Food Safety Testing Market Report

Published Date: 31 January 2026 | Report Code: food-safety-testing

Food Safety Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Safety Testing market from 2023 to 2033, including market dynamics, segmentation, regional insights, and future trends in food safety compliance.

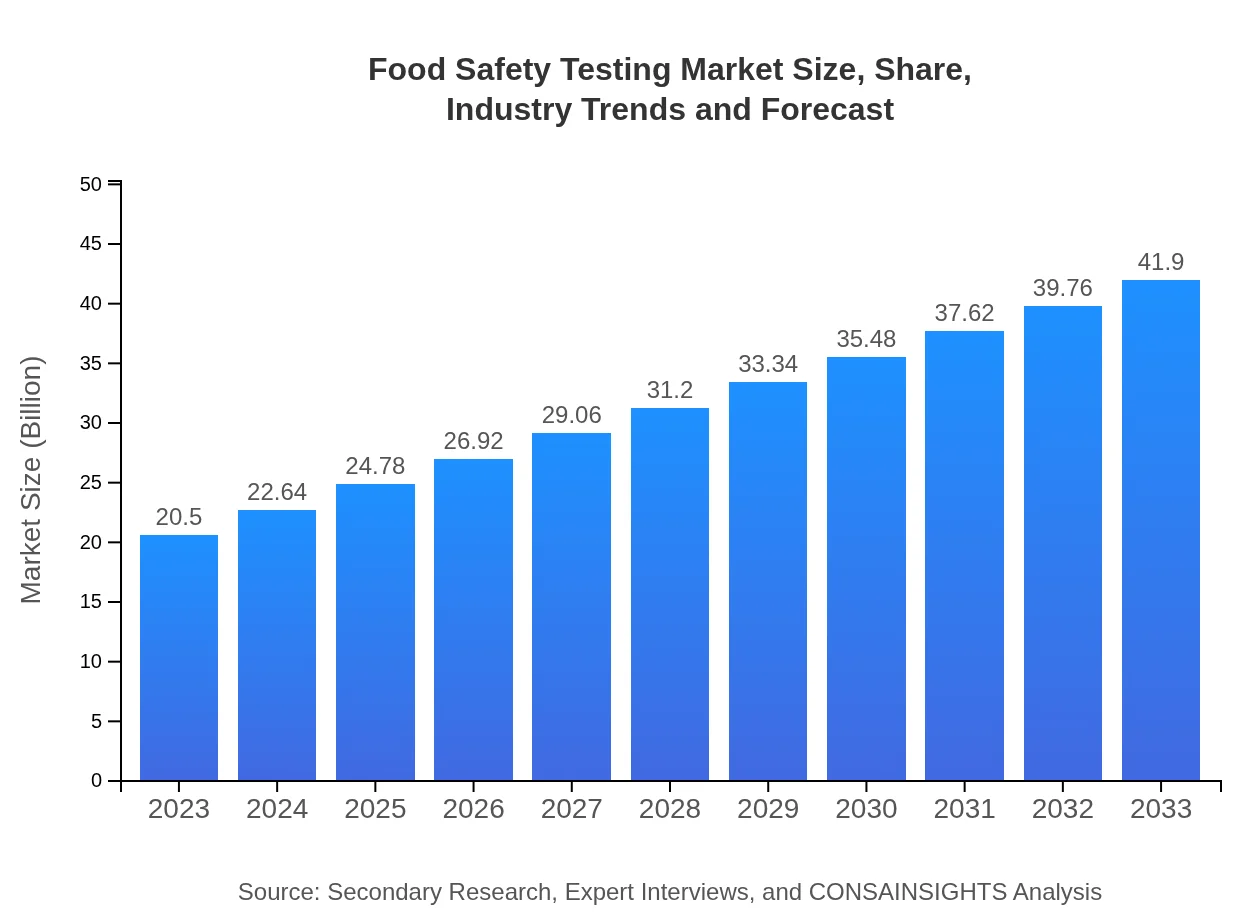

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $41.90 Billion |

| Top Companies | SGS SA, Eurofins Scientific, Intertek Group plc, Bureau Veritas, TUV SUD |

| Last Modified Date | 31 January 2026 |

Food Safety Testing Market Overview

Customize Food Safety Testing Market Report market research report

- ✔ Get in-depth analysis of Food Safety Testing market size, growth, and forecasts.

