Food Processing Ingredients Market Report

Published Date: 31 January 2026 | Report Code: food-processing-ingredients

Food Processing Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Food Processing Ingredients market from 2023 to 2033, focusing on key insights such as market size, growth trends, industry dynamics, and regional performance, along with an exploration of emerging technologies and innovations.

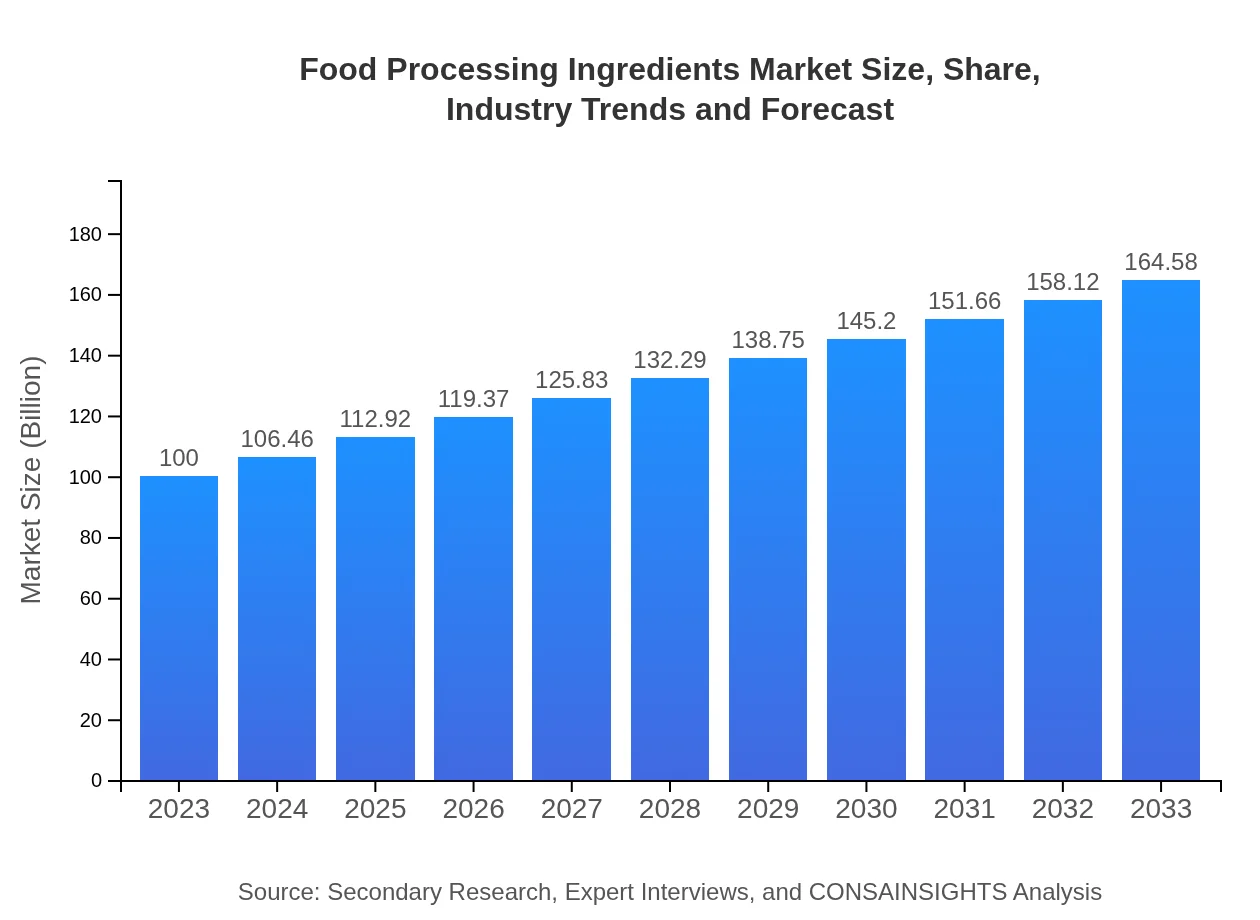

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Cargill Inc., Archer Daniels Midland Company (ADM), DuPont, Ingredion Incorporated |

| Last Modified Date | 31 January 2026 |

Food Processing Ingredients Market Overview

Customize Food Processing Ingredients Market Report market research report

- ✔ Get in-depth analysis of Food Processing Ingredients market size, growth, and forecasts.

