Food Fortifying Agents Market Report

Published Date: 31 January 2026 | Report Code: food-fortifying-agents

Food Fortifying Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Food Fortifying Agents market, analyzing trends, growth factors, and forecasts from 2023 to 2033. It delves into market size, segmentation, regional analysis, technological advancements, and the leading players shaping this dynamic industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

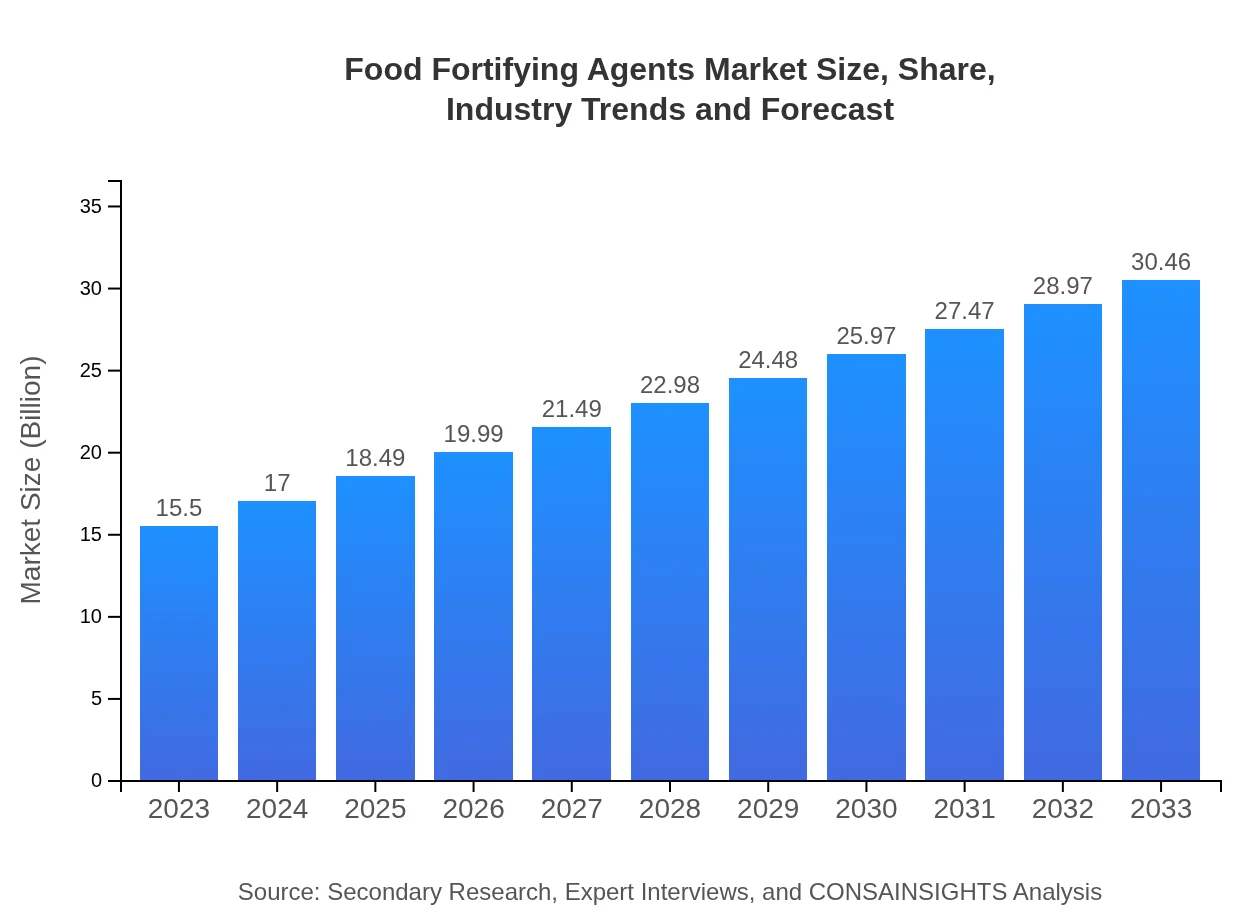

| 2023 Market Size | $15.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.46 Billion |

| Top Companies | Nestlé S.A., DSM Nutritional Products, BASF SE, Archer Daniels Midland Company (ADM) |

| Last Modified Date | 31 January 2026 |

Food Fortifying Agents Market Overview

Customize Food Fortifying Agents Market Report market research report

- ✔ Get in-depth analysis of Food Fortifying Agents market size, growth, and forecasts.

