Food Processing Machinery Market Report

Published Date: 31 January 2026 | Report Code: food-processing-machinery

Food Processing Machinery Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Food Processing Machinery market from 2023 to 2033, including market analysis, trends, forecasts, regional breakdowns, and key players in the industry.

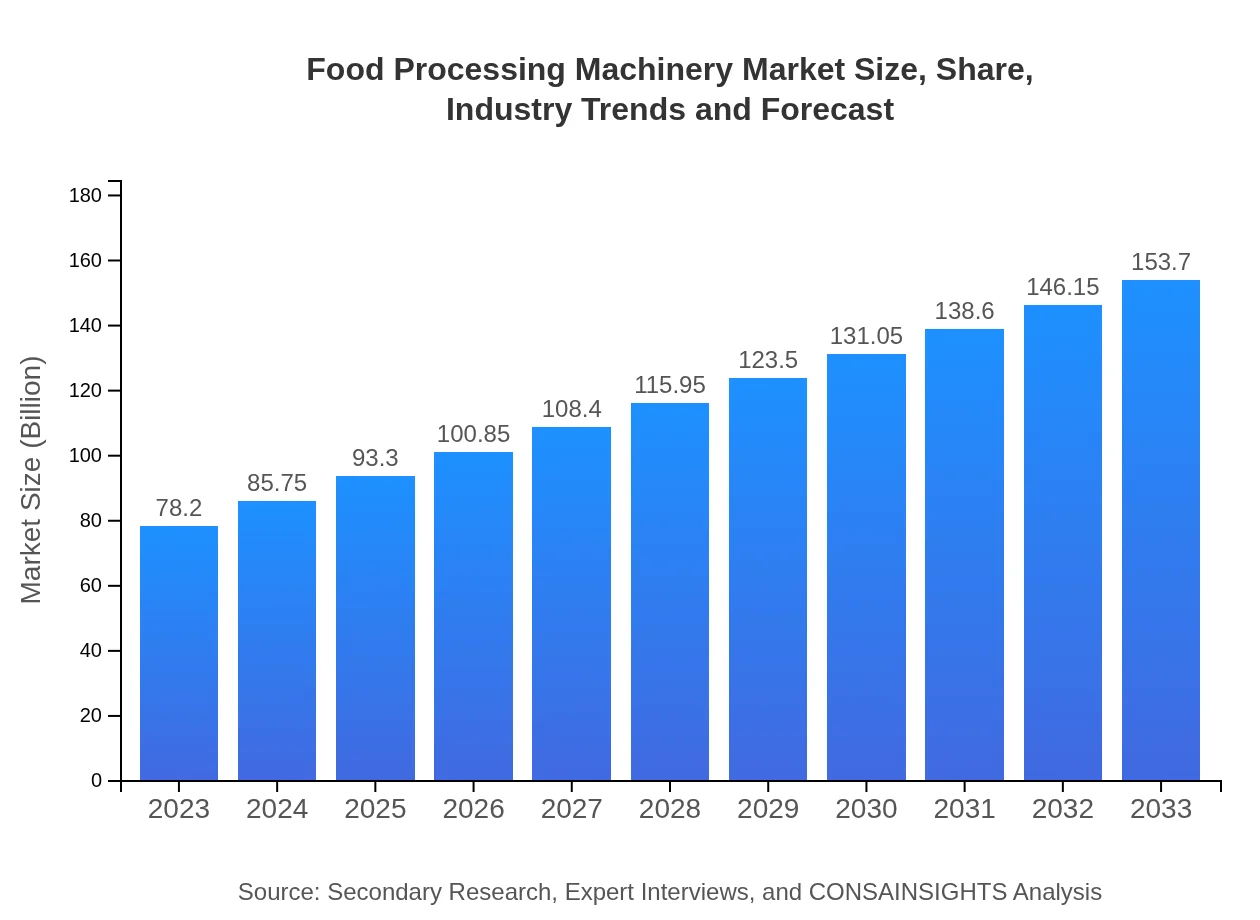

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $78.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $153.70 Billion |

| Top Companies | Krones AG, Marel, Tetra Pak |

| Last Modified Date | 31 January 2026 |

Food Processing Machinery Market Overview

Customize Food Processing Machinery Market Report market research report

- ✔ Get in-depth analysis of Food Processing Machinery market size, growth, and forecasts.

