Formulation Development Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: formulation-development-outsourcing

Formulation Development Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report explores the formulation development outsourcing market, providing insights and forecasts from 2023 to 2033. It includes market size, growth rates, regional analysis, and key segments affecting the industry’s dynamics.

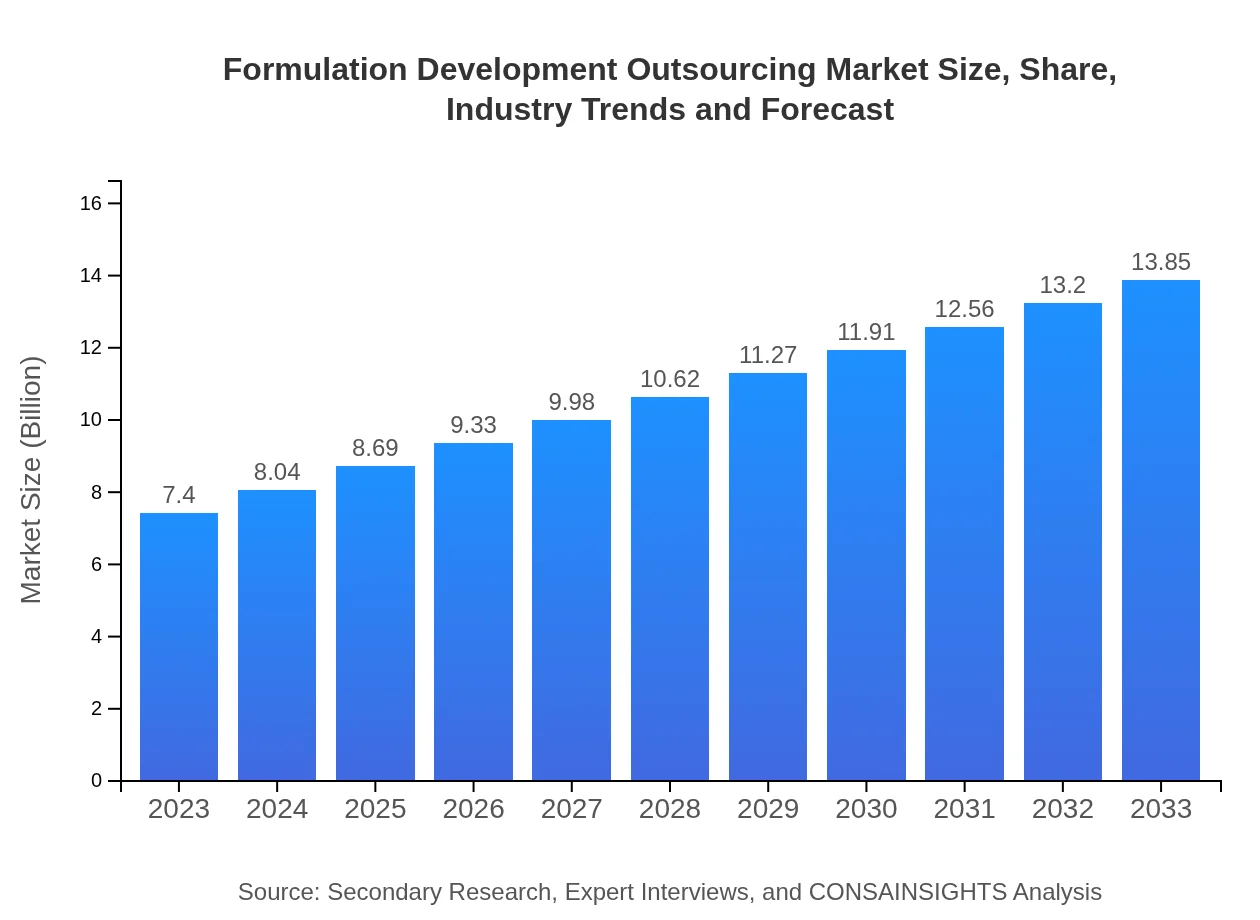

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.40 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $13.85 Billion |

| Top Companies | Charles River Laboratories, Covance, Boehringer Ingelheim, WuXi AppTec |

| Last Modified Date | 31 January 2026 |

Formulation Development Outsourcing Market Overview

Customize Formulation Development Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Formulation Development Outsourcing market size, growth, and forecasts.