- ✔ Understand Food Processing Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Processing Ingredients

What is the Market Size & CAGR of Food Processing Ingredients market in 2023?

Food Processing Ingredients Industry Analysis

Food Processing Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Processing Ingredients Market Analysis Report by Region

Europe Food Processing Ingredients Market Report:

In Europe, the market will grow from $27.88 billion in 2023 to $45.88 billion by 2033, supported by strong consumer demand for organic and clean label products. Regulatory frameworks regarding food safety and environmental sustainability also enhance market growth.Asia Pacific Food Processing Ingredients Market Report:

In the Asia Pacific region, the Food Processing Ingredients market is projected to grow from $21.20 billion in 2023 to $34.89 billion by 2033, driven by rising disposable incomes and changing dietary patterns. Increased urbanization and demand for convenience foods play pivotal roles in this growth, alongside a shift towards healthier options.North America Food Processing Ingredients Market Report:

In North America, the market size is expected to rise from $33.19 billion in 2023 to $54.62 billion by 2033. The growth is primarily driven by the high consumption of convenience foods and a significant focus on food safety, health, and nutrition. Innovations in ingredient formulations also support this expansion.South America Food Processing Ingredients Market Report:

The South American market is anticipated to increase from $8.98 billion in 2023 to $14.78 billion by 2033. Growth is fueled by rising demand for processed foods and the expansion of the retail market. Brazil and Argentina are leading contributors to this growth due to higher consumption rates.Middle East & Africa Food Processing Ingredients Market Report:

The Middle East and Africa region's market is projected to expand from $8.75 billion in 2023 to $14.40 billion by 2033. Growth in this region is influenced by increasing urbanization and changes in lifestyle leading to higher demand for processed food products.Tell us your focus area and get a customized research report.