- ✔ Understand Food Processing Machinery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Processing Machinery

What is the Market Size & CAGR of Food Processing Machinery market in 2023?

Food Processing Machinery Industry Analysis

Food Processing Machinery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Processing Machinery Market Analysis Report by Region

Europe Food Processing Machinery Market Report:

Europe, a mature market for food processing machinery, is projected to grow from 19.41 billion USD in 2023 to 38.15 billion USD by 2033. The region is heavily investing in sustainability and innovative processing technologies to enhance food security and quality.Asia Pacific Food Processing Machinery Market Report:

The Asia Pacific region shows significant growth potential, with market size projected to increase from 16.35 billion USD in 2023 to 32.14 billion USD by 2033. Countries like China and India are witnessing a surge in food processing owing to urbanization and changing dietary preferences, driving demand for modern machinery.North America Food Processing Machinery Market Report:

North America, led by the US and Canada, showcases a strong market, anticipated to grow from 27.48 billion USD in 2023 to 54.01 billion USD by 2033. The emphasis on food safety regulations and advanced processing technologies is expected to drive this growth.South America Food Processing Machinery Market Report:

In South America, the market is expected to rise from 6.66 billion USD in 2023 to 13.09 billion USD in 2033. The region is focusing on enhancing its food processing capabilities to meet both local and export demands, supported by government initiatives aimed at boosting food production.Middle East & Africa Food Processing Machinery Market Report:

The Middle East and Africa market is forecasted to expand from 8.30 billion USD in 2023 to 16.31 billion USD by 2033. The region’s focus on food processing quality and increased investments in processing facilities will support this growth.Tell us your focus area and get a customized research report.

