Food Processing And Handling Equipment Market Report

Published Date: 22 January 2026 | Report Code: food-processing-and-handling-equipment

Food Processing And Handling Equipment Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in-depth analysis of the Food Processing and Handling Equipment market, covering insights on market size, growth trends, and forecasts from 2023 to 2033. It includes regional analyses, industry segmentation, and highlights key players in the market.

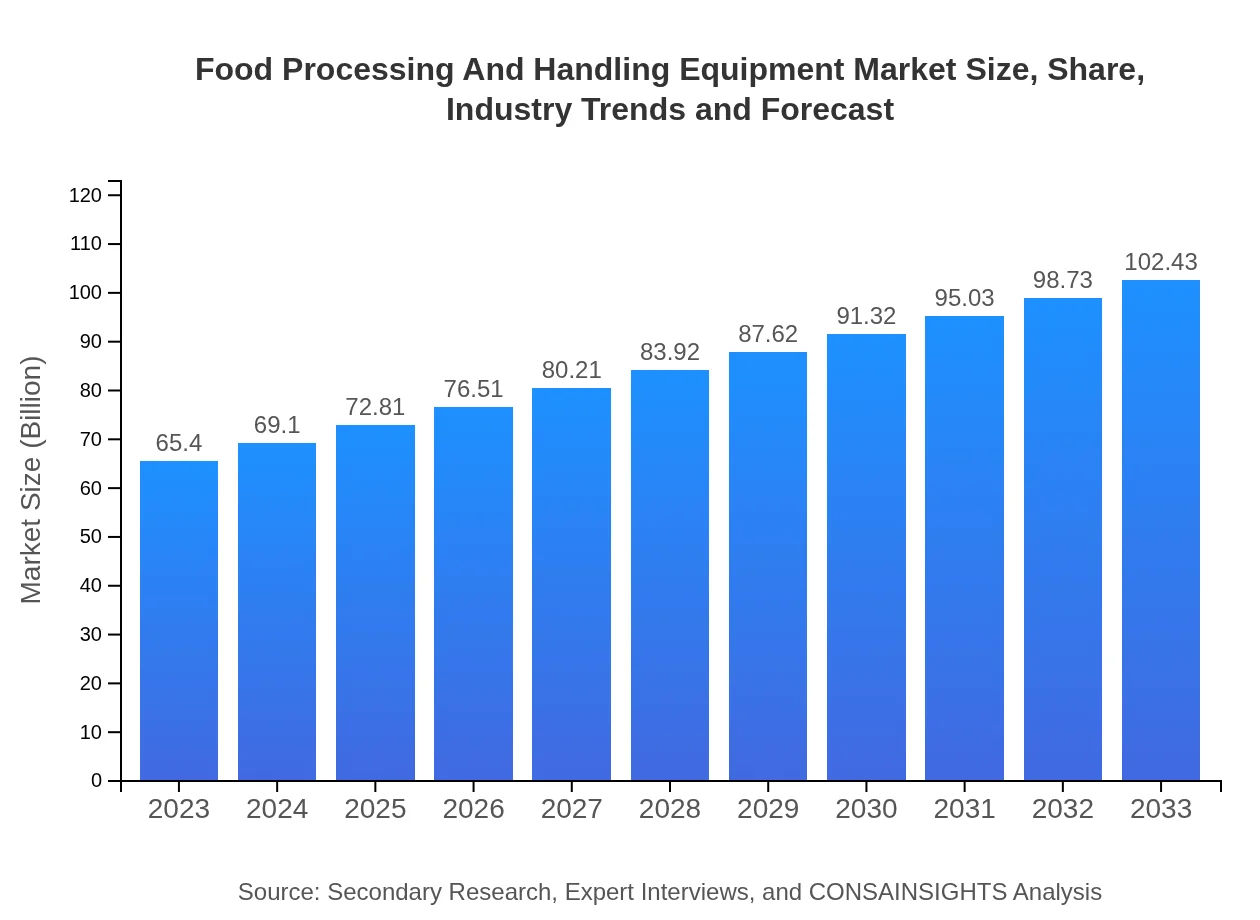

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $65.40 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $102.43 Billion |

| Top Companies | John Bean Technologies Corporation, Bühler AG, GEA Group, Marel |

| Last Modified Date | 22 January 2026 |

Food Processing And Handling Equipment Market Overview

Customize Food Processing And Handling Equipment Market Report market research report

- ✔ Get in-depth analysis of Food Processing And Handling Equipment market size, growth, and forecasts.

