Food Containers Market Report

Published Date: 31 January 2026 | Report Code: food-containers

Food Containers Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Food Containers market, analyzing trends, segmentation, regional performance, and forecasts from 2023 to 2033. It covers market size, growth potential, and the competitive landscape of key industry players.

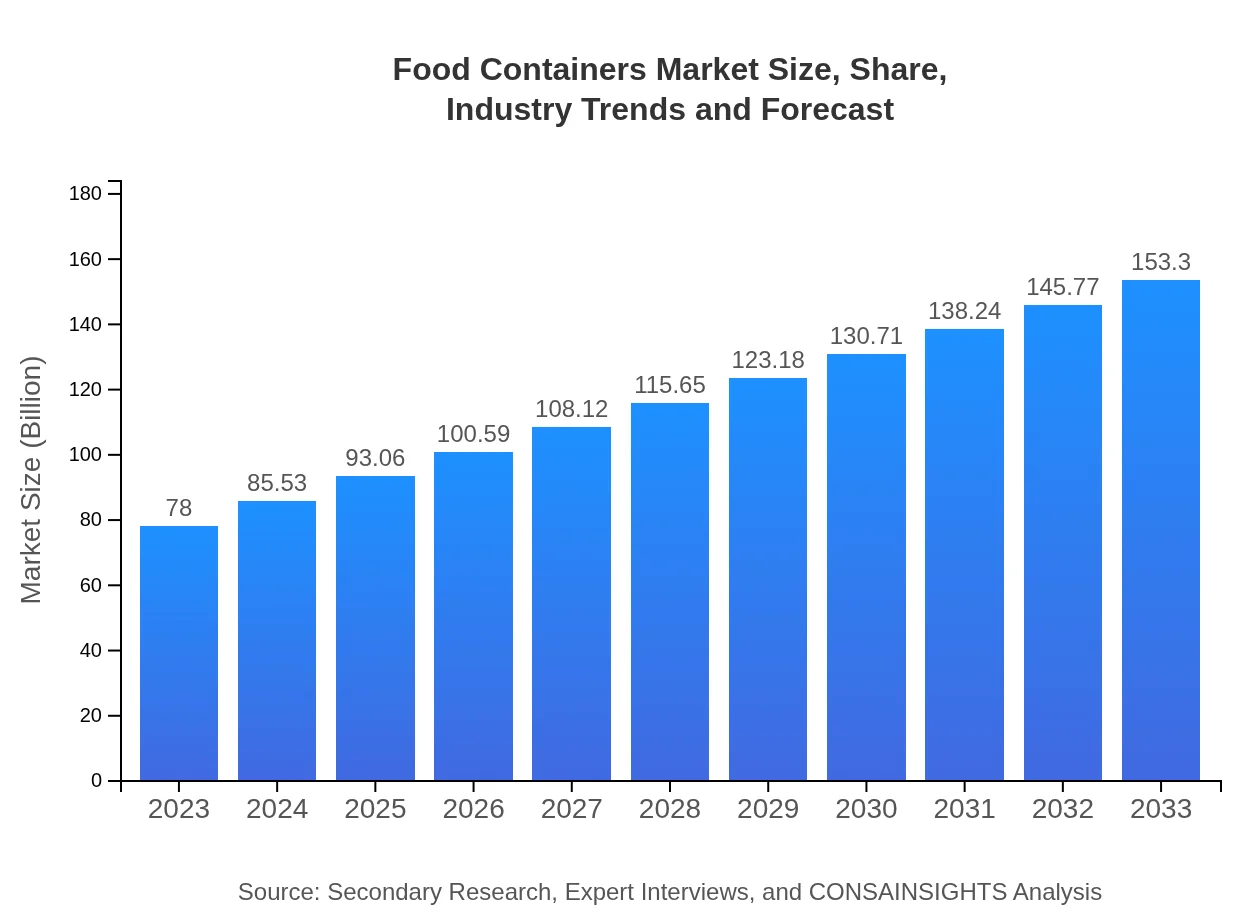

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $78.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $153.30 Billion |

| Top Companies | Tupperware Brands Corporation, Lock & Lock, Pyrex, Rubbermaid, Henkel AG |

| Last Modified Date | 31 January 2026 |

Food Containers Market Overview

Customize Food Containers Market Report market research report

- ✔ Get in-depth analysis of Food Containers market size, growth, and forecasts.

