Food Release Agents Market Report

Published Date: 31 January 2026 | Report Code: food-release-agents

Food Release Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Food Release Agents market, analyzing key trends, market sizes, and growth forecasts from 2023 to 2033. Insights on regional dynamics, competitive landscape, and future developments form the core of this report.

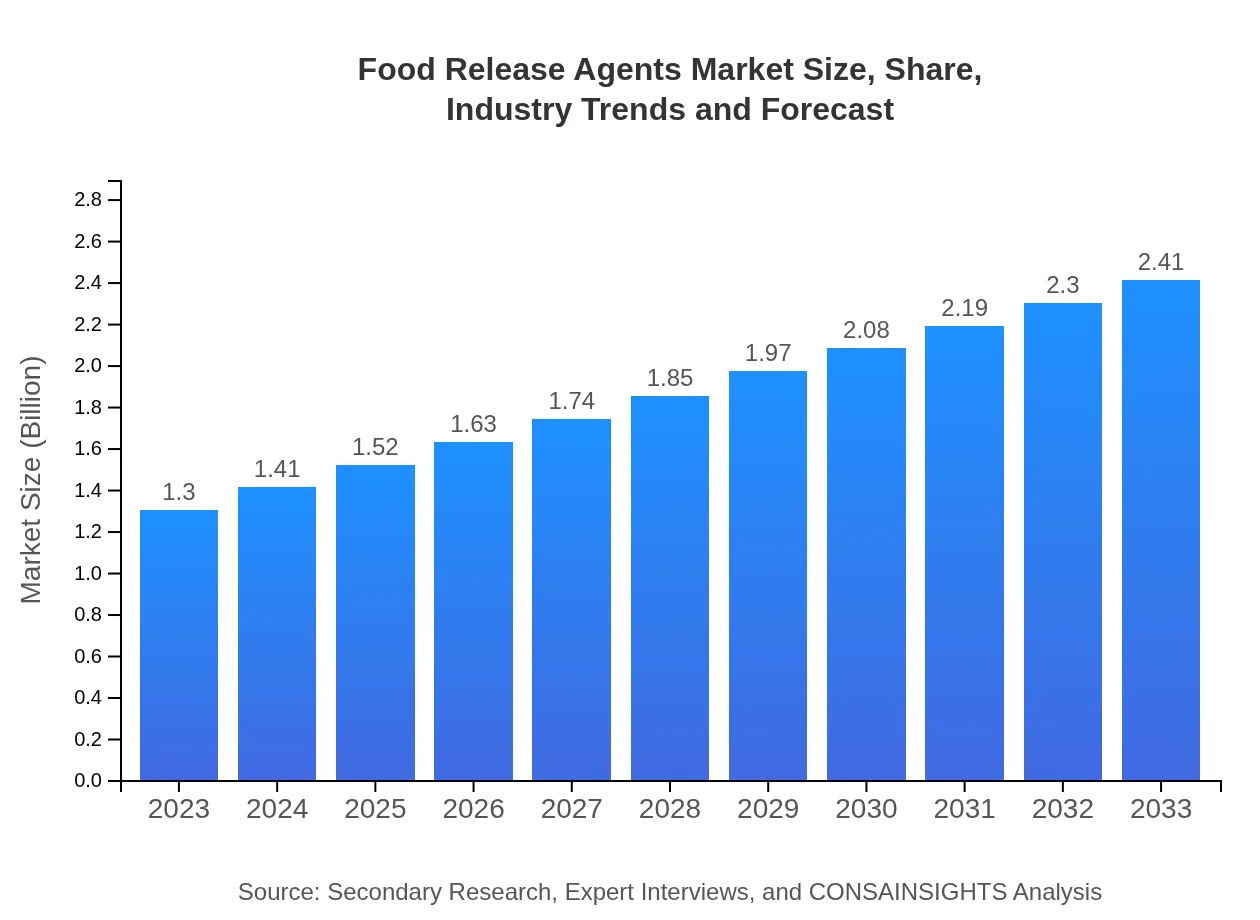

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.30 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.41 Billion |

| Top Companies | Cargill , Archer Daniels Midland Company (ADM), BASF, Palsgaard, Kerry Group |

| Last Modified Date | 31 January 2026 |

Food Release Agents Market Overview

Customize Food Release Agents Market Report market research report

- ✔ Get in-depth analysis of Food Release Agents market size, growth, and forecasts.

