Forestry Equipment Market Report

Published Date: 31 January 2026 | Report Code: forestry-equipment

Forestry Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the forestry equipment market from 2023 to 2033, including market size, trends, insights on regional performance, and key players in the industry.

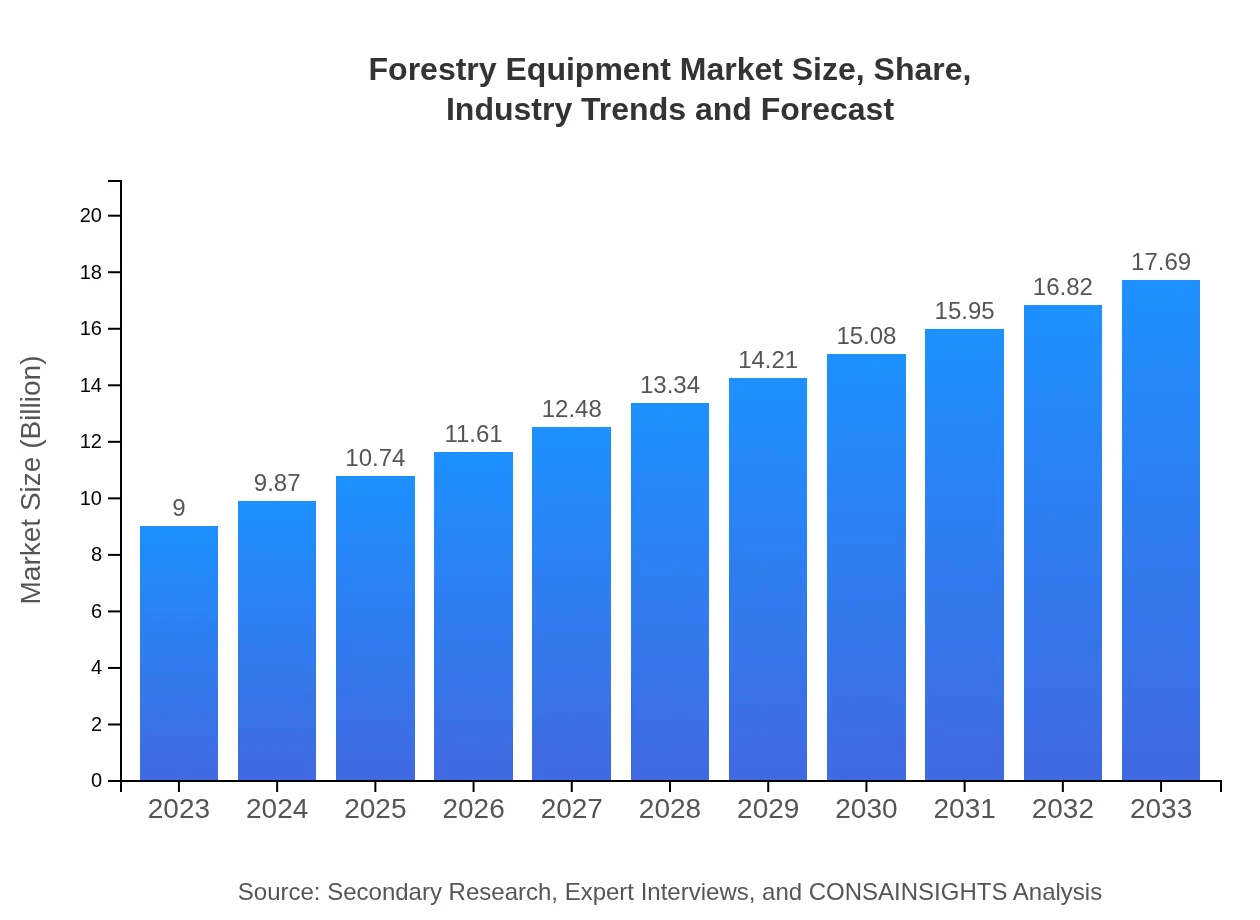

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $17.69 Billion |

| Top Companies | Caterpillar Inc., John Deere, Komatsu Forest |

| Last Modified Date | 31 January 2026 |

Forestry Equipment Market Overview

Customize Forestry Equipment Market Report market research report

- ✔ Get in-depth analysis of Forestry Equipment market size, growth, and forecasts.

