Food Encapsulation Market Report

Published Date: 31 January 2026 | Report Code: food-encapsulation

Food Encapsulation Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Food Encapsulation market covering market dynamics, size forecasts, technological advancements, and regional assessments from 2023 to 2033, aiming to provide stakeholders with valuable insights for informed decision-making.

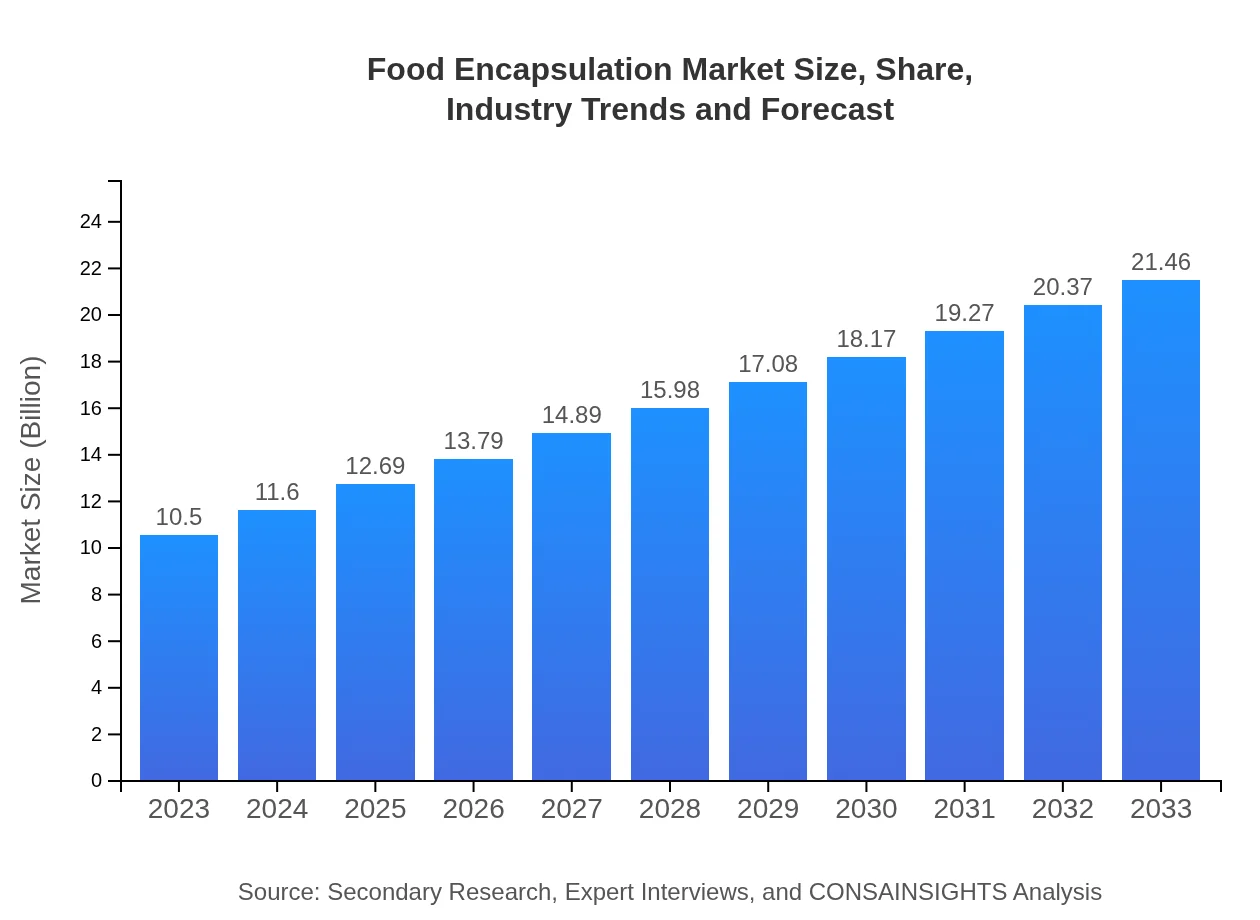

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | BASF SE, Cargill, Inc., Givaudan SA, International Flavors & Fragrances Inc., Sensient Technologies Corporation |

| Last Modified Date | 31 January 2026 |

Food Encapsulation Market Overview

Customize Food Encapsulation Market Report market research report

- ✔ Get in-depth analysis of Food Encapsulation market size, growth, and forecasts.