- ✔ Understand Food Release Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Release Agents

What is the Market Size & CAGR of Food Release Agents market in 2023?

Food Release Agents Industry Analysis

Food Release Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Release Agents Market Analysis Report by Region

Europe Food Release Agents Market Report:

The European market for Food Release Agents is expected to increase from $0.33 billion in 2023 to $0.61 billion by 2033. Factors such as stringent food safety regulations and a growing wellness trend are compelling manufacturers to adopt these agents in their processes.Asia Pacific Food Release Agents Market Report:

The Asia Pacific region holds a significant stake in the Food Release Agents market, valued at approximately $0.26 billion in 2023, projected to grow to $0.48 billion by 2033. The growth is driven by urbanization and an increasing middle-class population demanding processed food products.North America Food Release Agents Market Report:

North America represents one of the largest markets for Food Release Agents, estimated at $0.44 billion in 2023, expected to reach $0.81 billion by 2033. This growth is fueled by the high consumption of bakery and fried food products, alongside the trend for innovative food processing solutions.South America Food Release Agents Market Report:

In South America, the Food Release Agents market size was $0.10 billion in 2023, with forecasts estimating a rise to $0.18 billion by 2033. Increasing food safety regulations and a shifting consumer preference towards convenient food products are primary growth factors.Middle East & Africa Food Release Agents Market Report:

The Middle East and Africa market is projected to grow from $0.17 billion in 2023 to $0.32 billion by 2033, with rising demand for convenience foods and a growing restaurant industry supporting market advancement.Tell us your focus area and get a customized research report.

