Forage Analysis Market Report

Published Date: 02 February 2026 | Report Code: forage-analysis

Forage Analysis Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the forage analysis market, detailing industry insights, forecasts for 2023-2033, and data-driven recommendations for stakeholders looking to tap into this growing sector.

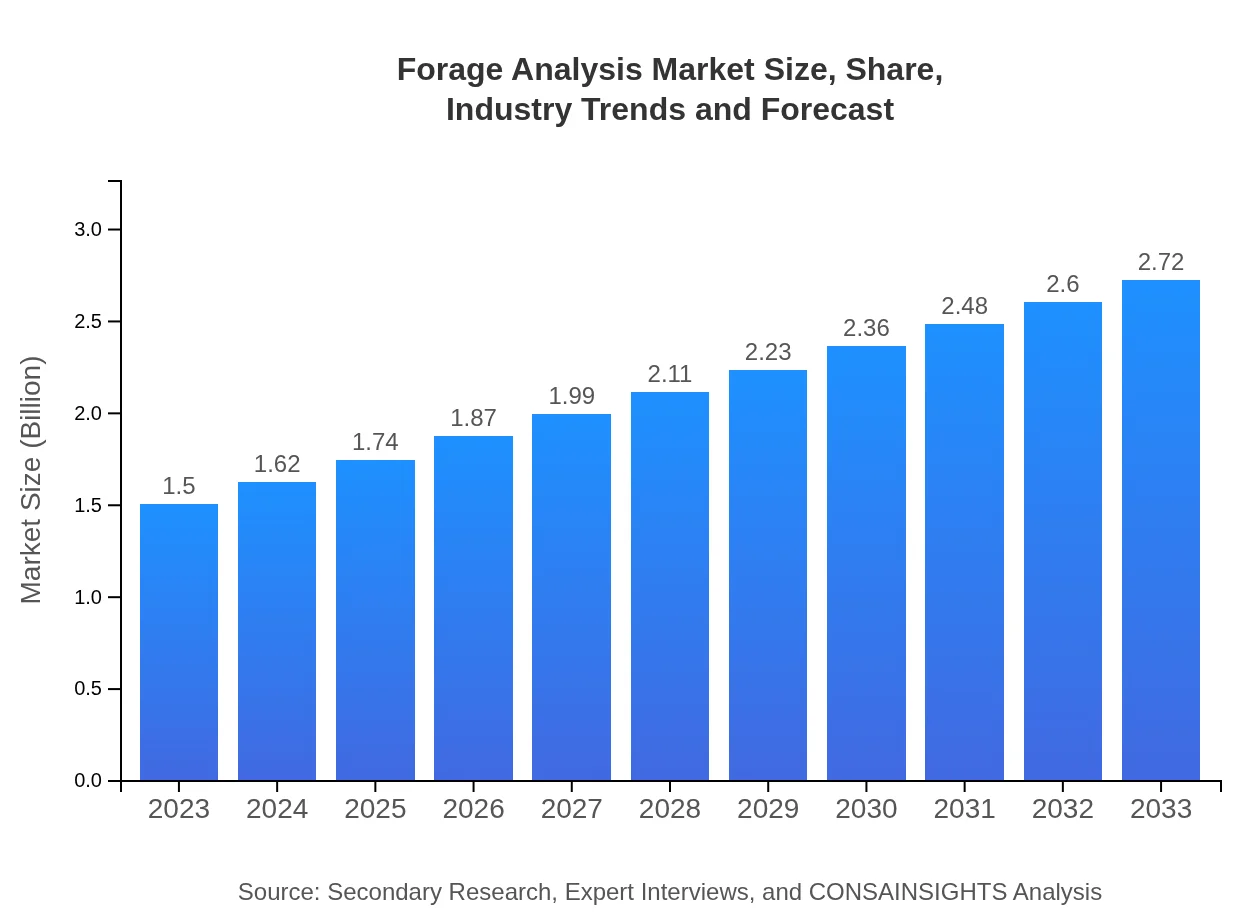

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $2.72 Billion |

| Top Companies | Eurofins Scientific, Neogen Corporation, Thermo Fisher Scientific, A & L Great Lakes Laboratories |

| Last Modified Date | 02 February 2026 |

Forage Analysis Market Overview

Customize Forage Analysis Market Report market research report

- ✔ Get in-depth analysis of Forage Analysis market size, growth, and forecasts.