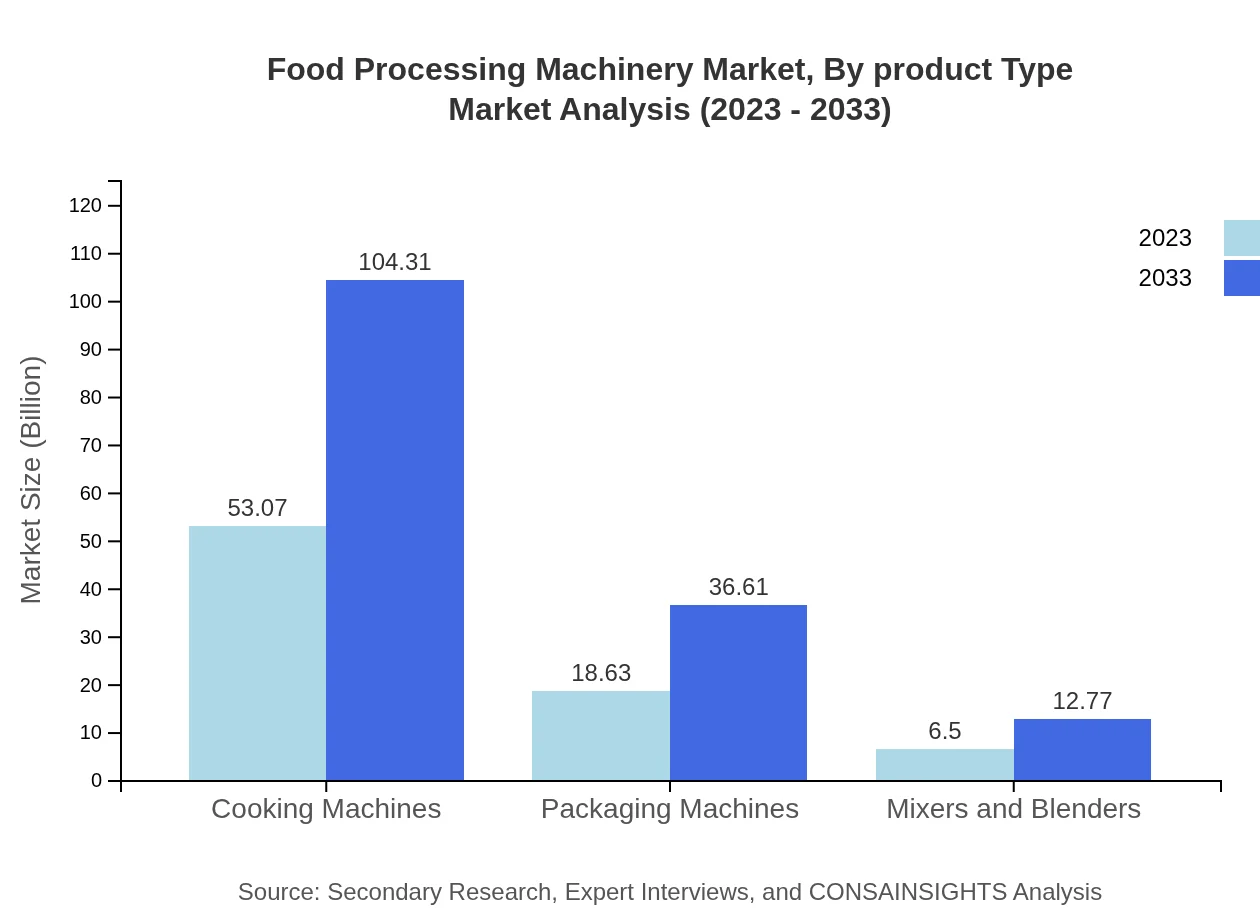

Food Processing Machinery Market Analysis By Product Type

The Cooking Machines segment is expected to lead the market with a size growing from 53.07 billion USD in 2023 to 104.31 billion USD by 2033. Followed by Packaging Machines and Mixers and Blenders, with sizes of 18.63 billion USD and 6.50 billion USD in 2023, respectively. Each product type serves a vital role in food production efficiency and quality enhancement.