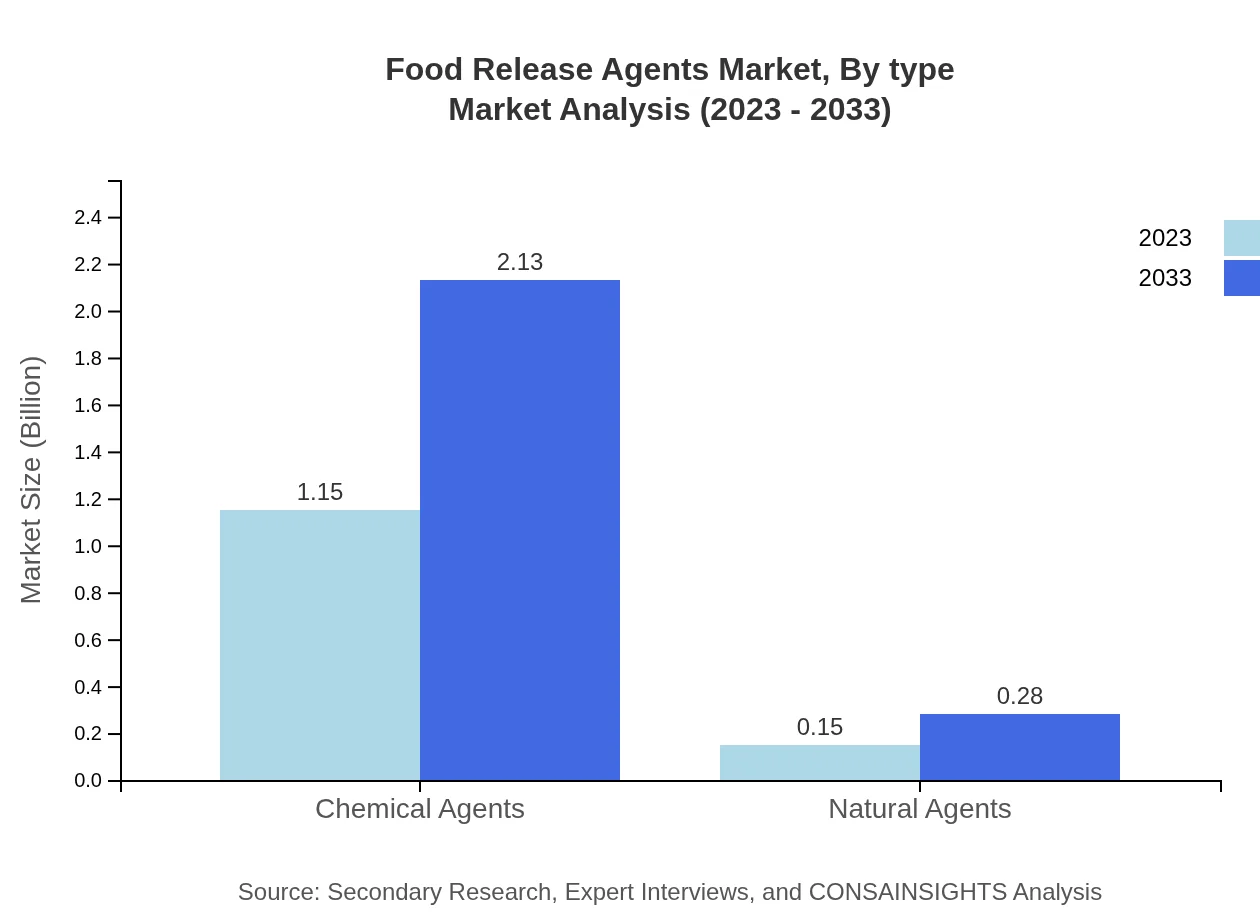

Food Release Agents Market Analysis By Type

In 2023, the Food Release Agents market by type highlights sprays as the dominant category with a market size of $0.86 billion, expected to grow to $1.60 billion by 2033. Sprays hold a significant market share of 66.29%, followed by chemical agents valued at $1.15 billion in 2023. Liquids and solids also contribute with projected sizes of $0.35 billion and $0.09 billion, respectively.