- ✔ Understand Food Fortifying Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Fortifying Agents

What is the Market Size & CAGR of Food Fortifying Agents market in 2023?

Food Fortifying Agents Industry Analysis

Food Fortifying Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Fortifying Agents Market Analysis Report by Region

Europe Food Fortifying Agents Market Report:

The European market for Food Fortifying Agents is estimated at $4.75 billion in 2023, anticipated to grow to $9.34 billion by 2033. The stringent regulations on food quality and safety, paired with an increase in health and wellness trends, are propelling market growth.Asia Pacific Food Fortifying Agents Market Report:

In 2023, the Asia Pacific region's market for Food Fortifying Agents is valued at approximately $2.85 billion, projected to reach $5.59 billion by 2033. Growth is driven by rising health consciousness, a growing middle-class population, and increasing regulatory support for fortification initiatives in countries like India and China.North America Food Fortifying Agents Market Report:

North America holds a significant market share, valued at $5.62 billion in 2023 and expected to reach $11.05 billion by 2033. The region's growth is largely driven by health trends, consumer awareness around obesity, and government mandates for fortified products.South America Food Fortifying Agents Market Report:

The South American market is valued at $0.16 billion in 2023, with projections of $0.31 billion by 2033. The forecasted growth reflects increasing consumer demand for fortified foods and development projects aimed at enhancing nutritional standards, despite economic challenges.Middle East & Africa Food Fortifying Agents Market Report:

In 2023, the Middle East and Africa market is valued at $2.12 billion, projected to grow to $4.17 billion by 2033. Efforts to combat malnutrition and food insecurity, alongside a rising young population, are major factors driving demand in this region.Tell us your focus area and get a customized research report.