- ✔ Understand Formulation Development Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Formulation Development Outsourcing

What is the Market Size & CAGR of Formulation Development Outsourcing market in 2023?

Formulation Development Outsourcing Industry Analysis

Formulation Development Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Formulation Development Outsourcing Market Analysis Report by Region

Europe Formulation Development Outsourcing Market Report:

The European market is valued at $2.16 billion in 2023 and is projected to reach $4.04 billion by 2033. A strong regulatory framework, high healthcare standards, and the presence of major pharmaceutical companies significantly enhance its value.Asia Pacific Formulation Development Outsourcing Market Report:

In the Asia Pacific region, the formulation development outsourcing market was valued at $1.41 billion in 2023 and is projected to reach $2.65 billion by 2033. This growth is fueled by increasing investments in healthcare, expanding pharmaceutical industries, and a propensity to outsource manufacturing and development processes, particularly in countries like India and China.North America Formulation Development Outsourcing Market Report:

North America dominates the formulation development outsourcing sector with a market value of $2.60 billion in 2023, anticipated to grow to $4.87 billion by 2033. The robust pharmaceutical infrastructure, heavy investment in R&D, and demand for novel therapeutics contribute heavily to this expansion.South America Formulation Development Outsourcing Market Report:

The South American market is valued at $0.36 billion in 2023 and is projected to grow to $0.67 billion by 2033. Growth prospects are driven by rising health awareness and an expanding market for generic drugs, although challenges like economic instability may temper growth.Middle East & Africa Formulation Development Outsourcing Market Report:

In the Middle East and Africa, the market size was approximately $0.87 billion in 2023, projected to grow to $1.63 billion by 2033. Rising investments in healthcare infrastructure and the emergence of local pharmaceutical companies drive this growth, despite challenges involving regulatory environments.Tell us your focus area and get a customized research report.