- ✔ Understand Forage Analysis's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Forage Analysis

What is the Market Size & CAGR of Forage Analysis market in 2023?

Forage Analysis Industry Analysis

Forage Analysis Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Forage Analysis Market Analysis Report by Region

Europe Forage Analysis Market Report:

The European forage analysis market is estimated to increase from $0.37 million in 2023 to $0.67 million by 2033. The emphasis on sustainable farming practices and animal health regulations is pushing for enhanced forage quality control.Asia Pacific Forage Analysis Market Report:

In 2023, the Asia Pacific forage analysis market is valued at approximately $0.29 million, projected to grow to $0.53 million by 2033. This region's growth is bolstered by increasing livestock production and investments in agricultural technology and practices.North America Forage Analysis Market Report:

North America currently leads the forage analysis market with a value of $0.50 million in 2023, estimated to grow to $0.91 million by 2033. The region's advanced agricultural practices and a strong livestock industry contribute to this robust market.South America Forage Analysis Market Report:

South America's forage analysis market is forecasted to grow from $0.15 million in 2023 to $0.27 million by 2033. The expanding livestock sector and rising exports of meat and dairy products are driving the demand for precision in forage quality testing.Middle East & Africa Forage Analysis Market Report:

The Middle East and Africa's forage analysis market is projected to grow from $0.19 million in 2023 to $0.35 million by 2033. Key growth factors include increased livestock farming and the need for better feed efficiency in arid climates.Tell us your focus area and get a customized research report.