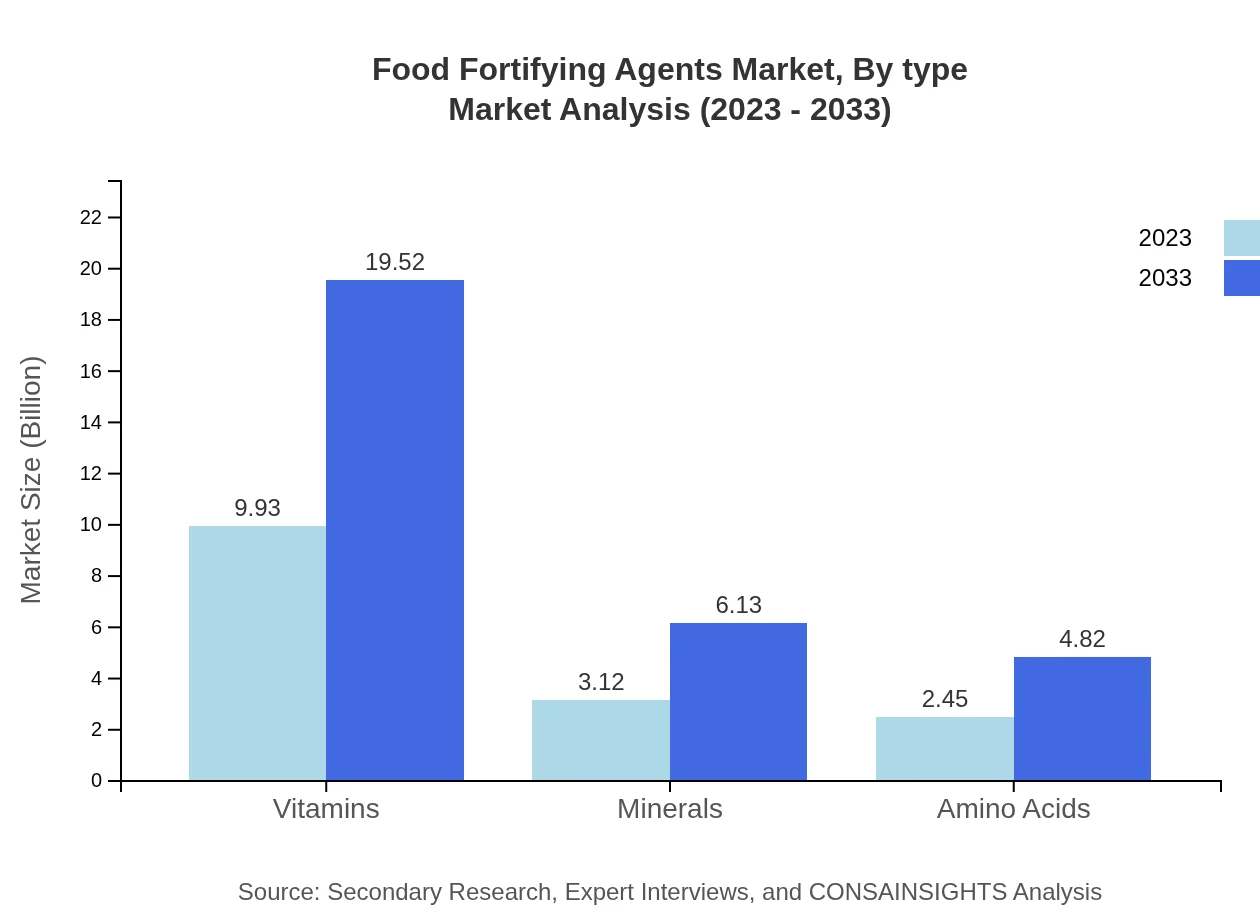

Food Fortifying Agents Market Analysis By Type

The Food Fortifying Agents market by type is segmented into several key categories, including vitamins, minerals, and amino acids. As of 2023, vitamins hold a significant market share with a size of $9.93 billion, expected to double by 2033 to $19.52 billion. Minerals follow, valued at $3.12 billion in 2023 with a projected growth to $6.13 billion by 2033. Amino acids and other agents also play critical roles, each contributing to the overall efficacy of food fortification strategies.

