Food Pathogen Testing Market Report

Published Date: 31 January 2026 | Report Code: food-pathogen-testing

Food Pathogen Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Pathogen Testing market, offering insights on market size, CAGR, technological developments, and industry trends from 2023 to 2033.

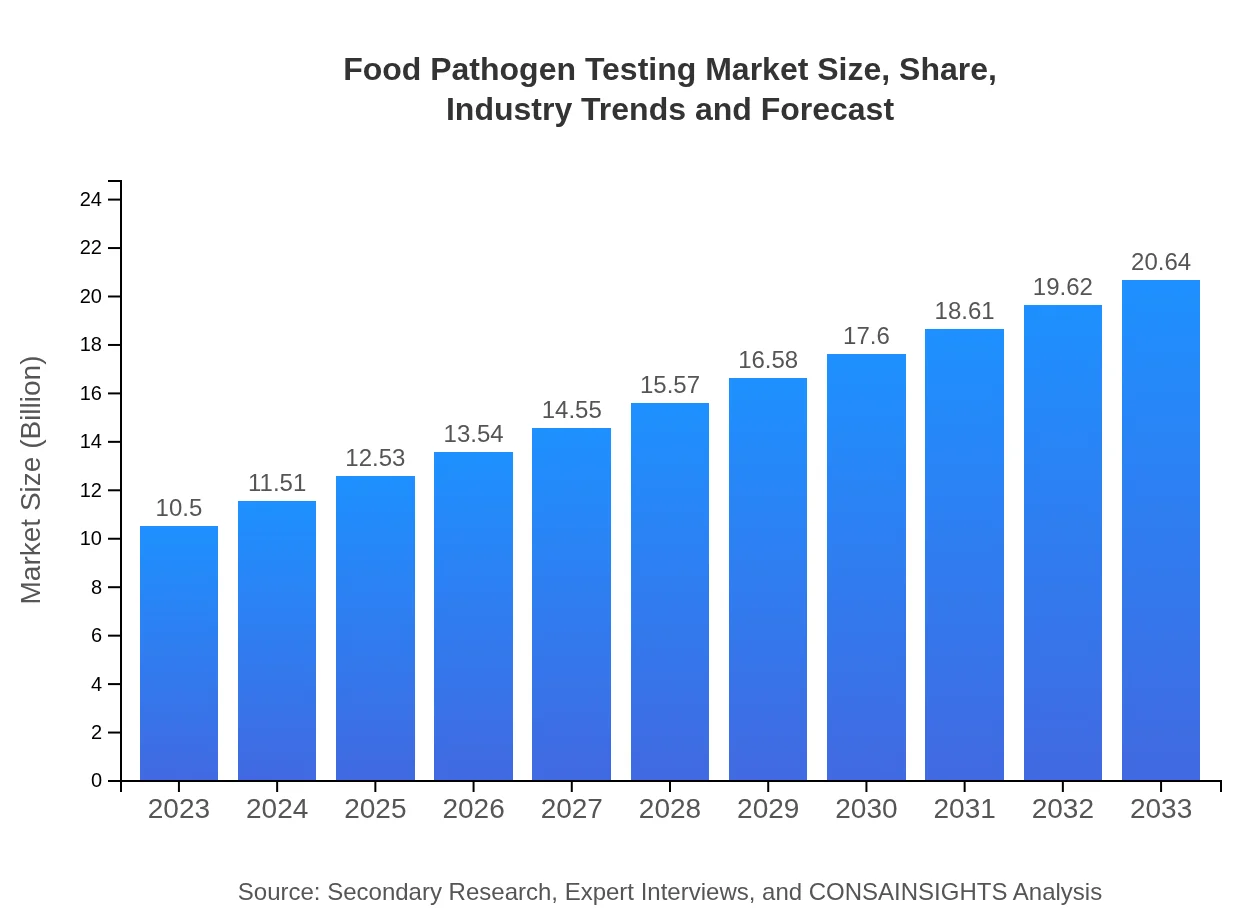

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Neogen Corporation, SGS SA, Eurofins Scientific |

| Last Modified Date | 31 January 2026 |

Food Pathogen Testing Market Overview

Customize Food Pathogen Testing Market Report market research report

- ✔ Get in-depth analysis of Food Pathogen Testing market size, growth, and forecasts.