- ✔ Understand Food Processing And Handling Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Processing And Handling Equipment

What is the Market Size & CAGR of Food Processing And Handling Equipment market in {Year}?

Food Processing And Handling Equipment Industry Analysis

Food Processing And Handling Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Processing And Handling Equipment Market Analysis Report by Region

Europe Food Processing And Handling Equipment Market Report:

Europe's market size stands at $20.14 billion in 2023, forecasting a growth to $31.54 billion by 2033. Growing health consciousness among consumers and an increase in demand for ready-to-eat meals are key factors shaping this market.Asia Pacific Food Processing And Handling Equipment Market Report:

In 2023, the Asia Pacific region will occupy a market size of $12.66 billion, projected to grow to $19.83 billion by 2033. Rapid urbanization, growing populations, and rising disposable incomes drive demand for processed food, creating opportunities for manufacturers in countries like China and India.North America Food Processing And Handling Equipment Market Report:

In North America, the market size will be approximately $21.65 billion in 2023 and is expected to reach $33.92 billion by 2033. The region's growth can be attributed to robust demand for innovative technology in food processing and strict regulatory requirements driving the need for advanced solutions.South America Food Processing And Handling Equipment Market Report:

The South American market is valued at $2.62 billion in 2023 and is projected to reach $4.11 billion by 2033. The industry is growing due to increasing investment in the food sector and a shift towards more efficient processing technologies.Middle East & Africa Food Processing And Handling Equipment Market Report:

The Middle East and Africa market, estimated at $8.33 billion in 2023 and projected to grow to $13.04 billion by 2033, is driven by industrial food processing advancements and an increase in food trade, highlighting the region's growth potential.Tell us your focus area and get a customized research report.

