Food Humectants Market Report

Published Date: 31 January 2026 | Report Code: food-humectants

Food Humectants Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Humectants market from 2023 to 2033, focusing on market size, growth forecasts, segmentation, regional insights, and emerging trends impacting the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

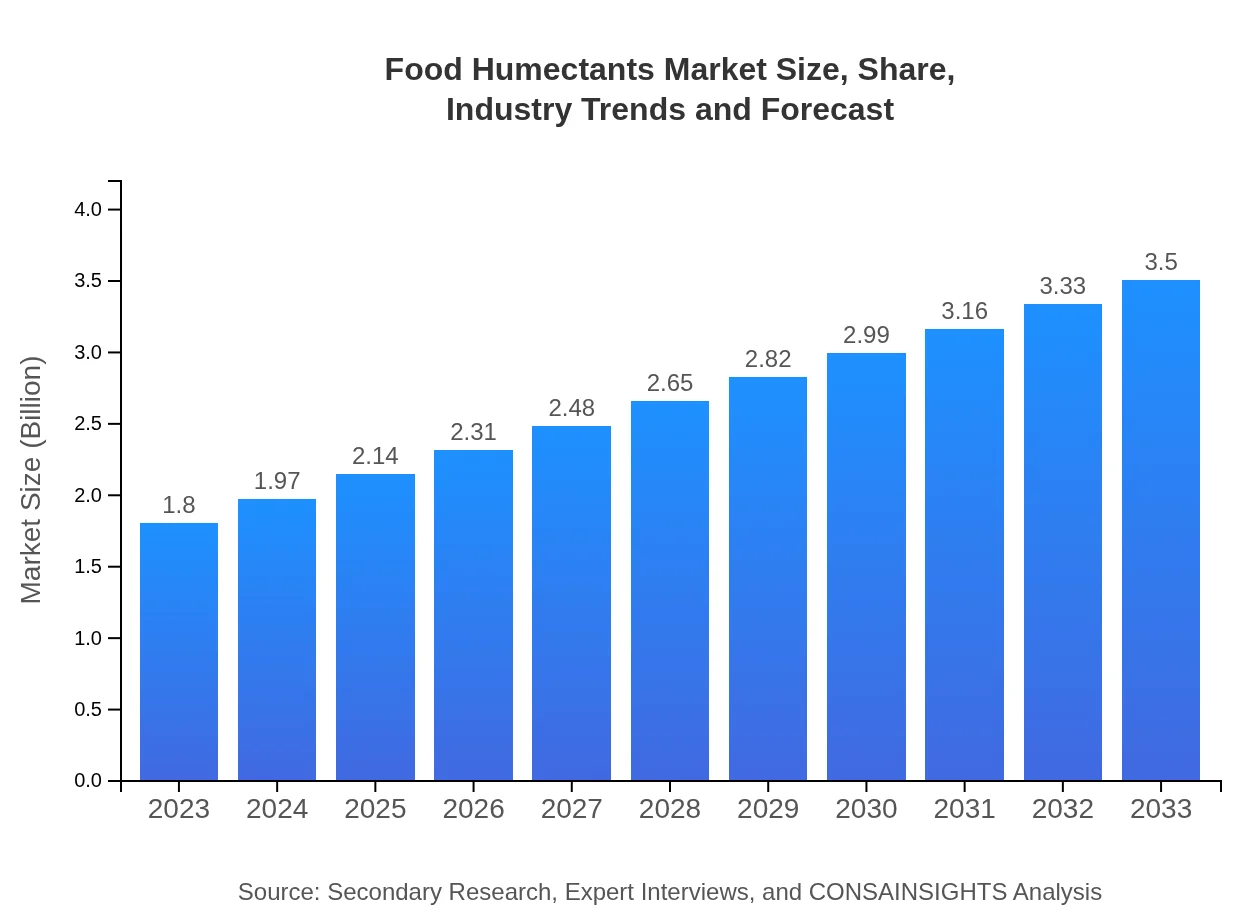

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $3.50 Billion |

| Top Companies | BASF SE, Cargill, Incorporated, DuPont, Tate & Lyle |

| Last Modified Date | 31 January 2026 |

Food Humectants Market Overview

Customize Food Humectants Market Report market research report

- ✔ Get in-depth analysis of Food Humectants market size, growth, and forecasts.