- ✔ Understand Food Pathogen Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Pathogen Testing

What is the Market Size & CAGR of Food Pathogen Testing market in 2023 and 2033?

Food Pathogen Testing Industry Analysis

Food Pathogen Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Pathogen Testing Market Analysis Report by Region

Europe Food Pathogen Testing Market Report:

Europe, currently valued at $3.14 billion, is projected to reach $6.17 billion by 2033. The growth rate in this region reflects stringent regulations surrounding food safety combined with a low tolerance for foodborne illness outbreaks.Asia Pacific Food Pathogen Testing Market Report:

The Asia Pacific region, valued at approximately $2.03 billion in 2023, is expected to grow to around $3.99 billion by 2033. This growth is driven by increasing investments in food safety technologies and growing consumer awareness about food safety standards.North America Food Pathogen Testing Market Report:

In North America, the market is expected to grow from $3.53 billion in 2023 to $6.94 billion by 2033. This region is characterized by high regulatory standards and a strong emphasis on food safety, pushing organizations to adopt advanced pathogen testing solutions.South America Food Pathogen Testing Market Report:

South America is projected to experience steady growth, rising from $0.84 billion in 2023 to $1.66 billion by 2033, primarily fueled by increased food exports and stringent regulations on food safety from major trading partners.Middle East & Africa Food Pathogen Testing Market Report:

The Middle East and Africa market is anticipated to grow from $0.96 billion in 2023 to $1.88 billion by 2033. This increase is driven by developing food safety standards and rising food exports, making pathogen testing more critical.Tell us your focus area and get a customized research report.

