Food Processing Blades Market Report

Published Date: 31 January 2026 | Report Code: food-processing-blades

Food Processing Blades Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Processing Blades market from 2023 to 2033, covering market size, segmentation, regional insights, key players, and trends that could shape the industry in the coming years.

| Metric | Value |

|---|---|

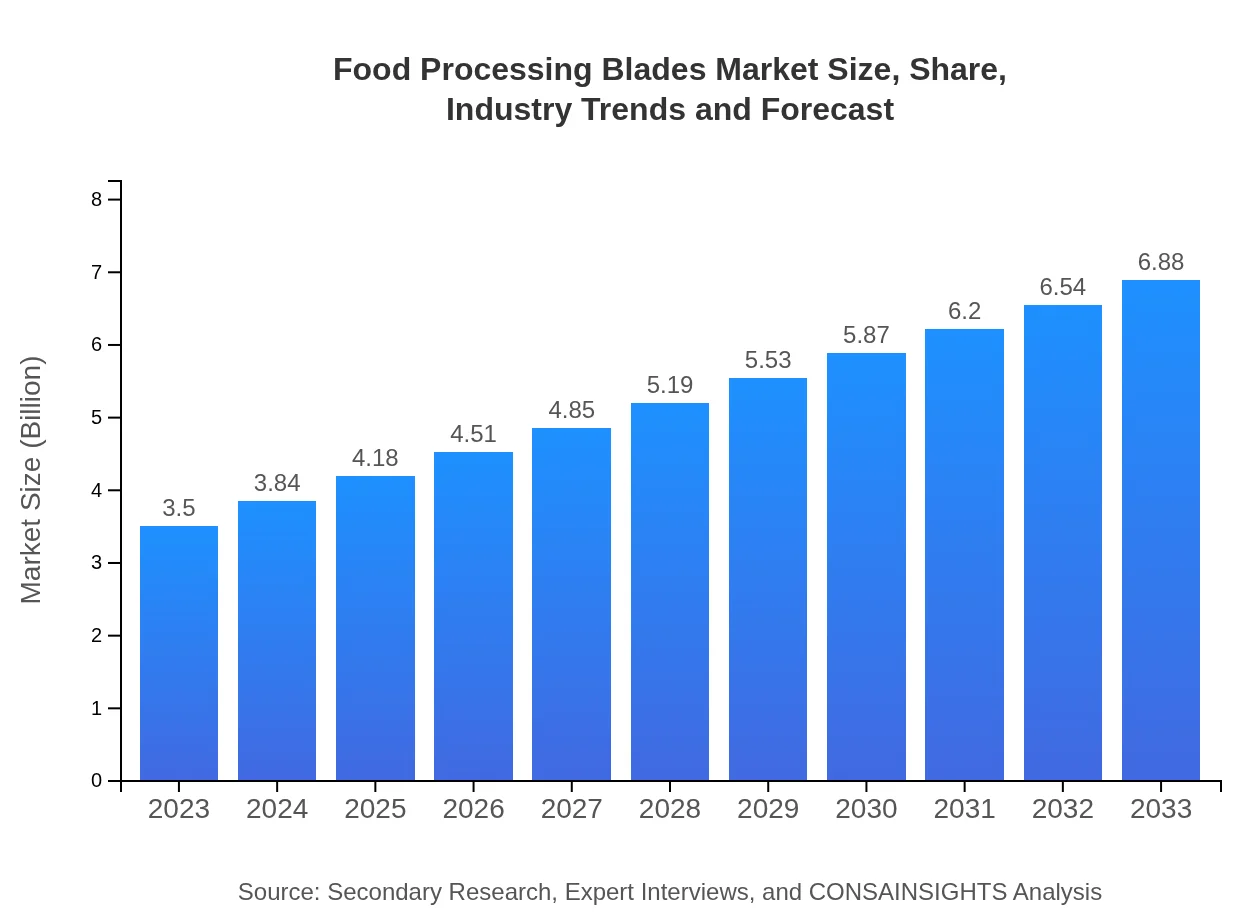

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Berkel, Wüsthof, Victorinox, F. Dick |

| Last Modified Date | 31 January 2026 |

Food Processing Blades Market Overview

Customize Food Processing Blades Market Report market research report

- ✔ Get in-depth analysis of Food Processing Blades market size, growth, and forecasts.

