Forage Feed Market Report

Published Date: 31 January 2026 | Report Code: forage-feed

Forage Feed Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Forage Feed market, offering forecasts from 2023 to 2033. It covers market size, industry trends, segmentation, regional insights, and key players, aiming to inform stakeholders on future opportunities and challenges.

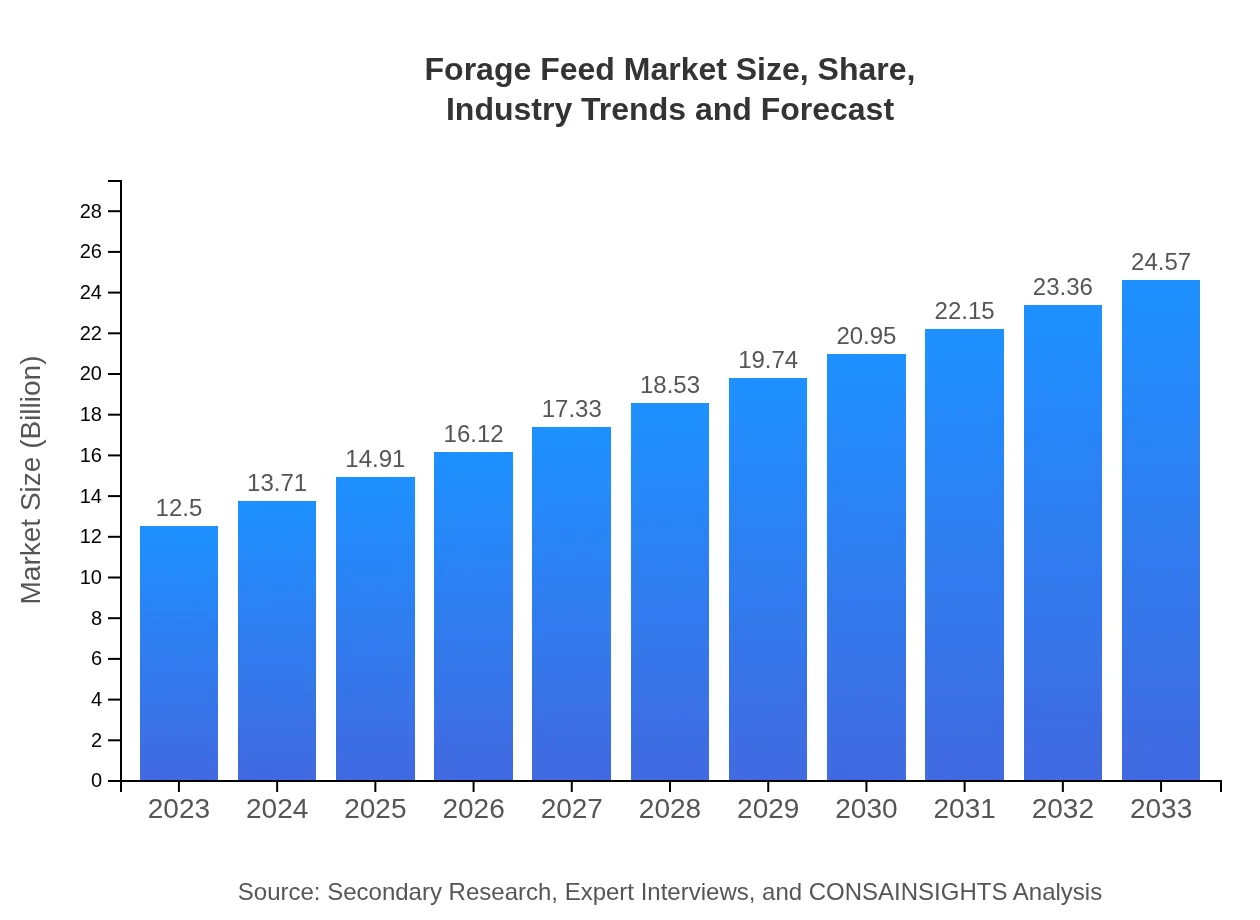

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Cargill Inc., Land O'Lakes, Inc., BASF SE, Nutreco N.V., ADM Animal Nutrition |

| Last Modified Date | 31 January 2026 |

Forage Feed Market Overview

Customize Forage Feed Market Report market research report

- ✔ Get in-depth analysis of Forage Feed market size, growth, and forecasts.

