Food Grade Gelatin Market Report

Published Date: 31 January 2026 | Report Code: food-grade-gelatin

Food Grade Gelatin Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Grade Gelatin market, covering insights on market size, segmentation, regional analysis, and future trends from 2023 to 2033.

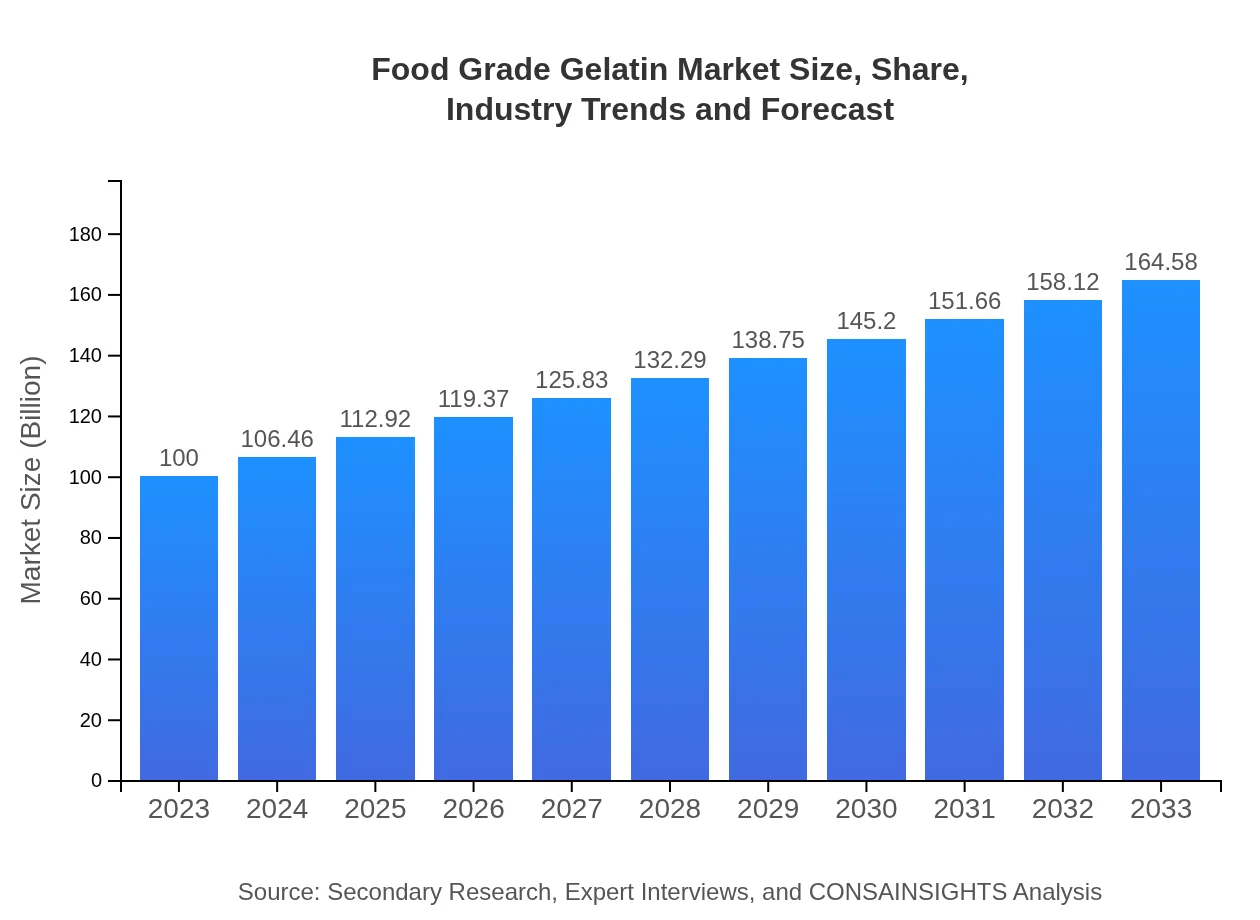

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Gelita AG, Collagen Solutions PLC, Harshin Gelatin |

| Last Modified Date | 31 January 2026 |

Food Grade Gelatin Market Overview

Customize Food Grade Gelatin Market Report market research report

- ✔ Get in-depth analysis of Food Grade Gelatin market size, growth, and forecasts.

