Food Service Equipment Market Report

Published Date: 31 January 2026 | Report Code: food-service-equipment

Food Service Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the food service equipment market, covering trends, opportunities, forecasts, and performance metrics from 2023 to 2033. It aims to deliver insights for stakeholders to make informed decisions in a rapidly evolving landscape.

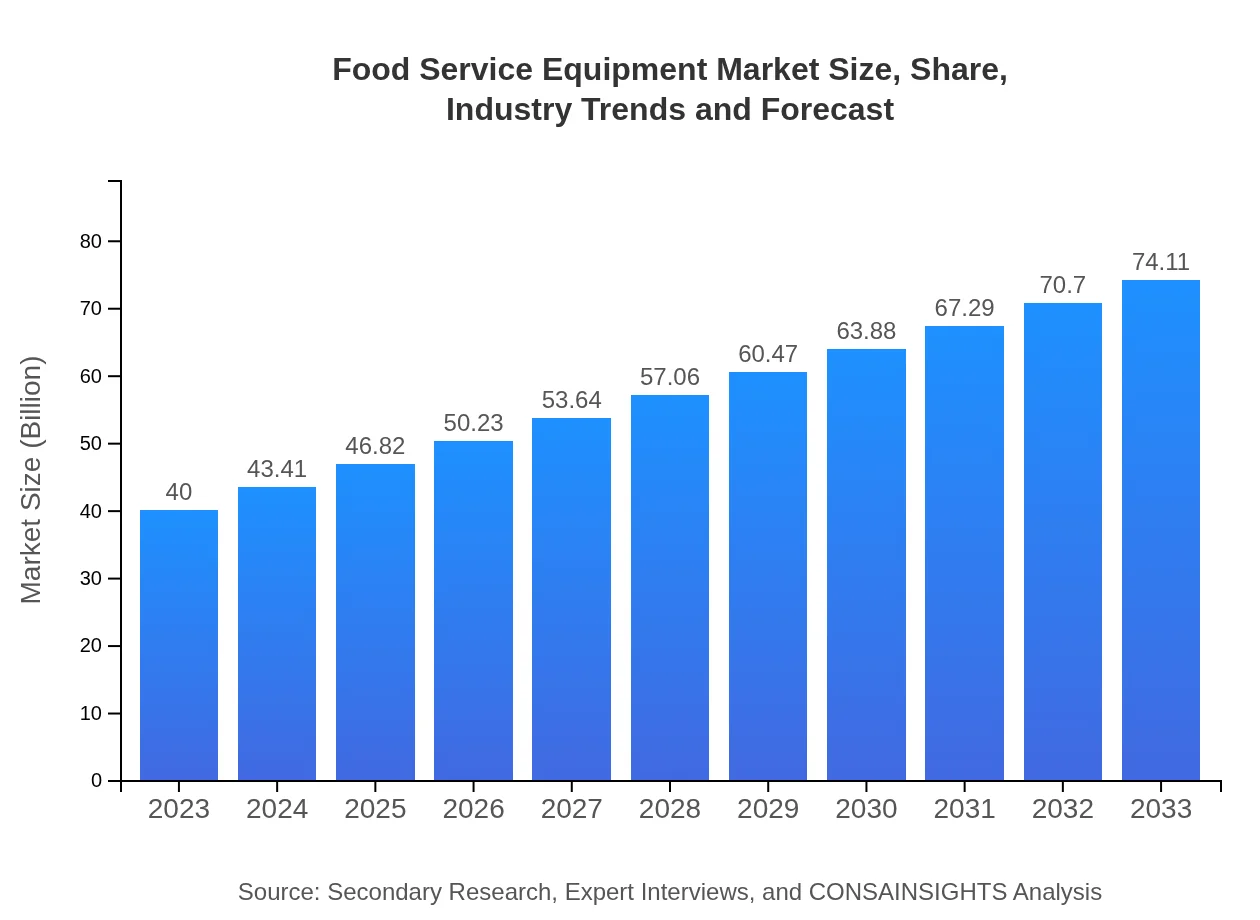

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $40.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $74.11 Billion |

| Top Companies | Electrolux Professional, Welbilt Inc., Middleby Corporation, Hoshizaki Corporation |

| Last Modified Date | 31 January 2026 |

Food Service Equipment Market Overview

Customize Food Service Equipment Market Report market research report

- ✔ Get in-depth analysis of Food Service Equipment market size, growth, and forecasts.

