Foot And Mouth Disease Vaccines Market Report

Published Date: 31 January 2026 | Report Code: foot-and-mouth-disease-vaccines

Foot And Mouth Disease Vaccines Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Foot And Mouth Disease Vaccines market, covering market trends, size projections, and regional insights from 2023 to 2033. It offers valuable insights for stakeholders looking to navigate this critical sector.

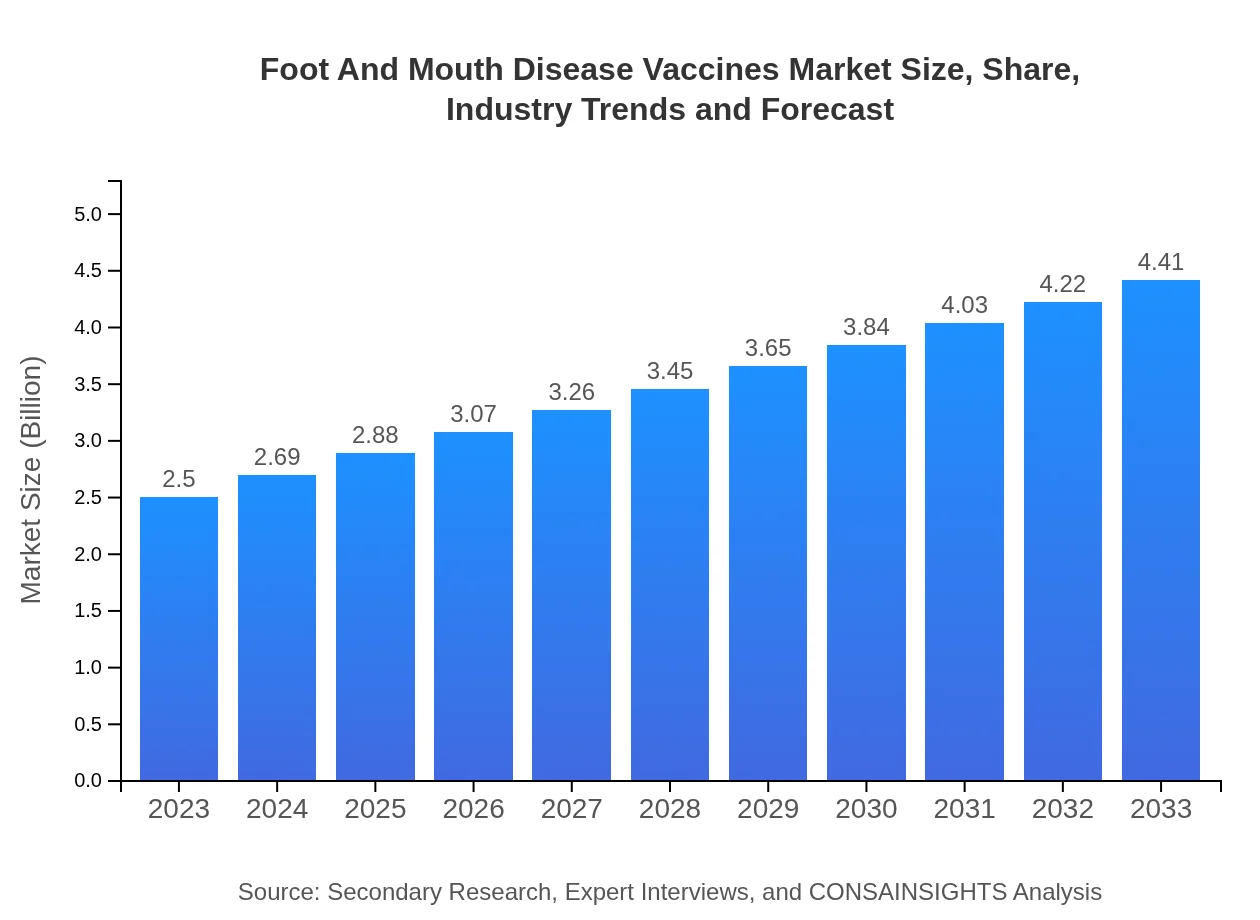

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $4.41 Billion |

| Top Companies | Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, IDT Biologika GmbH |

| Last Modified Date | 31 January 2026 |

Foot And Mouth Disease Vaccines Market Overview

Customize Foot And Mouth Disease Vaccines Market Report market research report

- ✔ Get in-depth analysis of Foot And Mouth Disease Vaccines market size, growth, and forecasts.

