Food Processing Equipment Market Report

Published Date: 31 January 2026 | Report Code: food-processing-equipment

Food Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Food Processing Equipment market from 2023 to 2033. It includes market size forecasts, industry trends, segmentation details, regional insights, and profiles of leading market players, aiming to equip stakeholders with critical data for informed decision-making.

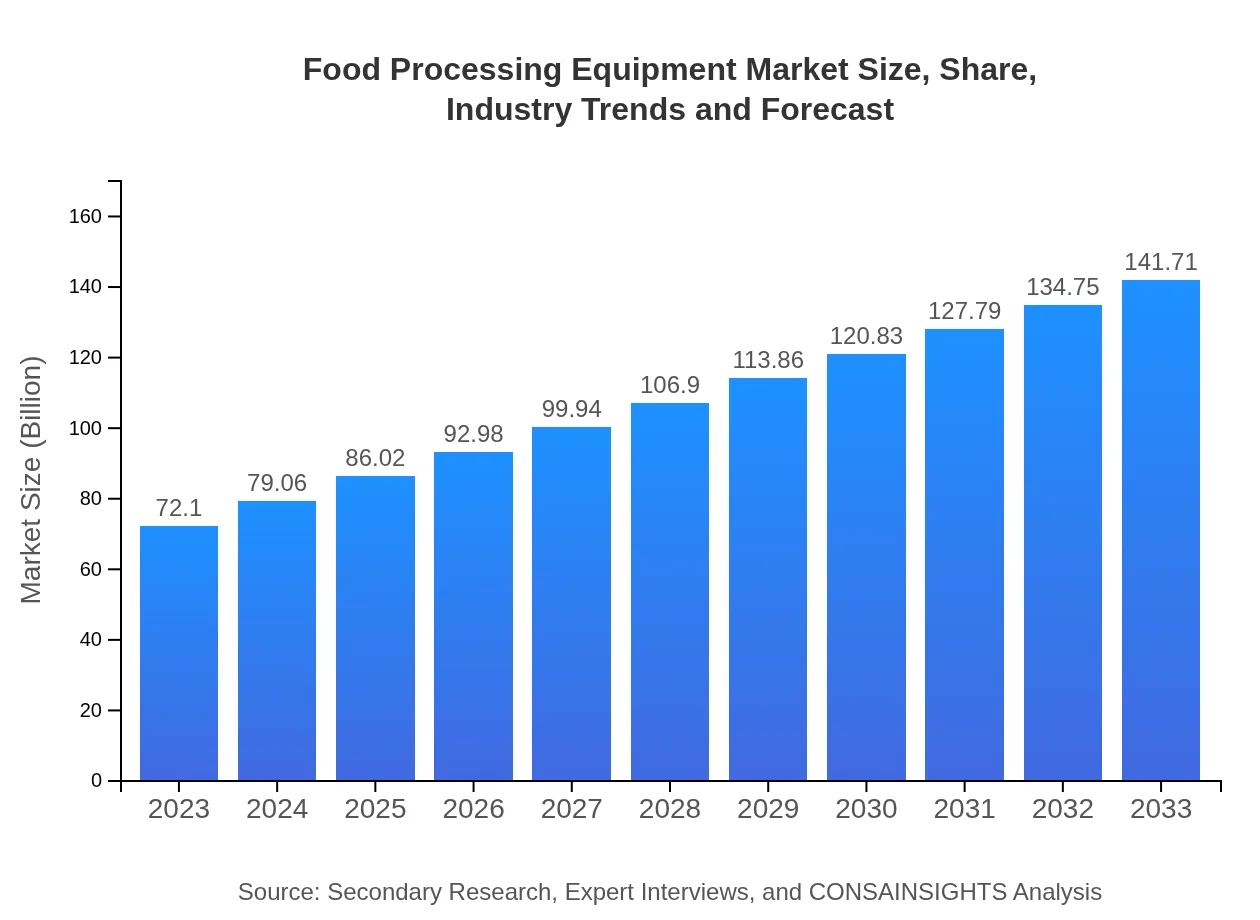

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $72.10 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $141.71 Billion |

| Top Companies | Bühler AG, Alfa Laval, GEA Group, Tetra Pak, JBT Corporation |

| Last Modified Date | 31 January 2026 |

Food Processing Equipment Market Overview

Customize Food Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Food Processing Equipment market size, growth, and forecasts.

