Food Packaging Testing Market Report

Published Date: 31 January 2026 | Report Code: food-packaging-testing

Food Packaging Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Packaging Testing market, offering insights into current conditions, market size, segmentation, and forecasts from 2023 to 2033.

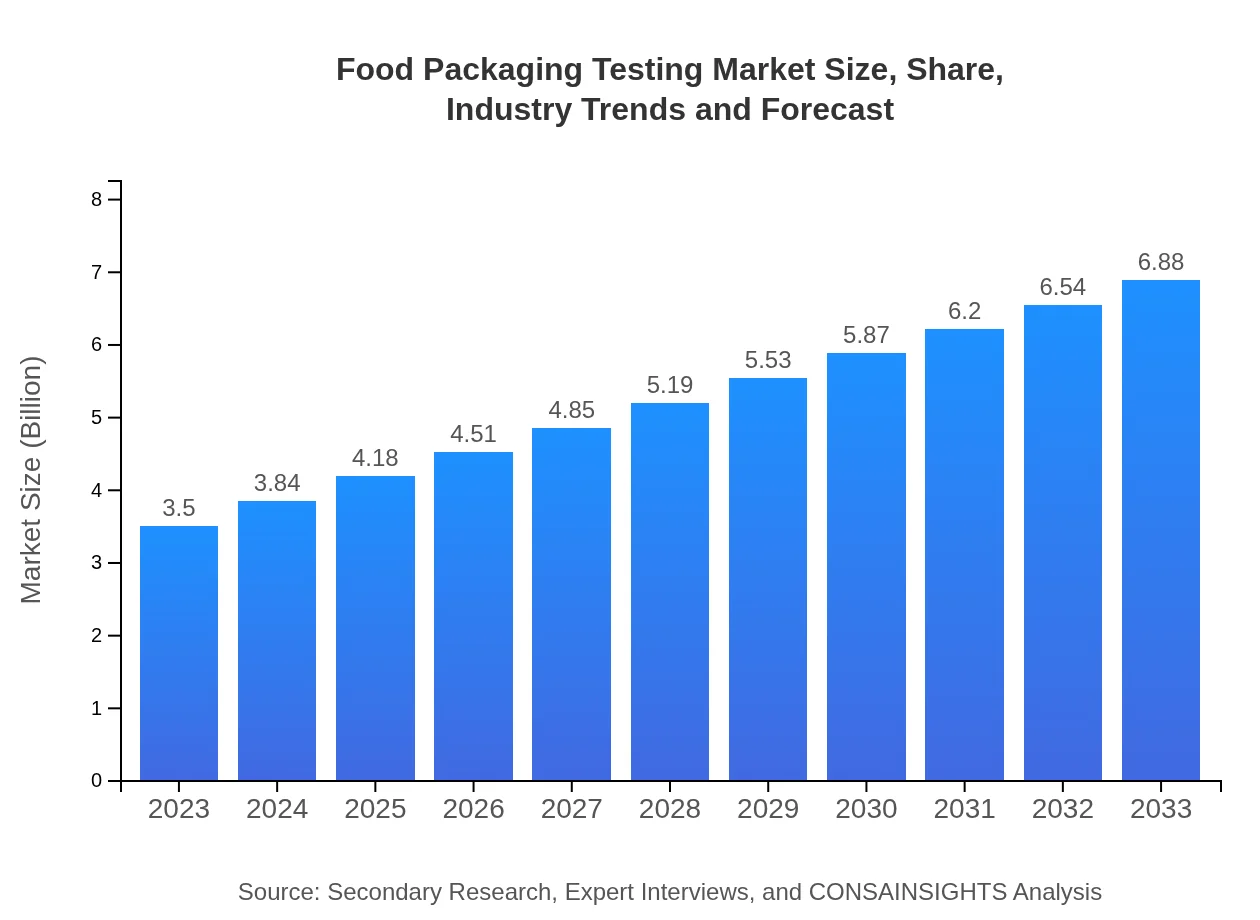

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | SGS SA, Intertek Group plc, Bureau Veritas |

| Last Modified Date | 31 January 2026 |

Food Packaging Testing Market Overview

Customize Food Packaging Testing Market Report market research report

- ✔ Get in-depth analysis of Food Packaging Testing market size, growth, and forecasts.

