Food Coating Ingredients Market Report

Published Date: 31 January 2026 | Report Code: food-coating-ingredients

Food Coating Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Food Coating Ingredients market, covering market size, growth forecasts, regional insights, and industry trends from 2023 to 2033.

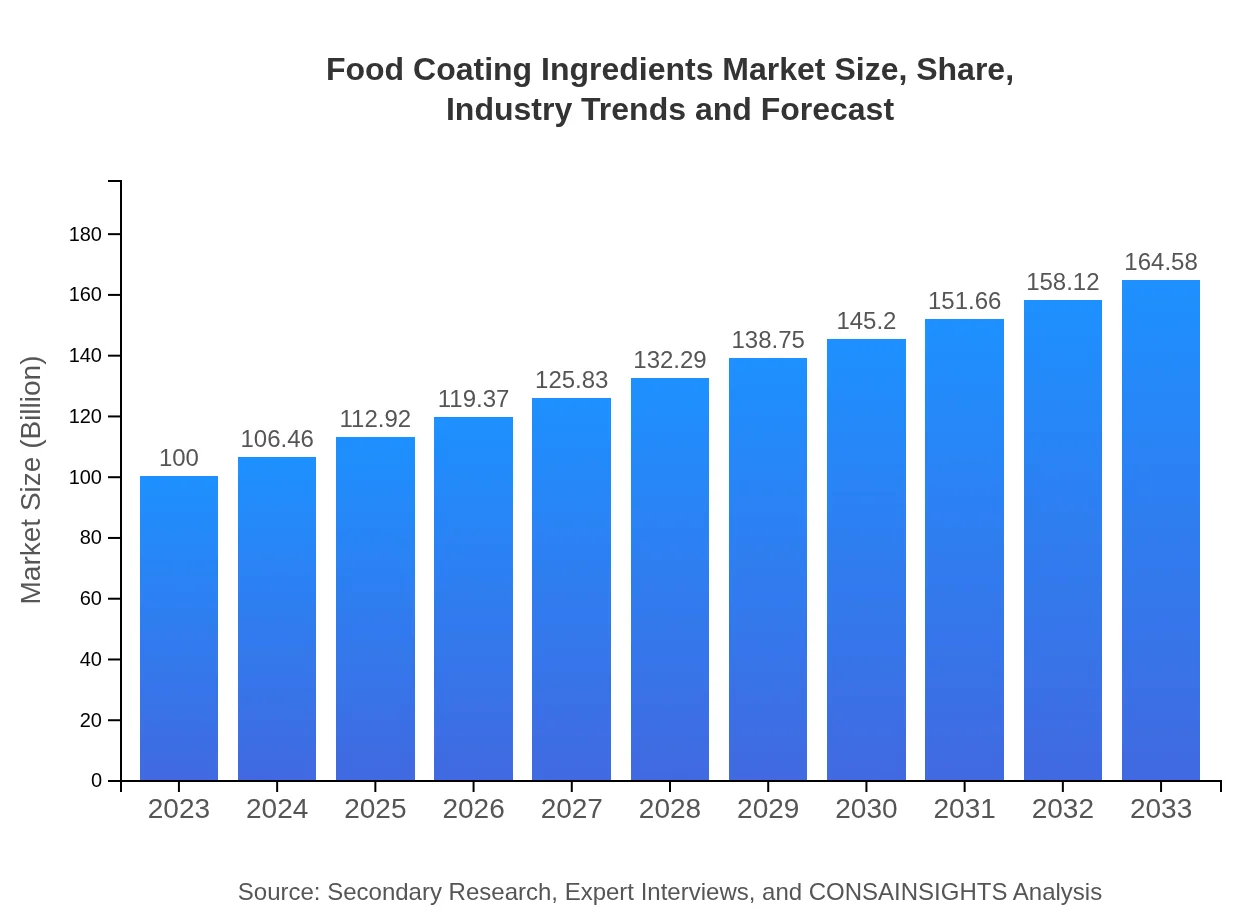

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Cargill, Incorporated, Kerry Group, Ingredion Incorporated, Friedrichs GmbH, Tate & Lyle PLC |

| Last Modified Date | 31 January 2026 |

Food Coating Ingredients Market Overview

Customize Food Coating Ingredients Market Report market research report

- ✔ Get in-depth analysis of Food Coating Ingredients market size, growth, and forecasts.