- ✔ Understand Forestry Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Forestry Equipment

What is the Market Size & CAGR of Forestry Equipment market in 2023?

Forestry Equipment Industry Analysis

Forestry Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Forestry Equipment Market Analysis Report by Region

Europe Forestry Equipment Market Report:

Europe's forestry equipment market, valued at $2.83 billion in 2023, is projected to expand to $5.56 billion by 2033. The region's stringent environmental regulations motivate investments in efficient and sustainable harvesting technologies.Asia Pacific Forestry Equipment Market Report:

In 2023, the Asia Pacific forestry equipment market is valued at $1.76 billion, projected to reach $3.47 billion by 2033. Countries like China and India drive the growth through increased timber demand and government investments in sustainable forestry.North America Forestry Equipment Market Report:

With a market size of $3.03 billion in 2023, North America is expected to grow to $5.95 billion by 2033. The U.S. and Canada are leading users of advanced forestry equipment, emphasizing automation and productivity.South America Forestry Equipment Market Report:

The South American market for forestry equipment is relatively smaller at $0.56 billion in 2023, estimated to grow to $1.09 billion by 2033. Brazil remains a significant player, focusing on both domestic utilization and export of timber.Middle East & Africa Forestry Equipment Market Report:

The forestry equipment market in the Middle East and Africa is valued at $0.82 billion in 2023, anticipated to reach $1.61 billion by 2033. Growing investments in sustainable forestry management and afforestation initiatives are key growth drivers.Tell us your focus area and get a customized research report.