- ✔ Understand Foot And Mouth Disease Vaccines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Foot And Mouth Disease Vaccines

What is the Market Size & CAGR of Foot And Mouth Disease Vaccines market in 2023?

Foot And Mouth Disease Vaccines Industry Analysis

Foot And Mouth Disease Vaccines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Foot And Mouth Disease Vaccines Market Analysis Report by Region

Europe Foot And Mouth Disease Vaccines Market Report:

The European market is set to increase from $0.92 billion in 2023 to $1.61 billion by 2033. The stringent regulations on livestock health and food safety significantly drive vaccine adoption and innovation in this region.Asia Pacific Foot And Mouth Disease Vaccines Market Report:

The Asia Pacific region is expected to witness strong growth, with the market size projected to reach $0.71 billion by 2033, up from $0.40 billion in 2023. This growth is driven by increasing livestock populations and the prevalence of FMD outbreaks, particularly in rural areas.North America Foot And Mouth Disease Vaccines Market Report:

North America holds a substantial share of the market, with a projection to grow from $0.82 billion in 2023 to $1.44 billion in 2033. The region's robust agricultural sector and proactive disease management strategies contribute to its market strength.South America Foot And Mouth Disease Vaccines Market Report:

In South America, the market is anticipated to grow from $0.10 billion in 2023 to $0.18 billion by 2033. This growth is attributed to governmental programs focused on enhancing livestock health and agricultural export competitiveness.Middle East & Africa Foot And Mouth Disease Vaccines Market Report:

The Middle East and Africa region's market is projected to expand from $0.26 billion to $0.46 billion over the same period, bolstered by international aid and initiatives aimed at improving animal health standards.Tell us your focus area and get a customized research report.

