Food Sweetener Market Report

Published Date: 31 January 2026 | Report Code: food-sweetener

Food Sweetener Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the food sweetener market, including trends, segmentation, and regional insights, along with a detailed forecast for the period from 2023 to 2033.

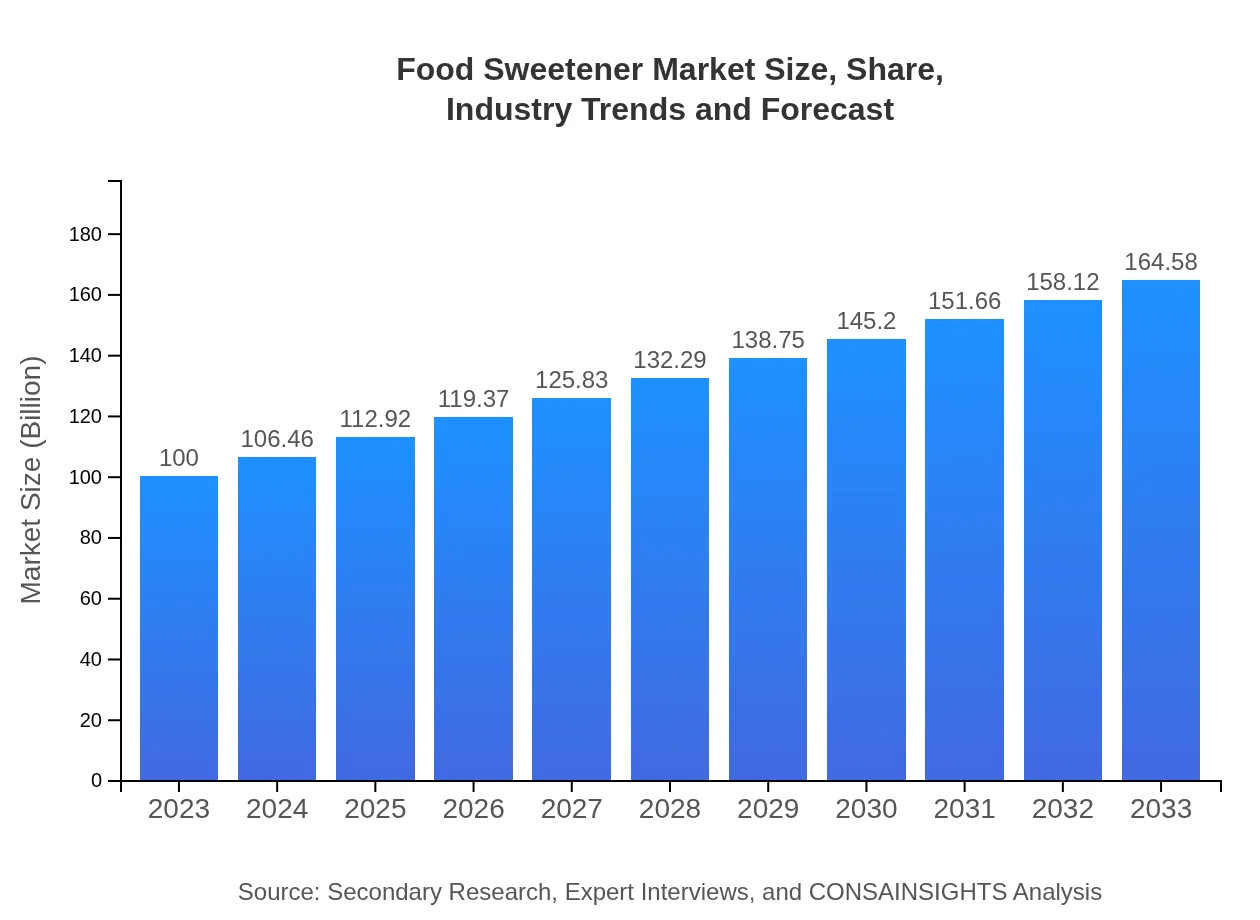

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Cargill, Inc., Ajinomoto Co., Inc., Tate & Lyle PLC., Sweet Leaf Stevia Company, Mondelez International, Inc. |

| Last Modified Date | 31 January 2026 |

Food Sweetener Market Overview

Customize Food Sweetener Market Report market research report

- ✔ Get in-depth analysis of Food Sweetener market size, growth, and forecasts.