- ✔ Understand Food Safety Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Safety Testing

What is the Market Size & CAGR of Food Safety Testing market in 2023?

Food Safety Testing Industry Analysis

Food Safety Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Safety Testing Market Analysis Report by Region

Europe Food Safety Testing Market Report:

The European market for food safety testing stands at approximately $6.81 billion in 2023, with expectations to double to $13.91 billion by 2033. This growth is attributed to strict regulatory frameworks, a high standard of living, and a vigilant consumer base demanding high-quality food products, prompting food manufacturers to engage in comprehensive safety testing.Asia Pacific Food Safety Testing Market Report:

The Asia Pacific region, with a market size of approximately $3.93 billion in 2023, is expected to grow to around $8.04 billion by 2033. Factors driving this growth include rising urbanization, an expanding middle class, and government initiatives focused on food safety regulations. Increasing imports and exports of food products further necessitate stringent testing protocols in this dynamic region.North America Food Safety Testing Market Report:

North America showcases a significant market value of around $6.61 billion in 2023, which is projected to grow to $13.51 billion by 2033, driven by stringent food safety standards, advanced technologies, and a high incidence of food recalls, further fostering a robust demand for food testing services among producers and providers.South America Food Safety Testing Market Report:

In South America, the market started at approximately $2.04 billion in 2023, and is projected to reach about $4.18 billion by 2033. The food safety testing market is fueled by enhanced awareness of food safety and quality among consumers and increasing export demands for safe food products, particularly in countries like Brazil and Argentina.Middle East & Africa Food Safety Testing Market Report:

The Middle East and Africa market began at $1.10 billion in 2023 and is forecasted to reach $2.26 billion by 2033. The region's growth is underpinned by burgeoning food industries and increased investments in quality control procedures attributed to rapid urbanization and the globalization of food supply chains.Tell us your focus area and get a customized research report.