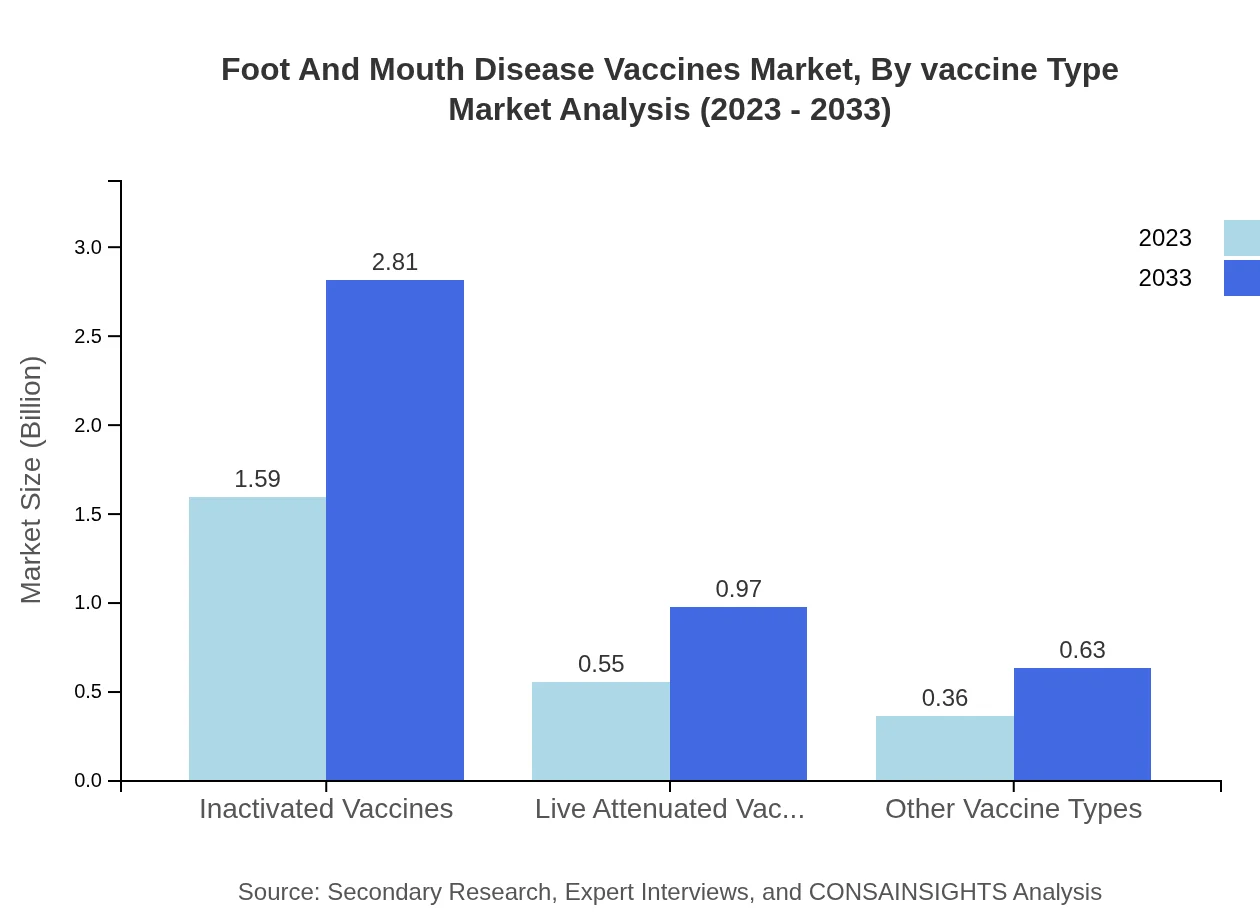

Foot And Mouth Disease Vaccines Market Analysis By Vaccine Type

The Foot-and-Mouth Disease Vaccines market can be segmented by vaccine types, including Inactivated Vaccines, Live Attenuated Vaccines, and Other Vaccine Types. Inactivated Vaccines dominate the market with a 63.67% share in 2023, projected to remain stable through 2033 as they provide reliable protection against FMD. Live Attenuated Vaccines hold a significant second position, accounting for 22.11% of the market share. Their effectiveness during outbreaks makes them a crucial option for controlling the disease. Other Vaccine types are also gaining traction but remain a smaller segment.