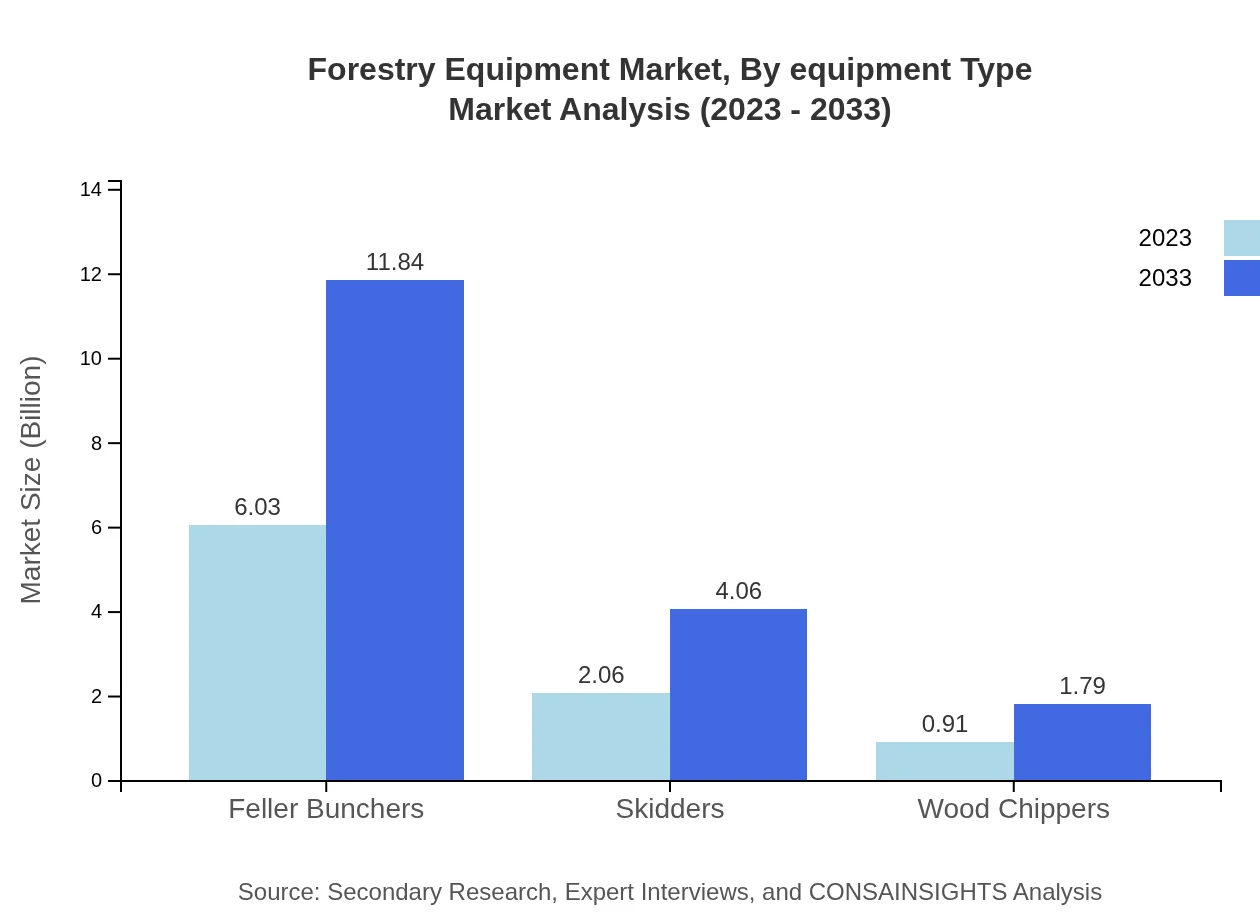

Forestry Equipment Market Analysis By Equipment Type

The equipment type segment is dominated by feller bunchers, accounting for $6.03 billion in 2023 and projected to grow to $11.84 billion by 2033. Skidders and wood chippers also show steady growth, reflecting advancements in machinery efficiency and automation.