- ✔ Understand Food Containers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Containers

What is the Market Size & CAGR of Food Containers market in 2023 and 2033?

Food Containers Industry Analysis

Food Containers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Containers Market Analysis Report by Region

Europe Food Containers Market Report:

The European market is expected to grow from $22.76 billion in 2023 to $44.73 billion by 2033. Factors such as stringent regulations promoting environmental sustainability, along with a growing inclination towards healthy eating habits, are shaping the food containers landscape in this region. Innovations in sustainable packaging are likely to spearhead market growth.Asia Pacific Food Containers Market Report:

In the Asia Pacific region, the market is expected to witness significant growth from $14.71 billion in 2023 to $28.91 billion in 2033. Rising urbanization, along with increasing disposable incomes, contributes to elevated demand for packaged food products, thereby boosting the food containers market. Additionally, growing concerns around food safety and preservation further support this growth.North America Food Containers Market Report:

North America holds a significant share in the food containers market with a value estimated at $29.05 billion in 2023, potentially growing to $57.11 billion by 2033. The growth trajectory is influenced by the increasing trend of meal prepping, heightened health awareness, and a robust presence of e-commerce platforms facilitating the distribution of food containers.South America Food Containers Market Report:

The South American food containers market, valued at $2.92 billion in 2023, is projected to expand to $5.73 billion by 2033. Increasing consumer awareness and a focus on convenience and sustainability drive the market dynamics. Local brands are also incorporating innovative solutions catering to the rising demand for leak-proof and microwave-safe containers.Middle East & Africa Food Containers Market Report:

In the Middle East and Africa, the food containers market is projected to rise from $8.56 billion in 2023 to $16.82 billion by 2033. The region's growth is driven by urbanization and a burgeoning foodservice industry complemented by increasing disposable incomes that allow consumers access to diverse food storage solutions.Tell us your focus area and get a customized research report.