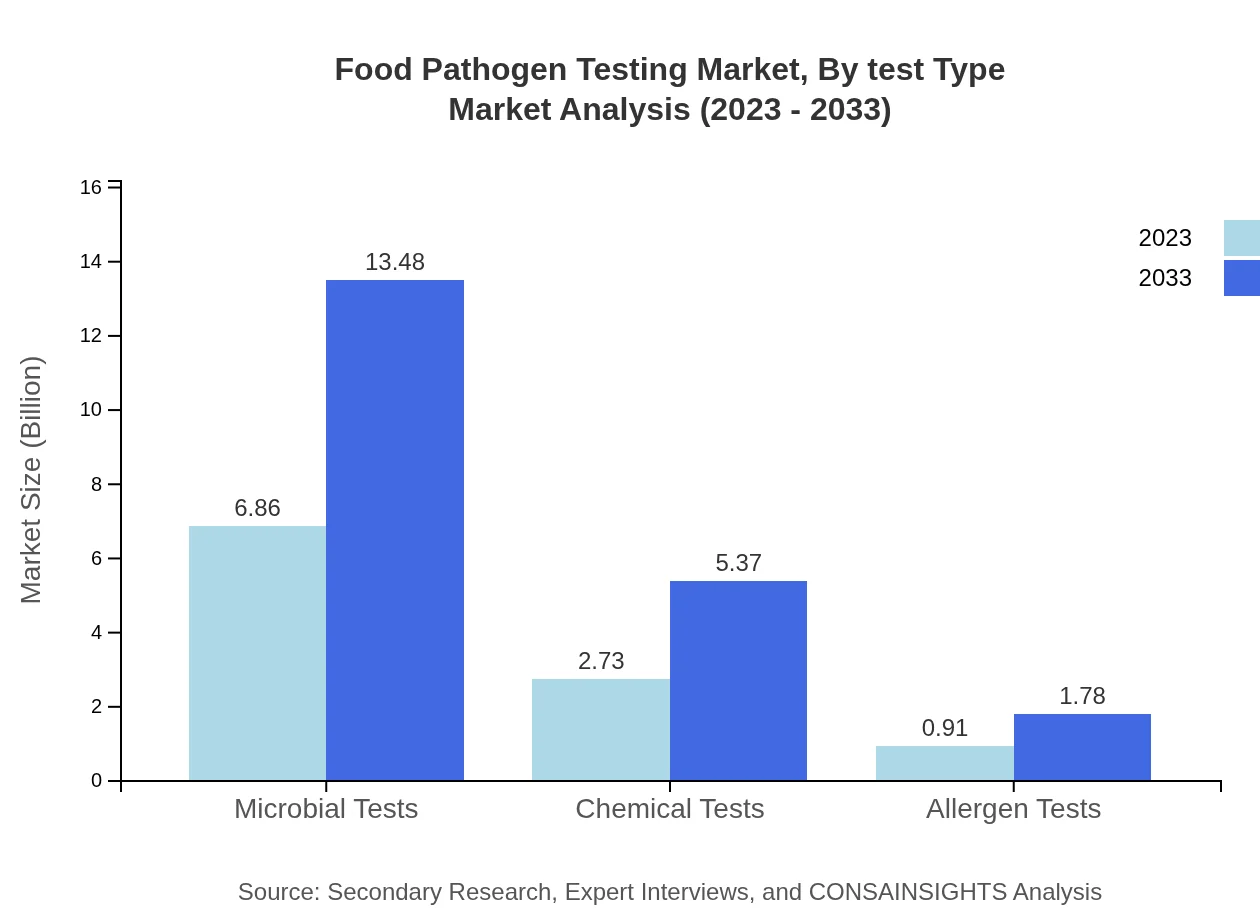

Food Pathogen Testing Market Analysis By Test Type

The Food Pathogen Testing market, by test type, is segmented into microbial tests, chemical tests, and allergen tests. Microbial tests represent the largest segment, boasting substantial market shares, driven by escalating importance in food safety compliance. Chemical tests, while smaller, are gaining ground due to rising concerns over chemical contaminants in food products, while allergen tests are becoming more significant due to growing consumer demand for allergen-free food.

