Food Grade Phosphoric Acid Market Report

Published Date: 31 January 2026 | Report Code: food-grade-phosphoric-acid

Food Grade Phosphoric Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Food Grade Phosphoric Acid market from 2023 to 2033, including market size, growth trends, segmentation, technological advancements, regional insights, and key industry players.

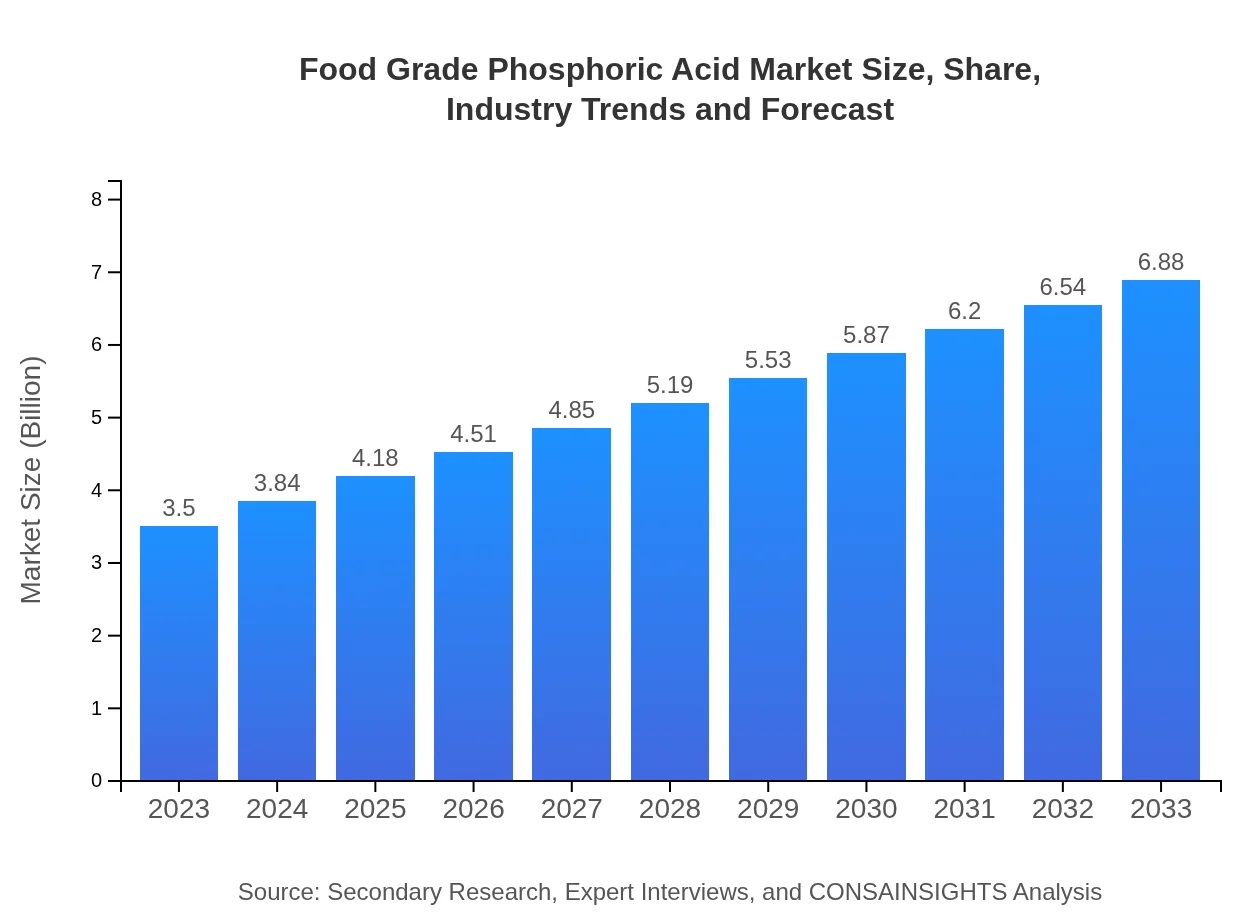

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Nutrien Ltd., The Mosaic Company, OCP Group, Yara International |

| Last Modified Date | 31 January 2026 |

Food Grade Phosphoric Acid Market Overview

Customize Food Grade Phosphoric Acid Market Report market research report

- ✔ Get in-depth analysis of Food Grade Phosphoric Acid market size, growth, and forecasts.

