Food Glazing Agents Market Report

Published Date: 31 January 2026 | Report Code: food-glazing-agents

Food Glazing Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Glazing Agents market from 2023 to 2033. It includes market size, growth trends, regional insights, segmentation analysis, and predicts future developments in the industry.

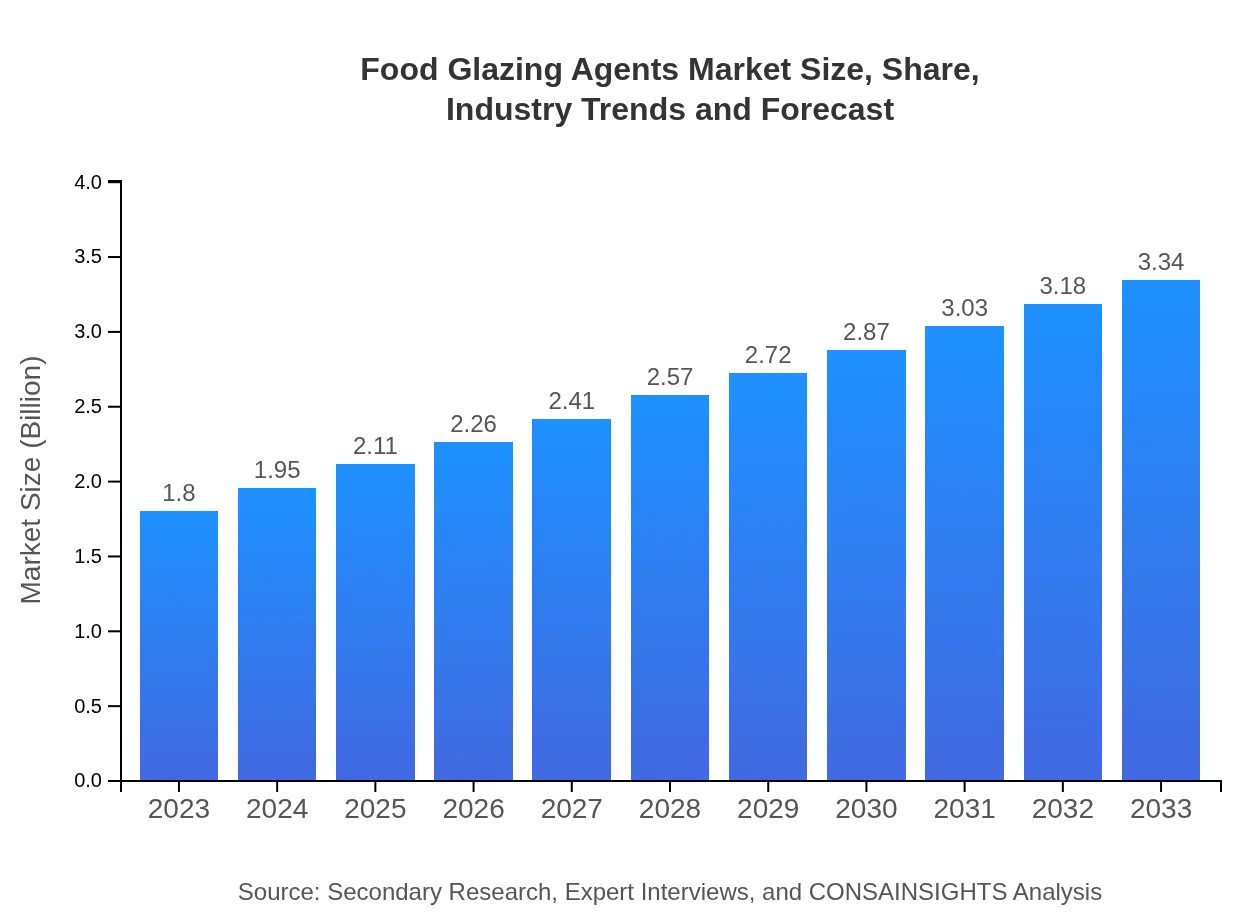

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Snyder's-Lance, Inc., Ingredients Solutions, Inc., Cargill, Inc., DuPont de Nemours, Inc., Kerry Group plc |

| Last Modified Date | 31 January 2026 |

Food Glazing Agents Market Overview

Customize Food Glazing Agents Market Report market research report

- ✔ Get in-depth analysis of Food Glazing Agents market size, growth, and forecasts.