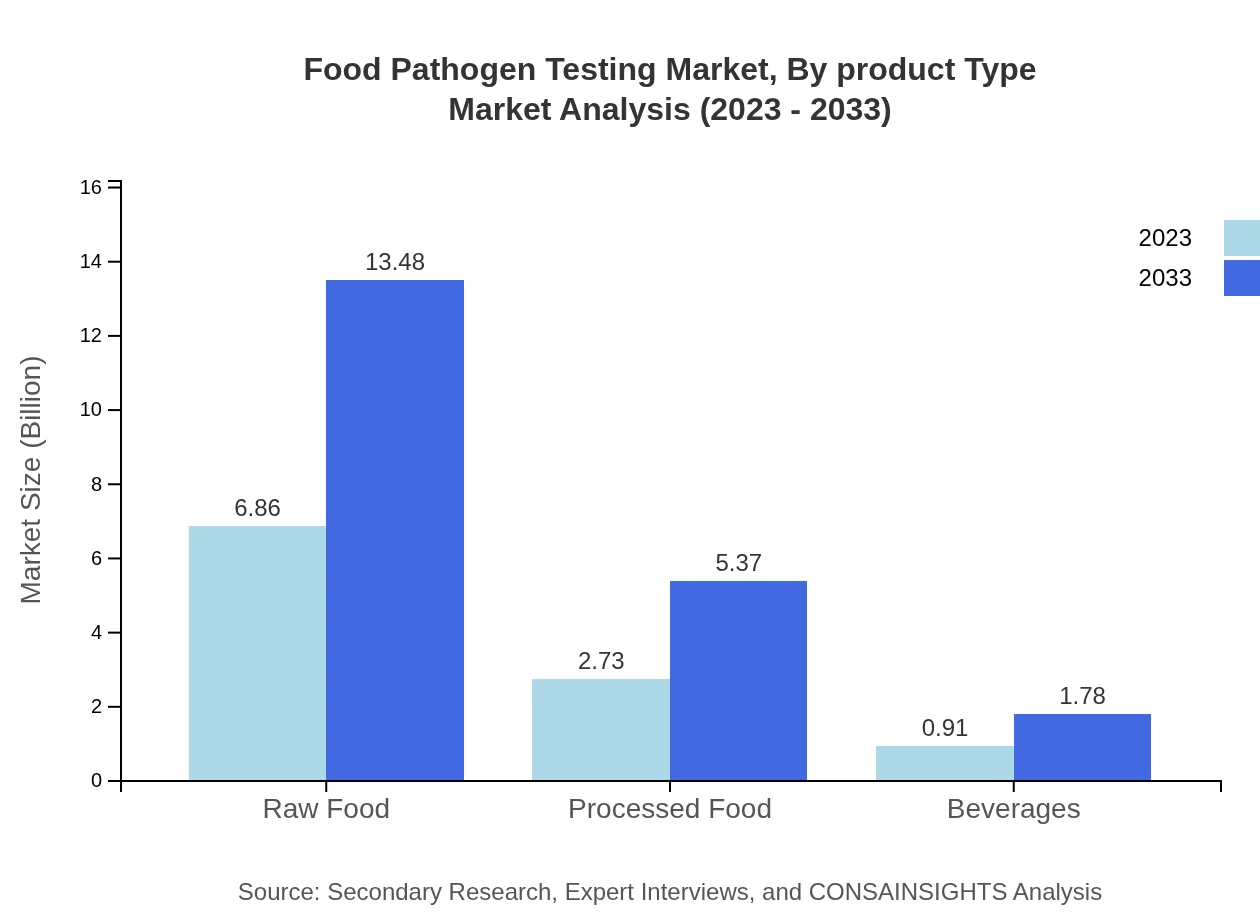

Food Pathogen Testing Market Analysis By Product Type

The market can be classified based on product types like raw food, processed food, and beverages. Raw food leads in size, registering a market size of $6.86 billion in 2023, and expected to reach approximately $13.48 billion by 2033, emphasizing the critical need for testing fresh produce. Processed food and beverages contribute significantly but are projected to grow at a slower rate, reflecting their already robust processing standards.