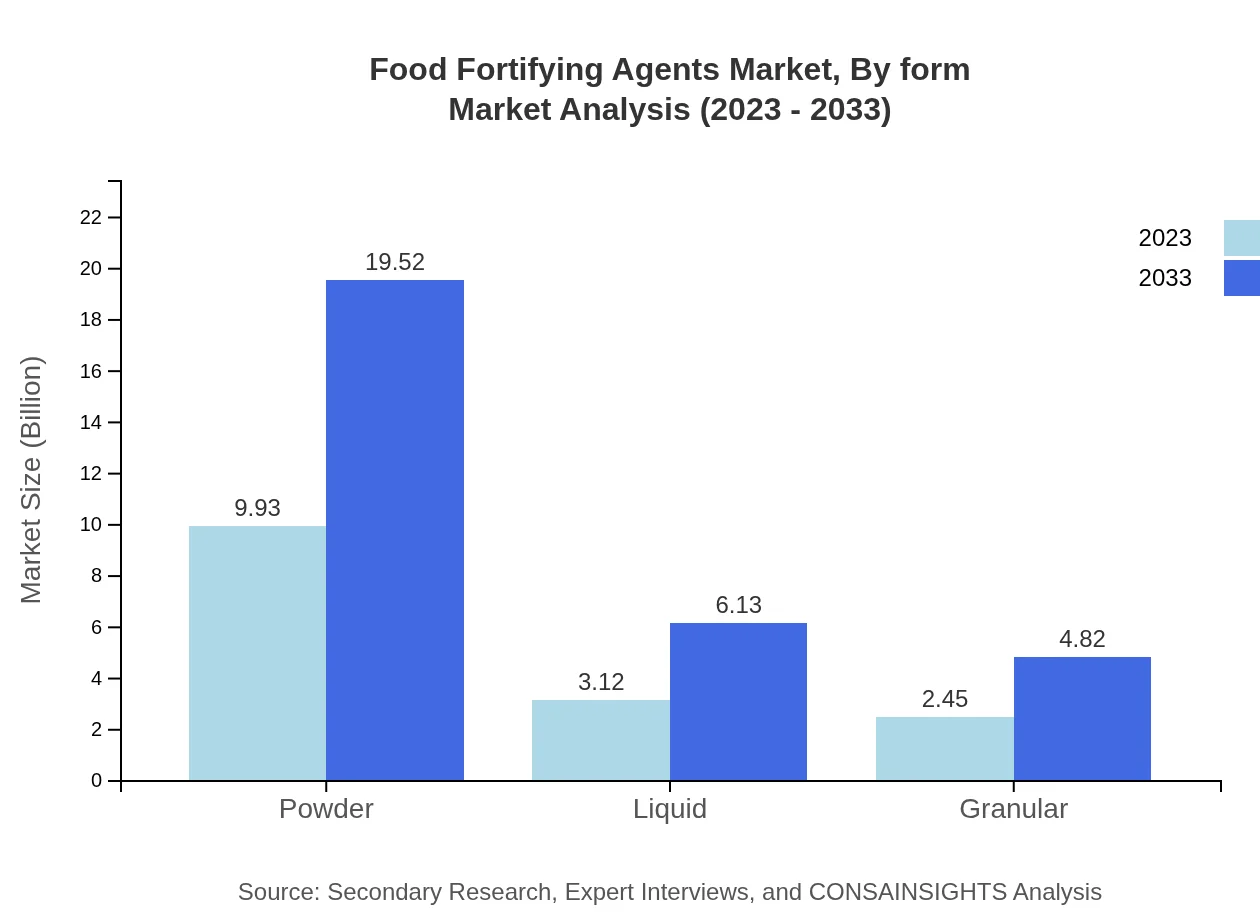

Food Fortifying Agents Market Analysis By Form

In terms of form, powders dominate the market, starting with a size of $9.93 billion in 2023 and anticipated to reach $19.52 billion by 2033, capturing a market share of 64.06%. Liquid forms follow with a size of $3.12 billion, growing to $6.13 billion by 2033, holding a 20.11% share. Granular forms exhibit steady growth with estimates from $2.45 billion to $4.82 billion over the same period.

Food Fortifying Agents Market Analysis By Application

Food fortifying agents find applications in various sectors, primarily bakery products, dairy products, beverages, and snacks. Bakery products lead with a size of $8.94 billion in 2023, expected to reach $17.58 billion by 2033. Dairy products are projected to show substantial growth as well, from $3.67 billion to $7.21 billion. Beverages and snacks are also significant segments contributing to market dynamism.