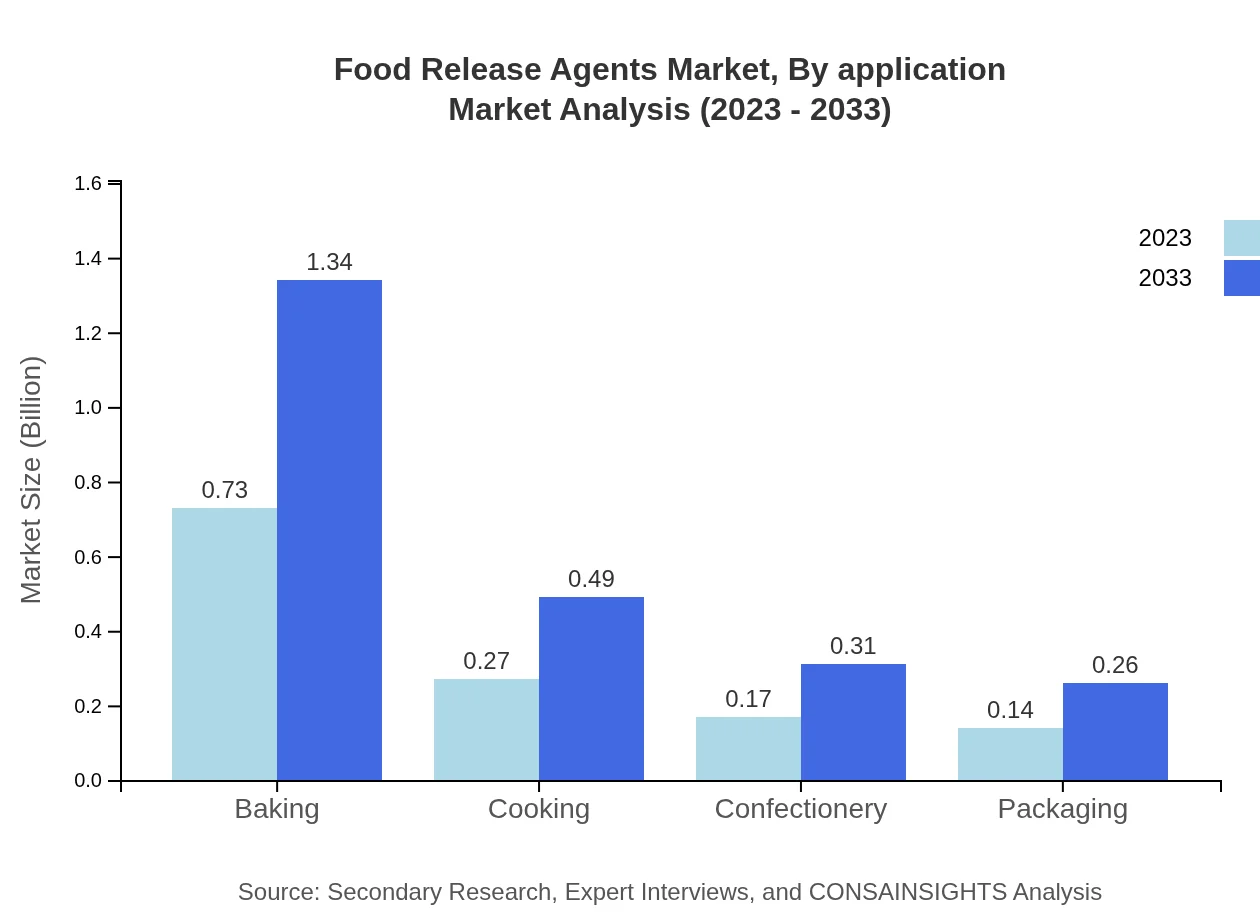

Food Release Agents Market Analysis By Application

The application landscape is led by baking with a market size of $0.73 billion in 2023, projected to rise to $1.34 billion by 2033. The cooking application follows with $0.27 billion and confectionery applications at $0.17 billion in 2023, reflecting diverse application usage across the sector.