- ✔ Understand Food Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Processing Equipment

What is the Market Size & CAGR of Food Processing Equipment market in 2033?

Food Processing Equipment Industry Analysis

Food Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Processing Equipment Market Analysis Report by Region

Europe Food Processing Equipment Market Report:

Europe is set to expand from USD 24.03 billion in 2023 to USD 47.23 billion by 2033, fueled by stringent food safety regulations and an increase in food exports. The region is a leader in technological innovation within the food processing sector, enabling enhanced automation and sustainable practices.Asia Pacific Food Processing Equipment Market Report:

In Asia Pacific, the market is expected to grow from USD 12.89 billion in 2023 to USD 25.34 billion by 2033, owing to rising population and rapid urbanization. Additionally, investments in food processing and technological advancements in countries like China and India significantly boost the region's market development.North America Food Processing Equipment Market Report:

North America holds one of the largest shares of the Food Processing Equipment market, projected to grow from USD 25.05 billion in 2023 to USD 49.24 billion in 2033. The rise of food safety standards and consumer preference for convenience foods drive this market growth, accompanied by technological innovation in machinery.South America Food Processing Equipment Market Report:

The South American market, with a growth from USD 6.69 billion in 2023 to USD 13.15 billion in 2033, is driven by increasing demand for processed foods, particularly in Brazil and Argentina. Improving economic conditions and investments in food safety regulations will propel market growth.Middle East & Africa Food Processing Equipment Market Report:

The Middle Eastern and African market is anticipated to increase from USD 3.43 billion in 2023 to USD 6.75 billion in 2033. This growth is attributed to an increasing focus on food security, coupled with economic diversification efforts in food processing industries.Tell us your focus area and get a customized research report.