- ✔ Understand Food Sweetener's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Sweetener

What is the Market Size & CAGR of Food Sweetener market in 2033?

Food Sweetener Industry Analysis

Food Sweetener Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Sweetener Market Analysis Report by Region

Europe Food Sweetener Market Report:

The European food sweetener market is expected to grow from USD 25.66 billion in 2023 to USD 42.23 billion by 2033. This increase is attributed to the high demand for low-calorie foods and beverages, as well as growing awareness of the health risks associated with sugar consumption.Asia Pacific Food Sweetener Market Report:

The Asia Pacific region, valued at approximately USD 21.77 billion in 2023, is expected to grow to USD 35.83 billion by 2033, fueled by the increasing population and rising disposable income. Consumer preferences are shifting towards healthier food options, and the demand for natural sweeteners is on the rise in countries like China and India.North America Food Sweetener Market Report:

North America remains a significant market for food sweeteners, with a size of USD 33.53 billion in 2023, anticipated to grow to USD 55.18 billion by 2033. This growth is driven by the high prevalence of health-conscious consumers and innovations in product offerings, particularly in the U.S.South America Food Sweetener Market Report:

In South America, the food sweetener market was valued at USD 6.20 billion in 2023, with projections indicating a growth to USD 10.20 billion by 2033. An increasing focus on health and wellness among consumers is promoting the adoption of sugar substitutes, especially in Brazil and Argentina.Middle East & Africa Food Sweetener Market Report:

The Middle East and Africa market, with a value of USD 12.84 billion in 2023, is projected to reach USD 21.13 billion by 2033. The shift towards healthier eating habits combined with urbanization and the introduction of innovative sweetener products are key growth factors.Tell us your focus area and get a customized research report.

