in 2023 to $16.92 billion by 2033, captures approximately 84.89% market share. Conversely, Third-Party Certification is expected to grow from $1.71 billion to $3.01 billion, maintaining a 15.11% market share. This growth reflects consumer trust in third-party validations, especially in safety-focused segments.

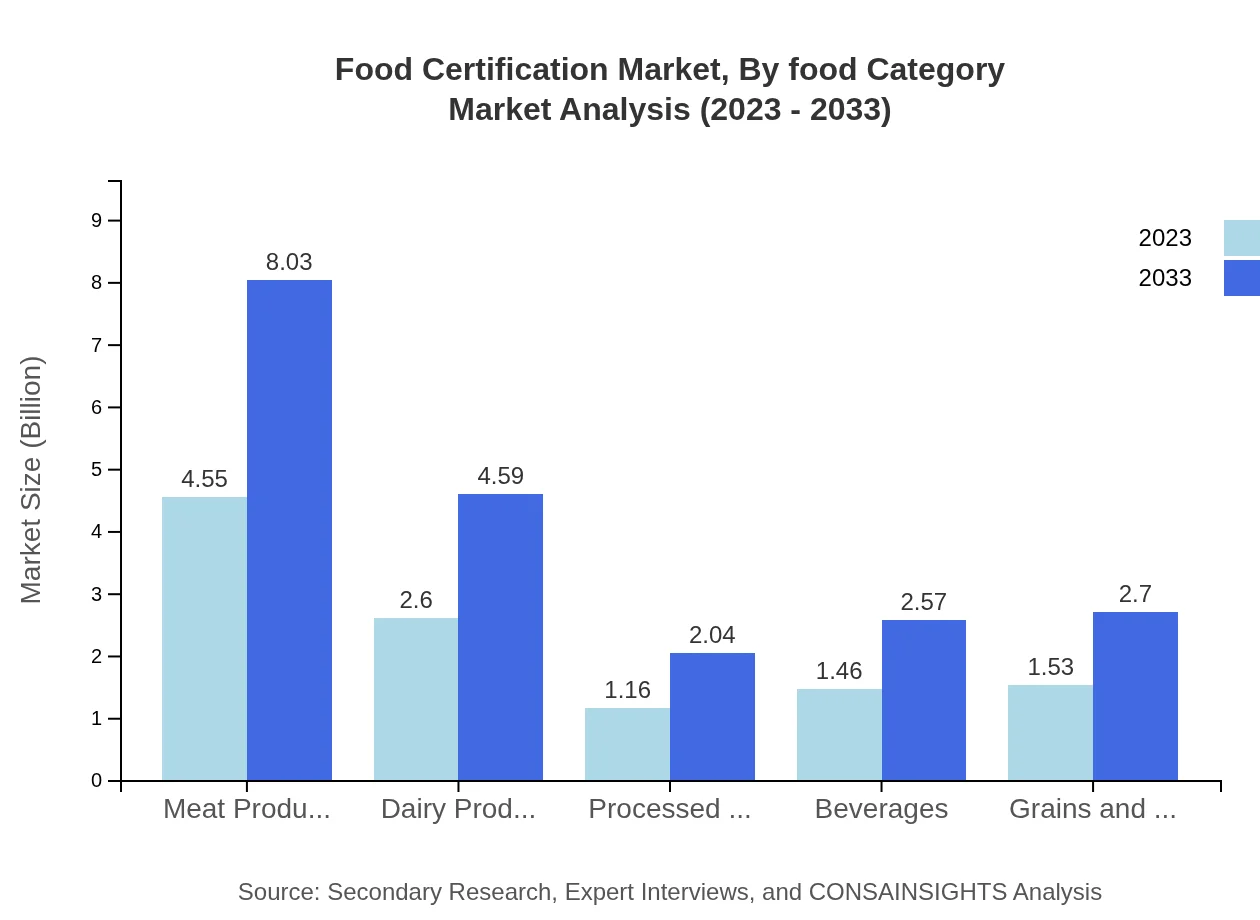

Food Certification Market Analysis By Food Category

The Food Certification market showcases substantial variance across food categories. Meat Products are at the forefront, with growth anticipated from $4.55 billion in 2023 to $8.03 billion in 2033, capturing a 40.29% share. Dairy Products and processed foods also show growth, highlighting the importance of certification in sectors highly scrutinized for health risks, showing rising figures alongside Organic and Halal certifications gaining traction in consumer preferences.