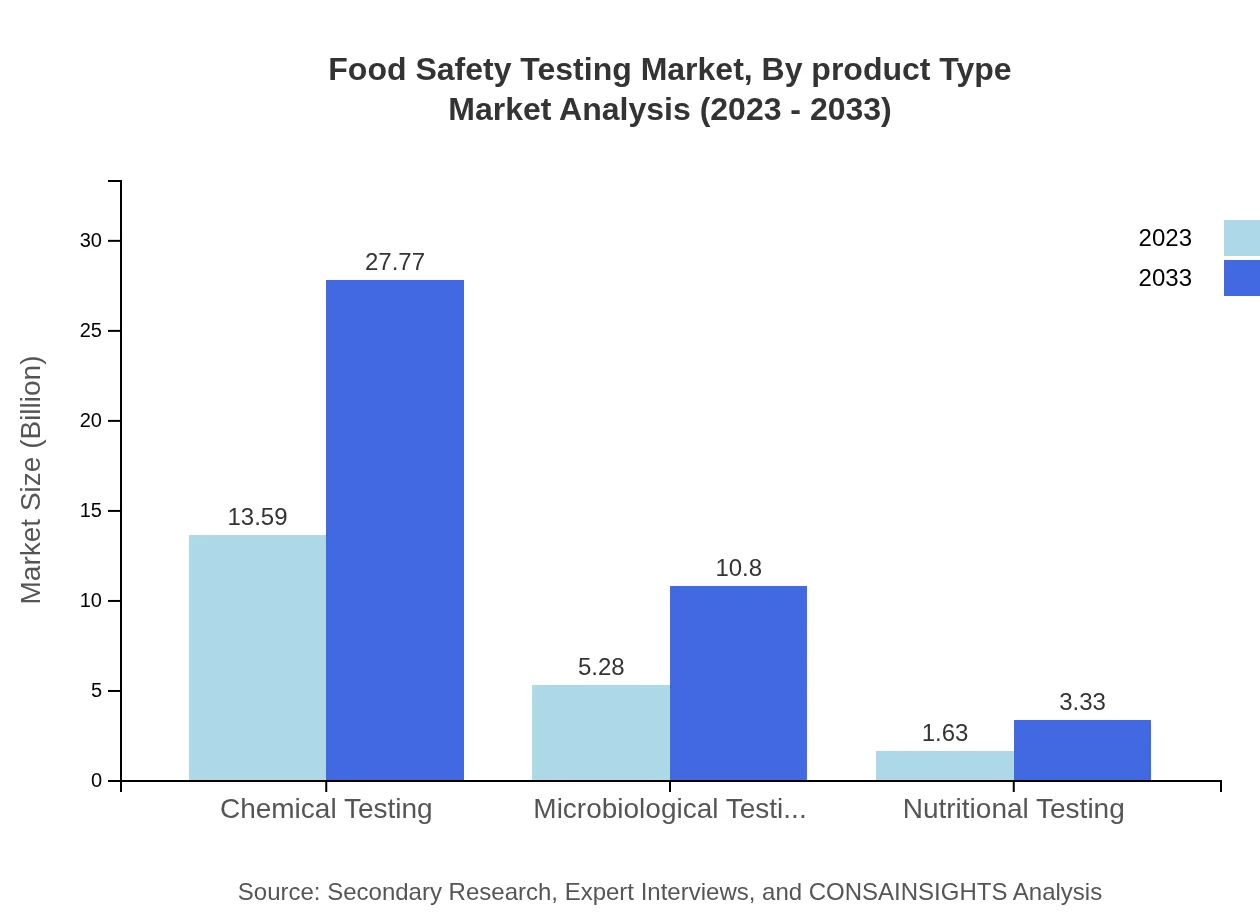

Food Safety Testing Market Analysis By Product Type

The market for food safety testing by product type includes segments such as chemical testing, microbiological testing, and nutritional testing. Chemical testing, primarily responsible for identifying contaminants such as pesticides and pollutants, constitutes a significant market share of approximately 66.28% in 2023. In parallel, microbiological testing is gaining attention, representing about 25.77% of the market share, primarily due to rising health concerns over foodborne pathogens.

