Fortified Wine Market Report

Published Date: 31 January 2026 | Report Code: fortified-wine

Fortified Wine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the fortified wine market from 2023 to 2033. It covers market size, growth trends, regional insights, and segment performance, along with forecasts and detailed insights into key market players and industry dynamics.

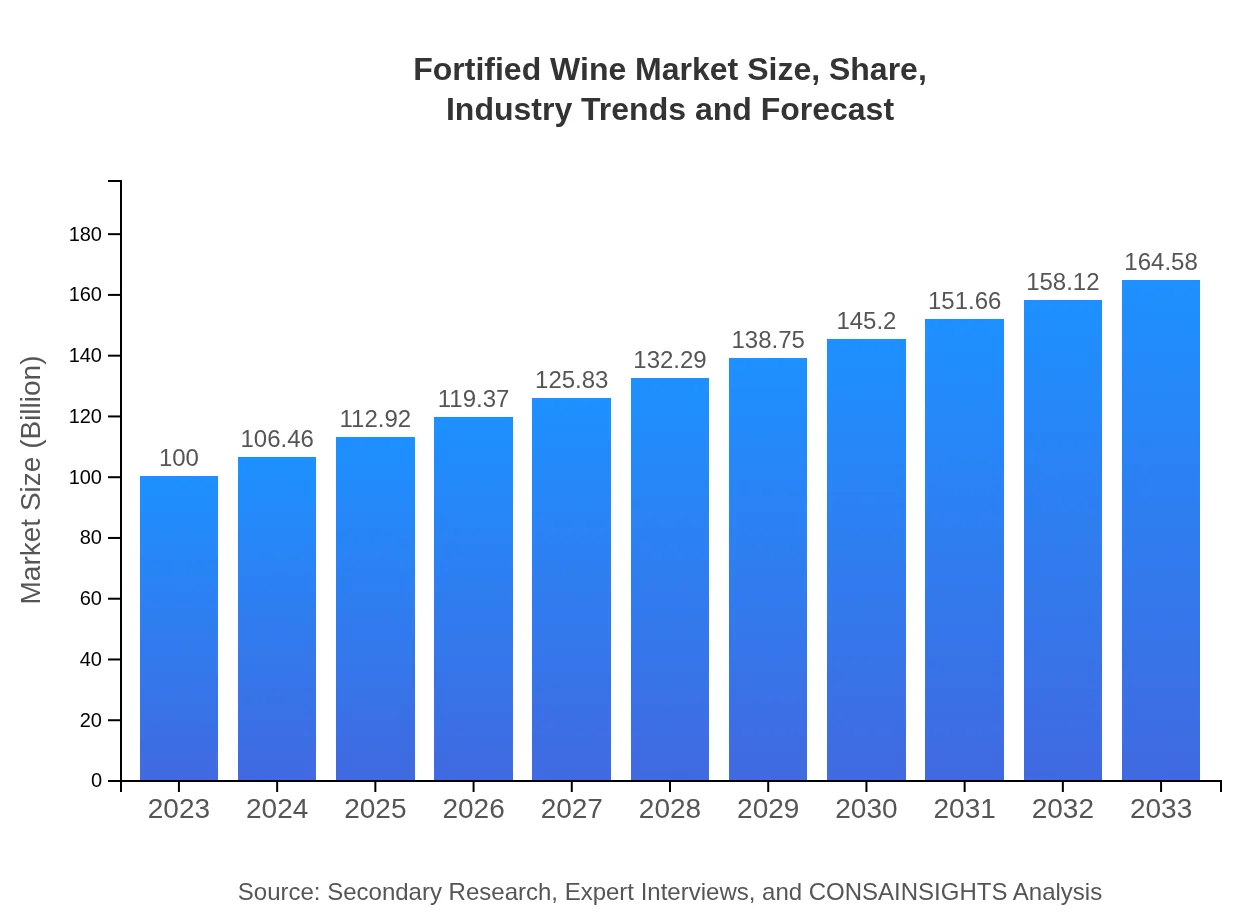

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Taylor's Port, Gonzalez Byass, Sandeman, Ravenswood |

| Last Modified Date | 31 January 2026 |

Fortified Wine Market Overview

Customize Fortified Wine Market Report market research report

- ✔ Get in-depth analysis of Fortified Wine market size, growth, and forecasts.