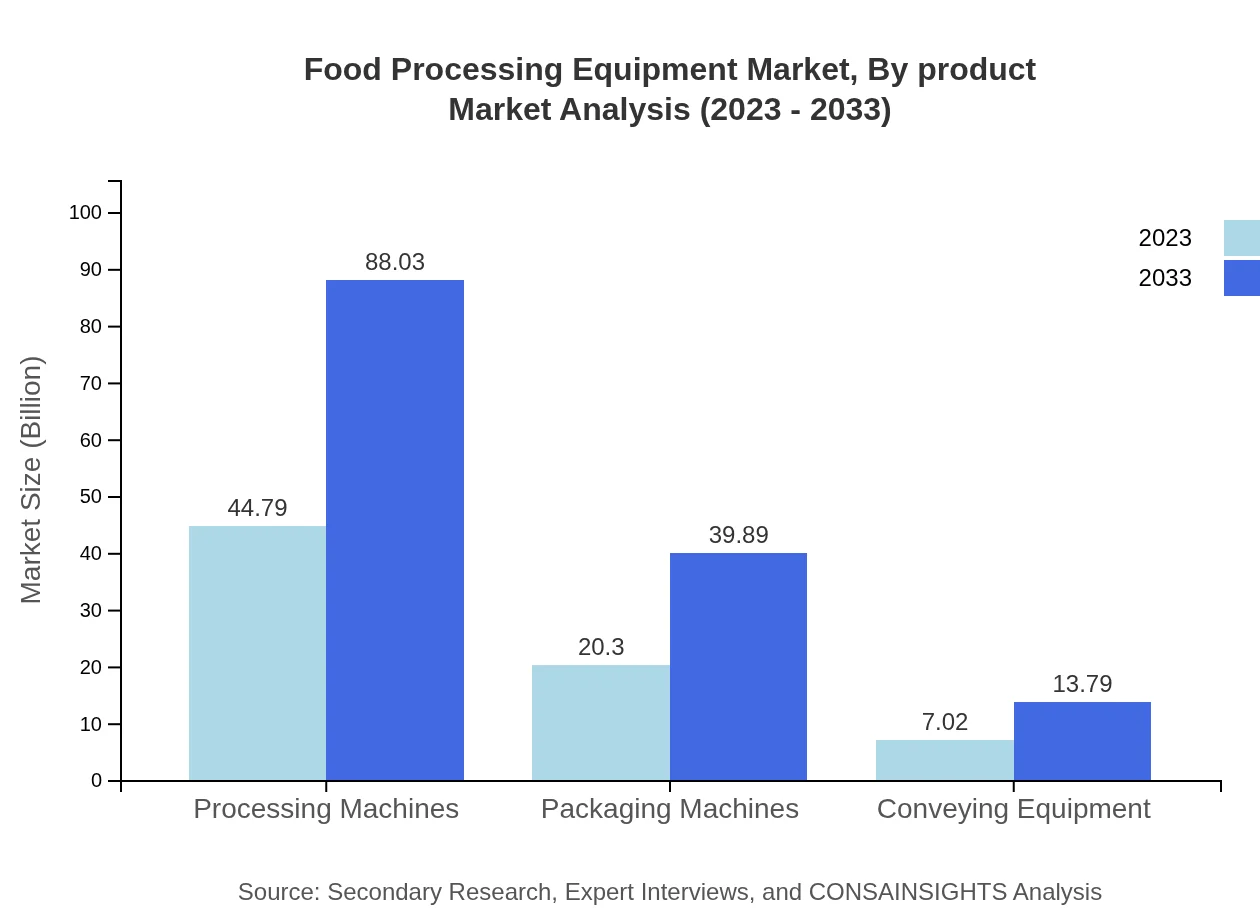

Food Processing Equipment Market Analysis By Product

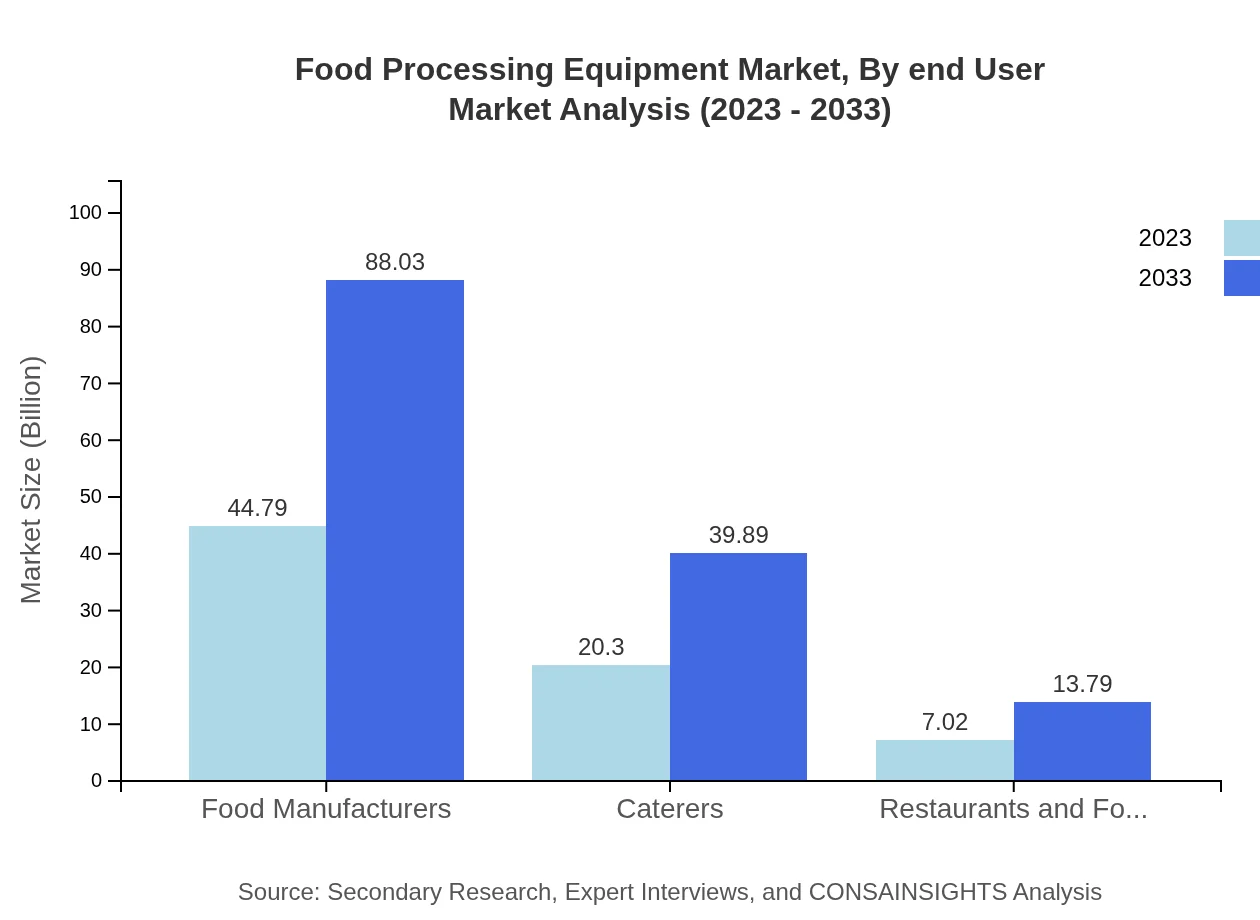

The Food Processing Equipment market is dominated by processing machines, which represented USD 44.79 billion in 2023 and is expected to reach USD 88.03 billion by 2033. Packaging machines follow, increasing from USD 20.30 billion to USD 39.89 billion over the same period. Additionally, conveying equipment, worth USD 7.02 billion in 2023, is projected to grow to USD 13.79 billion by 2033. The significance of each segment highlights the critical role these machines play in modern food manufacturing.