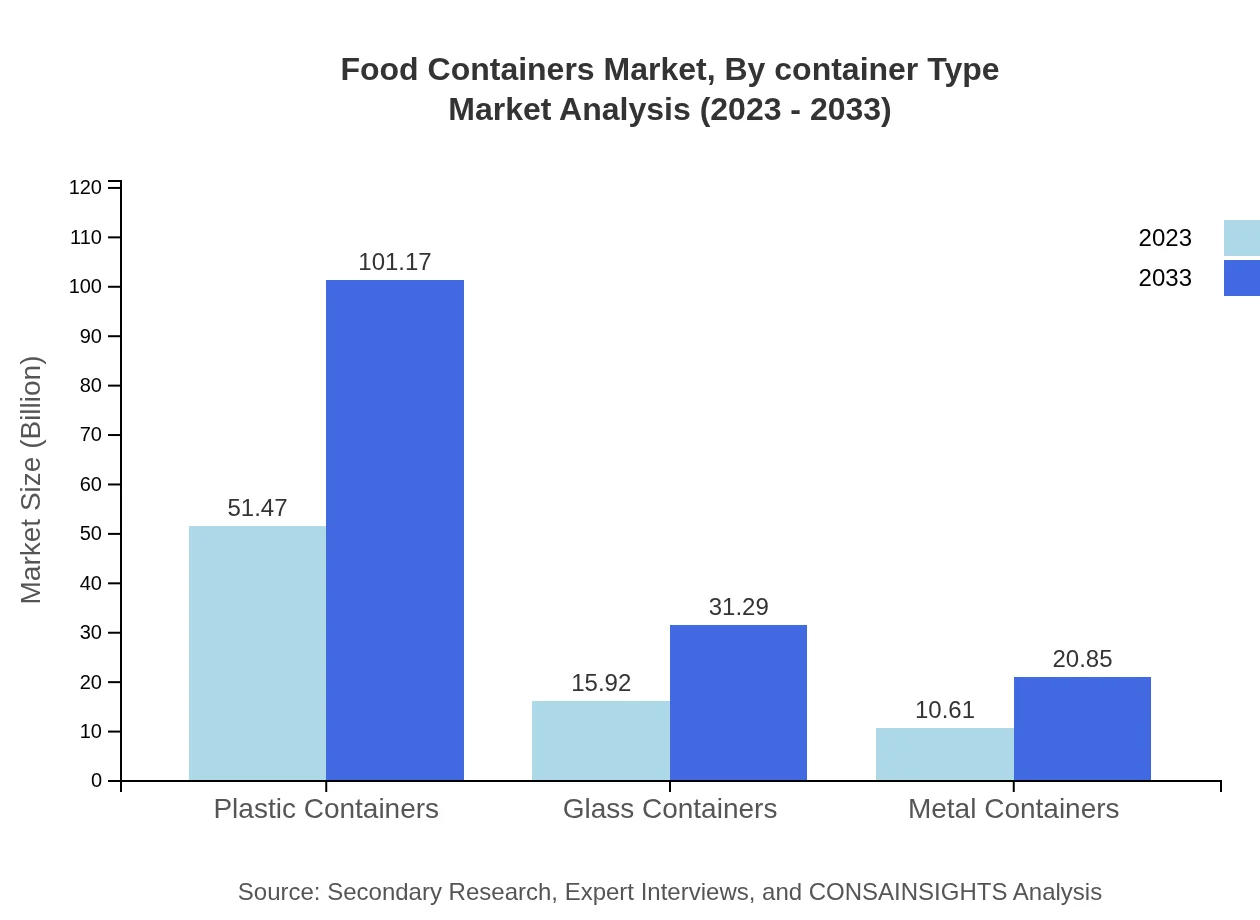

Food Containers Market Analysis By Container Type

The Food Containers market across various container types is dominated by plastic containers, constituting 65.99% market share in 2023, with projected growth following similar trends into 2033, while glass containers and metal containers maintain significant but smaller market shares due to higher price points.