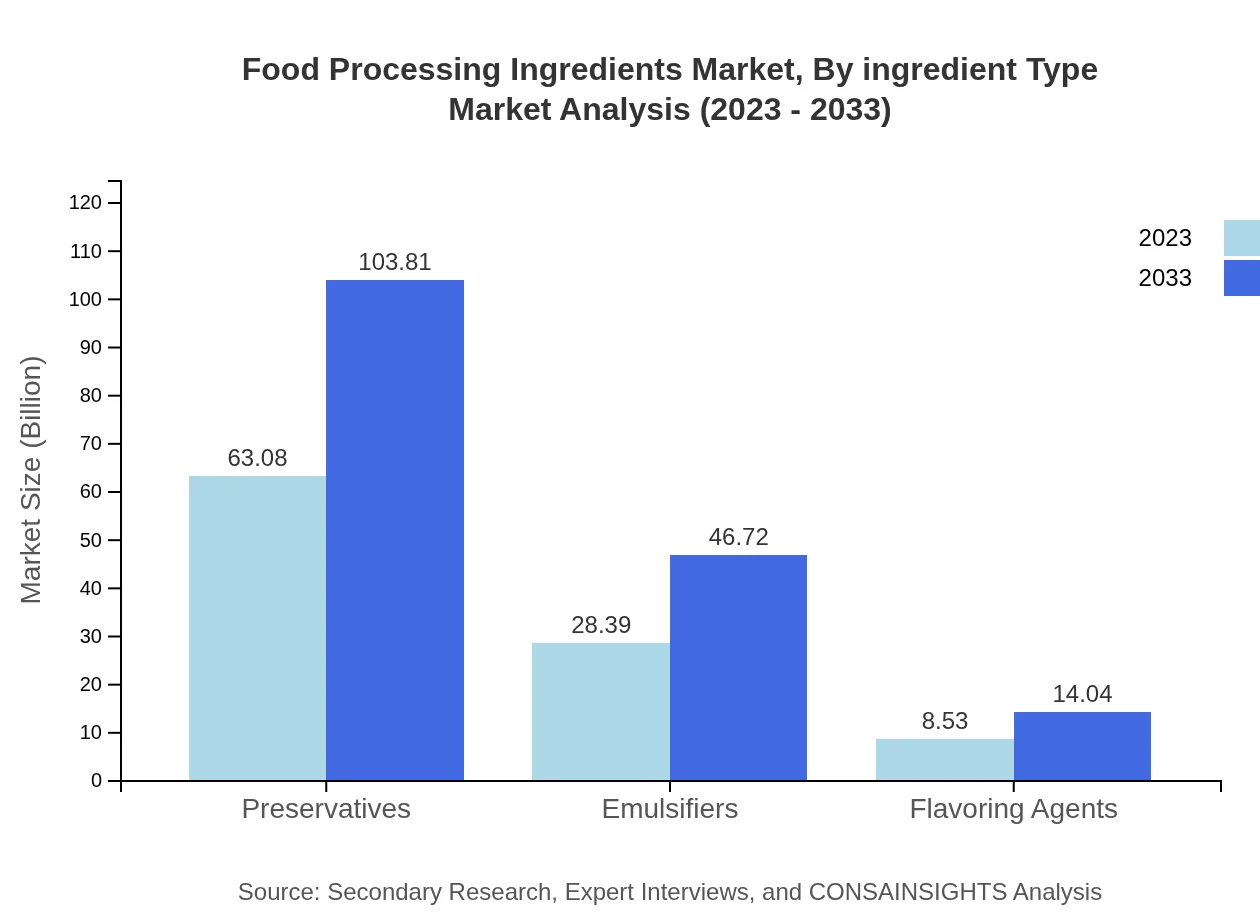

Food Processing Ingredients Market Analysis By Ingredient Type

The Food Processing Ingredients market is segmented by ingredient type, showing significant growth across various categories: Preservatives exhibit robust performance, growing from $63.08 billion in 2023 to $103.81 billion by 2033, driven by greater food safety and longer shelf life demands. Emulsifiers are forecasted to expand from $28.39 billion to $46.72 billion, while flavoring agents will increase from $8.53 billion to $14.04 billion as consumer preferences lean toward enhanced taste experiences.