- ✔ Understand Forage Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Forage Feed

What is the Market Size & CAGR of Forage Feed market in 2023?

Forage Feed Industry Analysis

Forage Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Forage Feed Market Analysis Report by Region

Europe Forage Feed Market Report:

With a market size of $3.50 billion in 2023, the European Forage Feed market is projected to grow to $6.87 billion by 2033. The focus on organic farming, consumer health awareness, and regulations promoting sustainable practices create a conducive environment for forage consumption.Asia Pacific Forage Feed Market Report:

In 2023, the Forage Feed market in the Asia Pacific region stands at $2.75 billion and is projected to grow to $5.40 billion by 2033. The region is witnessing rapid growth in its livestock sector, particularly in countries like China and India, where demand for animal products is skyrocketing. Sustainable farming practices and the adoption of new forage technologies are further driving this growth.North America Forage Feed Market Report:

North America houses a robust forage feed market, valued at $4.23 billion in 2023 and anticipated to reach $8.32 billion by 2033. The U.S. leads in production and consumption of forage due to an established livestock industry, coupled with advancements in forage crop technology and management practices.South America Forage Feed Market Report:

The South American Forage Feed market size is approximately $0.84 billion as of 2023 and is expected to reach $1.66 billion by 2033. Significant contributions from countries such as Brazil, known for its large cattle population, epitomize the need for enhanced forage solutions to bolster livestock productivity and meet international demands.Middle East & Africa Forage Feed Market Report:

The Middle East and Africa region's Forage Feed market is valued at $1.18 billion in 2023, with expected growth to $2.31 billion by 2033. The increase in livestock production driven by economic development and demographic shifts fuels market growth in this region.Tell us your focus area and get a customized research report.