- ✔ Understand Fortified Wine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fortified Wine

What is the Market Size & CAGR of Fortified Wine market in 2023?

Fortified Wine Industry Analysis

Fortified Wine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fortified Wine Market Analysis Report by Region

Europe Fortified Wine Market Report:

As a traditional hub for fortified wines, Europe showcases a robust market valued at $26.79 billion in 2023, anticipated to reach $44.09 billion by 2033. The European market is driven by heritage brands and a growing interest in wine tourism.Asia Pacific Fortified Wine Market Report:

In the Asia Pacific region, the fortified wine market was valued at $20.85 billion in 2023 and is expected to grow to $34.31 billion by 2033, indicating a strong annual growth rate driven by the increasing popularity of wine culture and premium beverages among younger demographics.North America Fortified Wine Market Report:

North America, especially the U.S., represents a lucrative market with a valuation of $33.69 billion in 2023, predicted to surge to $55.45 billion by 2033. The region benefits from a strong trend toward wine consumption and appreciation for distinctive fortified products in various social settings.South America Fortified Wine Market Report:

South America, with a market size of $8.91 billion in 2023, is projected to expand to $14.66 billion by 2033. The growth in this region can be attributed to greater exploration of diverse wine offerings and local production initiatives focusing on fortified wines.Middle East & Africa Fortified Wine Market Report:

The fortified wine market in the Middle East and Africa is estimated at $9.76 billion in 2023, with projections to reach $16.06 billion by 2033. Growth in this region is linked to burgeoning luxury lifestyle segments and the rise of high-end restaurants featuring global wine selections.Tell us your focus area and get a customized research report.