- ✔ Understand Food Humectants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Humectants

What is the Market Size & CAGR of Food Humectants market in 2023?

Food Humectants Industry Analysis

Food Humectants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Humectants Market Analysis Report by Region

Europe Food Humectants Market Report:

Europe's Food Humectants market size was $0.47 billion in 2023, expected to reach $0.92 billion by 2033. This market is driven by stringent regulations favoring natural ingredients, with significant consumer demand for clean label products. Countries like Germany, France, and the UK lead the market.Asia Pacific Food Humectants Market Report:

In the Asia Pacific region, the Food Humectants market was valued at $0.36 billion in 2023 and is projected to reach $0.71 billion by 2033. The growth is fueled by rising urbanization and increasing consumption of processed food products, notably in countries like China and India. Health considerations are also pushing demand for natural humectants over synthetics.North America Food Humectants Market Report:

In North America, the market is estimated to be $0.61 billion in 2023, expanding to $1.20 billion by 2033. The region's market growth is attributed to greater health awareness, prompting manufacturers to incorporate natural humectants into products. The U.S. and Canada, known for their robust food innovation sectors, dominate this market.South America Food Humectants Market Report:

South America is expected to see its Food Humectants market grow from $0.13 billion in 2023 to $0.25 billion by 2033. Growth drivers include increased local food processing capabilities and consumer preference for preserved food items. Brazil and Argentina are leading this growth, leveraging their agricultural advantages.Middle East & Africa Food Humectants Market Report:

The Middle East and Africa Food Humectants market is projected to grow from $0.22 billion in 2023 to $0.43 billion by 2033. This growth is influenced by evolving consumer preferences towards processed and convenient food solutions, alongside improvements in food preservation technologies.Tell us your focus area and get a customized research report.