- ✔ Understand Food Packaging Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Packaging Testing

What is the Market Size & CAGR of Food Packaging Testing market in 2023?

Food Packaging Testing Industry Analysis

Food Packaging Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Packaging Testing Market Analysis Report by Region

Europe Food Packaging Testing Market Report:

The European market for Food Packaging Testing is set to grow from $0.86 billion in 2023 to $1.70 billion in 2033. Growing consumer awareness regarding safe food practices and regulatory compliance demands drive this growth.Asia Pacific Food Packaging Testing Market Report:

In the Asia Pacific, the Food Packaging Testing market is projected to grow from $0.75 billion in 2023 to $1.47 billion in 2033. This growth is driven by rising food safety regulations and increasing consumer demand for quality packaging in countries like China and India.North America Food Packaging Testing Market Report:

In North America, the market is anticipated to expand from $1.14 billion in 2023 to $2.25 billion in 2033. The region is characterized by stringent food safety regulations and a high focus on innovative testing technologies.South America Food Packaging Testing Market Report:

The South American market size is expected to rise from $0.26 billion in 2023 to $0.51 billion by 2033, driven by improving food safety standards and market expansion in Brazil and Argentina.Middle East & Africa Food Packaging Testing Market Report:

The Middle East and Africa market is projected to expand from $0.49 billion in 2023 to $0.96 billion in 2033. The increasing food industry activity and a focus on improving food safety measures are key drivers.Tell us your focus area and get a customized research report.