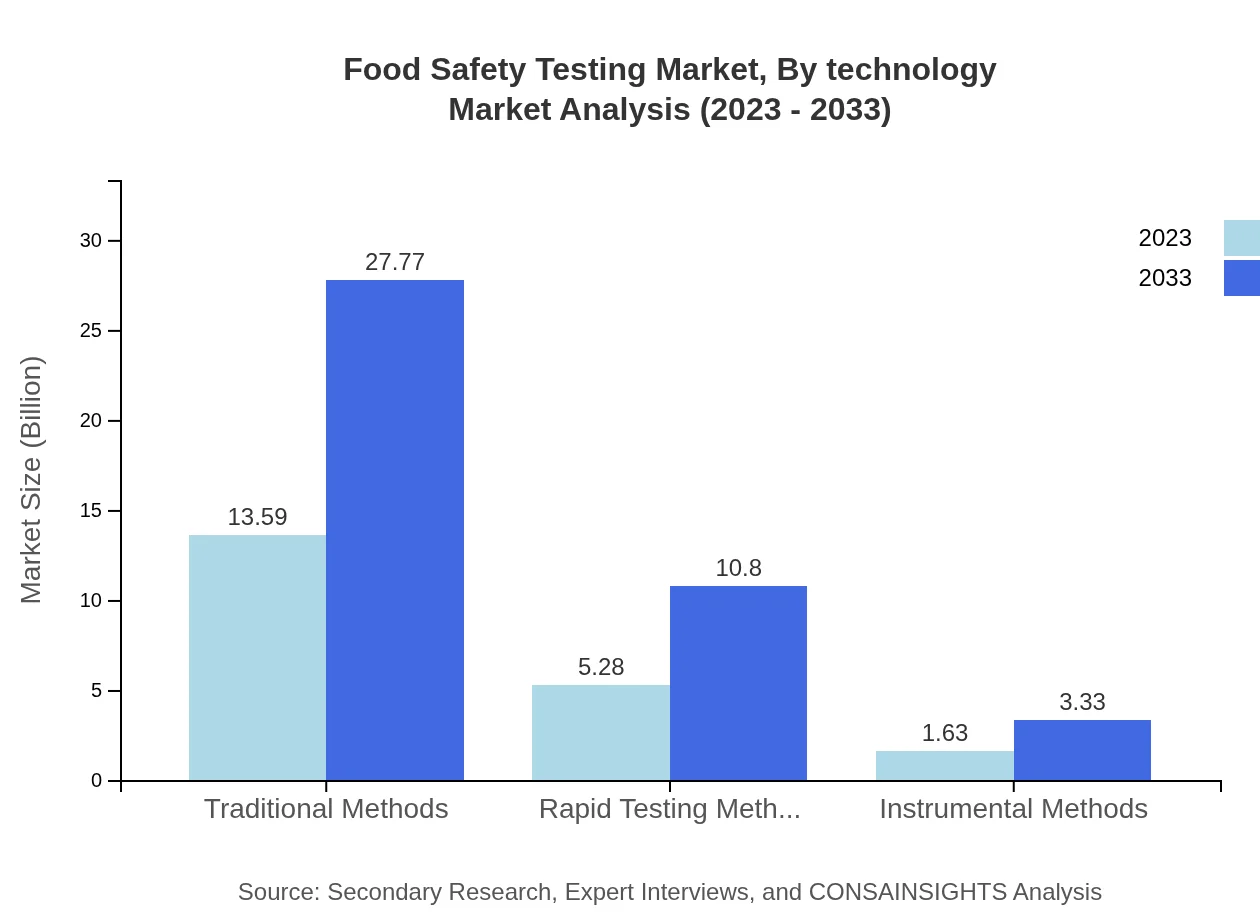

Food Safety Testing Market Analysis By Technology

In terms of technology, the food safety testing market is divided into traditional methods, rapid testing methods, and instrumental methods. Traditional testing remains popular due to established procedures, holding a 66.28% market share. However, rapid testing methods, benefiting from advancements in technology that suggest faster results, are projected to expand and enhance testing efficiency, comprising about 25.77% of the market.