- ✔ Understand Food Glazing Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Glazing Agents

What is the Market Size & CAGR of Food Glazing Agents market in 2023?

Food Glazing Agents Industry Analysis

Food Glazing Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Glazing Agents Market Analysis Report by Region

Europe Food Glazing Agents Market Report:

The European market for Food Glazing Agents is projected to grow from 0.56 billion USD in 2023 to 1.03 billion USD by 2033. This growth is primarily driven by consumer preferences for premium and high-quality food products. Strong regulations favoring food safety and a shift towards innovative glazing technologies are expected to augment market growth in this region.Asia Pacific Food Glazing Agents Market Report:

The Asia Pacific market for Food Glazing Agents is projected to grow from 0.38 billion USD in 2023 to 0.70 billion USD by 2033. This growth is driven by rising consumer demands for processed and frozen foods, along with the expanding food industry in countries like China and India. Increasing investments in food technology and a shift towards modern retail formats are also expected to significantly influence market dynamics in this region.North America Food Glazing Agents Market Report:

In North America, the Food Glazing Agents market is anticipated to expand from 0.58 billion USD in 2023 to 1.07 billion USD in 2033. The market is being driven by the growth of various food industries, stringent food safety regulations, and the increasing consumption of ready-to-eat meals. The presence of leading market players and continuous investment in product innovations are further bolstering growth.South America Food Glazing Agents Market Report:

Market size in South America is expected to grow from 0.06 billion USD in 2023 to 0.11 billion USD by 2033. Factors such as increasing urbanization and demand for convenience foods are propelling market growth. The region’s growing population and rising disposable incomes are also contributing to the expansion of the food sector, thereby boosting the demand for glazing agents.Middle East & Africa Food Glazing Agents Market Report:

In the Middle East and Africa, the market is expected to increase from 0.23 billion USD in 2023 to 0.42 billion USD by 2033. Factors such as rapid urbanization, improvements in food supply chains, and the expanding food service industry are major drivers. Increased investment in food processing facilities in emerging economies such as South Africa and the UAE is also expected to provide growth opportunities.Tell us your focus area and get a customized research report.