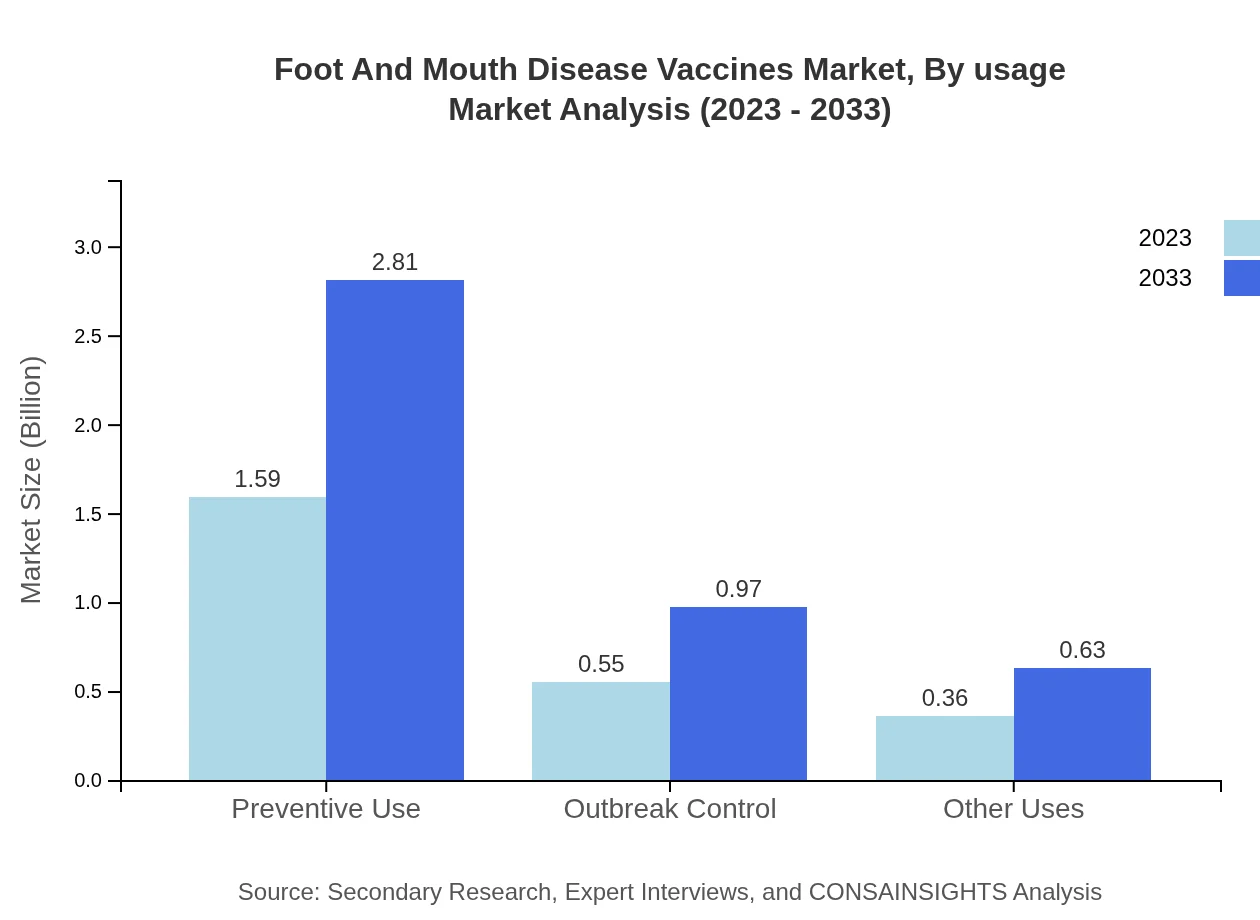

Foot And Mouth Disease Vaccines Market Analysis By Usage

In the usage segmentation, Preventive Use takes the lead, featuring a market share of 63.67% in 2023 and projected to reach 63.67% by 2033. The emphasis on preventative measures against the disease ensures this sector maintains its significance. Outbreak Control holds a 22.11% share, reflecting its importance during FMD outbreaks, with future growth predicted. Additionally, other uses of vaccines constitute a smaller portion but indicate a diversified approach in vaccination strategies.