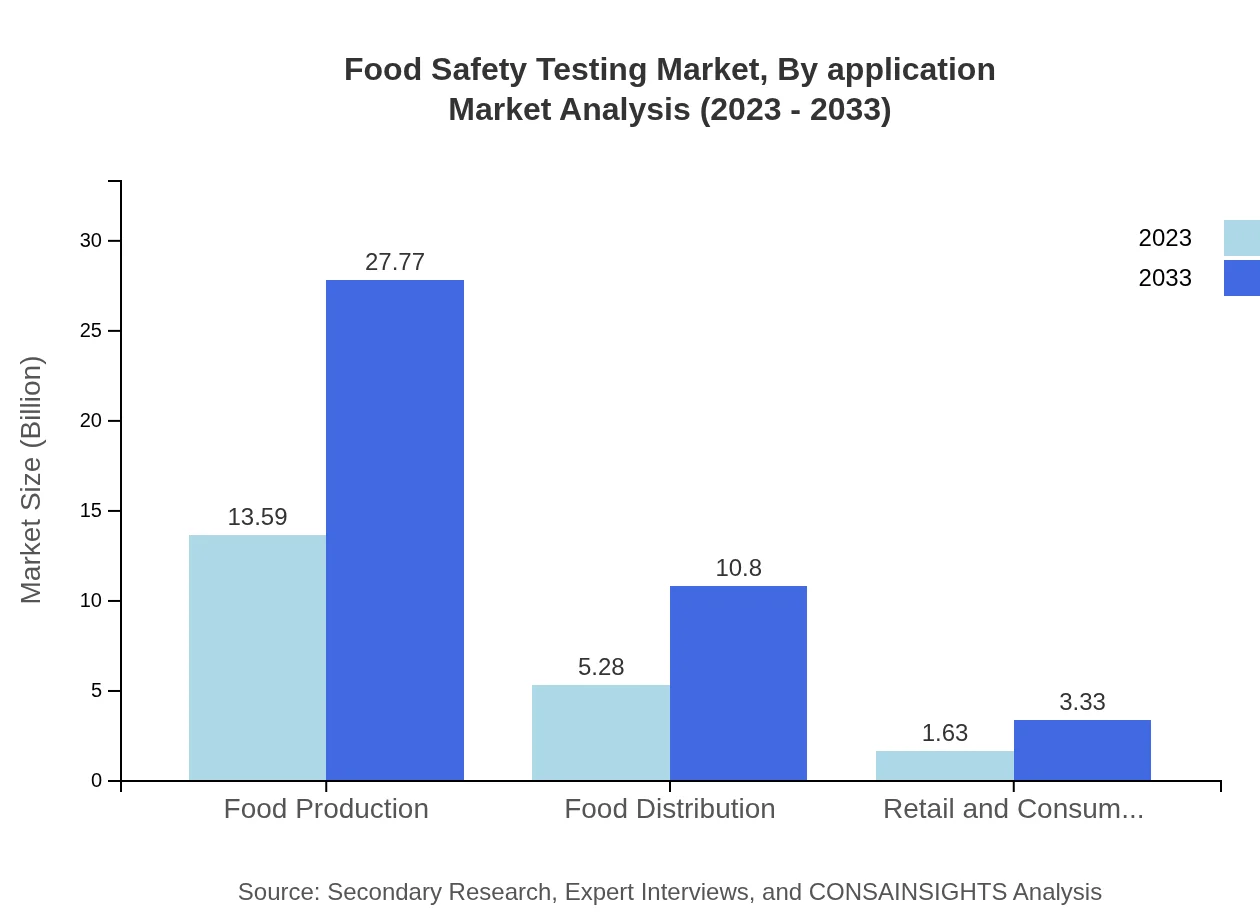

Food Safety Testing Market Analysis By Application

Application segments include food production, food distribution, and retail consumer testing. Food production commands a major share of approximately 66.28%, emphasizing quality assurance protocols for manufacturers. Meanwhile, food distribution and retail testing are emerging segments that are critically important for maintaining safety through supply chains, comprising about 25.77% and 7.95% market shares respectively.