- ✔ Understand Food Grade Gelatin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Grade Gelatin

What is the Market Size & CAGR of Food Grade Gelatin market in 2023?

Food Grade Gelatin Industry Analysis

Food Grade Gelatin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Grade Gelatin Market Analysis Report by Region

Europe Food Grade Gelatin Market Report:

The European market for Food Grade Gelatin is anticipated to grow from $29.88 million in 2023 to $49.18 million by 2033. The rise in demand for high-quality, organic products and stringent food safety regulations are driving the market in this region, particularly in the confectionery and dairy sectors.Asia Pacific Food Grade Gelatin Market Report:

In the Asia Pacific region, the Food Grade Gelatin market is forecasted to grow from $17.53 million in 2023 to $28.85 million by 2033, owing to rising disposable incomes and increasing consumption patterns of dairy and confectionery products. Countries like China and India are major contributors to this growth as they expand their food processing sectors.North America Food Grade Gelatin Market Report:

North America holds a significant share of the Food Grade Gelatin market, projected to rise from $38.32 million in 2023 to $63.07 million by 2033. The growth in this region is propelled by advancements in food technology and an increasing health-conscious population favoring gelatin-based supplements.South America Food Grade Gelatin Market Report:

The South American Food Grade Gelatin market is expected to increase from $2.62 million in 2023 to $4.31 million in 2033. Growth is stimulated by a burgeoning demand for convenience foods and innovative food items that utilize gelatin for texture and stability.Middle East & Africa Food Grade Gelatin Market Report:

In the Middle East and Africa, the Food Grade Gelatin market is projected to increase from $11.65 million in 2023 to $19.17 million by 2033. The growth trajectory is influenced by increasing urbanization and a shift towards processed and packaged foods.Tell us your focus area and get a customized research report.