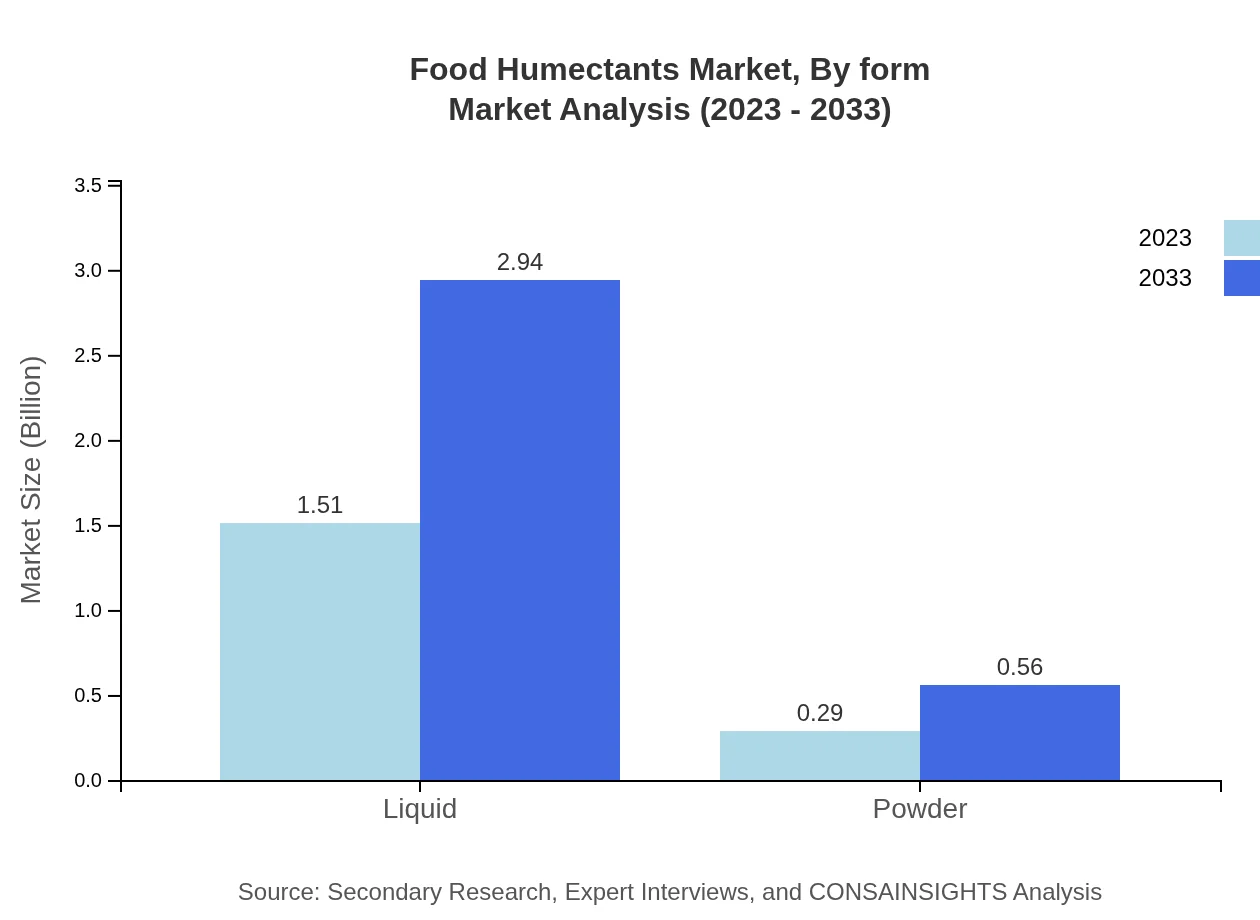

Food Humectants Market Analysis By Type

The Food Humectants market is primarily segmented into Liquid and Powder. In 2023, the Liquid segment leads with a market size of $1.51 billion, which is anticipated to grow to $2.94 billion by 2033, maintaining an 83.96% market share throughout the decade. The Powder segment, though significantly smaller, shows a promising growth trajectory from $0.29 billion in 2023 to $0.56 billion by 2033, constituting around 16.04% market share.