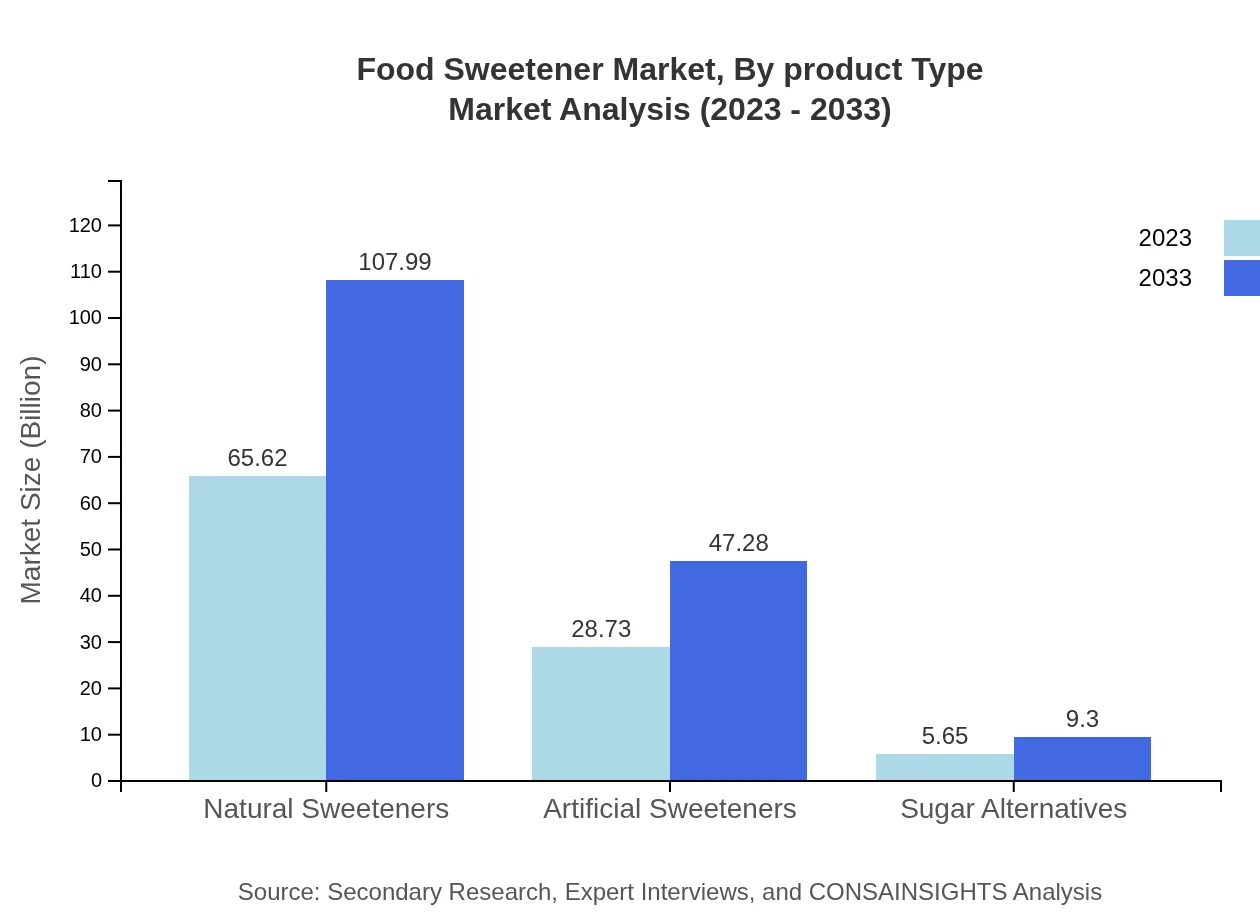

Food Sweetener Market Analysis By Product Type

Liquid sweeteners dominate the market, holding a share of USD 65.62 billion in 2023, expected to rise to USD 107.99 billion by 2033. Granuated sweeteners follow, growing from USD 28.73 billion to USD 47.28 billion. The natural sweeteners segment also shows strong performance, consistent with rising health trends.