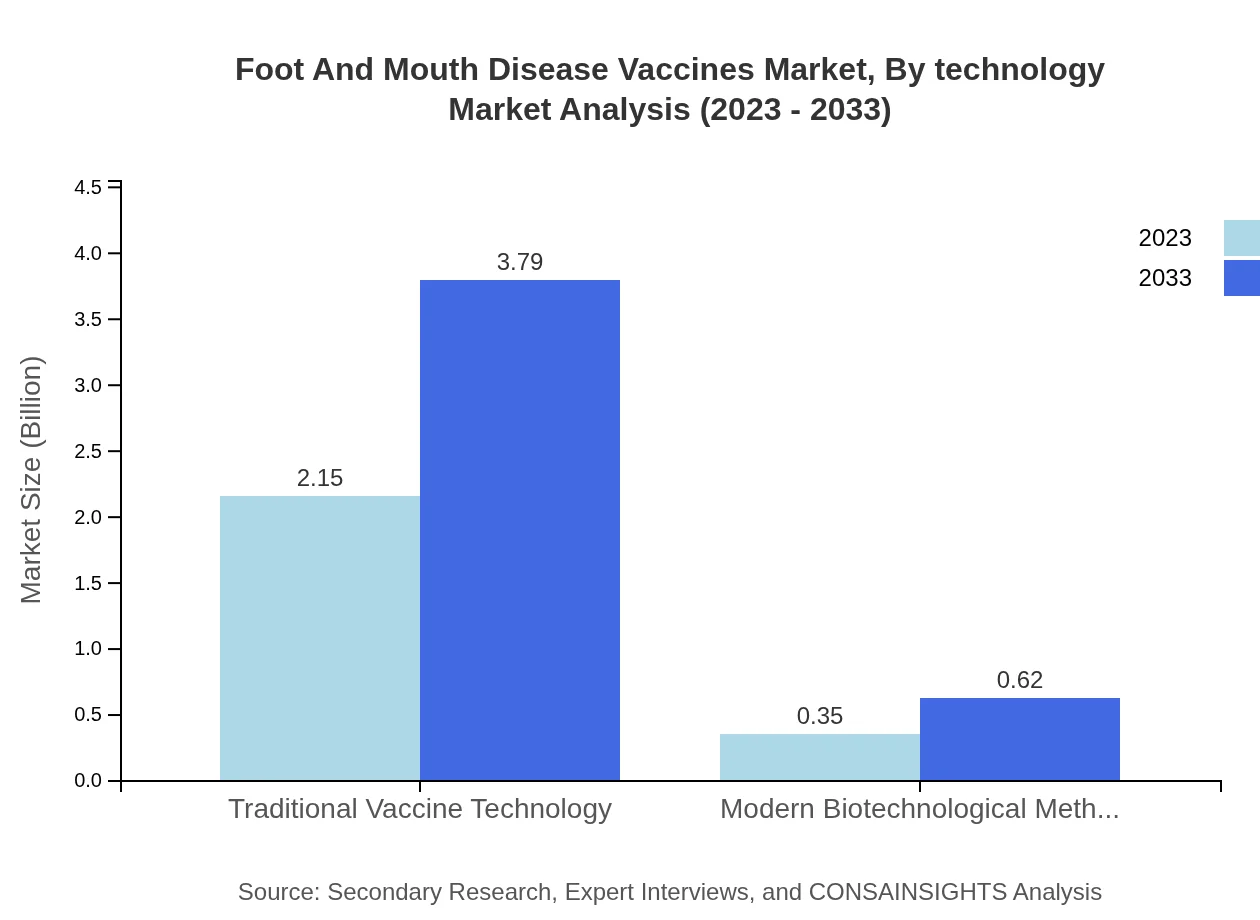

Foot And Mouth Disease Vaccines Market Analysis By Technology

The market by technology is segmented into Traditional Vaccine Technology and Modern Biotechnological Methods. Traditional Vaccine Technology holds a commanding share of 85.99% in 2023 and continues to be the principal choice due to its proven efficacy. However, advancements in Modern Biotechnological Methods are being recognized for their potential to offer more effective and quicker solutions to FMD, holding a 14.01% market share, projected to grow as innovations emerge in the field.