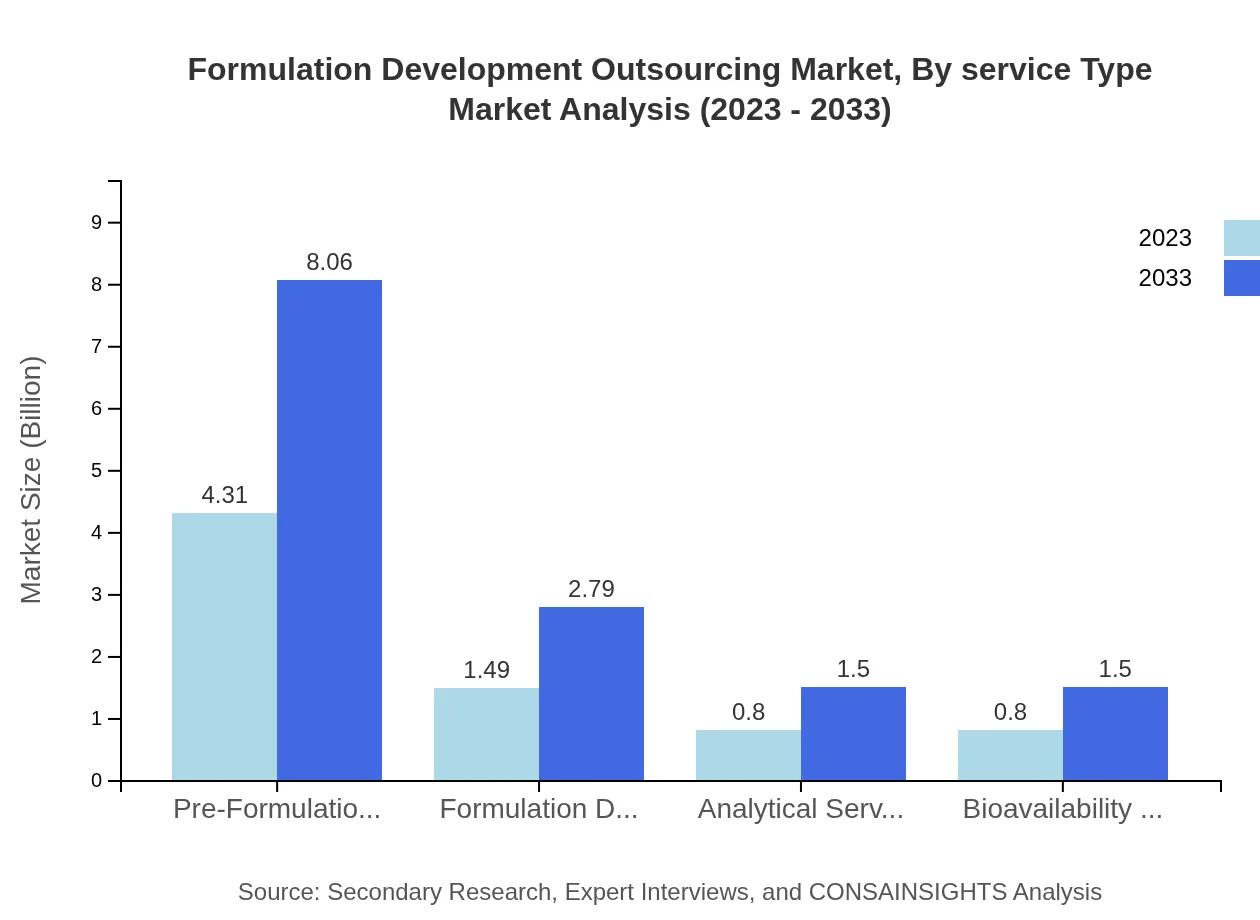

Formulation Development Outsourcing Market Analysis By Service Type

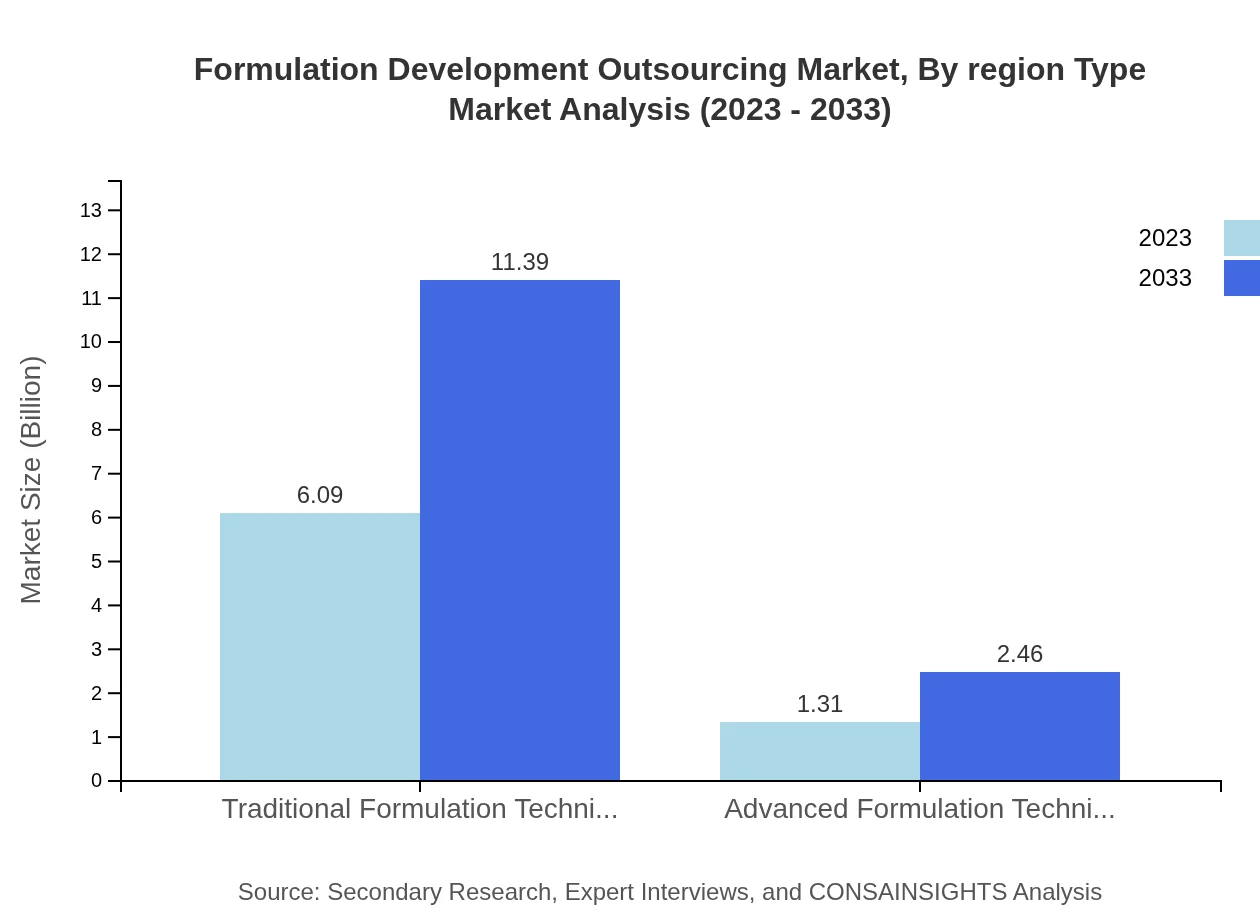

The service type segment is pivotal, with traditional formulation techniques dominating the market at a size of $6.09 billion in 2023, expected to rise to $11.39 billion by 2033. Advanced formulation techniques, although smaller, show promising growth from $1.31 billion to $2.46 billion. Pre-formulation services significantly contribute at $4.31 billion, while formulation development services and analytical services also play crucial roles, indicating a shift towards comprehensive service solutions.