- ✔ Understand Food Grade Phosphoric Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Grade Phosphoric Acid

What is the Market Size & CAGR of Food Grade Phosphoric Acid market in 2023 and 2033?

Food Grade Phosphoric Acid Industry Analysis

Food Grade Phosphoric Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Grade Phosphoric Acid Market Analysis Report by Region

Europe Food Grade Phosphoric Acid Market Report:

The European market is projected to grow from $1.00 billion in 2023 to $1.97 billion by 2033. Strong consumer awareness regarding food quality and safety, combined with innovations in the food processing industry, propels market growth in this region.Asia Pacific Food Grade Phosphoric Acid Market Report:

The Asia Pacific region, with a market size of $0.66 billion in 2023, is expected to grow to $1.30 billion by 2033. Factors such as rapid urbanization, an increasing population, and rising disposable incomes contribute to the growing demand for processed foods, driving the growth of this market.North America Food Grade Phosphoric Acid Market Report:

North America is anticipated to witness growth from $1.31 billion in 2023 to $2.58 billion in 2033. This growth is largely driven by stringent food safety regulations and a surge in demand for processed aseptic foods, emphasizing quality and safety.South America Food Grade Phosphoric Acid Market Report:

In South America, the Food Grade Phosphoric Acid market is projected to rise from $0.30 billion in 2023 to $0.58 billion by 2033. The region benefits from expanding food and beverage industries, particularly in Brazil and Argentina, which are the key drivers of market demand.Middle East & Africa Food Grade Phosphoric Acid Market Report:

The Middle East and Africa market is expected to grow from $0.23 billion in 2023 to $0.45 billion by 2033. The demand is primarily driven by growth in the food and beverage sector, with rising investment in food safety infrastructure.Tell us your focus area and get a customized research report.