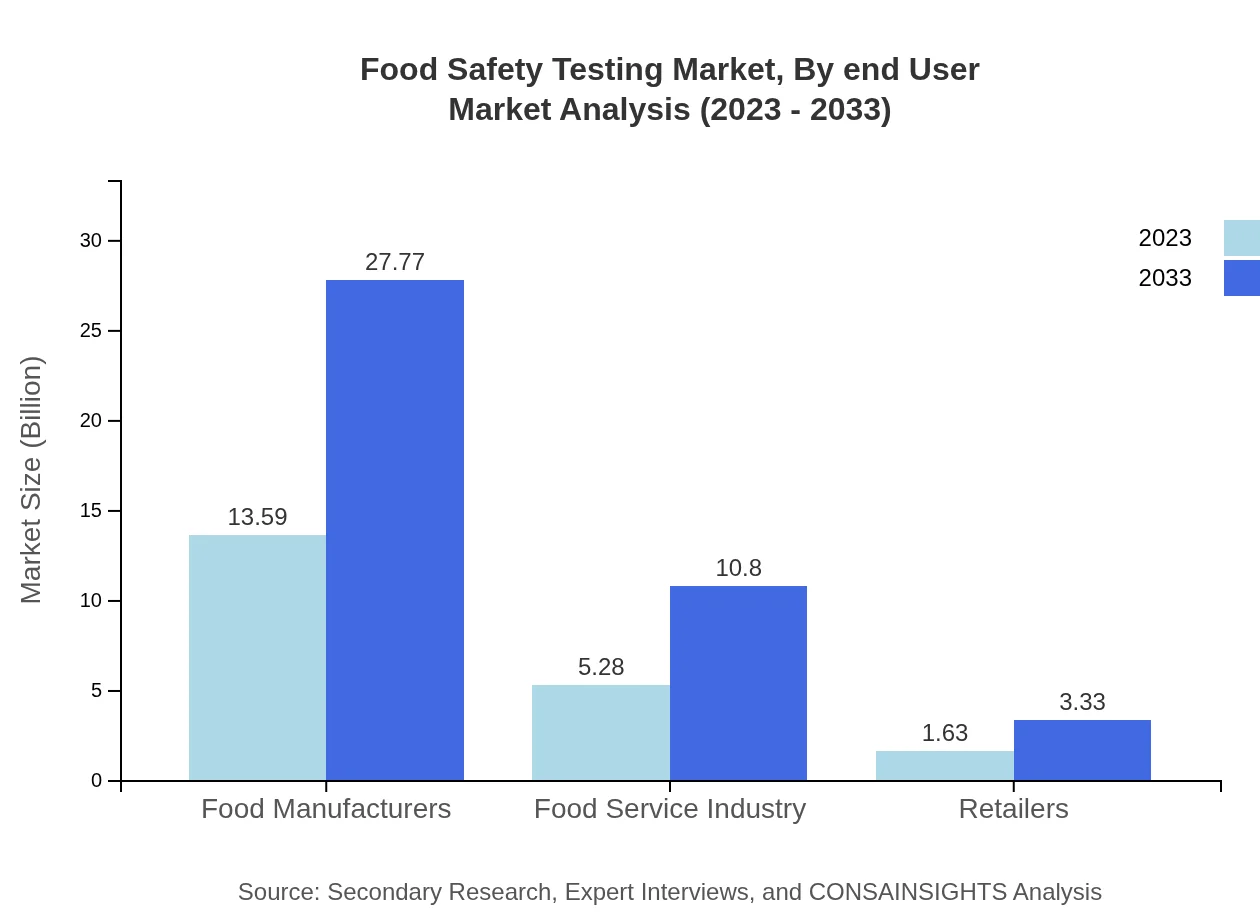

Food Safety Testing Market Analysis By End User

Key end-users of food safety testing include food manufacturers, the food service industry, and retailers. Food manufacturers occupy a leading position with a significant market share of 66.28%. The food service sector is also critical, representing about 25.77%, reflecting the need for extensive safety checks in restaurants and hospitality industries.