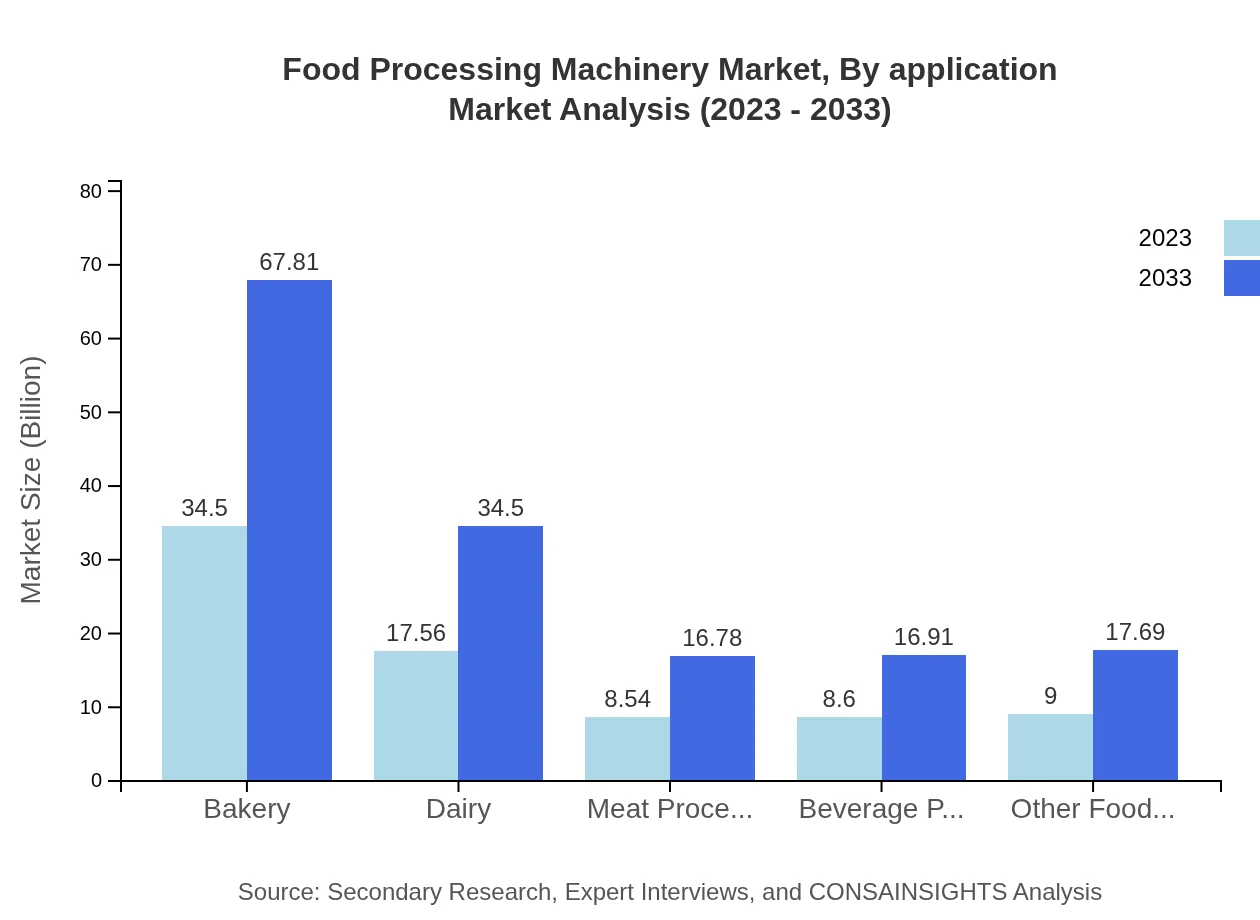

Food Processing Machinery Market Analysis By Application

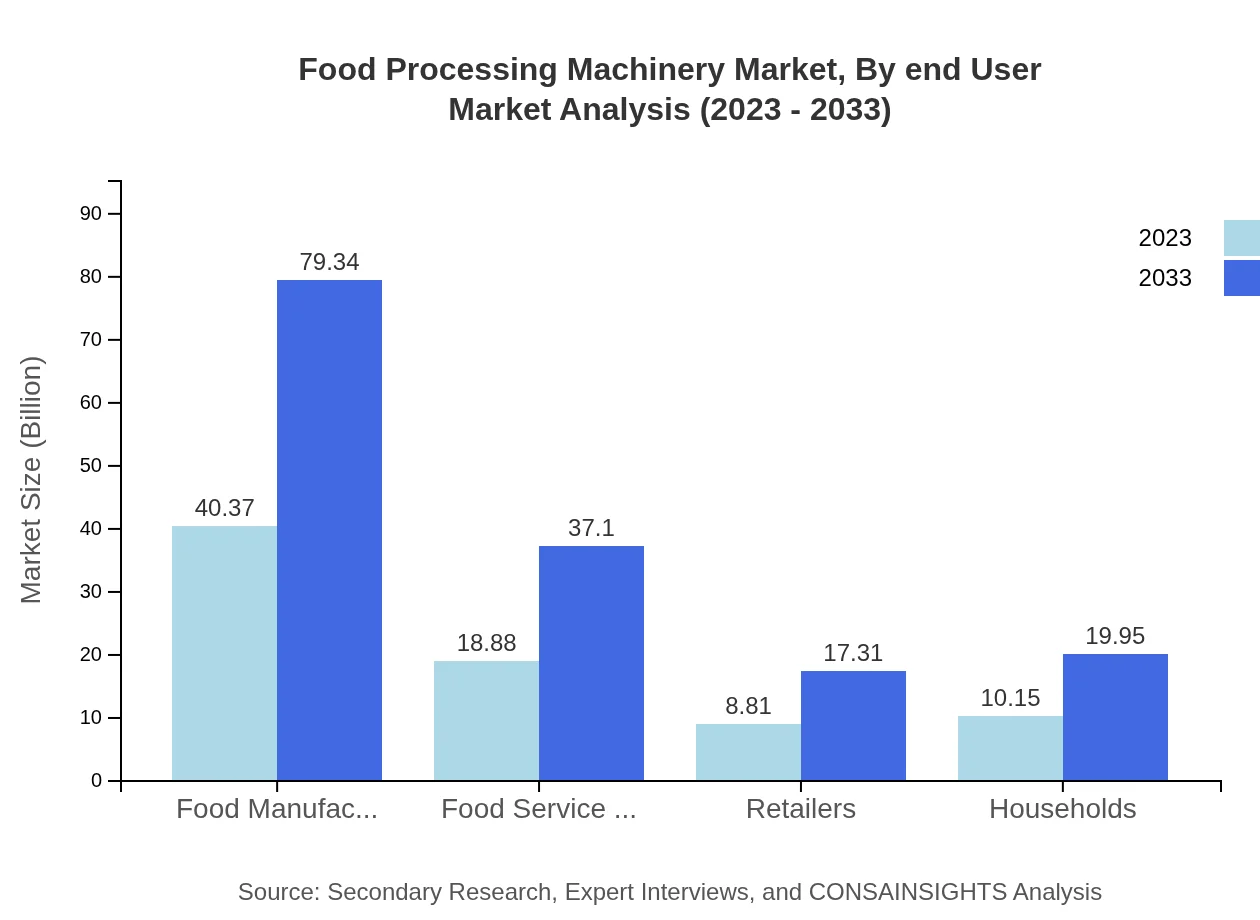

Food Manufacturers dominate the market with a size of 40.37 billion USD in 2023 and projected growth to 79.34 billion USD by 2033. Food Service Providers and Retailers are also significant, with projected sizes of 18.88 billion USD and 8.81 billion USD, respectively, illustrating the broad spectrum of applications in the market.

