Food Emulsifiers Market Report

Published Date: 31 January 2026 | Report Code: food-emulsifiers

Food Emulsifiers Market Size, Share, Industry Trends and Forecast to 2033

This report details the Food Emulsifiers market, offering insights on market trends, size forecasts from 2023 to 2033, industry analysis, and region-wise breakdowns to help stakeholders make informed decisions.

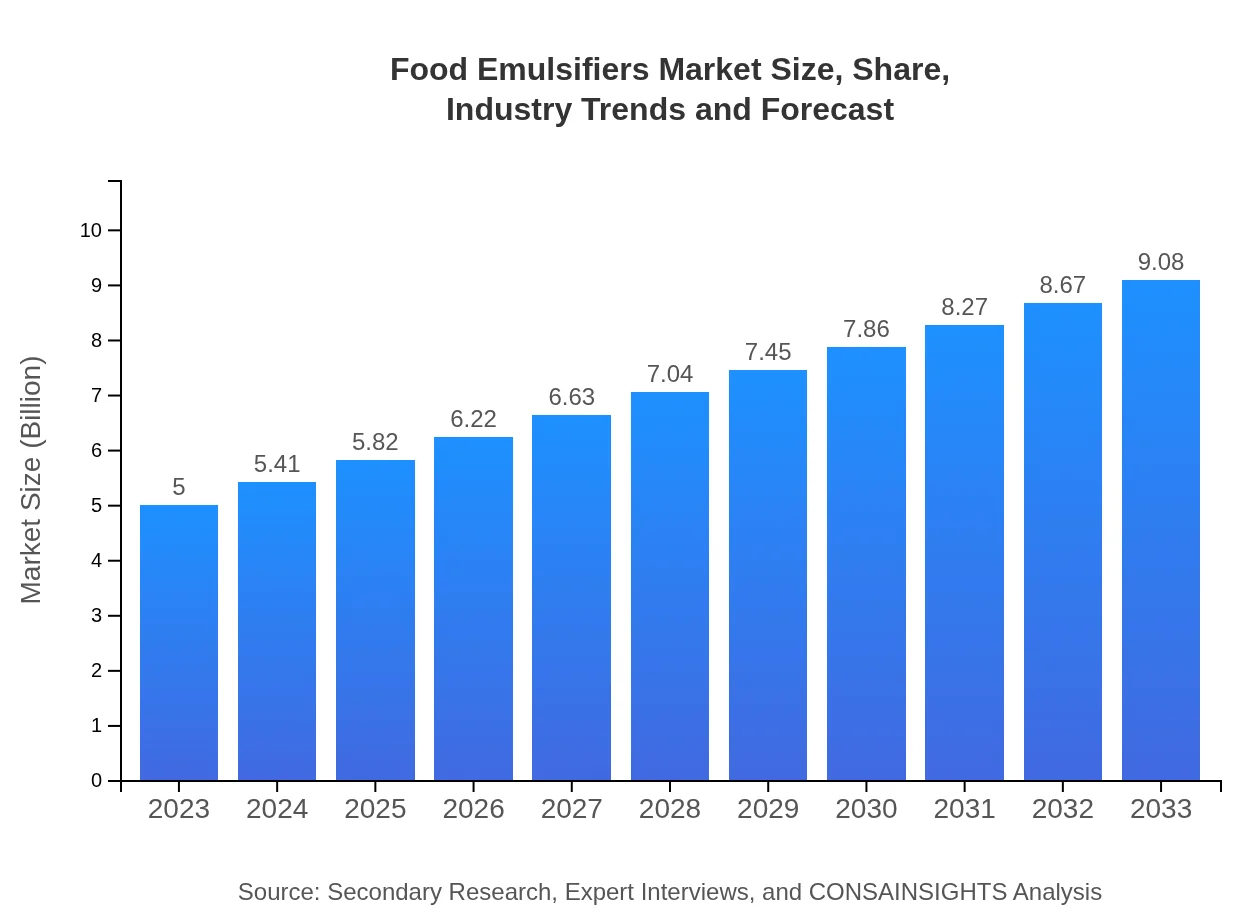

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Cargill, Incorporated, DowDuPont, BASF SE, Kerry Group, Tamworth Chemicals |

| Last Modified Date | 31 January 2026 |

Food Emulsifiers Market Overview

Customize Food Emulsifiers Market Report market research report

- ✔ Get in-depth analysis of Food Emulsifiers market size, growth, and forecasts.