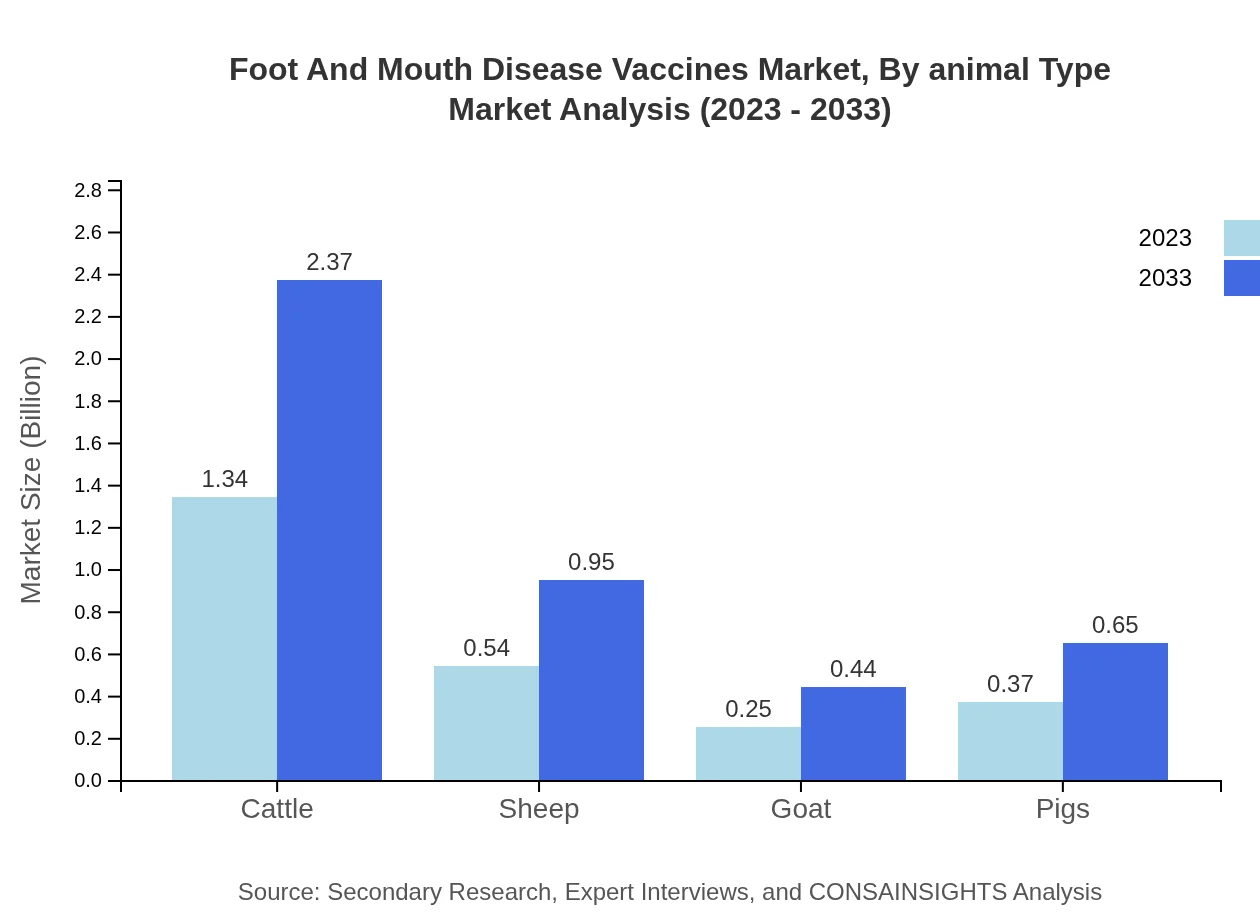

Foot And Mouth Disease Vaccines Market Analysis By Animal Type

By animal type, the market is largely driven by the Cattle segment, which boasts a 53.65% share in 2023, expected to grow significantly due to heightened cattle farming activities. The Sheep and Goat segments hold 21.46% and 10.05% shares, respectively, emphasizing the market's diversity in addressing vaccine needs across different animal types. Pigs also represent a notable segment, reflecting varied agricultural practices that necessitate targeted vaccine strategies.