- ✔ Understand Food Service Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Service Equipment

What is the Market Size & CAGR of Food Service Equipment market in 2023?

Food Service Equipment Industry Analysis

Food Service Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Service Equipment Market Analysis Report by Region

Europe Food Service Equipment Market Report:

The European food service equipment market is strong, expected to grow from USD 11.88 billion in 2023 to USD 22.00 billion by 2033. Factors contributing to this growth include the rise of food tourism, sustainability measures, and the increased adoption of energy-efficient equipment, driven by stricter regulatory policies.Asia Pacific Food Service Equipment Market Report:

The Asia Pacific region is projected to experience significant growth in the food service equipment market, starting at USD 7.56 billion in 2023 and expected to increase to USD 14.01 billion by 2033. This growth is fueled by rapid urbanization, an expanding middle class, and the increasing trend of dining out, particularly in countries like China and India, which boast burgeoning restaurant industries.North America Food Service Equipment Market Report:

In North America, the market for food service equipment is robust, commencing at USD 15.35 billion in 2023 and projected to reach USD 28.44 billion by 2033. Niche dining experiences and an emphasis on high-quality food experiences are propelling market growth, alongside advancements in technology that improve efficiency and reduce labor costs.South America Food Service Equipment Market Report:

The South American market is currently in a challenging position with a slight market decline projected from USD -0.38 billion in 2023 to USD -0.70 billion by 2033. Economic instability and supply chain disruptions hinder investments in food service infrastructure, leading to contraction in growth within this region.Middle East & Africa Food Service Equipment Market Report:

The Middle East and Africa market is anticipated to grow from USD 5.59 billion in 2023 to USD 10.36 billion by 2033. The growing hospitality sector and significant investments in food service infrastructure, particularly in tourist destinations and urban areas, will spur this growth.Tell us your focus area and get a customized research report.