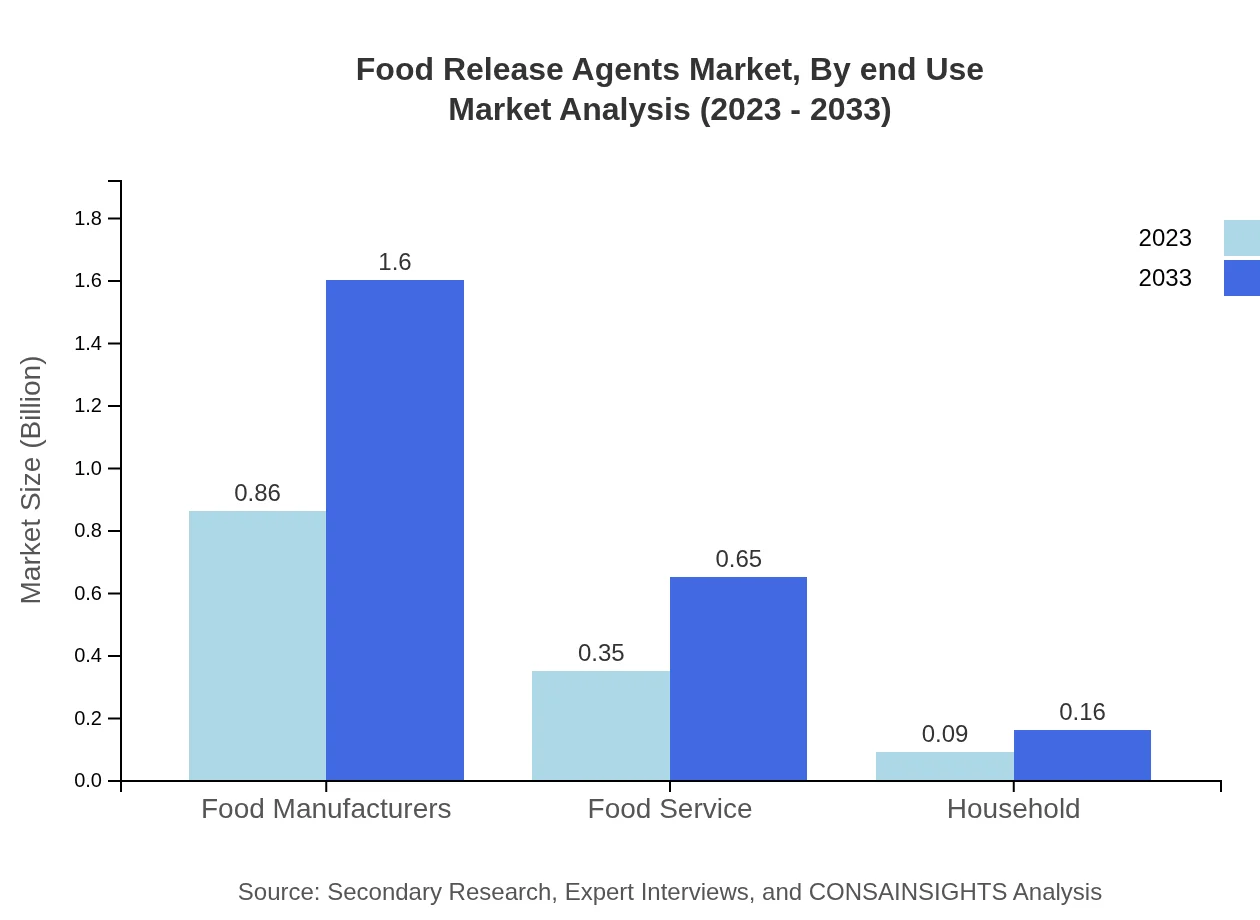

Food Release Agents Market Analysis By End Use

In the end-use sector, food manufacturers represent the largest share at around 66.29% in 2023, with a market size of $0.86 billion. The food service sector is also significant, valued at $0.35 billion, while the household segment is smaller at $0.09 billion by the same year.