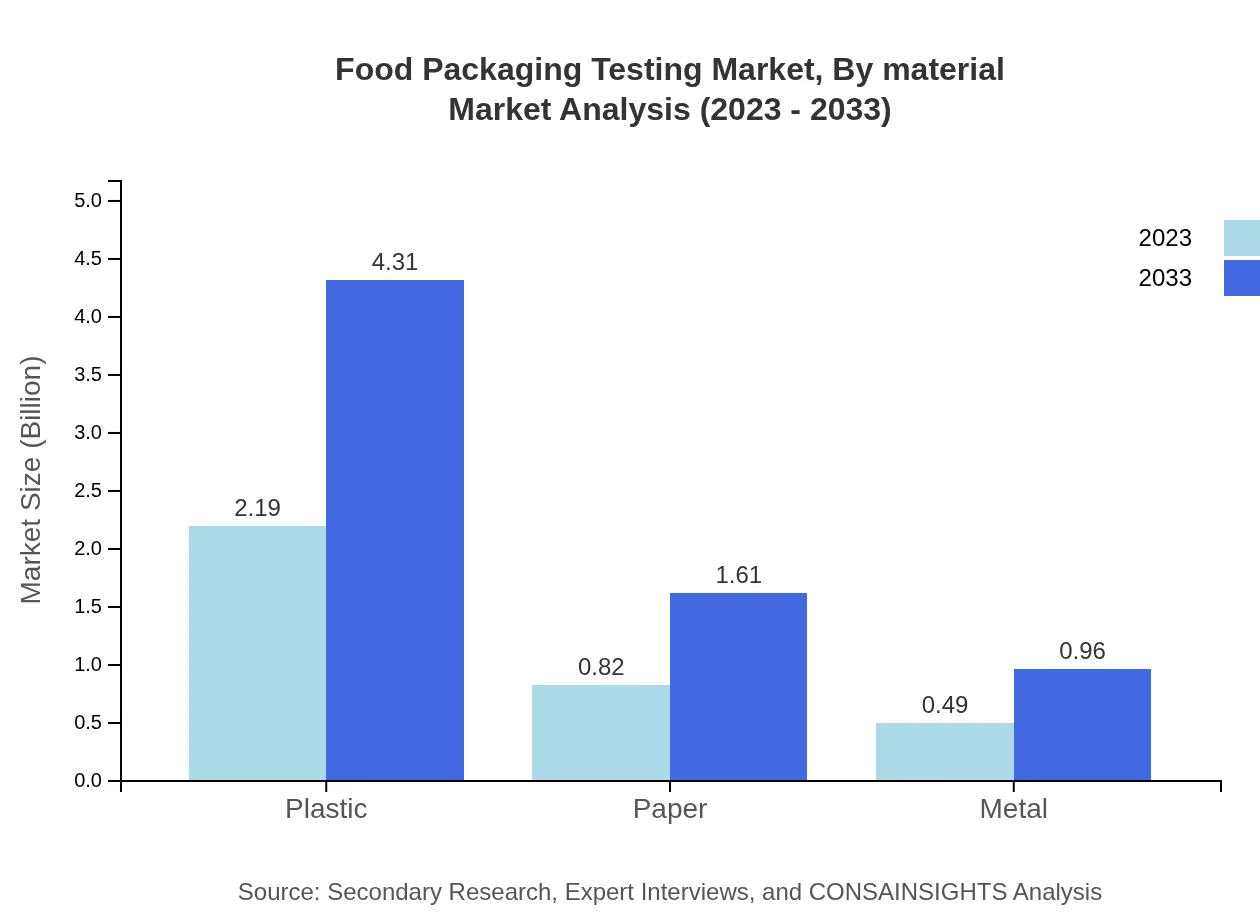

Food Packaging Testing Market Analysis By Material

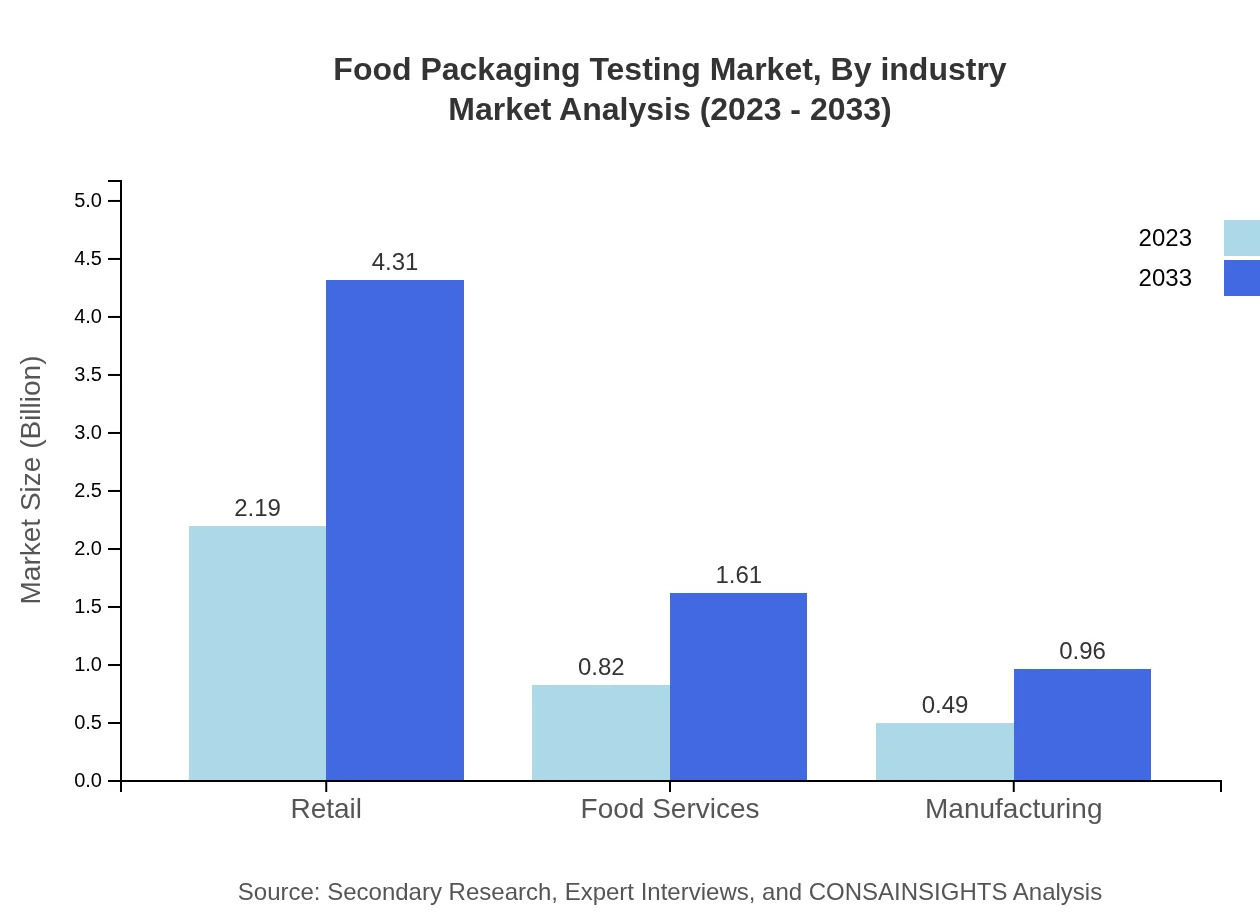

The Food Packaging Testing market is dominated by plastic materials, accounting for $2.19 billion in 2023 and projected to reach $4.31 billion by 2033. Paper materials are also significant, growing from $0.82 billion to $1.61 billion during this period, while metal packaging is expected to rise from $0.49 billion to $0.96 billion.