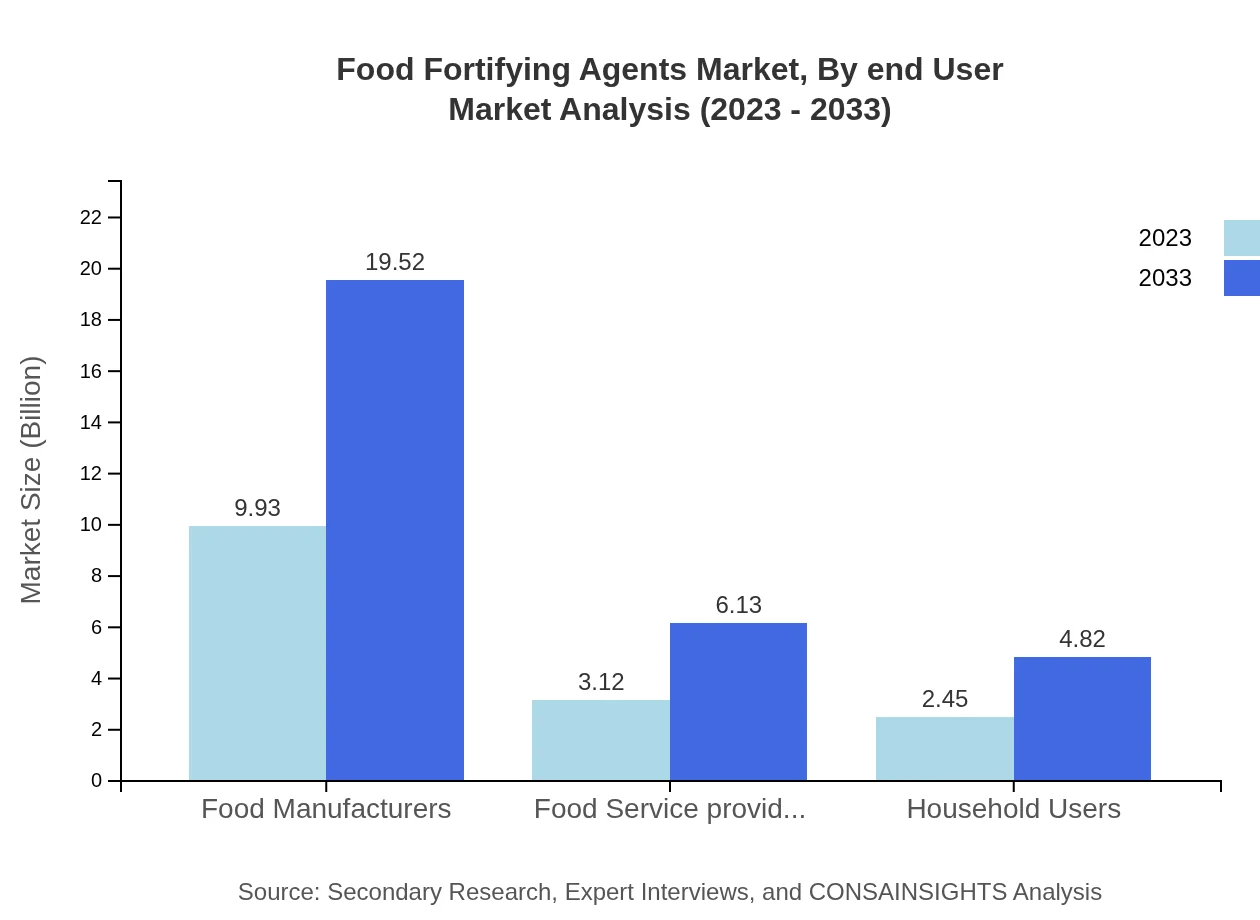

Food Fortifying Agents Market Analysis By End User

The end-user segmentation shows that food manufacturers lead the market with $9.93 billion and a stable share of 64.06% in 2023, extending to $19.52 billion by 2033. Food service providers, valued at $3.12 billion in 2023, are essential for growth, projected to reach $6.13 billion by 2033. Household users emerge as significant players as they increasingly seek nutrient-enhanced products.