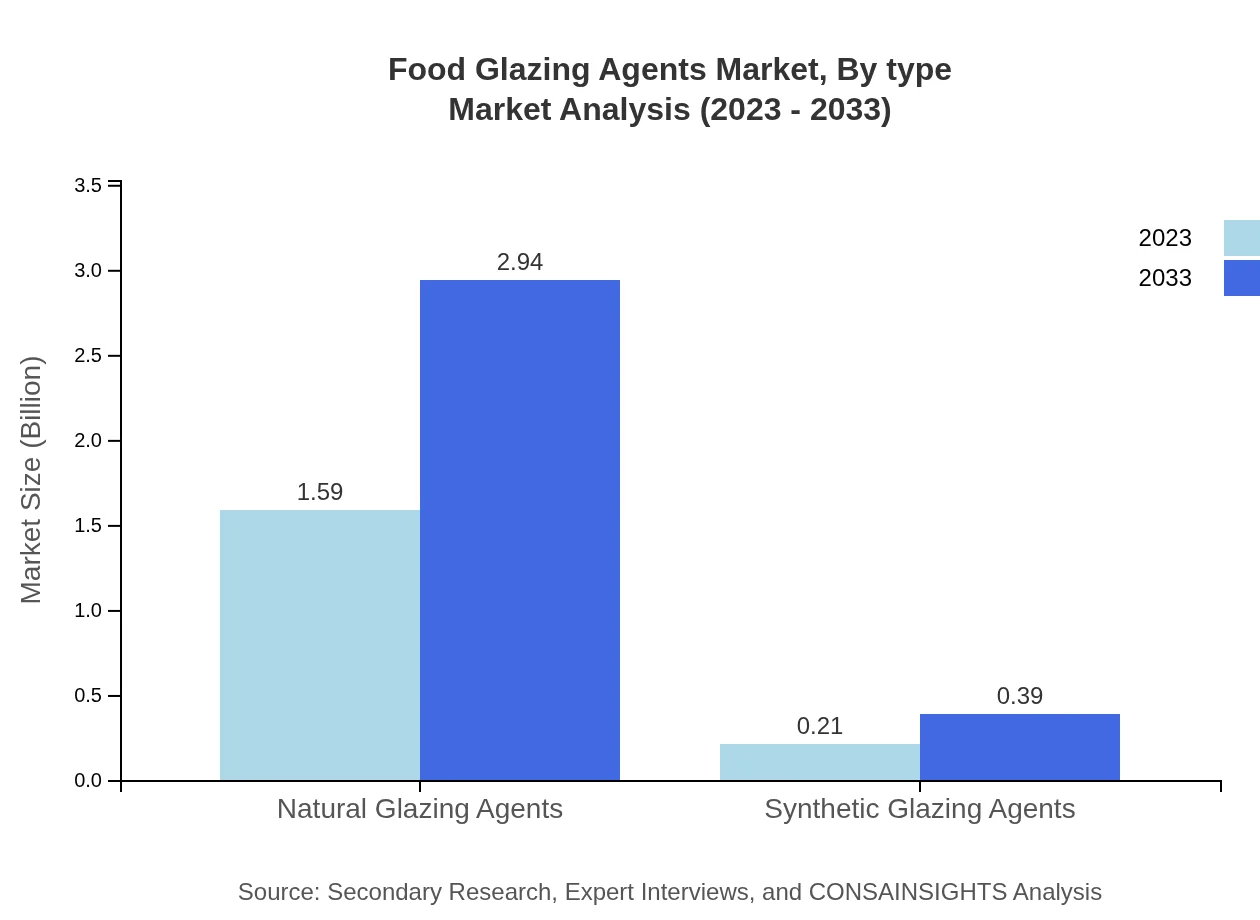

Food Glazing Agents Market Analysis By Type

The Food Glazing Agents market, categorized by type into natural and synthetic agents, shows a dominant market share for natural glazing agents, accounting for approximately 88.29% in 2023. In terms of market size, natural glazing agents are projected to grow from 1.59 billion USD in 2023 to 2.94 billion USD by 2033, due to the increasing consumer shift towards clean label products. Meanwhile, synthetic agents hold an 11.71% share, growing from 0.21 billion USD to 0.39 billion USD during the same period.