Food Humectants Market Analysis By Application

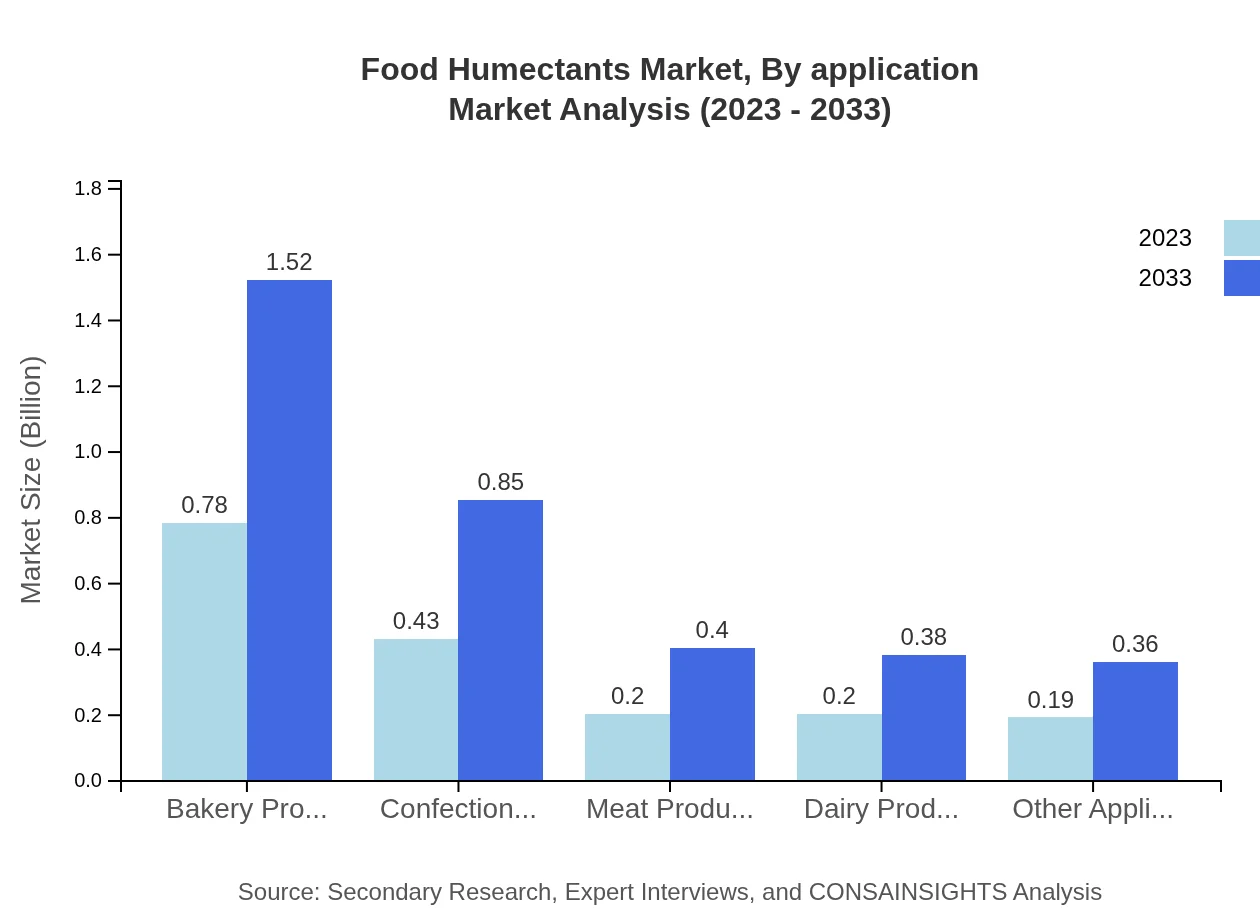

Bakery products dominate the application segment, with a market size of $0.78 billion in 2023, expected to double to $1.52 billion by 2033, holding a share of 43.25%. Other significant applications include Confectionery size growing from $0.43 billion to $0.85 billion (24.15% share), Meat products (11.36%), Dairy (10.94%), and Other Applications (10.3%).