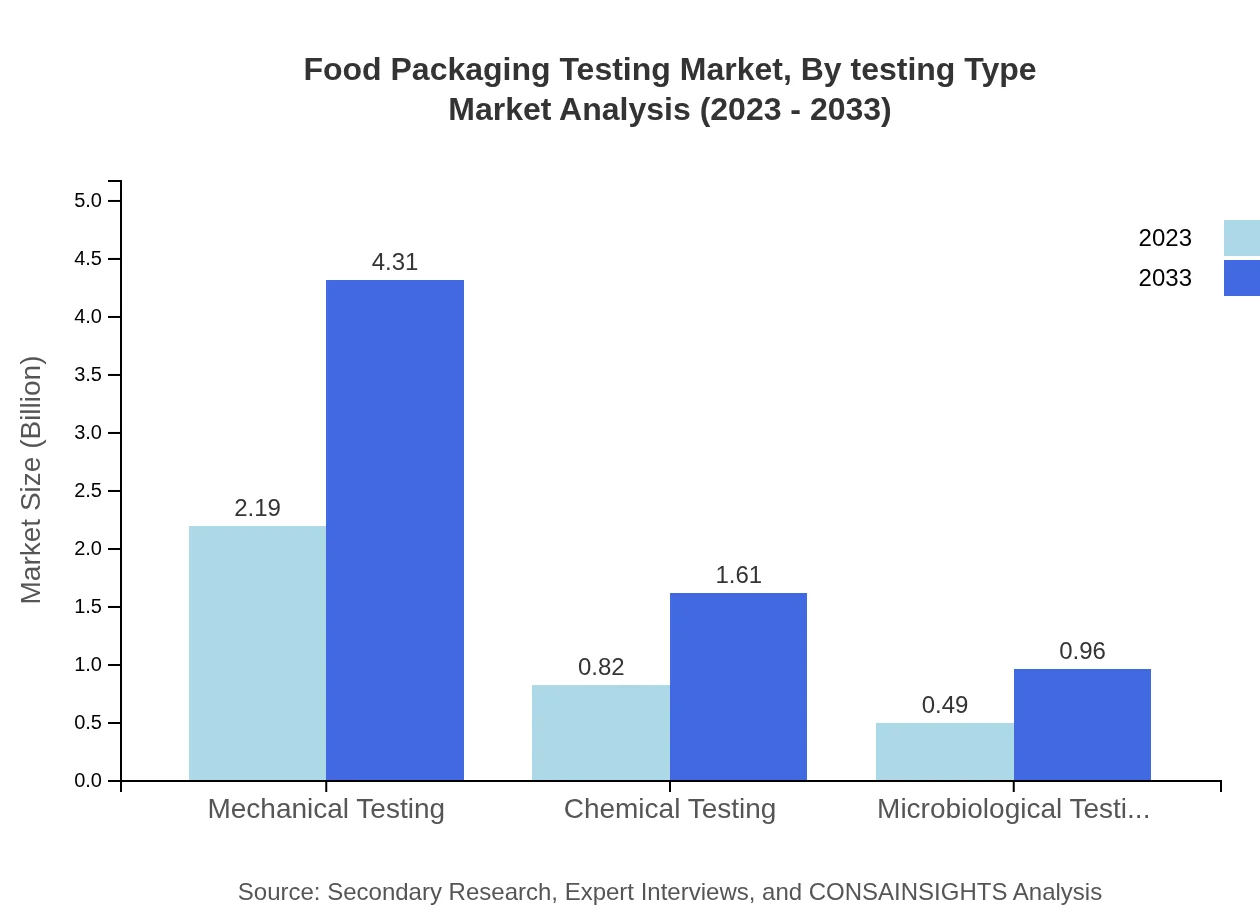

Food Packaging Testing Market Analysis By Testing Type

Mechanical testing represents the largest segment, valued at $2.19 billion in 2023 and reaching $4.31 billion by 2033. Chemical testing follows with a growth from $0.82 billion to $1.61 billion, and microbiological testing is projected to grow from $0.49 billion to $0.96 billion.