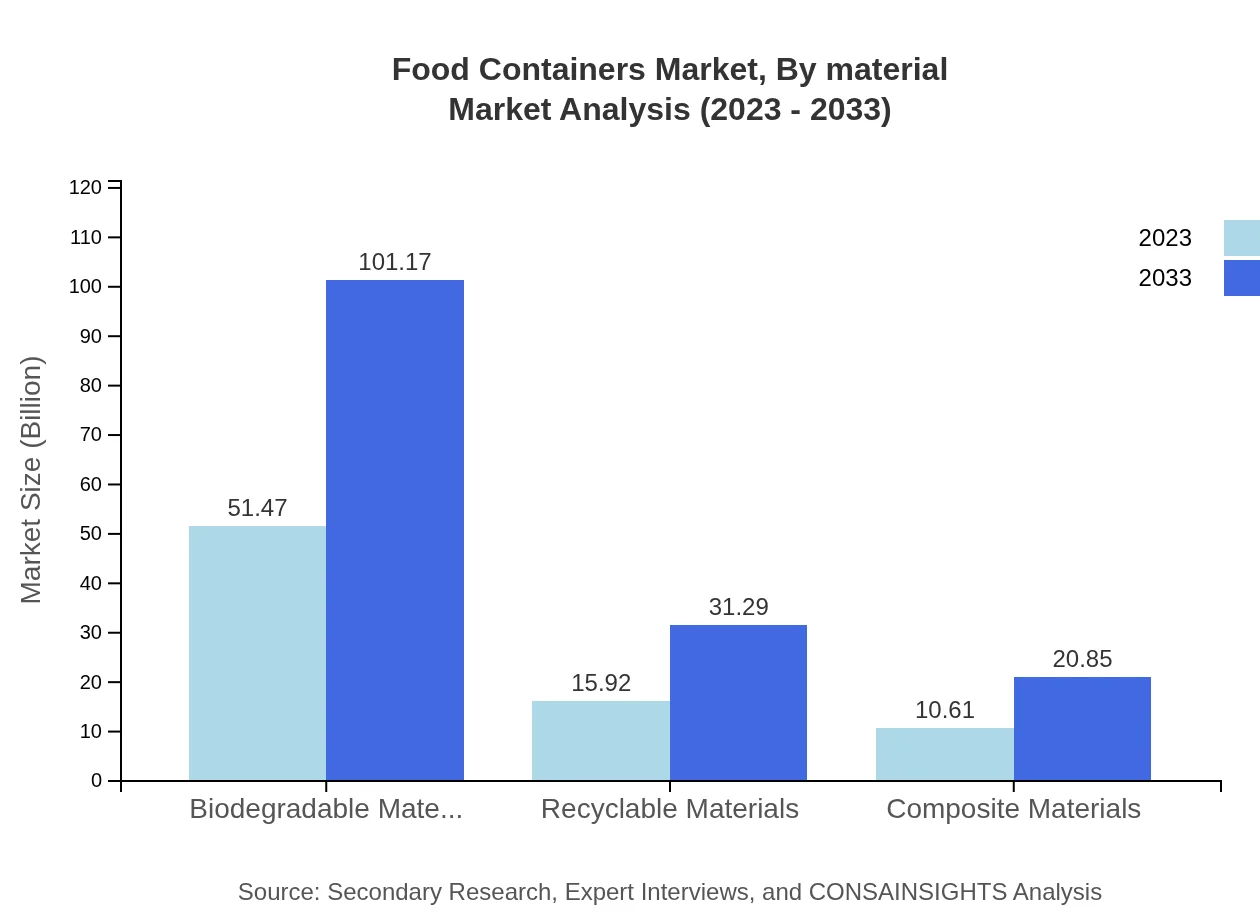

Food Containers Market Analysis By Material

Biodegradable and recyclable materials are gaining attention, as consumers increasingly prefer environmentally friendly options. The market share for biodegradable materials is set to maintain a leading role at 65.99%, reflecting growing environmental consciousness among consumers.