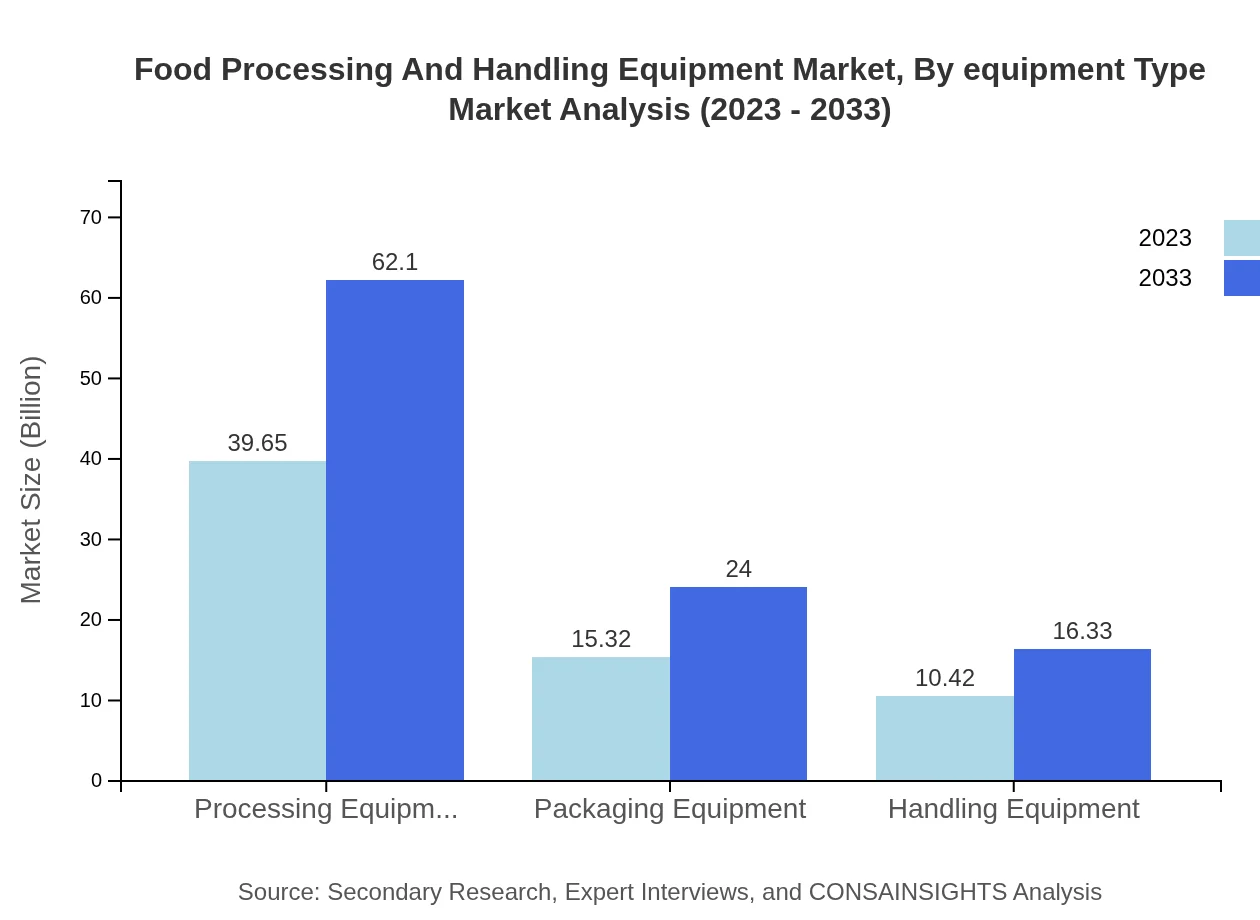

Food Processing And Handling Equipment Market Analysis By Equipment Type

The market is divided into three primary equipment types: processing, packaging, and handling equipment. In 2023, processing equipment leads with a market size of $39.65 billion, expected to grow to $62.10 billion by 2033. Packaging equipment and handling equipment follow, with sizes of $15.32 billion and $10.42 billion respectively, indicating significant roles in ensuring food quality and safety throughout the supply chain.