Food Glazing Agents Market Analysis By Application

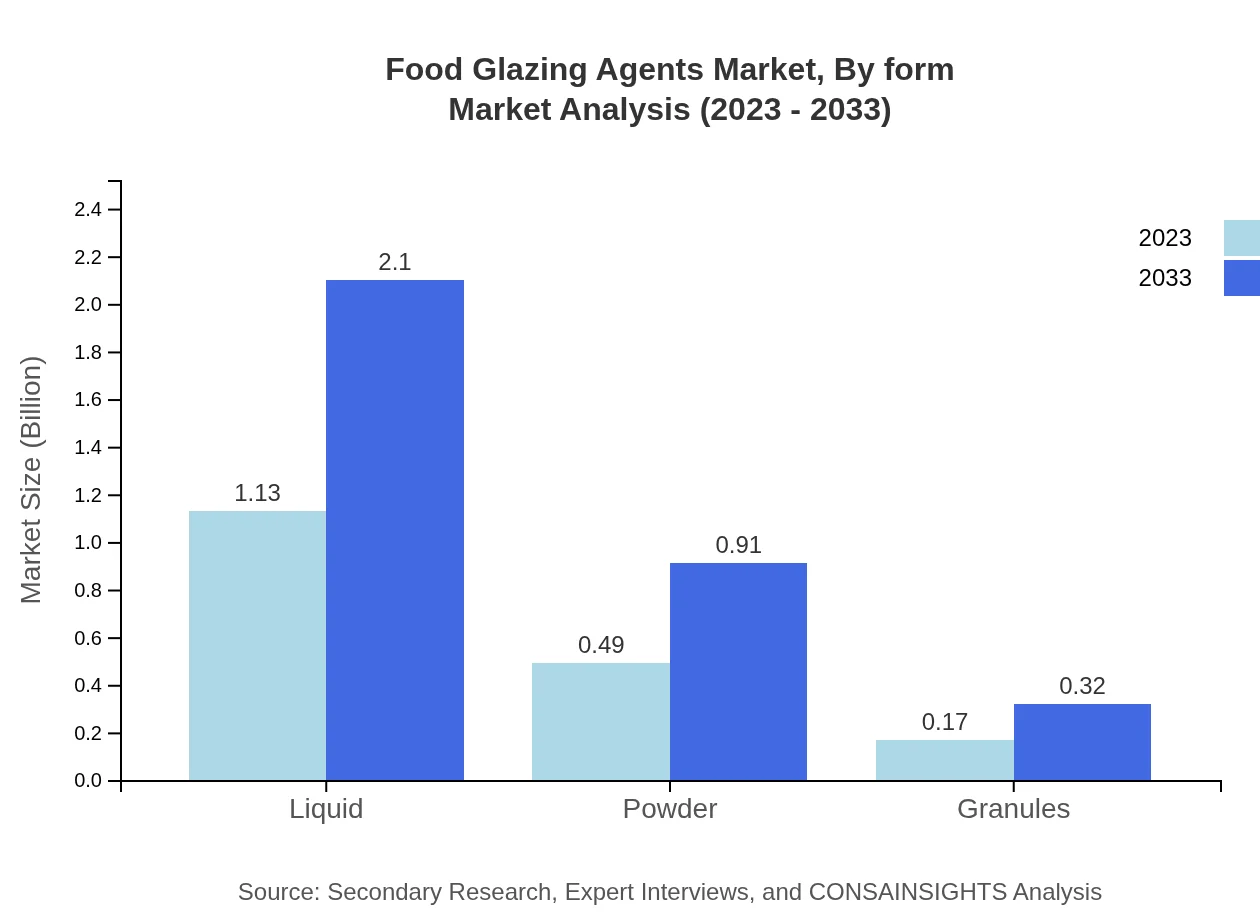

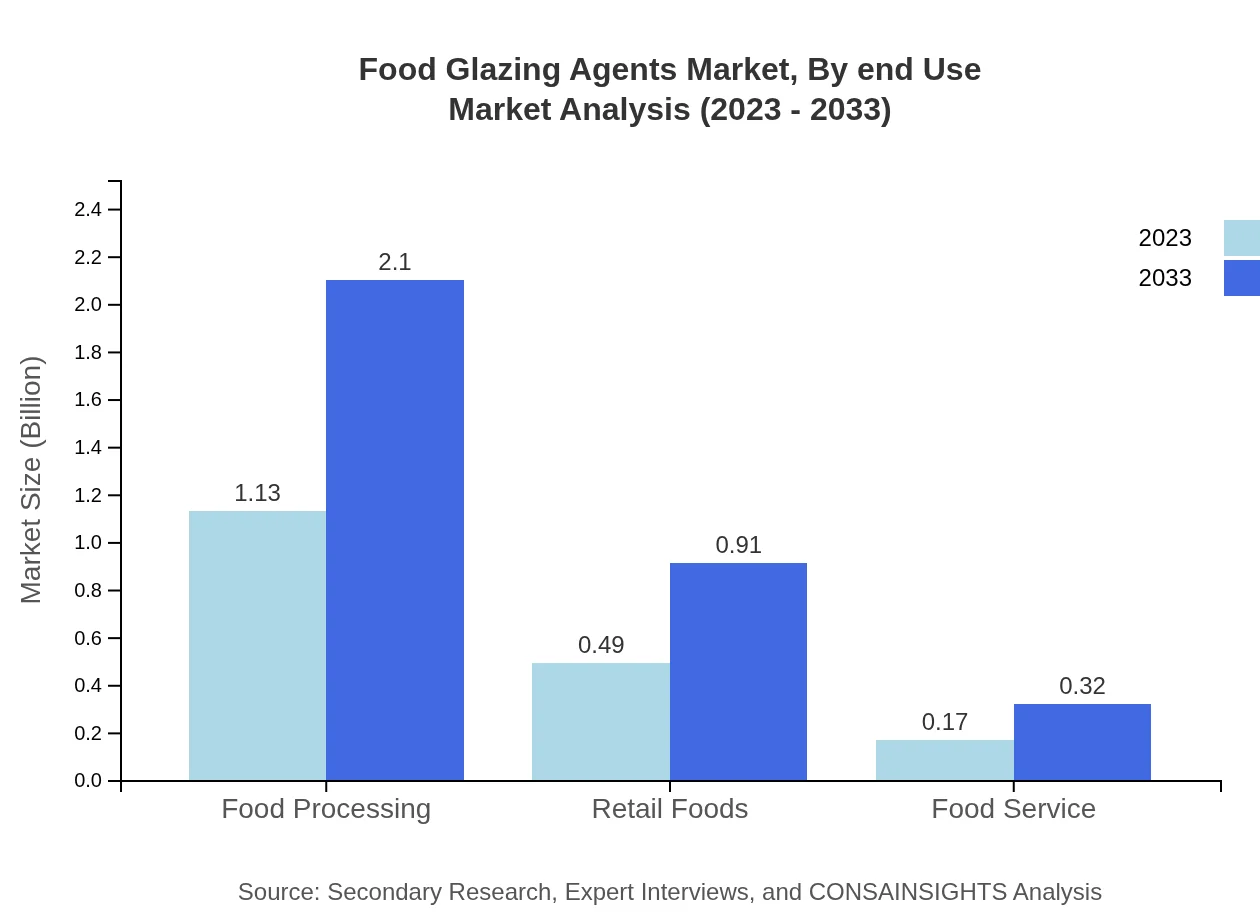

Market applications include food processing, retail foods, and food service. Food processing holds a significant share at 63.04%. It is predicted to grow from 1.13 billion USD in 2023 to 2.10 billion USD by 2033. The retail foods sector, comprising 27.42%, is also poised for growth from 0.49 billion USD to 0.91 billion USD. The food service sector, though smaller, is expected to experience growth from 0.17 billion USD to 0.32 billion USD, reflecting increased consumer spending on dining out.

Food Glazing Agents Market Analysis By Form

The Food Glazing Agents market can be segmented by form into liquid, powder, and granule categories. Liquid forms dominate the market with a size of 1.13 billion USD in 2023, expected to rise to 2.10 billion USD by 2033, maintaining a 63.04% market share. Powder forms account for 27.42%, expanding from 0.49 billion USD to 0.91 billion USD, while granules represent 9.54% and grow from 0.17 billion USD to 0.32 billion USD during the same decade.