- ✔ Understand Food Coating Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Coating Ingredients

What is the Market Size & CAGR of Food Coating Ingredients market in 2023?

Food Coating Ingredients Industry Analysis

Food Coating Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Coating Ingredients Market Analysis Report by Region

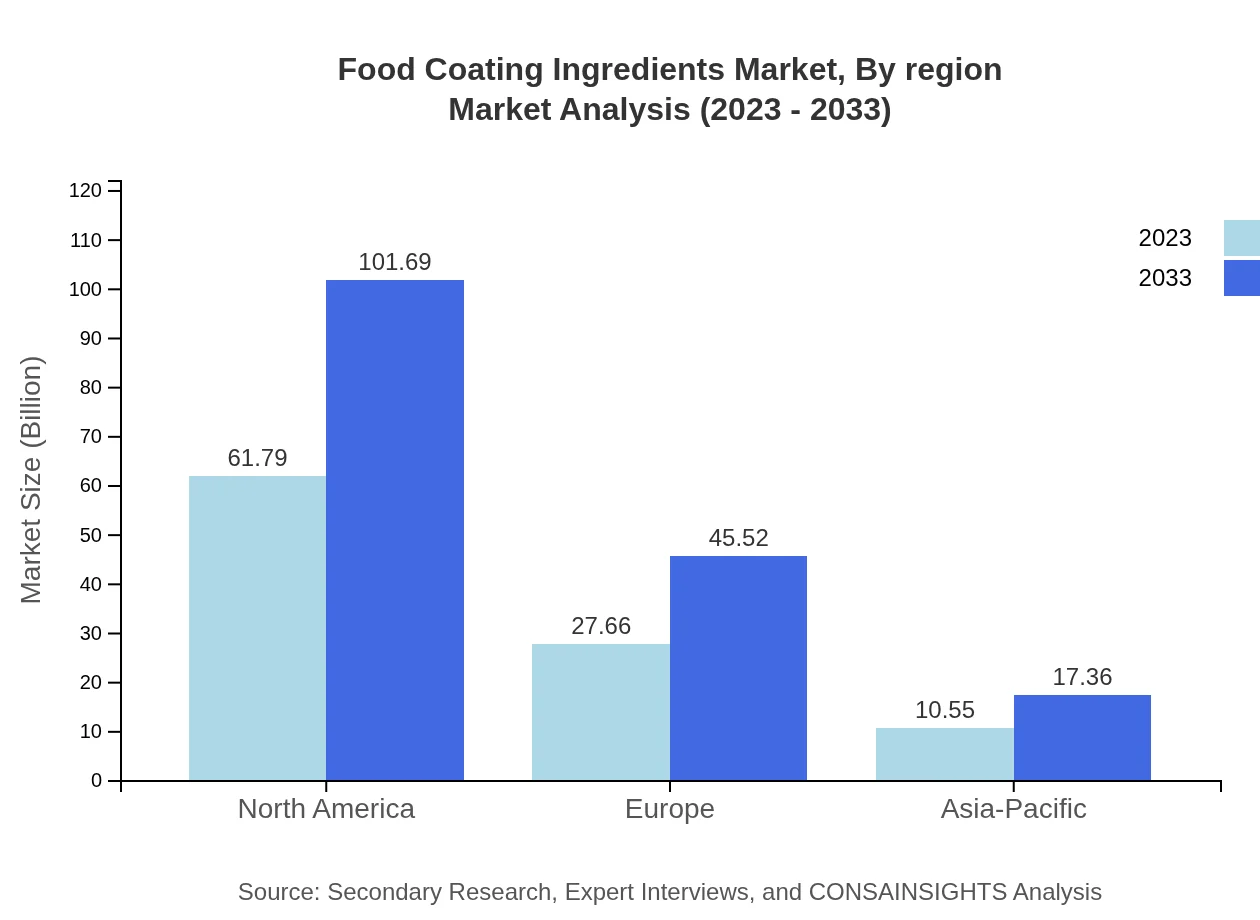

Europe Food Coating Ingredients Market Report:

The European food coating ingredients market is experiencing steady growth, transitioning from a valuation of $29.33 billion in 2023 to an anticipated $48.27 billion in 2033. This growth is spurred by increasing consumer awareness towards food quality and taste, alongside a shift towards clean-label products.Asia Pacific Food Coating Ingredients Market Report:

The Asia Pacific region is seeing substantial growth in the Food Coating Ingredients market, valued at approximately $17.62 billion in 2023 and projected to reach around $29 billion by 2033 due to urbanization, growing disposable incomes, and changing food consumption patterns. The demand for processed food products is particularly driving this growth.North America Food Coating Ingredients Market Report:

North America holds the largest share of the market, with a valuation of $38.83 billion in 2023, expected to rise to $63.90 billion by 2033. Factors such as robust food processing standards, high demand for convenience foods, and the thriving food service sector are key growth drivers.South America Food Coating Ingredients Market Report:

In South America, the Food Coating Ingredients market was valued at approximately $4.69 billion in 2023 and is estimated to reach $7.72 billion by 2033. The region's growing fast-food industry and increasing export of processed foods are contributing significantly to market growth.Middle East & Africa Food Coating Ingredients Market Report:

The Middle East and Africa's market is projected to grow from $9.53 billion in 2023 to $15.68 billion by 2033. The growing population, urbanization, and increasing food consumption are crucial trends influencing the market's expansion.Tell us your focus area and get a customized research report.