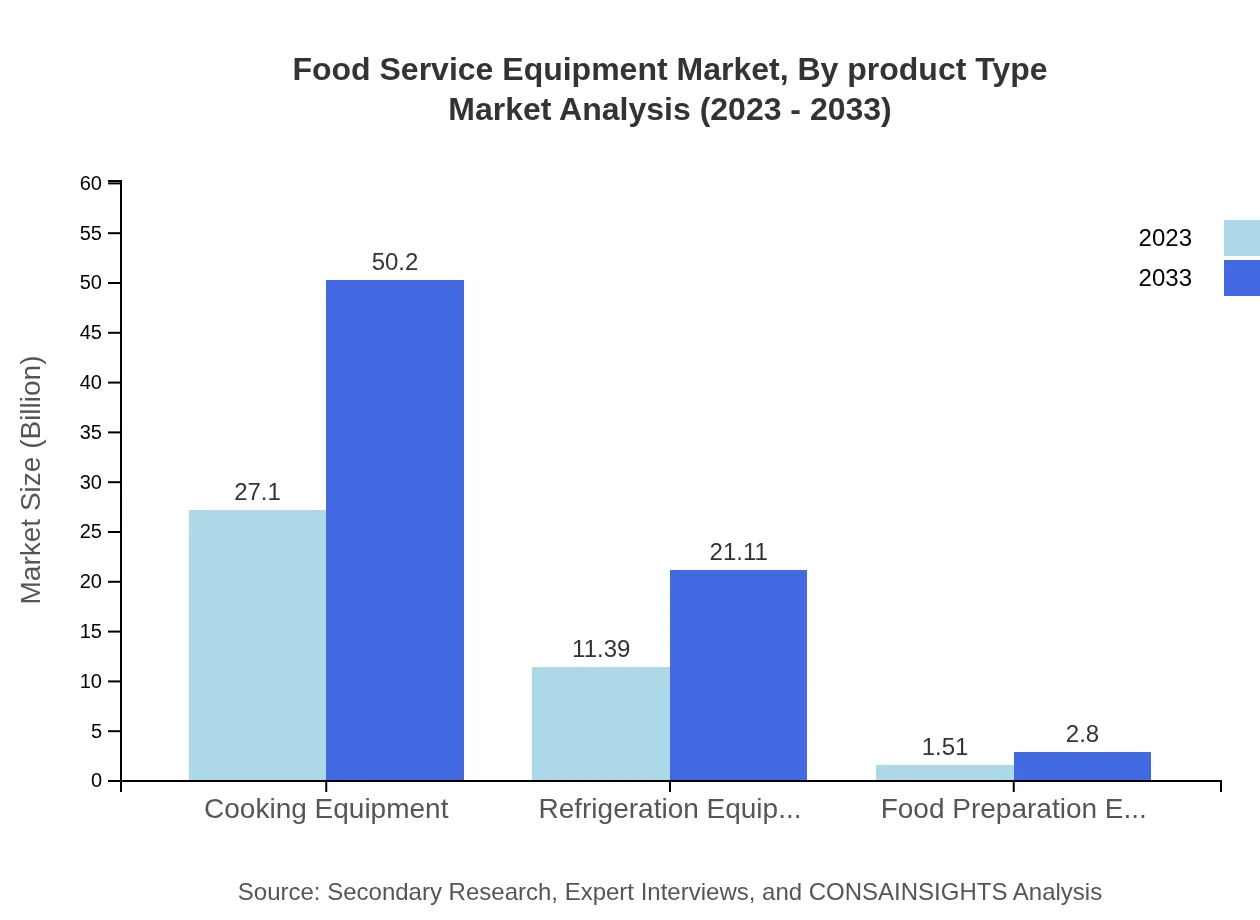

Food Service Equipment Market Analysis By Product Type

Cooking equipment dominates the food service equipment market, growing from USD 27.10 billion in 2023 to USD 50.20 billion by 2033. Refrigeration equipment follows with a growth trajectory from USD 11.39 billion to USD 21.11 billion. The traction for smart technologies is gradually increasing, expected to rise from USD 1.51 billion to USD 2.80 billion as consumers demand integrated, intelligent solutions.