- ✔ Understand Food Processing Blades's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Processing Blades

What is the Market Size & CAGR of Food Processing Blades market in 2023 and 2033?

Food Processing Blades Industry Analysis

Food Processing Blades Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Processing Blades Market Analysis Report by Region

Europe Food Processing Blades Market Report:

The European market for Food Processing Blades is estimated at around $0.99 billion in 2023, projected to nearly double to $1.95 billion by 2033. The region's focus on sustainability and the health-conscious population is fostering a demand for efficient processing tools that comply with environmental regulations.Asia Pacific Food Processing Blades Market Report:

The Asia-Pacific region holds a significant share of the Food Processing Blades market, valuing approximately $0.69 billion in 2023 and expected to grow to $1.36 billion by 2033. The rapid growth of the food processing industry and the rise in health-conscious consumers are contributing factors, making this region a vital area for market expansion.North America Food Processing Blades Market Report:

Valued at approximately $1.29 billion in 2023, the North American Food Processing Blades market is forecasted to reach $2.53 billion by 2033. Innovative food processing techniques and stringent food safety regulations drive demand in this highly developed market, along with a growing trend for plant-based products that require diverse cutting solutions.South America Food Processing Blades Market Report:

In South America, the Food Processing Blades market is valued at about $0.17 billion in 2023, with a projected growth to $0.33 billion by 2033. Increased urbanization and changing consumer eating habits are motivating the growth of food service sectors, consequently fueling the demand for food processing blades.Middle East & Africa Food Processing Blades Market Report:

In the Middle East and Africa, the market is valued at $0.36 billion in 2023 and is expected to increase to $0.71 billion by 2033. The growing population, along with rising food industry investments, contributes significantly to this market's growth, and there is an increasing focus on food quality and standards.Tell us your focus area and get a customized research report.