Food Humectants Market Analysis By Form

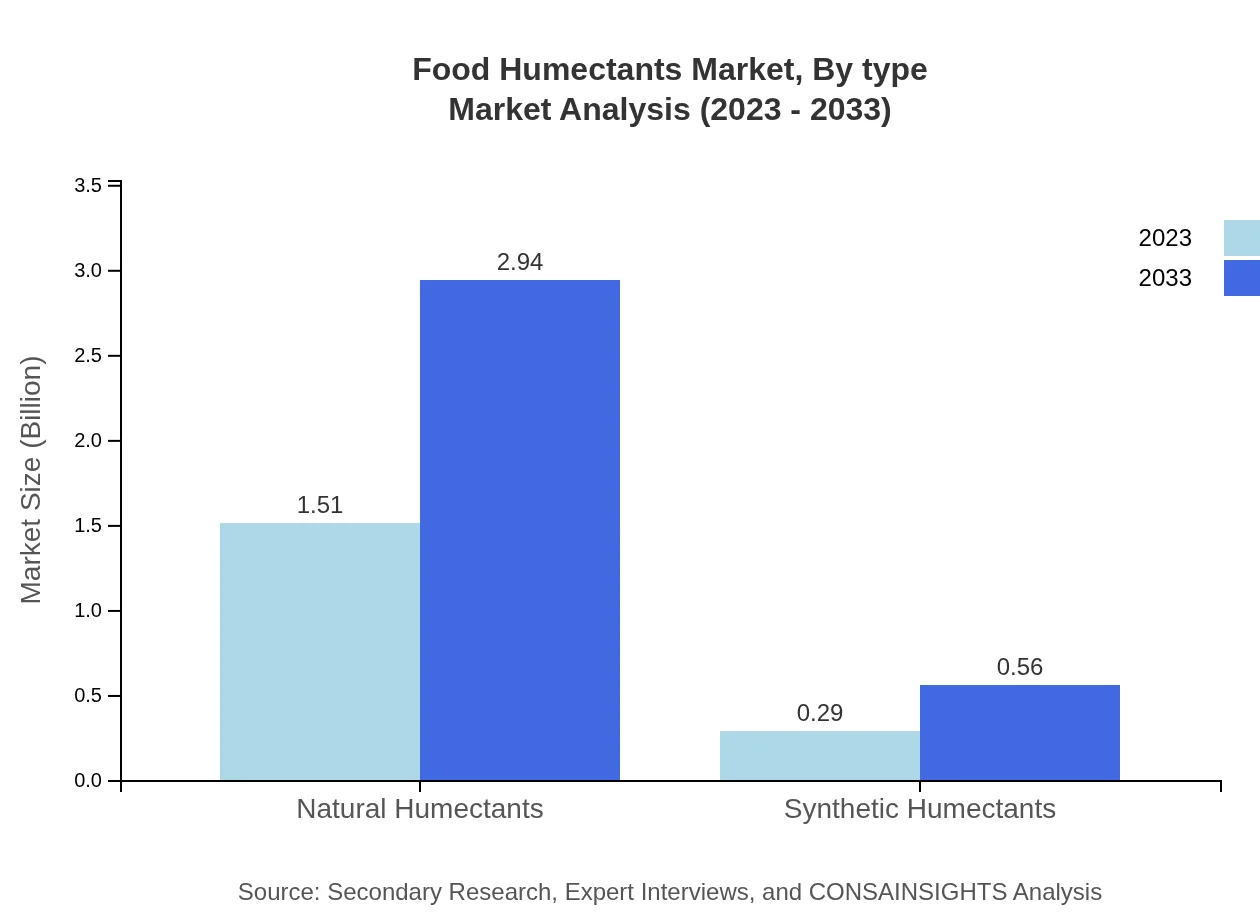

The market is classified into Natural and Synthetic Humectants. Natural Humectants dominate, accounting for a size of $1.51 billion in 2023 and projected to reach $2.94 billion by 2033 (83.96% share). Synthetic Humectants exhibit a smaller yet notable size from $0.29 billion to $0.56 billion (16.04% share).