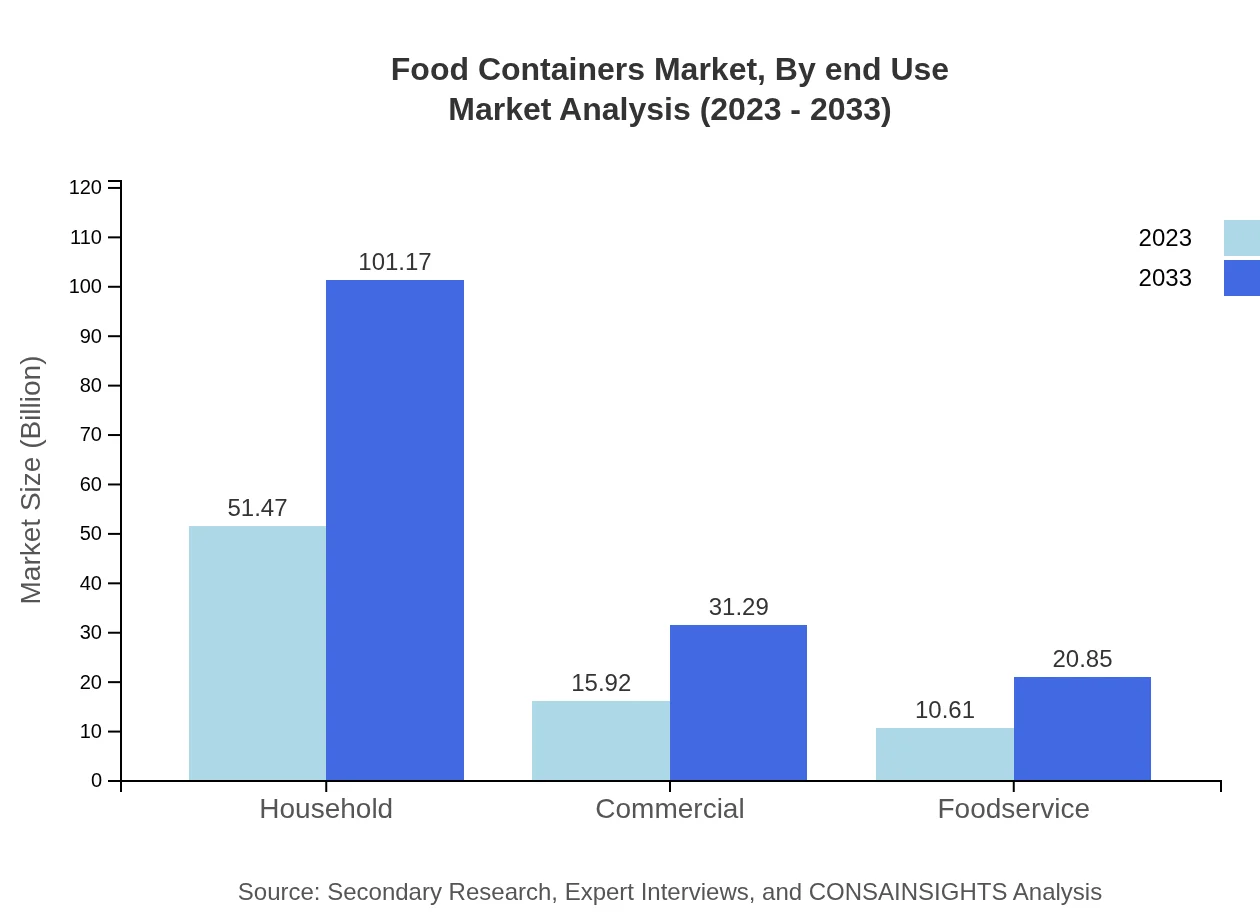

Food Containers Market Analysis By End Use

Household use represents the largest segment of the market, with a share of 65.99% in 2023, driven by trends in home-cooked meals and family dining. Commercial and foodservice uses also present robust growth opportunities as more chefs and restaurants opt for quality food storage solutions.