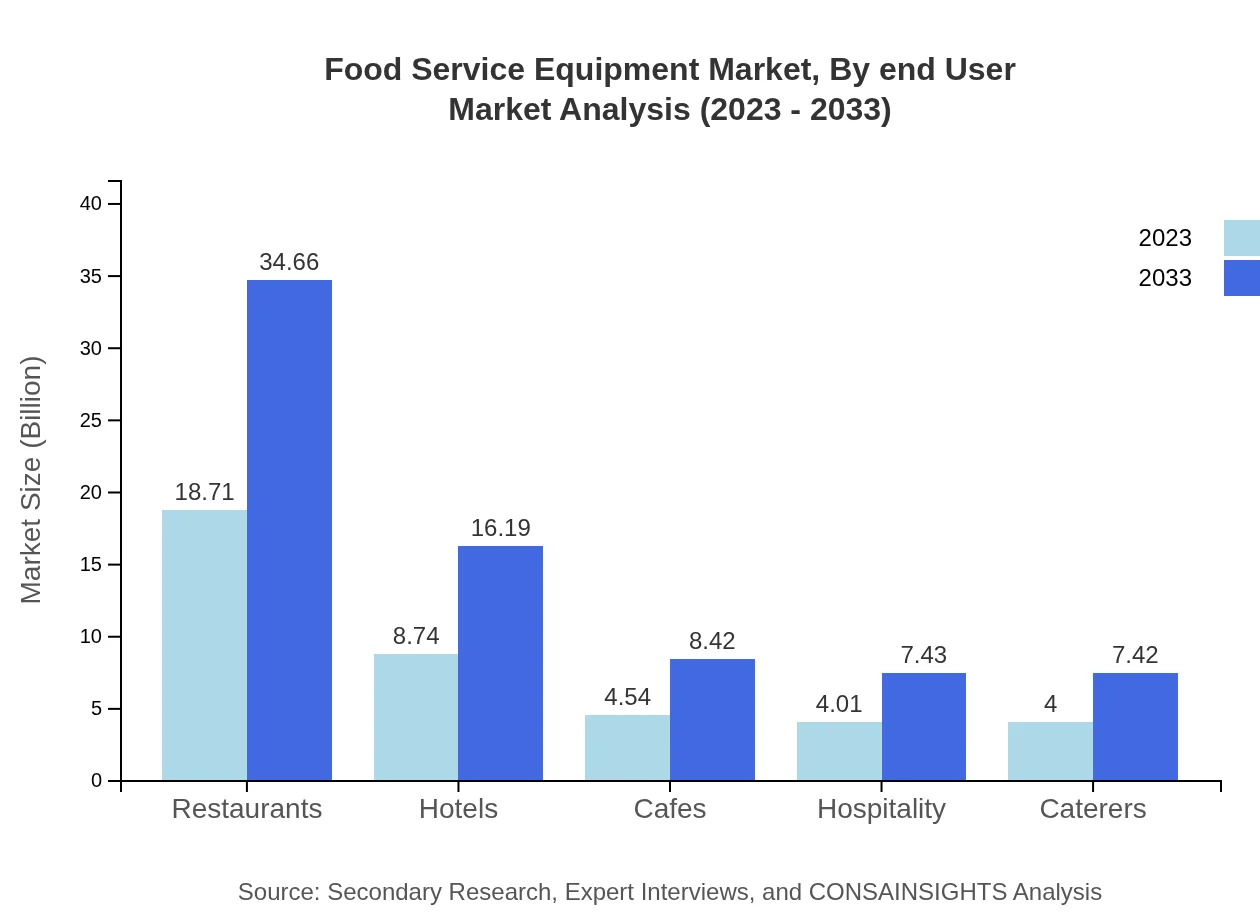

Food Service Equipment Market Analysis By End User

Restaurants hold the largest market share within the end-user segment, valued at USD 18.71 billion in 2023, growing to USD 34.66 billion by 2033, which reflects the industry's robust recovery post-pandemic. The hotel and catering services segments also show positive growth trends, driven largely by increasing tourism and event hosting.