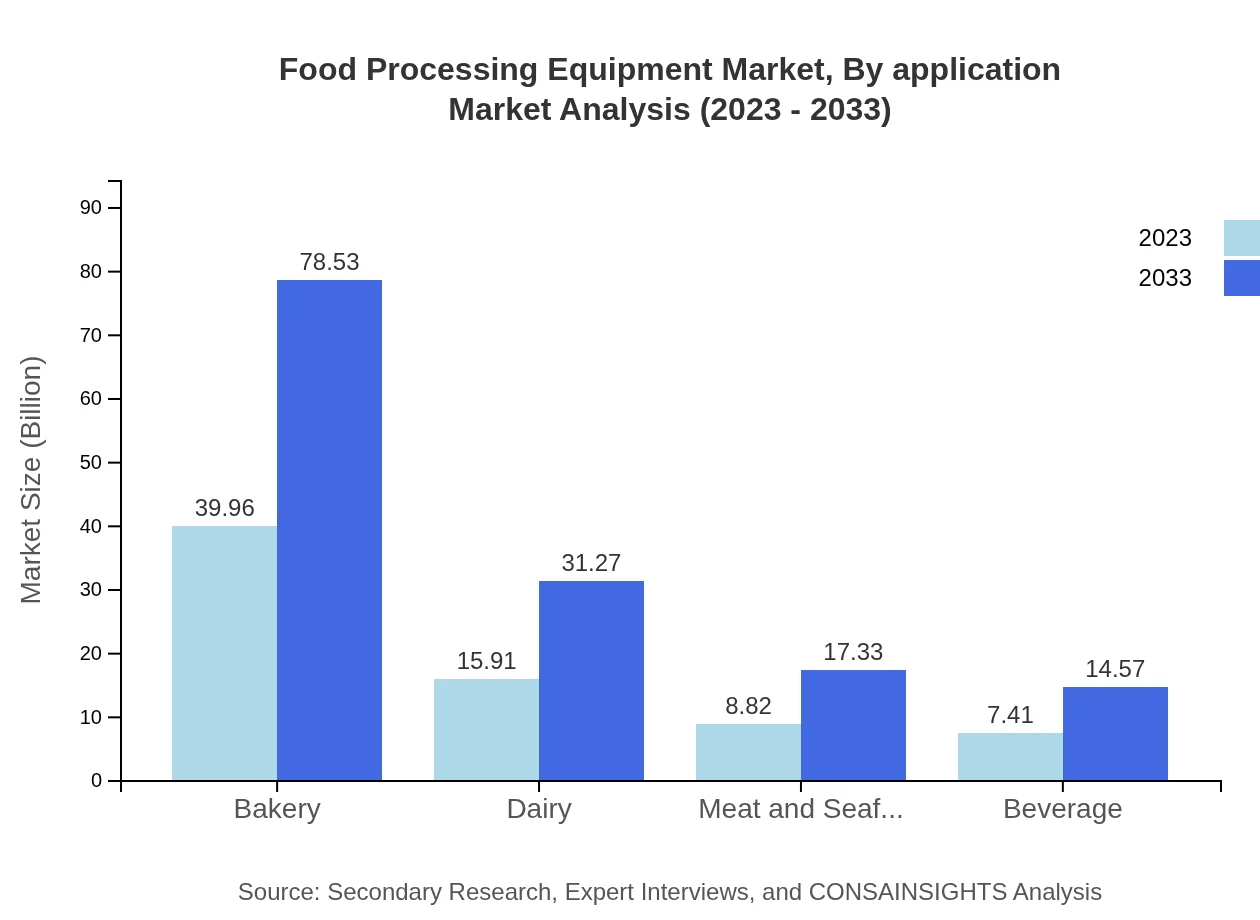

Food Processing Equipment Market Analysis By Application

Within the application segment, the bakery sector is a leading consumer, increasing from USD 39.96 billion in 2023 to USD 78.53 billion by 2033. Dairy applications are also notable, projected to expand from USD 15.91 billion to USD 31.27 billion. The demand for processing equipment in the meat and seafood as well as beverage sectors further underscores the critical role of food processing machinery in the food industry.