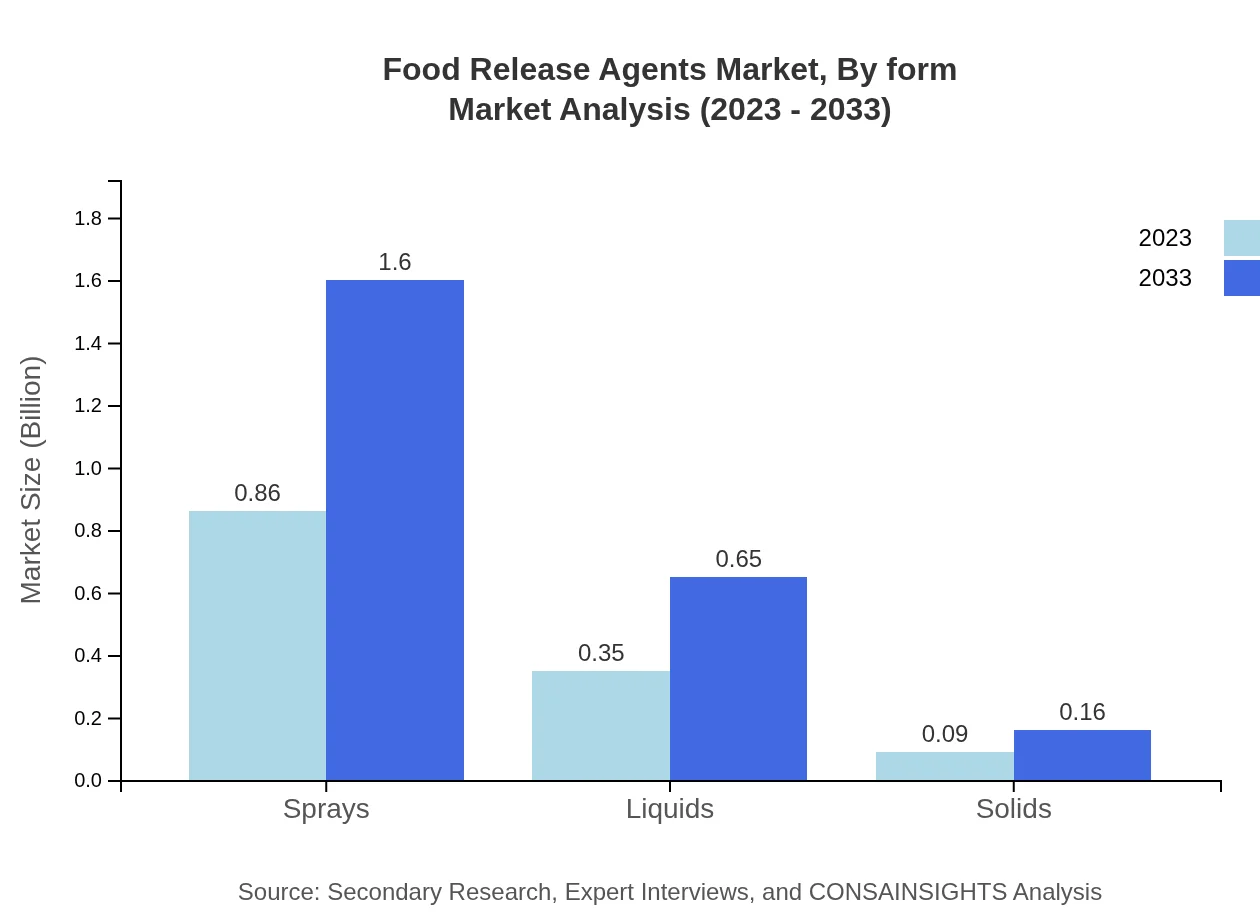

Food Release Agents Market Analysis By Form

The market by form is primarily divided into sprays, liquids, and solids. Sprays dominate with a substantial market size of $0.86 billion in 2023. Liquids command a market sizing of $0.35 billion and solid forms, while smaller, are diversifying product offerings in niche segments.