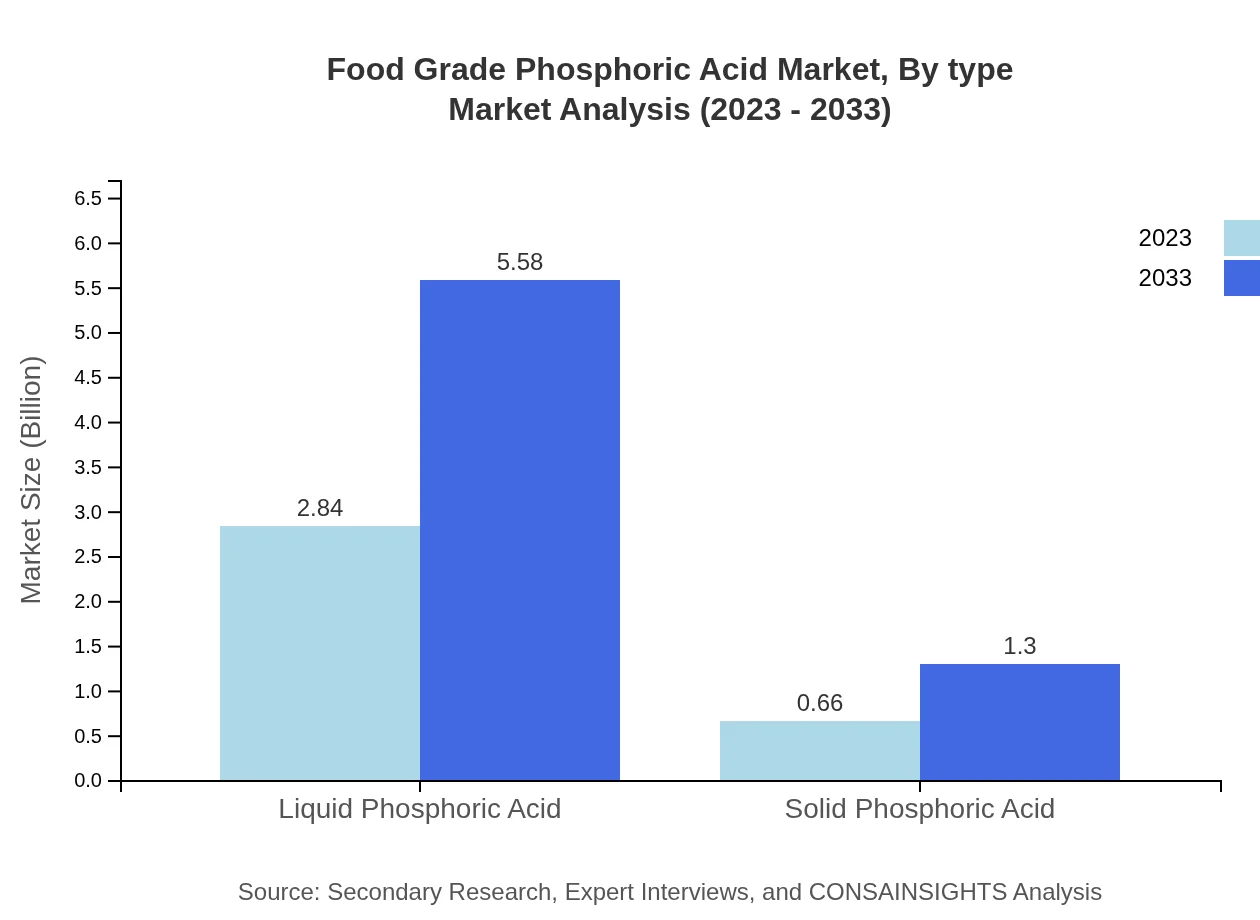

Food Grade Phosphoric Acid Market Analysis By Type

In the Food Grade Phosphoric Acid market, the key types include Liquid and Solid Phosphoric Acid. Liquid Phosphoric Acid comprises approximately 81.05% of the market share with an expected growth from $2.84 billion in 2023 to $5.58 billion by 2033. Solid Phosphoric Acid holds 18.95% of the market share, growing from $0.66 billion to $1.30 billion over the same period.