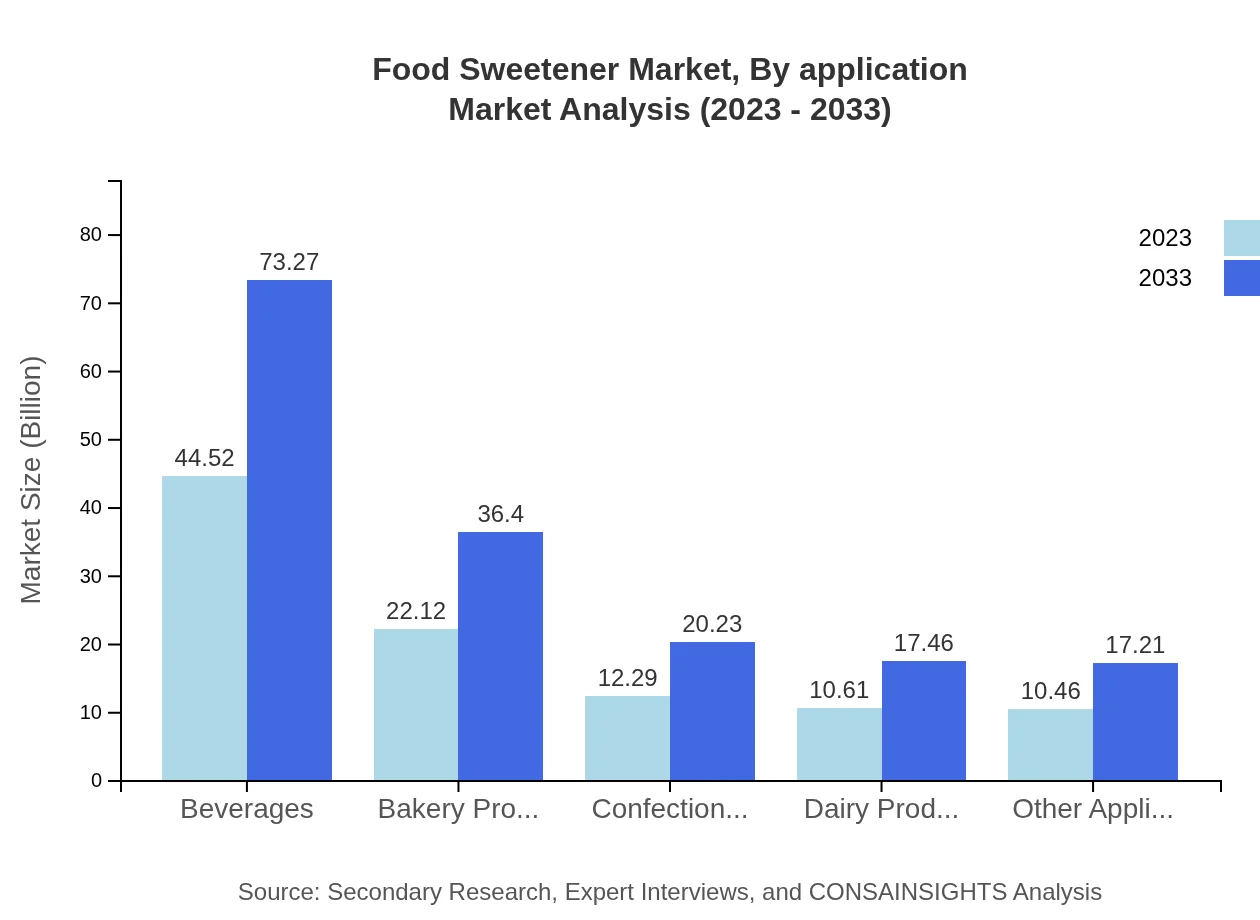

Food Sweetener Market Analysis By Application

In terms of application, beverages take the lead, with a market size of USD 44.52 billion in 2023 and expected to reach USD 73.27 billion by 2033. Bakery products are another essential category, growing from USD 22.12 billion to USD 36.40 billion, reflecting consumer trends for indulgent yet healthier options.