- ✔ Understand Food Encapsulation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Encapsulation

What is the Market Size & CAGR of Food Encapsulation market in 2023?

Food Encapsulation Industry Analysis

Food Encapsulation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Encapsulation Market Analysis Report by Region

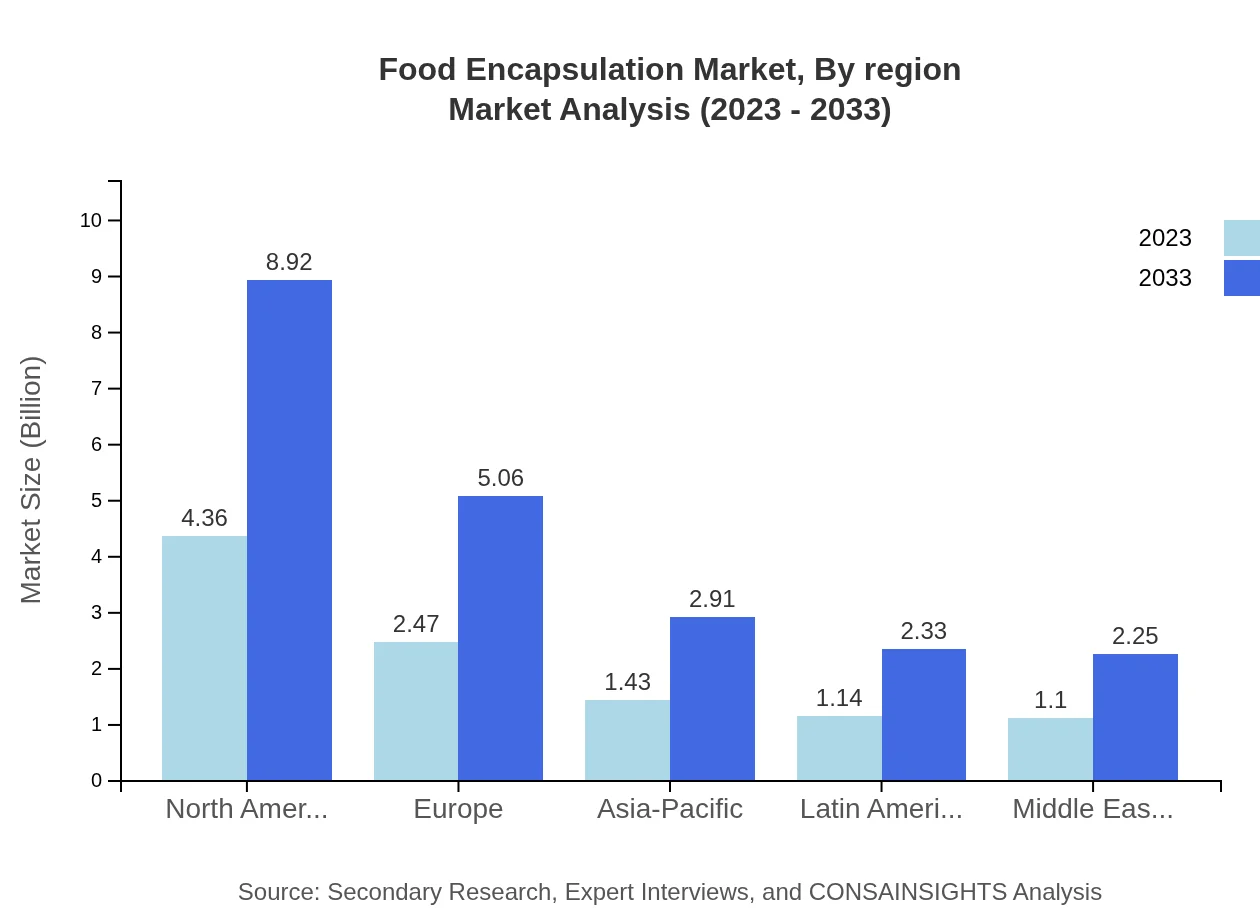

Europe Food Encapsulation Market Report:

The European Food Encapsulation market is forecasted to expand from $3.68 billion in 2023 to $7.52 billion by 2033. Major trends include stringent food quality regulations and a rising focus on food safety, which drive the adoption of advanced encapsulation technologies.Asia Pacific Food Encapsulation Market Report:

The Asia-Pacific region is projected to exhibit steady growth in the Food Encapsulation market, reaching approximately $3.83 billion by 2033, up from $1.87 billion in 2023. An increasing consumer base and rising investments in innovative food processing technologies are driving this trend.North America Food Encapsulation Market Report:

North America holds a significant share in the Food Encapsulation market, with a projected size of $7.08 billion by 2033, escalating from $3.46 billion in 2023. The region's well-established food industry and strong demand for health and wellness products contribute to its prominent market position.South America Food Encapsulation Market Report:

The South American market for Food Encapsulation is expected to grow from $0.14 billion in 2023 to $0.29 billion by 2033. The growth rate in this region is attributed to the expanding food and beverage sector and a growing preference for functional foods.Middle East & Africa Food Encapsulation Market Report:

In the Middle East and Africa, the market is anticipated to increase from $1.34 billion in 2023 to $2.75 billion by 2033, driven by growing urbanization and an increasing appetite for processed food products.Tell us your focus area and get a customized research report.