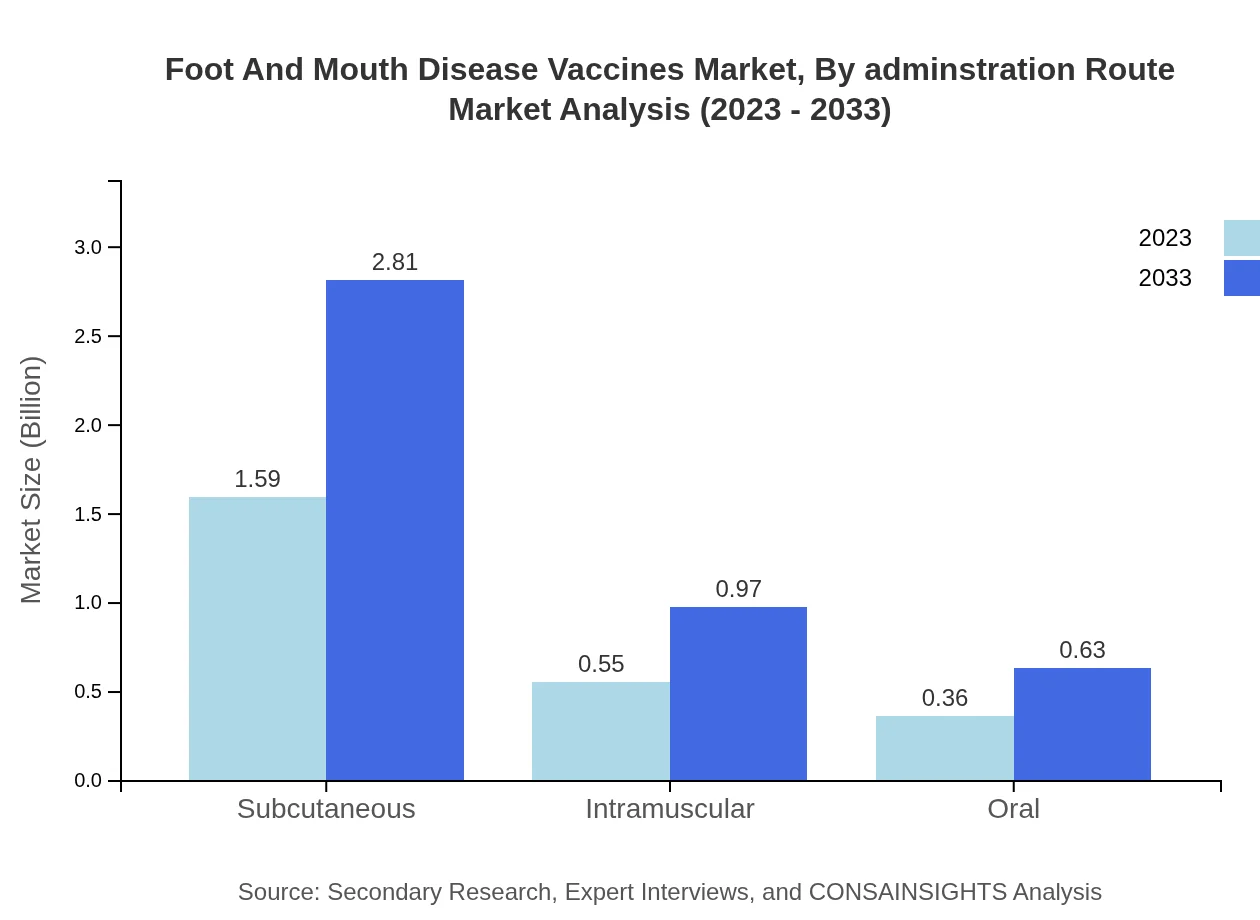

Foot And Mouth Disease Vaccines Market Analysis By Adminstration Route

Regarding administration routes, the Subcutaneous method dominates this segment with a 63.67% share in 2023, maintaining its prominence due to its effectiveness and ease of administration. Intramuscular and Oral routes together represent significant shares of 22.11% and 14.22%, respectively. The preference for Subcutaneous administration is expected to continue as the most reliable method for delivering vaccines to animals.

Foot And Mouth Disease Vaccines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Foot And Mouth Disease Vaccines Industry

Zoetis Inc.:

Zoetis is a global leader in animal health, providing a broad spectrum of vaccines and prevention solutions for livestock. Their commitment to innovation has established them as a key player in combating FMD.Merck Animal Health:

Merck Animal Health is renowned for its advanced veterinary medicines, including effective FMD vaccines. Their research and development efforts are central to addressing animal health challenges.Boehringer Ingelheim:

Boehringer Ingelheim is a significant contributor to the FMD vaccine market, focusing on developing and supplying a variety of specialized vaccines and health solutions.IDT Biologika GmbH:

IDT Biologika is recognized for its expertise in biopharmaceutical production, including vaccines for FMD, emphasizing quality and compliance with global health standards.We're grateful to work with incredible clients.

FAQs

What is the market size of Foot And-Mouth-Disease Vaccines?

The Foot-and-Mouth-Disease Vaccines market is valued at approximately $2.5 billion in 2023, with an expected Compound Annual Growth Rate (CAGR) of 5.7% through 2033, reflecting an expanding need for vaccination amidst rising animal agriculture demands.

What are the key market players or companies in the Foot And-Mouth-Disease Vaccines industry?

Key players in the Foot-and-Mouth-Disease Vaccines industry include global pharmaceutical firms and agro-biotech companies that specialize in veterinary vaccines. These companies are vital in developing advanced and effective vaccines to combat FMD outbreaks, ensuring animal health and productivity.

What are the primary factors driving the growth in the Foot And-Mouth-Disease Vaccines industry?

The growth in the Foot-and-Mouth-Disease Vaccines industry is driven by increasing livestock populations, heightened awareness of FMD impact on agriculture, government support for vaccination programs, and advancements in vaccine technology aimed at improving efficacy and safety.

Which region is the fastest Growing in the Foot And-Mouth-Disease Vaccines market?

The Asia Pacific region is experiencing rapid growth in the Foot-and-Mouth-Disease Vaccines market, with an increase from $0.40 billion in 2023 to an estimated $0.71 billion in 2033, attributed to growing livestock sectors and improved vaccination strategies.

Does ConsaInsights provide customized market report data for the Foot And-Mouth-Disease Vaccines industry?

Yes, ConsaInsights offers customized market reports tailored to the Foot-and-Mouth-Disease Vaccines industry, allowing clients to obtain specific insights, data segmentation, and detailed analyses to support strategic business decisions.

What deliverables can I expect from this Foot And-Mouth-Disease Vaccines market research project?

Deliverables from the Foot-and-Mouth-Disease Vaccines market research study include comprehensive market analysis reports, segmentation data, competitive landscape assessments, growth forecasts, and actionable insights tailored to your specific business needs.

What are the market trends of Foot And-Mouth-Disease Vaccines?

Market trends in the Foot-and-Mouth-Disease Vaccines sector indicate a shift towards more advanced vaccine technologies, increased investment in outbreak prevention strategies, and a greater emphasis on animal welfare, influencing production and distribution processes.