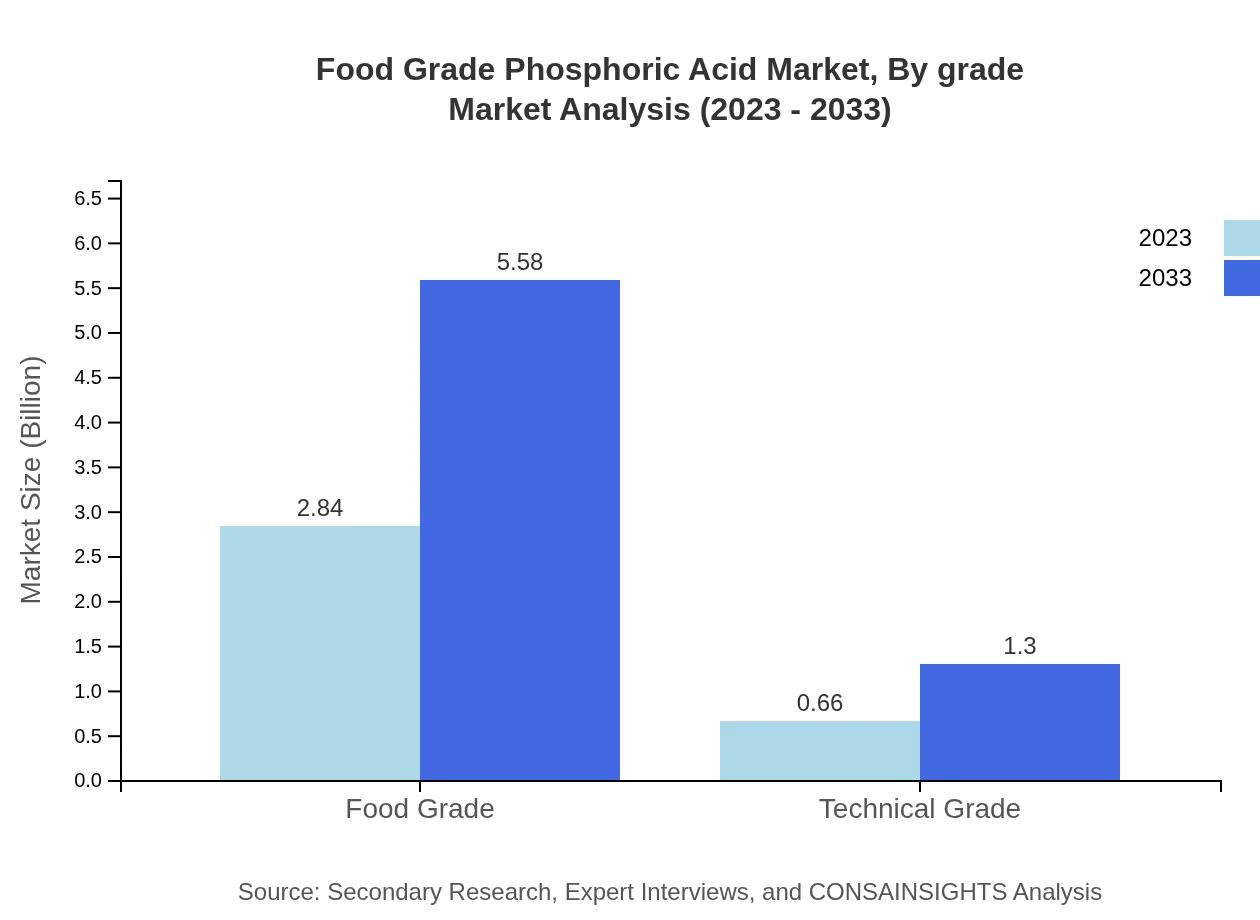

Food Grade Phosphoric Acid Market Analysis By Grade

The segments include Food Grade and Technical Grade Phosphoric Acid. Food Grade accounts for approximately 81.05% of the market in terms of share, expected to grow from $2.84 billion in 2023 to $5.58 billion in 2033. Technical Grade makes up the remainder, expanding from $0.66 billion to $1.30 billion.