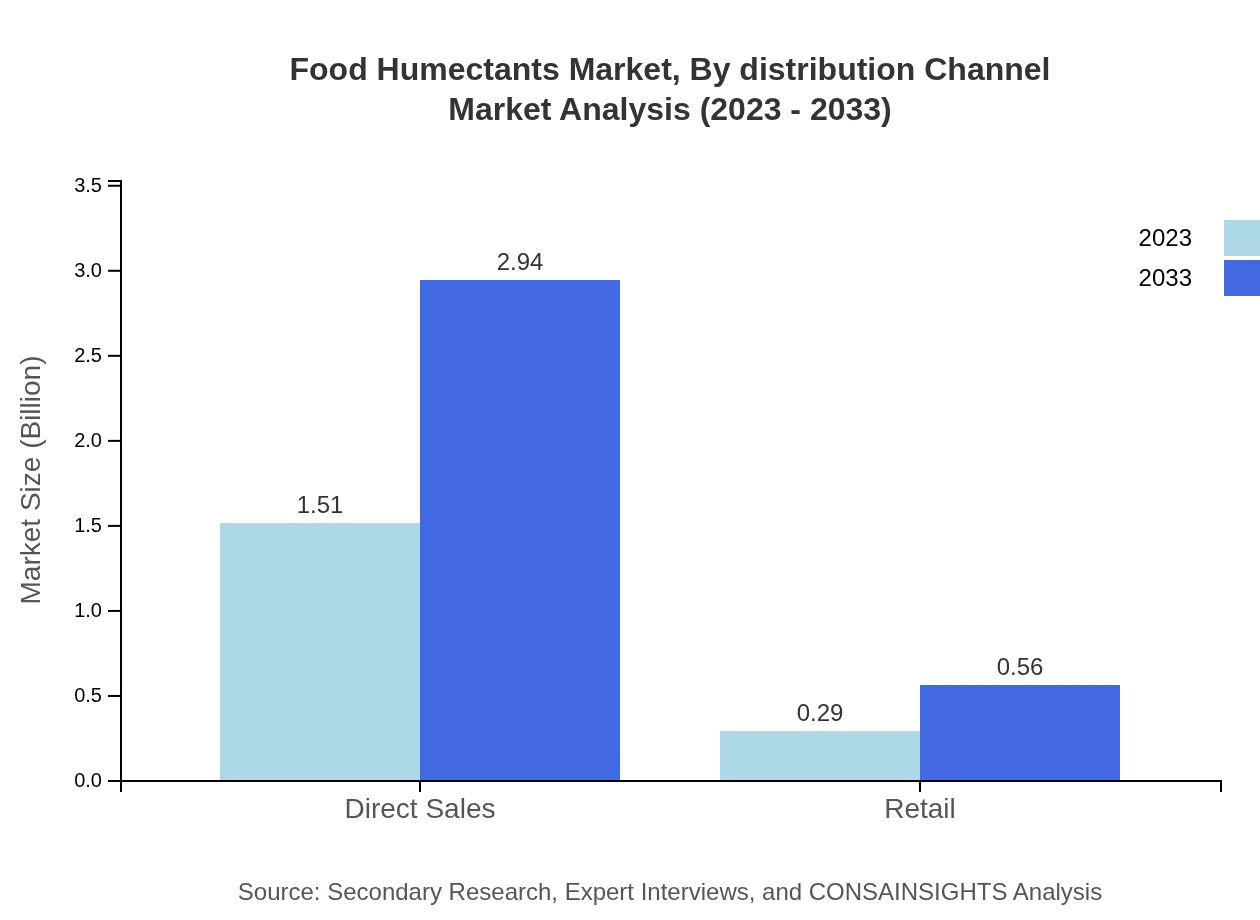

Food Humectants Market Analysis By Distribution Channel

The distribution channel for Food Humectants includes Direct Sales and Retail. Direct Sales segment leads with $1.51 billion in 2023, expected to maintain its share of 83.96% and grow to $2.94 billion by 2033. Retail channels represent a growing segment increasing from $0.29 billion to $0.56 billion (16.04% share).