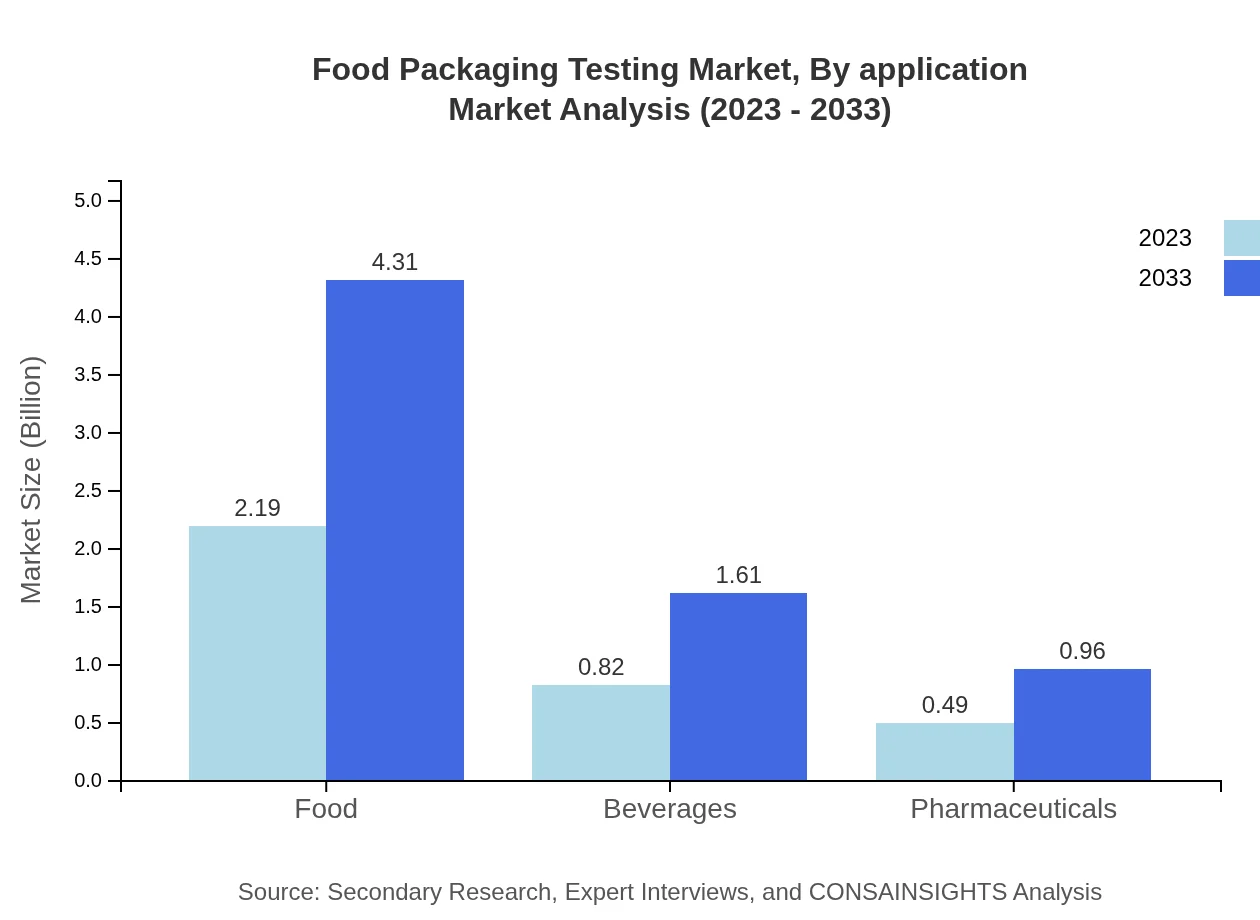

Food Packaging Testing Market Analysis By Application

The food segment dominates the application market, projected to grow from $2.19 billion in 2023 to $4.31 billion by 2033, bolstered by increasing demand for safe food packaging. Beverages are expected to rise from $0.82 billion to $1.61 billion, and the pharmaceutical segment is anticipated to grow from $0.49 billion to $0.96 billion.