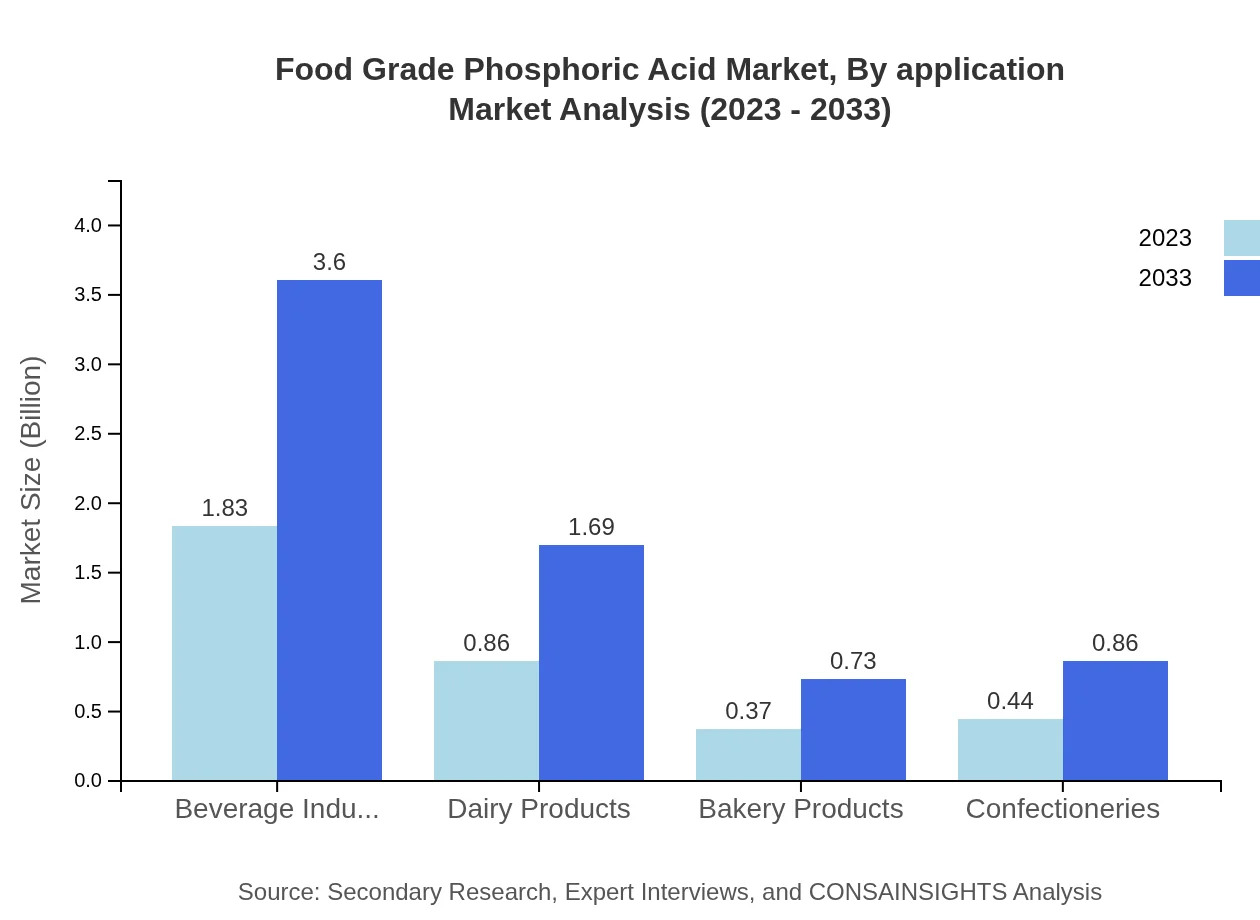

Food Grade Phosphoric Acid Market Analysis By Application

Applications of Food Grade Phosphoric Acid span across various sectors including food manufacturing, beverages, dairy products, and bakery products. Food manufacturing dominates the segment with a share of 61.76%, growing from $2.16 billion to $4.25 billion. The beverage sector follows with 28.06% market share, increasing from $0.98 billion to $1.93 billion.