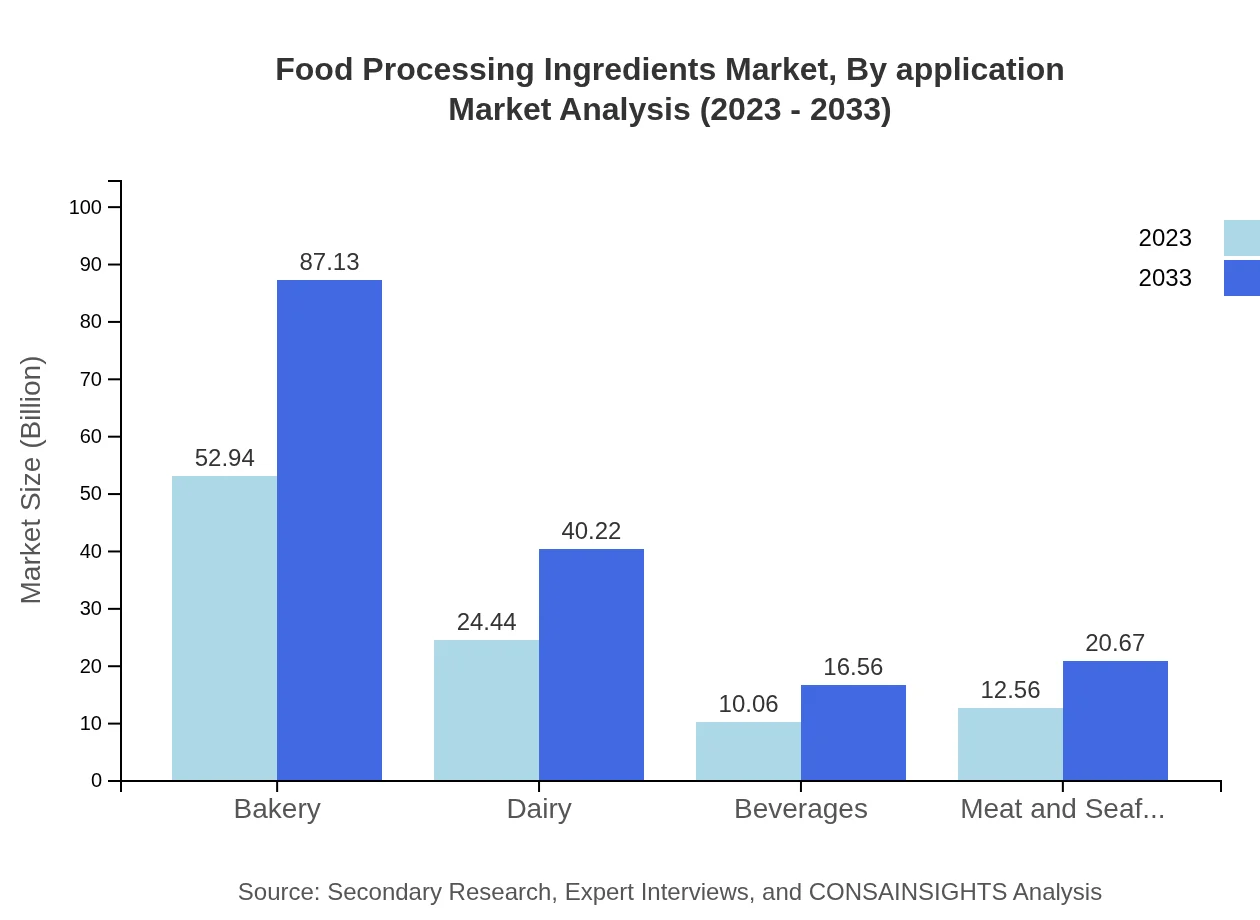

Food Processing Ingredients Market Analysis By Application

Market segmentation by application illustrates strong growth: Bakery products represent a significant share, growing from $52.94 billion in 2023 to $87.13 billion by 2033. The dairy application is also noteworthy, with an increase from $24.44 billion to $40.22 billion, reflecting consumer trends toward health-conscious dairy alternatives.