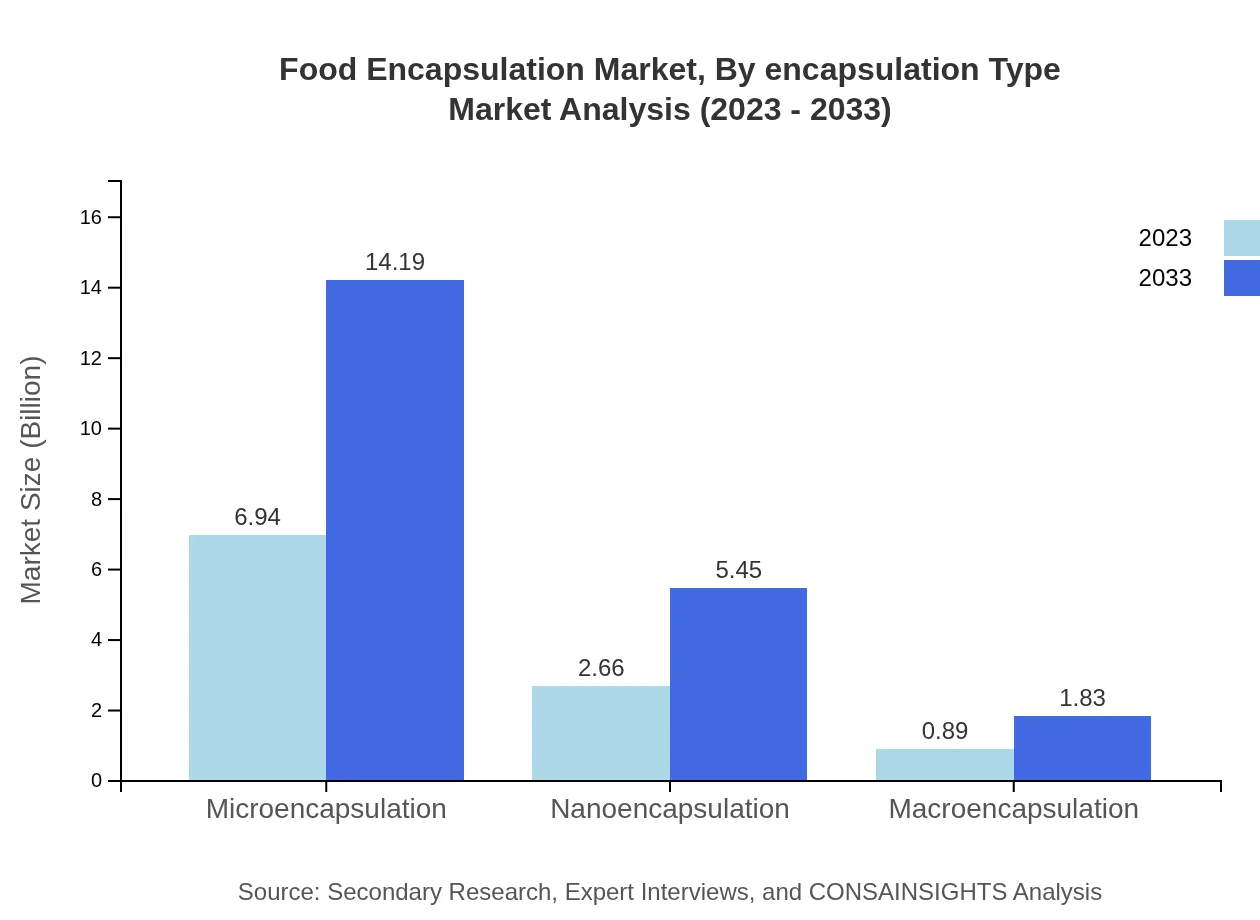

Food Encapsulation Market Analysis By Encapsulation Type

Microencapsulation dominates the Food Encapsulation market, valued at $6.94 billion in 2023, expected to reach $14.19 billion by 2033. Nanoencapsulation follows, with a 2023 value of $2.66 billion projected to grow to $5.45 billion. Macroencapsulation accounts for a smaller share but is essential in specific applications.