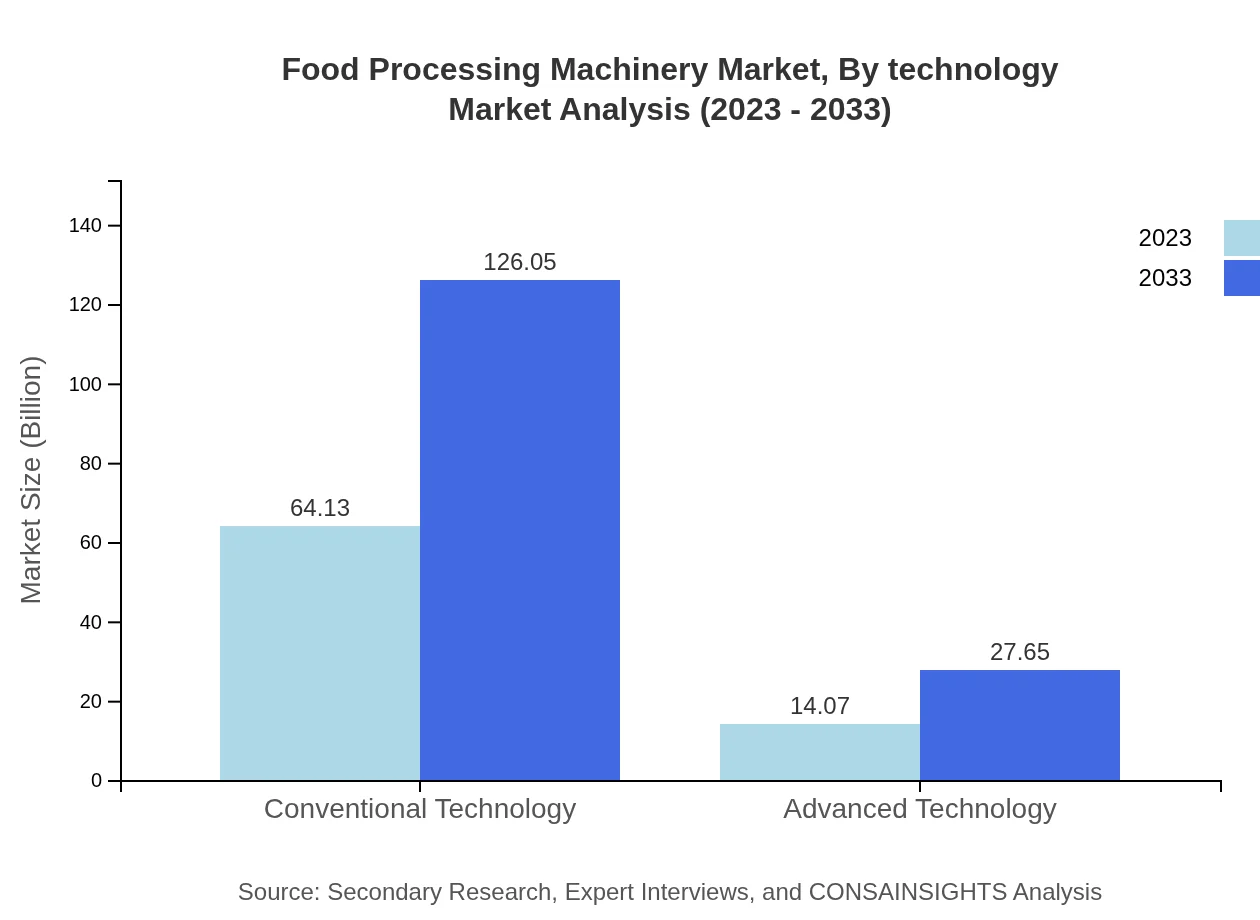

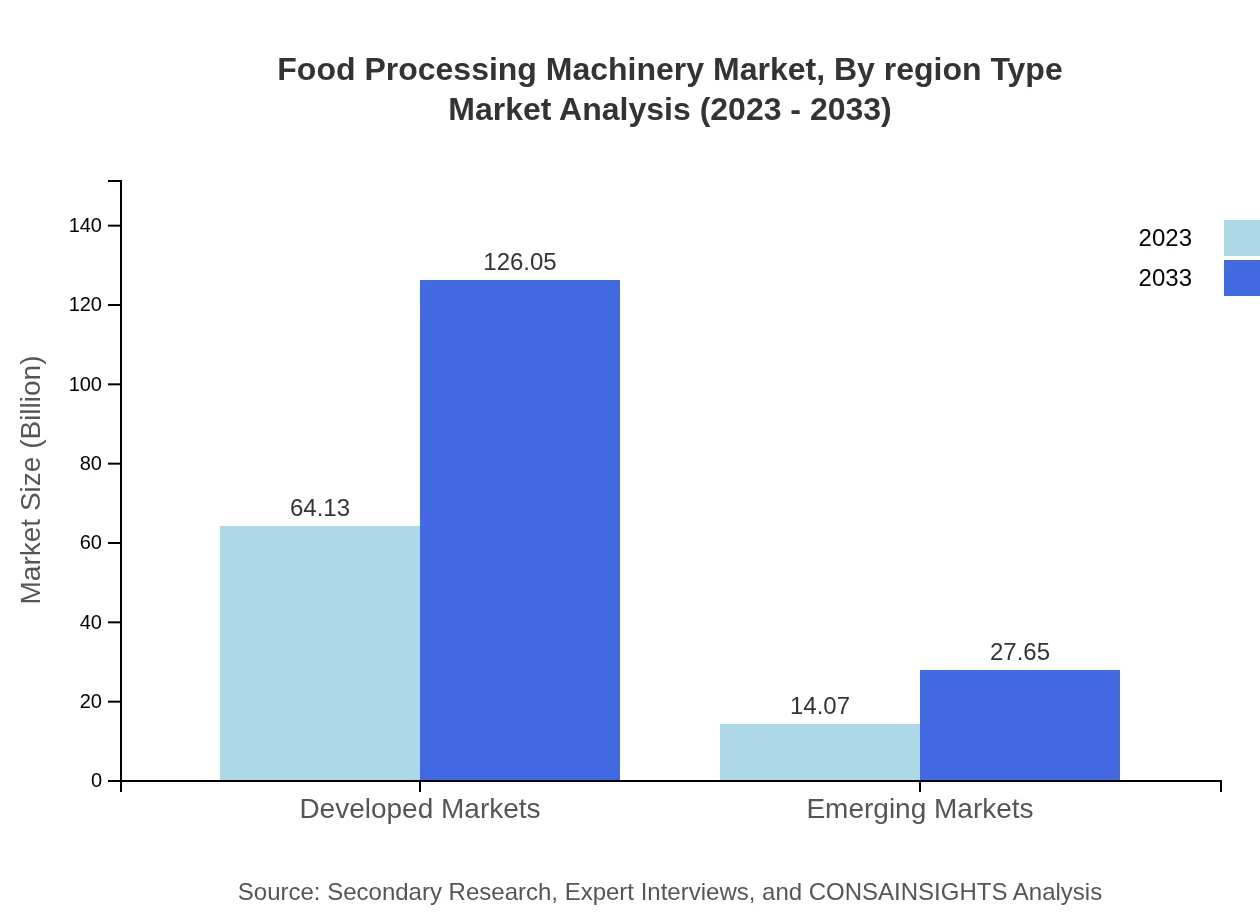

Food Processing Machinery Market Analysis By Technology

Conventional Technology holds the largest market size at 64.13 billion USD in 2023, with projections of reaching 126.05 billion USD by 2033. Advanced Technology, although smaller with 14.07 billion USD in 2023, is expected to grow rapidly owing to the increasing demand for automation and smart technologies.

Food Processing Machinery Market Analysis By End User

Developed Markets make up a substantial portion of the market, valued at 64.13 billion USD in 2023 and expanding significantly over the next decade. Emerging Markets are also gaining traction, supported by the increasing demand for food processing solutions.

Food Processing Machinery Market Analysis By Region Type

Regional analysis indicates that North America and Europe will benefit from advanced technologies and a focus on sustainability. In contrast, Asia Pacific and Latin America are likely to experience faster growth rates, driven by modernization efforts in food processing infrastructure.

Food Processing Machinery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Processing Machinery Industry

Krones AG:

Krones AG is a leading manufacturer specializing in bottling and packaging machinery for the beverage industry, demonstrating innovation in automated solutions.Marel:

Marel is known for providing advanced processing equipment and integrated systems for meat, poultry, and fish processing sectors worldwide.Tetra Pak:

Tetra Pak is a key player in food processing and packaging, focusing on sustainable solutions and advancing food safety technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of Food Processing Machinery?

The global food processing machinery market is projected to reach $78.2 billion by 2033, growing with a CAGR of 6.8%. It signifies a robust demand for machinery in diverse food sectors, enhancing production capabilities.