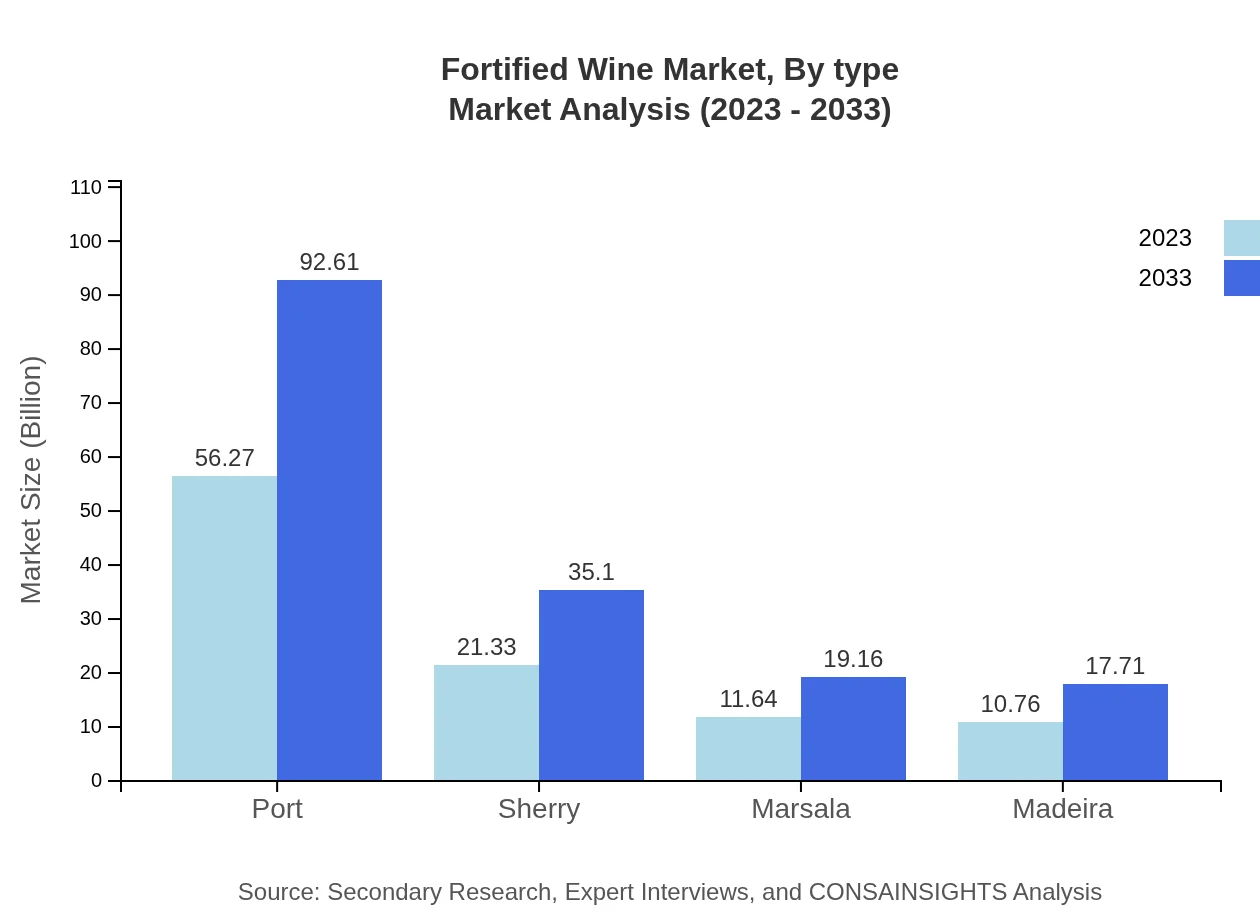

Fortified Wine Market Analysis By Type

The performance of various types of fortified wine shows significant demand variations. Port wines dominate the market, represented by a size of $56.27 billion in 2023 and expected to grow to $92.61 billion by 2033. Sherry follows with a market size of $21.33 billion in 2023 and projected growth to $35.10 billion by 2033. Other types, such as Marsala and Madeira, are also experiencing steady growth, supported by increasing consumer interest.