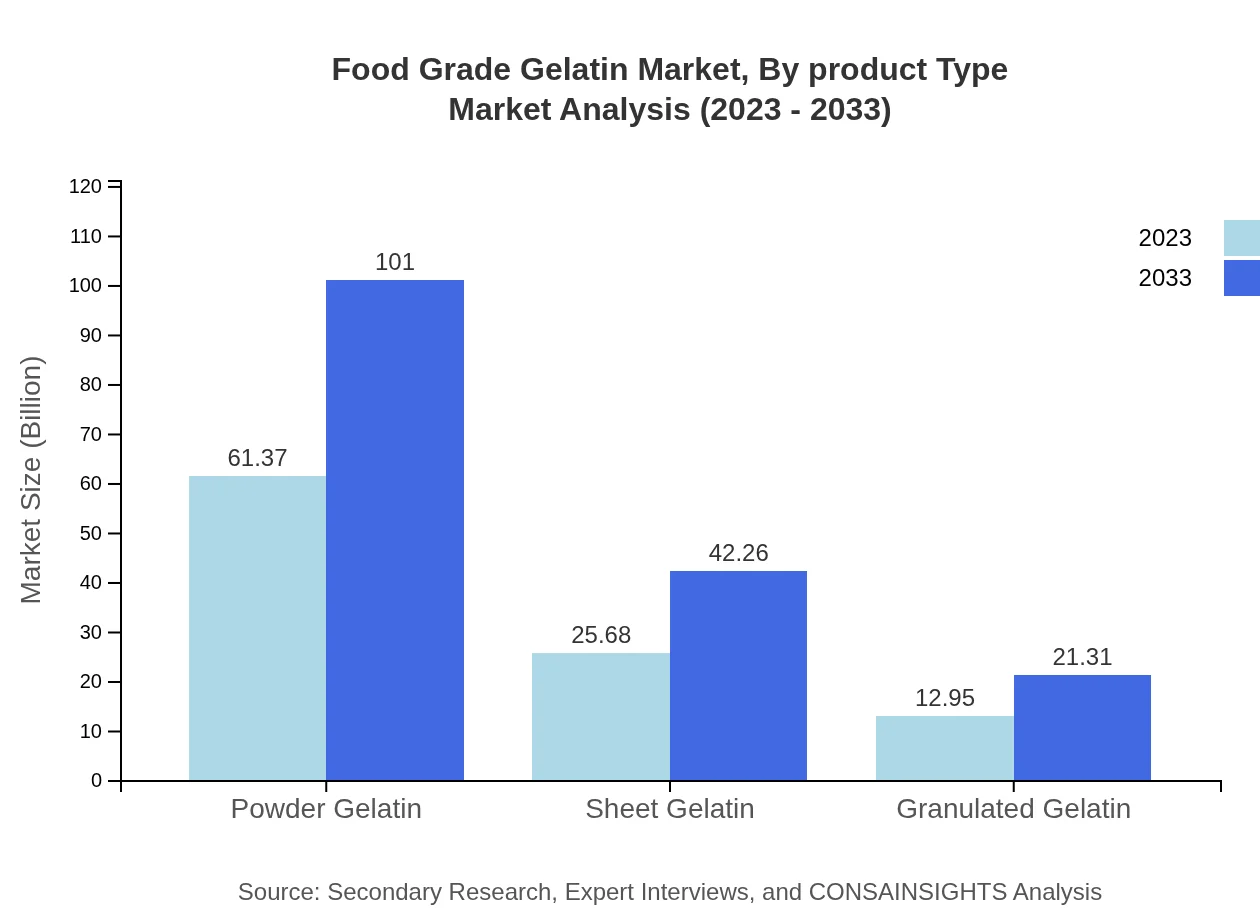

Food Grade Gelatin Market Analysis By Product Type

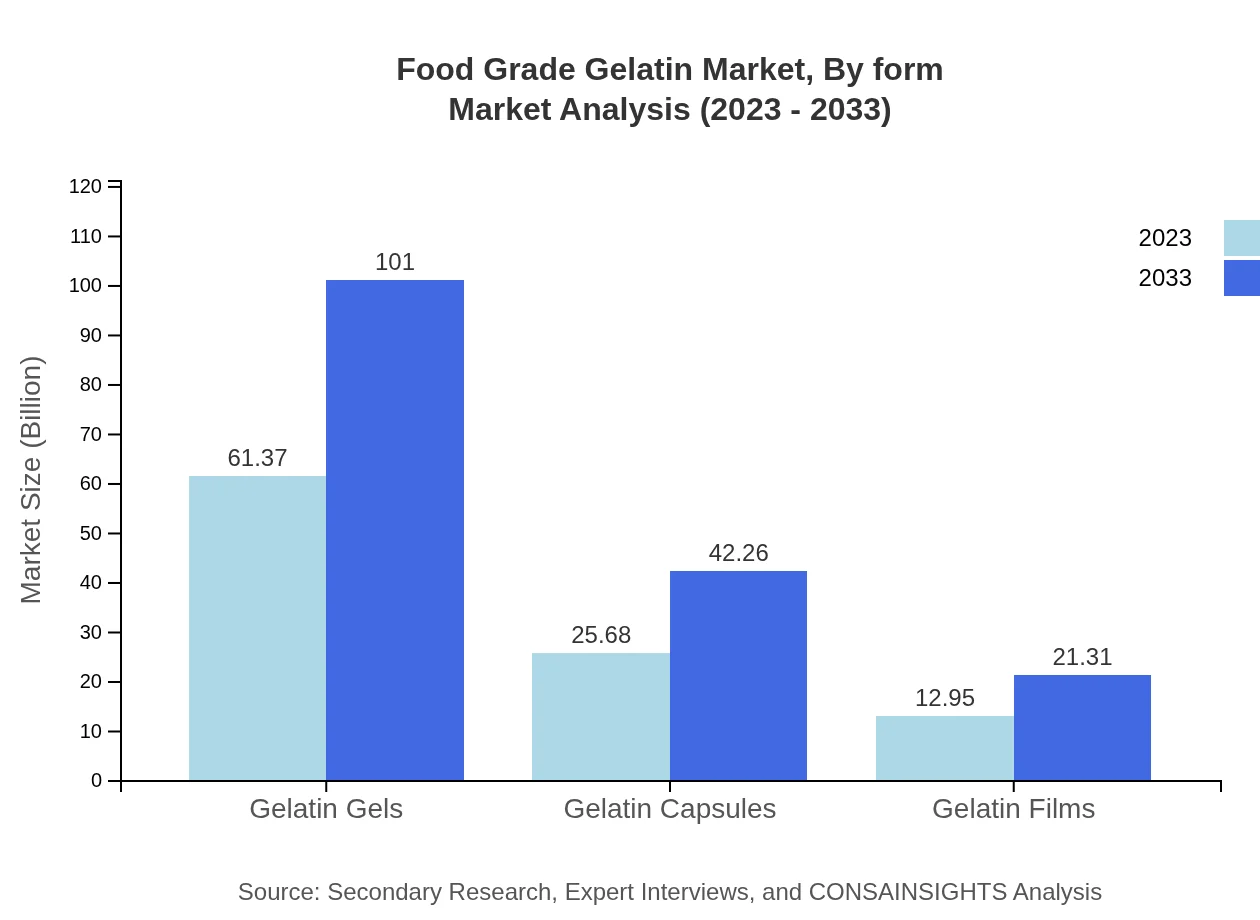

The product type segmentation indicates that 'Gelatin Gels' lead the market, with a size of $61.37 million in 2023, expected to reach $101.00 million by 2033. Following closely are 'Gelatin Capsules' projected to grow from $25.68 million to $42.26 million in the same period, reflecting increased demand in pharmaceutical and health supplement markets.