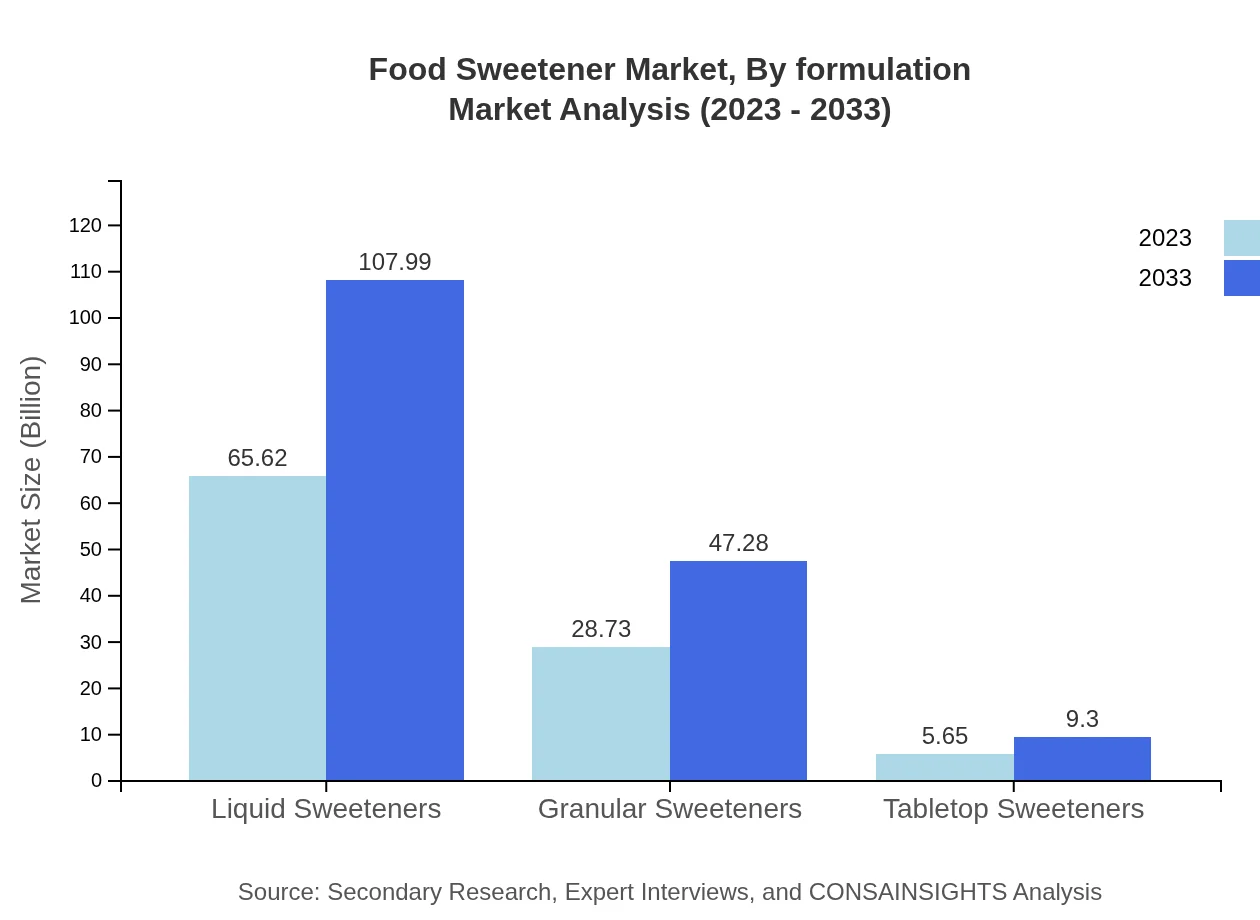

Food Sweetener Market Analysis By Formulation

Granulated and liquid formulations are the primary types seen in the market, with granulated sweeteners valued at USD 28.73 billion in 2023, projected to grow to USD 47.28 billion. Liquid formulations meet diverse consumer needs, especially in spontaneous consumption scenarios.