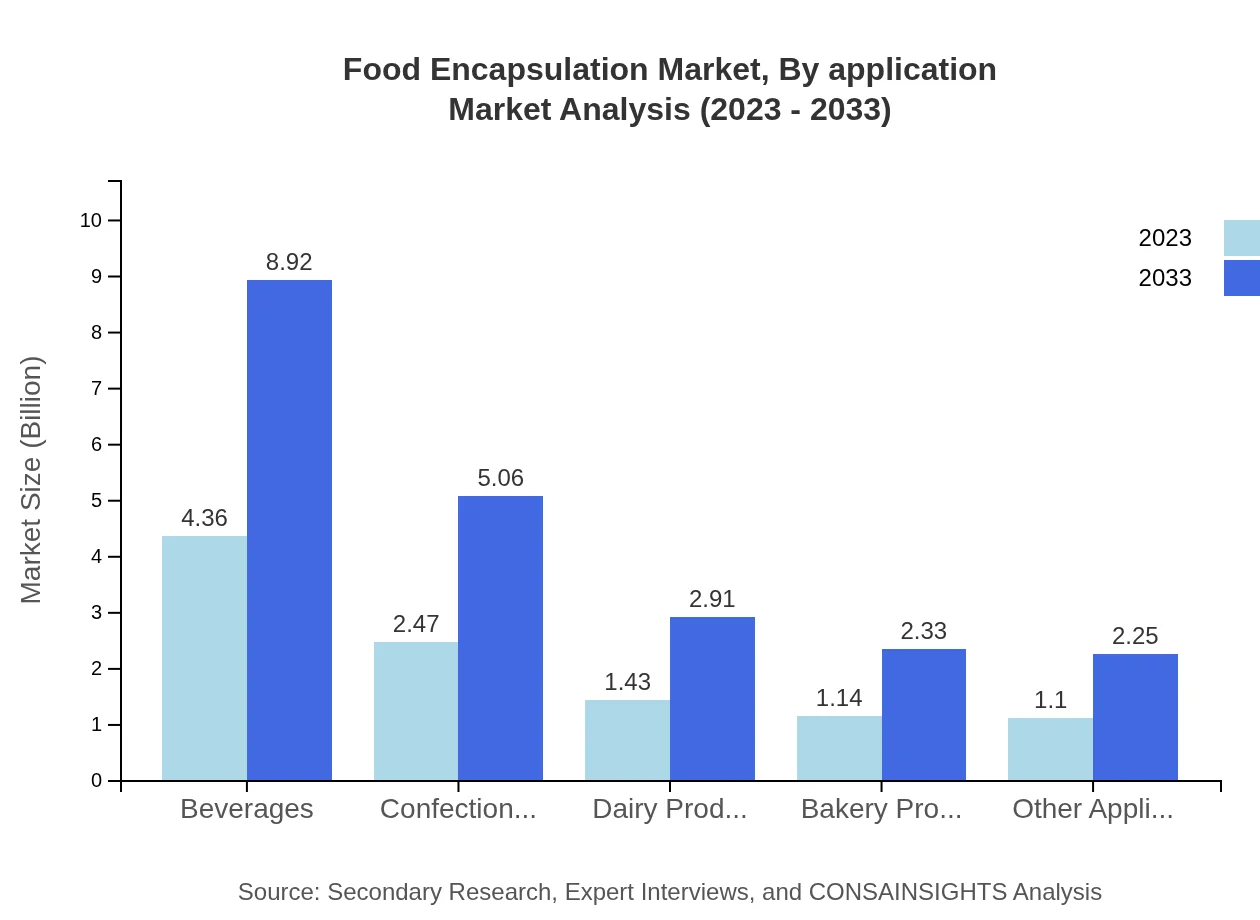

Food Encapsulation Market Analysis By Application

Beverages represent the largest segment, with a size of $4.36 billion in 2023, anticipated to rise to $8.92 billion by 2033. Confectionery follows at $2.47 billion growing to $5.06 billion. Dairy products and bakery applications also demonstrate significant growth potential, with rising consumer interest in fortified foods.