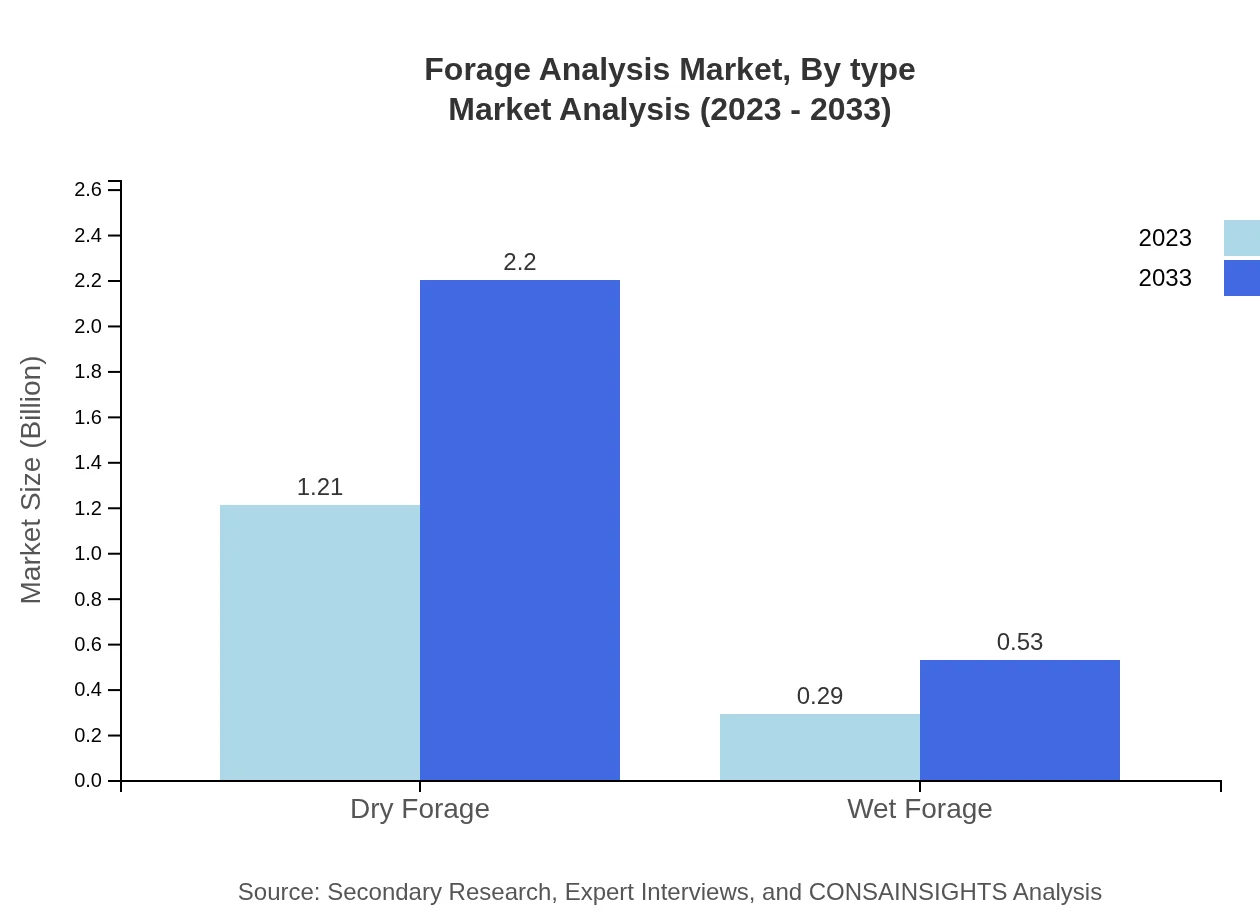

Forage Analysis Market Analysis By Type

The forage analysis market is dominantly led by dry forage, projected to grow from $1.21 million in 2023 to $2.20 million by 2033, accounting for 80.71% of the market share. Wet forage follows, with growth from $0.29 million to $0.53 million, holding a 19.29% share. The focus on dry forage indicates its importance in sustaining livestock productivity, especially in ruminant feed.