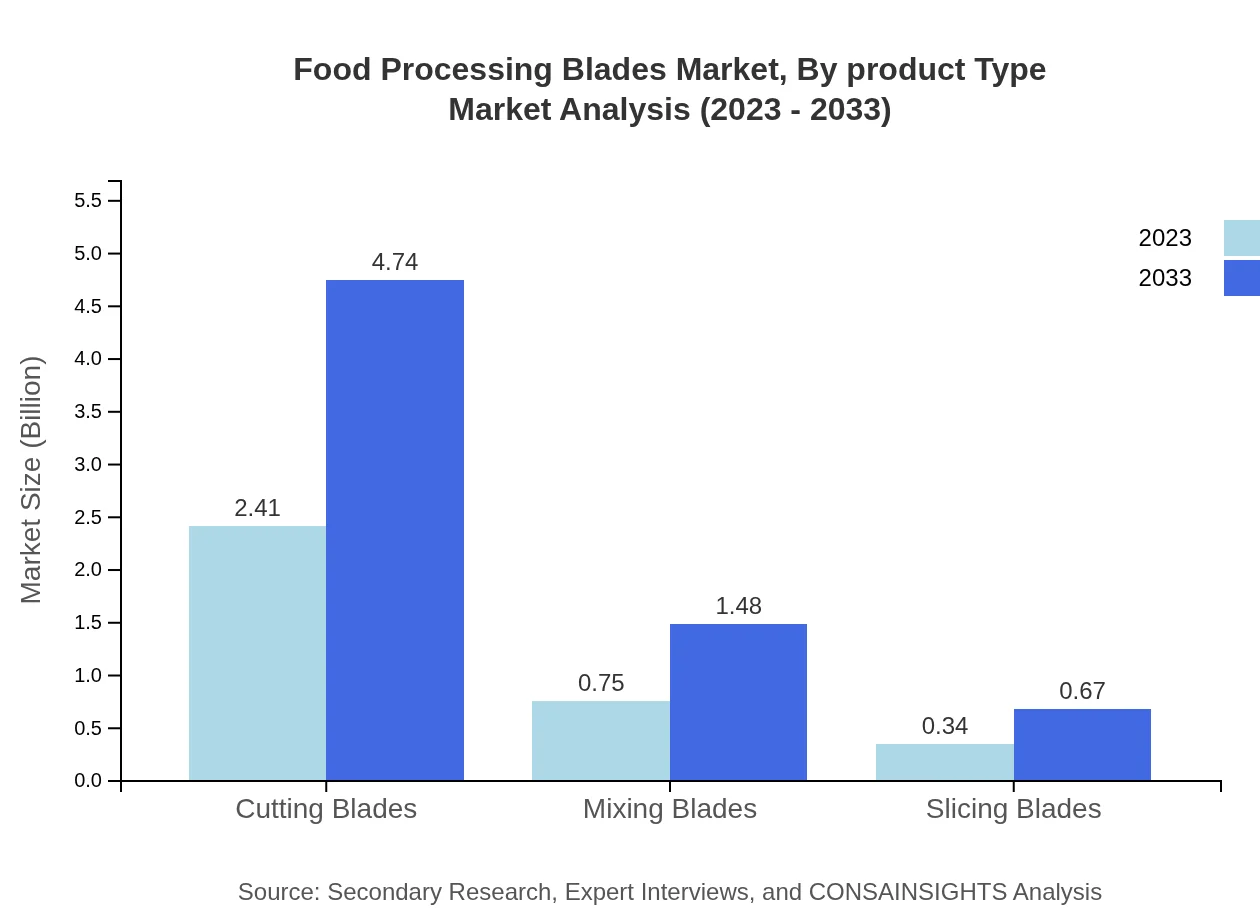

Food Processing Blades Market Analysis By Product Type

The cutting blades segment dominates the market, representing a considerable share with a size of approx $2.41 billion in 2023 and expected to reach $4.74 billion by 2033, highlighting their importance in meat processing. Mixing blades and slicing blades are also significant, catering to various food processing applications.