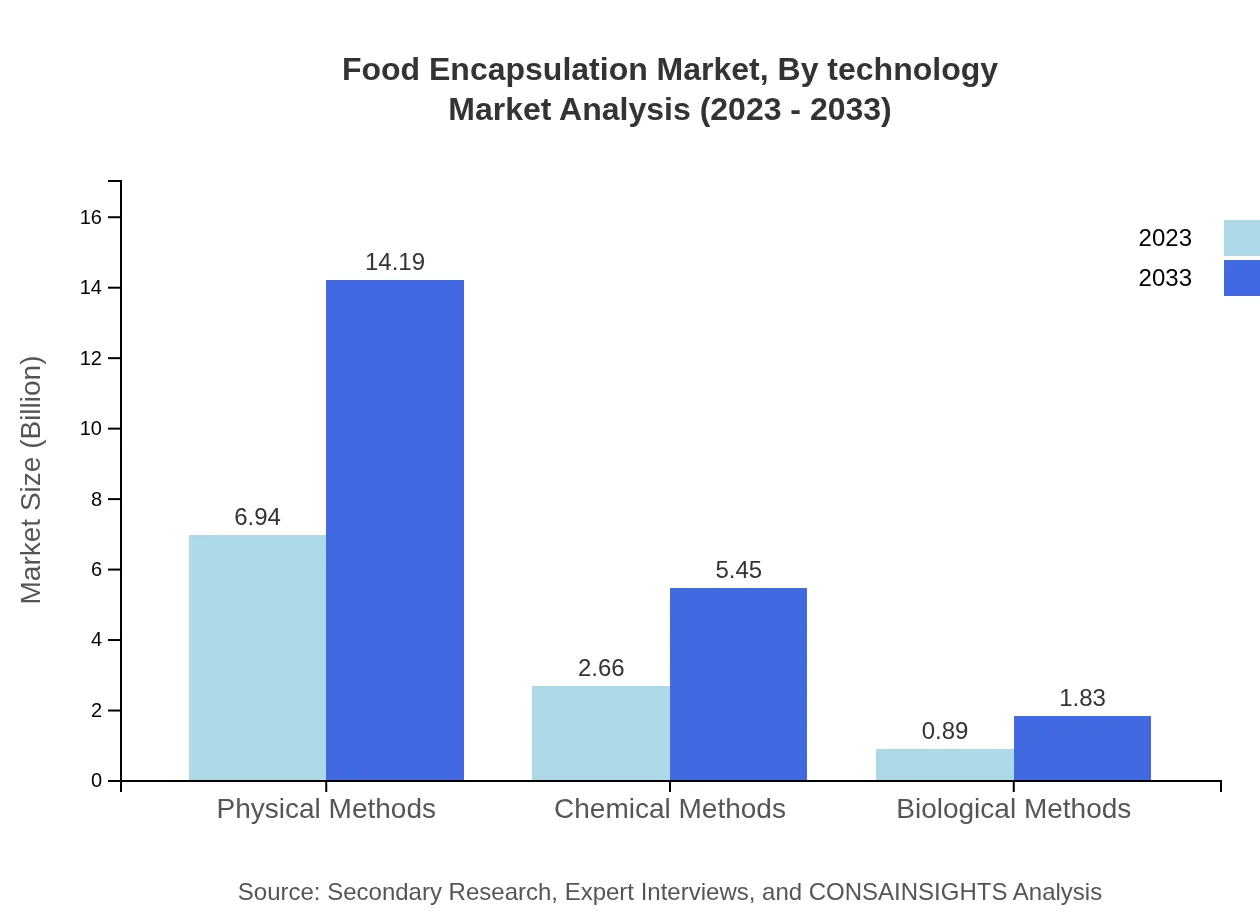

Food Encapsulation Market Analysis By Technology

In terms of technology, physical methods lead with a market share of 66.1% in 2023, indicating robust demand for conventional processes. Chemical methods account for 25.38% while biological methods, despite being niche, are witnessing growth due to the rise in clean-label products.