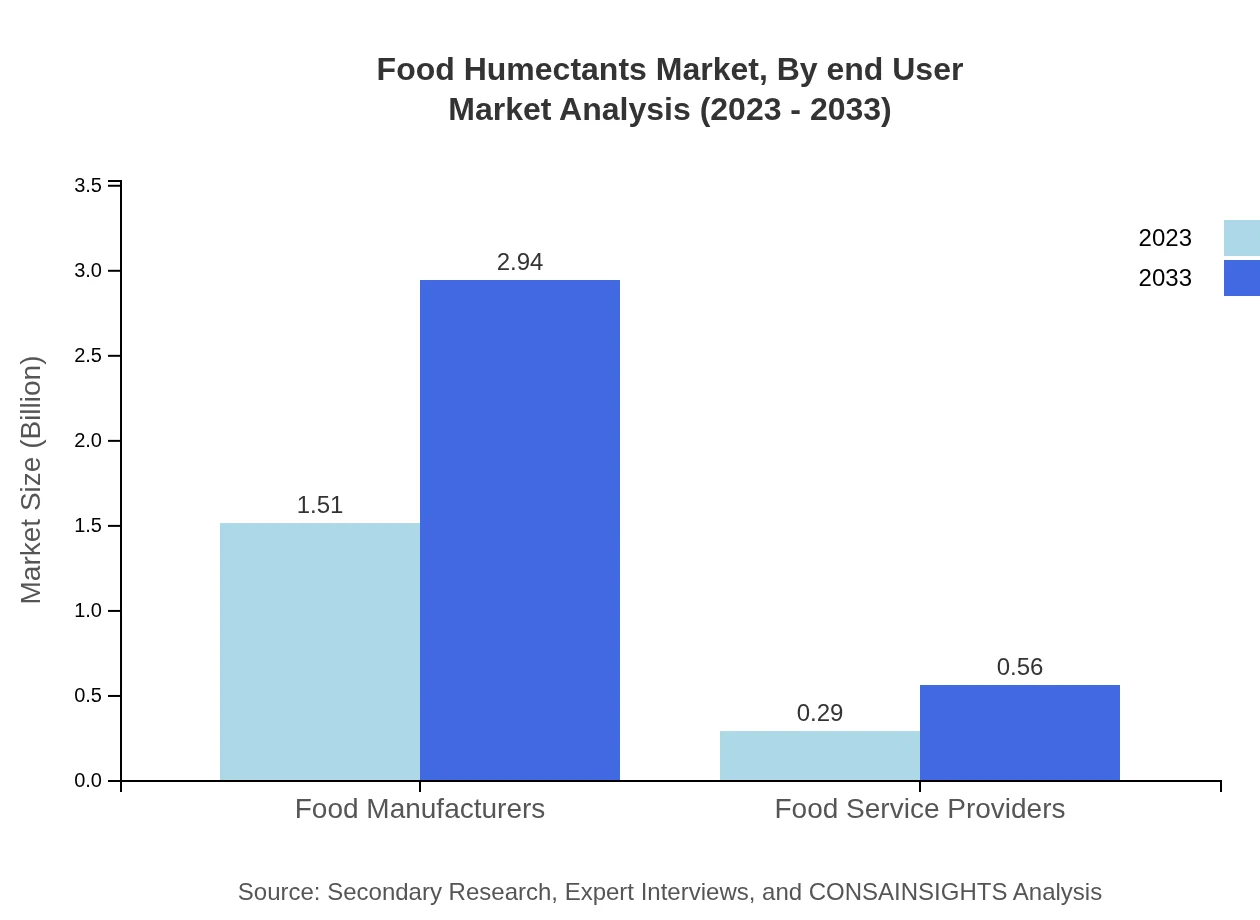

Food Humectants Market Analysis By End User

End-users of Food Humectants include Food Manufacturers and Food Service Providers. The Food Manufacturers segment with a size of $1.51 billion in 2023 shows substantial growth, reaching $2.94 billion (83.96% share) by 2033, while Food Service Providers are anticipated to grow from $0.29 billion to $0.56 billion (16.04% share) during the same period.

Food Humectants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Humectants Industry

BASF SE:

A leading global chemical company that develops innovative and sustainable solutions, including functional food ingredients such as humectants.Cargill, Incorporated:

An international producer and marketer of food, agricultural, financial and industrial products, providing a range of humectants for various applications.DuPont:

A science and technology company known for its leading advancements in biotechnology and material science, including a comprehensive portfolio of food humectants.Tate & Lyle:

Expert in food ingredients and solutions, specializing in developing healthy and sustainable products such as sugar substitutes and humectants.We're grateful to work with incredible clients.

FAQs

What is the market size of food Humectants?

The global food humectants market was valued at approximately $1.8 billion in 2023, and it is projected to grow at a CAGR of 6.7%, indicating significant expansion in the following years.

What are the key market players or companies in the food Humectants industry?

Key market players in the food-humectants industry include major food manufacturers that utilize humectants extensively in various products, ensuring quality and longevity of food items.

What are the primary factors driving the growth in the food Humectants industry?

The growth in the food-humectants industry is driven by the increasing demand for processed and packaged foods, alongside heightened consumer awareness about product quality and shelf-life.

Which region is the fastest Growing in the food Humectants?

North America is the fastest-growing region in the food-humectants market, projected to increase from $0.61 billion in 2023 to $1.20 billion by 2033, driven by high consumption rates and market innovations.

Does ConsaInsights provide customized market report data for the food Humectants industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the food-humectants industry, allowing for more precise insights and strategic decision-making.

What deliverables can I expect from this food Humectants market research project?

Deliverables include detailed market analyses, trend forecasts, segmentation insights, and competitive landscapes providing comprehensive views of the food-humectants market.

What are the market trends of food Humectants?

Current market trends in food-humectants include a shift towards natural humectants, innovations in formulation, and increased applications in various food segments, highlighting versatility and consumer preference.