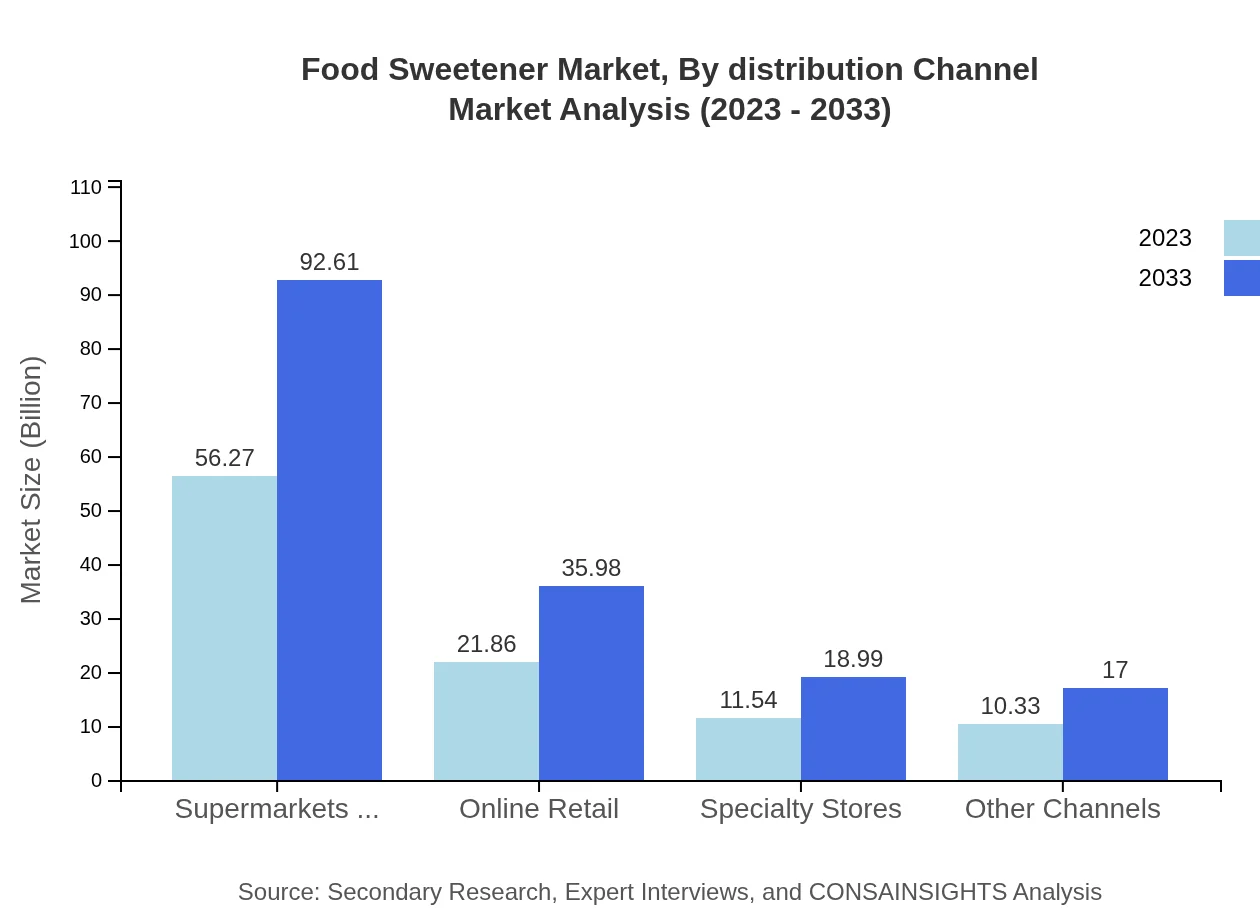

Food Sweetener Market Analysis By Distribution Channel

Distribution channels like supermarkets and hypermarkets were valued at USD 56.27 billion in 2023 and are expected to grow to USD 92.61 billion. Online retail channels show promising growth from USD 21.86 billion to USD 35.98 billion as consumers increasingly turn towards digital shopping.