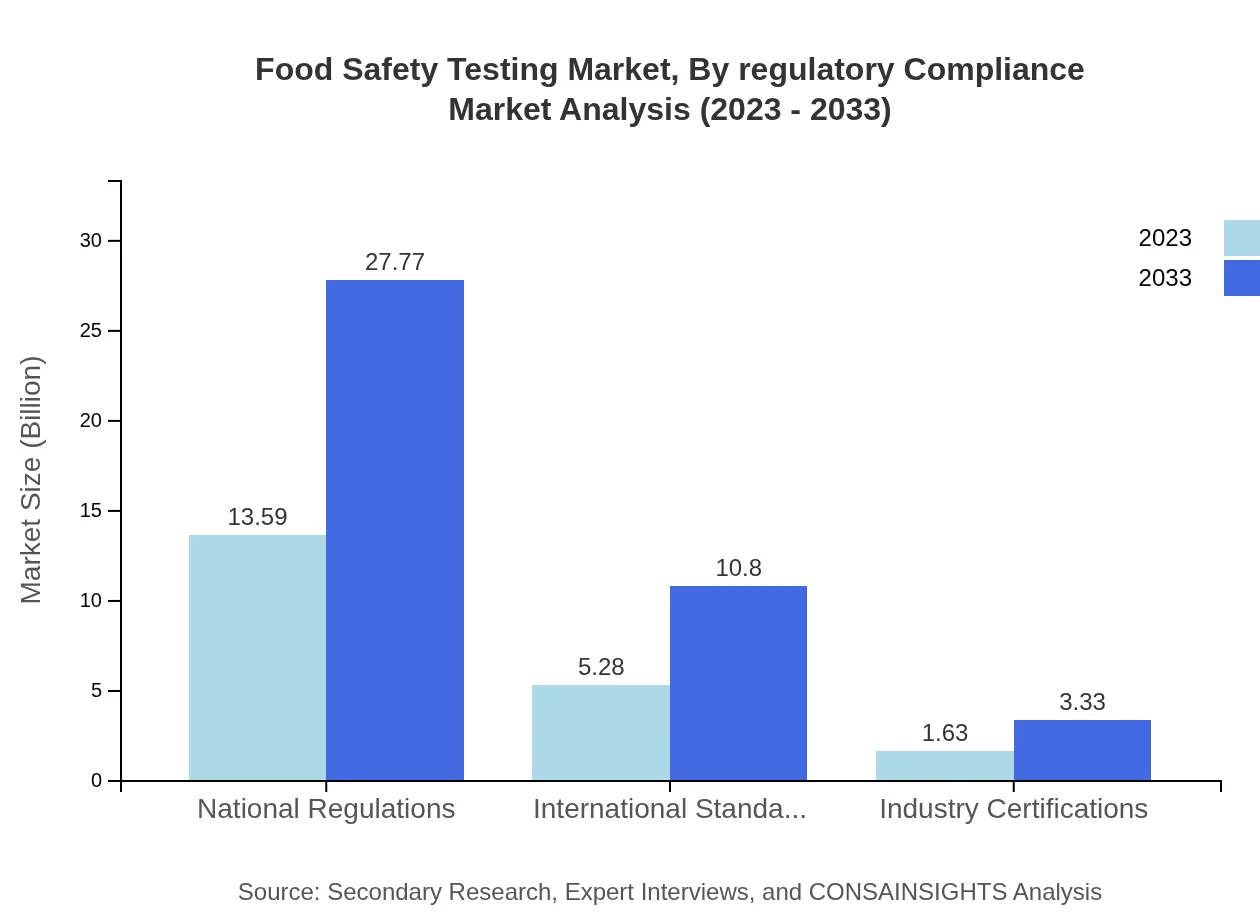

Food Safety Testing Market Analysis By Regulatory Compliance

Regulatory compliance includes national regulations, international standards, and industry certifications. National regulations account for a substantial 66.28% market share, signifying the critical role of laws in safeguarding food safety. Conversely, international standards and industry certifications reveal an increasing adherence to global safety benchmarks, holding shares of 25.77% and 7.95% respectively.

Food Safety Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Safety Testing Industry

SGS SA:

SGS is a leading inspection, verification, testing, and certification company known for its extensive network and capabilities in food safety testing across multiple sectors.Eurofins Scientific:

Eurofins offers an array of testing services and consultancy in the food industry, specializing in food and feed testing with a robust global presence.Intertek Group plc:

Intertek provides quality and safety solutions to various industries, with a focus on food safety testing, ensuring compliance and consumer satisfaction.Bureau Veritas:

Bureau Veritas is dedicated to improving safety, performance, and sustainability, providing food safety testing services across a wide range of food products.TUV SUD:

TUV SUD is a trusted partner in service and solutions for food safety testing, covering a wide spectrum from detection of residues to microbiological testing.We're grateful to work with incredible clients.

FAQs

What is the market size of food safety testing?

The food safety testing market is valued at approximately $20.5 billion in 2023 and is projected to grow at a CAGR of 7.2%, expanding continuously until 2033, with significant adoption across various sectors.

What are the key market players or companies in the food safety testing industry?

Key players in the food safety testing market include major companies such as Eurofins Scientific, SGS S.A., and Intertek Group. These companies are renowned for delivering comprehensive testing services and adhering to stringent quality standards.

What are the primary factors driving the growth in the food safety testing industry?

Factors driving growth in the food safety testing market include increasing foodborne illnesses, stringent government regulations for food safety, and rising consumer awareness regarding food quality and safety.

Which region is the fastest Growing in the food safety testing market?

The fastest-growing region in the food safety testing market is Europe, projected to grow from $6.81 billion in 2023 to $13.91 billion by 2033, indicating robust expansion driven by regulatory compliance and consumer protection.

Does ConsaInsights provide customized market report data for the food safety testing industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the food safety testing industry, enabling clients to access data and insights that align with their business objectives.

What deliverables can I expect from this food safety testing market research project?

Deliverables from this market research project include comprehensive reports, data forecasts, competitive analysis, and actionable insights tailored to strategic planning in the food safety testing sector.

What are the market trends of food safety testing?

Current trends in the food safety testing market include the increased adoption of rapid testing methods, an emphasis on microbiological testing, and the growing reliance on technology-driven solutions to enhance efficiency.