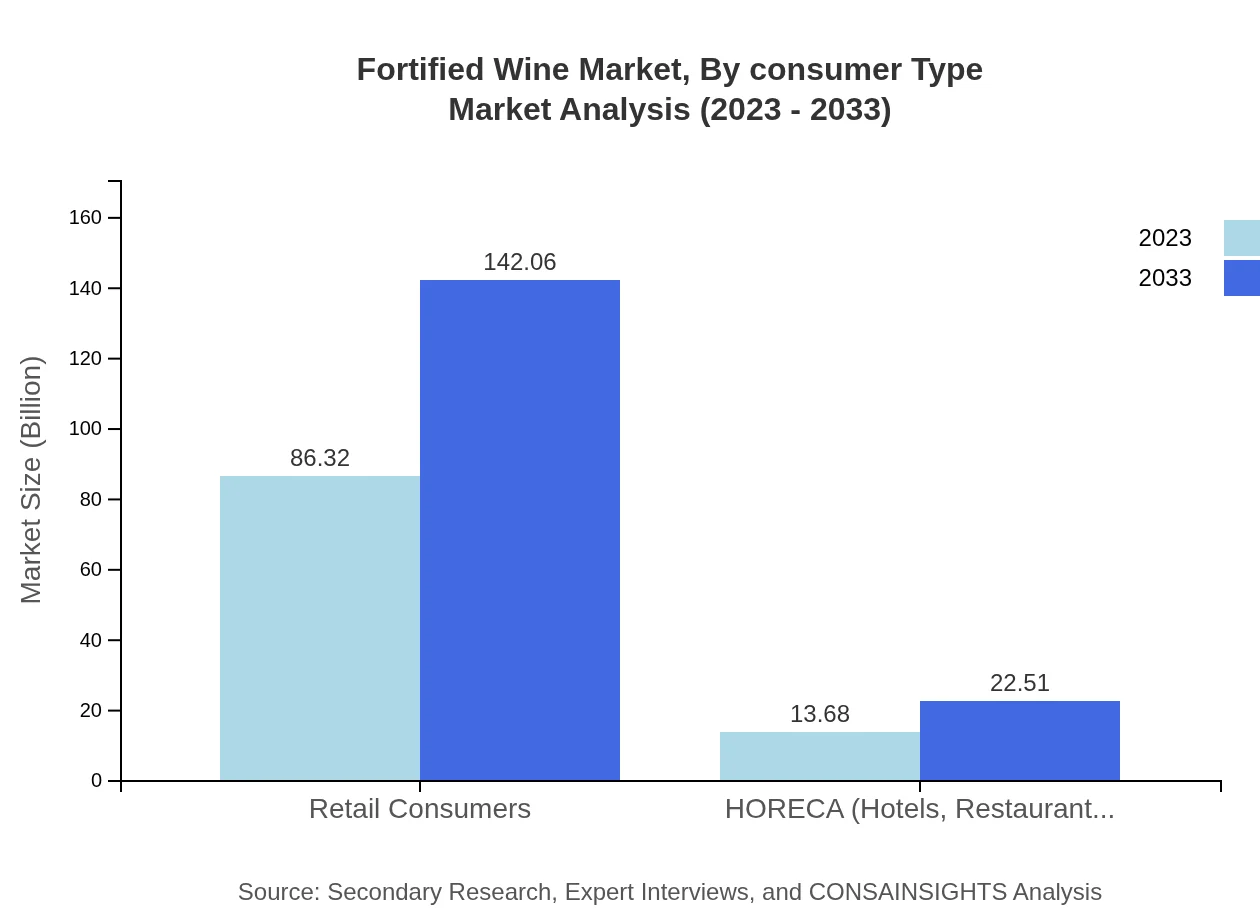

Fortified Wine Market Analysis By Consumer Type

The market analysis of fortified wine by consumer type reveals significant sales through retail consumers, valued at $86.32 billion in 2023 and expected to grow to $142.06 billion by 2033. Meanwhile, the HORECA sector, while smaller, shows healthy growth from $13.68 billion in 2023 to $22.51 billion in 2033, underscoring the strong position of fortified wines in both private and public dining settings.