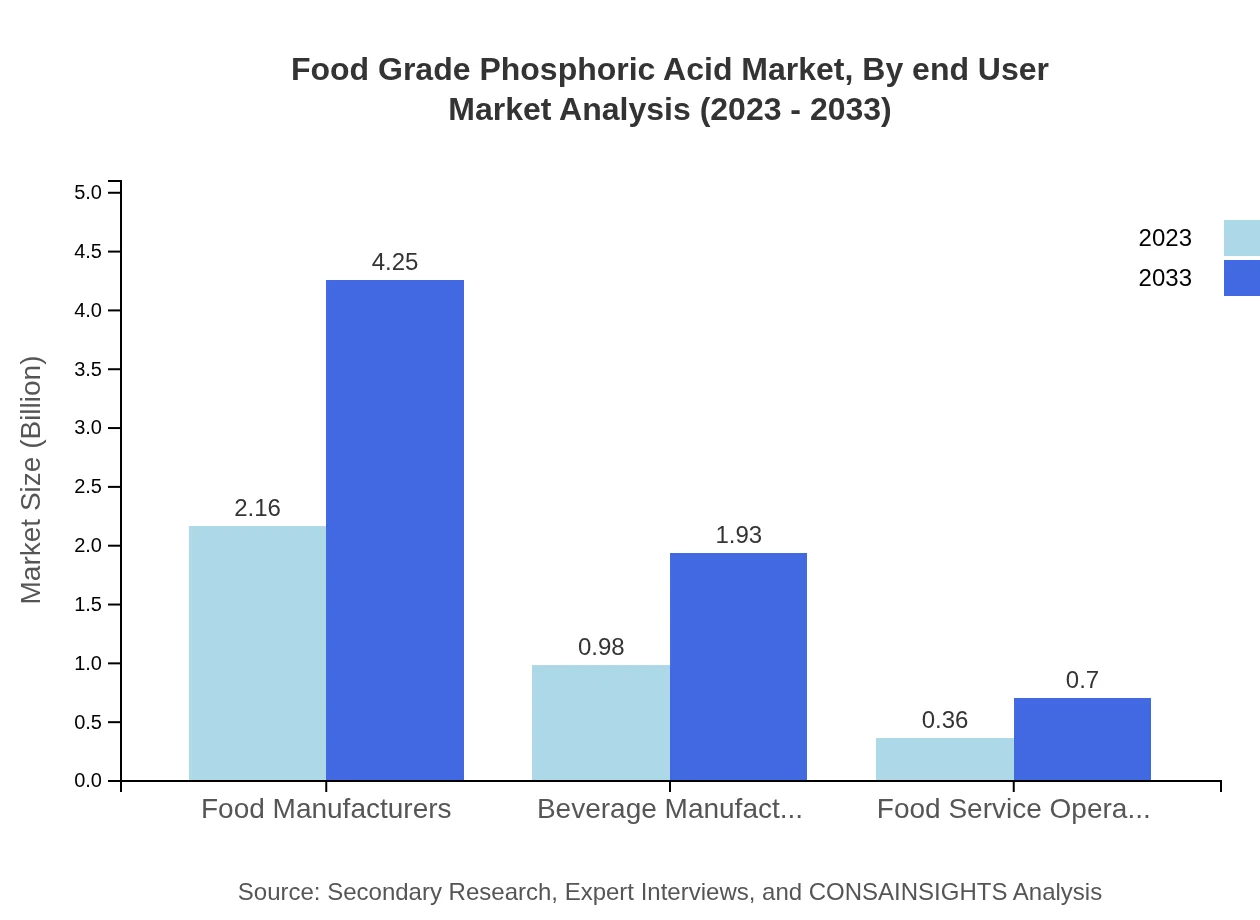

Food Grade Phosphoric Acid Market Analysis By End User

Key end-users of Food Grade Phosphoric Acid include food manufacturers, beverage producers, and food service operators. The food manufacturers segment holds the largest share at 61.76%, while the beverage industry accounts for 52.31% market share, emphasizing its critical role in production.

Food Grade Phosphoric Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Grade Phosphoric Acid Industry

Nutrien Ltd.:

A leading global producer of potash and phosphate fertilizers, Nutrien is a key player in the phosphoric acid market, focusing on sustainable agricultural solutions.The Mosaic Company:

Mosaic specializes in potash and phosphate crop nutrients and is a significant contributor to the Food Grade Phosphoric Acid market, with a focus on innovation and sustainability.OCP Group:

Based in Morocco, OCP is a major player in phosphates, providing high-quality phosphoric acid for food applications.Yara International:

A global chemical company, Yara produces fertilizers and phosphoric acid, emphasizing environmental sustainability in its operations.We're grateful to work with incredible clients.

FAQs

What is the market size of food Grade Phosphoric Acid?

The global food-grade phosphoric acid market is valued at approximately $3.5 billion in 2023, with a projected growth to significantly enhance by 2033, exhibiting a CAGR of 6.8% over this decade.

What are the key market players or companies in this food Grade Phosphoric Acid industry?

Key players in the food-grade phosphoric acid market include major chemical producers and food additive manufacturers, playing vital roles in product supply and innovation within the industry.

What are the primary factors driving the growth in the food Grade Phosphoric Acid industry?

Growth is driven by the increasing demand for food preservation, flavor enhancement, and the expanding beverage market, alongside regulatory approvals for food-grade applications.

Which region is the fastest Growing in the food Grade Phosphoric Acid?

The Asia-Pacific region is the fastest-growing market for food-grade phosphoric acid, expected to rise from $0.66 billion in 2023 to $1.30 billion by 2033, reflecting strong industrial demand.

Does ConsaInsights provide customized market report data for the food Grade Phosphoric Acid industry?

Yes, ConsaInsights offers tailored market report data for the food-grade phosphoric acid industry, enabling clients to receive insights specific to their business needs and regional dynamics.

What deliverables can I expect from this food Grade Phosphoric Acid market research project?

Deliverables typically include comprehensive market analysis reports, segment breakdowns, competitive landscape assessments, and future growth projections tailored to specific client requirements.

What are the market trends of food Grade Phosphoric Acid?

Key trends encompass rising consumption in the beverage industry, growing awareness of food safety, and innovations in phosphoric acid applications, driving sustainable use and formulation advancements.