Forage Feed Market Analysis By Type

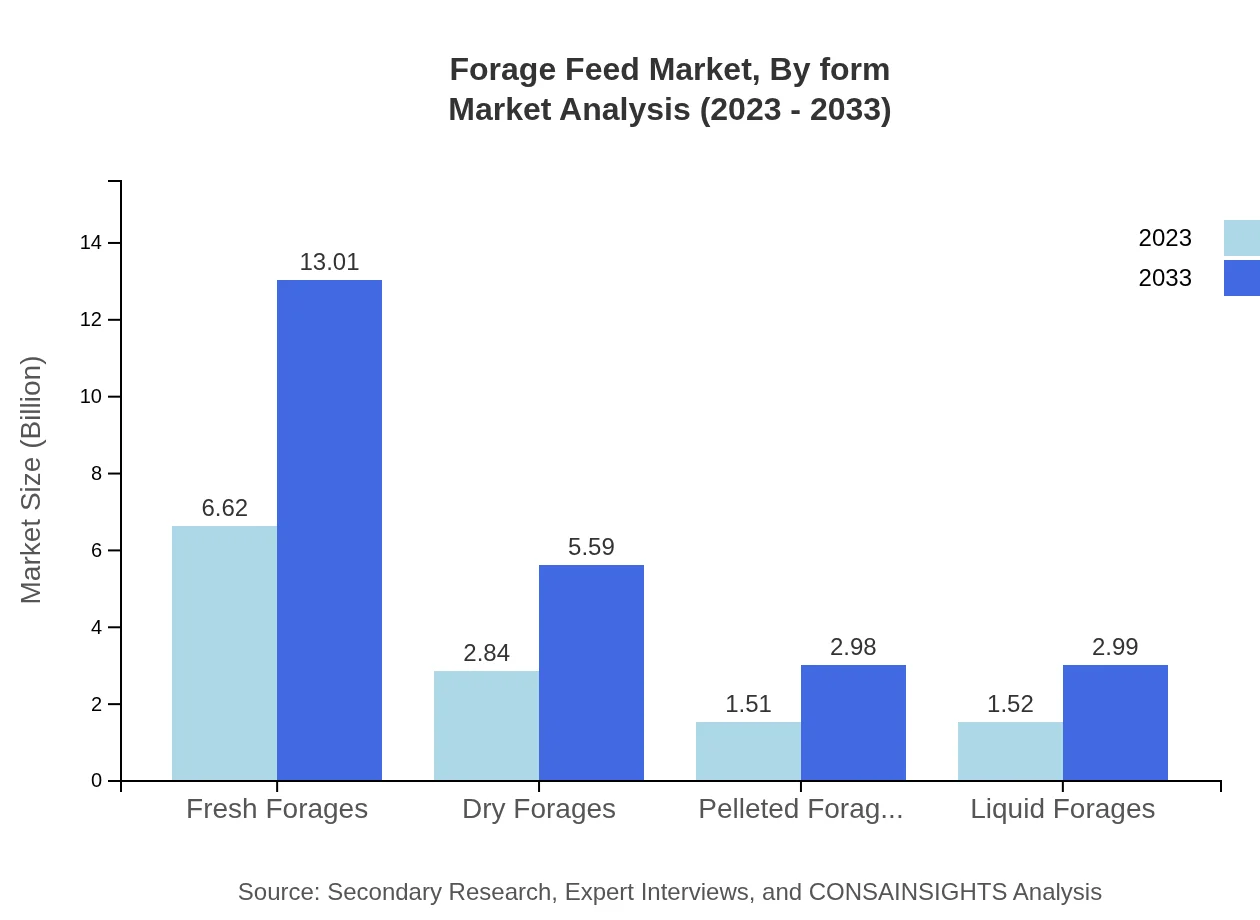

The Forage Feed market can be detailed by type: Fresh Forages dominate the market, projected to grow from $6.62 billion in 2023 to $13.01 billion by 2033. Dry Forages and Silages follow, with estimates at $2.84 billion and $1.50 billion in 2023, growing to $5.59 billion and $2.96 billion respectively by 2033.