What are the key market players or companies in the Food Processing Machinery industry?

Key players in the food processing machinery market include global leaders known for their innovative technology solutions, focusing on enhancing throughput and sustainability in food production processes.

What are the primary factors driving growth in the Food Processing Machinery industry?

Major factors fueling growth include the increasing demand for processed foods, advancements in technology, automation in food production, and rising consumer preferences for convenience, all enhancing operational efficiency.

Which region is the fastest growing in the Food Processing Machinery market?

The North American region is the fastest-growing market for food processing machinery, with an anticipated growth from $27.48 billion in 2023 to $54.01 billion by 2033, reflecting a significant increase in market activity.

Does ConsInsights provide customized market report data for the Food Processing Machinery industry?

Yes, ConsInsights offers customized market report data tailored to the needs of clients, enabling them to access specific insights regarding the food processing machinery industry and align strategies effectively.

What deliverables can I expect from this Food Processing Machinery market research project?

Deliverables from this market research project include detailed market reports, segment analyses, growth forecasts, competitive landscaping, and actionable insights tailored to the food processing machinery sector's dynamics.

What are the market trends of Food Processing Machinery?

Emerging trends in the food processing machinery market include increased automation, the integration of IoT technology for real-time monitoring, and enhanced focus on energy-efficient machinery to reduce operational costs.