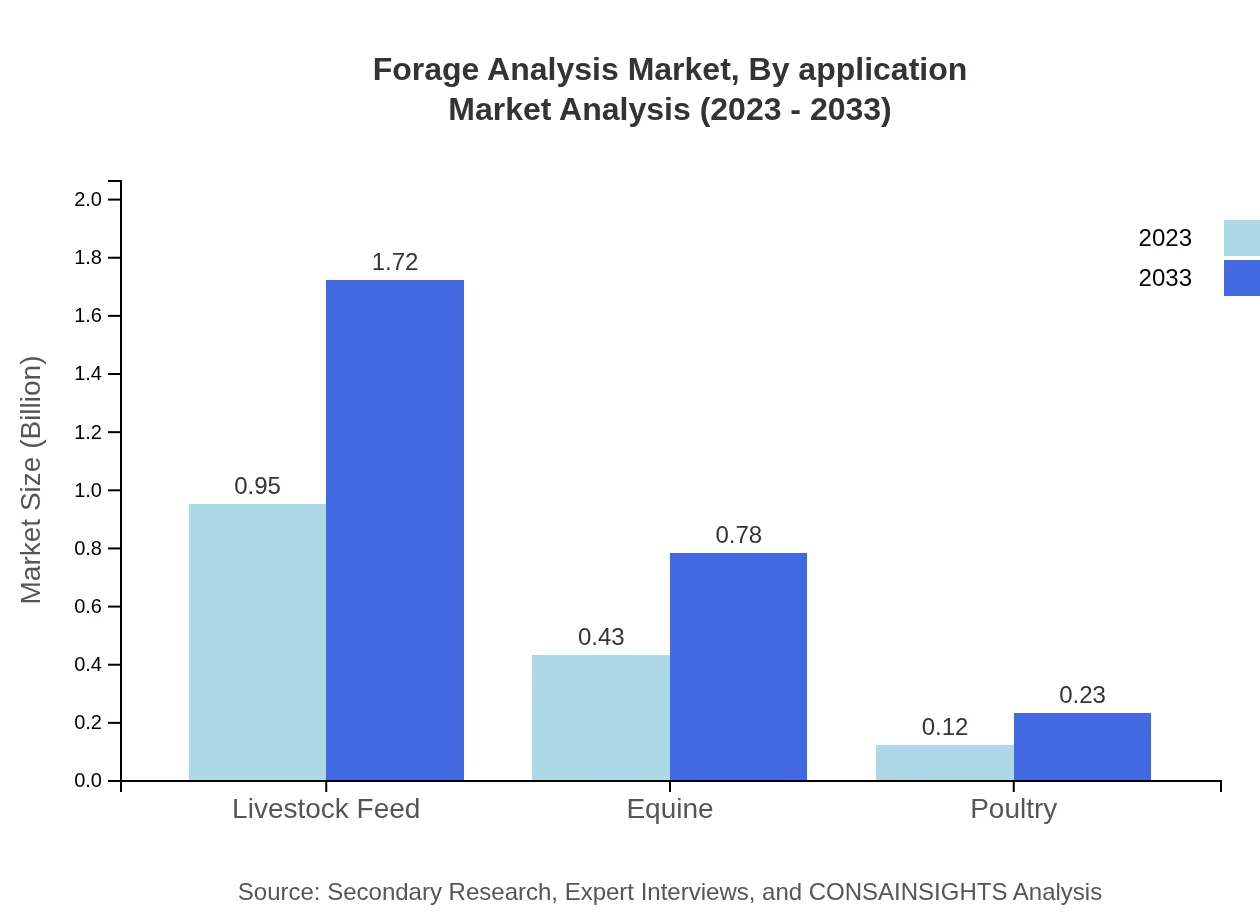

Forage Analysis Market Analysis By Application

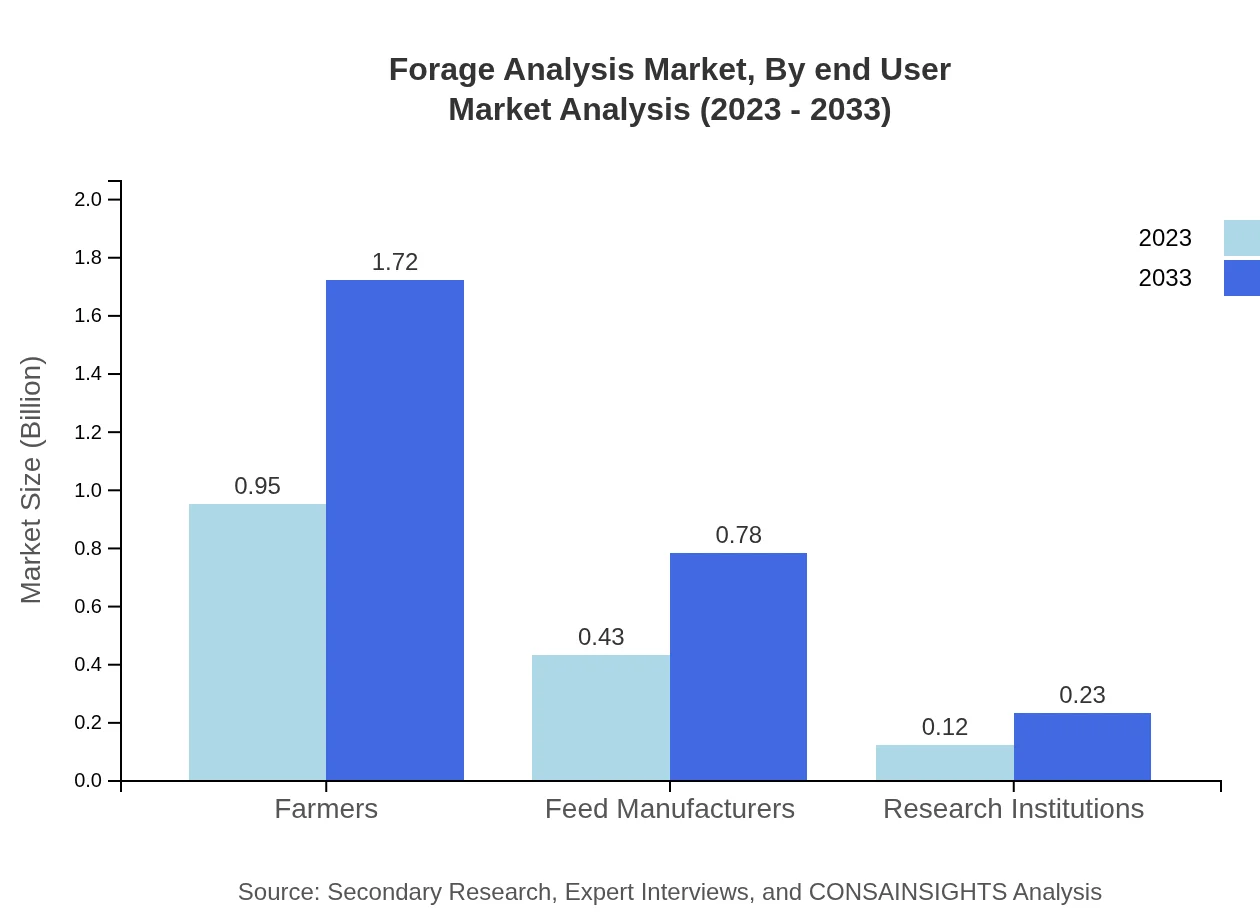

The application segment shows significant revenue contributions from farmers, currently $0.95 million in 2023 and projected to reach $1.72 million by 2033, maintaining a 63.17% share. Feed manufacturers represent another key segment, growing from $0.43 million to $0.78 million, with a 28.5% share. Research institutions, while smaller, also contribute with a growth from $0.12 million to $0.23 million, focusing on driving innovation.