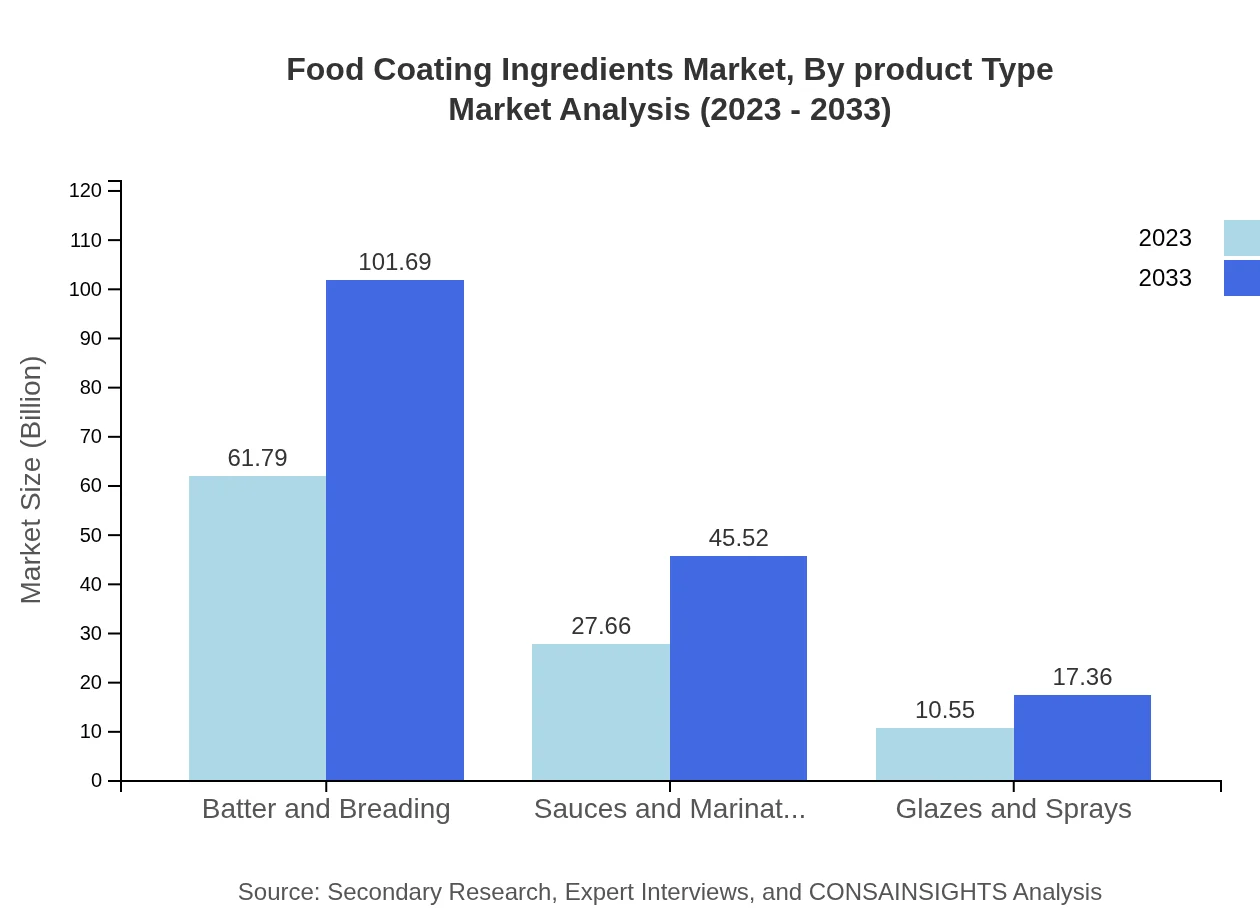

Food Coating Ingredients Market Analysis By Product Type

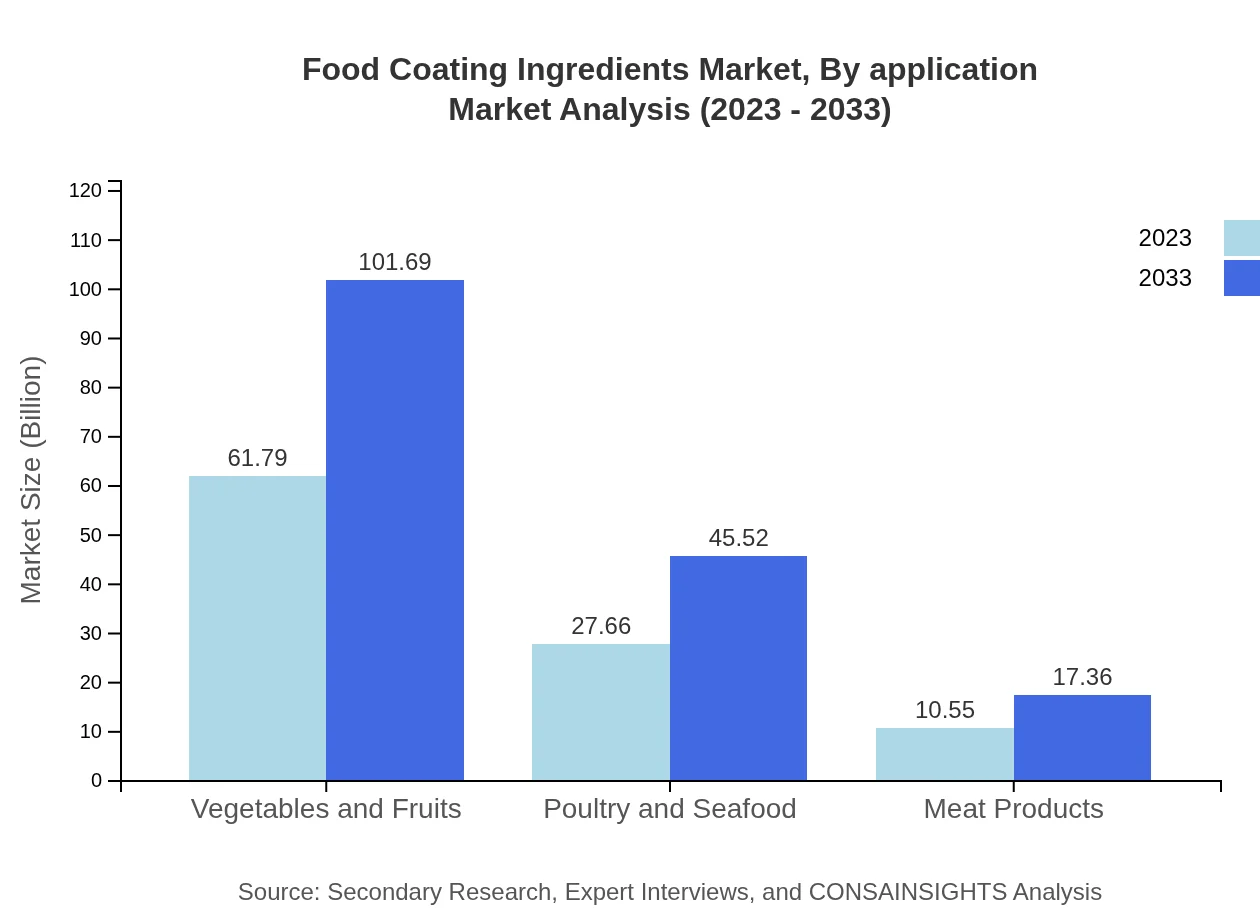

The market for Food Coating Ingredients is dominated by product types such as batter & breading, contributing to a size of $61.79 billion in 2023 and projected to reach $101.69 billion by 2033 due to high application in food service and retail sectors. Sauces and marination are next significant contributors, increasing from $27.66 billion to $45.52 billion over the same period.