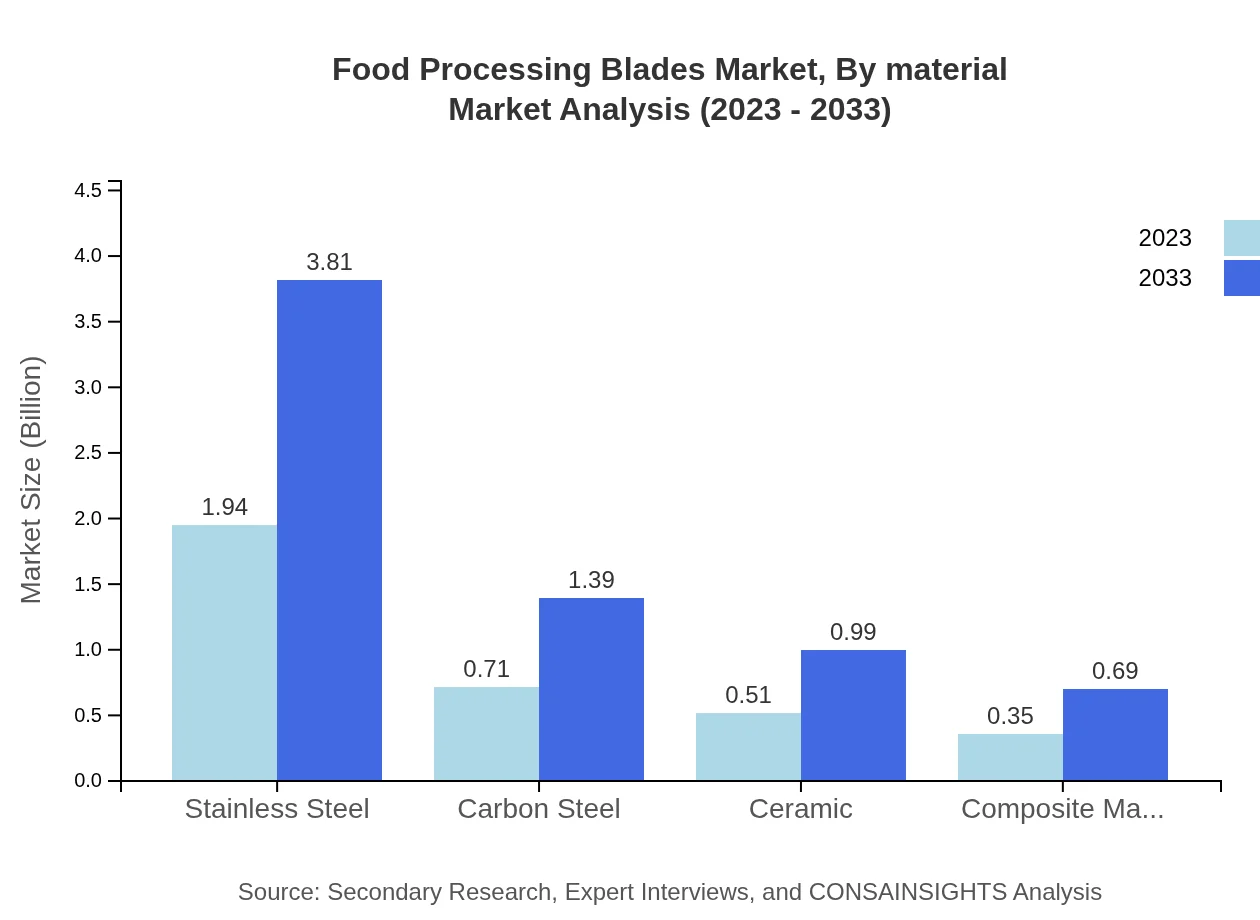

Food Processing Blades Market Analysis By Material

Stainless steel blades are the leading segment, with a market share of 55.33% in 2023 and projected growth paralleling market expansion. Carbon steel blades are another important segment, particularly in commercial applications, while ceramic and composite materials are gaining traction for specialized applications.