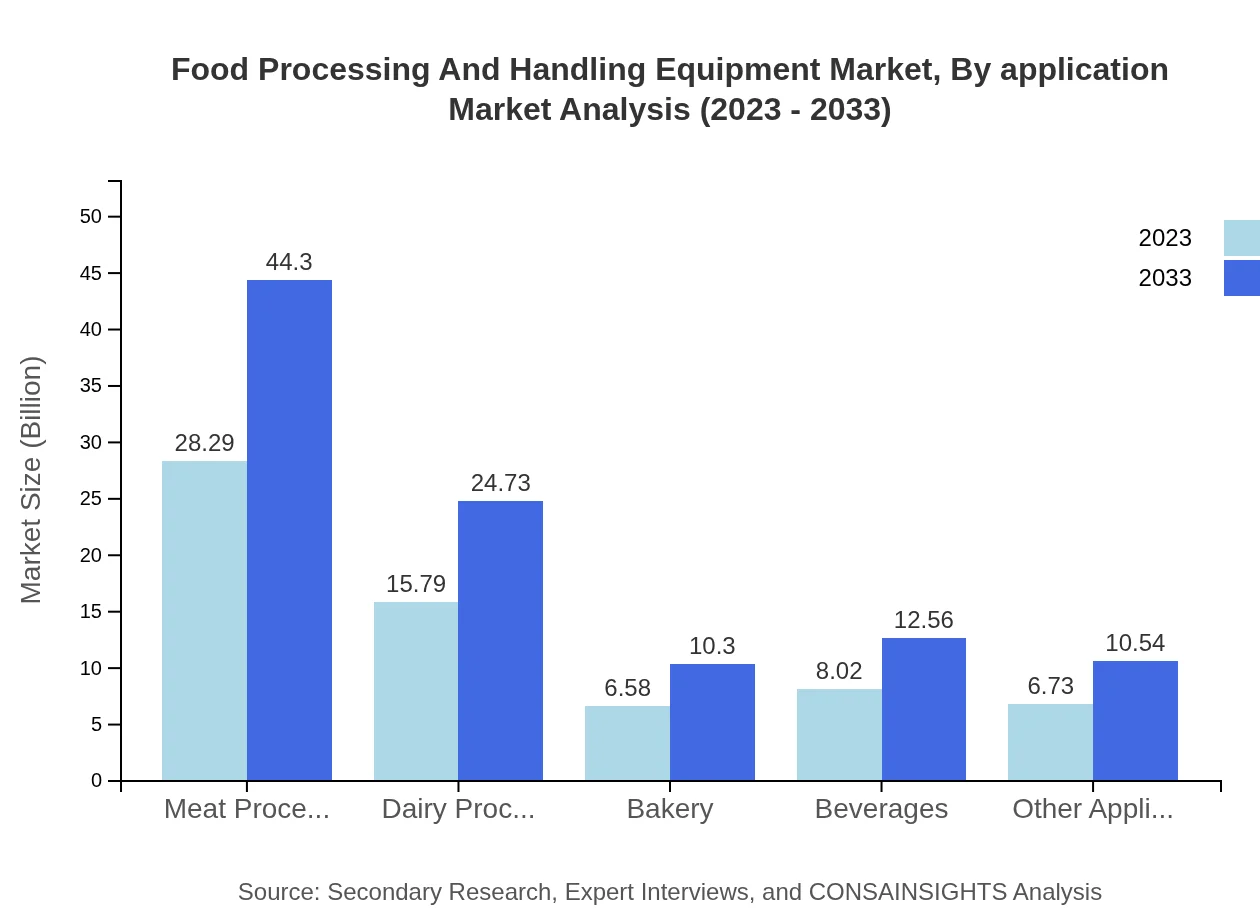

Food Processing And Handling Equipment Market Analysis By Application

The Food Processing and Handling Equipment market is further segmented by application into meat processing, dairy processing, bakery, beverages, and others. Meat processing holds a significant share of $28.29 billion in 2023 and is anticipated to rise to $44.30 billion by 2033, reflecting consumer demand for meat products. Other applications also show promising growth as consumer preferences evolve.