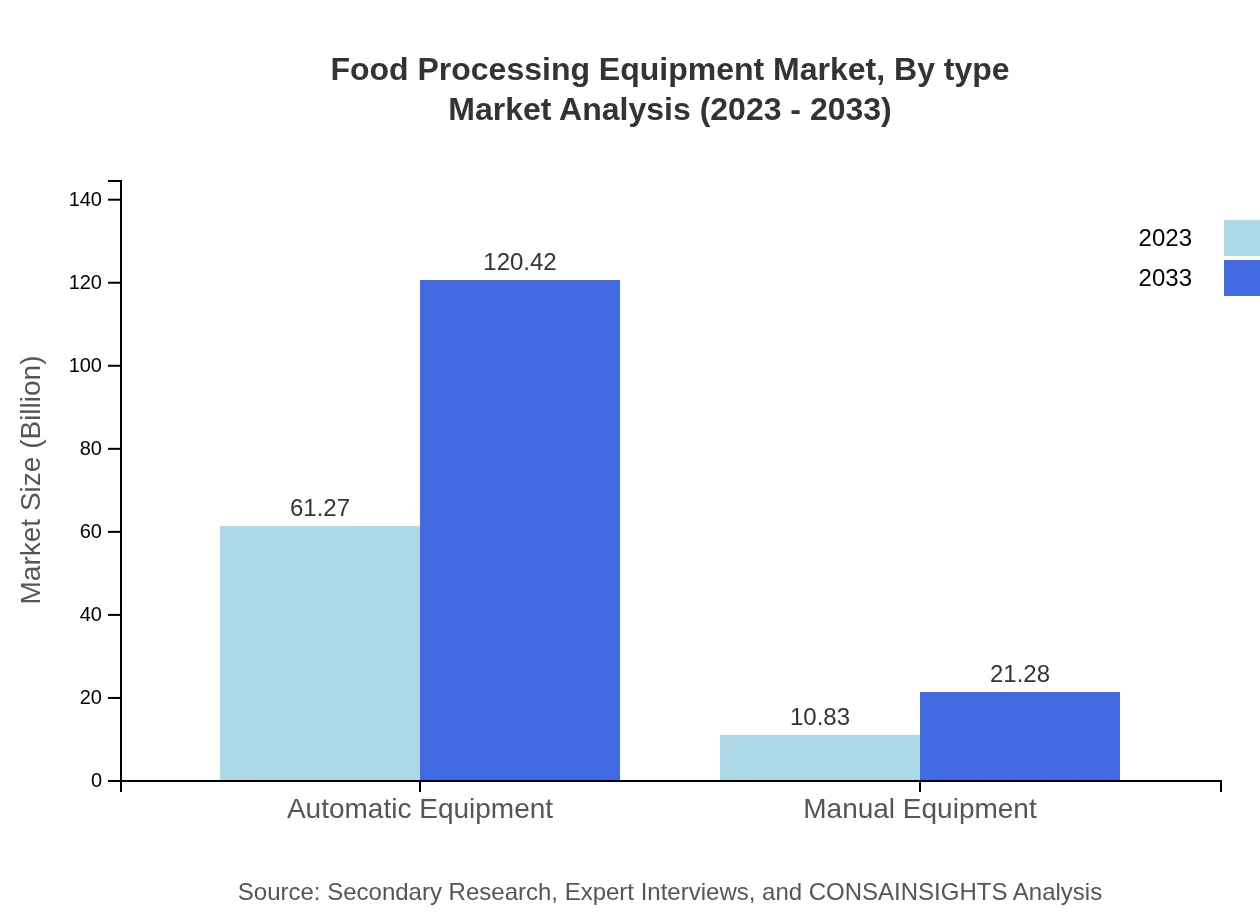

Food Processing Equipment Market Analysis By Type

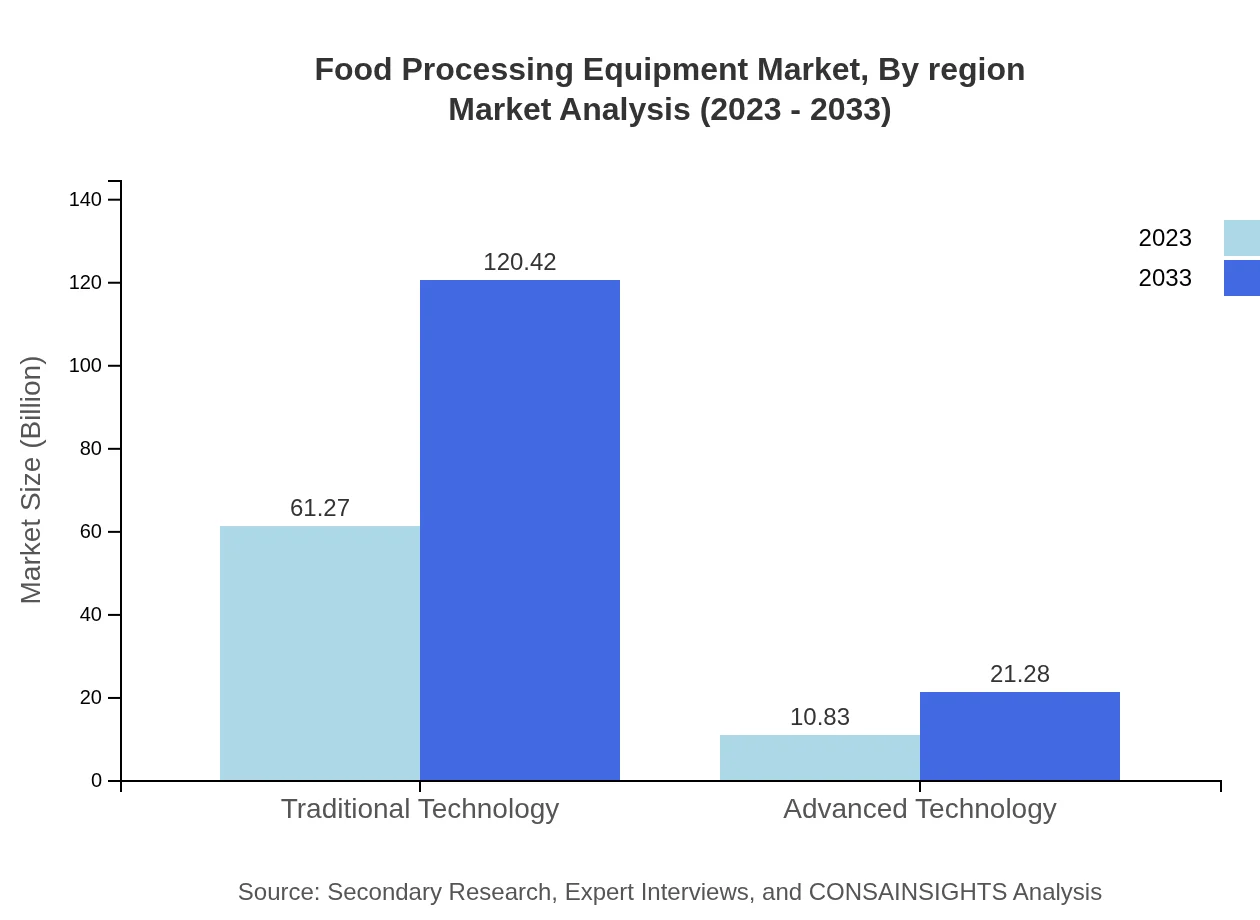

The market for automatic equipment dominates, expected to soar from USD 61.27 billion in 2023 to USD 120.42 billion by 2033, reflecting a strong paradigm shift towards automation in food processing. Conversely, manual equipment, while important, will grow more slowly, from USD 10.83 billion to USD 21.28 billion, indicating a gradual reliance on automation.

Food Processing Equipment Market Analysis By End User

Food manufacturers are the primary end-users, with their segment projected to grow from USD 44.79 billion to USD 88.03 billion. Caterers and restaurants also represent substantial segments, with respective expected growths from USD 20.30 billion to USD 39.89 billion and USD 7.02 billion to USD 13.79 billion. This reflects shifting consumer preferences towards more diverse and readily available food options.

Food Processing Equipment Market Analysis By Region

Technologically, traditional technology retains a large market share, maintaining USD 61.27 billion to USD 120.42 billion up to 2033. Advanced technology is steadily enhancing its footprint, growing from USD 10.83 billion to USD 21.28 billion as manufacturers adopt more sophisticated methods to improve efficiency and adapt to consumer preferences.

Food Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Processing Equipment Industry

Bühler AG:

Bühler AG is a Swiss multinational company specializing in food processing technology, particularly known for innovative equipment that enhances processing efficiency and product quality.Alfa Laval:

Alfa Laval is a Swedish company that manufactures specialized food processing equipment, focusing on heat transfer, separation, and fluid handling to optimize production processes in various food industries.GEA Group:

GEA Group is a German company providing equipment and process technology for the food industry, renowned for its state-of-the-art automation solutions and sustainability initiatives.Tetra Pak:

Tetra Pak is known for its innovative packaging solutions and processing equipment that ensure food safety, quality, and sustainability in the beverage and dairy sectors.JBT Corporation:

JBT Corporation delivers advanced food processing equipment and solutions, renowned for enhancing efficiency and product integrity across the food supply chain.We're grateful to work with incredible clients.

FAQs

What is the market size of food Processing Equipment?

The global food processing equipment market is valued at approximately $72.1 billion in 2023, with a projected CAGR of 6.8% over the next decade, indicating robust growth driven by increasing food production demands.

What are the key market players or companies in this food Processing Equipment industry?

Key players in the food processing equipment market include established companies like Buhler AG, Tetra Pak, JBT Corporation, ITW, and Marel, which specialize in a wide range of processing solutions to meet diverse industry needs.

What are the primary factors driving the growth in the food Processing Equipment industry?

Growth factors include heightened demand for processed foods, advancements in technology, increased food safety regulations, and the need for automation, leading to enhanced efficiency and productivity in food processing plants.

Which region is the fastest Growing in the food Processing Equipment?

The North American region stands out as the fastest-growing area in the food processing equipment market, projected to grow from $25.05 billion in 2023 to $49.24 billion by 2033 due to increased investment in food technology and processing facilities.

Does ConsaInsights provide customized market report data for the food Processing Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the food processing equipment industry, ensuring detailed insights and strategic analysis relevant to their goals.

What deliverables can I expect from this food Processing Equipment market research project?

Expect comprehensive deliverables from the food processing equipment market research project, including detailed reports, market forecasts, growth analysis, competitive landscape assessments, and actionable insights for strategic planning.

What are the market trends of food Processing Equipment?

Current market trends include a shift toward automation and smart technology integration, growing sustainability practices, and an increased focus on energy-efficient equipment, reflecting the industry's adaptation to modern consumer preferences and regulatory standards.