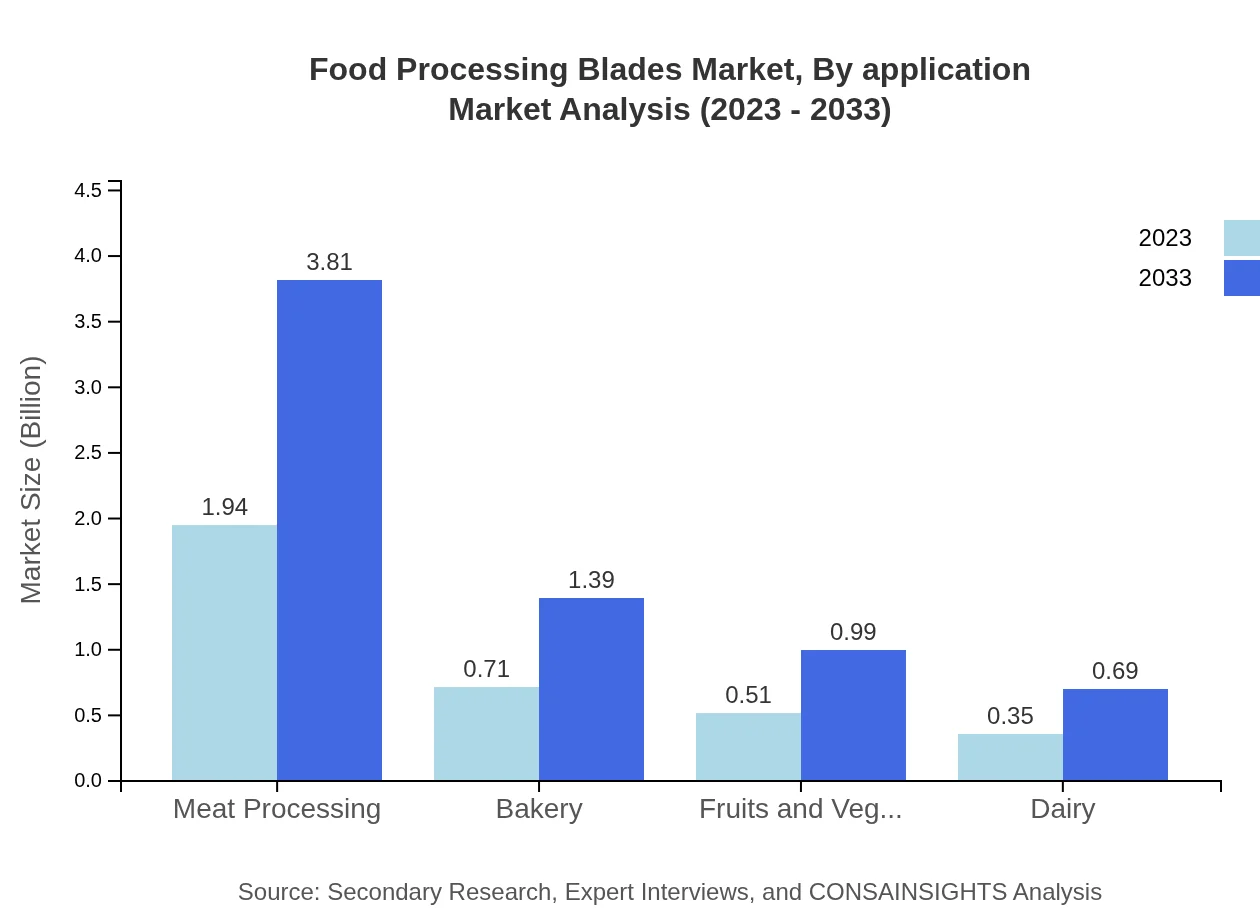

Food Processing Blades Market Analysis By Application

Meat processing holds the largest share among applications, while segments such as bakery and dairy also significantly contribute to overall growth. These applications represent the essential nature of food processing blades in various sectors of the food industry.