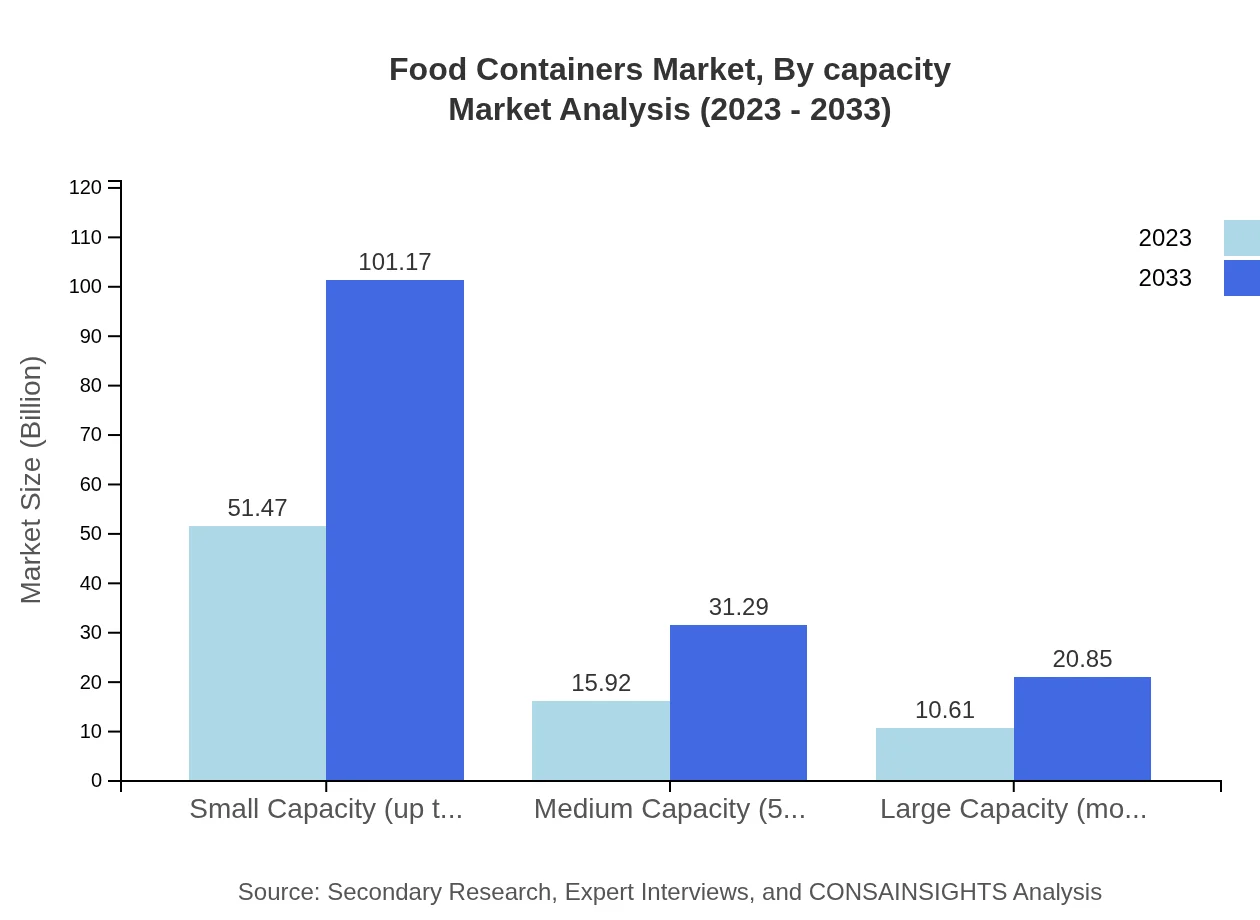

Food Containers Market Analysis By Capacity

Small capacity containers dominate the market with a share of 65.99% in 2023 due to their convenience and versatility, while medium capacity containers also exhibit positive growth trends as meal portioning becomes more prevalent.