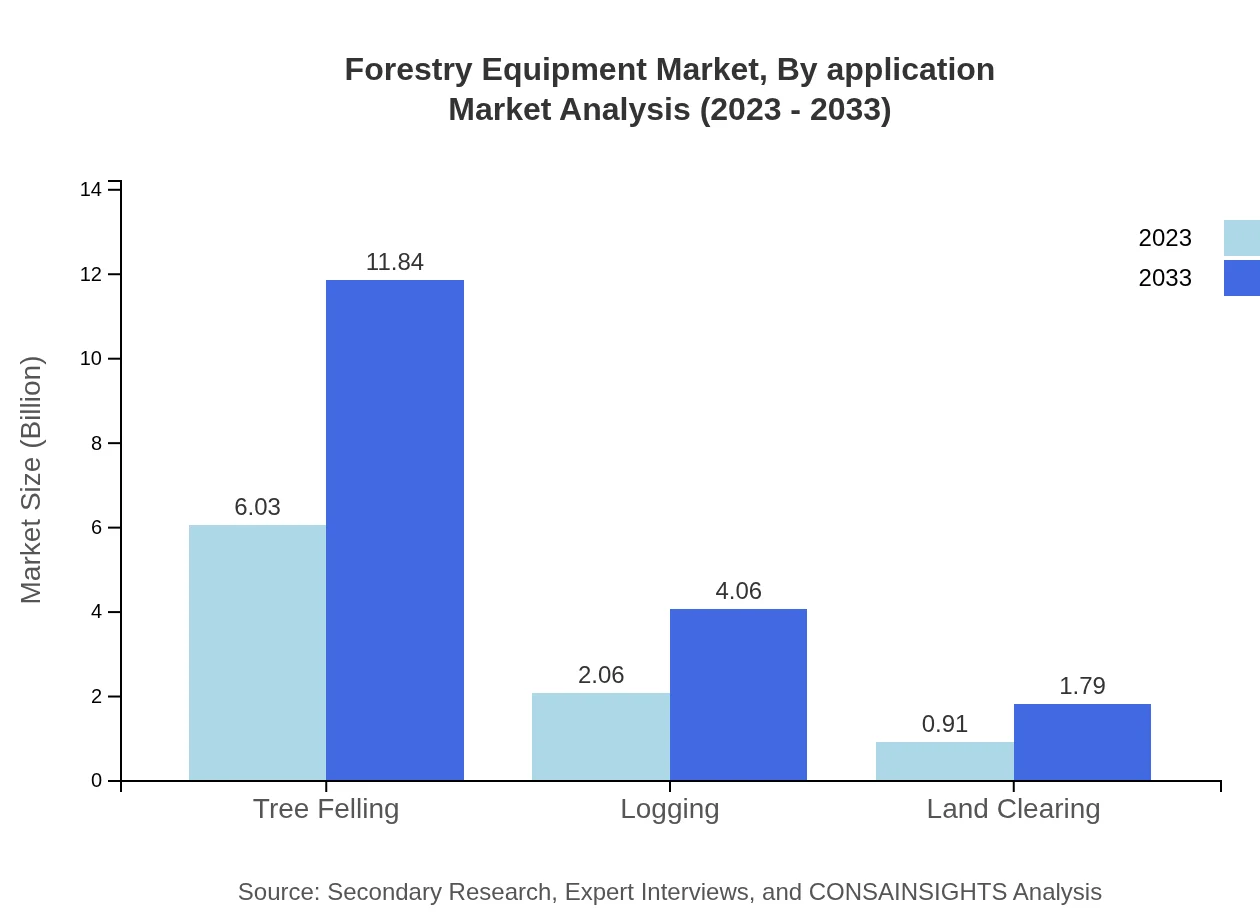

Forestry Equipment Market Analysis By Application

Commercial applications hold the largest share, with a projected market size of $6.03 billion in 2023, growing to $11.84 billion by 2033. Government and industrial applications also represent significant segments, emphasizing the importance of sustainable forestry practices.