Forage Feed Market Analysis By Animal

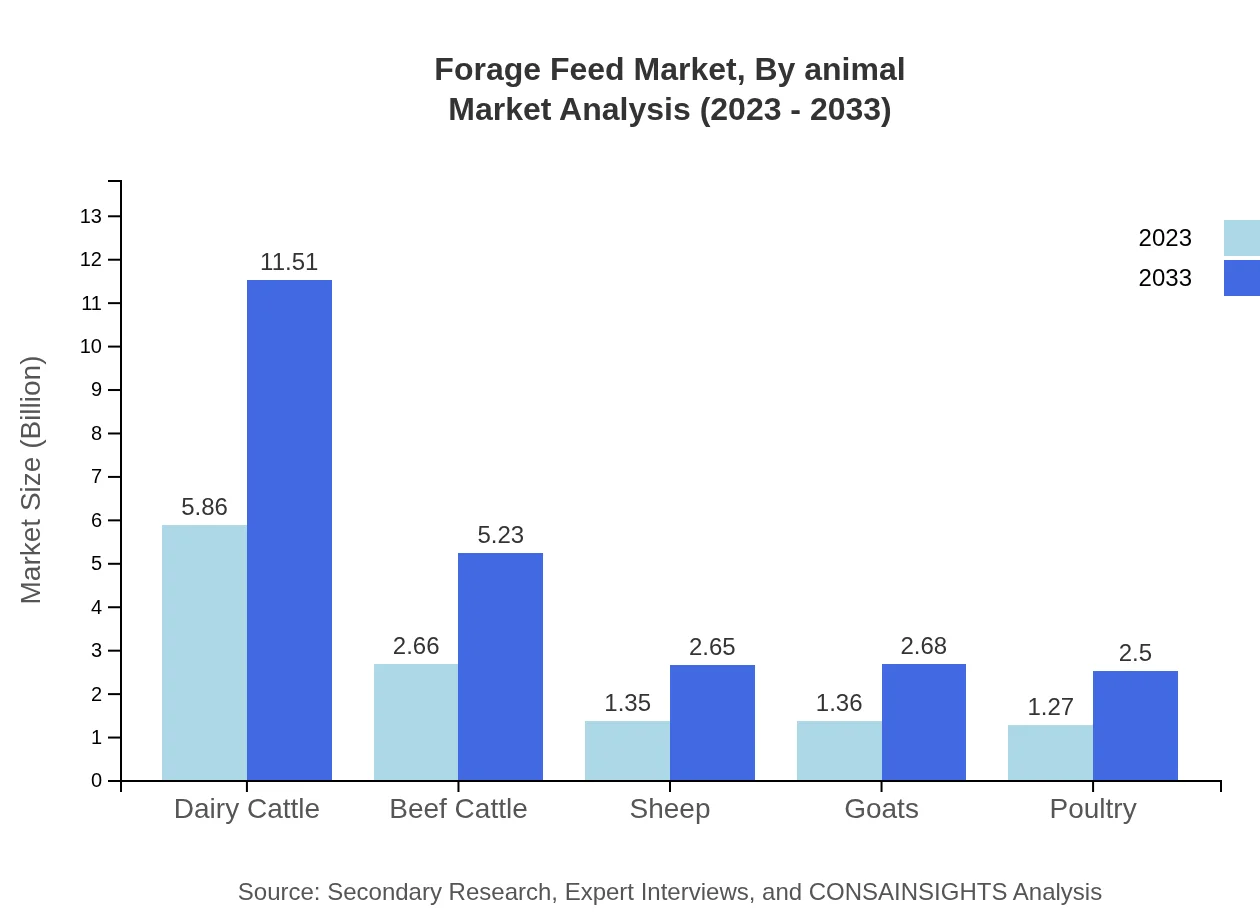

Dairy Cattle lead the forage feed consumption, having a market size of $5.86 billion in 2023, expected to advance to $11.51 billion by 2033. Beef Cattle and Goats also represent significant market shares as seen with $2.66 billion and expected growth to $5.23 billion and $1.36 billion to $2.68 billion respectively by 2033.