- ✔ Understand Food Emulsifiers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Emulsifiers

What is the Market Size & CAGR of Food Emulsifiers market in 2023?

Food Emulsifiers Industry Analysis

Food Emulsifiers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Emulsifiers Market Analysis Report by Region

Europe Food Emulsifiers Market Report:

Europe’s market for Food Emulsifiers is valued at $1.46 billion in 2023 and expected to grow to $2.66 billion by 2033. As consumers demand high-quality food products, the focus has shifted to sustainability and health benefits.Asia Pacific Food Emulsifiers Market Report:

In 2023, the Asia Pacific Food Emulsifiers market is valued at $0.94 billion and is expected to grow to $1.71 billion by 2033. Rapid urbanization, growing disposable incomes, and increasing consumption of processed foods propel market growth in this region.North America Food Emulsifiers Market Report:

North America leads the Food Emulsifiers market with a size of $1.87 billion in 2023, projected to reach $3.40 billion by 2033. The demand for convenience foods and a rising preference for homemade foods are key trends in this region.South America Food Emulsifiers Market Report:

The South American market for Food Emulsifiers is projected to grow from $0.28 billion in 2023 to $0.50 billion by 2033. An increase in food manufacturing and a trend towards premium food products are driving this growth.Middle East & Africa Food Emulsifiers Market Report:

In the Middle East and Africa, the Food Emulsifiers market is expected to grow from $0.45 billion in 2023 to $0.81 billion by 2033. Growth in this region is largely driven by an increase in bakery and dairy product consumption.Tell us your focus area and get a customized research report.