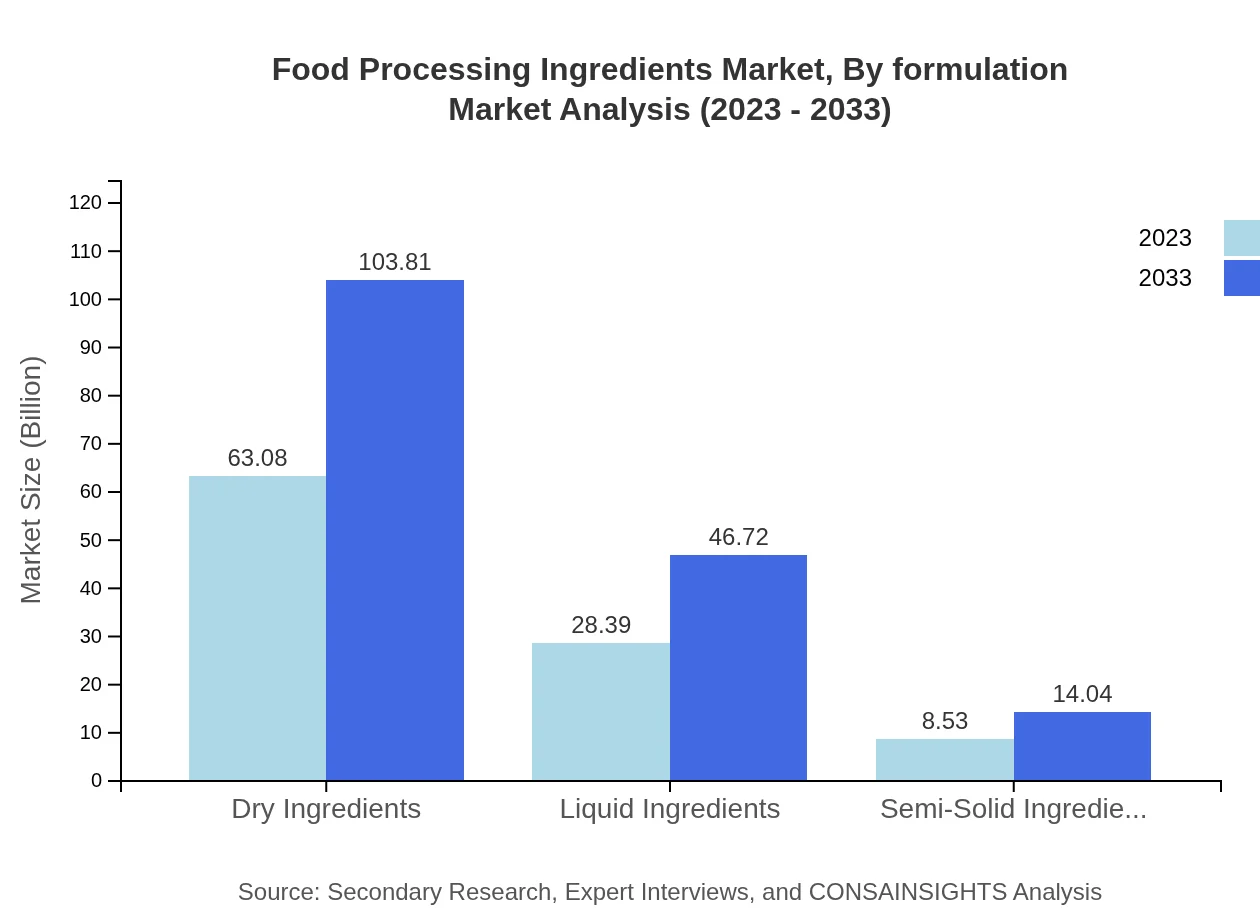

Food Processing Ingredients Market Analysis By Formulation

Segmenting by formulation, the dry ingredients category is anticipated to maintain its dominance, growing from $63.08 billion in 2023 to $103.81 billion by 2033. Liquid ingredients are expected to increase from $28.39 billion to $46.72 billion, while semi-solid ingredients will rise from $8.53 billion to $14.04 billion, highlighting emerging trends in food texture preferences.