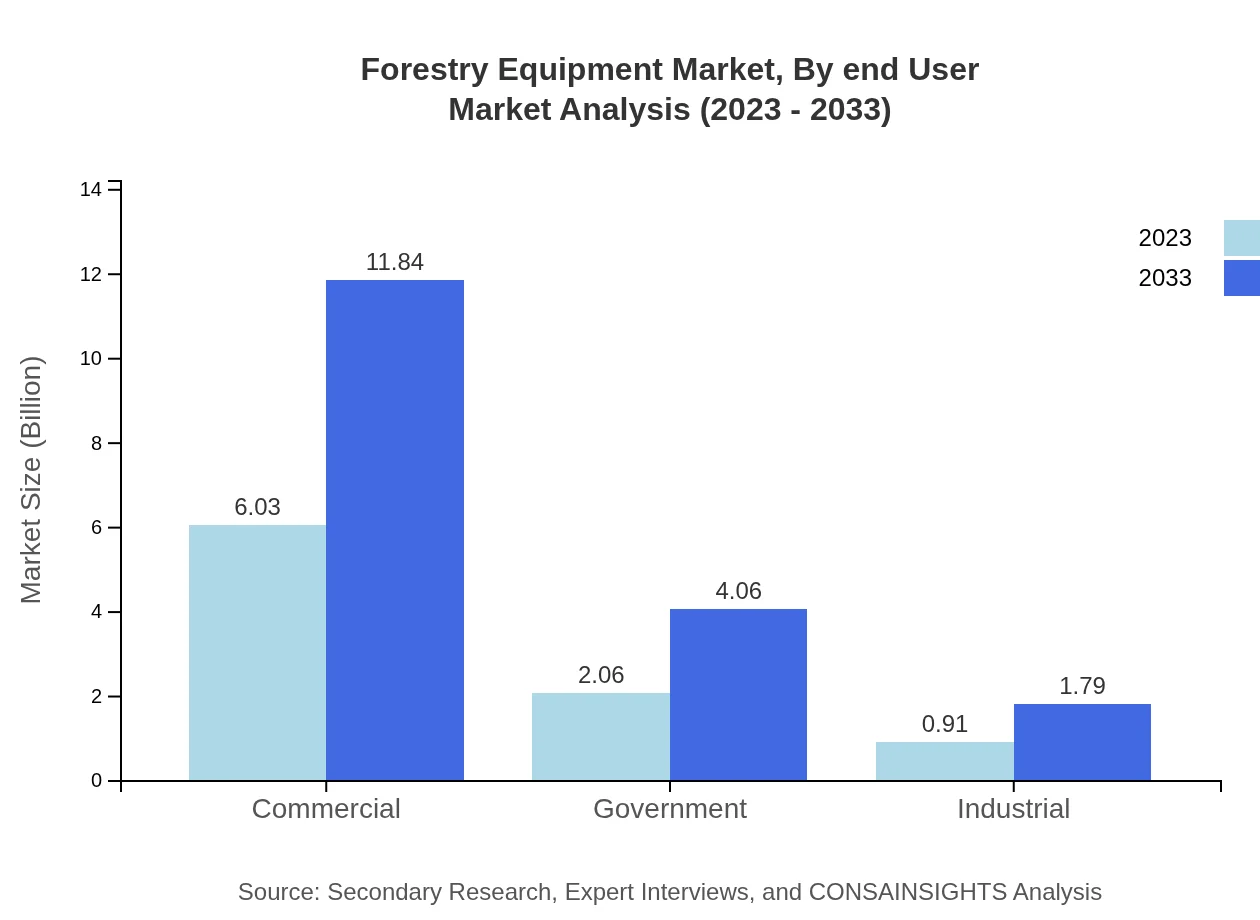

Forestry Equipment Market Analysis By End User

End-user segmentation reflects the diverse demand for forestry equipment. Commercial users dominate with a market share of 66.96% in 2023. Government and industrial users account for 22.94% and 10.1%, respectively, indicating broad market applicability.