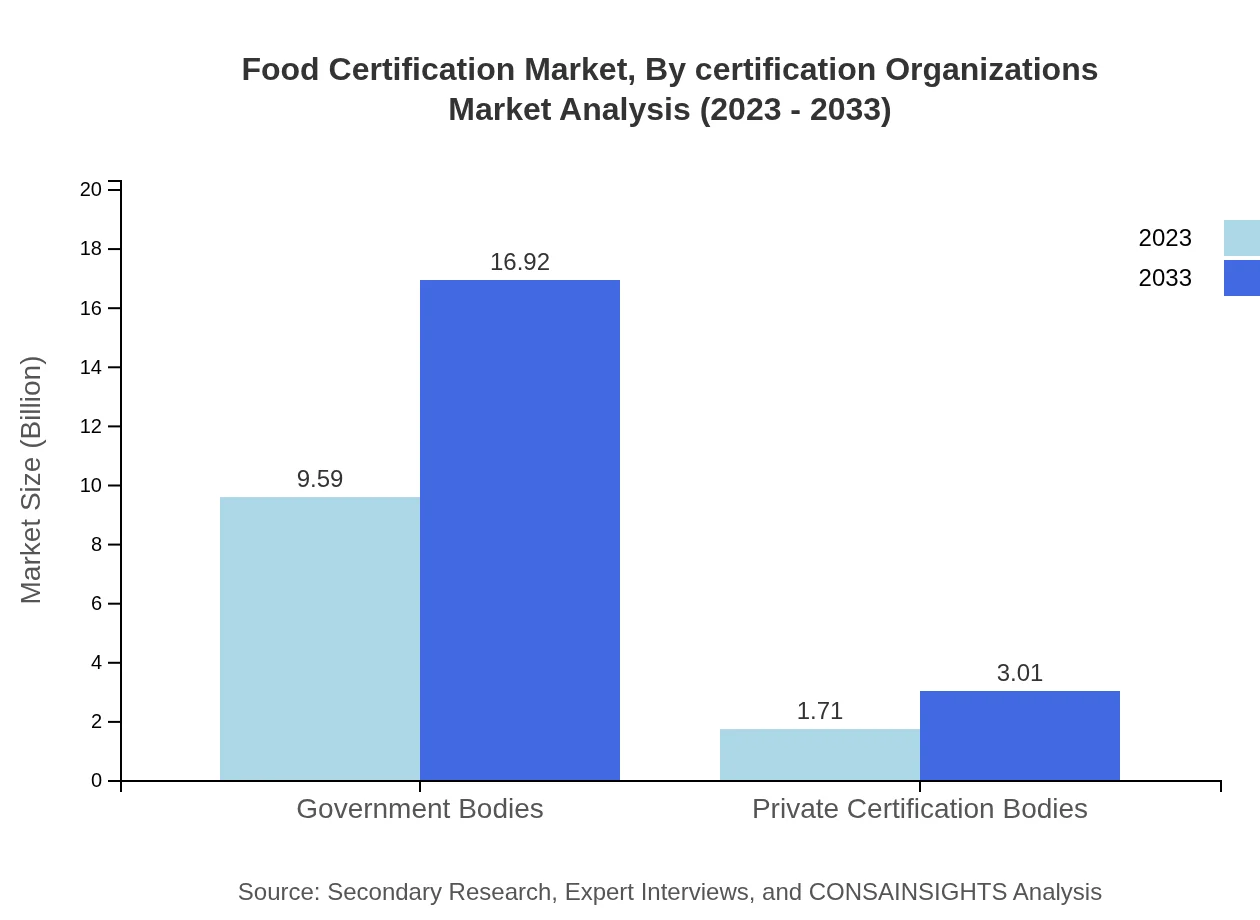

Food Certification Market Analysis By Certification Organizations

The Food Certification market is shaped by various certifying organizations, including Government Bodies and Private Certification Bodies. Government Bodies command a major share due to stringent regulations, with the market expected to rise from $9.59 billion to $16.92 billion. Private Certification Bodies, while smaller ($1.71 billion to $3.01 billion), play a significant role in specialized certifications suiting niche markets, providing alternative pathways for companies seeking certification.

Food Certification Market Analysis By Process Type

In the Food Certification sector, the process type affects overall efficiency and market dynamics. Certification processes are being modernized, focusing on quick, digital inspections and audits versus traditional methods. This trend supports stronger compliance across regions, increasing transparency and reliability, allowing for quicker market access for certified products.