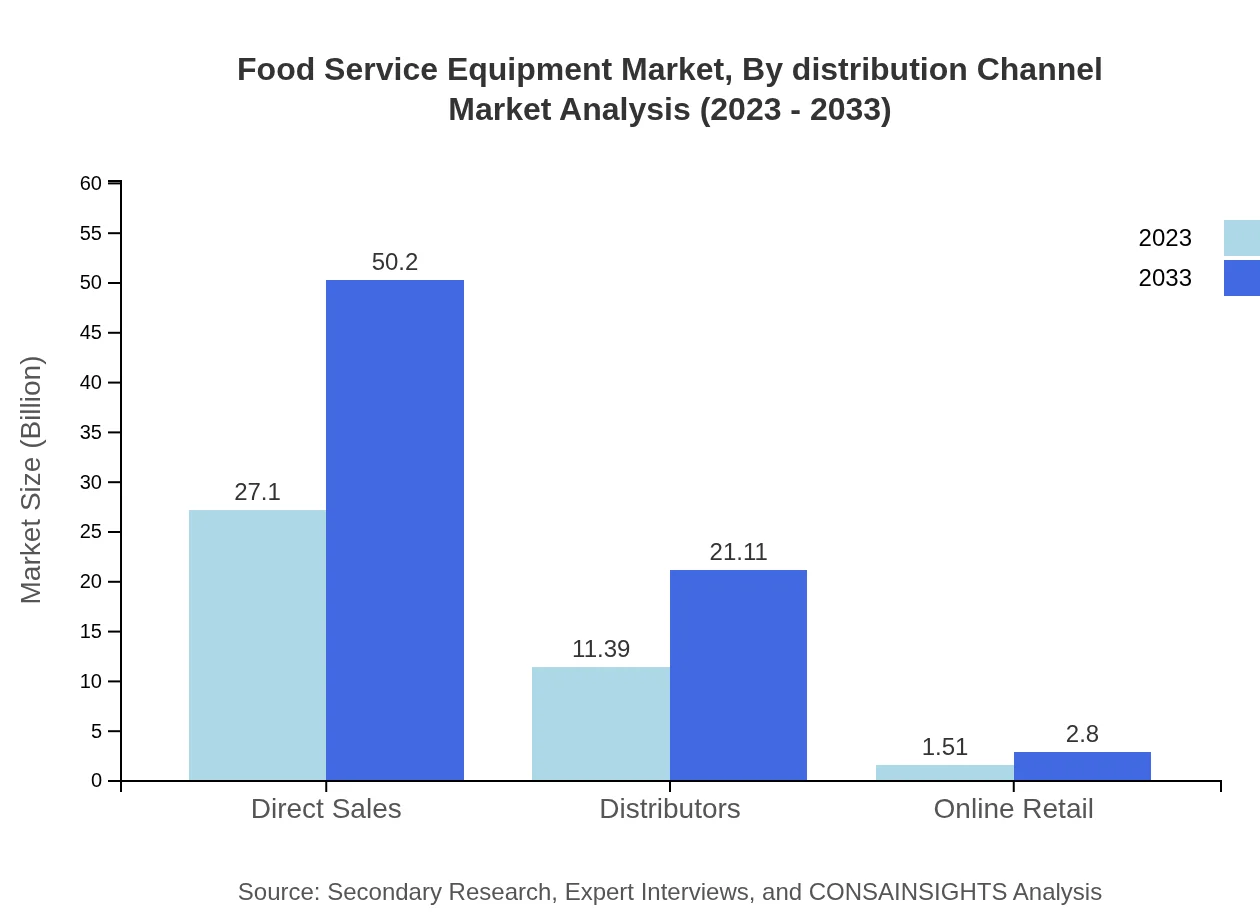

Food Service Equipment Market Analysis By Distribution Channel

Direct sales dominate the sales distribution channel, starting at USD 27.10 billion and projected to reach USD 50.20 billion by 2033. Conversely, online retailing is gaining traction as businesses seek to optimize their procurement processes, projected to grow from USD 1.51 billion to USD 2.80 billion over the forecast period.