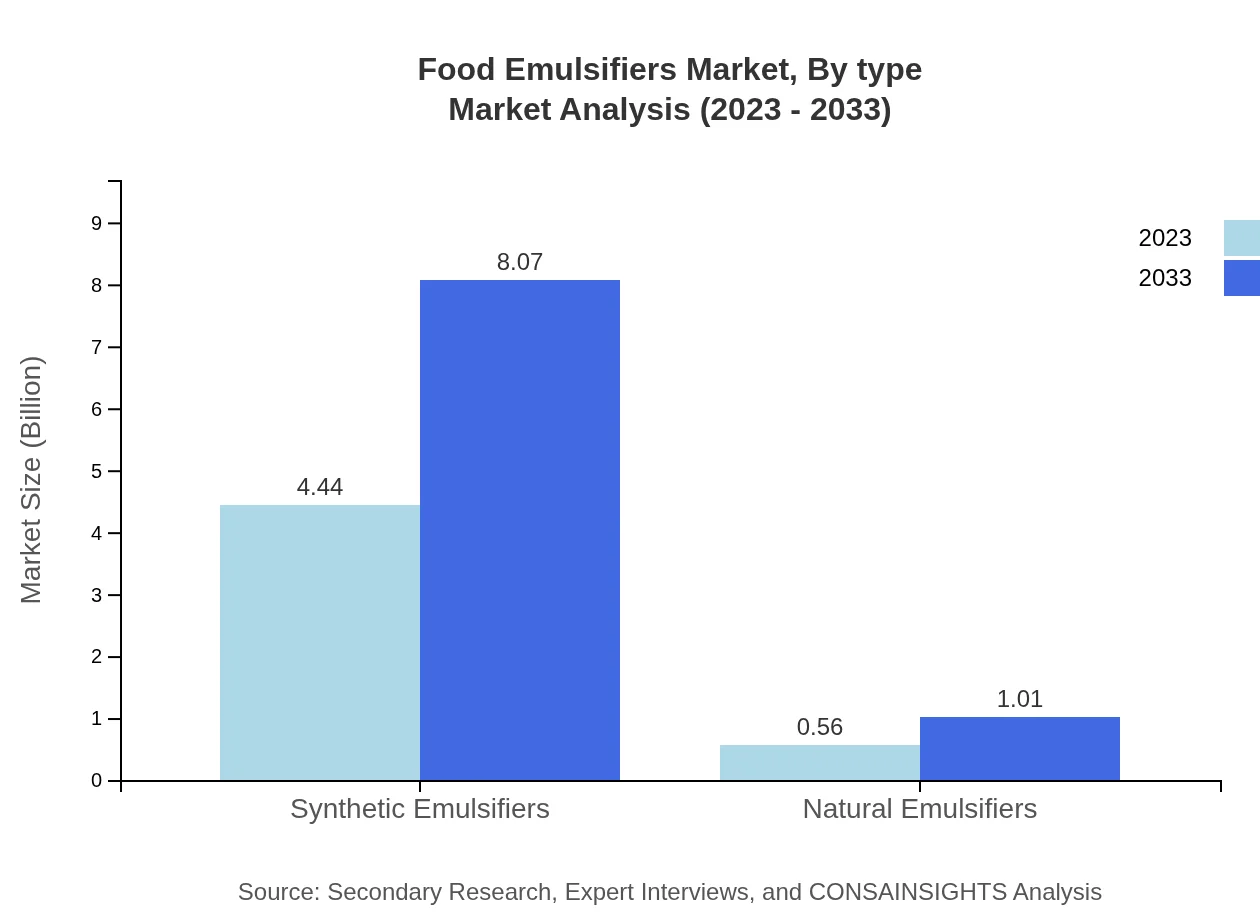

Food Emulsifiers Market Analysis By Type

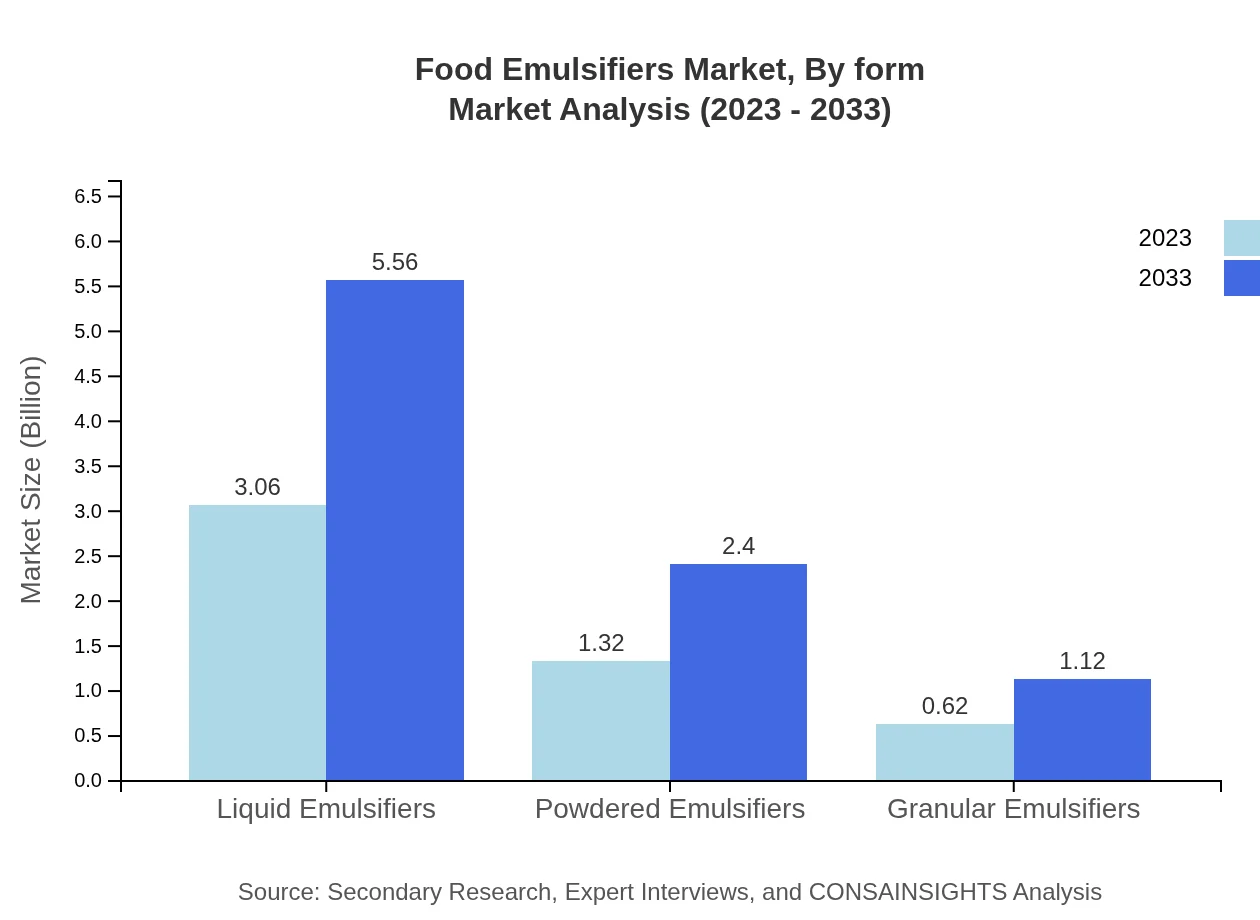

In 2023, the market for liquid emulsifiers stands at $3.06 billion, projected to increase to $5.56 billion by 2033, holding a consistent market share of 61.22%. Powdered emulsifiers also see robust growth, from $1.32 billion to $2.40 billion, retaining a 26.45% share. Granular emulsifiers exhibit steady growth from $0.62 billion to $1.12 billion, making up 12.33%. Furthermore, the synthetic emulsifiers market dominates with $4.44 billion (88.85% share in 2023), while natural emulsifiers represent a growing segment from $0.56 billion to $1.01 billion (11.15% share).