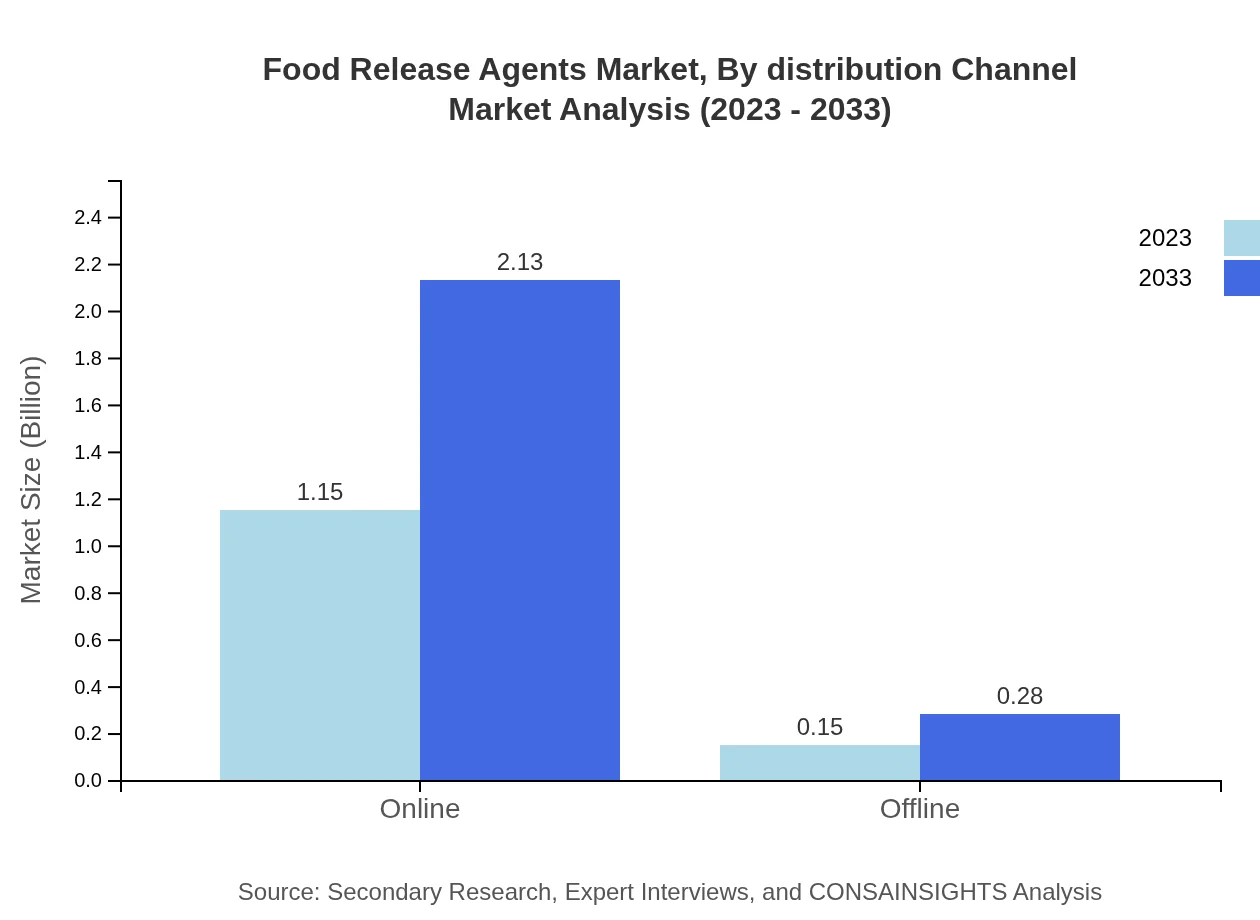

Food Release Agents Market Analysis By Distribution Channel

Distribution channels are mainly classified into online and offline methods. Online sales lead with a market size of $1.15 billion in 2023, significantly driven by the convenience and accessibility they provide. Offline retail remains relevant, capturing interest for local distribution.

Food Release Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Release Agents Industry

Cargill :

Cargill is a major player in the food ingredients sector, providing innovative food release agent solutions aimed at improving food processing while enhancing sustainability.Archer Daniels Midland Company (ADM):

ADM specializes in food and beverage ingredients across the globe, including a robust portfolio of food release agents that cater to diverse market needs.BASF:

BASF is a leading provider of chemical solutions, including high-performance food release agents, focusing on product safety and compliance with global food standards.Palsgaard:

Palsgaard combines expertise in emulsifiers and stabilizers to produce high-quality food release agents tailored to the bakery and dairy industries.Kerry Group:

Kerry Group is known for flavor innovation and food ingredients, offering a range of food release agents that support healthy and trendy food formulations.We're grateful to work with incredible clients.

FAQs

What is the market size of Food Release Agents?

The global food release agents market is valued at approximately $1.3 billion in 2023 and is expected to grow at a CAGR of 6.2% through 2033. This growth is driven by the increasing demand for convenience foods and baking applications.

What are the key market players or companies in the Food Release Agents industry?

Key players in the food release agents industry include major manufacturers and chemical companies that specialize in food additives and release agents, focusing on product innovation and sustainability to maintain market leadership.

What are the primary factors driving the growth in the Food Release Agents industry?

The growth of the food release agents market is propelled by rising consumer trends for convenience foods, a growing bakery industry, and increased focus on food safety and quality, driving demand for efficient products in food processing.

Which region is the fastest Growing in the Food Release Agents market?

The Asia Pacific region leads in growth, with market size projected to increase from $0.26 billion in 2023 to $0.48 billion by 2033. This expansion is attributed to increasing urbanization and food manufacturing activities in emerging economies.

Does ConsaInsights provide customized market report data for the Food Release Agents industry?

Yes, ConsaInsights offers customized market research reports tailored to specific client needs, providing detailed insights into market size, segments, and competitive analysis in the food release agents industry.

What deliverables can I expect from this Food Release Agents market research project?

Expect comprehensive reports that include market analysis, segmentation data, growth forecasts, competitive landscapes, and insights into emerging trends in the food release agents market, facilitating informed business decisions.

What are the market trends of Food Release Agents?

Current trends in the food release agents market include a shift towards natural and organic alternatives, increased automation in food manufacturing, and growing e-commerce for food-related products, aligning with consumer demands for health and convenience.