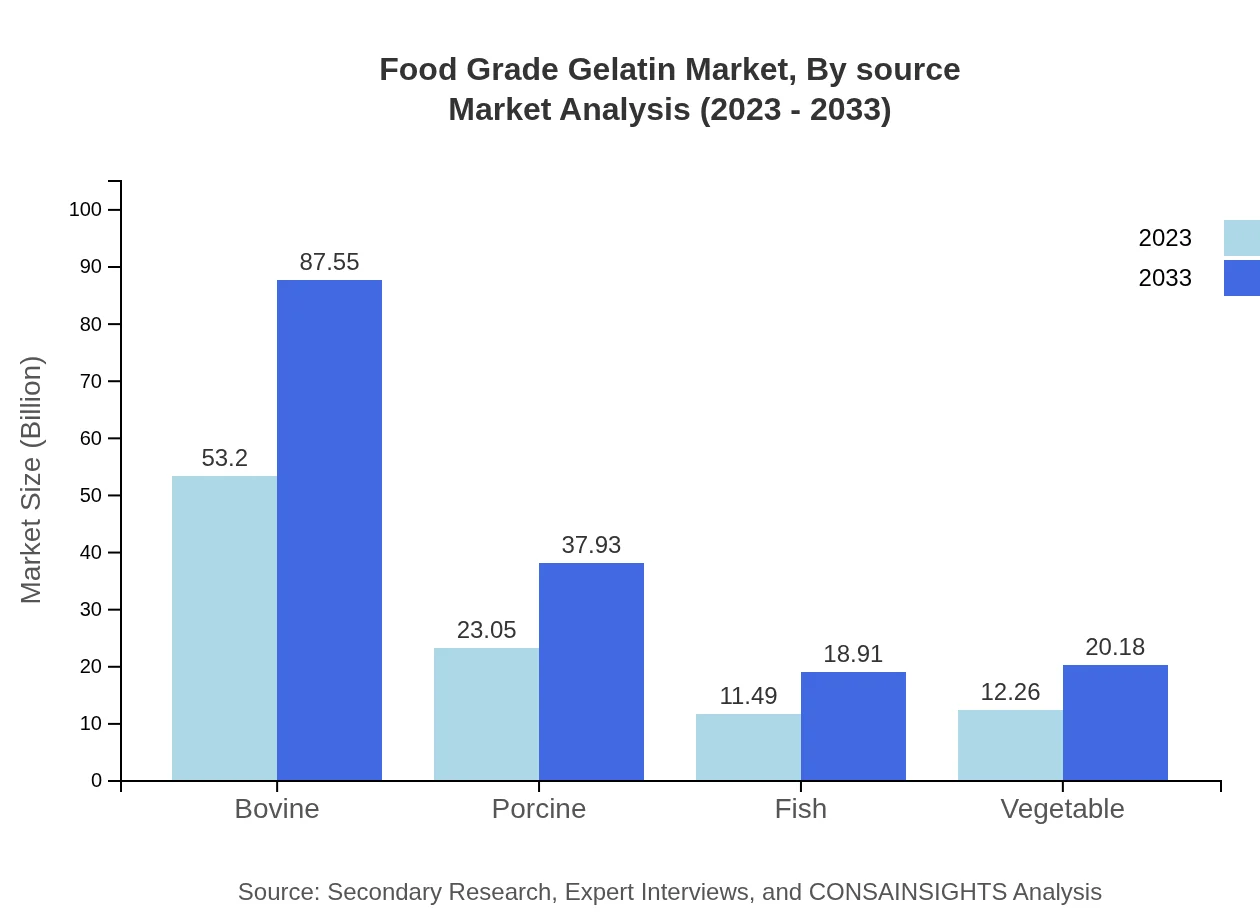

Food Grade Gelatin Market Analysis By Source

By source, 'Bovine Gelatin' dominates the market with a size of $53.20 million in 2023, potentially expanding to $87.55 million by 2033. Meanwhile, 'Porcine' and 'Fish Gelatins' are also notable, increasing from $23.05 million and $11.49 million to $37.93 million and $18.91 million respectively, driven by dietary preferences and the rise of aquatic food sources.