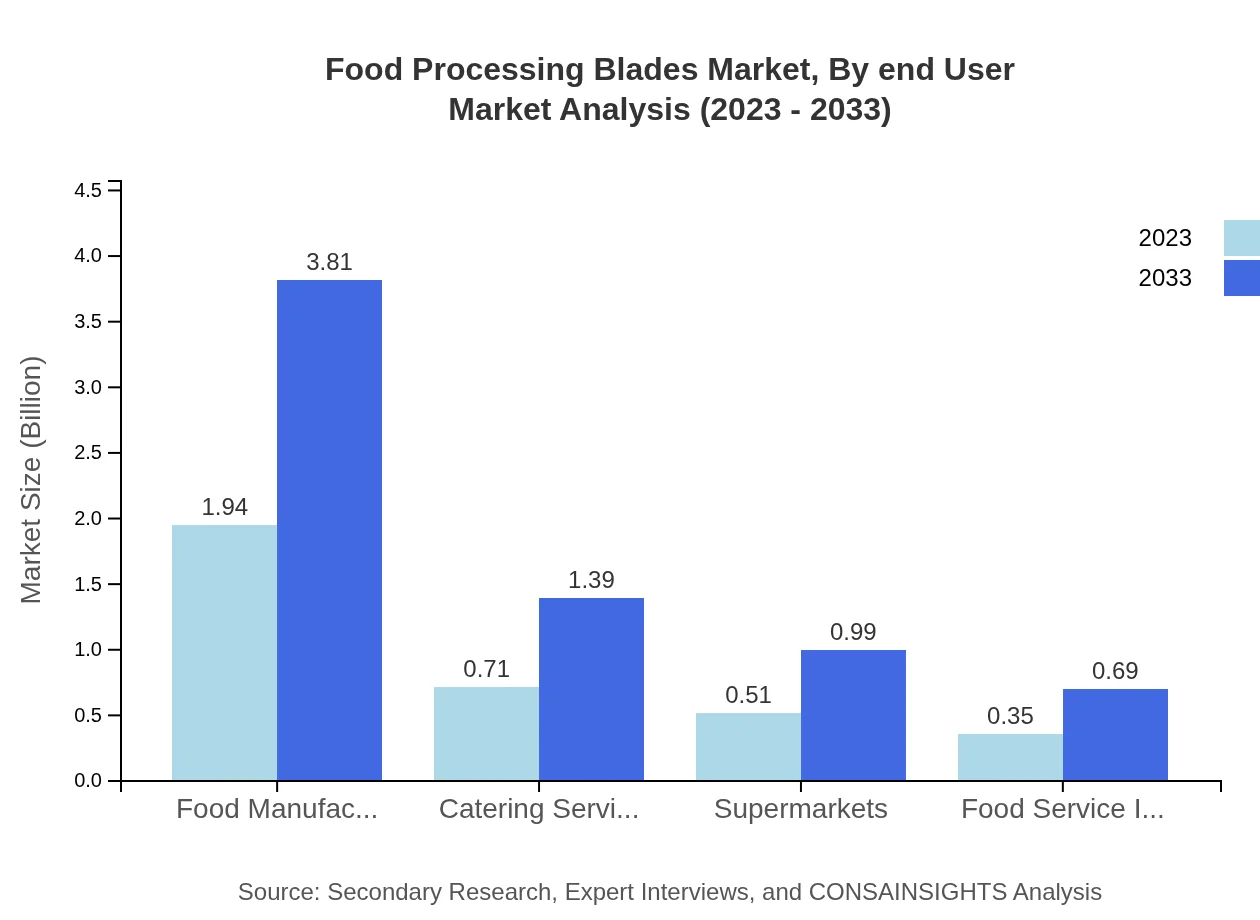

Food Processing Blades Market Analysis By End User

Food manufacturers constitute the largest end-user segment. Their demand spans across various processes, focusing on efficiency and safety standards. Catering and food service industries are also crucial, displaying consistent growth as they adapt to changing consumer preferences.