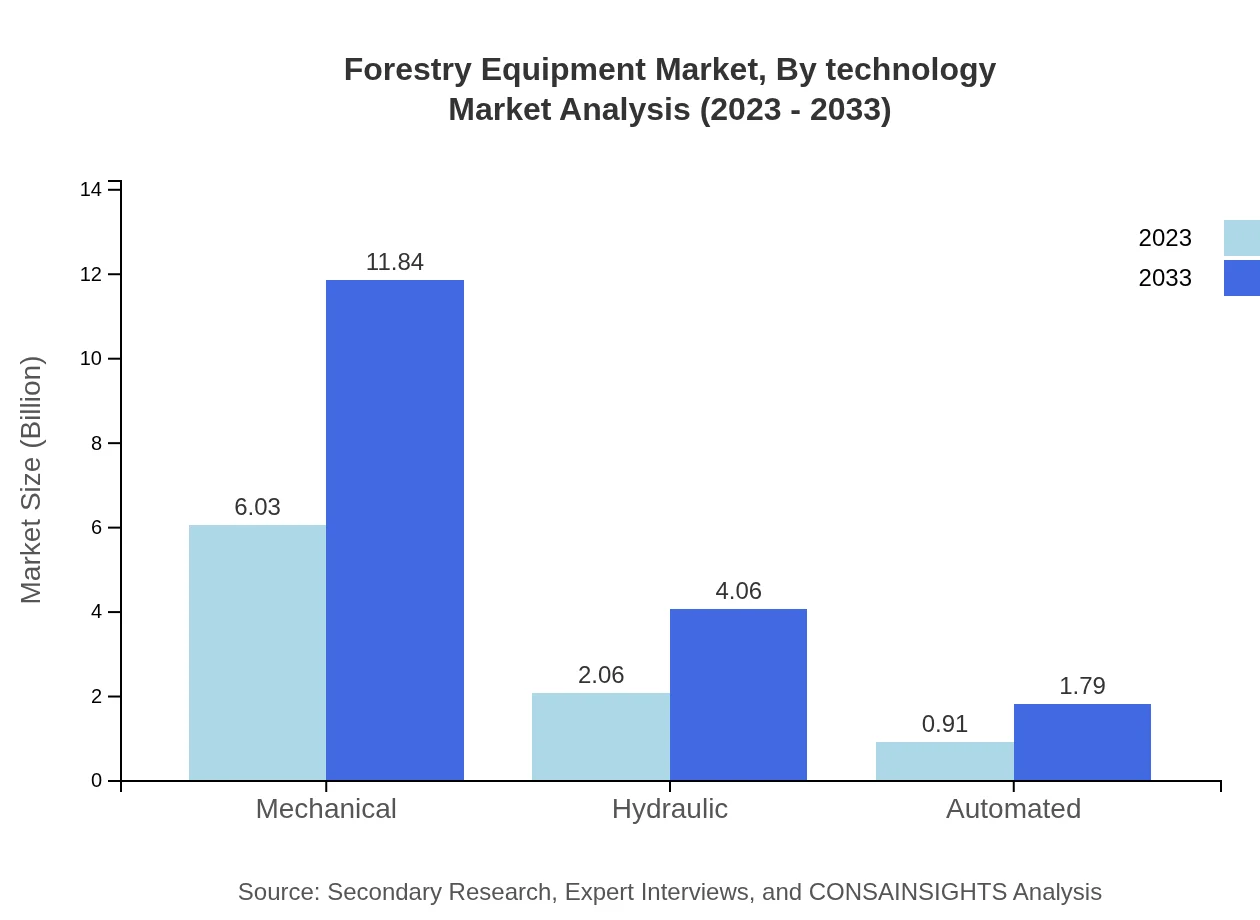

Forestry Equipment Market Analysis By Technology

Innovative technologies like automated and hydraulic systems are at the forefront of market development. Mechanical technologies remain the most prevalent, expected to maintain a market share of 66.96%, along with increasing adoption of automated solutions.