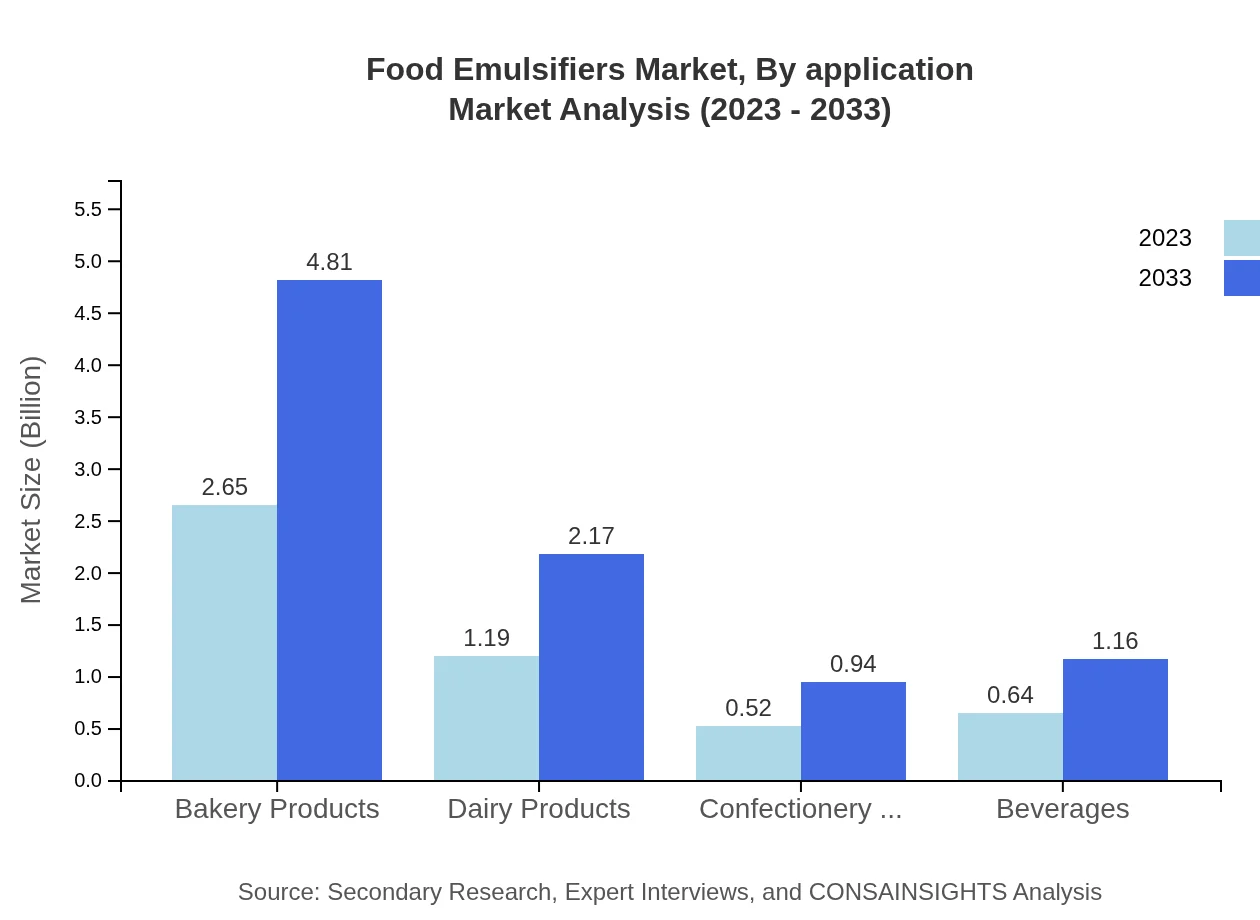

Food Emulsifiers Market Analysis By Application

Bakery products are the leading application segment with a market size anticipated to rise from $2.65 billion in 2023 to $4.81 billion by 2033, maintaining a 52.98% market share. Dairy products will see an increase from $1.19 billion to $2.17 billion, representing 23.85% market share. Confectionery products hold a 10.35% share with growth from $0.52 billion to $0.94 billion. The beverage sector also exhibits potential with growth from $0.64 billion to $1.16 billion, retaining a market share of 12.82%.