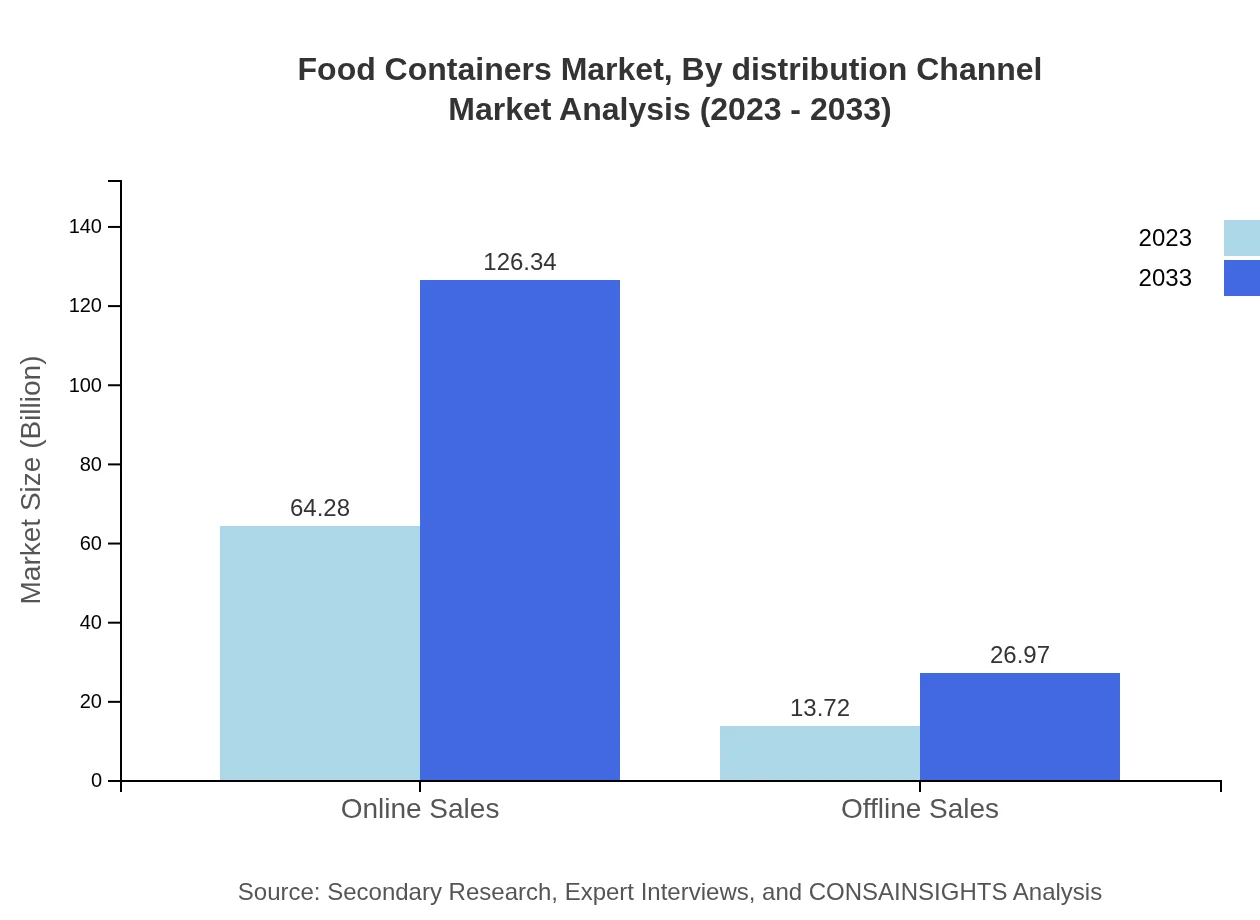

Food Containers Market Analysis By Distribution Channel

Online sales have significantly impacted market dynamics, constituting 82.41% of the market share in 2023. E-commerce's growth has shifted consumer purchasing behavior towards convenience, enhancing the reach of food container brands.

Food Containers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Containers Industry

Tupperware Brands Corporation:

A leading manufacturer of reusable food containers, renowned for their innovative designs and commitment to sustainability.Lock & Lock:

Specializes in airtight food storage solutions with a heavy emphasis on using eco-friendly materials across their product lines.Pyrex:

Known for its robust glass containers suitable for food storage, Pyrex integrates technology with durability, supported by their strong brand equity.Rubbermaid:

A household name in food storage solutions, Rubbermaid continues to innovate by introducing a range of products designed for different consumer needs.Henkel AG:

Holding diverse interests, Henkel produces a variety of food container solutions, focusing on sustainable packaging practices.We're grateful to work with incredible clients.

FAQs

What is the market size of food Containers?

The global food containers market is projected to reach approximately $78 billion by 2033, growing at a CAGR of 6.8%. This growth reflects increasing demand for convenience and sustainable packaging solutions.

What are the key market players or companies in this food Containers industry?

Key players in the food containers market include major packaging manufacturers, distributors, and retailers. These companies are implementing innovative practices to compete in the expanding market.

What are the primary factors driving the growth in the food Containers industry?

The growth in the food containers industry is driven by rising consumer demand for convenient and portable food solutions, sustainability efforts in packaging materials, and innovations in production technology.

Which region is the fastest Growing in the food Containers?

The Asia Pacific region is the fastest-growing area in the food containers market, with its size expected to increase from $14.71 billion in 2023 to $28.91 billion by 2033, reflecting strong economic growth.

Does ConsaInsights provide customized market report data for the food Containers industry?

Yes, ConsaInsights offers customized market report data for the food containers industry, allowing businesses to gain tailored insights specific to their needs and market dynamics.

What deliverables can I expect from this food Containers market research project?

Deliverables include comprehensive market analysis reports, growth projections, competitive landscape assessments, trend analysis, and detailed data segmentation by region and material type.

What are the market trends of food Containers?

Current market trends include a shift towards biodegradable and recyclable materials, an increase in e-commerce sales, and innovations in container design to enhance usability and sustainability.