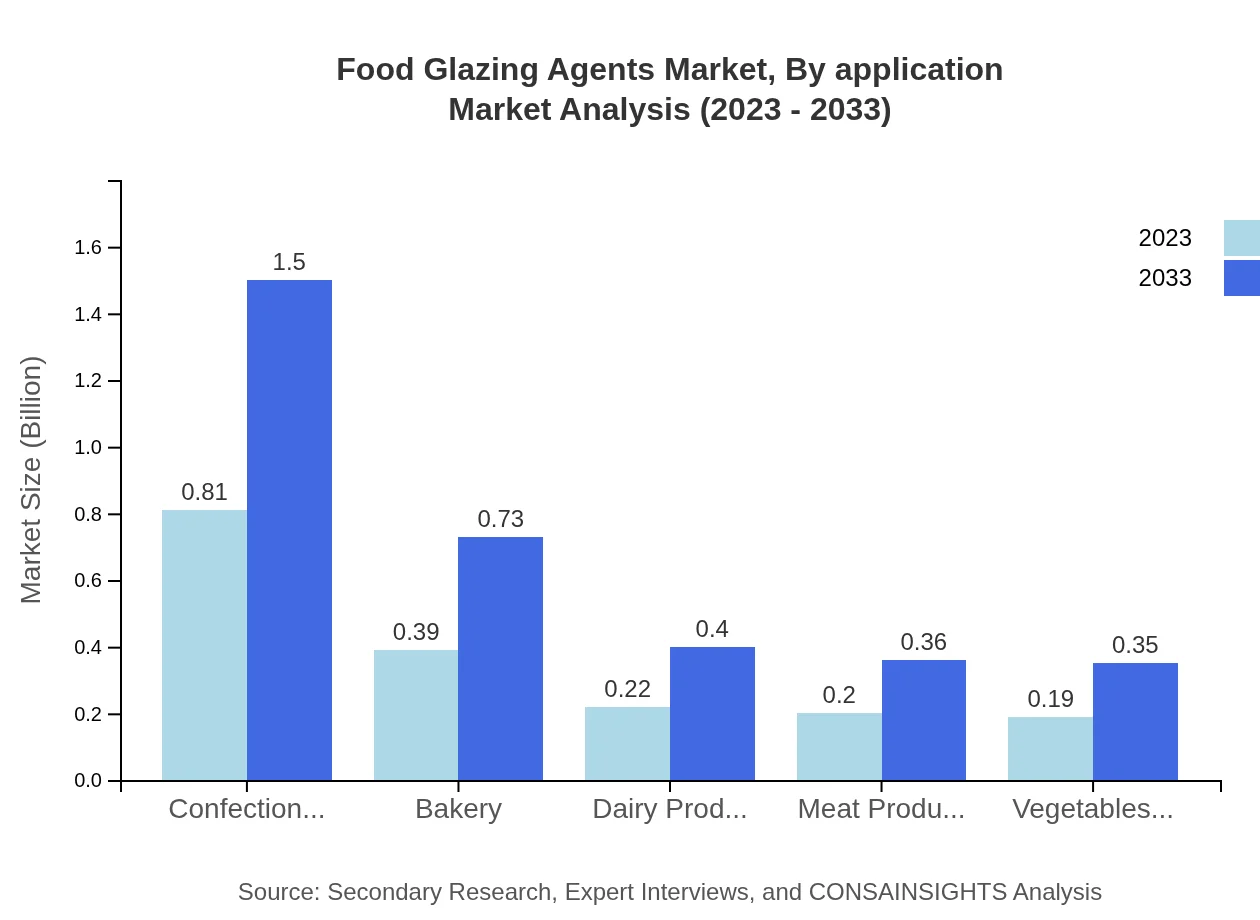

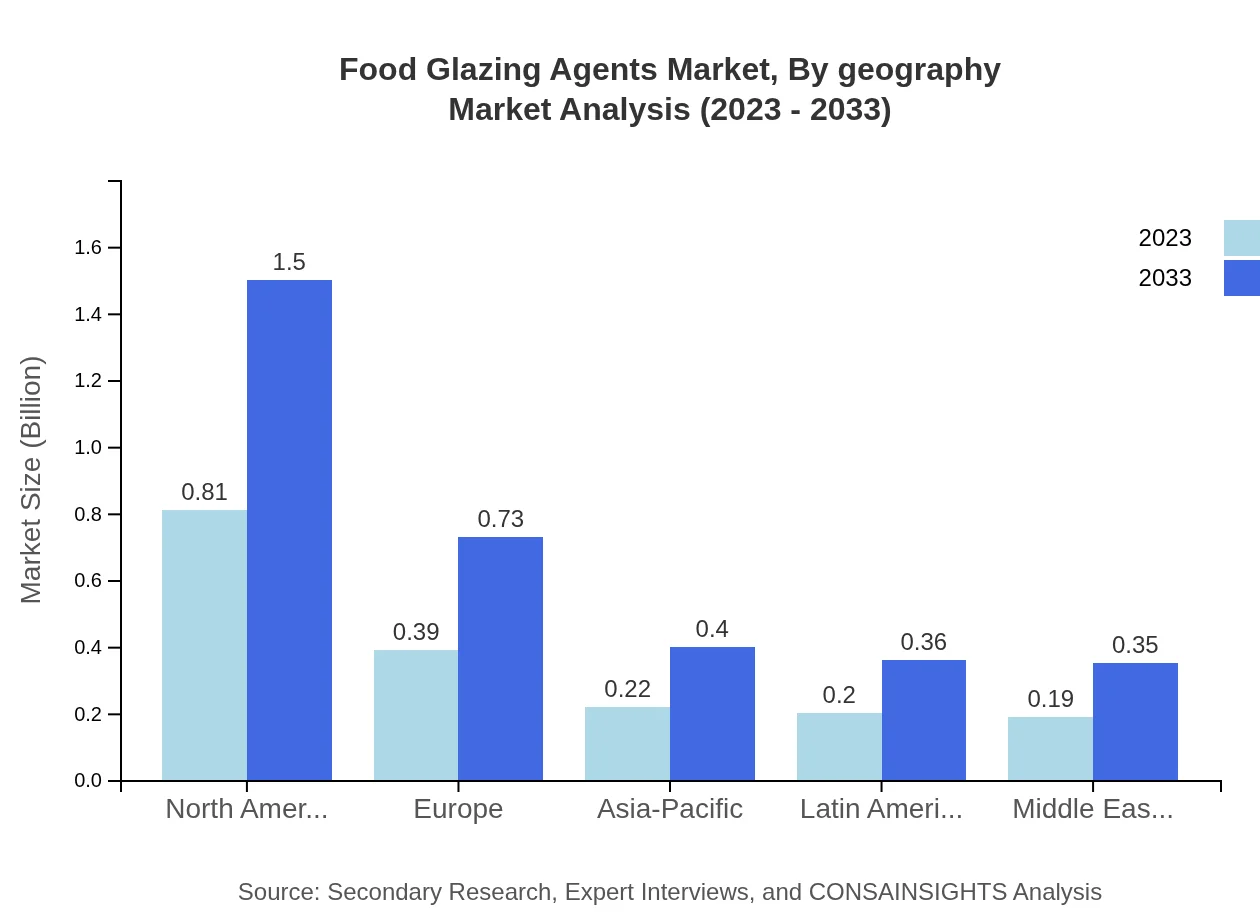

Food Glazing Agents Market Analysis By End Use

The Food Glazing Agents market is utilized in various end-use industries including confectionery, bakery, dairy products, meat products, and fruits & vegetables. The confectionery sector leads with a size of 0.81 billion USD in 2023, anticipated to grow to 1.50 billion USD by 2033. The bakery segment follows closely, accounting for 21.79% share, projected to increase from 0.39 billion USD to 0.73 billion USD, indicating ongoing demand for attractive baked goods.

Food Glazing Agents Market Analysis By Geography

Geographically, the North America market holds a significant share of 44.85%. The region is expected to see growth from 0.81 billion USD in 2023 to 1.50 billion USD in 2033. Europe and Asia-Pacific regions follow with shares of 21.79% and 12.01% respectively. Collectively, these regions are essential for market growth, underpinning future trends in glaze technology and application innovations.

Food Glazing Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Glazing Agents Industry

Snyder's-Lance, Inc.:

A major player in the food and snack industry, Snyder's-Lance produces a diverse range of glazing agents that enhance product quality and appearance, primarily focusing on natural ingredients.Ingredients Solutions, Inc.:

Known for its innovative solutions in food glazing, Ingredients Solutions specializes in developing custom glazing formulations to meet the evolving needs of food manufacturers.Cargill, Inc.:

Cargill is a global leader in food and agricultural products, providing a wide range of food glazing agents known for quality and safety.DuPont de Nemours, Inc.:

DuPont offers advanced food processing technologies, including glazing agents that enhance shelf life and visual appeal, continually focusing on sustainability.Kerry Group plc:

Operating in the food processing and flavor industry, Kerry Group provides innovative glazing solutions designed to enhance food products' aesthetics and marketability.We're grateful to work with incredible clients.