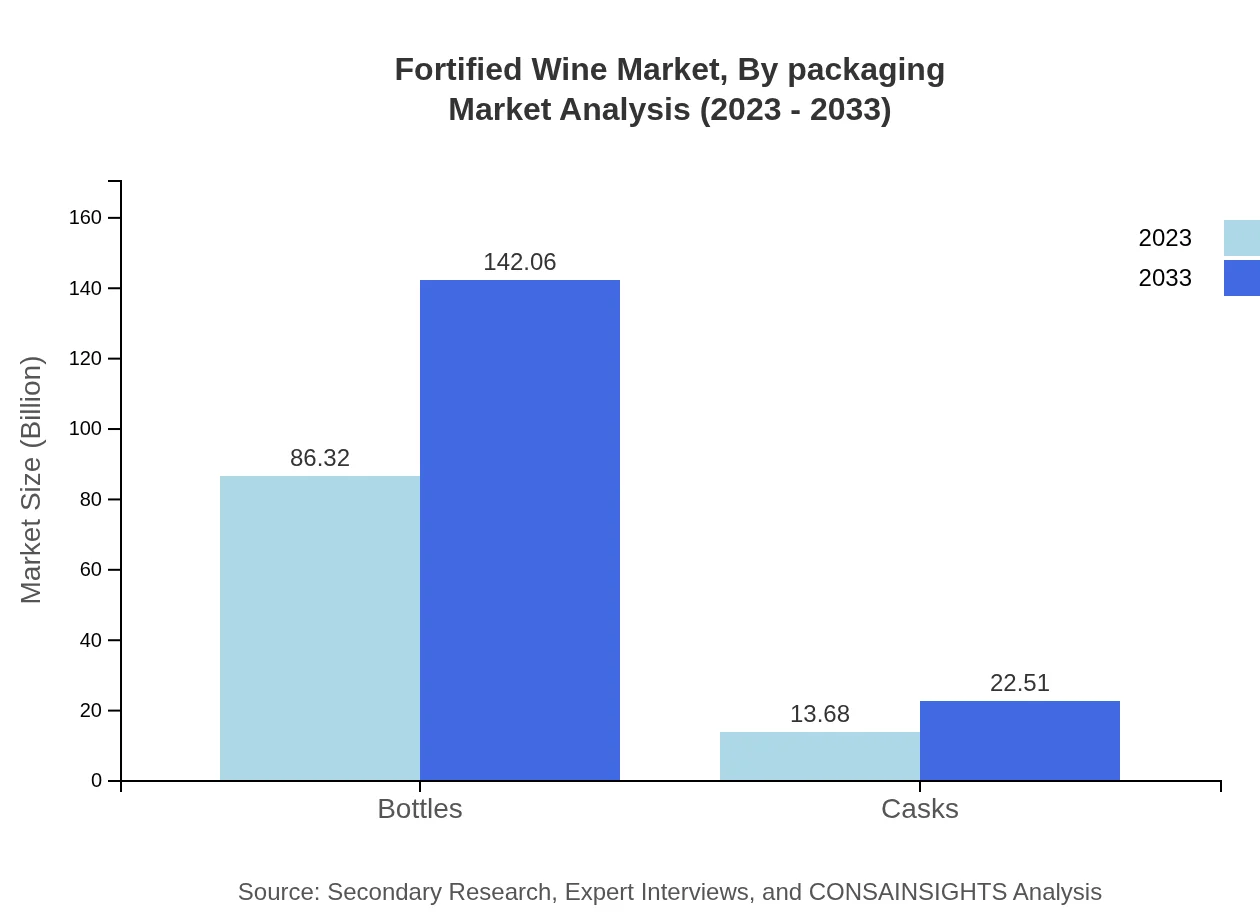

Fortified Wine Market Analysis By Packaging

In terms of packaging, bottles dominate the market with a size of $86.32 billion in 2023, projected to reach $142.06 billion by 2033. Cask packaging, while representing a smaller segment, is also on the rise, showing growth from $13.68 billion in 2023 to $22.51 billion in 2033, demonstrating diverse consumer preferences.