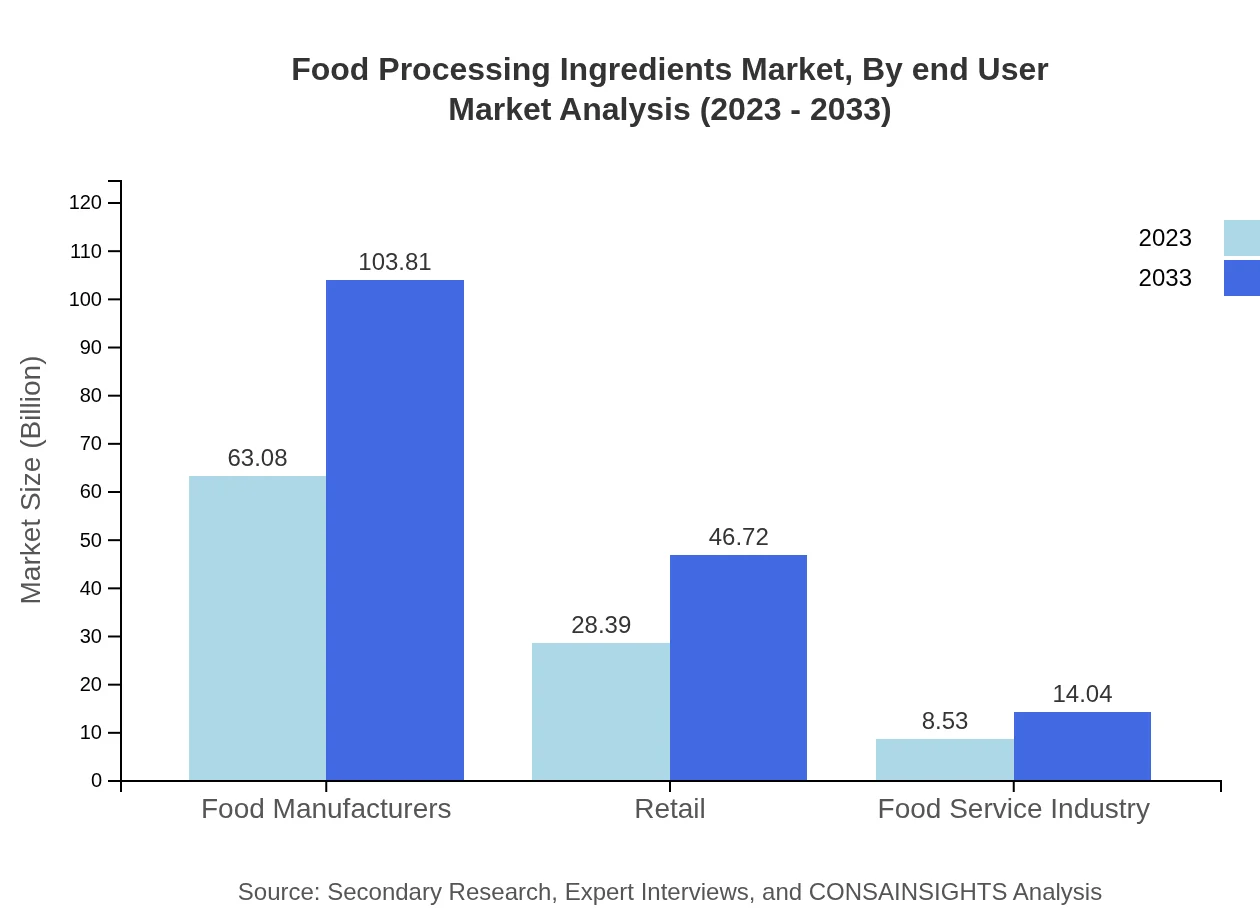

Food Processing Ingredients Market Analysis By End User

In terms of end-users, food manufacturers hold a substantial market share, with sizes growing from $63.08 billion to $103.81 billion from 2023 to 2033. The retail sector is also significant, expanding from $28.39 billion to $46.72 billion, showcasing the increasing role of supermarkets and grocery chains in sourcing food processing ingredients.

Food Processing Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Processing Ingredients Industry

Cargill Inc.:

A global leader in food ingredients, Cargill provides a wide range of solutions, including sweeteners, oils, and emulsifiers, catering to various food applications.Archer Daniels Midland Company (ADM):

ADM is a significant player in the food processing ingredients industry, specializing in ingredients derived from grains and oilseeds, including proteins, sweeteners, and flavoring agents.DuPont:

DuPont offers a diverse portfolio of food ingredient technologies, focusing on solutions for emulsifiers, stabilizers, and nutritional ingredients, contributing to enhanced food processing and quality.Ingredion Incorporated:

Ingredion is a prominent specialty ingredient solutions provider, producing a range of starches and sweeteners that improve food texture and flavor.We're grateful to work with incredible clients.

FAQs

What is the market size of food Processing Ingredients?

The global food processing ingredients market is projected to grow from $100 million in 2023, with a CAGR of 5%. It reflects an increasing demand for processed food products, leading to a robust market expansion by 2033.

What are the key market players or companies in this food Processing Ingredients industry?

In the food processing ingredients industry, key players include global companies involved in the production and supply of food additives, flavoring agents, and stabilizers. Collaborations and partnerships among these companies significantly contribute to market innovation.

What are the primary factors driving the growth in the food Processing Ingredients industry?

Key drivers of growth in the food processing ingredients market are rising consumer demand for convenience foods, increased health consciousness, and advancements in food preservation techniques. Moreover, innovation in food technologies enhances ingredient functionality.

Which region is the fastest Growing in the food Processing Ingredients?

The fastest-growing region in the food processing ingredients market is projected to be Europe, expanding from $27.88 million in 2023 to $45.88 million by 2033, closely followed by North America due to demand for processed food.

Does ConsaInsights provide customized market report data for the food Processing Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the food processing ingredients sector. This allows clients to obtain deeper insights based on their unique business challenges.

What deliverables can I expect from this food Processing Ingredients market research project?

From the food processing ingredients market research project, you can expect comprehensive reports including market analysis, segment performance, regional insights, and forecasts, along with actionable strategies tailored to your business objectives.

What are the market trends of food Processing Ingredients?

Current trends in the food processing ingredients market include increasing demand for clean label products, the use of natural preservatives, and a shift towards healthier options. Innovation in ingredient technologies drives growth and product development.