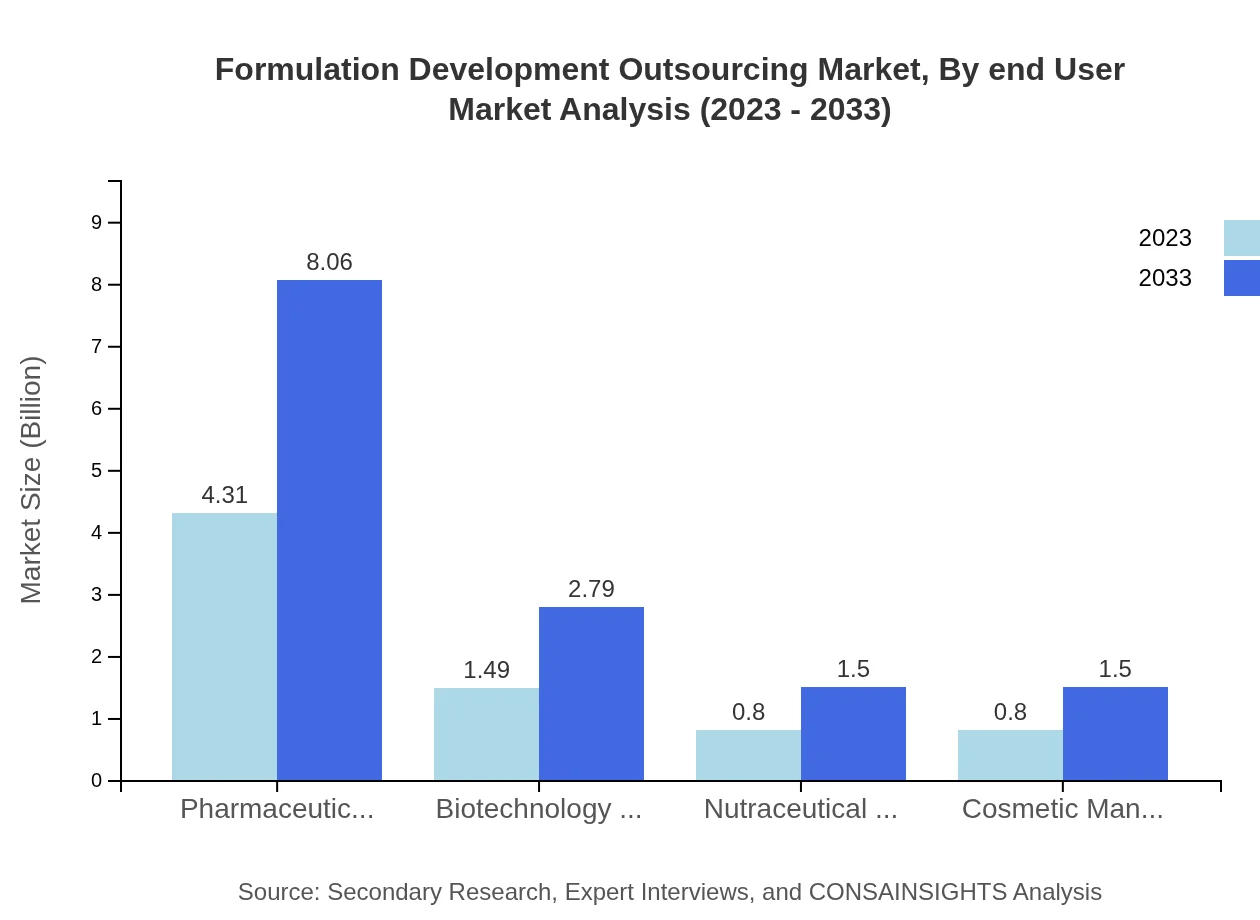

Formulation Development Outsourcing Market Analysis By End User

Pharmaceutical companies are the largest segment in the end-user market, with a size of $4.31 billion in 2023 and expected growth to $8.06 billion by 2033. Biotechnology firms account for $1.49 billion, growing to $2.79 billion, as biopharmaceuticals gain traction. Nutraceuticals and cosmetics also hold significant market shares, highlighting the expansive nature of formulation outsourcing beyond traditional pharmaceuticals.

Formulation Development Outsourcing Market Analysis By Region Type

Protective formulation techniques are essential in developing competitive products. The market’s focus on innovation drives the adoption of advanced technologies alongside traditional methods, ensuring compliance and efficacy. The emerging trend towards personalized medicine necessitates the use of advanced techniques that cater to specific patient needs, further embedding technology as a central pillar in formulation development outsourcing.