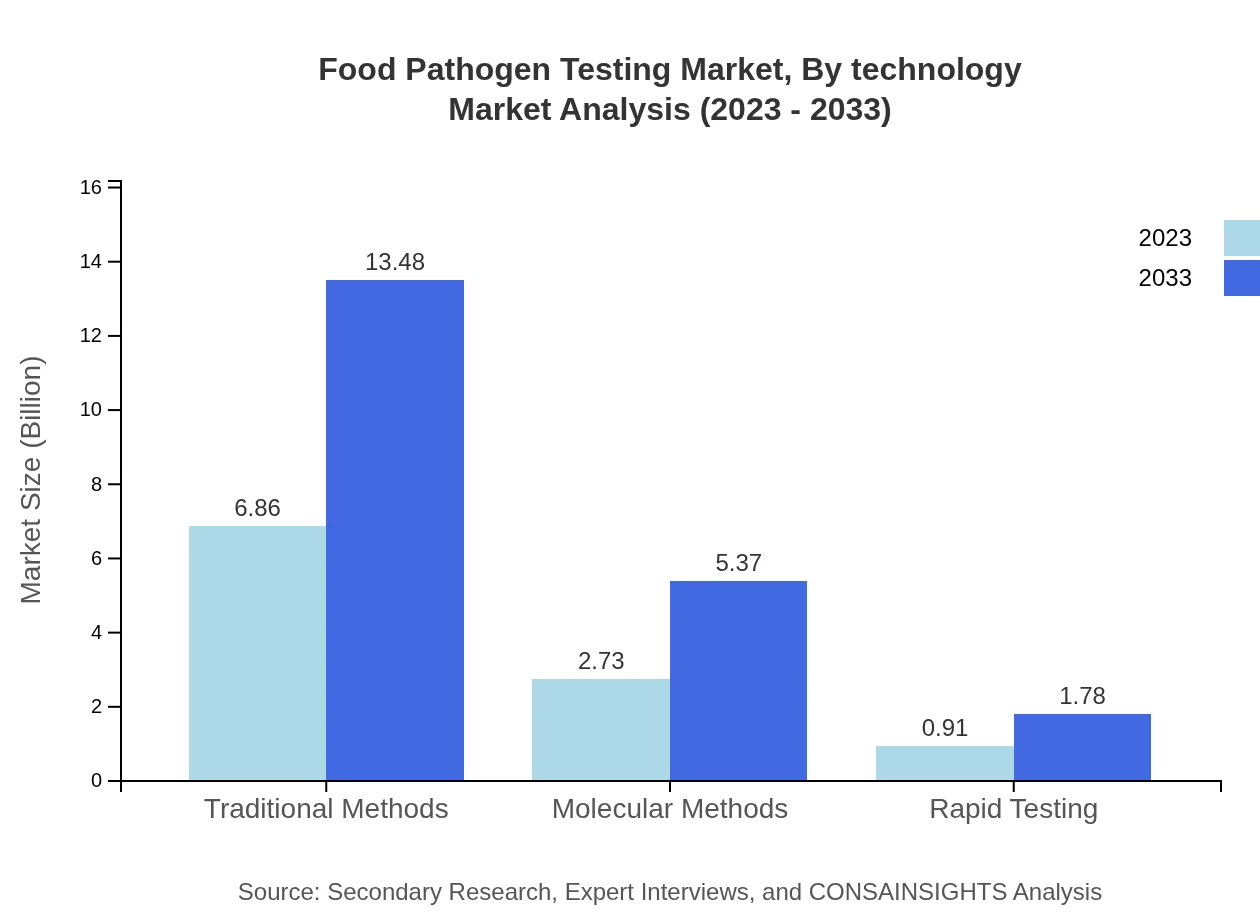

Food Pathogen Testing Market Analysis By Technology

Technological advancements play a crucial role in shaping the Food Pathogen Testing market. Traditional methods dominate the market as of 2023, but rapid testing technologies are on the rise, offering quicker results and greater efficiency. Molecular methods are also emerging in success, indicating a shift towards more innovative approaches in pathogen detection as they provide greater accuracy.