Food Certification Market Analysis By Market Application

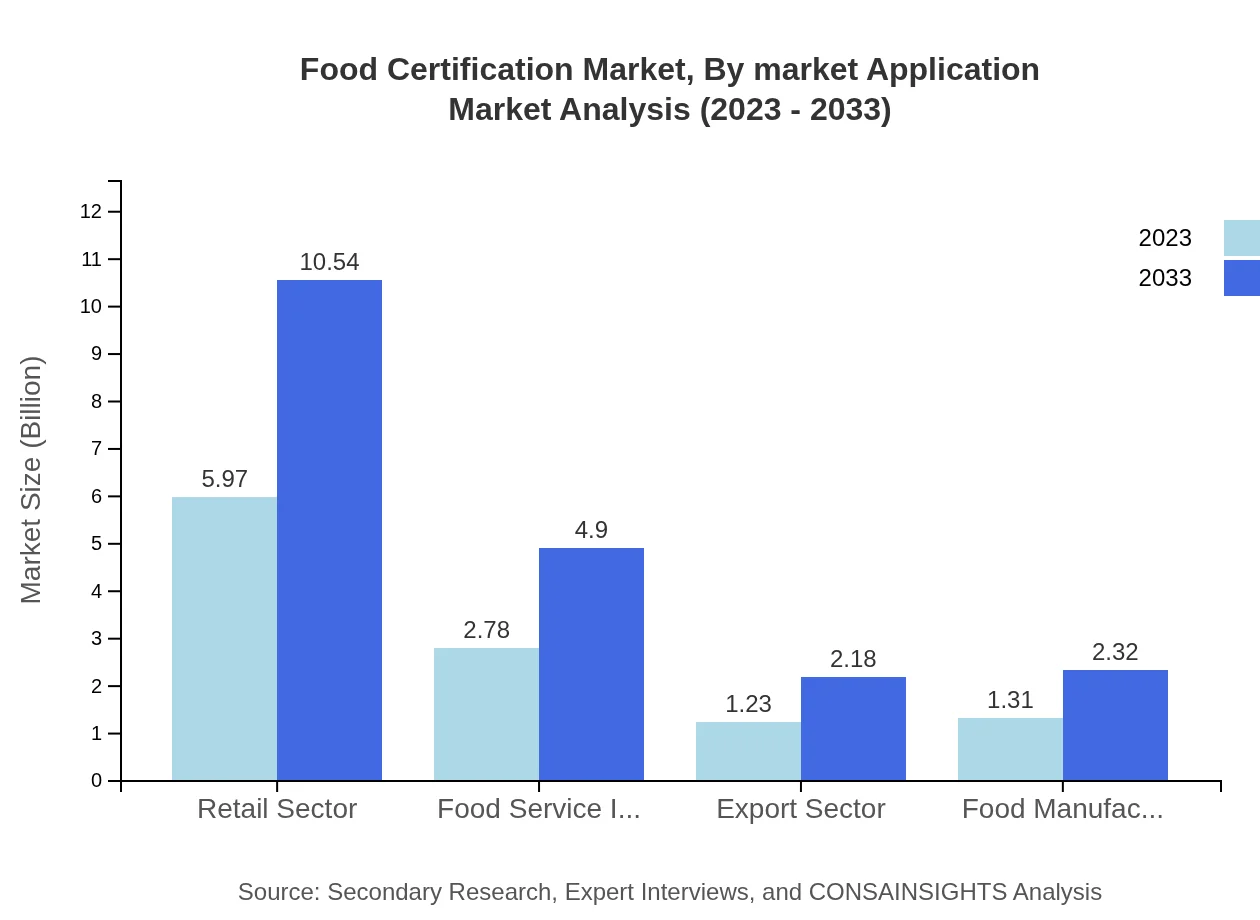

The market applications for Food Certification span Food Manufacturing, Retail, Food Services, and Exporting sectors. The Retail Sector is the largest, poised to grow from $5.97 billion to $10.54 billion by 2033, holding a 52.87% market share. Food Manufacturing and Export Sector also show solid growth, emphasizing the ongoing demand for certified products across all points in the supply chain.

Food Certification Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Certification Industry

SGS SA:

SGS is a global leader in inspection, verification, testing, and certification services, with a comprehensive food safety certification portfolio ensuring compliance with international standards.Bureau Veritas:

Bureau Veritas specializes in testing, inspection, and certification across diverse industries, offering extensive food safety certifications that support businesses in adhering to quality and safety regulations.Intertek Group:

Intertek provides quality and safety solutions across various sectors, including food and beverage certifications that enhance product credibility and consumer trust.TÜV SÜD:

TÜV SÜD offers reliable certification and auditing services in food safety that help businesses to maintain regulatory compliance and improve operational procedures.DNV GL:

DNV GL is a world-leading provider of risk management and quality assurance with a robust portfolio in food safety and health certifications tailored for global clientele.We're grateful to work with incredible clients.

FAQs

What is the market size of food Certification?

The global food certification market is valued at approximately $11.3 billion in 2023, with a projected CAGR of 5.7% through 2033. This growth reflects increasing demand for quality products and adherence to safety standards.

What are the key market players or companies in this food Certification industry?

Key players in the food certification industry include major certification bodies such as SGS, Bureau Veritas, and Intertek. These companies provide various services like audits, inspections, and certifications to ensure food safety and quality standards.

What are the primary factors driving the growth in the food certification industry?

Factors driving growth include rising consumer awareness of food safety, regulatory compliance requirements, globalization of food trade, and the increasing impact of foodborne illnesses, prompting retailers and manufacturers to adopt certification processes.

Which region is the fastest Growing in the food Certification?

The fastest-growing region in food certification is Europe, projected to grow from $3.65 billion in 2023 to $6.44 billion by 2033. This growth is driven by stringent regulatory frameworks and consumer preferences for quality and safety.

Does ConsaInsights provide customized market report data for the food Certification industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the food certification industry, allowing businesses to obtain insights relevant to their unique market challenges and opportunities.

What deliverables can I expect from this food Certification market research project?

Deliverables include comprehensive market analysis reports, trend analysis, competitive landscape assessments, regional insights, and forecasts, helping businesses make informed decisions backed by data within the food certification sector.

What are the market trends of food Certification?

Current trends include a shift towards third-party certifications, increased demand for organic and specialty certifications, and a growing emphasis on sustainability. The market is evolving to include innovative certification processes that address emerging consumer concerns.