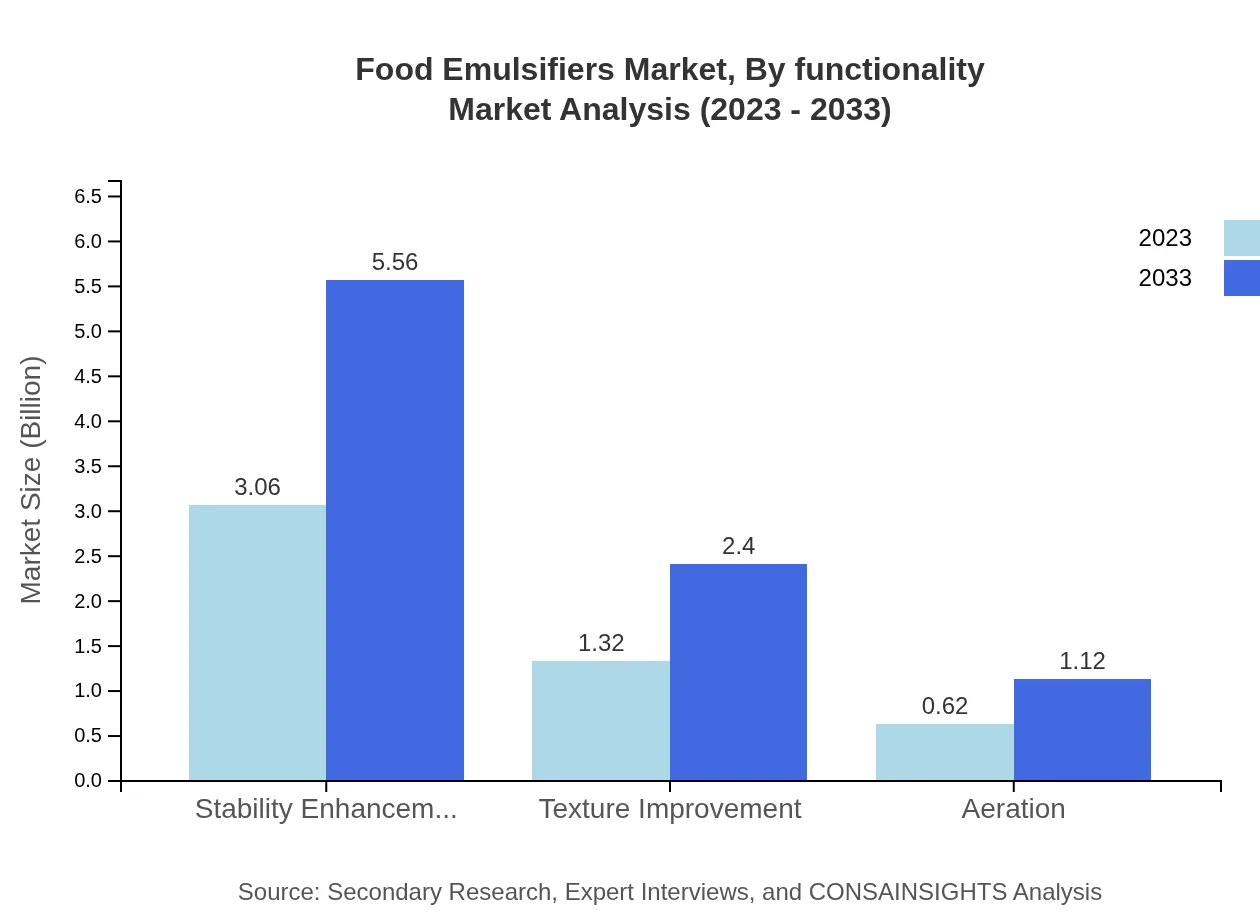

Food Emulsifiers Market Analysis By Functionality

In terms of functionality, stability enhancement leads with $3.06 billion (61.22% market share), projected to grow to $5.56 billion. Texture improvement follows closely from $1.32 billion to $2.40 billion, holding 26.45% market share. Aeration stands at a 12.33% share, moving from $0.62 billion to $1.12 billion over the forecast period.

Food Emulsifiers Market Analysis By Form

The Food Emulsifiers market is dominated by liquid forms accounting for the largest share in usage due to their versatility across applications, leading in utilization for manufacturing. Powdered and granular forms also maintain significant roles, particularly in specialized applications requiring different properties, contributing to the overall market growth.

Food Emulsifiers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Emulsifiers Industry

Cargill, Incorporated:

Cargill is a global leader in food production, providing a range of emulsifiers and stabilizers aimed at improving food quality and texture.DowDuPont:

DowDuPont offers advanced emulsifier solutions, focusing on innovation and sustainability in food manufacturing.BASF SE:

BASF is a leading chemical company that provides high-quality food emulsifiers with a focus on functionality and regulatory compliance.Kerry Group:

Kerry Group specializes in food ingredients and flavorings, including unique emulsifier formulations that enhance product performance.Tamworth Chemicals:

Tamworth Chemicals produces a variety of emulsifiers designed for use in food applications, contributing to enhanced shelf life and quality.We're grateful to work with incredible clients.

FAQs

What is the market size of food emulsifiers?

The global food emulsifiers market is valued at approximately $5 billion in 2023, with a projected growth rate of 6% CAGR. By 2033, the market is anticipated to significantly expand, reflecting a growing demand across various food applications.

What are the key market players or companies in this food emulsifiers industry?

Key players in the food emulsifiers industry include major companies like DowDuPont, BASF, and Ingredion. These companies dominate the market through extensive product offerings and strategic partnerships, ensuring high-quality emulsifiers for various food applications.

What are the primary factors driving the growth in the food emulsifiers industry?

Growth in the food emulsifiers industry is driven by rising demand for processed foods, increasing consumer preference for convenience products, and innovations in food technology. Additionally, the growing popularity of natural emulsifiers contributes significantly to market expansion.

Which region is the fastest Growing in the food emulsifiers market?

North America is currently the fastest-growing region in the food emulsifiers market, with a market value projected to increase from $1.87 billion in 2023 to $3.40 billion by 2033. Europe also shows robust growth, indicating a strong market potential.

Does ConsaInsights provide customized market report data for the food emulsifiers industry?

Yes, ConsaInsights offers customized market research reports tailored to the specific needs of clients in the food emulsifiers industry, ensuring that businesses receive relevant insights and data that cater to their unique requirements.

What deliverables can I expect from this food emulsifiers market research project?

Customers can expect comprehensive market analysis reports, detailed industry insights, segmentation data, competitive landscape assessments, and future outlook projections, equipping stakeholders with the necessary tools for informed decision-making.

What are the market trends of food emulsifiers?

Current market trends in the food emulsifiers sector include a shift towards natural emulsifiers, increased adoption of clean label products, and innovation in functional food ingredients. These trends align with growing consumer demands for healthier and more sustainable food options.