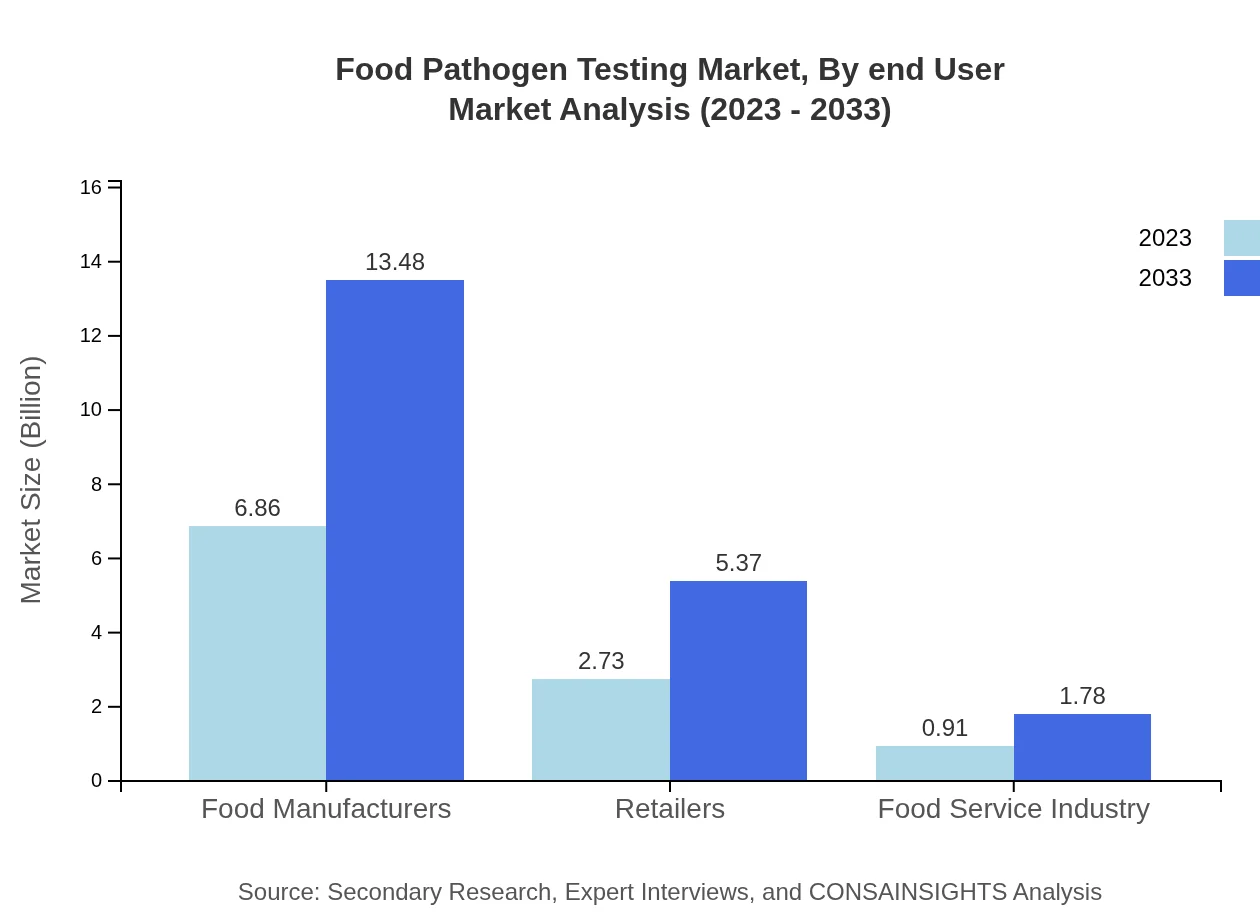

Food Pathogen Testing Market Analysis By End User

The key end-users of food pathogen testing include food manufacturers, retailers, and the food service industry. Food manufacturers hold the largest market share, reflecting their responsibility for ensuring the safety of products reaching consumers, accounting for about 65.34% market share. Retailers and food service industries also show significant growth as consumer awareness promotes safer food handling and sales practices.

Food Pathogen Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Pathogen Testing Industry

Thermo Fisher Scientific Inc.:

A leader in laboratory and food safety solutions, offering innovative pathogen testing technologies that enhance food safety compliance.Bio-Rad Laboratories, Inc.:

Specializing in biotechnological products, Bio-Rad provides sophisticated testing solutions that assist food manufacturers in meeting regulatory requirements.Neogen Corporation:

Neogen focuses exclusively on food safety and animal health products, providing a broad range of pathogen testing solutions.SGS SA:

As a global inspection company, SGS offers comprehensive food safety solutions, including extensive pathogen testing services.Eurofins Scientific:

Recognized for its testing and laboratory services, Eurofins provides rapid testing solutions tailored to the food and beverage sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of food Pathogen Testing?

The market size for food-pathogen testing is estimated to reach $10.5 billion by 2033, growing at a CAGR of 6.8% from its current valuation in 2023.

What are the key market players or companies in the food Pathogen Testing industry?

Key players include multinational corporations and specialized testing laboratories, contributing to a competitive landscape that drives innovation and pricing strategies within the food-pathogen testing market.

What are the primary factors driving the growth in the food Pathogen Testing industry?

Growth drivers include increasing food safety regulations, rising consumer health awareness, and technological advancements in testing methods, leading to a heightened demand for effective testing solutions.

Which region is the fastest Growing in the food Pathogen Testing?

The North America region is anticipated to be the fastest-growing market, projected to expand from $3.53 billion in 2023 to $6.94 billion by 2033.

Does ConsaInsights provide customized market report data for the food Pathogen Testing industry?

Yes, ConsaInsights offers customized market report data tailored to unique client requirements in the food-pathogen testing industry, ensuring relevant insights and analysis.

What deliverables can I expect from this food Pathogen Testing market research project?

Deliverables include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, and strategic recommendations aligned with the food-pathogen testing market.

What are the market trends of food Pathogen Testing?

Current market trends indicate a shift towards rapid testing methodologies, increased investment in R&D, and a focus on enhancing quality control processes within food production.