Forage Feed Market Analysis By Form

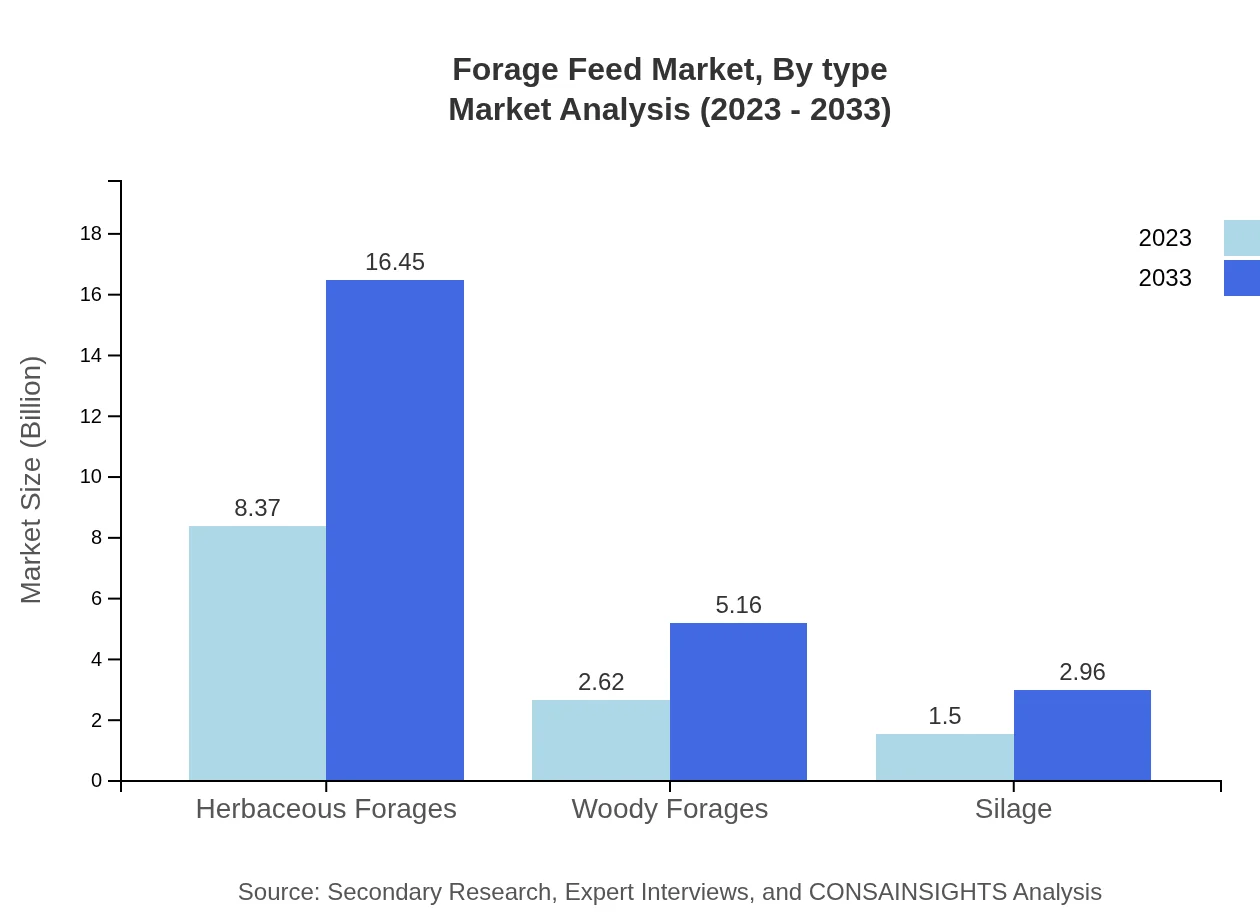

Herbaceous Forages account for a significant portion of the market, growing from $8.37 billion in 2023 to $16.45 billion by 2033. Liquid and Pelleted Forages also show promising growth denoting diversification in feed formulations.