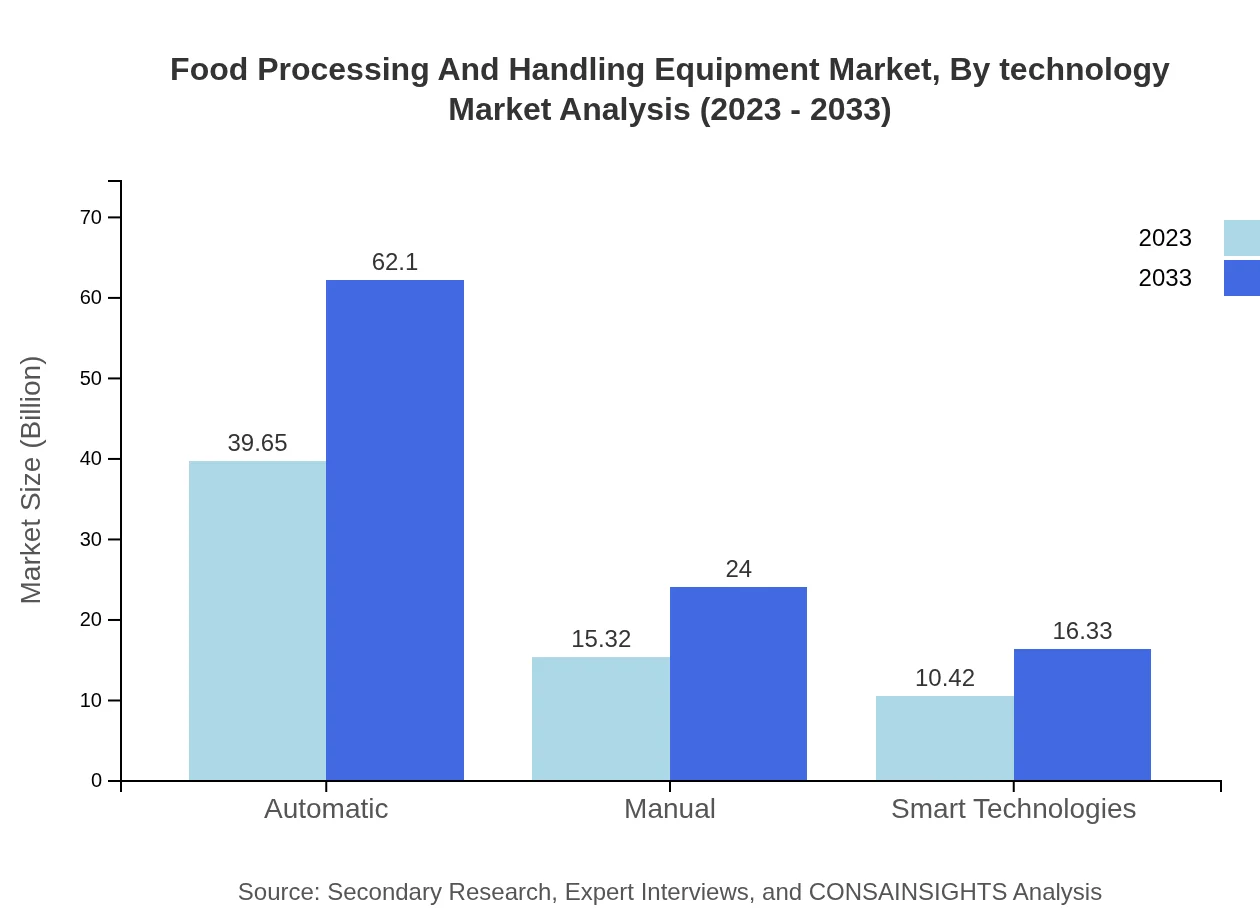

Food Processing And Handling Equipment Market Analysis By Technology

Technological advancements play a pivotal role in the Food Processing And Handling Equipment market. Automation and smart technologies are gaining traction, with the market for smart technology forecasted at $10.42 billion in 2023, likely to reach $16.33 billion by 2033. This shift towards automation is expected to enhance efficiency and ensure food safety across various operations.