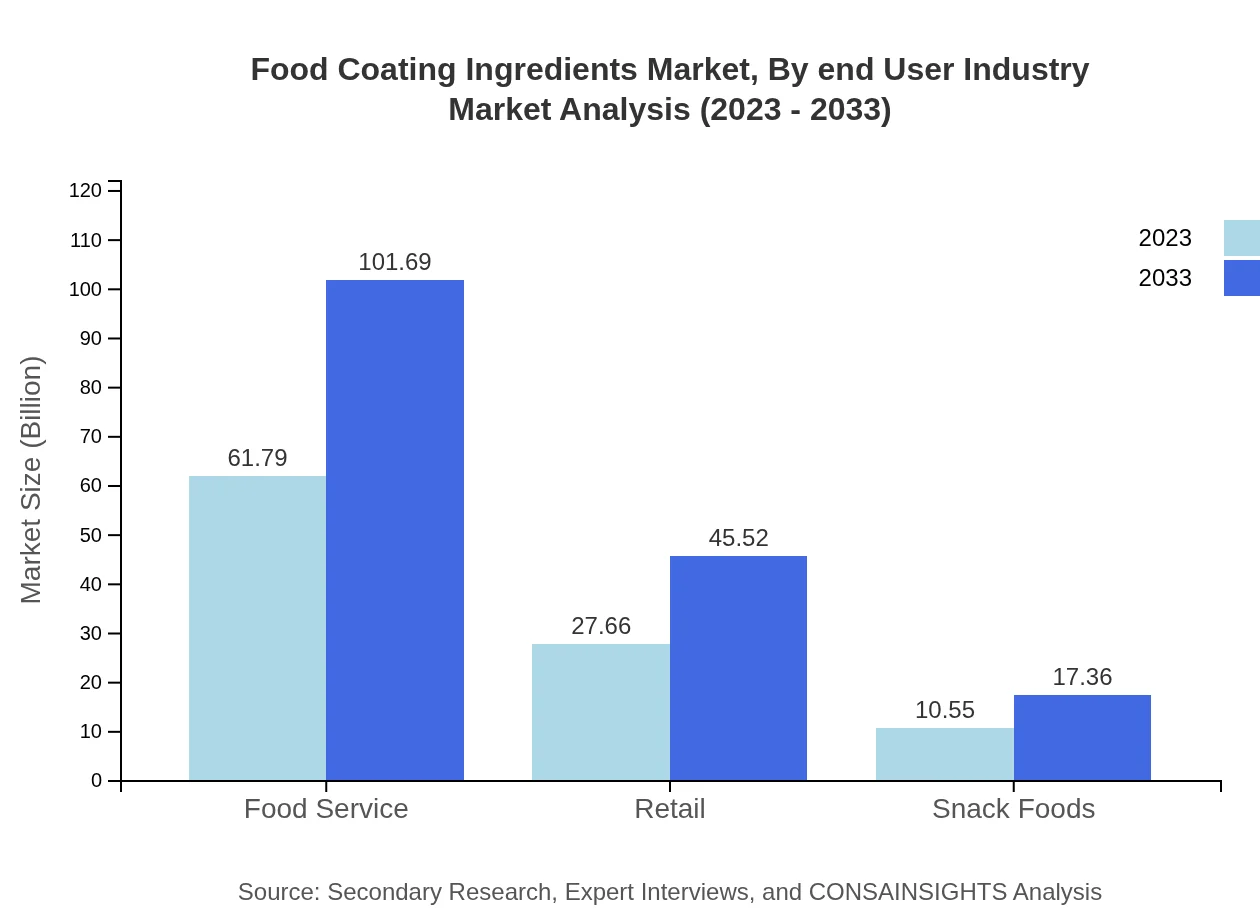

Food Coating Ingredients Market Analysis By End User Industry

The food service sector commands the largest share, with a size of $61.79 billion in 2023, expected to grow to $101.69 billion by 2033. Retail and snack foods follow, increasing from $27.66 billion and $10.55 billion in 2023 to $45.52 billion and $17.36 billion respectively.

Food Coating Ingredients Market Analysis By Region

Regional analysis reveals North America leading the market share with $61.79 billion in 2023, followed by Europe at $27.66 billion and Asia-Pacific at $10.55 billion. This spectrum of market dynamics showcases varying consumer demands and regulatory environments.

Food Coating Ingredients Market Analysis By Application

Applications include a growing trend towards gluten-free and low-carb options in coatings, leading to significant R&D in product formulations. The rising demand for organic and natural coatings directly affects product development direction and market dynamics.

Food Coating Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Coating Ingredients Industry

Cargill, Incorporated:

Cargill is a leader in the food industry, providing high-quality food coating solutions with a focus on sustainability and innovation to meet consumer demands.Kerry Group:

Kerry Group specializes in food ingredients and flavors, known for its extensive portfolio of functional ingredients and culinary expertise that cater to various food segments.Ingredion Incorporated:

Ingredion is a global ingredients solutions company that focuses on product development in food and beverages, with significant investment into food coatings technology and innovation.Friedrichs GmbH:

Friedrichs is notable for its specialty in batters and breaders, serving the meat and poultry markets effectively with innovative and versatile coating solutions.Tate & Lyle PLC:

Tate & Lyle is recognized for its broad selection of food ingredients, providing innovative solutions that enhance the texture, moisture, and flavor of coated food products.We're grateful to work with incredible clients.

FAQs

What is the market size of food Coating Ingredients?

The global food coating ingredients market size is projected to reach $100 million by 2033 with a CAGR of 5% from 2023. This growth reflects increasing demand in various food applications, highlighting the importance of these ingredients in enhancing food quality and shelf life.

What are the key market players or companies in this food Coating Ingredients industry?

Key players in the food coating ingredients market typically include major food ingredient suppliers, manufacturers, and distributors. These companies often focus on innovation, quality enhancement, and sustainable practices to capture market shares and meet consumer demands.

What are the primary factors driving the growth in the food Coating Ingredients industry?

Significant growth drivers in the food-coating-ingredients market are increasing consumer demand for processed food, trends favoring convenience foods, and the need for superior texture and taste in food products. Additionally, health consciousness leads to innovations in healthier coating options.

Which region is the fastest Growing in the food Coating Ingredients?

Among global regions, North America is the fastest-growing market for food coating ingredients, expected to grow from $38.83 million in 2023 to $63.90 million by 2033. Europe and Asia-Pacific also show significant growth potentials due to rising demand.

Does ConsaInsights provide customized market report data for the food Coating Ingredients industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the food-coating-ingredients industry. Clients can request detailed analyses based on particular segments, geographic areas, or demographic criteria to meet their strategic needs.

What deliverables can I expect from this food Coating Ingredients market research project?

Deliverables from the food-coating-ingredients market research project will typically include comprehensive reports, detailed market analyses, market forecasts, segment insights, and strategic recommendations that guide decision-making for stakeholders in the food industry.

What are the market trends of food Coating Ingredients?

Current market trends in food-coating-ingredients indicate a shift towards natural and organic coatings, the rise of vegan alternatives, and innovative applications in diverse food categories. Sustainability practices are also influencing ingredient sourcing and production processes.