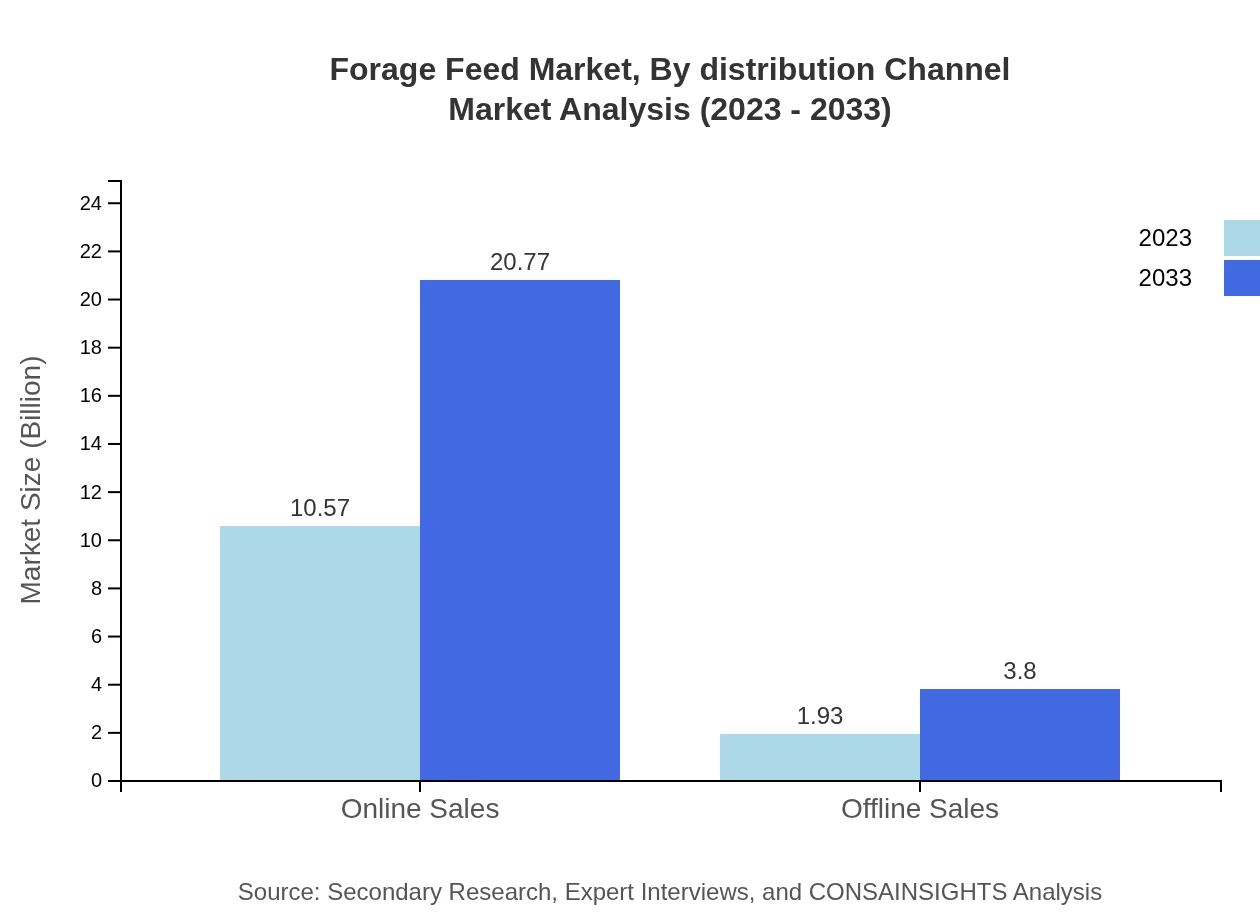

Forage Feed Market Analysis By Distribution Channel

Online sales of forage feed lead the distribution segment with a market size of $10.57 billion in 2023 projected to reach $20.77 billion by 2033, showcasing a shift towards e-commerce. Offline sales remain significant but grow comparatively slower.