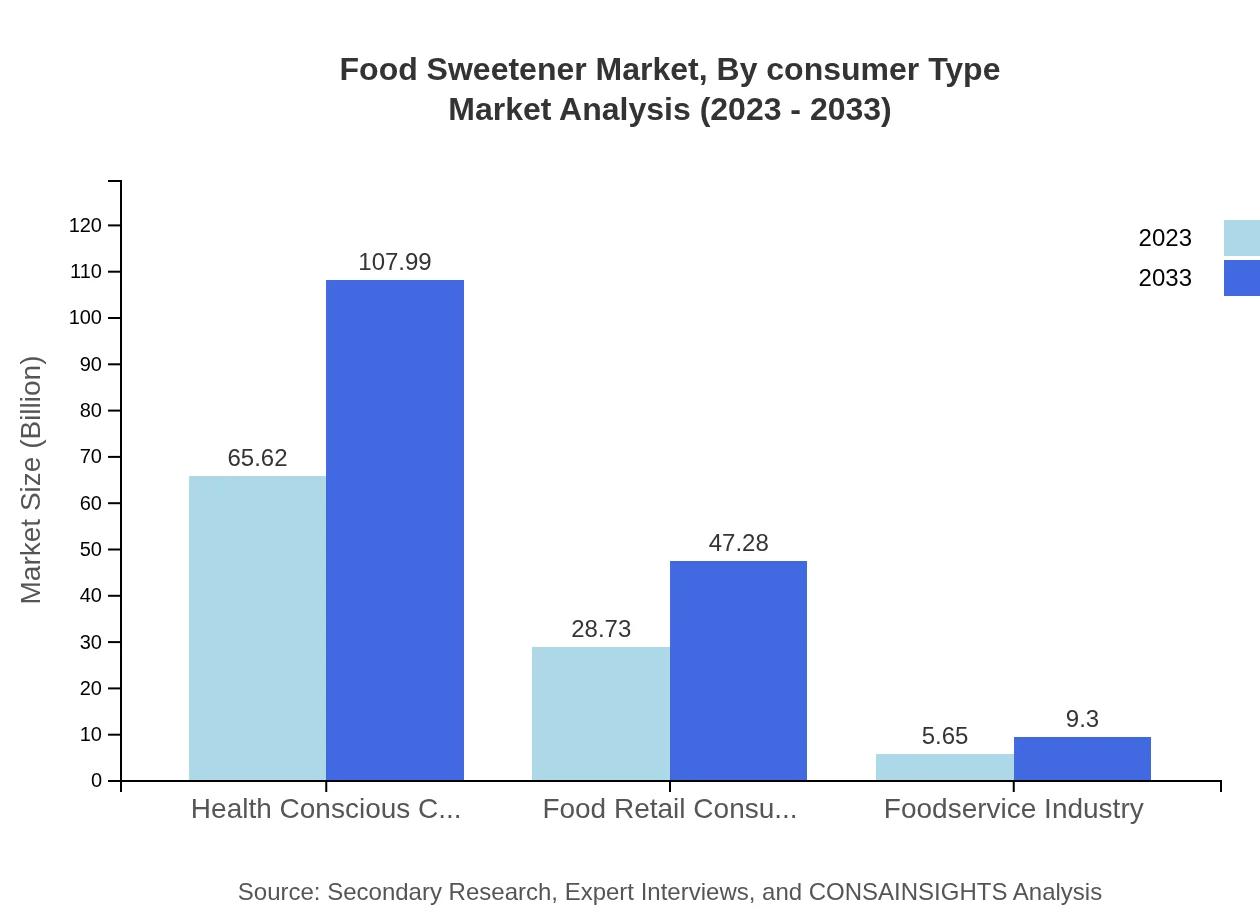

Food Sweetener Market Analysis By Consumer Type

Health-conscious consumers drive the market significantly, with a size of USD 65.62 billion in 2023 and expected to reach USD 107.99 billion. The food retail consumer segment follows, demonstrating steady growth due to the increasing demand for sweeteners in everyday food products.

Food Sweetener Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Sweetener Industry

Cargill, Inc.:

A major player in the food industry, Cargill is known for its wide range of sweeteners and innovative solutions that cater to a diverse clientele, including food manufacturers, retailers, and consumers.Ajinomoto Co., Inc.:

As a leading global company, Ajinomoto specializes in amino acids and sweeteners, producing aspartame and other artificial sweeteners, focusing heavily on health and nutrition solutions.Tate & Lyle PLC.:

A prominent global provider of food ingredients, Tate & Lyle produces a variety of sweeteners and has a strong emphasis on developing healthier, lower-calorie sweetening options.Sweet Leaf Stevia Company:

Known for its high-quality stevia products, Sweet Leaf focuses on producing natural sweeteners that cater to health-conscious consumers looking for sugar alternatives.Mondelez International, Inc.:

A leading snack company with a focus on sweet ingredients, Mondelez incorporates various sweeteners into its products, emphasizing reductions in sugar and calories for healthier options.We're grateful to work with incredible clients.

FAQs

What is the market size of food Sweetener?

The global food sweetener market is projected to reach approximately $100 million in 2023, growing at a CAGR of 5%. By 2033, this market is anticipated to expand significantly, reflecting increasing demand and diversification of sweetener types.

What are the key market players or companies in this food Sweetener industry?

Key players in the food sweetener industry include major global corporations such as Cargill, ADM, Tate & Lyle, and Sweetener Solutions. These companies are pivotal in driving innovation and expanding product offerings to meet consumer preference.

What are the primary factors driving the growth in the food Sweetener industry?

Growth in the food-sweetener industry is driven by rising health consciousness among consumers, increased demand for natural sweeteners, and innovations in food technology that enhance sweetener efficacy. Additionally, the trend towards sugar reduction in diets fuels market expansion.

Which region is the fastest Growing in the food Sweetener?

The Asia Pacific region is poised to be the fastest-growing market for food sweeteners, with growth from $21.77 million in 2023 to $35.83 million by 2033. This growth is driven by urbanization and increasing disposable incomes.

Does ConsaInsights provide customized market report data for the food Sweetener industry?

Yes, Consainsights provides tailored market report data specific to the food sweetener industry. Clients can request customized insights based on unique requirements and regional analysis to support strategic decision-making.

What deliverables can I expect from this food Sweetener market research project?

From this market research project, clients can expect comprehensive deliverables including detailed market analysis reports, regional market breakdowns, competitive landscape insights, and forecasts covering the next ten years.

What are the market trends of food Sweetener?

Market trends in the food-sweetener sector include a shift towards natural and organic sweeteners, an increased focus on health and wellness, innovations in sugar alternatives, and a rise in demand for low-calorie sweeteners across various food applications.