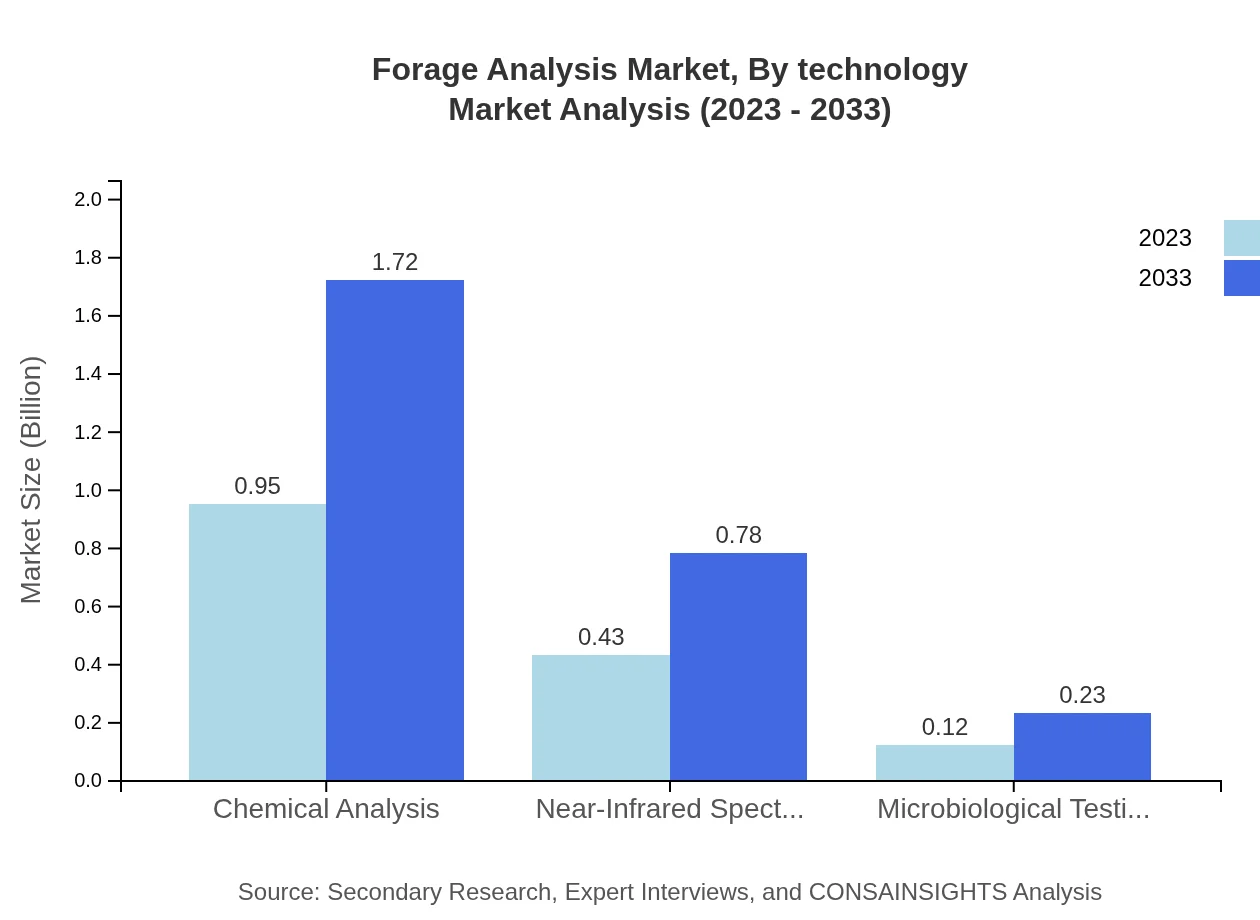

Forage Analysis Market Analysis By Technology

Technological advancements in the forage analysis market are significant, with chemical analysis leading at $0.95 million in 2023, expected to grow to $1.72 million, maintaining a 63.17% share. Near-infrared spectroscopy is also important, growing from $0.43 million to $0.78 million, with a 28.5% share, showcasing the industry's reliance on sophisticated analysis techniques for accurate forage assessments.

Forage Analysis Market Analysis By End User

Livestock feed remains the primary end-user segment, with a market size of $0.95 million in 2023, projected to rise to $1.72 million by 2033, capturing a 63.17% share. The equine and poultry sectors are also present but at lower shares, representing opportunities for growth as interest in specialized feed continues to grow.

Forage Analysis Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Forage Analysis Industry

Eurofins Scientific:

A global leader in laboratory services, Eurofins offers a wide range of forage analysis solutions, emphasizing quality and efficiency in testing environments.Neogen Corporation:

Known for its advances in food and animal safety, Neogen develops innovative analysis methods for forage, ensuring optimal nutrient delivery in livestock diets.Thermo Fisher Scientific:

Thermo Fisher provides comprehensive solutions for agricultural analytics, including specialized equipment for forage quality testing.A & L Great Lakes Laboratories:

This company focuses on providing high-quality laboratory analysis services for agriculture, including forage testing that supports sustainable farming practices.We're grateful to work with incredible clients.

FAQs

What is the market size of forage Analysis?

The forage-analysis market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.0% over the next decade, indicating a robust growth trajectory. By 2033, the market size is expected to reflect significant expansion.

What are the key market players or companies in this forage Analysis industry?

The forage-analysis industry features prominent players including leading agricultural firms, technology providers, and research institutions, contributing significantly to the market's evolution. These companies leverage advancements in technology to enhance forage testing and analysis methodologies.

What are the primary factors driving the growth in the forage Analysis industry?

Key drivers of growth in the forage-analysis industry include rising demand for quality livestock feed, advancements in analytical technologies, increased livestock production, and an emphasis on sustainable agricultural practices. Consumer preferences for healthier and safe animal products also contribute significantly.

Which region is the fastest Growing in the forage Analysis?

The fastest-growing region in the forage-analysis market is North America, projected to grow from $0.50 billion in 2023 to $0.91 billion by 2033. Europe and Asia Pacific also exhibit strong growth potential, bolstered by increasing agricultural activities and livestock production.

Does ConsaInsights provide customized market report data for the forage Analysis industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the forage-analysis industry. This allows clients to gain valuable insights relevant to their business objectives and market dynamics.

What deliverables can I expect from this forage Analysis market research project?

Deliverables from a forage-analysis market research project typically include detailed market size reports, growth forecasts, competitive landscape analysis, regional insights, and segment-specific data, providing a comprehensive overview crucial for strategic decision-making.

What are the market trends of forage Analysis?

Current trends in the forage-analysis market involve increased adoption of precision agriculture technologies, growing emphasis on sustainability, and expansion of laboratory services for accurate crop assessment. These trends are shaping the future of agricultural practices and animal husbandry.