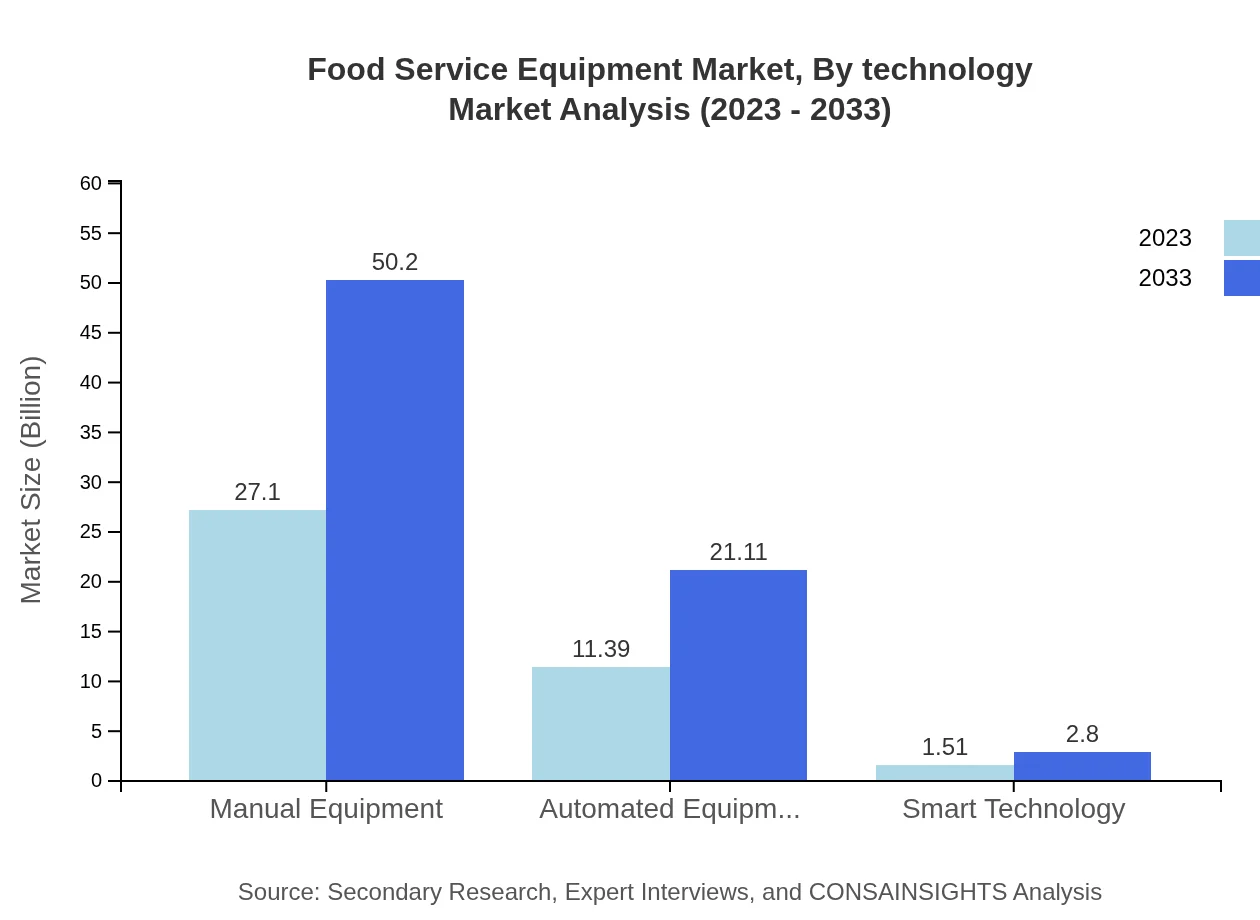

Food Service Equipment Market Analysis By Technology

The industry is seeing a shift towards smart technology adoption, where devices that integrate with kitchen management systems improve operational efficiencies. This segment is anticipated to grow from USD 1.51 billion in 2023 to USD 2.80 billion by 2033, driven by innovations that enhance food safety and energy conservation.