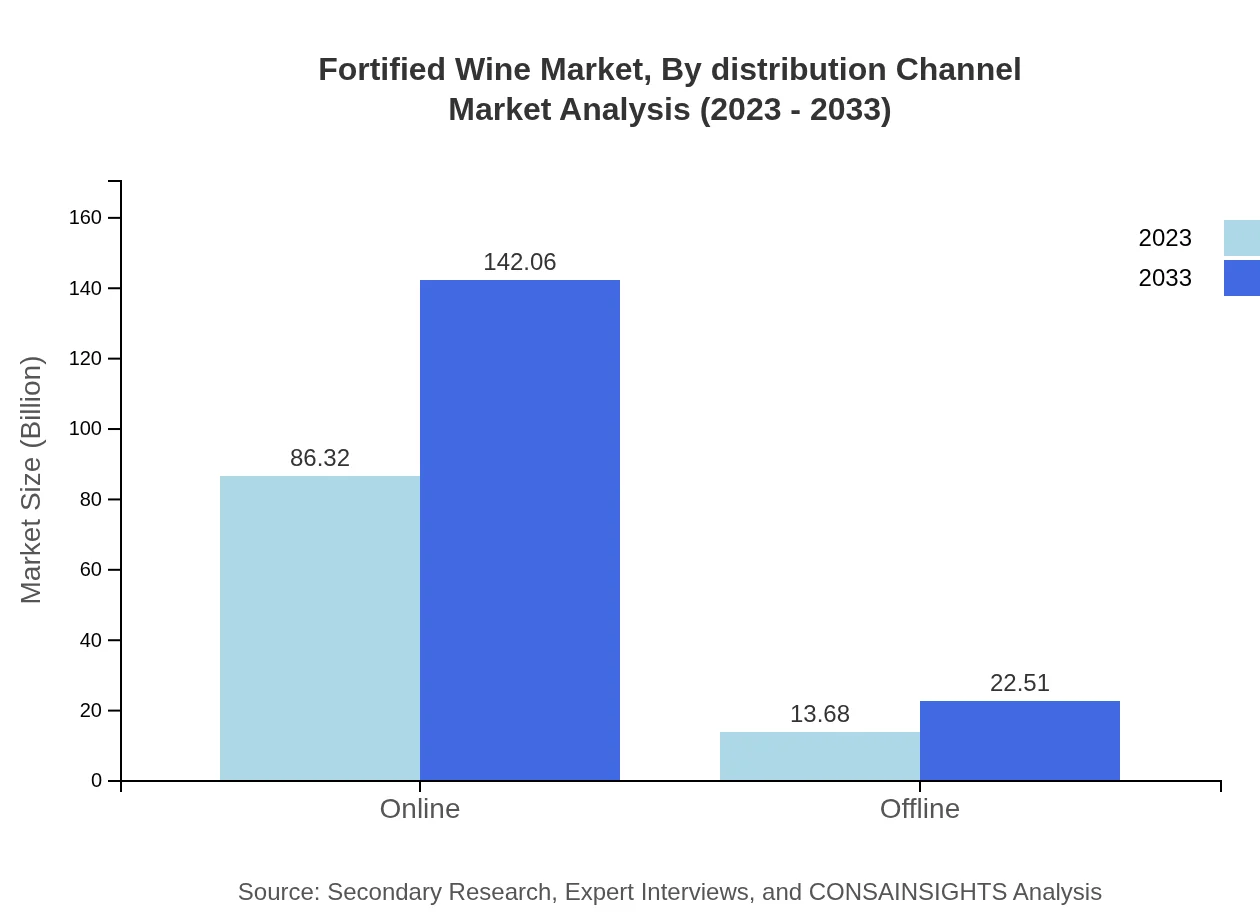

Fortified Wine Market Analysis By Distribution Channel

The distribution channel analysis indicates a strong online market presence, projected at $86.32 billion in 2023 and expected to reach $142.06 billion by 2033. Offline sales channels, while smaller, are also anticipated to grow steadily, moving from $13.68 billion in 2023 to $22.51 billion in 2033, highlighting the importance of traditional retail and emerging e-commerce platforms.

Fortified Wine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fortified Wine Industry

Taylor's Port:

One of the oldest port producers in the world, Taylor's has a rich heritage and is known for premium quality and exclusive offerings in the fortified wine market.Gonzalez Byass:

A leading producer of sherry and other fortified wines, Gonzalez Byass is recognized for its innovative approaches and commitment to traditional production methods.Sandeman:

With a strong brand presence, Sandeman is renowned for both its Port and Sherry products, appealing to a diverse consumer base with luxury offerings.Ravenswood:

As a prominent name in the U.S. wine market, Ravenswood has expanded into fortified wines, focusing on unique flavor profiles and regional specialties.We're grateful to work with incredible clients.

FAQs

What is the market size of fortified wine?

The global fortified wine market is currently valued at approximately $100 million in 2023, with a projected CAGR of 5% from 2023 to 2033. This growth is indicative of the increasing demand and consumption of fortified wines worldwide.

What are the key market players or companies in this fortified wine industry?

The fortified wine industry features prominent players including large producers of Port, Sherry, and Madeira, such as Sogrape Vinhos, Sandeman, and Graham’s, contributing significantly to the market with their diverse product offerings.

What are the primary factors driving the growth in the fortified wine industry?

Key growth drivers in the fortified wine market include increasing preference for premium alcoholic beverages, the rising trend of cocktail culture, and expanding distribution channels that enhance accessibility for consumers.

Which region is the fastest Growing in the fortified wine market?

North America is the fastest-growing region in the fortified wine market, projected to grow from $33.69 million in 2023 to $55.45 million by 2033, fueled by a rise in consumer interest and the expanding HORECA sector.

Does ConsaInsights provide customized market report data for the fortified wine industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the fortified wine industry, ensuring relevant insights for strategic decision-making and market positioning.

What deliverables can I expect from this fortified wine market research project?

From the fortified wine market research project, you can expect detailed reports including market size estimates, CAGR analysis, regional breakdowns, key trends, and insights into major market players and consumer preferences.

What are the market trends of fortified wine?

Current trends in the fortified wine market include a surge in online sales, the popularity of premium and artisanal products, and innovative cocktail recipes that highlight fortified wines, driving consumer engagement and market growth.