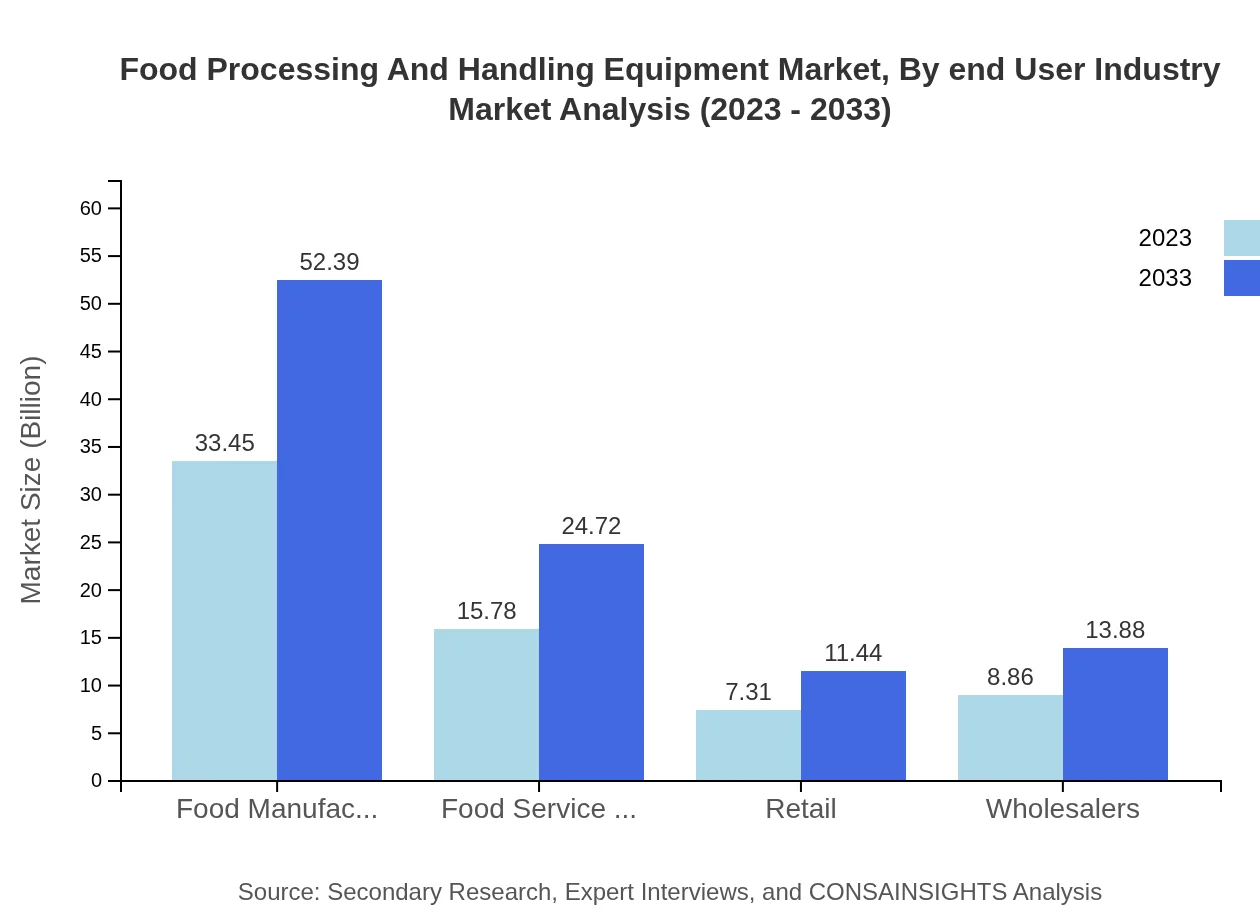

Food Processing And Handling Equipment Market Analysis By End User Industry

The market is segmented into food manufacturers, food service providers, retail, and wholesalers. Food manufacturers dominate the market, with a size of $33.45 billion in 2023, which is set to grow to $52.39 billion by 2033. The food service providers segment also shows healthy growth, increasing from $15.78 billion in 2023 to $24.72 billion by 2033, highlighting the increasing importance of food processing in various consumer engagement channels.

Food Processing And Handling Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Processing And Handling Equipment Industry

John Bean Technologies Corporation:

A leading global supplier of advanced food processing and packaging solutions, known for its innovative technologies that enhance efficiency and product quality.Bühler AG:

Specializes in food processing equipment and technologies, focusing on innovative solutions in the fields of grain milling, chocolate production, and animal feed processing.GEA Group:

Provides equipment and technology for food production, specializing in dairy and meat processing equipment and aimed at improving sustainability in food processing.Marel:

A manufacturer of innovative food processing equipment, focused on fish, meat, and poultry processing technologies, providing integrated solutions to the sector.We're grateful to work with incredible clients.

FAQs

What is the market size of food Processing And Handling Equipment?

The food processing and handling equipment market is valued at approximately $65.4 billion in 2023, with a projected CAGR of 4.5%, indicating steady growth driven by increasing food production and processing demands.

What are the key market players or companies in the food Processing And Handling Equipment industry?

Key players include well-established companies such as John Bean Technologies Corporation, Illinois Tool Works Inc., and Bühler AG, recognized for providing innovative food processing and handling solutions critical to the market.

What are the primary factors driving the growth in the food Processing And Handling Equipment industry?

The primary growth drivers include advancements in food processing technology, rising global food demand, evolving consumer preferences for processed foods, and strict hygiene and safety regulations.

Which region is the fastest Growing in the food Processing And Handling Equipment market?

The Asia Pacific region is projected to be the fastest-growing market, with significant gains from a market size of $12.66 billion in 2023 to $19.83 billion by 2033, due to rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the food Processing And Handling Equipment industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, enabling clients to focus on particular segments or geographic insights in the food processing and handling equipment industry.

What deliverables can I expect from this food Processing And Handling Equipment market research project?

Expect comprehensive insights including market size data, growth forecasts, competitor analysis, segmentation breakdowns, and regional insights, presented in detailed reports to support strategic decision-making.

What are the market trends of food Processing And Handling Equipment?

Trends include increased automation in processing equipment, growing adoption of smart technologies, sustainability in packaging, and a shift towards healthier food processing practices, driven by consumer awareness.