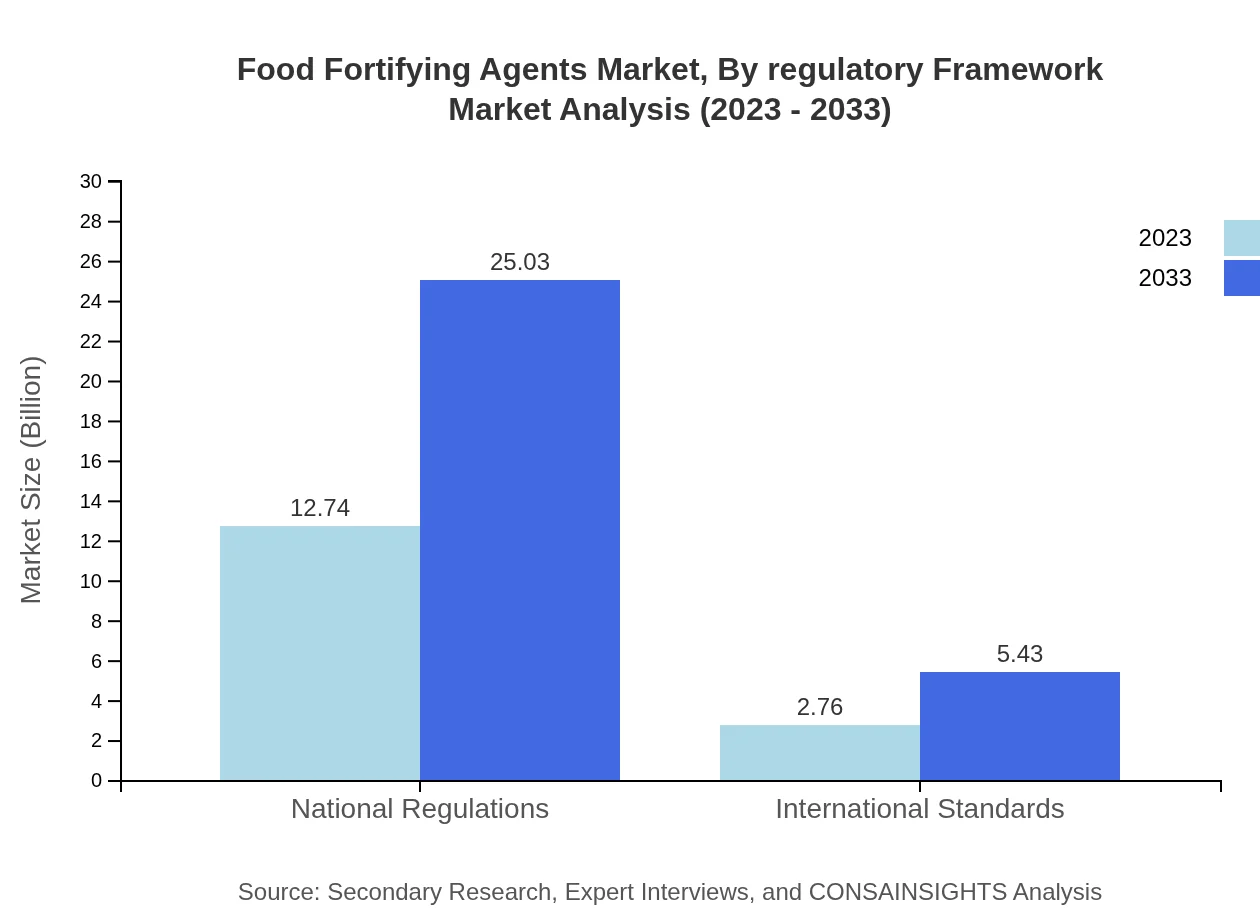

Food Fortifying Agents Market Analysis By Regulatory Framework

The regulatory framework in the Food Fortifying Agents market is essential for standardization and safety. The national regulations segment holds a market size of $12.74 billion and a share of 82.17% in 2023, predicted to grow to $25.03 billion by 2033. International standards, although smaller, also play a role with a size increasing from $2.76 billion to $5.43 billion during the same timeline.

Food Fortifying Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Fortifying Agents Industry

Nestlé S.A.:

Nestlé is a multinational food and beverage company that leads the market with innovative fortification strategies, focusing on nutritional improvement and health-driven product developments.DSM Nutritional Products:

DSM is a global leader in vitamin production, emphasizing sustainable practices and innovative nutrient delivery systems in fortified food products worldwide.BASF SE:

BASF is a prominent chemical company that invests heavily in research and development for fortifying agents, providing a wide range of vitamins and minerals to the food industry.Archer Daniels Midland Company (ADM):

ADM offers a broad portfolio of food ingredients and has a strong presence in the fortifying agents market, focusing on sustainable and health-enhancing solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of food Fortifying Agents?

The global food fortifying agents market is valued at approximately $15.5 billion in 2023, with an expected CAGR of 6.8% projected through 2033. This growth reflects a rising awareness of health and nutrition across the globe.

What are the key market players or companies in the food Fortifying Agents industry?

Key players in the food fortifying agents market include major companies specializing in nutritional products and food ingredients. These may consist of global corporations dedicated to health and wellness, focusing on the development of innovative fortification solutions.

What are the primary factors driving the growth in the food fortifying agents industry?

The growth in the food fortifying agents market is primarily driven by increasing health consciousness, rising prevalence of nutrient deficiencies, and expanding regulatory initiatives supporting food fortification as a public health strategy to combat malnutrition.

Which region is the fastest Growing in the food fortifying agents market?

The fastest-growing region in the food fortifying agents market is North America. The market is expected to grow from $5.62 billion in 2023 to $11.05 billion by 2033, showcasing strong demand for fortified foods and adherence to health trends.

Does ConsaInsights provide customized market report data for the food fortifying agents industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the food fortifying agents sector. This includes in-depth analysis, forecasts, and insights that cater to various stakeholders in the industry.

What deliverables can I expect from this food fortifying agents market research project?

Deliverables from the food fortifying agents market research project typically include comprehensive market analysis reports, trends and forecast data, segmentation insights, competitive landscapes, and actionable recommendations to guide strategic decisions.

What are the market trends of food fortifying agents?

Market trends for food fortifying agents include a shift towards natural and organic fortification, the growth of ready-to-eat meals with enhanced nutrients, and increased consumer demand for transparency regarding ingredient sourcing and health benefits.