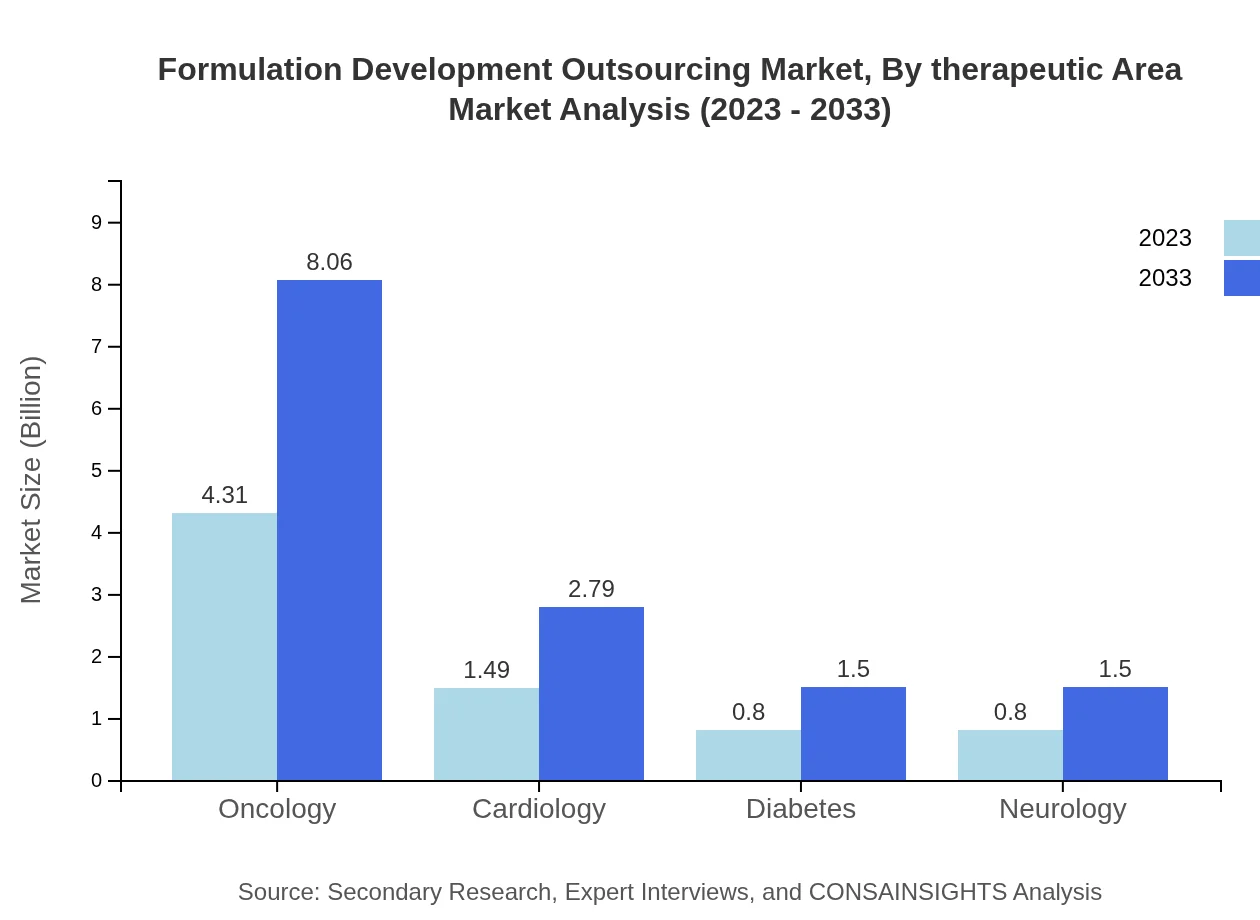

Formulation Development Outsourcing Market Analysis By Therapeutic Area

Oncology leads the therapeutic area segment, with a market size of $4.31 billion in 2023, set to expand to $8.06 billion by 2033, reflecting the escalating demand for targeted oncology therapies. Cardiology and diabetes segments exhibit similar growth patterns, emphasizing the need for specialized formulations to address chronic conditions.

Formulation Development Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Formulation Development Outsourcing Industry

Charles River Laboratories:

A global leader in preclinical and clinical laboratory services, Charles River provides comprehensive formulation development services to pharmaceutical and biotechnology firms.Covance:

Covance, part of LabCorp, offers a wide range of drug development and commercialization services, including formulation development outsourcing, to accelerate drug development processes.Boehringer Ingelheim:

Known for its therapeutic innovations, this company also provides contract development and manufacturing services focusing on personalized medicine.WuXi AppTec:

WuXi AppTec offers a global platform for services ranging from drug discovery to manufacturing, playing a significant role in formulation development outsourcing.We're grateful to work with incredible clients.

FAQs

What is the market size of formulation Development Outsourcing?

The formulation-development-outsourcing market is valued at approximately $7.4 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.3% through 2033, indicating robust growth in this sector.

What are the key market players or companies in this formulation Development Outsourcing industry?

Key players in the formulation-development-outsourcing industry include major pharmaceutical companies such as Pfizer, Johnson & Johnson, and Novartis, as well as biotechnology firms like Genentech and Amgen aiming to enhance product development services.

What are the primary factors driving the growth in the formulation Development Outsourcing industry?

Growth in the formulation-development-outsourcing industry is primarily driven by rising R&D expenditures, increased demand for innovative drugs, regulatory complexities, and the need to accelerate time-to-market for new products.

Which region is the fastest Growing in the formulation Development Outsourcing?

The Asia Pacific region is the fastest-growing in the formulation-development-outsourcing market, expanding from $1.41 billion in 2023 to an estimated $2.65 billion by 2033, reflecting a growing emphasis on outsourcing in emerging markets.

Does ConsaInsights provide customized market report data for the formulation Development Outsourcing industry?

Yes, ConsaInsights does offer customized market report data tailored to the formulation-development-outsourcing industry, allowing businesses to gain insights specific to their needs, challenges, and target markets.

What deliverables can I expect from this formulation Development Outsourcing market research project?

Expect comprehensive deliverables including market size analysis, competitive landscapes, growth forecasts, regional assessments, and detailed segmentation data that covers various segments of the formulation-development-outsourcing industry.

What are the market trends of formulation Development Outsourcing?

Current market trends include increasing adoption of advanced technologies, a focus on sustainability in formulations, rising preference for outsourcing to enhance efficiency, and growth in personalized medicine, shaping future industry's direction.