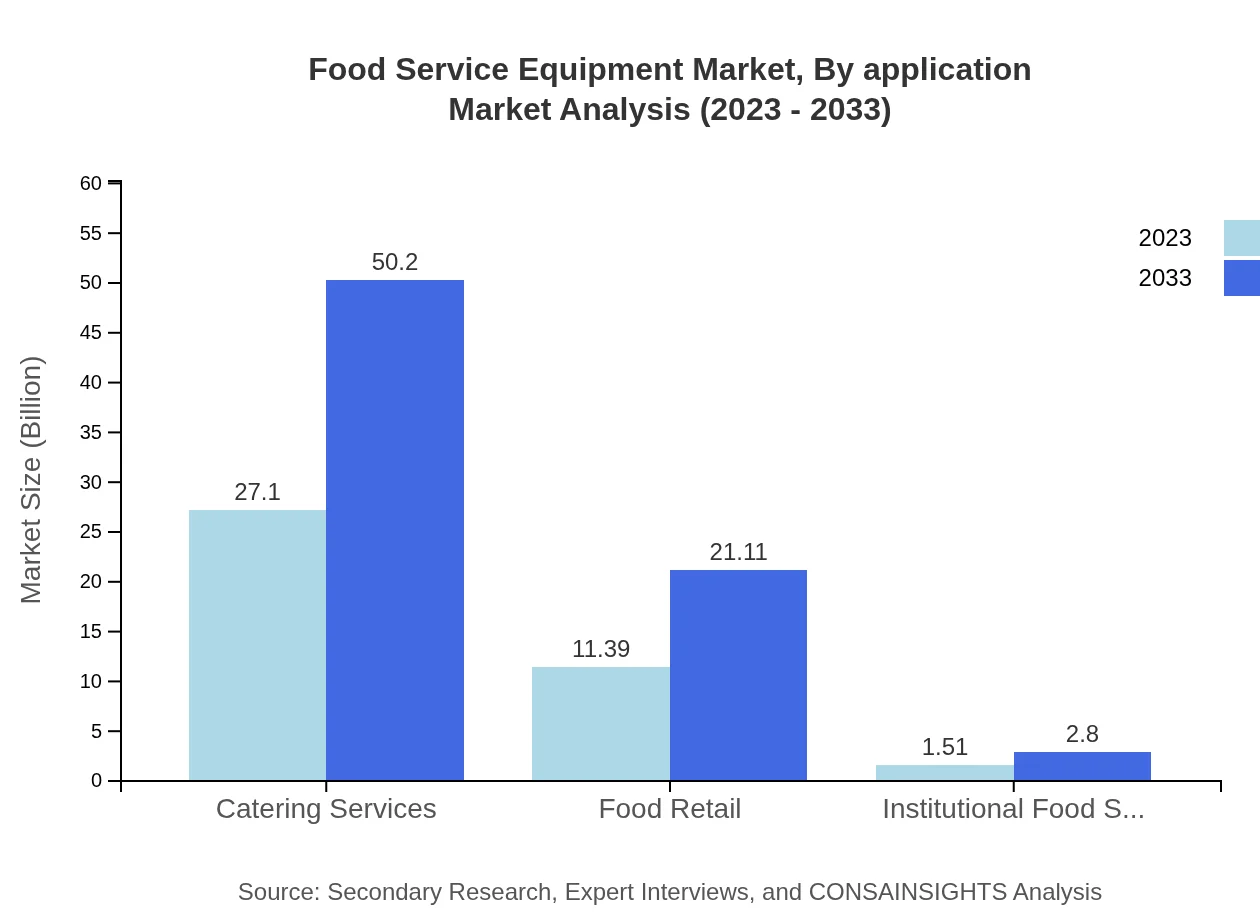

Food Service Equipment Market Analysis By Application

The application in commercial kitchens significantly dominates the market as restaurants and catering services seek to enhance productivity and operational efficiencies. The rise of food delivery models also encourages lighter, portable types of equipment for quick service.

Food Service Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Service Equipment Industry

Electrolux Professional:

A global leader providing integrated solutions in food services, offering a range of equipment from cooking to cleaning appliances designed for commercial kitchens.Welbilt Inc.:

Specializes in commercial food service equipment, focusing on innovative technologies and energy-efficient appliances that cater to the evolving needs of food service establishments.Middleby Corporation:

Known for its diverse range of food service equipment solutions, they cater to various market segments including restaurants, hotels, and retail food service operations.Hoshizaki Corporation:

A major player in the refrigeration equipment market, providing high-quality solutions for businesses across the global food service landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of food Service Equipment?

The food service equipment market is currently valued at approximately $40 billion, with a projected CAGR of 6.2%. This growth reflects an expanding demand across the food and hospitality industries, increasing the market significantly over the next decade.

What are the key market players or companies in this food Service Equipment industry?

Key players in the food service equipment industry include well-established brands known for commercial kitchen appliances, cooking devices, and catering solutions. These companies range from large multinational corporations to specialized equipment manufacturers that serve niche markets.

What are the primary factors driving the growth in the food service equipment industry?

Growth factors include the rise in food service establishments, increasing consumer spending on dining out, technological advancements in kitchen equipment, and the demand for energy-efficient appliances aimed at reducing operational costs in the hospitality sector.

Which region is the fastest Growing in the food Service Equipment?

North America, particularly the United States, is currently the fastest-growing region in the food service equipment market, projected to rise from $15.35 billion in 2023 to $28.44 billion by 2033, driven by robust demand in the restaurant and hospitality sectors.

Does ConsaInsights provide customized market report data for the food Service Equipment industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs. This service includes detailed analysis of market trends, forecasts, and competitive landscapes, ensuring clients receive relevant and actionable insights for their strategic decision-making.

What deliverables can I expect from this food Service Equipment market research project?

Deliverables include a comprehensive report detailing market size and growth projections, competitive analysis of key players, regional insights, segment analysis, and trends affecting the food service equipment industry, all designed to support informed business decisions.

What are the market trends of food Service Equipment?

Trends indicate a growing emphasis on automation and smart technology in food service equipment, alongside a shift towards sustainable and energy-efficient products. Additionally, there is increasing investment in online sales channels as digital shifts impact consumer purchasing behavior.