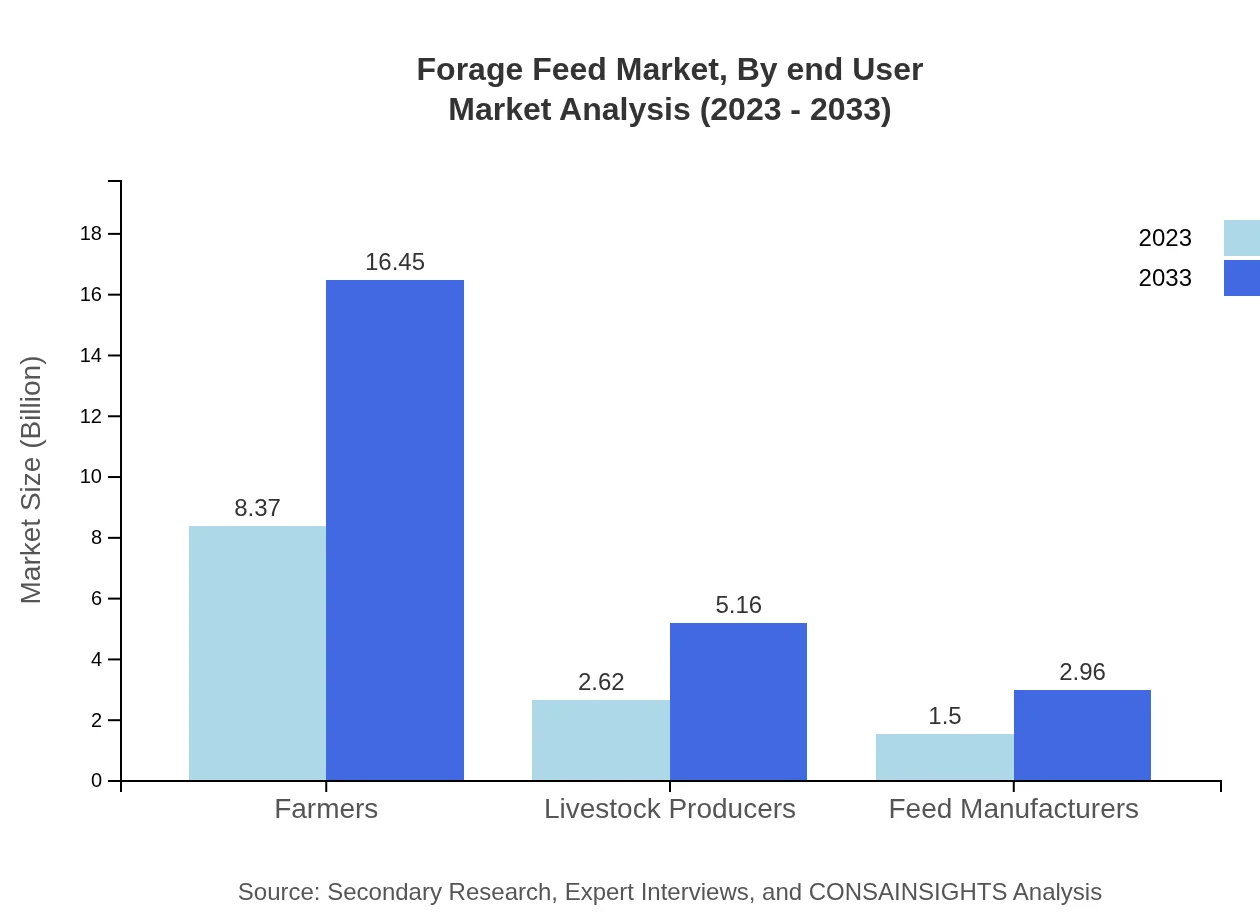

Forage Feed Market Analysis By End User

Farmers represent the largest end-user segment, with forage feed consumption valued at $8.37 billion in 2023, anticipated to reach $16.45 billion by 2033. Livestock producers and feed manufacturers are also vital players, highlighting the supply chain dynamics in the forage feed sector.

Forage Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Forage Feed Industry

Cargill Inc.:

Cargill is a major global player in the forage feed market, providing a wide range of high-quality feed products and solutions for livestock nutrition.Land O'Lakes, Inc.:

A farmer-owned cooperative, Land O’Lakes offers premium forage feeds and is committed to sustainable agricultural practices.BASF SE:

BASF is known for its innovative solutions in agricultural products, including advanced forage feed formulations to enhance livestock health.Nutreco N.V.:

Nutreco specializes in animal nutrition and aquafeed, emphasizing the importance of high-quality forage feeds in their product range.ADM Animal Nutrition:

A leading provider of animal nutrition products, ADM provides a comprehensive line of forage feed solutions to help optimize livestock performance.We're grateful to work with incredible clients.

FAQs

What is the market size of forage Feed?

The global forage-feed market is valued at approximately $12.5 billion in 2023 and is projected to grow at a CAGR of 6.8% through 2033, indicating a robust growth trajectory.

What are the key market players or companies in this forage Feed industry?

Key players in the forage-feed industry include major agricultural firms, livestock feed manufacturers, and online sales platforms. These companies lead the market through innovation, product diversification, and strategic partnerships.

What are the primary factors driving the growth in the forage Feed industry?

Several factors contribute to the growth of the forage-feed market, including increasing livestock production, a rising demand for dairy and meat products, and advancements in feed technology that enhance animal nutrition.

Which region is the fastest Growing in the forage Feed?

The fastest-growing region in the forage-feed market is North America, with market size projected to rise from $4.23 billion in 2023 to approximately $8.32 billion by 2033, fueled by increasing livestock farming activities.

Does ConsaInsights provide customized market report data for the forage Feed industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the forage-feed industry, allowing clients to gain insights that suit their strategic planning and operational requirements.

What deliverables can I expect from this forage Feed market research project?

Deliverables from the forage-feed market research project include comprehensive reports, insightful market analyses, competitive landscape assessments, and detailed segmentation data, providing a deep understanding of market dynamics.

What are the market trends of forage Feed?

Market trends in the forage-feed industry include a shift towards sustainable farming practices, an increase in online sales channels, and growing preferences for organic feed alternatives among livestock producers.