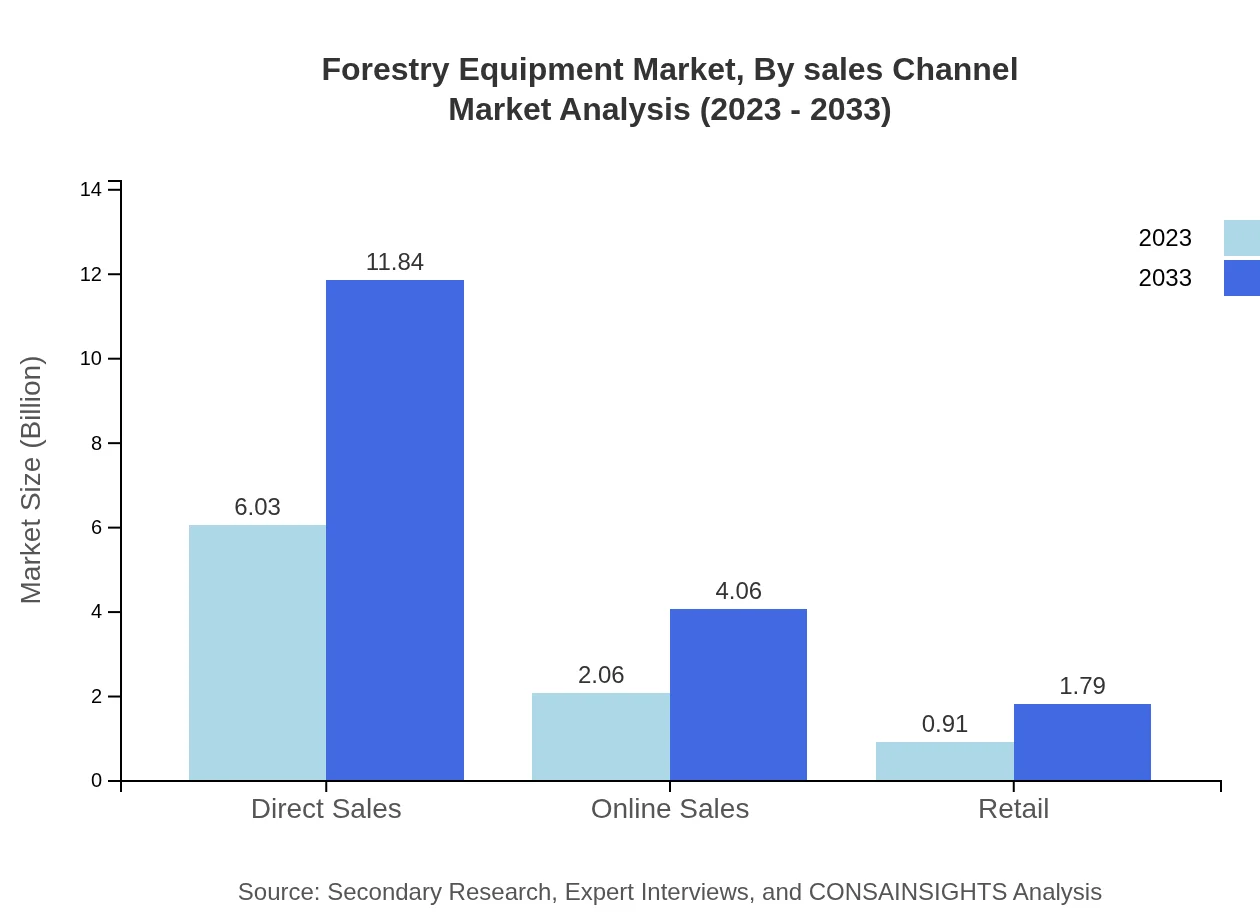

Forestry Equipment Market Analysis By Sales Channel

Direct sales lead the market with $6.03 billion in 2023, while online sales grow steadily, emphasizing the importance of e-commerce in this sector. Retail channels also play a crucial role, particularly in reaching smaller consumers.

Forestry Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Forestry Equipment Industry

Caterpillar Inc.:

Caterpillar is a leading player in the forestry equipment sector, known for its advanced machinery and innovative solutions that enhance productivity and sustainability.John Deere:

John Deere offers a robust range of forestry equipment, focusing on sustainable practices and technology-driven machinery to meet the evolving needs of the industry.Komatsu Forest:

Komatsu Forest specializes in forest machines and equipment, emphasizing quality and sustainability in forestry management through sophisticated technological integration.We're grateful to work with incredible clients.

FAQs

What is the market size of forestry equipment?

The forestry equipment market is valued at approximately $9 billion in 2023 with a projected CAGR of 6.8%. It is expected to grow significantly by 2033, reflecting expanding needs in the forestry sector.

What are the key market players or companies in the forestry equipment industry?

Key market players in the forestry equipment industry include well-established manufacturers and various regional companies, focusing on innovative technologies and sustainable practices to maintain competitiveness in the market.

What are the primary factors driving the growth in the forestry equipment industry?

Key drivers of growth in the forestry equipment industry include increasing demand for sustainable forestry practices, advancements in technology, and rising investments in reforestation and afforestation projects worldwide.

Which region is the fastest Growing in the forestry equipment market?

The fastest-growing region in the forestry equipment market is Europe, expected to grow from $2.83 billion in 2023 to $5.56 billion by 2033, largely due to stringent environmental regulations and growth in forest management.

Does ConsaInsights provide customized market report data for the forestry equipment industry?

Yes, ConsaInsights offers customized market report data tailored to the unique requirements of clients in the forestry equipment industry, ensuring they receive relevant, actionable insights.

What deliverables can I expect from this forestry equipment market research project?

Deliverables from the forestry equipment market research project typically include comprehensive market reports, insights on trends, competitive analysis, and projections for growth across segments and regions.

What are the market trends of forestry equipment?

Current market trends for forestry equipment include increased automation, a shift towards eco-friendly equipment, and rising integration of advanced technology, such as IoT and AI, into forestry operations.