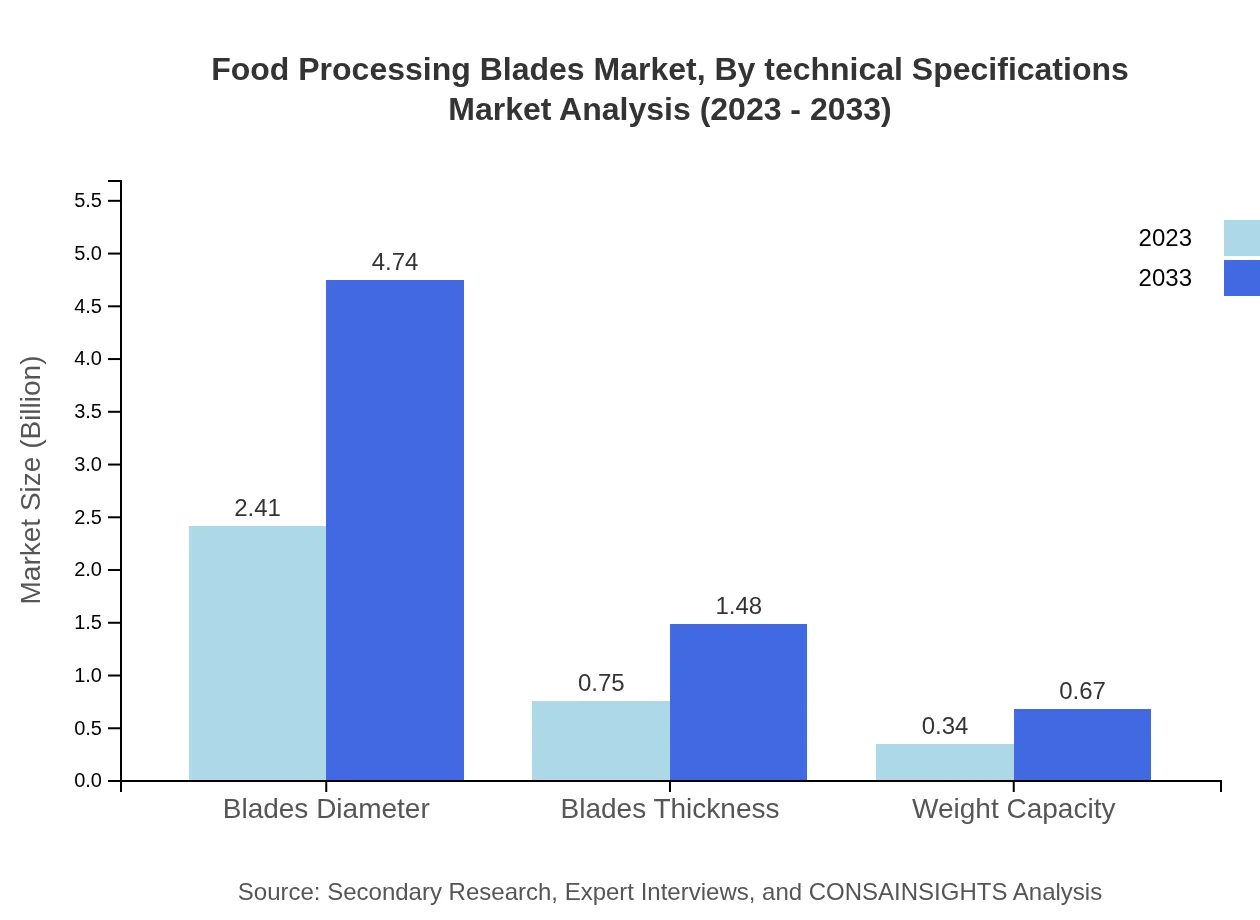

Food Processing Blades Market Analysis By Technical Specifications

Segments such as blades diameter, thickness, and weight capacity are important for performance. Advancements in these technical specifications enhance the customization and efficiency of blades, resulting in a tailored solution for diverse food processing needs.

Food Processing Blades Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Processing Blades Industry

Berkel:

Known for its high-quality slicing machines and blades, Berkel offers innovative solutions that enhance food processing efficiency.Wüsthof:

A leader in knife and blade manufacturing, Wüsthof is recognized for its precision cutlery products for both professional and home kitchens.Victorinox:

Famous for Swiss army knives, Victorinox also produces high-quality kitchen blades designed for food processing and culinary applications.F. Dick:

A significant player in the professional food processing equipment market, specializing in knives and blades tailored for the meat industry.We're grateful to work with incredible clients.

FAQs

What is the market size of food Processing Blades?

The global food-processing blades market is valued at approximately $3.5 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 6.8% through 2033, reflecting significant growth potential in the industry.

What are the key market players or companies in this food Processing Blades industry?

Key players in the food-processing blades market include major manufacturers and suppliers that specialize in producing high-quality blades tailored for various food processing applications, including food equipment providers and stainless steel component manufacturers focusing on innovation.

What are the primary factors driving the growth in the food Processing blades industry?

Growth in the food-processing blades industry is primarily driven by technological advancements, increasing food production demands, and the rise of automation in food processing, as well as a growing emphasis on food safety and quality standards.

Which region is the fastest Growing in the food Processing blades?

The Asia Pacific region is among the fastest-growing markets for food-processing blades, projected to expand from $0.69 billion in 2023 to $1.36 billion by 2033, indicating a robust growth trajectory fueled by rising demand in the food sector.

Does ConsaInsights provide customized market report data for the food Processing blades industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the food-processing blades industry, allowing stakeholders to obtain detailed insights aligned with their unique market interests and strategic objectives.

What deliverables can I expect from this food Processing Blades market research project?

Expected deliverables from the food-processing blades market research project include a comprehensive market analysis report, detailed segmentation data, actionable insights, industry trends, competitive landscape assessments, and customized recommendations for market entry or expansion.

What are the market trends of food Processing blades?

Current trends in the food-processing blades market highlight an increasing preference for advanced materials like stainless steel and ceramic, innovations in blade technology for efficiency, and a focus on sustainability within manufacturing processes, reflecting evolving consumer preferences.

What segments are available in the food Processing blades market?

The food-processing blades market is segmented by material types, including stainless steel, carbon steel, and ceramic, as well as by application segments such as meat processing, bakery, and dairy, each showing distinctive growth rates and market share predictions.