FAQs

What is the market size of food Glazing agents?

The food glazing agents market is valued at approximately $1.8 billion in 2023, with a projected CAGR of 6.2% through 2033. This growth trajectory indicates increasing applications across various food industries.

What are the key market players or companies in the food Glazing agents industry?

Key players in the food glazing agents market include prominent companies that manufacture both natural and synthetic agents, ensuring product quality and compliance with food safety regulations to cater to diverse food processing requirements.

What are the primary factors driving the growth in the food Glazing agents industry?

The growth in the food-glazing agents industry is primarily driven by increasing demand for processed foods, advancements in food preservation technologies, and a growing consumer preference for visually appealing food products.

Which region is the fastest Growing in the food Glazing agents market?

Asia-Pacific is currently the fastest-growing region in the food-glazing agents market, with anticipated growth from $0.38 billion in 2023 to $0.70 billion by 2033, driven by rising urbanization and food consumption.

Does ConsaInsights provide customized market report data for the food Glazing agents industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the food-glazing agents industry, ensuring relevant insights according to market preferences and regional demands.

What deliverables can I expect from this food Glazing agents market research project?

From this food-glazing agents market research project, clients can expect comprehensive market analysis reports, detailed segment data, competitive landscape overviews, and actionable insights tailored to strategic decision-making.

What are the market trends of food Glazing agents?

Current trends in the food-glazing agents market include a shift towards natural glazing agents, increasing applications in health-focused products, and a burgeoning interest in innovative formulations that enhance food shelf life and appeal.