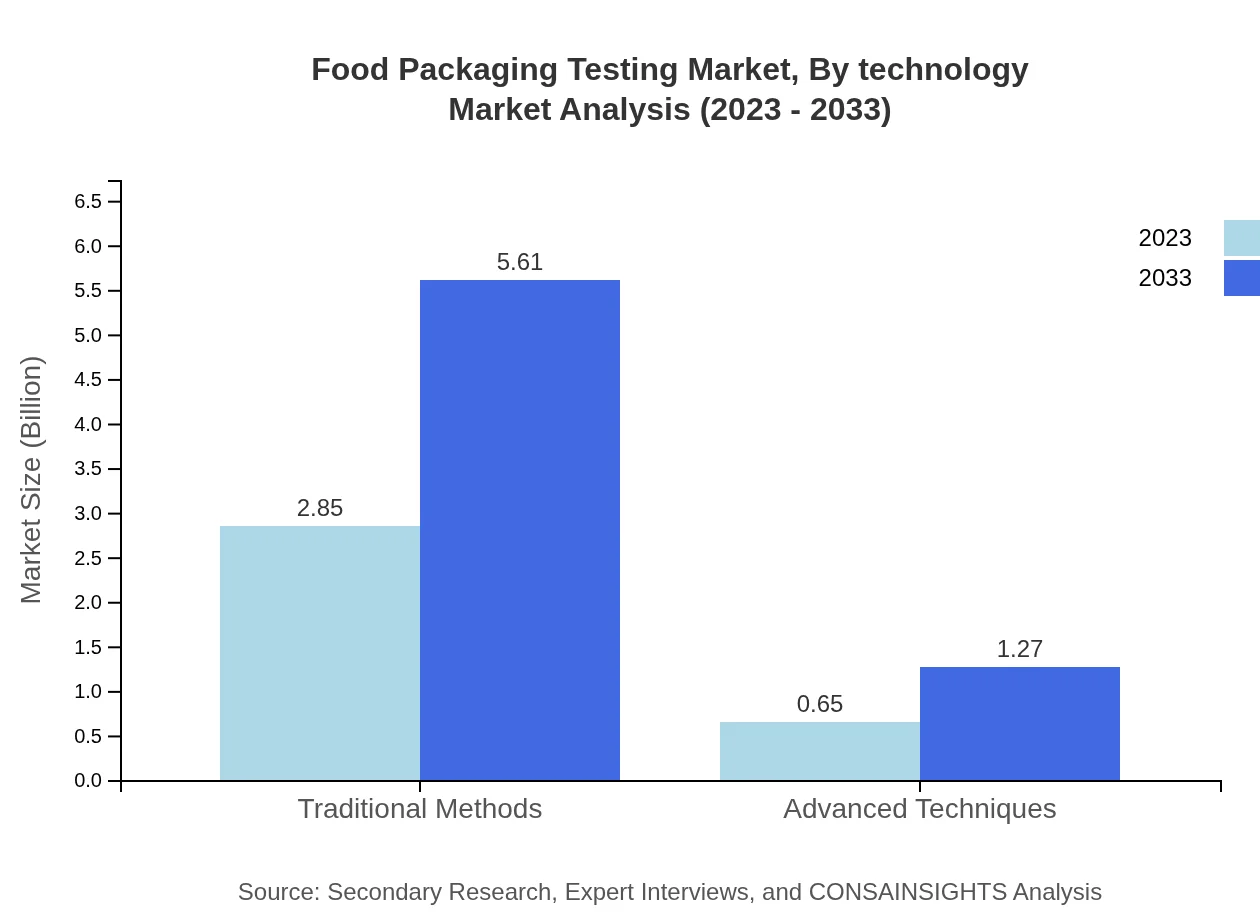

Food Packaging Testing Market Analysis By Technology

Traditional methods account for approximately 81.53% of the testing market, with a size of $2.85 billion in 2023, projected to reach $5.61 billion by 2033. This indicates a preference for conventional testing techniques despite the growth in advanced methods, estimated to grow from $0.65 billion to $1.27 billion over the same period.

Food Packaging Testing Market Analysis By Industry

The industry analysis highlights a significant concentration in the food and beverages sector, with the food segment expected to account for $2.19 billion in 2023, reaching $4.31 billion by 2033. The pharmaceutical testing segment is projected to rise from $0.49 billion to $0.96 billion, indicating diverse applications across multiple sectors.

Food Packaging Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Packaging Testing Industry

SGS SA:

SGS is the world’s leading inspection, verification, testing, and certification company, providing state-of-the-art testing services for food packaging materials.Intertek Group plc:

Intertek is a total quality assurance provider that offers comprehensive testing services for food packaging to ensure safety and compliance with international standards.Bureau Veritas:

Bureau Veritas specializes in the certification and control of compliance with regulations, providing testing services across various food packaging materials.We're grateful to work with incredible clients.

FAQs

What is the market size of food Packaging Testing?

The food packaging testing market was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 6.8% over the next decade, reaching significant milestones by 2033.

What are the key market players or companies in this food Packaging Testing industry?

Major players in the food packaging testing market include SGS SA, Intertek Group plc, Eurofins Scientific, and Bureau Veritas, which provide critical testing services ensuring quality, safety, and compliance with packaging standards.

What are the primary factors driving the growth in the food Packaging Testing industry?

Key growth drivers include increasing consumer awareness regarding food safety, stringent regulations on food packaging materials, and innovations in sustainable packaging solutions that enhance product shelf-life and quality.

Which region is the fastest Growing in the food Packaging Testing?

The Asia-Pacific region is the fastest-growing market for food packaging testing, projected to rise from $0.75 billion in 2023 to $1.47 billion by 2033, driven by rapid urbanization and growing food industries.

Does ConsaInsights provide customized market report data for the food Packaging Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the food packaging testing industry, allowing for detailed insights and market segmentation analysis.

What deliverables can I expect from this food Packaging Testing market research project?

Deliverables typically include a comprehensive report detailing market size, trends, segmentation, competitive landscape, growth forecasts, and strategic recommendations tailored to stakeholders' requirements.

What are the market trends of food Packaging Testing?

Current trends include a shift towards eco-friendly materials, increased automation in testing processes, and an emphasis on digital testing methodologies to enhance efficiency and accuracy in food safety regulations.