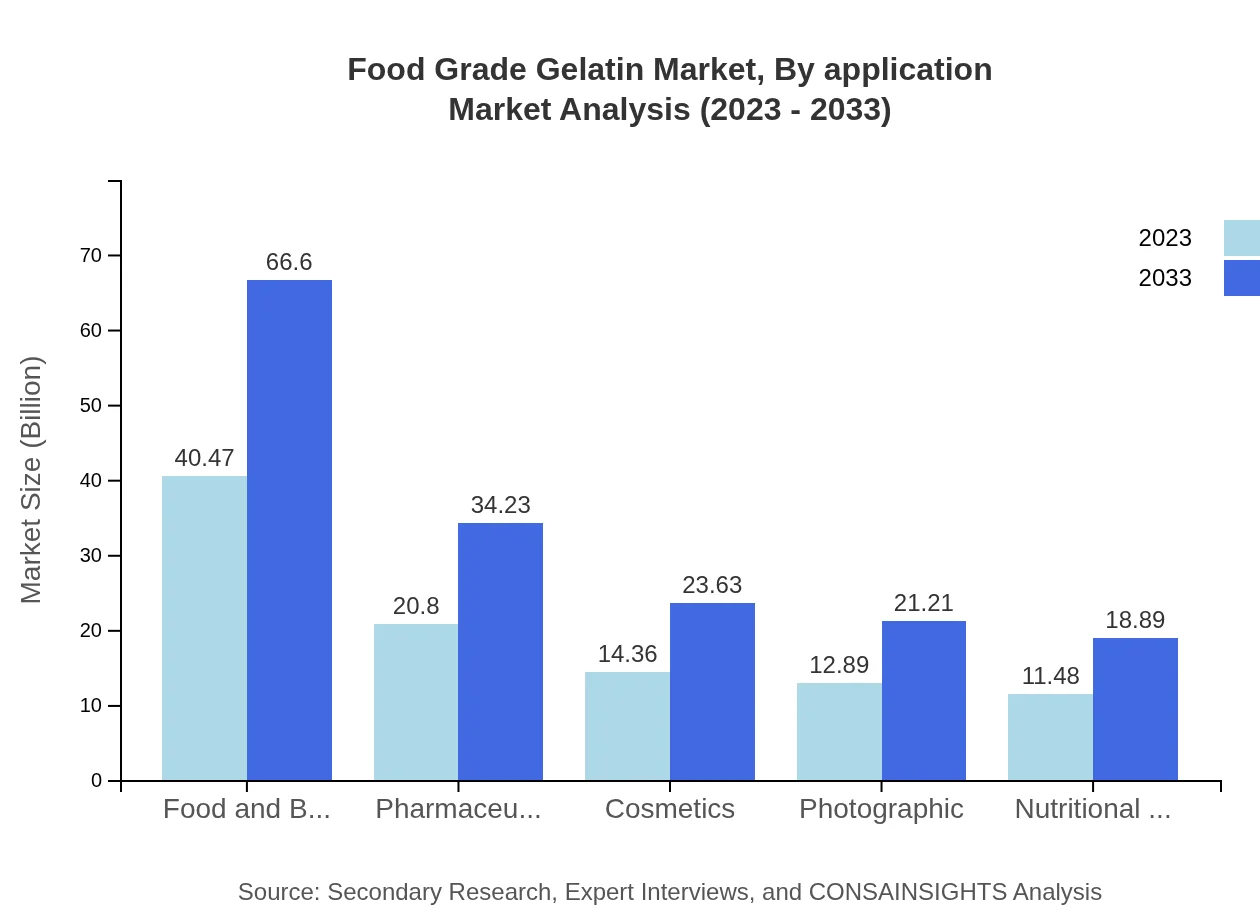

Food Grade Gelatin Market Analysis By Application

In terms of application, 'Food and Beverage' holds a leading position with a market size of $40.47 million in 2023, projected to climb to $66.60 million by 2033. The 'Pharmaceuticals' sector is also substantial, expected to grow from $20.80 million to $34.23 million, indicating an increasing reliance on gelatin in health-related products.

Food Grade Gelatin Market Analysis By Form

The form analysis shows that 'Powder Gelatin' is prominent with a size of $61.37 million in 2023, reaching $101.00 million by 2033. Meanwhile, 'Sheet Gelatin' and 'Granulated Gelatin' are projected to grow from $25.68 million to $42.26 million and $12.95 million to $21.31 million, respectively, as consumers favor versatile forms in cooking and baking.

Food Grade Gelatin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Grade Gelatin Industry

Gelita AG:

A global leader in gelatin production, Gelita AG offers a wide range of gelatin products for food, pharmaceuticals, and nutritional applications, focusing on innovation and sustainability.Collagen Solutions PLC:

Specializing in collagen products, Collagen Solutions PLC is notable for its advancements in gelatin technologies that cater to health and wellness segments.Harshin Gelatin:

A significant player in the Asia-Pacific region, Harshin Gelatin is rapidly expanding its market share with high-quality gelatin and catering to the food and beverage industry.We're grateful to work with incredible clients.

FAQs

What is the market size of food Grade Gelatin?

The global food-grade gelatin market is estimated to be valued at approximately $100 million in 2023, with an anticipated compound annual growth rate (CAGR) of 5% from 2023 to 2033, reflecting strong demand across various sectors.

What are the key market players or companies in the food Grade Gelatin industry?

Key market players include Gelita AG, Darling Ingredients, and PB Gelatins. These companies dominate the industry through innovative product offerings and strategic partnerships, contributing significantly to market growth.

What are the primary factors driving the growth in the food Grade Gelatin industry?

The growth is driven by increasing demand for convenience foods, health supplements, and expanding applications in pharmaceuticals. Innovations in production processes and rising consumer preference for plant-based gels also contribute significantly.

Which region is the fastest Growing in the food Grade Gelatin?

North America is the fastest-growing region in the food-grade gelatin market, projected to rise from a market size of $38.32 million in 2023 to $63.07 million by 2033, due to a growing health-conscious consumer base.

Does ConsaInsights provide customized market report data for the food Grade Gelatin industry?

Yes, ConsaInsights provides customized market reports for the food-grade gelatin industry, tailored to specific client needs, ensuring relevant and actionable insights based on current market dynamics.

What deliverables can I expect from this food Grade Gelatin market research project?

Expect comprehensive market analysis, including market size data, CAGR forecasts, competitive landscape insights, segmentation analysis, and regional insights, as well as tailored recommendations for strategic planning.

What are the market trends of food Grade Gelatin?

Key trends include a shift towards plant-based alternatives, rising health consciousness among consumers, and innovation in product applications. Additionally, the sustainable sourcing of raw materials is increasingly influencing market dynamics.