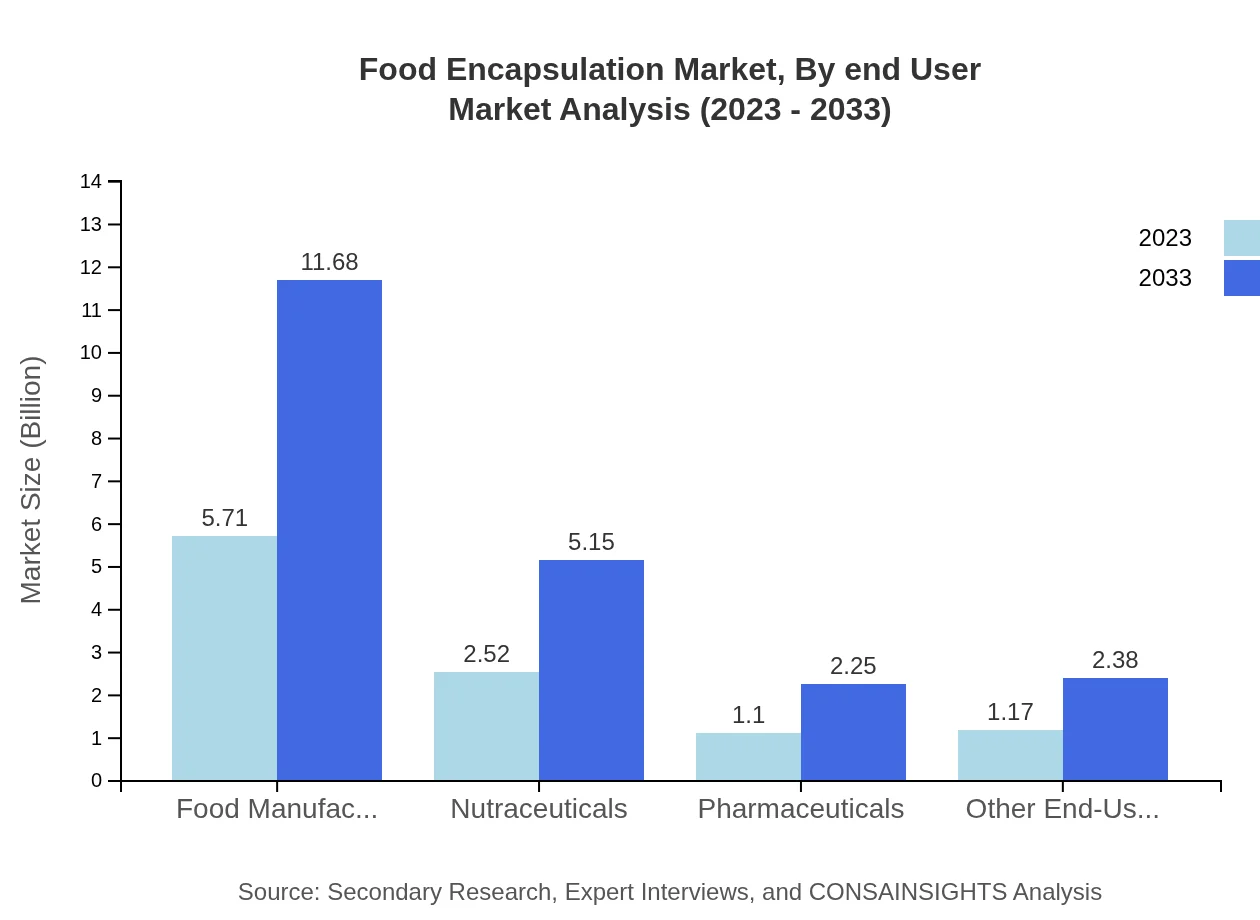

Food Encapsulation Market Analysis By End User

Food manufacturers dominate the end-user segment, controlling a market share of 54.42%. Nutraceuticals also represent a significant market with 23.98%, reflecting increased consumer health awareness and demand for dietary supplements.

Food Encapsulation Market Analysis By Region

Each region has distinct characteristics, with North America leading in revenue, followed by Europe, where strict regulations promote encapsulation technology. Asia-Pacific shows rapid growth due to increasing disposable incomes and changing dietary patterns, making it a region of interest for industry players.

Food Encapsulation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Encapsulation Industry

BASF SE:

BASF SE is a leading chemical manufacturer focused on innovative solutions, including encapsulation technologies for food preservation and enhanced nutrient delivery.Cargill, Inc.:

Cargill is a prominent player in the food industry, investing in encapsulation technology to improve flavor retention and health benefits in their food products.Givaudan SA:

Givaudan specializes in flavors and fragrances and leverages encapsulation to provide texture and flavor stability in food applications.International Flavors & Fragrances Inc.:

IFF offers encapsulation solutions tailored to the beverage and food industry, enhancing shelf life and product performance.Sensient Technologies Corporation:

Sensient focuses on color and flavor solutions for food and beverages, employing advanced encapsulation techniques to ensure consistent quality.We're grateful to work with incredible clients.

FAQs

What is the market size of food Encapsulation?

The global food encapsulation market is projected to reach USD 10.5 billion by 2033, growing at a CAGR of 7.2% from its current size in 2023. This growth reflects the increasing demand for advanced food preservation and nutrition delivery methods.

What are the key market players or companies in this food Encapsulation industry?

Key players in the food encapsulation industry include BASF SE, Syngenta AG, Givaudan SA, and Evonik Industries AG. These companies lead through innovation, strategic partnerships, and product diversification to cater to the market's evolving needs.

What are the primary factors driving the growth in the food Encapsulation industry?

The growth in the food-encapsulation industry is driven by rising consumer demand for functional foods, advancements in encapsulation technologies, and the need for improved product stability and shelf life. Increased health awareness further propels market expansion.

Which region is the fastest Growing in the food Encapsulation?

Asia Pacific is the fastest-growing region in the food encapsulation market, with forecasted growth from USD 1.87 billion in 2023 to USD 3.83 billion by 2033. This growth is driven by rapid urbanization and increasing disposable incomes.

Does ConsaInsights provide customized market report data for the food Encapsulation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the food encapsulation industry. You can request targeted insights that provide a competitive advantage and deeper understanding of market dynamics.

What deliverables can I expect from this food Encapsulation market research project?

From the food encapsulation market research project, you can expect detailed market analysis reports, trend assessments, competitive landscape evaluations, and forecasts. These reports provide insights into market size, growth opportunities, and key players.

What are the market trends of food Encapsulation?

Current market trends in food encapsulation include increasing adoption of microencapsulation, focus on clean label products, and enhanced delivery systems to meet consumer demand for convenience and health benefits.